Marine Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Marine Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

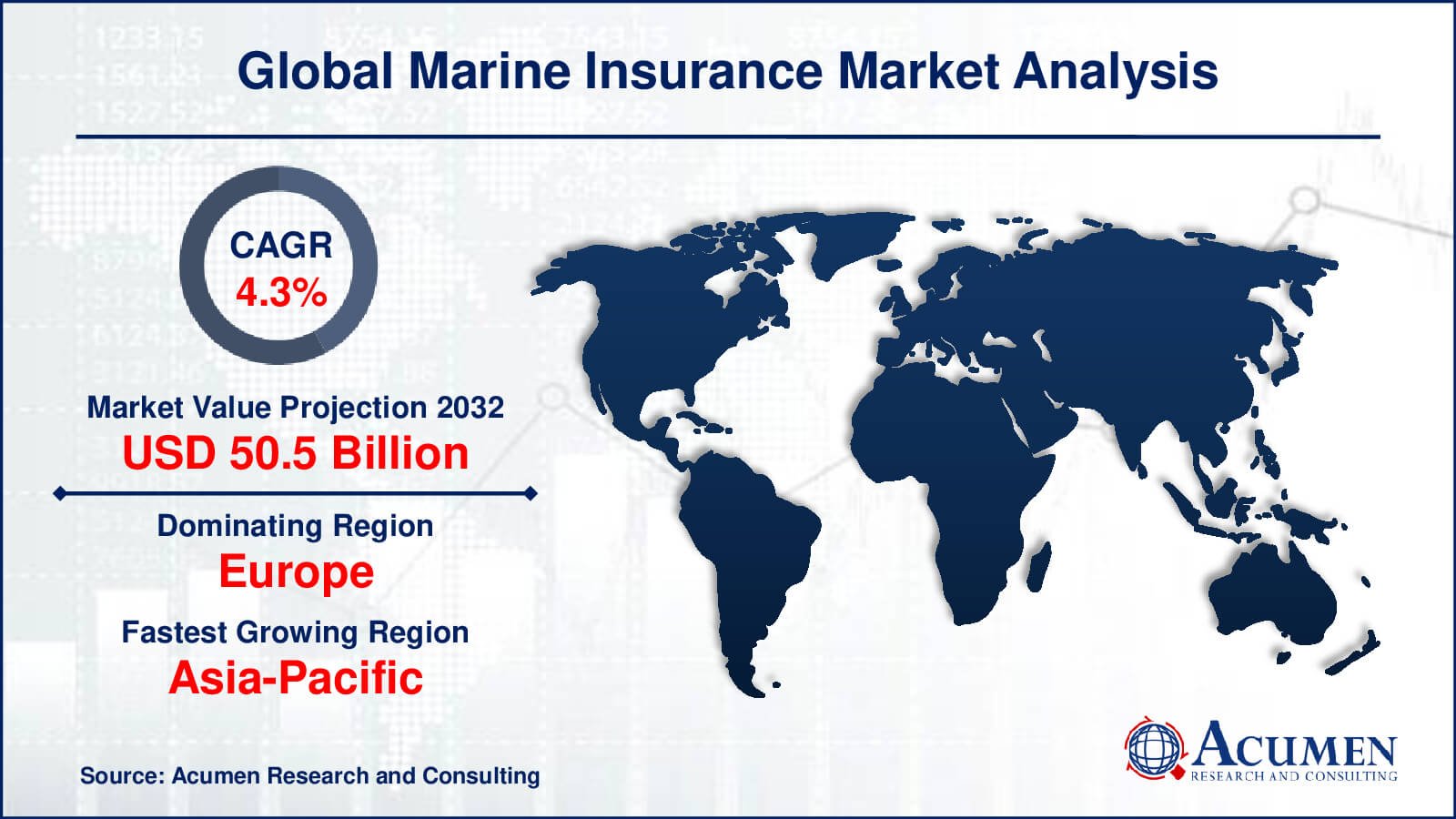

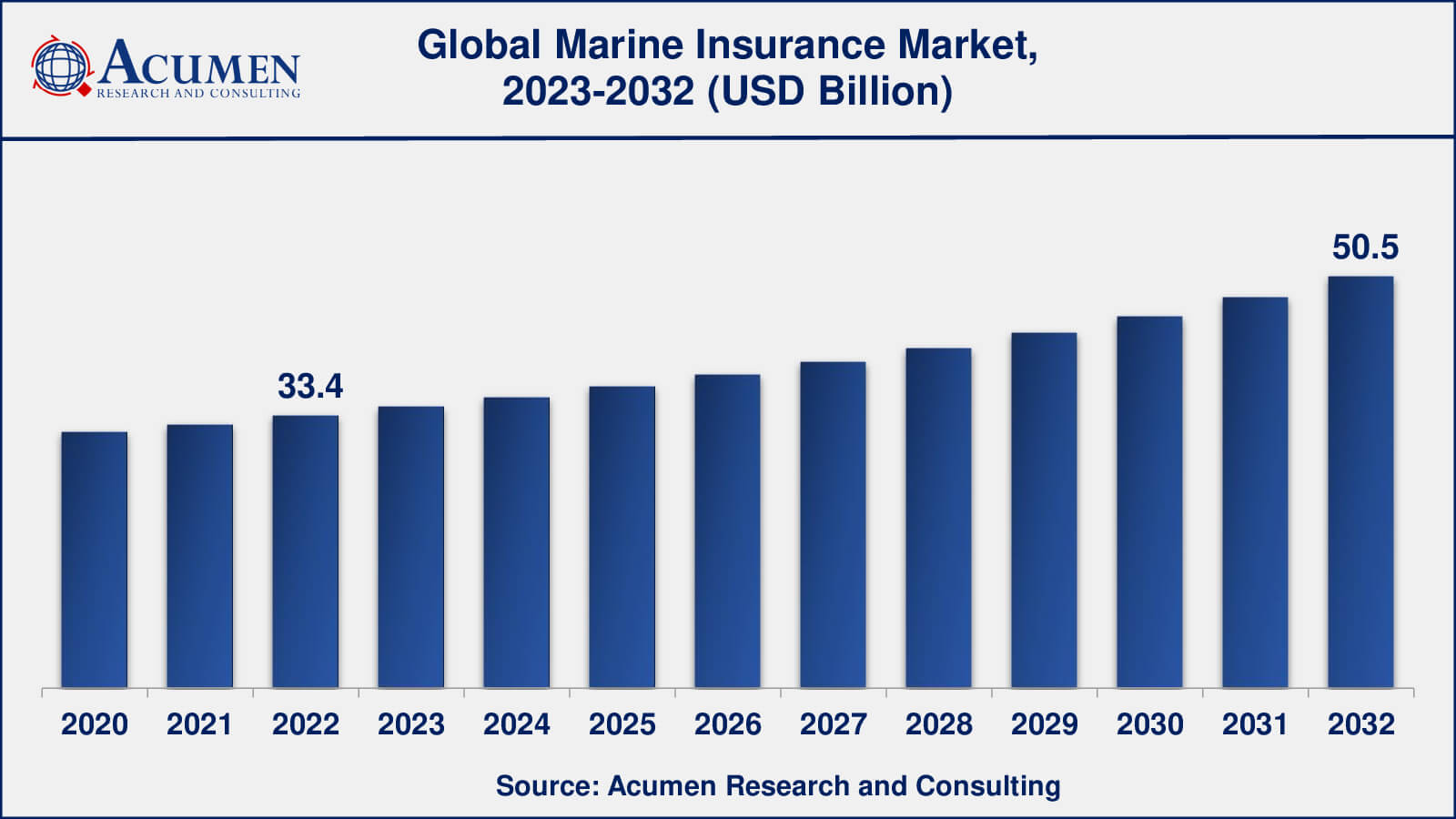

The Global Marine Insurance Market Size accounted for USD 33.4 Billion in 2022 and is estimated to achieve a market size of USD 50.5 Billion by 2032 growing at a CAGR of 4.3% from 2023 to 2032.

Marine Insurance Market Highlights

- Global marine insurance market revenue is poised to garner USD 50.5 billion by 2032 with a CAGR of 4.3% from 2023 to 2032

- Europe marine insurance market value occupied more than USD 15 billion in 2022

- Asia-Pacific marine insurance market growth will record a CAGR of around 5% from 2023 to 2032

