Medical Device Testing Services Market | Acumen Research and Consulting

Medical Device Testing Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

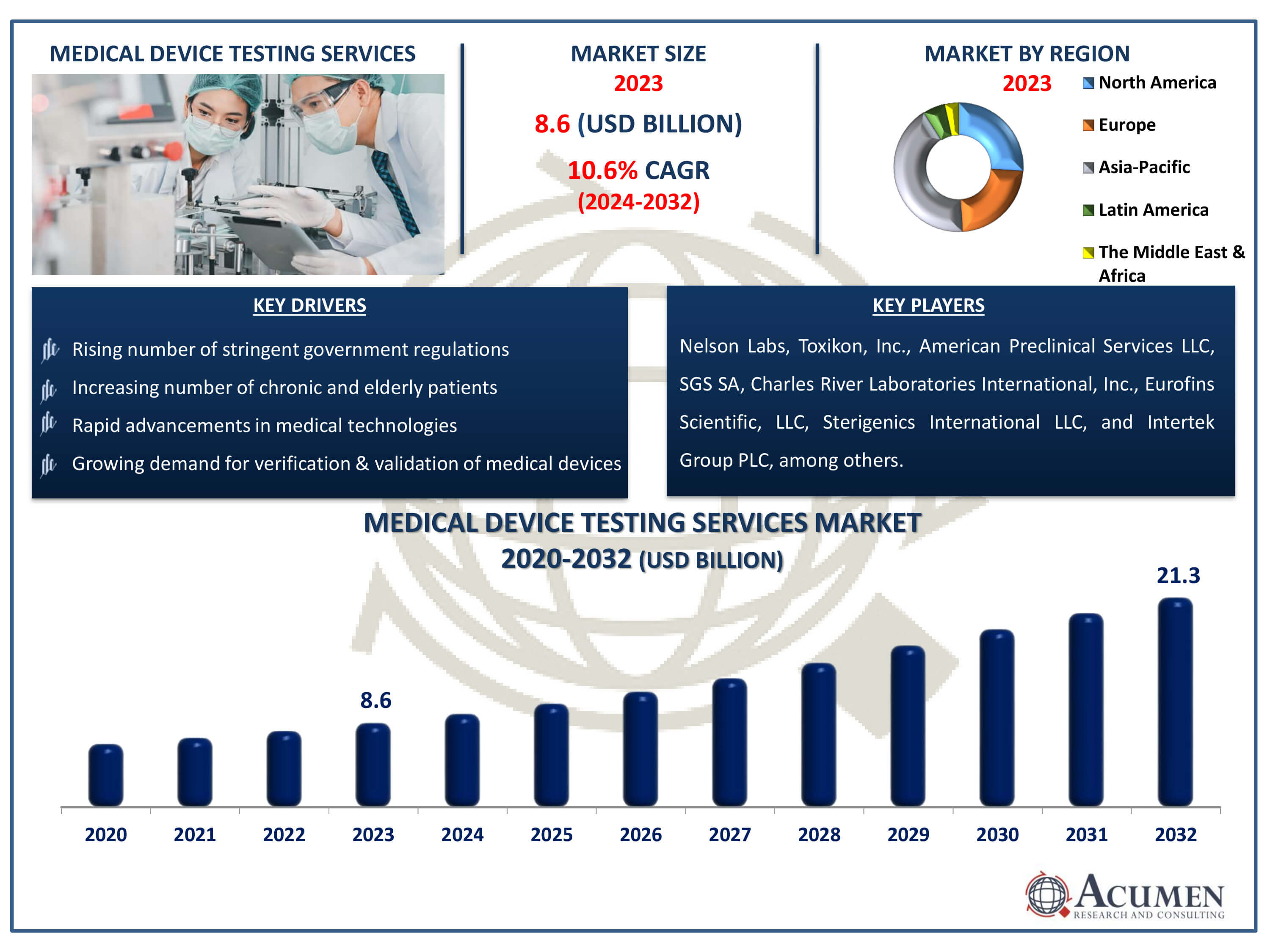

The Medical Device Testing Services Market Size accounted for USD 8.6 Billion in 2023 and is estimated to achieve a market size of USD 21.3 Billion by 2032 growing at a CAGR of 10.6% from 2024 to 2032.

