Logistics Robotics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Logistics Robotics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

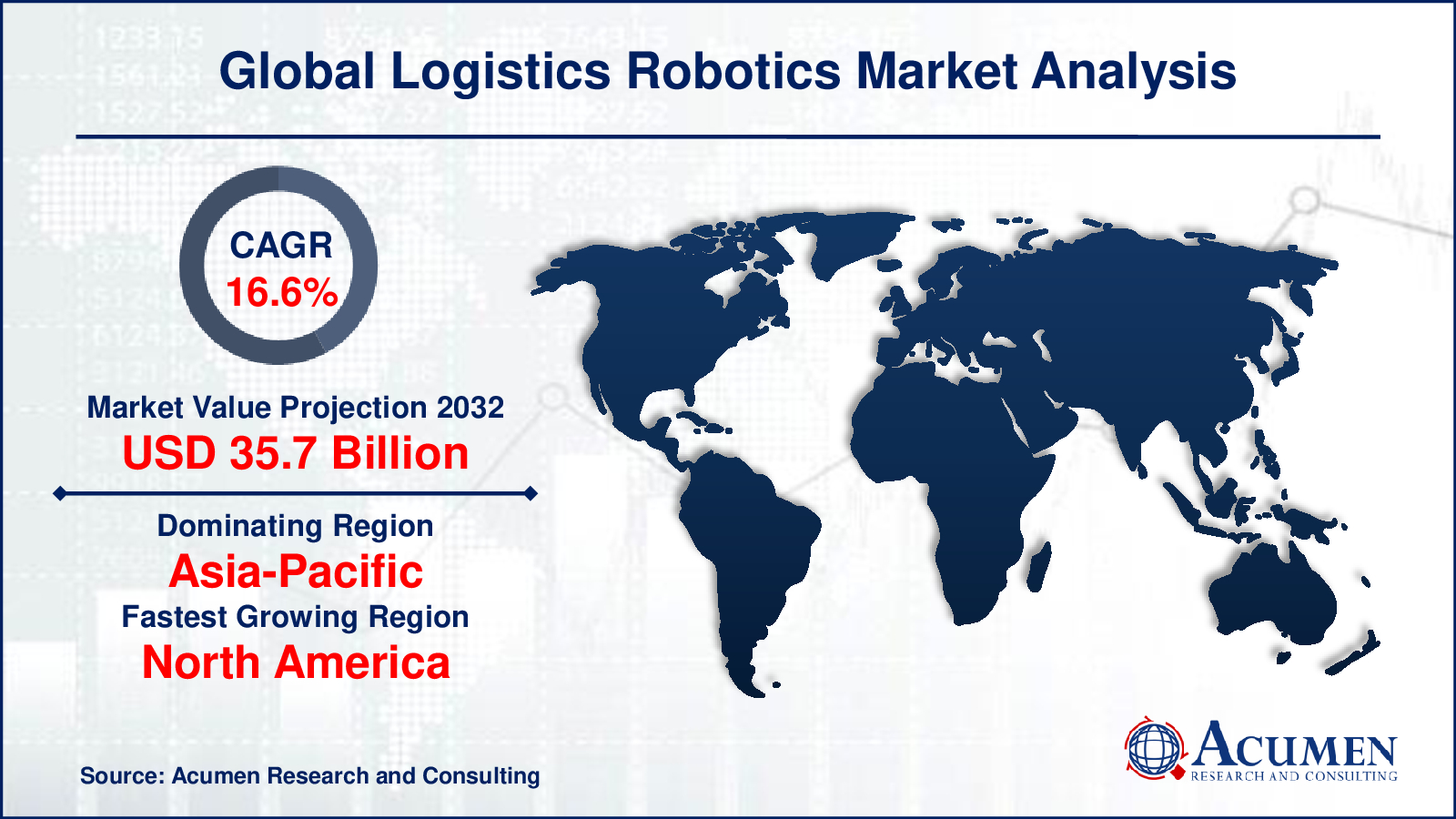