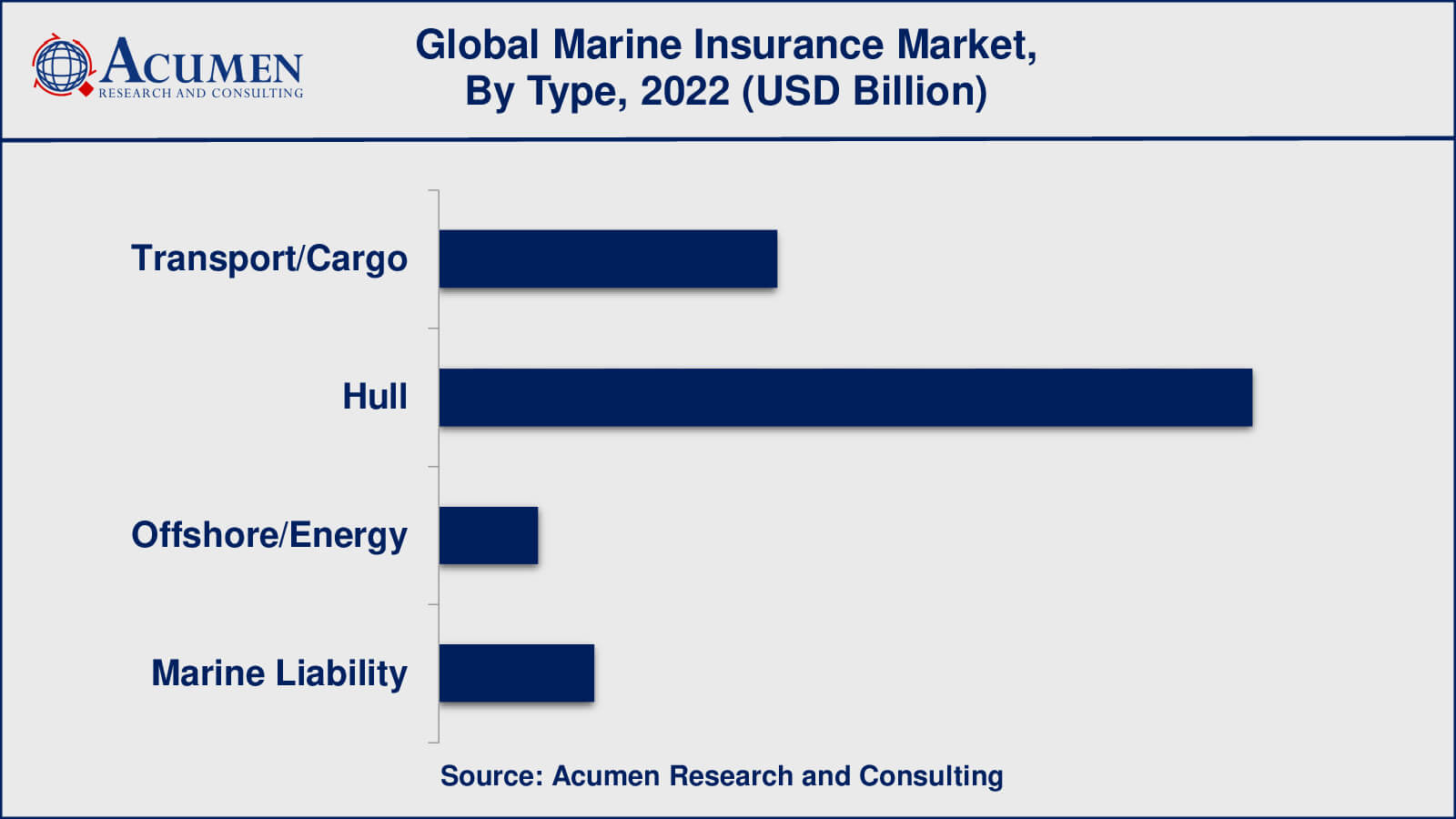

- Among type, the hull sub-segment generated US$ 19.4 billion revenue in 2022

- Based application, the energy sub-segment generated around 30% share in 2022

- Rising implementation of data analytics and machine learning is popular marine insurance market trend that fuels the industry demand

Marine protection covers the misfortune or harm of boats, loads, terminals, and any vehicle or payload by which property is exchanged, gained, or held between the start and end of transport. Freight protection is a sub-branch of marine protection, however, marine likewise incorporates onshore and offshore uncovered property, (compartment terminals, ports, oil stages, pipelines), hull, marine casualty, and marine liability. Shipping protection is utilized when the products are transported via mail or messenger. Marine insurance, also known as cargo insurance, is a type of insurance that assures you pay you if something unpleasant happens to the goods traveling via sea route. After globalization, there has been an increase in the import and export of goods wherein, most of the trade takes place through sea routes. As a result, trading via sea routes demands a need for marine insurance.

