Maleic Anhydride Market | Acumen Research and Consulting

Maleic Anhydride Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

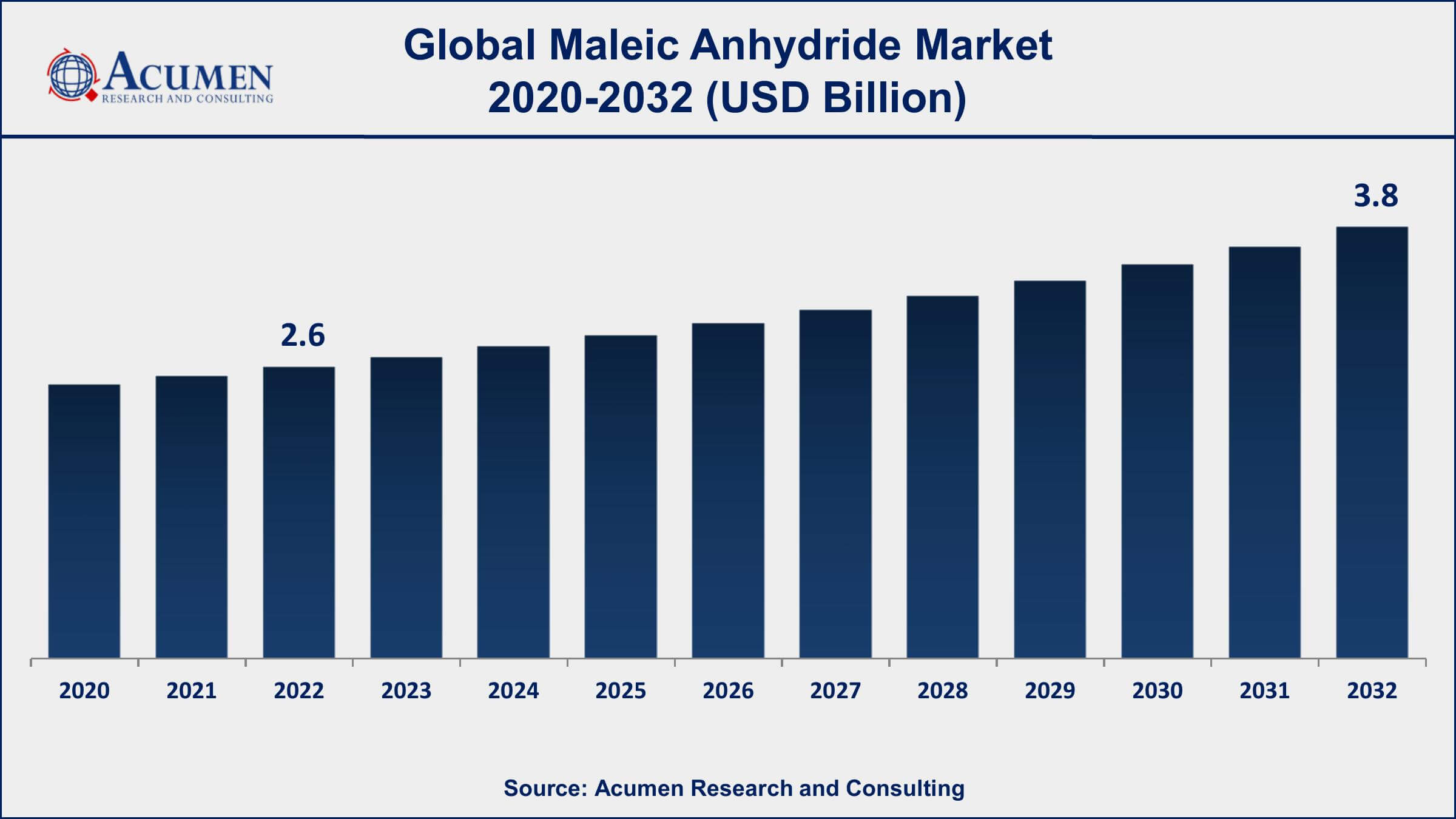

The Global Maleic Anhydride Market Size accounted for USD 2.6 Billion in 2022 and is projected to achieve a market size of USD 3.8 Billion by 2032 growing at a CAGR of 4.1% from 2023 to 2032.

