Location Intelligence Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Location Intelligence Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

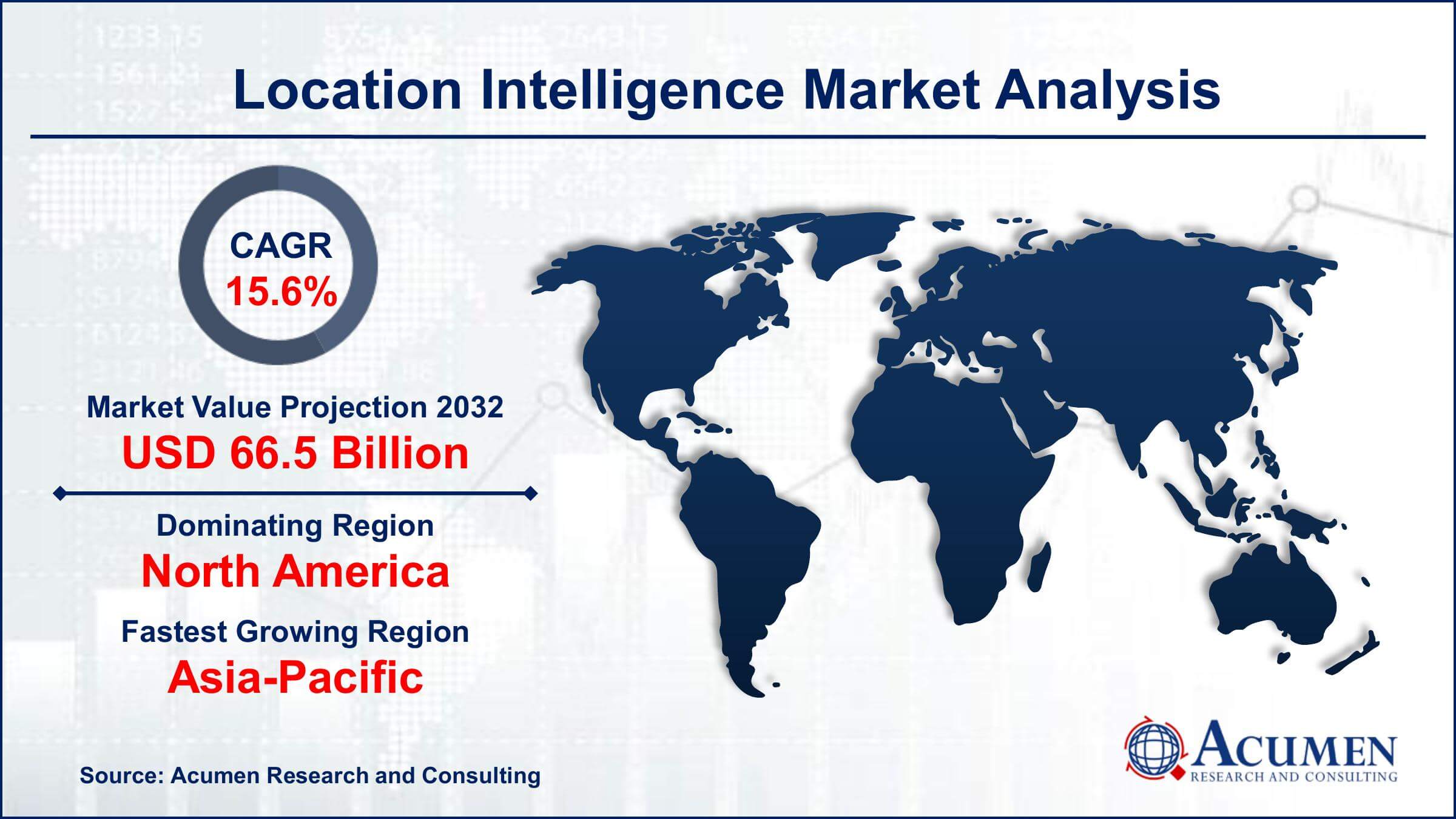

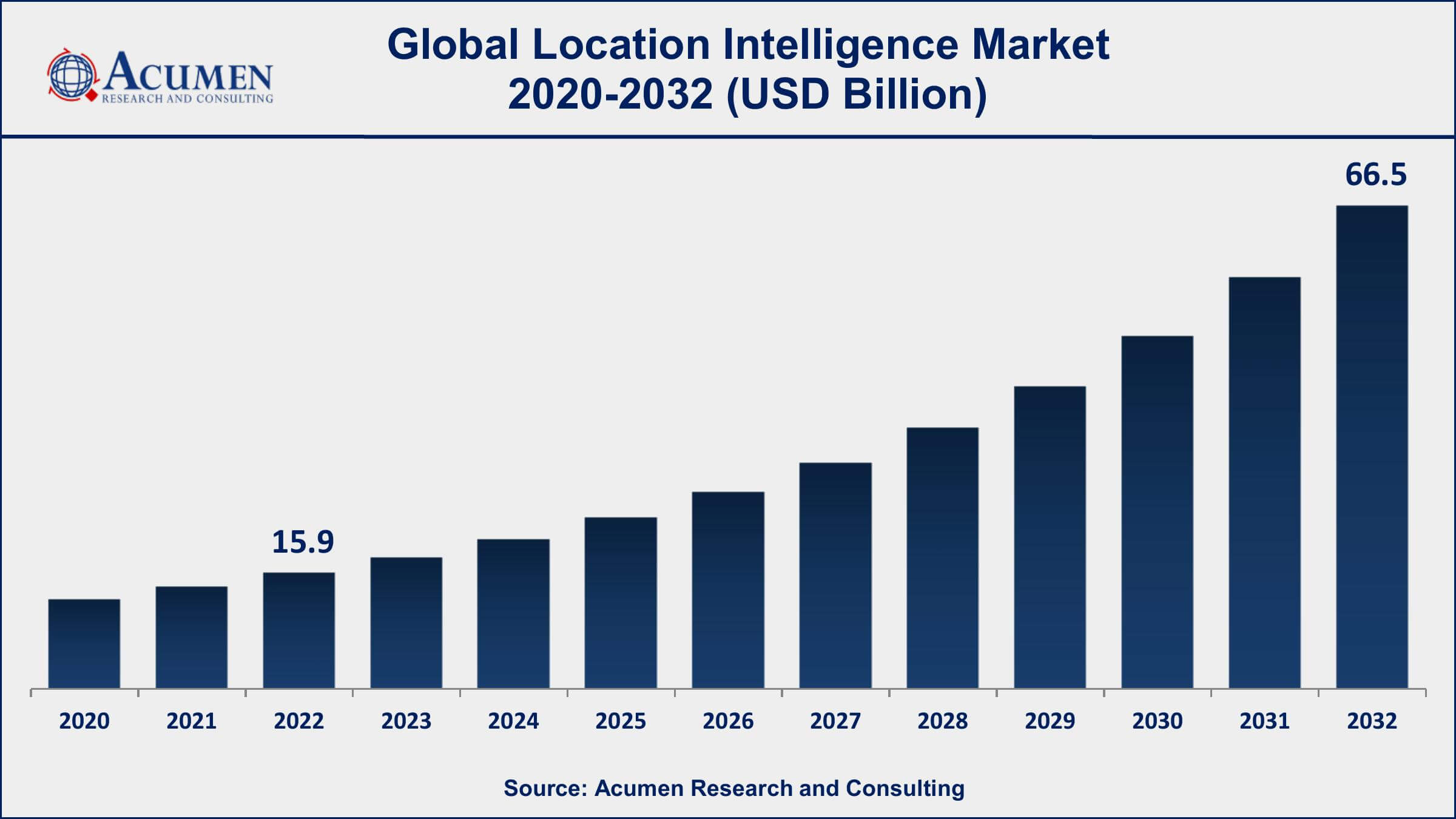

The Global Location Intelligence Market Size accounted for USD 15.9 Billion in 2022 and is projected to achieve a market size of USD 66.5 Billion by 2032 growing at a CAGR of 15.6% from 2023 to 2032.

