Malaria Diagnostics Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Malaria Diagnostics Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

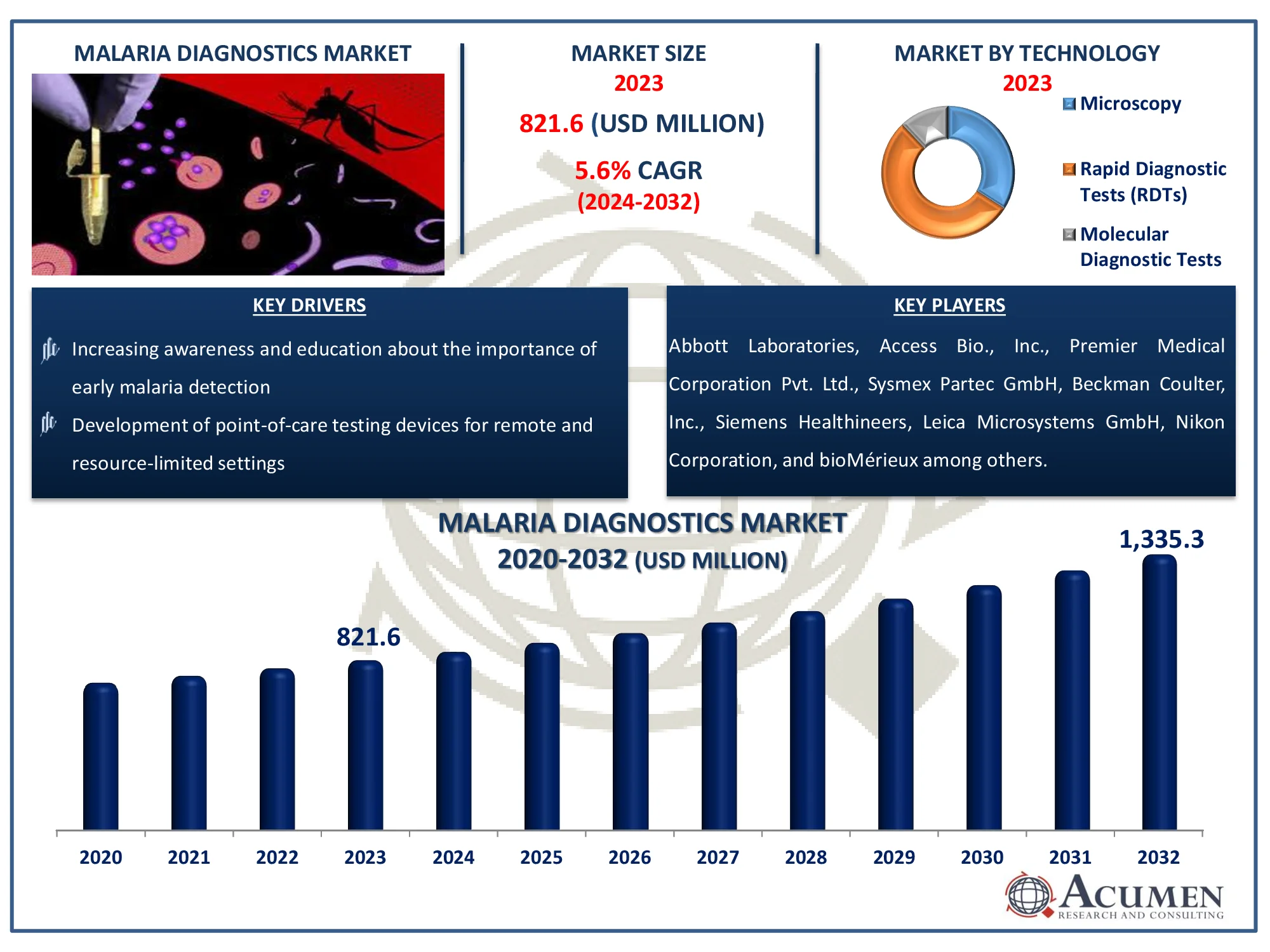

The Global Malaria Diagnostics Market Size accounted for USD 821.6 Million in 2022 and is estimated to achieve a market size of USD 1,335.3 Million by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Malaria Diagnostics Market Highlights

- Global malaria diagnostics market revenue is poised to garner USD 1,335.3 million by 2032 at CAGR of 5.6% from 2023 to 2032