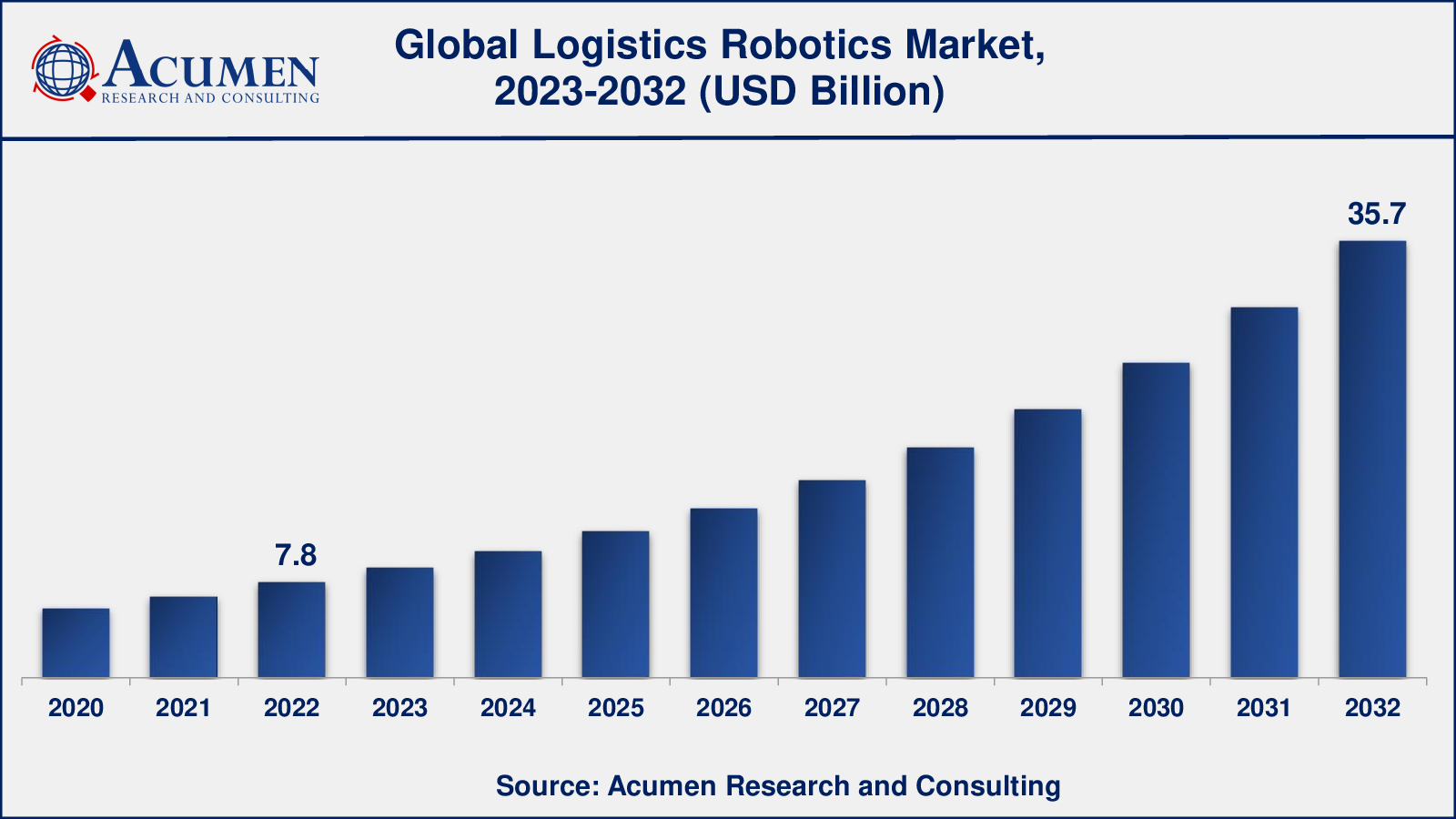

Request Sample Report

The Global Logistics Robotics Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 35.7 Billion by 2032 growing at a CAGR of 16.6% from 2023 to 2032.

