Marine Engines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Marine Engines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

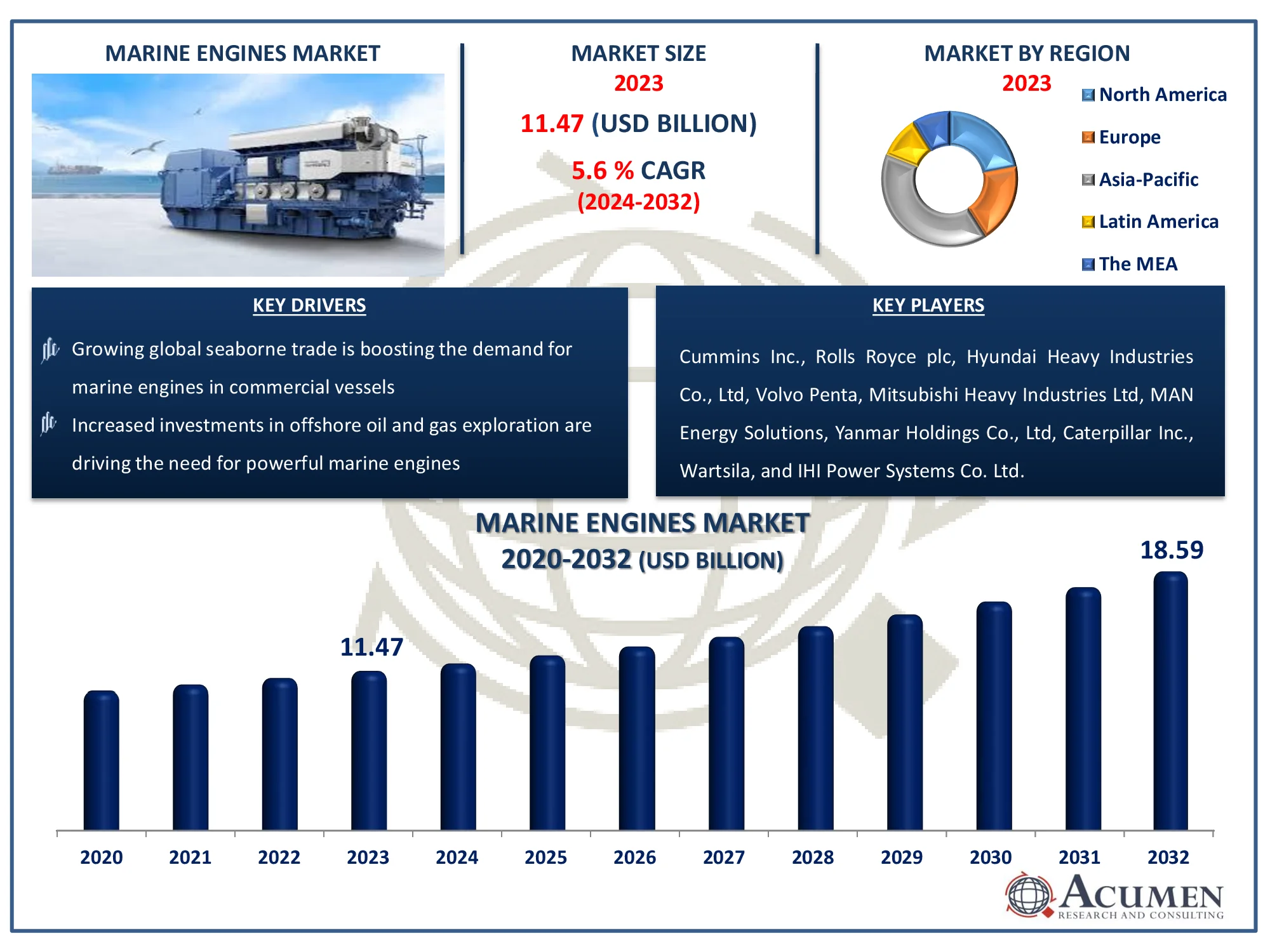

Request Sample Report

The Global Marine Engines Market Size accounted for USD 11.47 Billion in 2023 and is estimated to achieve a market size of USD 18.59 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Marine Engines Market Highlights

- Global marine engines industry revenue is poised to garner USD 18.59 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