Location Intelligence Market Highlights

- Global Location Intelligence Market revenue is expected to increase by USD 66.5 Billion by 2032, with a 15.6% CAGR from 2023 to 2032

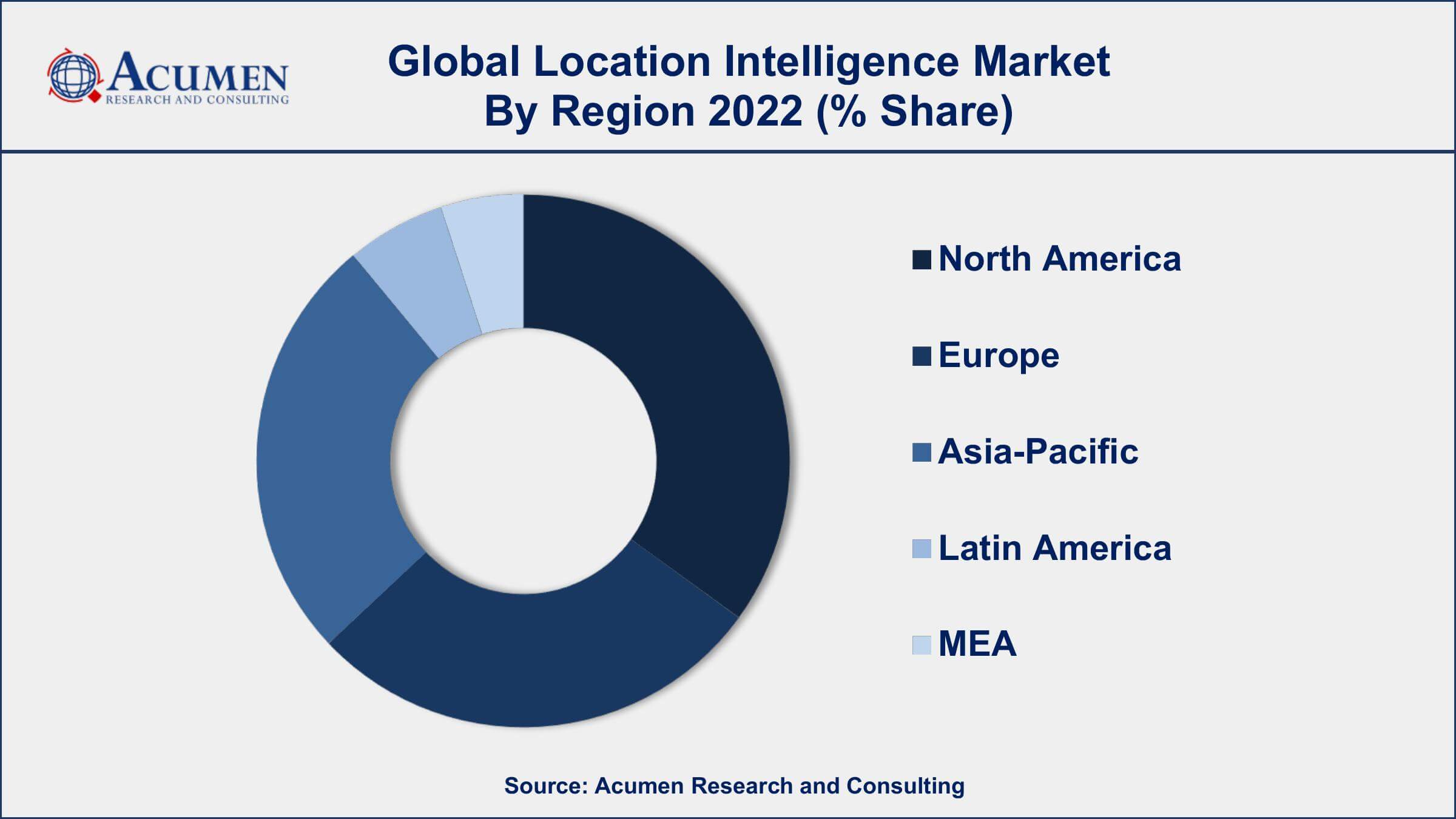

- North America region led with more than 34% of Location Intelligence Market share in 2022

- Asia-Pacific Location Intelligence Market growth will record a CAGR of more than 16.4% from 2023 to 2032

- By service, the system integration segment has accounted more than 46% of the revenue share in 2022

- By vertical, the retail and consumer goods segment is expected to expand at the biggest CAGR of 16.2% from 2023 to 2032

- Rising adoption of IoT and connected devices, drives the Location Intelligence Market value

Location Intelligence, often referred to as LI or spatial intelligence, is a technology-driven approach that combines geographic and location-based data with advanced analytics to provide valuable insights and business intelligence. It empowers organizations to make data-driven decisions by visualizing, analyzing, and understanding the spatial relationships within their data. Location Intelligence leverages tools such as Geographic Information Systems (GIS), mapping, and geospatial analysis to help organizations optimize operations, enhance customer experiences, and gain a competitive edge.