Logistics Robotics Market Highlights:

- Global logistics robotics market revenue is poised to garner USD 35.7 Billion by 2032 with a CAGR of 16.6% from 2023 to 2032

- Asia-Pacific logistics robotics market value occupied around USD 2.4 billion in 2022

- North America logistics robotics market growth will record a CAGR of more than 17% from 2023 to 2032

- Among type, the autonomous guided vehicles (AGVs) sub-segment generated over US$ 3.5 billion revenue in 2022

- Based on end-use industry, the e-commerce sub-segment generated around 35% share in 2022

- Emergence of robotics-as-a-service models is a popular market trend that fuels the industry demand

Logistics robots, which combine computer applications and machine tools, play a crucial role in various sectors by aiding in manufacturing and design processes. They significantly reduce human efforts while improving product quality and accuracy. The logistics robots market is experiencing rapid growth due to several key factors. The increasing demand from the e-commerce sector, warehouses, and expanding supply chains is driving the growth of the logistics robotics market. Companies are turning to robotics technology to enhance operational efficiency and meet the rising demands of these industries. Additionally, the need to reduce labor costs is a significant driver for the adoption of robotics solutions.

Various sectors, including automotive, retail, healthcare, and food and beverages, are increasingly utilizing robotics technology. The versatility of robots and their ability to perform a wide range of tasks make them valuable assets in these industries. The availability of easily accessible and cost-effective robotic solutions has further accelerated their adoption. In the warehouse and retail industries, safety and security in the supply chain have become critical concerns. By implementing robotics systems, companies can address these issues and minimize workplace accidents. The improved safety measures offered by robots contribute to the overall growth of the logistics robots market.

In summary, the logistics robotics market is witnessing substantial growth due to the rising demand from e-commerce, warehouses, and expanding supply chains. Factors such as cost-cutting, increased efficiency, improved safety, and the availability of affordable robotic solutions are driving the adoption of robotics technology across various industries.

Global Logistics Robotics Market Dynamics

Market Drivers

- Expansion of e-commerce industry

- Increasing digitization

- Growing product utilization in warehouses for operational efficiency

Market Restraints

- Issues associated with logistics robots

- Impact of raw material shortages and shipping delays and current market conditions

- Anticipated impact of economic downturn on prices and availability of products

Market Opportunities

- Raising popularity of autonomous warehouses

- Increasing investment by logistics service providers

Logistics Robotics Market Report Coverage

| Market | Logistics Robotics Market |

| Logistics Robotics Market Size 2022 | USD 7.8 Billion |

| Logistics Robotics Market Forecast 2032 | USD 35.7 Billion |

| Logistics Robotics Market CAGR During 2023 - 2032 | 16.6% |

| Logistics Robotics Market Analysis Period | 2020 - 2032 |

| Logistics Robotics Market Base Year | 2022 |

| Logistics Robotics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Component, By Application, By End-Use Industry, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB, Aramex, Bastian Solutions, LLC, Clearpath Robotics Inc., Clipper Logistics plc, DHL International GmbH, Fetch Robotics, FANUC Corporation, FedEx, KION GROUP AG, Krones AG, KUKA AG, Midea Group, OMRON Corporation, Sidel Group, Toshiba Corporation, Universal Robots, and YASKAWA ELECTRIC CORPORATION. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Logistics Robotics Market Insights

The logistics robotics market is experiencing significant growth, primarily driven by the rising demand from the e-commerce industry. As the number of online customers continues to increase, e-commerce businesses are seeking ways to reduce operation time and enhance customer satisfaction. Robotics technologies play a crucial role in achieving these goals by assisting in packaging, product movement, and delivery. Within the e-commerce sector, there are three main categories: business-to-business, business-to-customer, and customer-to-customer, each of which benefits from the efficiency and accuracy provided by robotics solutions. Meeting customers' requirements in a timely manner is of utmost importance for e-commerce companies, and robotics technology enables them to fulfill these demands efficiently.

