Lithotripsy Device Market | Acumen Research and Consulting

Lithotripsy Device Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

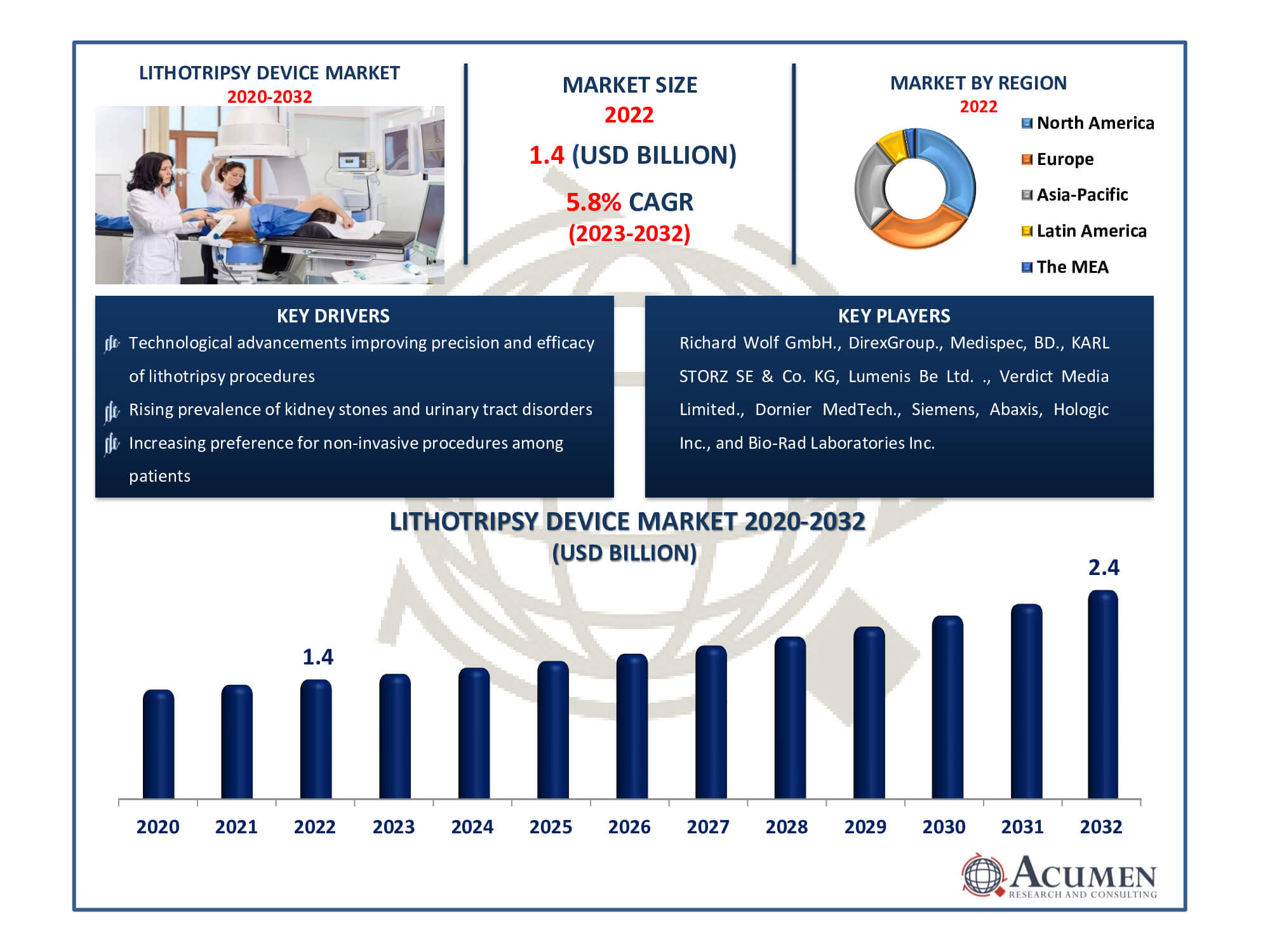

The Lithotripsy Device Market Size accounted for USD 1.4 Billion in 2022 and is estimated to achieve a market size of USD 2.4 Billion by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Lithotripsy Device Market Highlights

- Global lithotripsy device market revenue is poised to garner USD 2.4 billion by 2032 with a CAGR of 5.8% from 2023 to 2032