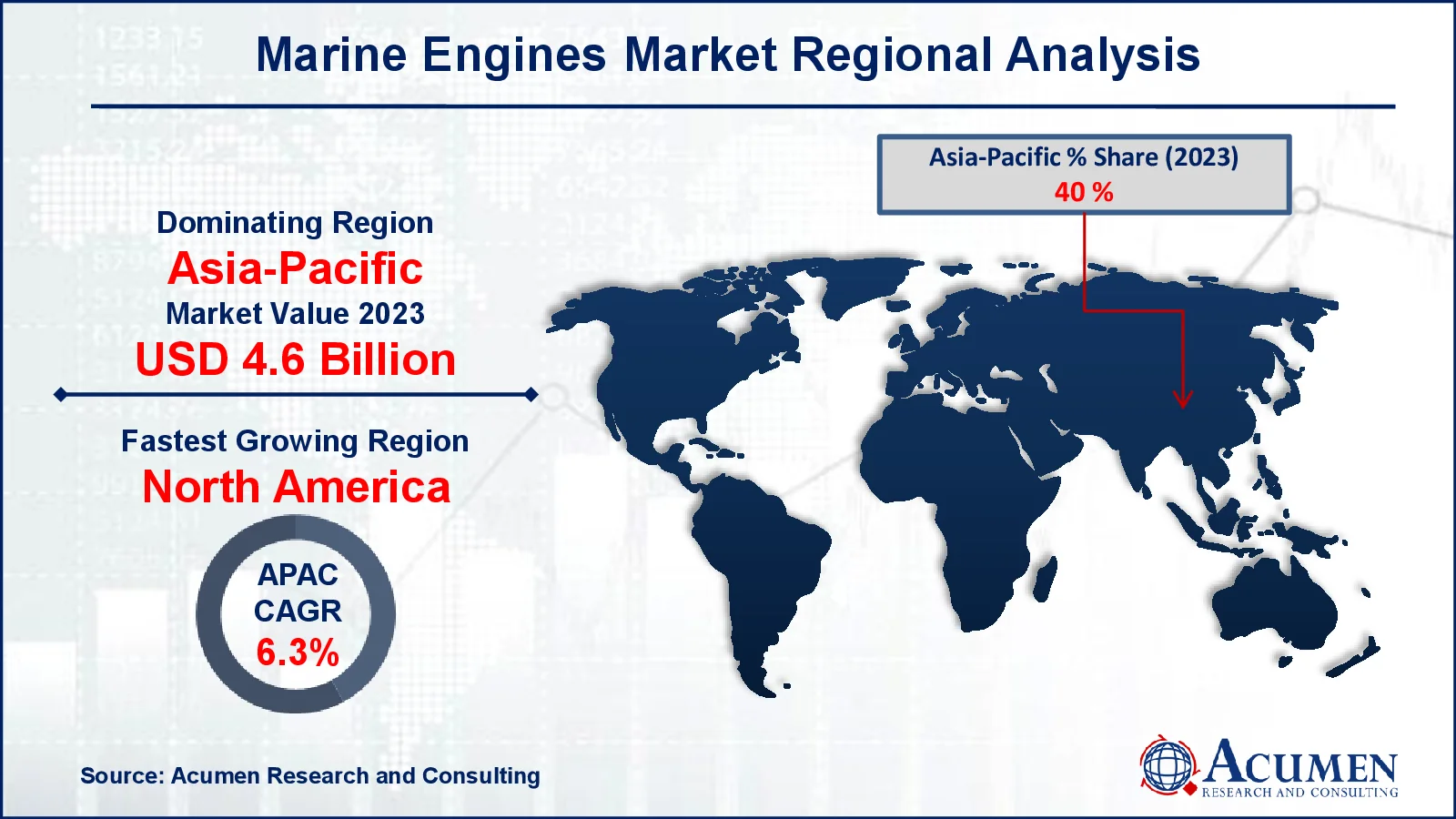

- Asia-Pacific marine engines market value occupied around USD 4.6 billion in 2023

- North America marine engines market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Among fuel, the heavy fuel oil sub-segment generated 33% of the marine engines market share in 2023

- Based on engine, the propulsion engine sub-segment generated 71% marine engines market share in 2023

- Expansion in emerging economies drives demand for new and efficient marine engines to support local maritime sectors is the marine engines market trend that fuels the industry demand

Marine engines are power systems developed specifically for propulsion and auxiliary functions on ships, boats, and other marine vessels. These engines must function effectively in harsh marine settings, which typically include saltwater exposure and extended operation. They are available in a variety of types, including diesel, gas, and dual-fuel engines, each tailored to the unique vessel type and operational requirements. Diesel engines are particularly popular due to their long life, fuel efficiency, and ability to generate significant power, making them suitable for cargo ships, tankers, and huge fishing boats. Marine engines are designed to meet tight environmental requirements, with a focus on lowering emissions and fuel consumption. Advanced marine engine technology allows for smoother operations, lower maintenance, and increased reliability in the maritime industry.