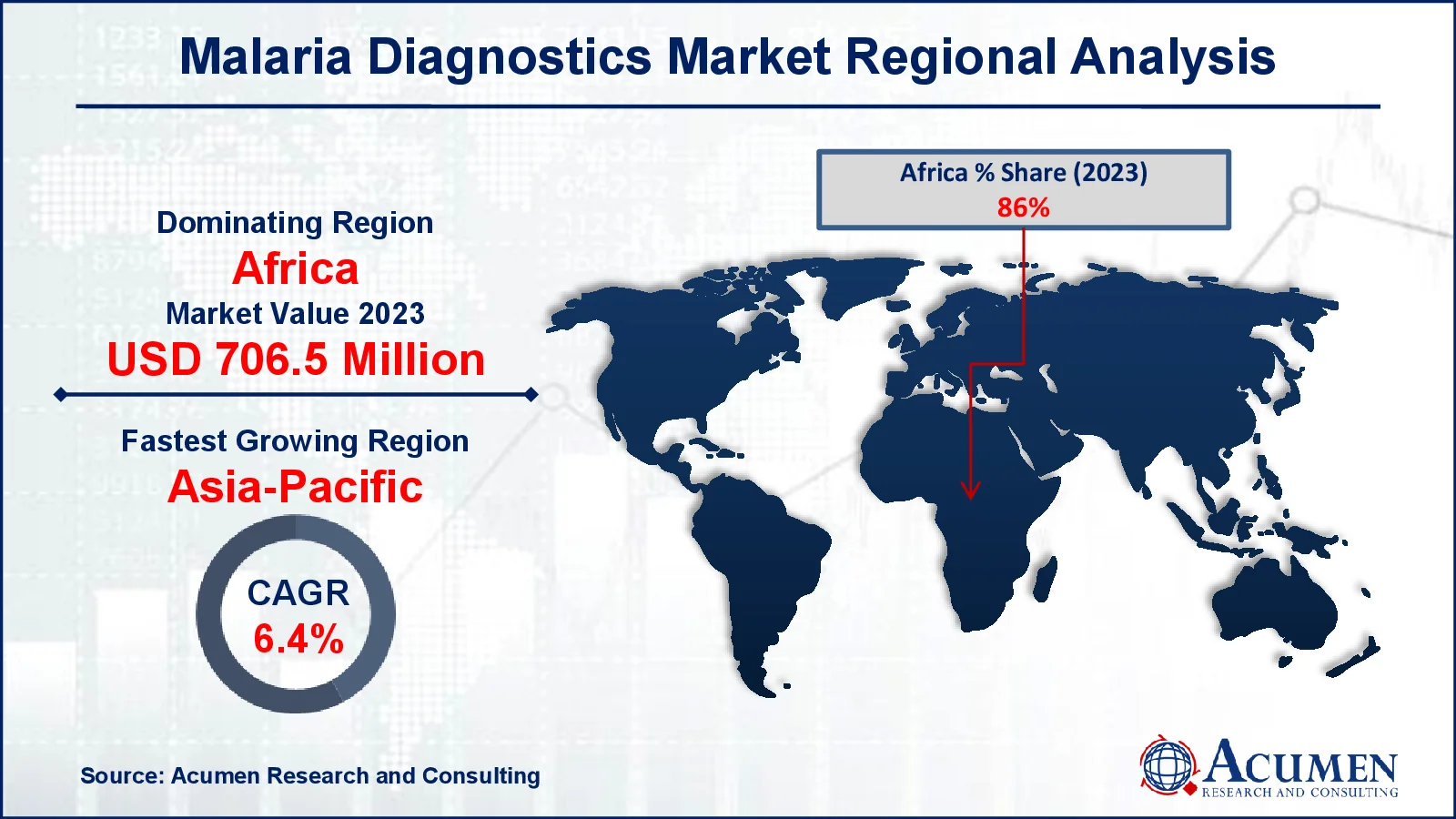

- Africa malaria diagnostics market value occupied around USD 706.5 million in 2022

- Asia-Pacific malaria diagnostics market growth will record a CAGR of more than 6.4% from 2023 to 2032

- Among technology, the rapid diagnostic tests (RDTs) sub-segment generated more than USD 443.7 billion revenue in 2022

- Based on end-use, the clinics sub-segment generated around 43% market share in 2022

- Rising demand for innovative diagnostic solutions. is a popular malaria diagnostics market trend that fuels the industry demand

Malaria is caused by plasmodium parasites, which are transmitted by female Anopheles mosquitoes. Diagnosis of malaria involves microscopy and blood testing. In 2012, the World Health Organization (WHO) estimated 203 million cases of malaria, resulting in an estimated 627,000 fatalities. There were 33 million instances of malaria, respectively. Accurate and early diagnosis of malaria is essential because patients recover quickly when early therapy is initiated, leading to increased investment in diagnostic methods. This has spurred technological advancements in developing rapid diagnostic testing, driving the growth of this market. Challenges facing this market include expediting the recognition and use of diagnostic tests in malaria diagnosis. The WHO has updated its Malaria Guidelines, recommending testing for all suspected cases of malaria. Global initiatives by partners aim to provide universal access to diagnostic kits.