Maleic Anhydride Market Report Key Highlights

- Global maleic anhydride market revenue is expected to increase by USD 3.8 Billion by 2032, with a 4.1% CAGR from 2023 to 2032

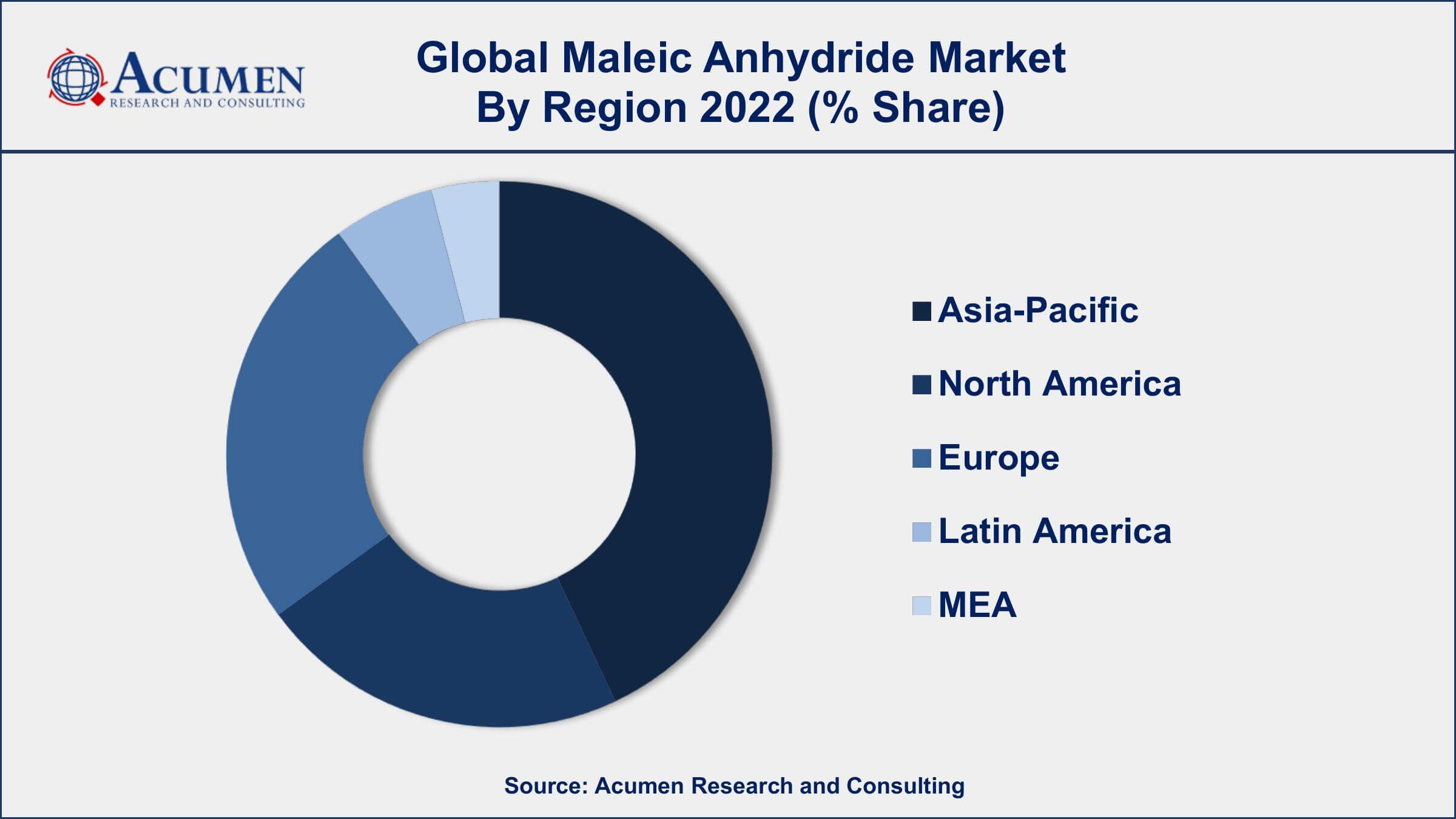

- Asia-Pacific region led with more than 43% of maleic anhydride market share in 2022

- The global consumption of maleic anhydride was around 3.3 million tons in 2020.