Global Marine Engines Market Dynamics

Market Drivers

- Growing global seaborne trade is boosting the demand for marine engines in commercial vessels

- Increased investments in offshore oil and gas exploration are driving the need for powerful marine engines

- Rising demand for energy-efficient, eco-friendly engines is pushing technological advancements in the marine engine market

- Expansion of the cruise and tourism industry is increasing the adoption of advanced marine engines

Market Restraints

- High initial costs and maintenance expenses deter smaller players from adopting advanced marine engines

- Stringent environmental regulations add complexity and costs to engine manufacturing processes

- Volatility in fuel prices impacts operational costs, affecting marine engine market demand

Market Opportunities

- Development of hybrid and electric marine engines offers sustainable alternatives for future vessels

- Growing investments in renewable marine propulsion open doors for green innovation in the market

- Increasing retrofit activities to upgrade existing fleets presents opportunities for aftermarket services

Marine Engines Market Report Coverage

| Market | Marine Engines Market |

| Marine Engines Market Size 2022 |

USD 11.47 Billion |

| Marine Engines Market Forecast 2032 | USD 18.59 Billion |

| Marine Engines Market CAGR During 2023 - 2032 | 5.6% |

| Marine Engines Market Analysis Period | 2020 - 2032 |

| Marine Engines Market Base Year |

2022 |

| Marine Engines Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Engine, By Fuel, By Power, By Technology, By Propulsion, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cummins Inc., Rolls Royce plc, Hyundai Heavy Industries Co., Ltd, Volvo Penta, Mitsubishi Heavy Industries Ltd, MAN Energy Solutions, Yanmar Holdings Co., Ltd, Caterpillar Inc., Wartsila, and IHI Power Systems Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Marine Engines Market Insights

Marine motors are used to power offshore ships, business ships and other naval ships working on a range of fuels, including gas oil, diesel petroleum, hybrids and LNG. The main considerations in item assembly include fuel efficiency, simple servicing, low damaging emissions, durability, elevated performance, and smooth operation.

Increasing worldwide seaborne trade in the developing economies will encourage the marine motors market share to grow, owing to a favorable perspective for the shipping industry. Advances in technology and layout, quick shifts from traditional gas to low sulfur fuel, and stringent public requirements to clean fuel will increase demand for LNG, LSFO and hybrid gas motors.

Implementing public laws aimed at reducing marine pollution in large part across Emission Control Areas (ECAs) has driven the need for low-emission motors. Enhanced attempts to increase motor capacity have resulted to the growth of reliably sophisticated technologies. Increasing demand for economically feasible motors and increased maritime tourism will further boost the implementation of products.

Marine Engines Market Segmentation

The worldwide marine engines market is split based on engine, fuel, power, technology, propulsion, application, and geography.

Marine Engines Market By Engine

- Auxiliary Engine

- Propulsion Engine

According to the marine engines industry analysis, propulsion engines are the major segment, accounting for more than 71% of the market due to their importance in vessel movement and efficiency. These engines supply primary power to propulsion systems, making them essential for commercial transportation, fishing vessels, and naval forces. The rising need for international trade and maritime transportation has boosted the use of propulsion engines. Their complicated designs offer optimum fuel efficiency and operational dependability, which are essential for long-distance and high-capacity vessels. Furthermore, developments in hybrid and dual-fuel engine systems broaden their appeal by meeting higher environmental criteria. Because of their importance in propelling ships, propulsion engines have the largest market share in the maritime industry.

Marine Engines Market By Fuel

- Heavy Fuel Oil

- Marine Diesel Oil

- Marine Gas Oil

- Others

Heavy fuel oil (HFO) is expected to dominate the industry during the marine engines market forecast period owing to its widespread use in big commercial transport boats. HFO is appreciated for its low cost and high energy density, making it an ideal fuel for bulk carriers, tankers, and cargo ships. Despite stricter environmental rules, its established infrastructure and competitive prices keep it at the top of the industry. Furthermore, developments in scrubber technology and a variety of compliance solutions allow for the continued use of HFO while satisfying emissions targets. However, as stricter limits and environmental goals become more common, competing cleaner fuels like marine diesel oil and marine gas oil gain pace, although HFO remains the most popular market in terms of demand and profit.

Marine Engines Market By Power

- > 20,000 HP

- 10,000-20,000 HP

- 5,000-10,000 HP

- 1,000-5,000 HP

- < 1,000 HP

< 1,000 HP marine motors will see notable growth over the in the marine engines market forecast period. These devices are mounted in big vessels for improved car transit energy requirements. Motors are commonly used in commercial vessels including freight vessels, bulk carriers, tanker vessels and containers. In submarines, yachts and tug boats, > 20,000 HP engines are widely used. The business scenario will be complemented by increasing demand for yachts, passenger ships, commercial ships and cruise ships. Increasing disposable incomes and improved living standards are further driving product adoption.

