LPG Tanker Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

LPG Tanker Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

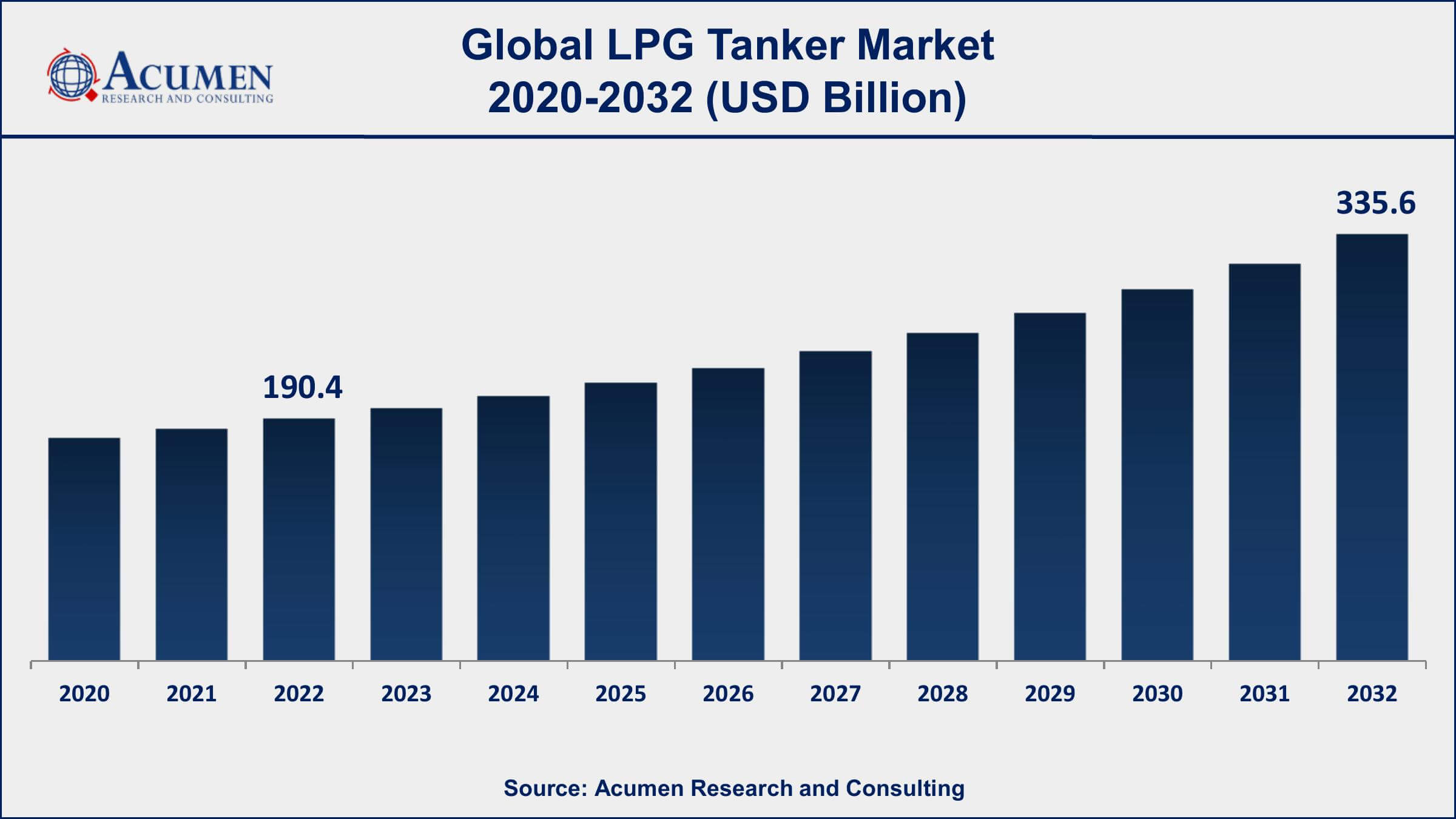

The Global LPG Tanker Market Size accounted for USD 190.4 Billion in 2022 and is projected to achieve a market size of USD 335.6 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

LPG Tanker Market Report Key Highlights

- Global LPG Tanker market revenue is expected to increase by USD 335.6 Billion by 2032, with a 5.4% CAGR from 2023 to 2032