Global Marine Insurance Market Dynamics

Market Drivers

- Increasing international trade

- Growing demand for energy

- Growth in the leisure boat industry

Market Restraints

- Low profitability and intense competition

- Geopolitical risks

Market Opportunities

- Insurance of autonomous vessels

- Growing adoption of green marine insurance

Marine Insurance Market Report Coverage

| Market | Marine Insurance Market |

| Marine Insurance Market Size 2022 | USD 33.4 Billion |

| Marine Insurance Market Forecast 2032 | USD 50.5 Billion |

| Marine Insurance Market CAGR During 2023 - 2032 | 4.3% |

| Marine Insurance Market Analysis Period | 2020 - 2032 |

| Marine Insurance Market Base Year | 2022 |

| Marine Insurance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Insurance Coverage, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lloyd's, Bluewater Insurance, Allianz Global Corporate & Specialty (AGCS), Fuji Fire and Marine Insurance, Assuranceforeningen Gard, North of England P&I Association, Norwegian Hull Club, Shoreline Managers, Assuranceforeningen Skuld, and Tokio Marine Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Marine Insurance Market Insights

The increasing trade of goods after globalization has been increasing every year. Most of the import and export of goods happens through sea routes which have directly increased the demand for marine insurance. The marine transport of cargo involves huge costs and, any misfortune while transporting goods could result in huge losses to any company. Hence insuring the goods, vessel or even some ship damages can reduce the risk of a complete loss. Marine insurance is a sigh of relief to shipping owners, cargo owners, governments, etc. as all of them can be benefited from such insurance.

Marine Insurance Market Segmentation

The worldwide market for marine insurance is split based on type, insurance coverage, and geography.

Marine Insurance Market By Type

- Transport/Cargo

- Hull

- Offshore/Energy

- Marine Liability

According to the marine insurance industry analysis, the transport/cargo sub-segment accounted for utmost shares in 2020. Transport/cargo type of marine insurance provides coverage for loss or damage to cargo while in transit. It is one of the largest segments of the marine insurance market and is often required by shippers and other parties involved in international trade.

Hull insurance provides coverage for physical damage to ships and vessels. This includes damage caused by collisions, grounding, and other accidents. Hull insurance is a significant segment of the marine insurance market, particularly for larger vessels such as cargo ships and tankers.

This type of marine insurance provides coverage for oil rigs, platforms, and other offshore energy infrastructure. It includes coverage for physical damage to these structures, as well as liability coverage for environmental damage and other risks associated with offshore energy production.

Marine liability insurance covers third-party liability risks associated with marine operations, such as collisions, pollution, and personal injury. It includes coverage for shipowners, cargo owners, and other parties involved in marine operations.

Marine Insurance Market By Insurance Coverage

- Loss/Damage

- Fire/Explosion

- Natural Calamity

- Others

According to the marine insurance market forecast, the the loss/damage sub-segment is anticipated to witness a significant market share from 2023 to 2032. Protection against loss or damage to products and cargo while in transit by sea, air, or land is provided by loss/damage marine insurance coverage. This insurance often protects products being shipped between two places and offers coverage against a variety of hazards, including theft, damage from accidents or natural disasters, and loss due to non-delivery.

All-risk coverage and specified perils coverage are the two main categories that loss/damage marine insurance coverage falls under. The most comprehensive protection is offered by all-risk coverage, which includes all dangers unless they are specifically excluded. On the other hand, named perils coverage only offers protection against particular hazards that are mentioned in the policy.