Marine Engines Navigation Market By Technology

- High Speed

- Moderate Speed

- Low Speed

Medium speed is due to low maintenance and lightweight growth. Growing maritime tourism and rising demand for passenger and recreational boats will increase product adoption. In addition, the systems are extensively deployed in ships including cruises and ferries.

Growing demand for tugboats together with continued development and development of local seaports will fuel acceptance of high-speed marine motors. The motors are mainly installed on ferries or boats, small vessels, fishing boats and yachts. The industry outlook will also be further strengthened by underline factors including compact size, improved engine performance and efficiency.

Marine Engines Market By Propulsion

- 4-stroke

- 2-stroke

Two-stroke motors are expected to grow maximum percent by 2032 in the marine engines market. The business landscape will be encouraged by technological improvements along with improved operational efficiency. Enhanced fuel efficiency, elevated load durability, standardized turning times and decreased wear & tear resistance are expected to improve item acceptance.

Due to reduced noise levels, high speed, cost efficiency and higher fuel efficiency, the four-stroke propulsion engines can see significant growth in the marine engines market. Moreover, there is no need for engines to add lubricant which generates less pollution and thus increases the business landscape.

Marine Engines Market By Application

- Recreational

- Offshore

- Commercial

- Navy

- Others

It is expected that the offshore engine sector will achieve maximum by 2032 in the marine engines market. Increasing demand for offshore aid ships to conduct separate activities will encourage item implementation. The sector situation will further consolidate the positive perspective for boiling operations combined with solid development in Exploration and Production (E&P) operations. The growing naval trade across the emerging economies and the increase of shipbuilding activity will stimulate demand for commercial marine motors. The opening and extension of main transport paths, particularly the choke points, will encourage item assembly.

Marine Engines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Marine Engines Market Regional Analysis

The Asia-Pacific region dominates the marine engines market, owing to its substantial commercial maritime activity and strong shipbuilding industries, particularly in China, South Korea, and Japan. These countries are world leaders in ship production, accounting for a sizable share of worldwide vessel demand. The region's growing imports and exports, combined with increased investment in maritime infrastructure, boost the demand for efficient marine engines in a variety of vessel types, including cargo ships, tankers, and fishing boats. Furthermore, Asia-Pacific's increasing demand for energy-efficient, low-emission engines coincides with stricter environmental restrictions, accelerating marine engines market growth.

North America is seeing the fastest growth in the marine engine market throughout the forecast period, thanks to technological advancements and greater investment in cleaner propulsion systems. The United States, in particular, is seeing rising demand for marine engines in both the commercial and leisure sectors, owing to a strong preference for environmentally friendly solutions. Stringent emission laws, such as those imposed by the United States Environmental Protection Agency (EPA), are encouraging manufacturers to develop low-emission engines, which is fuelling regional growth. North America's well-established maritime tourism and recreational boating industries also help to drive demand for high-performance engines. Together, these factors contribute to North America's quick growth, with an emphasis on technological innovation and long-term solutions for marine engines.

Marine Engines Market Players

Some of the top marine engines market companies offered in our report include Cummins Inc., Rolls Royce plc, Hyundai Heavy Industries Co., Ltd, Volvo Penta, Mitsubishi Heavy Industries Ltd, MAN Energy Solutions, Yanmar Holdings Co., Ltd, Caterpillar Inc., Wartsila, and IHI Power Systems Co. Ltd.

Frequently Asked Questions

How big is the marine engines market?

The marine engines market size was valued at USD 11.47 billion in 2023.

What is the CAGR of the global marine engines market from 2024 to 2032?

The CAGR of marine engines is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the marine engines market?

The key players operating in the global market are including Cummins Inc., Rolls Royce plc, Hyundai Heavy Industries Co., Ltd, Volvo Penta, Mitsubishi Heavy Industries Ltd, MAN Energy Solutions, Yanmar Holdings Co., Ltd, Caterpillar Inc., Wartsila, and IHI Power Systems Co. Ltd.

Which region dominated the global marine engines market share?

Asia-Pacific held the dominating position in marine engines market during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of marine engines during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global marine engines industry?

The current trends and dynamics in the marine engines market include growing global seaborne trade is boosting the demand for marine engines in commercial vessels, and increased investments in offshore oil and gas exploration are driving the need for powerful marine engines

Which fuel held the maximum share in 2023?

The heavy fuel oil held the notable share of the marine engines industry.?