Managed File Transfer Market | Acumen Research and Consulting

Managed File Transfer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

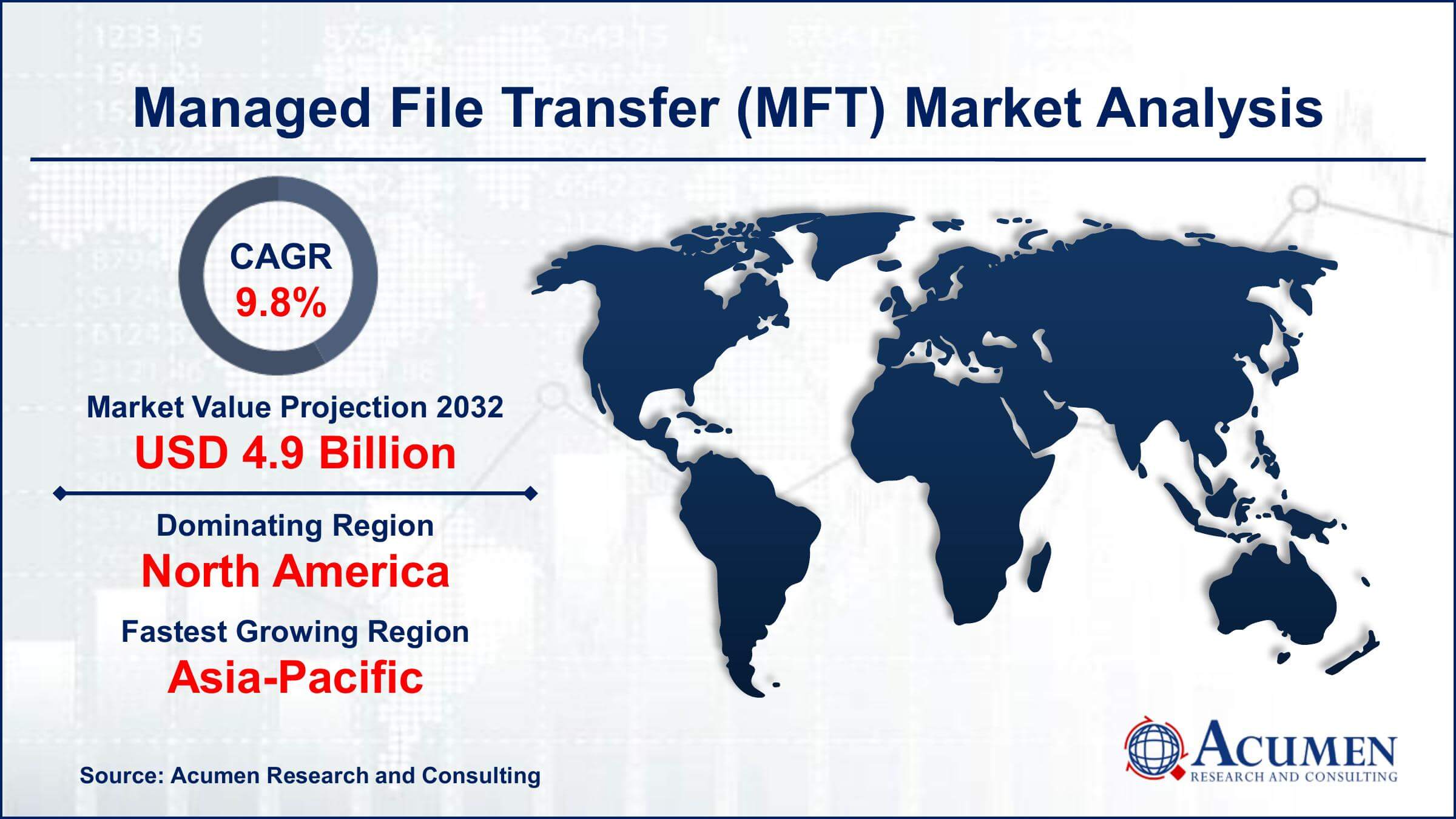

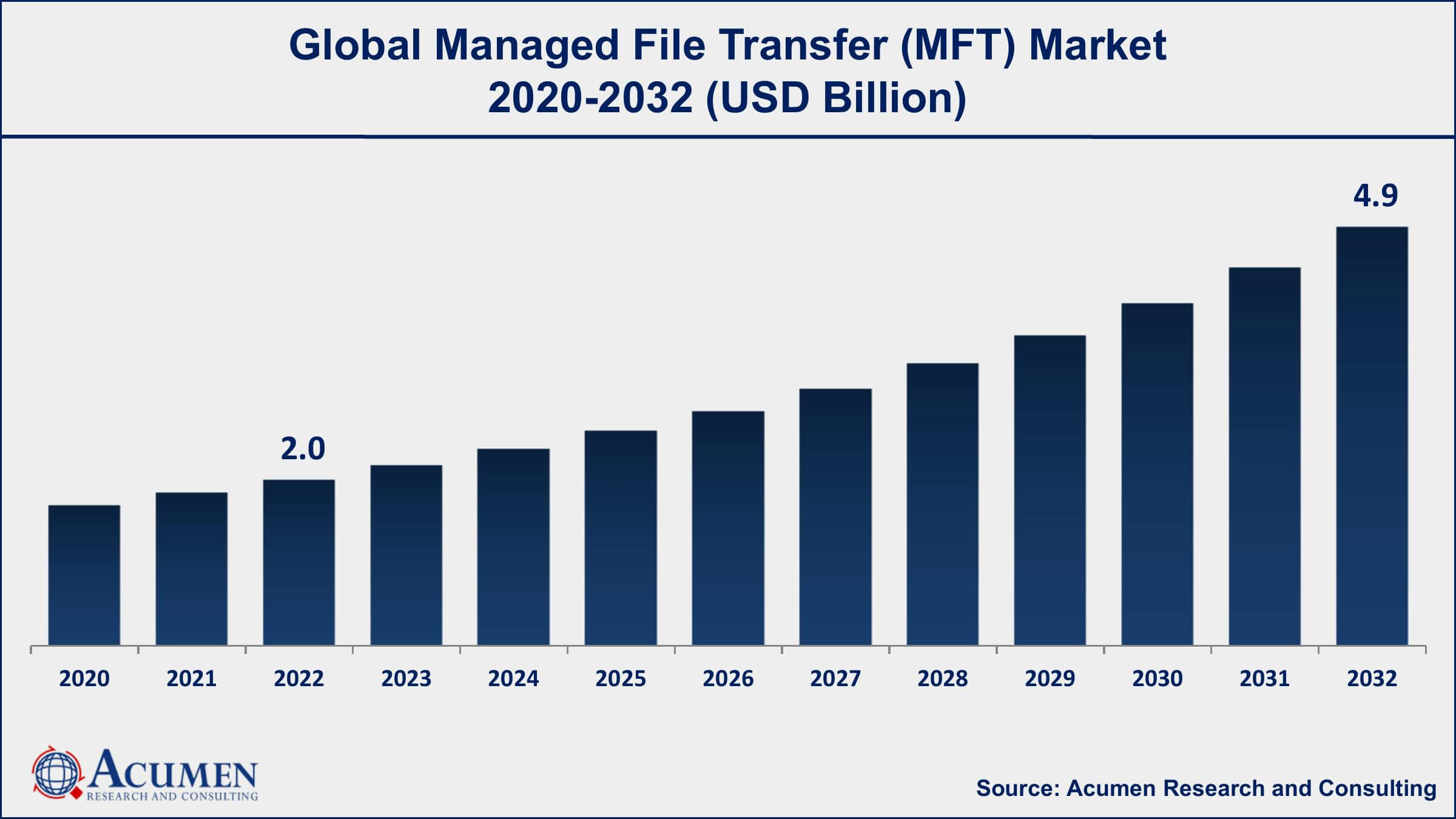

The Global Managed File Transfer (MFT) Market Size accounted for USD 2.0 Billion in 2022 and is projected to achieve a market size of USD 4.9 Billion by 2032 growing at a CAGR of 9.8% from 2023 to 2032.