Medical Device Testing Services Market Highlights

- Global medical device testing services market revenue is poised to garner USD 21.3 billion by 2032 with a CAGR of 10.6% from 2024 to 2032

- Asia-Pacific medical device testing services market share accounted for over 42% shares in 2023

- According to the a recent statistics, unsafe medical devices have caused 1.7 million injuries worldwide and roughly 83,000 deaths in the last 12 years

- Asia-Pacific medical device testing services market growth will record substantial CAGR from 2024 to 2032

- Based on service, microbiology & sterility testing captured over 36% of the overall market share in 2023

- Among phases, clinical occupied more than 70% of the market share from 2024 to 2032

- Surging technological advancements in device testing is a popular medical device testing services market trend that is fueling the industry demand

The market for medical device testing services is quickly expanding, driven by rising demand for medical device quality and safety. The preclinical phase of medical device development is a vital stage in which devices are examined to guarantee compliance with regulatory requirements and safety for human usage. Medical device testing services are critical in this process because they ensure that medical devices such as MRI machines, defibrillators, and other equipment work properly and are free of faults.

Medical device testing encompasses a variety of operations, including hardware and software verification and validation. Hardware testing entails evaluating the device's physical components, such as mechanical functionality and electrical performance. In contrast, software testing entails testing the device's software components, such as its programming and algorithms. Medical device testing also encompasses certificate, manufacturing, and R&D testing.

Several factors contribute to the rising need for medical device testing, including the increasing complexity of medical devices, the requirement for faster time-to-market, and the growing relevance of regulatory compliance. Medical device makers are under pressure to guarantee that their products meet stringent regulatory criteria, such as those imposed by the FDA in the United States and the European Union's Medical Device Regulations. Medical device testing service providers assist manufacturers in meeting these standards by providing a range of services such as testing, validation, and certification.

Global Medical Device Testing Services Market Dynamics

Market Drivers

- Rising number of stringent government regulations

- Increasing number of chronic and elderly patients

- Growing demand for verification and validation of medical devices

- Rapid advancements in medical technologies

Market Restraints

- Dynamic rules and regulations across different regions

- Lack of skilled professionals and testing facilities

Market Opportunities

- Robust growth of medical devices industries in emerging nations

- Advent of AI and IoT in medical device testing service industry

Medical Device Testing Services Market Report Coverage

| Market | Medical Device Testing Services Market |

| Medical Device Testing Services Market Size 2022 | USD 8.6 Billion |

| Medical Device Testing Services Market Forecast 2032 |

USD 21.3 Billion |

| Medical Device Testing Services Market CAGR During 2024 - 2032 | 10.6% |

| Medical Device Testing Services Market Analysis Period | 2020 - 2032 |

| Medical Device Testing Services Market Base Year |

2022 |

| Medical Device Testing Services Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Service, By Phase, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nelson Labs, Toxikon, Inc., American Preclinical Services LLC, SGS SA, Charles River Laboratories International, Inc., Eurofins Scientific, LLC, Sterigenics International LLC, Intertek Group PLC, North American Science Associates, Inc., WuXiAppTec Group, and Pace Analytical Services, LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Device Testing Services Market Insights

The medical device testing market is driven by the increasing complexity of medical devices, which requires rigorous testing to ensure their safety and effectiveness. The rise of drug-device combinations, personalized medication, and artificial intelligence (AI) in medical devices has led to a more complex ecosystem. As a result, medical devices must undergo extensive testing in augmented conditions to obtain marketing approval. Conducting these tests in-house can be time-consuming, costly, and labor-intensive, making it more practical for companies to outsource these services to specialized testing providers. This trend is expected to drive the growth of the medical device testing services market as companies seek to streamline their testing processes and reduce costs.

The need for outsourcing medical device testing services is also driven by the growing demand for in-vitro tests, which are becoming increasingly popular as a replacement for traditional in-vivo tests that require animal testing. Many Contract Research Organizations (CROs) are developing novel in-vitro test methods that can mimic the human body's response to medical devices. The development of standardized in-vitro test approaches for sensitization, cytotoxicity, and irritation is also expected to support the growth of the industry. These tests are essential for ensuring the safety and efficacy of medical devices, and the increasing adoption of in-vitro testing is expected to drive the growth of the medical device testing services market. Additionally, the growing demand for real-time patient monitoring and personalized medicine is also driving the growth of the market, as medical devices must be designed to meet the specific needs of individual patients.