The market for Location Intelligence has been experiencing significant growth in recent years. This growth can be attributed to several factors, including the increasing volume of location-based data generated by mobile devices, IoT sensors, and other sources. As organizations recognize the value of this data, they are investing in Location Intelligence solutions to extract actionable insights. Additionally, industries such as retail, transportation, real estate, and healthcare are leveraging Location Intelligence to improve resource allocation, optimize supply chains, and enhance customer engagement. The market is also benefiting from advances in AI and machine learning, which enable more sophisticated spatial analysis and predictive modeling.

Global Location Intelligence Market Trends

Market Drivers

- Growing demand for spatial data analytics

- Rising adoption of IoT and connected devices

- Increasing use of location-based services in mobile apps

- Enhanced decision-making capabilities through location insights

- Expansion of smart cities and urban planning projects

Market Restraints

- Privacy and security concerns with location data

- High costs associated with geospatial technology

- Limited awareness and expertise in Location Intelligence

Market Opportunities

- Growth in the use of Location Intelligence in healthcare and real estate

- Advancements in AI and machine learning for spatial analysis

- Customized Location Intelligence solutions for niche industries

Location Intelligence Market Report Coverage

| Market | Location Intelligence Market |

| Location Intelligence Market Size 2022 | USD 15.9 Billion |

| Location Intelligence Market Forecast 2032 | USD 66.5 Billion |

| Location Intelligence Market CAGR During 2023 - 2032 | 15.6% |

| Location Intelligence Market Analysis Period | 2020 - 2032 |

| Location Intelligence Market Base Year |

2022 |

| Location Intelligence Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Service, By Application, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Esri, HERE Technologies, Google LLC, TomTom, CARTO, Mapbox, Pitney Bowes, Foursquare, TIBCO Software Inc. (formerly Swoop), Precisely (formerly Pitney Bowes Software and Data), Alteryx, and Hexagon AB |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Location Intelligence (LI) is a powerful technology-driven approach that combines geographic and location-based data with advanced analytics to provide valuable insights and business intelligence. It enables organizations to understand the spatial relationships within their data, which can range from customer demographics and sales figures to infrastructure and environmental factors. LI leverages tools such as Geographic Information Systems (GIS), mapping, and geospatial analysis to help organizations make informed decisions. It not only enhances data visualization but also supports predictive modeling and optimization, making it an invaluable tool for businesses across various industries.

Location Intelligence finds applications in a wide range of fields. In retail, for example, LI can be used to analyze store locations, customer demographics, and competitor proximity to optimize site selection and marketing strategies. In logistics and transportation, it helps improve route planning and fleet management. For urban planning and smart cities, LI aids in infrastructure development, traffic management, and disaster preparedness. In healthcare, it can optimize healthcare facility locations and resource allocation. LI is also crucial in natural resource management, environmental monitoring, and agriculture, where it aids in land use planning and precision farming.

The Location Intelligence (LI) market has been experiencing robust growth over the past few years, driven by a confluence of factors that are reshaping industries across the board. With the proliferation of smartphones and IoT devices, there's been an unprecedented surge in location-based data generation. Organizations are capitalizing on this wealth of data to gain actionable insights, optimize operations, and make informed decisions. The LI market has seen substantial demand across various sectors, including retail, transportation, real estate, healthcare, and more. One significant driver of this market growth is the integration of LI into business processes and decision-making tools. The ability to visualize data on maps and analyze it in a spatial context has become invaluable. Additionally, advancements in AI and machine learning have enhanced the predictive capabilities of LI, allowing businesses to forecast trends and optimize resources with greater accuracy.

Location Intelligence Market Segmentation

The global Location Intelligence Market segmentation is based on service, application, vertical, and geography.

Location Intelligence Market By Service

- System Integration

- Consulting

- Others

According to the location intelligence industry analysis, the system integration segment accounted for the largest market share in 2022. System integration services play a pivotal role in ensuring that these components work seamlessly together, enabling organizations to leverage the full potential of LI for their specific needs. Moreover, as the LI market matures, businesses are increasingly realizing the need for customized solutions tailored to their unique requirements. System integrators specialize in designing and implementing bespoke LI solutions that align with the specific goals and workflows of organizations. This has driven demand for their expertise, particularly among industries such as transportation, logistics, and retail, where the integration of location-based data with existing systems is critical for operational efficiency and competitive advantage. Additionally, the growth of the Internet of Things (IoT) and the increasing volume of data generated by connected devices have created a complex ecosystem that requires adept system integration.