Managed File Transfer Market Report Key Highlights

- Global managed file transfer market revenue is expected to increase by USD 4.9 Billion by 2032, with a 9.8% CAGR from 2023 to 2032

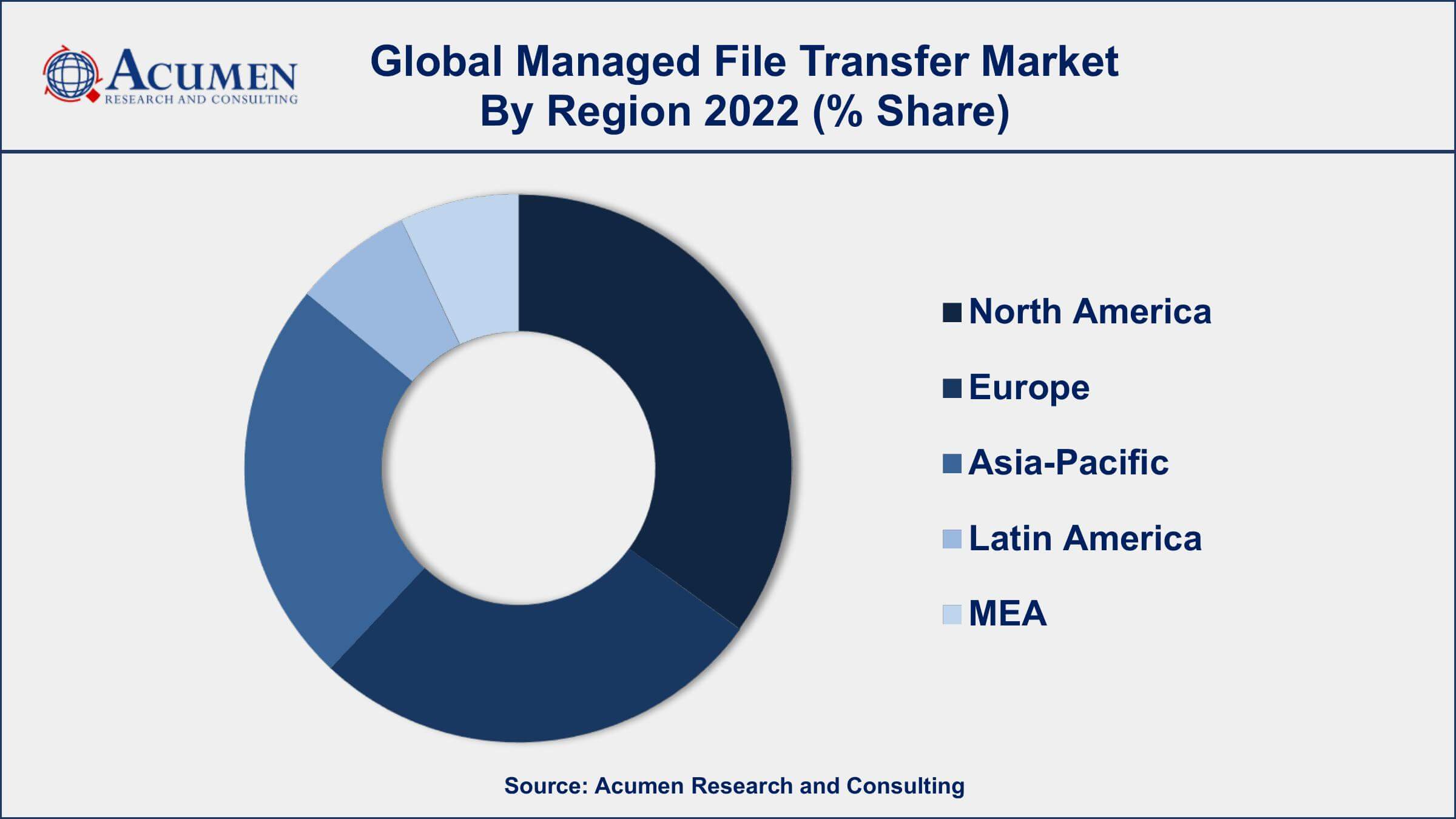

- North America region led with more than 35% of managed file transfer market share in 2022

- Asia-Pacific Managed File Transfer market growth will record a CAGR of over 10.4% from 2023 to 2032

- According to an Ipswitch report, 67% of firms use MFT to transfer sensitive or secret data.