However, the growth of the logistics robotics market is hindered by a scarcity of trained workers and skilled professionals in the field of robotics technology. This lack of expertise acts as a significant restraint. Additionally, the market faces challenges due to the high initial investment and maintenance costs associated with robotics systems, which can deter some companies from adopting these solutions.

On the other hand, the presence of logistics service providers investing in robotics technology presents an opportunity for the logistics robotics market. These providers recognize the advantages that robotics solutions bring to their operations and are actively incorporating them into their services. Moreover, the growing popularity of warehouses creates further opportunities for the market. Robots are capable of performing a wide range of tasks within warehouses, such as packing, scanning, transportation, and more. This versatility and efficiency make robotics technology a compelling choice for warehouse operations.

Logistics Robotics Market Segmentation

The worldwide market for logistics robotics is split based on type, component, application, end-use industry, and geography.

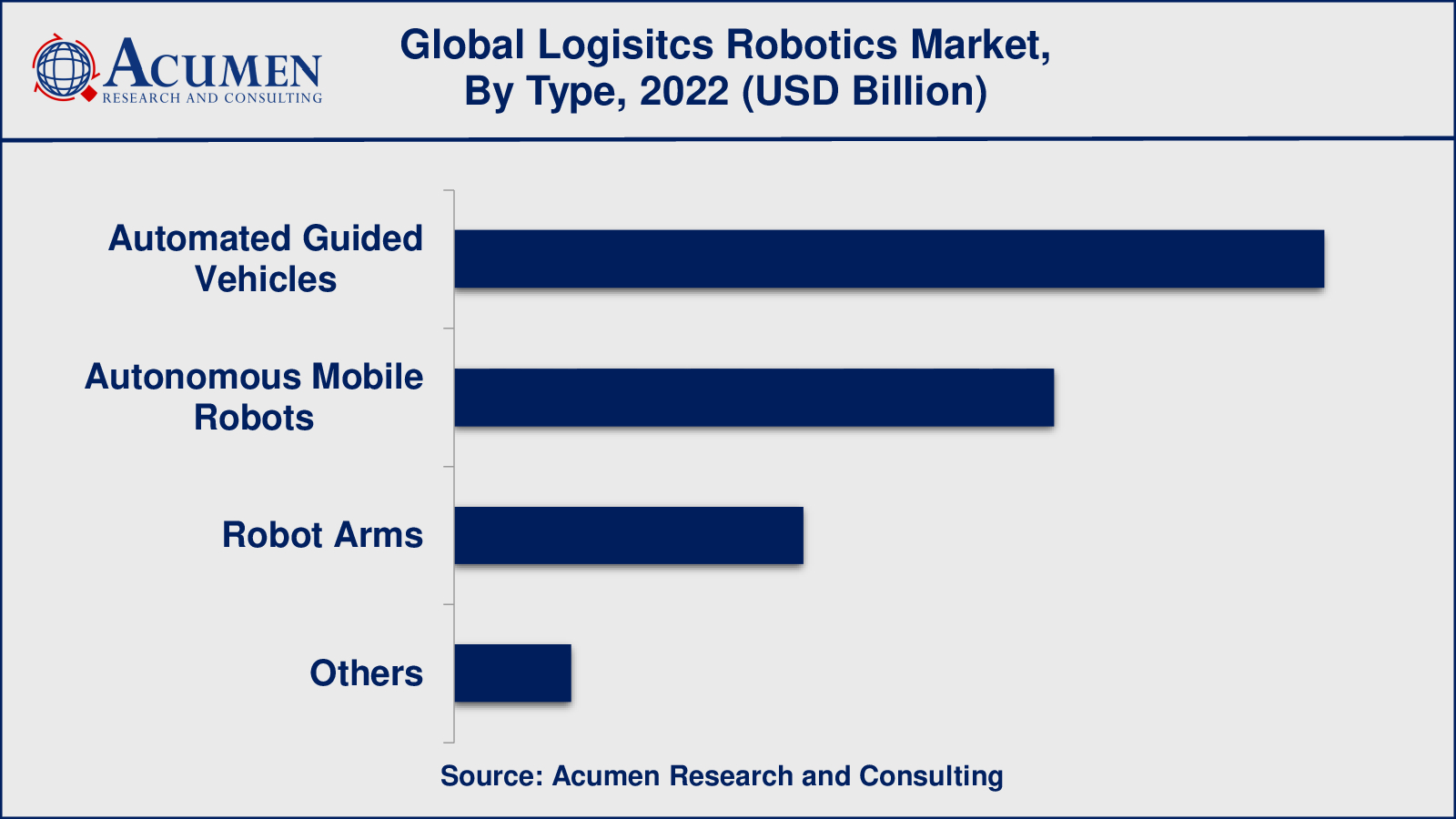

Logistics Robotics Types

- Autonomous Mobile Robots

- Automated Guided Vehicles

- Robot Arms

- Others

According to a logistics robotics industry analysis, automated guided vehicles (AGVs) accounted for significant market share in 2022. Automated guided vehicles (AGVs) are robotic vehicles that are steered throughout a facility by specified courses or markers. AGVs are commonly employed in warehouses, distribution centres, and industrial facilities for material handling and transportation operations. They are programmed to travel certain routes and may deliver cargo, pallets, or other objects, resulting in enhanced efficiency and decreased labour needs in logistical operations.

Another essential sort of robotics solution in the logistics business is robot arms, sometimes known as articulated robotic arms. Because these robotic arms have numerous joints, they can replicate human arm movements and do precise operations including selecting, sorting, palletizing, and depalletizing. Warehouse automation, order fulfilment, and other material handling activities frequently employ robot arms.

While AMRs, AGVs, and robot arms have been dominant in the logistics robotics business, it is crucial to remember that the sector is dynamic and ever-changing. Other robotics solutions, such as robotic exoskeletons, drones, or specialised robots intended for certain logistical applications, may potentially acquire popularity as a result of industrial demands and technology improvements.