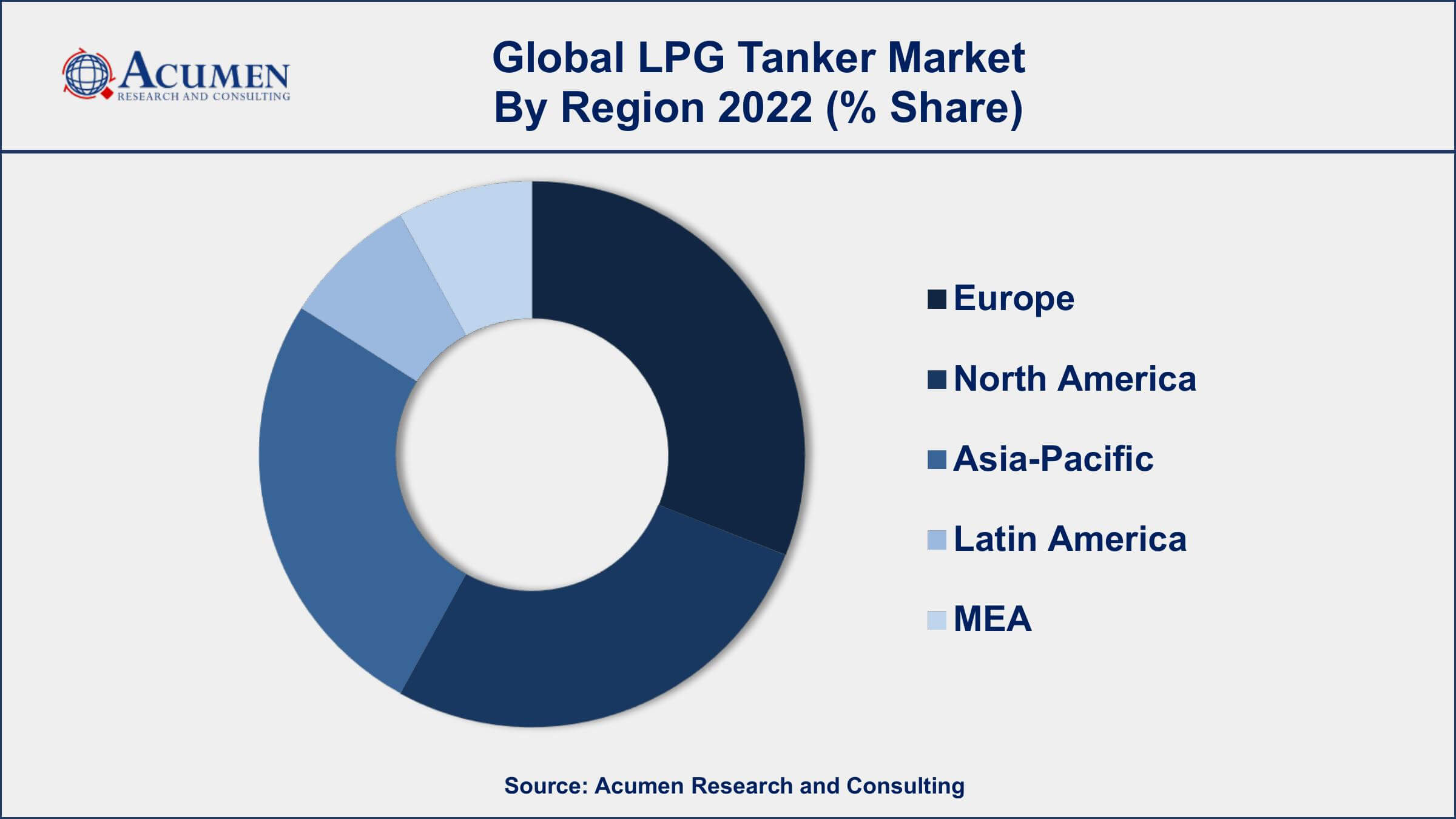

- Europe region led with more than 29% of LPG Tanker market share in 2022

- According to the International Energy Agency (IEA), LPG use was 295 million tons in 2019 and is expected to reach 406 million tons by 2040.

- According to GIIGNL, there were 1,178 LPG carriers in the global fleet as of January 1, 2021.