- According to an IBM poll, data breaches and cyber-attacks are the top concerns for businesses when it comes to file sharing.

- According to a HelpSystems survey, the most prevalent MFT use cases are automated file transfers, ad hoc file transfers, and big file transfers.

- Growing need for secure and compliant file transfer solutions, drives the managed file transfer market size

Managed File Transfer (MFT) is a type of software solution that enables the secure and reliable transfer of data between different organizations, systems, and locations. MFT solutions facilitate the exchange of large files, data sets, and other sensitive information between trading partners, employees, and customers without compromising data integrity, confidentiality, and compliance with data privacy regulations. MFT solutions provide end-to-end visibility into file transfer processes, automate file transfer workflows, and ensure data encryption, authentication, and audibility. MFT solutions are used by enterprises in various industries, including finance, healthcare, retail, manufacturing, and government, to improve operational efficiency, reduce costs, mitigate risks, and enhance customer satisfaction.

The global MFT market has witnessed significant growth in recent years, driven by the increasing demand for secure and compliant file transfer solutions in the digital economy. The MFT market growth is fueled by various factors, such as the rising adoption of cloud-based MFT solutions, the need for end-to-end visibility and control over file transfer processes, the growing awareness of data privacy regulations, and the emergence of advanced technologies, such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain.

Global Managed File Transfer Market Trends

Market Drivers

- Growing need for secure and compliant file transfer solutions across various industries

- Rising adoption of cloud-based MFT solutions to support digital transformation initiatives

- Increasing awareness of data privacy regulations and the need for data governance and compliance

- Growing demand for end-to-end visibility and control over file transfer processes

- Emergence of advanced technologies, such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain

Market Restraints

- High implementation and maintenance costs of MFT solutions

- Complexities associated with integrating MFT solutions with existing IT infrastructure and applications

Market Opportunities

- Rising need for secure file transfer solutions in healthcare, finance, and government sectors

- Increasing popularity of Software-as-a-Service (SaaS) and cloud-based MFT solutions, which offer scalability and cost-effectiveness

Managed File Transfer Market Report Coverage

| Market | Managed File Transfer Market |

| Managed File Transfer Market Size 2022 | USD 2.0 Billion |

| Managed File Transfer Market Forecast 2032 | USD 4.9 Billion |

| Managed File Transfer Market CAGR During 2023 - 2032 | 9.8% |

| Managed File Transfer Market Analysis Period | 2020 - 2032 |

| Managed File Transfer Market Base Year | 2022 |

| Managed File Transfer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Organization Size, By Solution, By Deployment, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Accellion, Axway, BMC Software, Globalscape, IBM, Ipswitch, JSCAPE, Micro Focus, Progress Software, Seeburger, Software AG, and TIBCO. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The various aspects of globalization, mobilization, digitization, and virtualization are bringing about a transition in the manner of execution of various operations, communications, and functioning of enterprises. These changes are resulting in large data volumes, that are transferred across various organizations and surpass global boundaries. However, it is very critical to maintaining the safety of business data in the process of transfer across various digital paths thereby making it important for organizations to possess dependable file transfer mechanisms and solutions in place. The process of managed file transfer (MFT) has come across as a useful alternative to traditional file transfer methods such as e-mails and file transfer protocol (FTP).

Managed File Transfer Market Segmentation

The global managed file transfer market segmentation is based on organization size, solution, deployment, end-user industry, and geography.

Managed File Transfer Market By Organization Size

- Large Enterprises

- SMEs

According to our managed file transfer industry analysis, the large enterprise segment held the largest market share in 2022. Large enterprises typically use MFT solutions to streamline their file transfer processes, automate workflows, and ensure compliance with data privacy regulations. They also require MFT solutions to integrate with their existing IT infrastructure, such as Enterprise Resource Planning (ERP) systems, Customer Relationship Management (CRM) software, and Supply Chain Management (SCM) applications. Large enterprises have a higher budget and greater resources to invest in MFT solutions, making them a lucrative market for MFT vendors. These enterprises often require customized solutions to meet their specific needs, such as multi-tenant architecture, high availability, disaster recovery, and multi-factor authentication. MFT vendors that can provide such tailored solutions to large enterprises have a competitive advantage in the market.