Logistics Robotics Components

- Hardware

- Software

- Services

Hardware are considered to be the largest revenue generating segment in the logistics robotics market. Hardware elements are essential to the operation and performance of logistics robots, including physical robotic systems, sensors, actuators, processors (such as CPUs and GPUs), and other mechanical and electrical components. Material handling, transportation, picking, sorting, and other logistical procedures are all made possible by these physical components. They serve as the physical foundation and backbone of robotics systems.

While software and services are important components of robotics systems, hardware often accounts for a bigger revenue share due to the high costs of producing, installing, and maintaining actual robots and their related components. However, it is crucial to remember that the market environment can shift, and software and services components might acquire significance as artificial intelligence, machine learning, and robotic control systems progress.

Logistics Robotics Applications

- Warehousing and Distribution

- Sorting and Transportation

- Packaging and Palletizing

- Last-Mile Delivery

- Others

In warehouse and distribution operations, robots solutions are widely utilised to optimise activities such as inventory management, order fulfilment, and products storage. Robots, such as automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), play an important part in warehouse and distribution centre duties such as products transportation, picking, sorting, and replenishing. The need to enhance productivity, decrease mistakes, and satisfy the growing needs of e-commerce and omnichannel fulfilment has resulted in robotics' supremacy in this sector.

Logistics Robotics End-Use Industries

- E-commerce

- Healthcare

- Retail

- Food and Beverage

- Automotive

- Others

According to the logistics robotics market forecast, e-commerce sector is expected to gain utmost demand throughout 2023 to 2032. The rapid growth of the e-commerce sector has been a major driving force behind the adoption of logistics robotics. E-commerce companies rely heavily on efficient and accurate order fulfillment, inventory management, and warehouse operations. Robots are employed in e-commerce to pick and drop products from one location to another. In the e-commerce business, robotics are also employed for supply chain, transportation, and manufacturing. The expansion of the market is being driven by the e-commerce businesses.