- According to Lloyd's List Intelligence, the top three LPG tanker operators by fleet size in January 2022 were BW LPG, Avance Gas, and Dorian LPG. BW LPG had the largest fleet, with 55 vessels and a combined capacity of around 4.2 million cubic meters.

- According to the World LPG Association (WLPGA), there are over 100,000 LPG-powered vehicles worldwide, with the largest fleets in Turkey, Poland, and Italy.

- Adoption of LPG as an alternative fuel for transportation, drives the LPG Tanker market size

LPG Tankers are vessels used to transport liquefied petroleum gas (LPG), a by-product of natural gas processing and crude oil refining. These tankers are designed to carry large quantities of LPG safely and efficiently across oceans, seas, and rivers. The market for LPG Tankers has seen significant growth over the years, driven by a variety of factors such as increasing demand for cleaner-burning fuels, growth in the petrochemical industry, and a rise in domestic LPG consumption.

One of the key drivers of the LPG Tanker market is the growing demand for cleaner-burning fuels. LPG is widely regarded as a cleaner alternative to traditional fossil fuels, with lower greenhouse gas emissions and fewer harmful particulates. This has led to an increase in the use of LPG for both residential and commercial applications, and subsequently a rise in demand for LPG transportation. The growing petrochemical industry has also contributed to the increase in demand for LPG Tankers, as LPG is a key feedstock for the production of a wide range of chemicals and plastics.

Global LPG Tanker Market Trends

Market Drivers

- Increasing demand for cleaner-burning fuels

- Growth in the petrochemical industry

- Rising domestic LPG consumption

- Expansion of LPG infrastructure

- Favorable government regulations and policies

Market Restraints

- Stringent environmental regulations

- Volatility in LPG prices

Market Opportunities

- Adoption of LPG as an alternative fuel for transportation

- Expansion of LPG distribution networks

LPG Tanker Market Report Coverage

| Market | LPG Tanker Market |

| LPG Tanker Market Size 2022 | USD 190.4 Billion |

| LPG Tanker Market Forecast 2032 | USD 335.6 Billion |

| LPG Tanker Market CAGR During 2023 - 2032 | 5.4% |

| LPG Tanker Market Analysis Period | 2020 - 2032 |

| LPG Tanker Market Base Year | 2022 |

| LPG Tanker Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Refrigeration & Pressurization, By Vessel Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BW LPG Limited, Exmar NV, Hyundai Heavy Industries Co., Ltd., Kawasaki Heavy Industries, Ltd., Mitsui O.S.K. Lines, Ltd. (MOL), Navigator Gas LLC, Nippon Yusen Kabushiki Kaisha (NYK Line), Pacific Gas Limited, Petredec Limited, Reliance Industries Limited, Scorpio Tankers Inc., and Yara International ASA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The high rate of production of shale gas in some parts of the world will act as a high-impact driver for the growth of the LPG tanker market value. This market is expected to grow at a rapid pace. Due to the high production rate of shale gas, there has been an unprecedented rise in LPG trade. Also, there is a high demand for LPG for cooking and HVAC applications, thereby fueling the demand for safe transportation and storage of LPG. In general, there has been an increase in the activities related to energy commodities across the globe, thereby driving the growth of this market. Thus, the demand for LPG tankers is expected to rise at a high pace. A number of LPG carriers and tanker firms have initiated or completed the expansion of their capacities.

Factors such as the rise in international gas trade, increased shale gas production from untapped reserves, and continued usage of LPG as a cooking fuel are boosting the LPG tankers market growth. The volatility in crude oil prices has also driven the industry towards extracting oil and shale gas. This has been carried out on a large scale owing to the technological improvements in excavating practices. There has been an upsurge in shale gas amount being transported from the U.S. to other regions such as Asia-Pacific and North Africa. High demand for LPG for cooking is fuelling the growth of this market further. Transportation costs have been reduced owing to the decline in oil prices, and as a result, the market for LPG transportation is catching momentum. However, the unpredictable behavior of crude oil prices has led to the high prices of LPG, thereby hampering the demand to some extent.

LPG Tanker Market Segmentation

The global LPG tanker market segmentation is based on refrigeration & pressurization, vessel size, and geography.