Managed File Transfer Market By Solution

- Real-Time Monitoring and Control

- Automate Application Transfers

- Fast Partner Onboarding/Collaboration

- Other

In terms of solutions, the real-time monitoring and control segment is a crucial component of the Managed File Transfer (MFT) market. It allows organizations to keep a watchful eye on their file transfer processes and ensure that they are completed efficiently and without any issues. Real-time monitoring and control allow IT administrators to detect and address any problems that may arise during the transfer process, such as failed transfers, security breaches, or system errors. Real-time monitoring and control also provide organizations with greater visibility into their file transfer operations, enabling them to track performance metrics such as transfer speed, success rates, and file size. This information can be used to optimize the transfer process and improve overall efficiency. Additionally, real-time monitoring and control features often include automated alerts and notifications, enabling administrators to respond quickly to any issues and prevent potential problems from escalating.

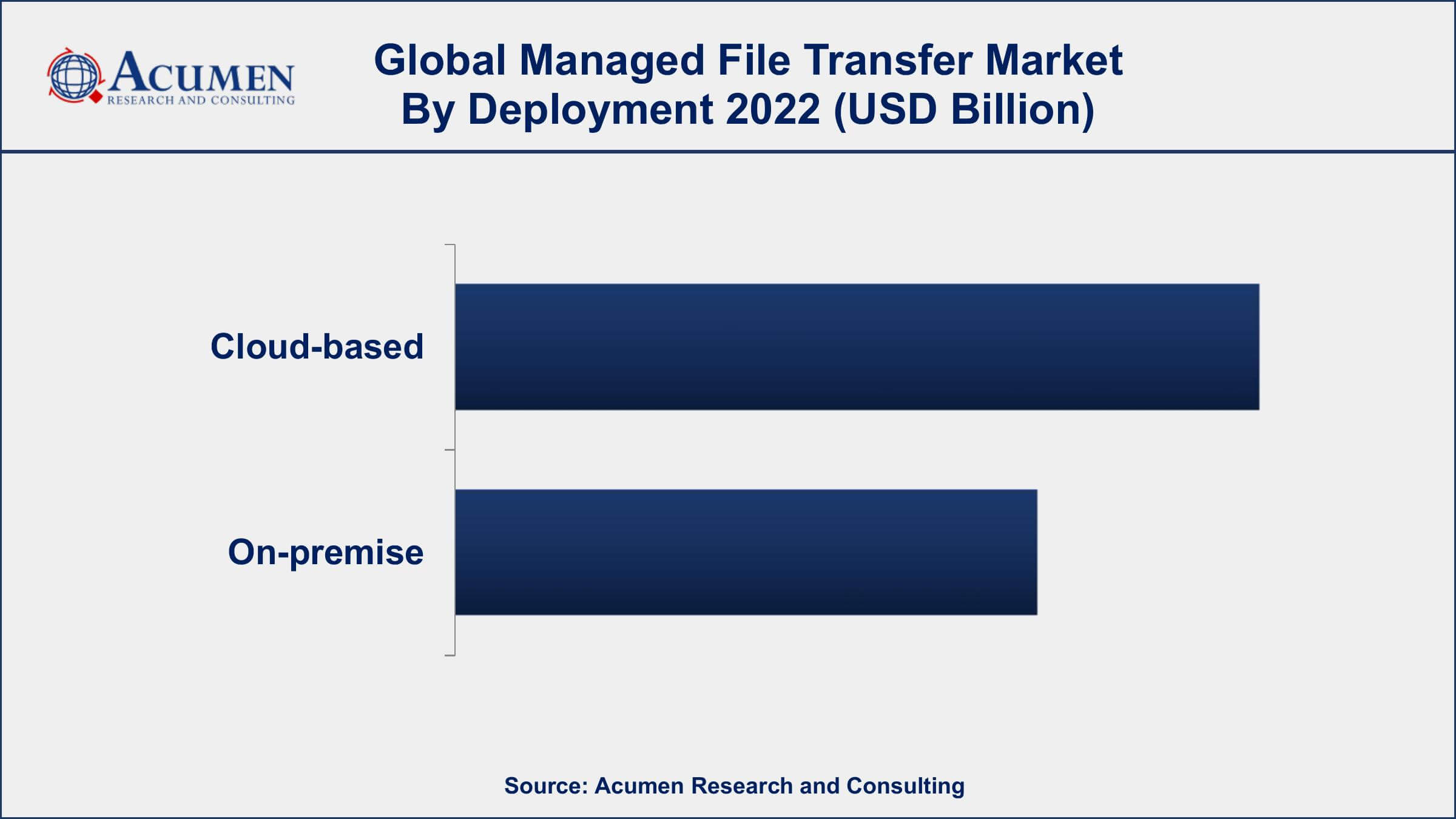

Managed File Transfer Market By Deployment

- Cloud-based

- On-premise

According to the managed file transfer market forecast, the cloud-based segment is expected to witness a considerable growth rate in the coming years. Cloud-based MFT solutions are delivered through a Software-as-a-Service (SaaS) model, which enables users to access MFT functionalities through a web browser, without the need for on-premises infrastructure. Cloud-based MFT solutions offer several advantages, including scalability, cost-effectiveness, flexibility, and ease of use. One of the key advantages of cloud-based MFT solutions is scalability. Organizations can easily scale their MFT solution up or down based on their changing business needs. This is particularly important for organizations with fluctuating file transfer requirements, such as retailers during holiday seasons or manufacturers during peak production periods. Cloud-based MFT solutions also offer cost-effectiveness by eliminating the need for on-premises hardware and software, which can reduce upfront costs and ongoing maintenance costs.

Managed File Transfer Market By End-user Industry

- IT & Telecommunication

- Retail

- BFSI

- Media & Entertainment

- Healthcare

- Other

In terms of the end-user industry, the BFSI segment dominates the managed file transfer market in 2022. This sector generates and handles a vast amount of sensitive data, including financial transactions, personal and account information, and other sensitive documents that need to be securely transferred within the organization and with external partners. MFT solutions offer a range of security features that are critical for the BFSI sector, including encryption, authentication, and access controls. These features ensure that data is securely transmitted and received, minimizing the risk of data breaches, compliance violations, and other security incidents. In addition to security features, MFT solutions also provide advanced automation capabilities that can help BFSI organizations streamline their file transfer operations.