Global Malaria Diagnostics Market Dynamics

Market Drivers

- Breakthroughs in molecular diagnostic technologies

- Rising support from governments and NGOs for malaria eradication programs

- Increasing awareness and education about the importance of early malaria detection

- Development of point-of-care testing devices for remote and resource-limited settings

Market Restraints

- Limited healthcare infrastructure in some regions

- Variability in malaria strains impacting test accuracy

- Challenges in expediting recognition and use of diagnostic tests

Market Opportunities

- Collaborative efforts to enhance diagnostic capabilities

- Expansion of healthcare infrastructure in developing regions

- Integration of diagnostic tools into telemedicine and remote healthcare services

Malaria Diagnostics Market Report Coverage

| Market | Malaria Diagnostics Market |

| Malaria Diagnostics Market Size 2022 |

USD 821.6 Million |

| Malaria Diagnostics Market Forecast 2032 | USD 1,335.3 Million |

| Malaria Diagnostics Market CAGR During 2023 - 2032 | 5.6% |

| Malaria Diagnostics Market Analysis Period | 2020 - 2032 |

| Malaria Diagnostics Market Base Year |

2022 |

| Malaria Diagnostics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technology, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Access Bio., Inc., Premier Medical Corporation Pvt. Ltd., Sysmex Partec GmbH, Beckman Coulter, Inc., Siemens Healthineers, Leica Microsystems GmbH, Nikon Corporation, bioMérieux, Olympus Corporation, Bio-Rad Laboratories, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Malaria Diagnostics Market Insights

Advanced technology has revolutionized the diagnosis of malaria, making it highly sought after. Successful detection of malaria parasite antigens has been achieved through these advancements. The demand for malaria diagnostics is expected to rise due to increased public financing in the healthcare industry and investments in research and development of new therapies. Common methods used for malaria detection include the QBC method, peripheral blood smears, and serological tests. Additionally, commonly used medications for malaria therapy include atovaquone-proguanil (Malarone), artemether-lumefantrine (Coartem), clindamycin, and quinidine. Factors impacting demand in these drug classes are also evaluated. The study also assesses the potential impact on the global malaria diagnostics industry due to the impending patent expiry of blockbuster drugs. However, technological issues with some frequently used diagnostic techniques could potentially limit market development.

The market is driven by an increased demand for malaria diagnostics and the development of new diagnostic methods. Malaria poses one of the largest lifelong threats, typically occurring in tropical and subtropical regions due to changing climates, low economic growth, underdeveloped health infrastructure, and a lack of access to advanced therapies.

According to the 2017 World Health Organization (WHO) report, over 435,000 people died from the tropical disease caused by infections from female Anopheles mosquitoes carrying Plasmodium species worldwide. Data from the same source indicate that over 219 million malaria cases were recorded globally, with over 92% occurring in Africa, 6% in Southeast Asia, and 2% in the Eastern Mediterranean. The increasing incidence of the disease is expected to drive market growth over the malaria diagnostics industry forecast period.

In many African, Asian, and Latin American countries such as Uganda, the Democratic Republic of Congo, Colombia, Peru, and India, malaria is a major cause of death. Malaria can result in low birth weight, stillbirths, and congenital infections during pregnancy. Technological advancement is also anticipated to be a significant market driver. Increasing demand for high-quality and cost-effective diagnostic techniques can improve access to diagnostics, particularly in remote areas. Heavy investments by governments and private investors to reduce disease incidence are also key drivers of the economy. According to WHO data, in 2017, private global investors and government authorities invested around USD 3.1 billion in endemic countries to control and eliminate this disease. Globally, over 312 million rapid tests were conducted, with most of them in WHO Africa, the worst-affected region.

Malaria Diagnostics Market Segmentation

The worldwide market for malaria diagnostics is split based on product, technology end-use, and geography.

Malaria Diagnostics Products

- Instruments

- Kits & reagents

According to malaria diagnostics industry analysis, kits and reagents are predicted to be the most important category. This is largely owing to their critical role in the accurate and quick diagnosis of malaria. Kits and reagents include a wide range of goods, including fast diagnostic test kits and other reagents used in laboratory-based testing procedures such as microscopy and molecular diagnostics. As worldwide demand for malaria diagnostics grows, particularly in disease-endemic countries, the need for cost-effective and easily accessible diagnostic technologies becomes increasingly important. Kits and reagents are a popular choice among healthcare practitioners and laboratories because to their convenience and affordability, making them a prominent category in the malaria diagnostics market. Furthermore, technological developments and the introduction of novel diagnostic devices within this area will help to drive its expected expansion.