- Research is ongoing to find new applications for maleic anhydride, including in the production of adhesives, coatings, and pharmaceuticals

- By product type, the unsaturated polyester resin sub-segment generated around 40% share in 2022

- Increasing demand for high-quality, long-lasting, and sustainable infrastructure, drives the maleic anhydride market size

Maleic anhydride (MA) is an organic compound with the chemical formula C4H2O3. It is a colorless solid that is soluble in water and polar organic solvents. MA is widely used in the chemical industry as a raw material for the production of a wide range of products such as unsaturated polyester resins, alkyd resins, and lubricating oil additives. Additionally, it is used as a cross-linking agent for polymer modification, a coating and adhesive component, and a feedstock for the production of tetrahydrofuran, gamma-butyrolactone, and other chemicals.

One of the key drivers for the maleic anhydride market growth is its increasing use in the production of unsaturated polyester resins (UPRs). UPRs are widely used in the production of composites, which find application in a wide range of end-use industries such as automotive, aerospace, and construction. As the demand for lightweight and high-strength materials continues to rise, the demand for UPRs is also expected to increase, thereby driving the growth of the maleic anhydride market.

Global Maleic Anhydride Market Trends

Market Drivers

- Increasing demand for unsaturated polyester resins (UPR) in the construction and automotive industries

- Growing demand for lubricant additives in the automotive industry

- Rising demand for tetrahydrofuran (THF) in the production of spandex and polyurethane

- Increasing demand for gamma-butyrolactone (GBL) in pharmaceuticals, personal care products, and industrial applications

Market Restraints

- Volatility in the prices of raw materials used in the production of maleic anhydride

- Stringent regulations regarding the use of maleic anhydride in certain applications

Market Opportunities

- Development of new applications for maleic anhydride

- Growing demand for sustainable and eco-friendly materials

Maleic Anhydride Market Report Coverage

| Market | Maleic Anhydride Market |

| Maleic Anhydride Market Size 2022 | USD 2.6 Billion |

| Maleic Anhydride Market Forecast 2032 | USD 3.8 Billion |

| Maleic Anhydride Market CAGR During 2023 - 2032 | 4.1% |

| Maleic Anhydride Market Analysis Period | 2020 - 2032 |

| Maleic Anhydride Market Base Year | 2022 |

| Maleic Anhydride Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huntsman Corporation, Ashland Inc., Flint Hills Resources, LP, LANXESS Corporation, Mitsubishi Chemical Corporation, Thirumalai Chemicals Ltd., Nippon Shokubai Co., Ltd., Polynt SpA, Bartek Ingredients Inc., DSM NV, Zhejiang Jiangshan Chemical Co., Ltd., and Changzhou Yabang Chemical Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Maleic Anhydride is a colorless and white solid that is manufactured at a large scale for coatings and polymeric applications. It is produced by the vapor phase oxidation of butane and oxidation of benzene. This is the main reason why n-butane and benzene is the two prominent raw material used in the production of maleic anhydride. It is a versatile chemical intermediate used in the preparation of a range of chemicals. Maleic anhydride is an acid anhydride of maleic acid colorless organic compounds in a large number of industrial chemicals. Some of the known applications of the maleic anhydride include construction, automotive, food & beverages, textile, pharmaceuticals, personal care, agriculture, and others

The global maleic anhydride market value is gradually moving towards its saturation phase in its industry life cycle. Some of the factors contributing to the overall growth of this global maleic anhydride market include the rising production of some of the industrial chemicals such as malic or maleic acid, UPRs, lubricating oil additives, alkenyl succinic anhydrides, and fumaric acid. This is a due large demand for these chemicals to cater to the demand for end products in various industries. Moreover, maleic anhydride is an excellent cross-linking agent and conjunction agent which made him highly favorable in polymer applications.

The growth of this market is highly driven by expanding coating and polymer industries due to the high demand for BDO and UPR (unsaturated polyester resin). Maleic anhydride is used in the production of lubricants for smooth-functioning automotive parts. Hence, the flourishing automotive sector is further driving the demand for maleic anhydride. Lubricants are not only used in automotive production but during the life cycle of the vehicle which is expected to drive overall market growth during the forecast period. Rising demand for unsaturated polyester resin in construction activities due to its application-specific nature.

However, driven by these factors the growth of this market is restrained by the strict environmental regulations pertinent environments. Maleic anhydride products have adverse effects on the environment and rising awareness among consumers can be led to its lower adoption by restraining the overall market growth. Nevertheless, technological advancement is expected to come up with new product formulations and offer new growth opportunities to this market during the forecast period.

Maleic Anhydride Market Segmentation

The global maleic anhydride market segmentation is based on product type, end-user industry, and geography.