Managed File Transfer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Managed File Transfer Market Regional Analysis

North America is the largest and most dominant region in the managed file transfer (MFT) market, with a significant market share. There are several factors that contribute to North America's dominance in the MFT market. Firstly, North America has a highly developed IT infrastructure, which has led to high adoption rates of MFT solutions. The region is home to many large enterprises with complex IT environments and data transfer requirements, which require robust and secure MFT solutions. The region's high level of technological sophistication and adoption of advanced technologies such as cloud computing, artificial intelligence, and big data analytics has further driven demand for MFT solutions.

Moreover, North America has a well-established regulatory environment that mandates compliance with data privacy and security regulations. This has increased the need for secure and compliant file transfer solutions, driving demand for MFT market share. North American organizations also face stringent regulations related to data sovereignty and cross-border data transfers, which has further driven the adoption of MFT solutions.

Managed File Transfer Market Player

Some of the top managed file transfer market companies offered in the professional report includes Accellion, Axway, BMC Software, Globalscape, IBM, Ipswitch, JSCAPE, Micro Focus, Progress Software, Seeburger, Software AG, and TIBCO.

Frequently Asked Questions

What was the market size of the global managed file transfer in 2022?

The market size of managed file transfer was USD 2.0 Billion in 2022.

What is the CAGR of the global managed file transfer market during forecast period of 2023 to 2032?

The CAGR of managed file transfer market is 9.8% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global managed file transfer market are Accellion, Axway, BMC Software, Globalscape, IBM, Ipswitch, JSCAPE, Micro Focus, Progress Software, Seeburger, Software AG, and TIBCO.

Which region held the dominating position in the global managed file transfer market?

North America held the dominating position in managed file transfer market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for managed file transfer market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global managed file transfer market?

The current trends and dynamics in the managed file transfer industry include the increasing awareness of data privacy regulations and the need for data governance and compliance.

Which organization size held the maximum share in 2022?

The large enterprises organization size held the maximum share of the managed file transfer market.