Marine Insurance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

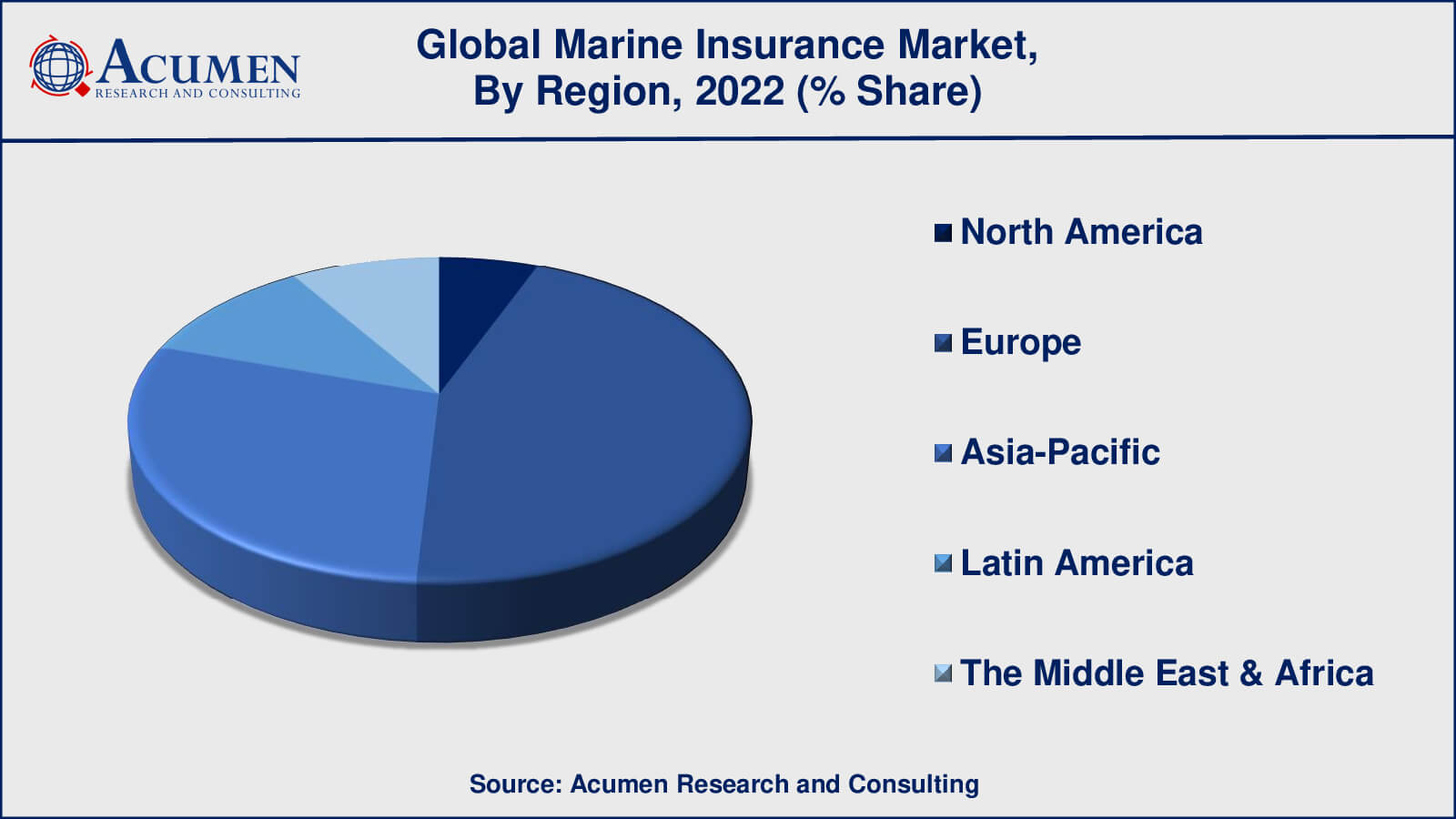

Marine Insurance Market Regional Analysis

According to our marine insurance market analysis, the largest region in the global marine insurance market is Europe. This is because the region has major ports and shipping hubs, as well as a high volume of trade and shipping activity. Many of the nation's top marine insurance companies are also headquartered in Europe, bolstering the continent's market dominance.

Asia-Pacific is expected to be the fastest-growing region. This is due to increased economic growth and development in nations like China, India, and Japan, which is driving up regional trade and shipping activity. Furthermore, the region's large population and rising middle class are providing opportunities for the leisure boat industry to grow, which is driving demand for marine insurance.

Marine Insurance Market Players

Some of the top marine insurance companies offered in the professional report include Lloyd's, Bluewater Insurance, Allianz Global Corporate & Specialty (AGCS), Fuji Fire and Marine Insurance, Assuranceforeningen Gard, North of England P&I Association, Norwegian Hull Club, Shoreline Managers, Assuranceforeningen Skuld, and Tokio Marine Group.

Frequently Asked Questions

What was the market size of the global marine insurance in 2022?

The market size of marine insurance was USD 33.4 billion in 2022.

What is the CAGR of the global marine insurance market from 2023 to 2032?

The CAGR of marine insurance is 4.3% during the analysis period of 2023 to 2032.

Which are the key players in the marine insurance market?

The key players operating in the global market are including Lloyd's, Bluewater Insurance, Allianz Global Corporate & Specialty (AGCS), Fuji Fire and Marine Insurance, Assuranceforeningen Gard, North of England P&I Association, Norwegian Hull Club, Shoreline Managers, Assuranceforeningen Skuld, and Tokio Marine Group.

Which region dominated the global marine insurance market share?

Europe held the dominating position in marine insurance industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of marine insurance during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global marine insurance industry?

The current trends and dynamics in the marine insurance industry include increasing international trade, growing demand for energy, and growth in the leisure boat industry.

Which type held the maximum share in 2022?

The loss/damage type held the maximum share of the marine insurance industry.