Malaria Diagnostics Technology

- Microscopy

- Rapid Diagnostic Tests (RDTs)

- Molecular Diagnostic Tests

- Conventional PCR

- Real-Time PCR (qPCR)

Rapid diagnostic tests (RDTs) dominate the malaria diagnostics industry because of its simplicity, speed, and accessibility. They provide rapid and straightforward detection of malaria antigens, making them ideal for application in resource-constrained environments where complex equipment and competent staff may be scarce. Microscopy stands as the second-largest segment in the malaria diagnostics market, owing to its status as one of the most traditional and reliable disease diagnostic techniques. According to estimates by the World Health Organization (WHO), over 204 million microscopic malarial tests are conducted worldwide. This technique allows for the identification of malaria parasites in various stages of their life cycle, including P. falciparum, P. ovale, P. malariae, and P. vivax. Moreover, it enables the quantification of parasite density, enhancing its diagnostic utility. However, the most rapid development in the forecast period is expected in the molecular test section, which includes standard PCR and quantitative or real-time (qPCR) polymerase chain reaction. These molecular tests offer precise diagnosis, particularly valuable for identifying low parasite levels and mixed infections. Despite their exactness and sensitivity, the market share of molecular tests remains less significant due to their high costs and the requirement for dedicated laboratories and qualified personnel.

Malaria Diagnostics End-Uses

- Clinics

- Hospitals

- Diagnostic Centers

According to the malaria diagnostics market analysis, in the ever-changing landscape of the industry, the clinics sector emerges as the clear leader, holding enormous influence and commanding attention. Clinics are critical centers of healthcare accessibility, frequently functioning as the initial point of contact for those seeking medical attention. Their strategic deployment inside communities enables rapid and effective detection of malaria cases, providing prompt intervention and treatment. Furthermore, clinics provide a personalized and patient-centered approach, which fosters trust and dependability among individuals. Clinics, with their emphasis on accessibility, convenience, and quality treatment, represent the cutting edge of the malaria diagnostics industry, empowering communities and creating good health outcomes.

Malaria Diagnostics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Malaria Diagnostics Market Regional Analysis

Africa is likely to dominate the market due to its high illness burden. The most common malaria parasite in the region, P. falciparum, is estimated to account for 99% of all malaria cases in Africa. Approximately 92% of worldwide malaria cases and 93% of global malaria fatalities are registered in Africa, highlighting the increasing malaria prevalence in the continent. The Southeast Asian market is projected to hold the second-largest share and it is expected to increase over the malaria diagnostics market forecast period. In India, microscopy tests are the primary method for diagnosing diseases in terms of quantity. As awareness of malaria grows and private sector financing increases, the need for diagnostic control and surveillance systems is expected to rise, thereby driving market growth.

Malaria Diagnostics Market Players

Some of the top malaria diagnostics companies offered in our report includes Abbott Laboratories, Access Bio., Inc., Premier Medical Corporation Pvt. Ltd., Sysmex Partec GmbH, Beckman Coulter, Inc., Siemens Healthineers, Leica Microsystems GmbH, Nikon Corporation, bioMérieux, Olympus Corporation, and Bio-Rad Laboratories, Inc.

Frequently Asked Questions

How big is the malaria diagnostics market?

The malaria diagnostics market size was valued at USD 821.6 million in 2022.

What is the CAGR of the global malaria diagnostics market from 2023 to 2032?

The CAGR of malaria diagnostics is 5.6% during the analysis period of 2023 to 2032.

Which are the key players in the malaria diagnostics market?

The key players operating in the global market are including Abbott Laboratories, Access Bio., Inc., Premier Medical Corporation Pvt. Ltd., Sysmex Partec GmbH, Beckman Coulter, Inc., Siemens Healthineers, Leica Microsystems GmbH, Nikon Corporation, bioMérieux, Olympus Corporation, and Bio-Rad Laboratories, Inc.

Which region dominated the global malaria diagnostics market share?

Africa held the dominating position in malaria diagnostics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of malaria diagnostics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global malaria diagnostics industry?

The current trends and dynamics in the malaria diagnostics industry include breakthroughs in molecular diagnostic technologies, increasing awareness and education about the importance of early malaria detection, rising support from governments and NGOs for malaria eradication programs, and development of point-of-care testing devices for remote and resource-limited settings.

Which the technologies of malaria diagnostics market?

The clinics end use held the maximum share of the malaria diagnostics industry.