LPG Tanker Market By Refrigeration & Pressurization

- Ethylene

- Semi Refrigerated

- Full Refrigerated

- Full Pressurized

According to an LPG tanker industry analysis, the full pressurized segment accounted for a significant share of the market, and its demand is expected to continue to grow in the coming years. This growth is driven by factors such as increasing domestic consumption of LPG, expansion of LPG distribution networks, and favorable government regulations. Additionally, full pressurized LPG Tankers are often more cost-effective than other types of LPG Tankers, as they require less insulation and other safety features due to the constant pressure and temperature at which the gas is stored. These tankers are designed to carry LPG in a fully pressurized state, where the gas is kept at constant high pressure and temperature to maintain its liquid state. Full pressurized LPG Tankers are often used for transporting LPG over shorter distances, typically within a region or country, as they have a smaller storage capacity than other types of LPG Tankers.

LPG Tanker Market By Vessel Size

- Small Gas Carriers (SGC)

- Medium Gas Carriers (MGC)

- Large Gas Carriers (LGC)

- Very Large Gas Carriers (VLGC)

According to the LPG tanker market forecast, the very large gas carriers segment is expected to grow significantly in the coming years. Very large gas carriers (VLGCs) are a type of LPG Tanker designed to transport large quantities of LPG across long distances, typically between different regions or countries. VLGCs have a storage capacity of between 50,000 and 85,000 cubic meters, making them one of the largest types of LPG Tankers in the market. The VLGC segment of the LPG Tanker market has seen significant growth in recent years, driven by factors such as increasing global demand for LPG, growth in the petrochemical industry, and rising domestic consumption of LPG in developing countries. Additionally, VLGCs are often more cost-effective than smaller LPG Tankers, as they can transport larger quantities of LPG at once, leading to economies of scale.

LPG Tanker Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

LPG Tanker Market Regional Analysis

Europe is currently dominating the LPG tanker market due to a number of factors. Firstly, Europe has a well-established LPG infrastructure, including storage facilities, distribution networks, and import and export terminals, which makes it an attractive market for LPG tanker operators. In addition, there is a high demand for LPG in Europe, particularly for use in heating and cooking, which has driven growth in the LPG tanker market in the region. Another factor contributing to Europe's dominance in the LPG tanker market is its strategic location between major LPG producers in the Middle East and major LPG consumers in Asia. Europe serves as a key transit hub for LPG shipments, enabling LPG tanker operators to transport LPG from the Middle East to Asia via European ports. This has led to the development of large LPG import and export terminals in Europe, which have further fueled growth in the LPG tanker market in the region.

LPG Tanker Market Player

Some of the top LPG tanker market companies offered in the professional report includes BW LPG Limited, Exmar NV, Hyundai Heavy Industries Co., Ltd., Kawasaki Heavy Industries, Ltd., Mitsui O.S.K. Lines, Ltd. (MOL), Navigator Gas LLC, Nippon Yusen Kabushiki Kaisha (NYK Line), Pacific Gas Limited, Petredec Limited, Reliance Industries Limited, Scorpio Tankers Inc., and Yara International ASA.

Frequently Asked Questions

What was the market size of the global LPG tanker in 2022?

The market size of LPG tanker was USD 190.4 Billion in 2022.

What is the CAGR of the global LPG tanker market during forecast period of 2023 to 2032?

The CAGR of LPG tanker market is 5.4% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global LPG tanker market are BW LPG Limited, Exmar NV, Hyundai Heavy Industries Co., Ltd., Kawasaki Heavy Industries, Ltd., Mitsui O.S.K. Lines, Ltd. (MOL), Navigator Gas LLC, Nippon Yusen Kabushiki Kaisha (NYK Line), Pacific Gas Limited, Petredec Limited, Reliance Industries Limited, Scorpio Tankers Inc., and Yara International ASA.

Which region held the dominating position in the global LPG tanker market?

Europe held the dominating position in LPG tanker market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

North America region exhibited fastest growing CAGR for LPG tanker market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global LPG tanker market?

The current trends and dynamics in the LPG tanker industry include the increasing demand for cleaner-burning fuels, and growth in the petrochemical industry.

Which refrigeration & pressurization segment held the maximum share in 2022?

The full pressurized refrigeration & pressurization held the maximum share of the LPG tanker market.