However, the healthcare industry has shown increasing interest in adopting robotics technology to enhance logistics and supply chain operations. Robotics solutions are being integrated into retail operations to improve inventory management, optimize product handling, and enhance the overall shopping experience. The food and beverage industry has started adopting robotics to improve processes such as packaging, palletizing, and quality control. In addition, the automotive industry has also seen the use of robotics in logistics and supply chain management.

Logistics Robotics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

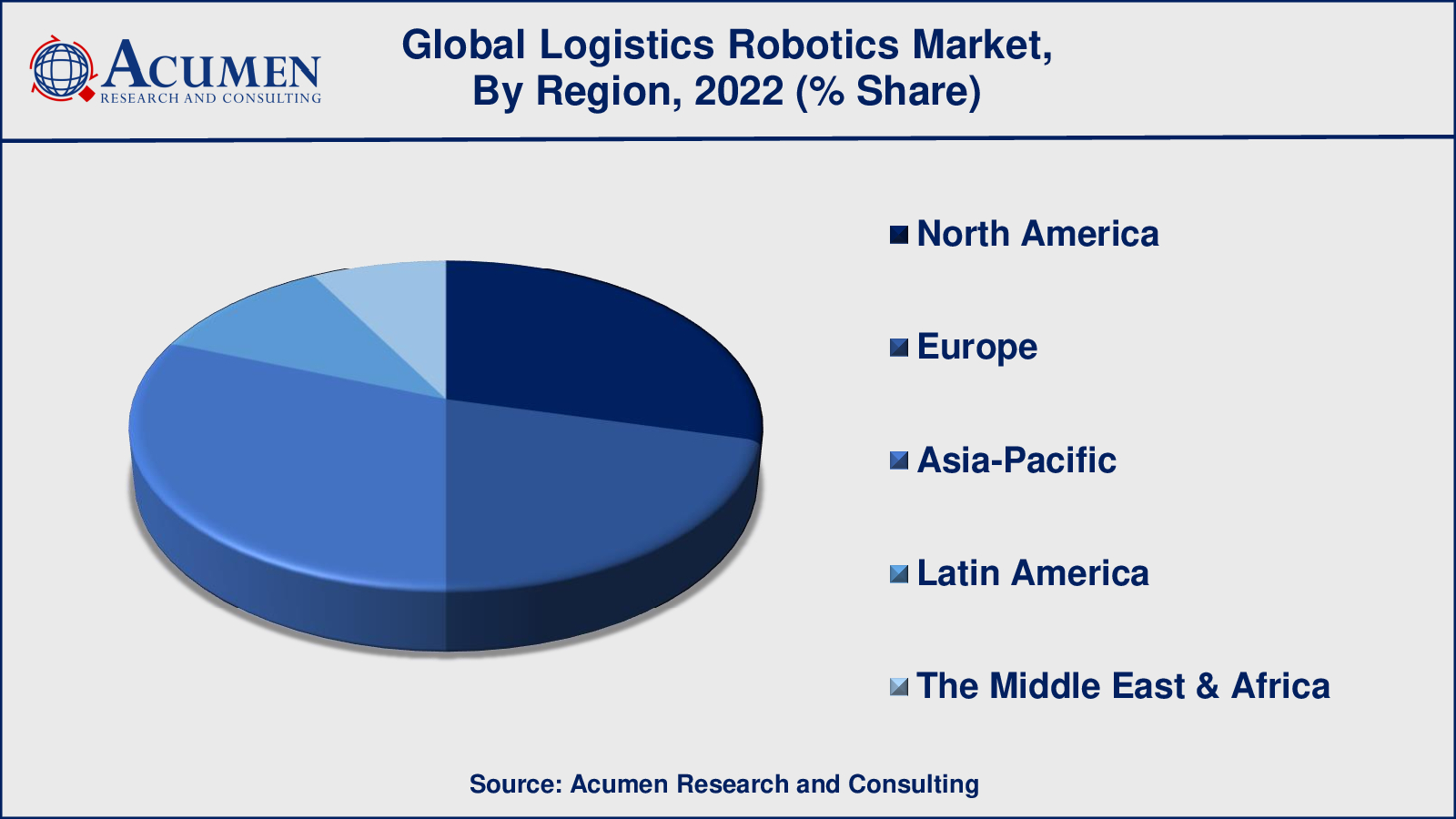

Logistics Robotics Market Regional Analysis

In 2022, the Asia-Pacific region emerged as the leading market for logistics robotics, holding the largest share of market revenue. This can be attributed to the increasing demand for logistics robots in countries like China, Japan, and India, where the market is rapidly expanding. These growing regions are actively adopting logistics robotics to improve productivity and reduce losses in their operations. The use of robots also facilitates easier product delivery, providing advantages across various sectors.

Looking ahead, it is expected that the logistics robotics market in North America will witness significant growth in the coming years. This can be attributed to the expanding market for logistics services in the region, driven by the rising adoption of Artificial Intelligence (AI), automation, and the pursuit of enhanced productivity and efficiency. These factors will contribute to the overall growth of the logistics robotics market in the region.

To summarize, the Asia-Pacific region currently dominates the logistics robotics market, driven by the increasing adoption of logistics robots in countries like China, Japan, and India. In the future, North America is expected to experience substantial growth in the market due to the expanding logistics sector and the integration of AI and automation technologies to drive productivity and efficiency.

Logistics Robotics Market Players