Location Intelligence Market By Application

- Workforce Management

- Facility Management

- Asset Management

- Customer management

- Risk Management

- Sales & Marketing Optimization

- Remote Monitoring

- Others

In terms of applications, the sales & marketing optimization segment is expected to witness significant growth in the coming years. Location Intelligence provides insights into consumer behavior, preferences, and demographics, enabling companies to target their marketing efforts more precisely and tailor products or services to specific geographic areas. Furthermore, the growth of e-commerce and online marketing has intensified the demand for location-based insights. Marketers are leveraging LI to optimize their digital advertising campaigns, ensuring that advertisements are delivered to the right audience at the right time and place. Additionally, the integration of LI into customer relationship management (CRM) systems has empowered sales teams to identify potential leads, plan routes for sales visits, and enhance their overall sales strategies. This has not only improved efficiency but also contributed to revenue growth.

Location Intelligence Market By Vertical

- Retail and Consumer Goods

- Manufacturing & Industrial

- Government & Defense

- IT & Telecom

- Transportation & Logistics

- BFSI

- Media & Entertainment

- Utilities & Energy

According to the location intelligence market forecast, the retail and consumer goods segment is expected to witness significant growth in the coming years. This growth is primarily driven by the increasing adoption of LI solutions by retailers and consumer goods companies to gain a competitive edge in a rapidly evolving market. One of the key drivers is the desire to enhance the customer shopping experience. Retailers are using location data to personalize marketing efforts, optimize store layouts, and implement location-based promotions, thereby improving customer engagement and loyalty. Moreover, LI technology is aiding in supply chain optimization and inventory management. Retailers are leveraging real-time location data to track goods through the supply chain, reduce transit times, and minimize stockouts.

Location Intelligence Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Location Intelligence Market Regional Analysis

North America's dominance in the Location Intelligence (LI) market can be attributed to several key factors that have contributed to its leadership position in this rapidly evolving technology sector. North America is home to some of the world's largest technology hubs and innovation centers, particularly in Silicon Valley and other tech-savvy regions. This concentration of tech companies and startups has fueled the development and adoption of LI solutions, leading to a thriving ecosystem of LI providers. Furthermore, North American businesses have been quick to recognize the potential of location-based insights, leading to early adoption and widespread integration of LI into various industries, from retail and real estate to healthcare and logistics. Moreover, the region has a mature and well-established infrastructure for collecting and managing location data. North America has robust GPS and mapping systems, extensive cellular and IoT networks, and a culture of data-driven decision-making. These factors create a fertile ground for the growth of the LI market. Additionally, the presence of leading companies like Esri, Google, and HERE Technologies in North America has not only stimulated the market but also fostered competition and innovation.

Location Intelligence Market Player

Some of the top location intelligence market companies offered in the professional report include Esri, HERE Technologies, Google LLC, TomTom, CARTO, Mapbox, Pitney Bowes, Foursquare, TIBCO Software Inc. (formerly Swoop), Precisely (formerly Pitney Bowes Software and Data), Alteryx, and Hexagon AB.

Frequently Asked Questions

What was the market size of the global location intelligence in 2022?

The market size of location intelligence was USD 15.9 Billion in 2022.

What is the CAGR of the global location intelligence market from 2023 to 2032?

The CAGR of location intelligence is 15.6% during the analysis period of 2023 to 2032.

Which are the key players in the location intelligence market?

The key players operating in the global market are including Esri, HERE Technologies, Google LLC, TomTom, CARTO, Mapbox, Pitney Bowes, Foursquare, TIBCO Software Inc. (formerly Swoop), Precisely (formerly Pitney Bowes Software and Data), Alteryx, and Hexagon AB.

Which region dominated the global location intelligence market share?

North America held the dominating position in location intelligence industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of location intelligence during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global location intelligence industry?

The current trends and dynamics in the location intelligence industry include growing demand for spatial data analytics, rising adoption of IoT and connected devices, and increasing use of location-based services in mobile apps.

Which application held the maximum share in 2022?

The sales & marketing optimization application held the maximum share of the location intelligence industry.