Maleic Anhydride Market By Product Type

- Unsaturated Polyester Resin

- Lubricant Additives

- 1,4-Butanediol

- Malic Acid

- Surfactants and Plasticizers

- Maleic Anhydride Copolymers

- Alkyl Succinic Anhydrides

- Furmaric Acid

- Other

According to a maleic anhydride industry analysis, the unsaturated polyester resin (UPR) segment accounted for a significant share of the maleic anhydride market, and its demand is expected to continue to grow in the coming years. The increasing demand for lightweight materials in the automotive and aerospace industries is driving the growth of the UPR segment. MA-based UPRs are used in the production of lightweight composites, which are increasingly being used in the manufacturing of automotive parts, such as bumpers, hoods, and doors, to improve fuel efficiency and reduce emissions. Furthermore, the growing construction industry is also driving the demand for UPRs. MA-based UPRs are used in the production of building materials such as roofing sheets, pipes, and tanks. The increasing demand for sustainable and eco-friendly materials in the construction industry is expected to further fuel the demand for MA-based UPRs.

Maleic Anhydride Market By End-user Industry

- Construction

- Pharmaceuticals

- Electronics

- Oil Products

- Food and Beverage

- Personal Care

- Automobile

- Agriculture

According to the maleic anhydride market forecast, the automobile segment is expected to continue to be a significant end-user of MA in the coming years. This growth is driven by the increasing demand for lightweight materials in the automotive industry to improve fuel efficiency and reduce emissions. Additionally, the growing demand for sustainable and eco-friendly materials in the automotive industry is expected to further fuel the demand for MA-based products. MA-based coatings are also used in the automotive industry to improve the durability and aesthetic appeal of vehicles. The growing demand for eco-friendly coatings in the automotive industry is expected to further fuel the demand for MA-based coatings.

Maleic Anhydride Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Maleic Anhydride Market Regional Analysis

The Asia-Pacific region dominates the maleic anhydride market due to several factors, including the presence of a large number of manufacturers, growing industrialization, and increasing demand from various end-use industries. The region is home to some of the largest producers of maleic anhydride, including China, Japan, and South Korea. These countries have a significant capacity for the production of maleic anhydride, and their proximity to major end-use markets in the region helps to reduce transportation costs and improve supply chain efficiency.

Furthermore, the Asia-Pacific region is witnessing rapid industrialization and urbanization, which is driving the demand for maleic anhydride in various end-use industries, such as construction, automotive, and electronics. The increasing demand for lightweight materials in the automotive and aerospace industries is also driving the maleic anhydride market growth in the region. In addition, the region has a large and growing population, which is driving the demand for consumer goods such as personal care products, adhesives, and coatings, all of which use maleic anhydride as a key raw material.

Maleic Anhydride Market Player

Some of the top maleic anhydride market companies offered in the professional report includes Huntsman Corporation, Ashland Inc., Flint Hills Resources, LP, LANXESS Corporation, Mitsubishi Chemical Corporation, Thirumalai Chemicals Ltd., Nippon Shokubai Co., Ltd., Polynt SpA, Bartek Ingredients Inc., DSM NV, Zhejiang Jiangshan Chemical Co., Ltd., and Changzhou Yabang Chemical Co., Ltd.

Frequently Asked Questions

What was the market size of the global maleic anhydride in 2022?

The market size of maleic anhydride was USD 3.8 Billion in 2022.

What is the CAGR of the global maleic anhydride market during forecast period of 2023 to 2032?

The CAGR of maleic anhydride market is 4.1% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global maleic anhydride market are Huntsman Corporation, Ashland Inc., Flint Hills Resources, LP, LANXESS Corporation, Mitsubishi Chemical Corporation, Thirumalai Chemicals Ltd., Nippon Shokubai Co., Ltd., Polynt SpA, Bartek Ingredients Inc., DSM NV, Zhejiang Jiangshan Chemical Co., Ltd., and Changzhou Yabang Chemical Co., Ltd.

Which region held the dominating position in the global maleic anhydride market?

Asia-Pacific held the dominating position in maleic anhydride market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for maleic anhydride market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global maleic anhydride market?

The current trends and dynamics in the maleic anhydride industry include the growing demand for high-performance asphalt in road construction and maintenance activities.

Which product type held the maximum share in 2022?

The unsaturated polyester resin product type held the maximum share of the maleic anhydride market.