Medical Device Testing Services Market Segmentation

The worldwide market for medical device testing services is split based on product, type, and geography.

Medical Device Testing Services Market By Service

- Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Analytical method development and validation

- Chemical characterization (E&L)

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Testing

- Bio-Burden Determination

- Pyrogen and Endotoxin Testing

- Sterility Test and Validation

- Anti-microbial Activity Testing

- Other Services

- Package Validation

According to the medical device testing services industry analysis, microbiology & sterility testing sub-segment grabbed the maximum revenue in 2023 and is expected to do so in the coming years. Microbiology and sterility testing are performed to eliminate or reduce the risk of contamination in the manufacturing process, which could lead to infections in patients or product users. On the other hand, chemistry test is one of the sub-segments that is anticipated to witness fastest growth rate during the projected timeframe from 2024 to 2032.

Medical Device Testing Services Market By Phase

- Preclinical

- Antimicrobial Wound Dressings

- Medical Coatings

- Others

- Clinical

As per medical device testing services market forecast, the clinical sub-segment accounted for over 2/3rd of the total market shares in 2023 and is likely to maintain this trend over the estimated timeframe of 2024 to 2032. Additionally, it is projected that during the forecast period this segment will expand the fastest. The cost of medical device testing services for the clinical stage is significantly greater than for the preclinical stage, which is a crucial element in deciding the clinical stage's greatest market.

Medical Device Testing Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Medical Device Testing Services Market Regional Analysis

The medical device testing services market is led by the Asia-Pacific region, driven by the growing trend of outsourcing in countries such as India and China. Contract Research Organizations (CROs) are investing heavily in these emerging nations due to the lower cost and availability of skilled labor. The Asia-Pacific region is expected to continue its dominance in the market, driven by the increasing demand for medical device testing services.

The North America region is expected to be the second-largest medical device testing market, with significant growth anticipated during the forecast period. This is attributed to the region's reputation as a hub for complex, high-end, and reliable medical devices. Many CROs have established a strong presence in the region, offering a comprehensive range of testing services to businesses.

The Europe region is led by the EU5 nations (Germany, Spain, UK, France, and Italy), where the demand for cost-cutting and increasing complexity in product design is driving the growth of the medical device testing services market. The region is expected to experience significant growth as companies look to streamline their testing processes and reduce costs while ensuring the quality and safety of their medical devices.

Medical Device Testing Services Market Players

Market companies are concentrating on implementing new strategies for instance regional expansion, partnerships, mergers and acquisitions, new product launches, and distribution agreements to surge their revenue share. The major players associated with the medical device testing services market are Nelson Labs, Toxikon, Inc., American Preclinical Services LLC, SGS SA, Charles River Laboratories International, Inc., Eurofins Scientific, LLC, Sterigenics International LLC, Intertek Group PLC, North American Science Associates, Inc., WuXiAppTec Group, and Pace Analytical Services, LLC.

Frequently Asked Questions

How big is the medical device testing services market?

The medical device testing services market size was valued at USD 8.6 billion in 2023.

What is the CAGR of the global medical device testing services market from 2024 to 2032?

The CAGR of medical device testing services industry is 10.6% during the analysis period of 2024 to 2032.

Which are the key players in the medical device testing services market?

The key players operating in the global market are including Nelson Labs, Toxikon, Inc., American Preclinical Services LLC, SGS SA, Charles River Laboratories International, Inc., Eurofins Scientific, LLC, Sterigenics International LLC, Intertek Group PLC, North American Science Associates, Inc., WuXiAppTec Group, and Pace Analytical Services, LLC

Which region dominated the global medical device testing services market share?

North America held the dominating position in medical device testing services industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of medical device testing services during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global medical device testing services industry?

The current trends and dynamics in the medical device testing services industries include rising number of stringent government regulations, increasing number of chronic and elderly patients, and growing demand for verification and validation of medical devices.

Which service held the maximum share in 2023?

The microbiology & sterility testing service held the maximum share of the medical device testing services industry.