Some of the top logistics robotics companies offered in our report includes ABB, Aramex, Bastian Solutions, LLC, Clearpath Robotics Inc., Clipper Logistics plc, DHL International GmbH, Fetch Robotics, FANUC Corporation, FedEx, KION GROUP AG, Krones AG, KUKA AG, Midea Group, OMRON Corporation, Sidel Group, Toshiba Corporation, Universal Robots, and YASKAWA ELECTRIC CORPORATION.

- Clearpath Robotics has introduced the OTTO 750, a heavy-duty autonomous mobile robot designed for material delivery in industrial environments. The OTTO 750 can carry payloads weighing up to 750 kg (1650 lbs) and is outfitted with extensive safety measures and navigation capabilities for smooth operations in challenging conditions.

- KUKA developed an automated robotic picking system for e-commerce order fulfillment in collaboration with a large European retailer. The system combines KUKA robotic technology with AI-powered software to enable efficient and precise product picking, hence improving the retailer's logistical operations.

Frequently Asked Questions

What was the market size of the global Logistics Robotics in 2022?

The market size of Logistics Robotics was USD 7.8 Billion in 2022.

What is the CAGR of the global Logistics Robotics market from 2023 to 2032?

The CAGR of Logistics Robotics is 16.6% during the analysis period of 2023 to 2032.

Which are the key players in the Logistics Robotics market?

The key players operating in the global market are including ABB, Aramex, Bastian Solutions, LLC, Clearpath Robotics Inc., Clipper Logistics plc, DHL International GmbH, Fetch Robotics, FANUC Corporation, FedEx, KION GROUP AG, Krones AG, KUKA AG, Midea Group, OMRON Corporation, Sidel Group, Toshiba Corporation, Universal Robots, and YASKAWA ELECTRIC CORPORATION.

Which region dominated the global Logistics Robotics market share?

North America held the dominating position in Logistics Robotics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Logistics Robotics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Logistics Robotics industry?

The current trends and dynamics in the logistics robotics industry include raising and expansion of e-commerce industry, increasing digitization, and increasing product utilization in warehouses for operational efficiency.

Which type held the maximum share in 2022?

The AGVs type held the maximum share of the Logistics Robotics industry.