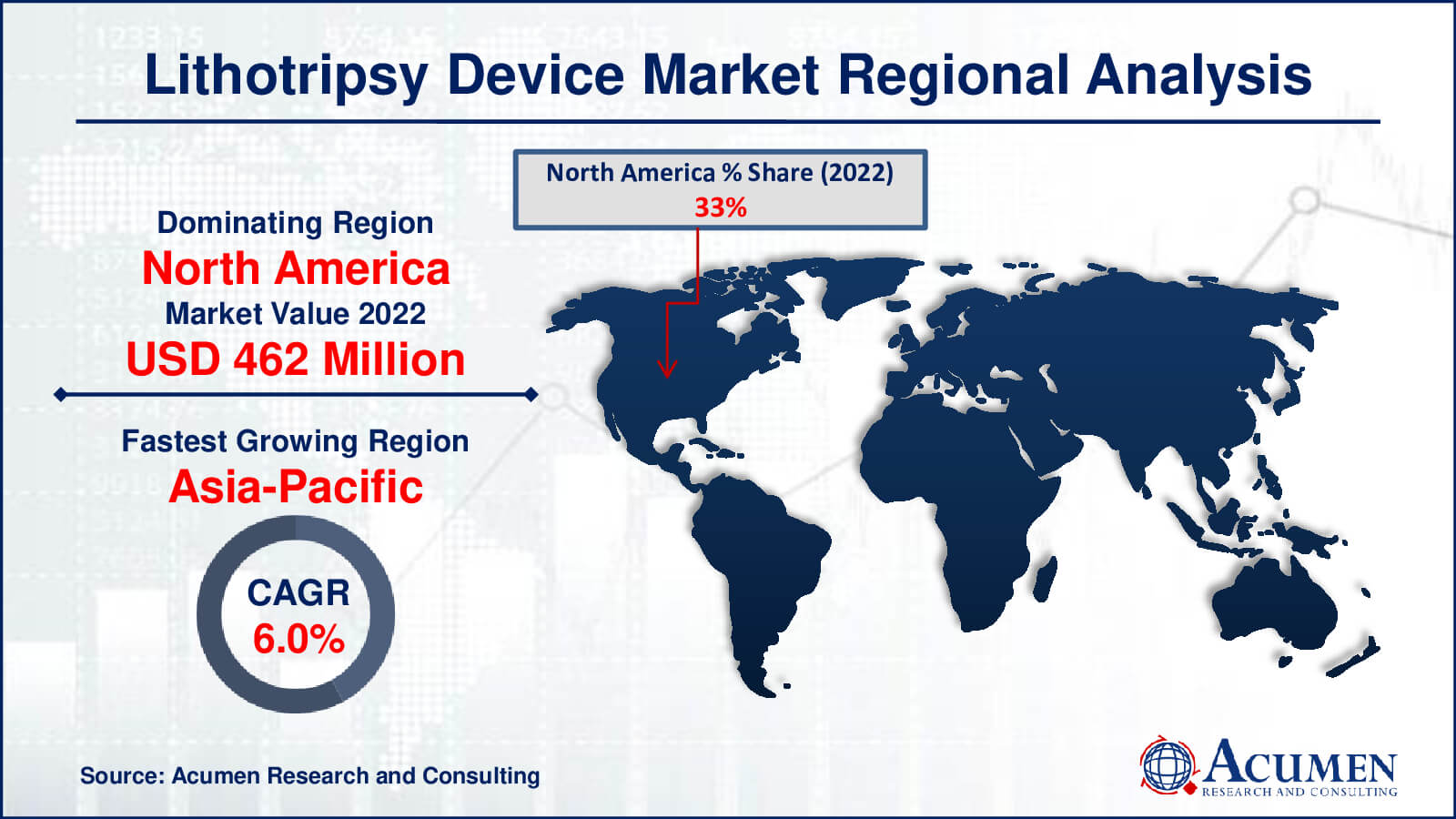

- North America lithotripsy device market value occupied around USD 462 million in 2022

- Asia-Pacific lithotripsy device market growth will record a CAGR of more than 6% from 2023 to 2032

- Among type, the extracorporeal shock wave lithotripsy devices sub-segment generated over US$ 714 million revenue in 2022

- Based on end-use, the hospitals sub-segment generated around 46% share in 2022

- Rising adoption of outpatient settings for lithotripsy procedures, enhancing convenience for patients is a popular lithotripsy device market trend that fuels the industry demand

Lithotripsy is a process used to break stones in the kidney and other organs such as the gall bladder, liver, and urethra using ultrasound shock waves. Kidney stones form when substances in urine crystallize, creating solid masses in the kidneys that obstruct urine passage. This blockage can cause bleeding, intense urinary pain, infections, and kidney damage. The most common causes of blood in urine are kidney stones in the urinary tract. Extracorporeal shock wave lithotripsy (ESWL) is a commonly used non-invasive procedure that utilizes high-energy shock waves, similar to sound waves, x-rays, or ultrasound, to break kidney stones. ESWL is safe, typically lasting around 45 minutes and requiring no incisions. Laser lithotripsy, an operation to remove stones from the kidney, ureter, and bladder, is a surgical procedure that takes longer to perform.

Global Lithotripsy Device Market Dynamics

Market Drivers

- Technological advancements improving precision and efficacy of lithotripsy procedures

- Rising prevalence of kidney stones and urinary tract disorders globally

- Increasing preference for non-invasive procedures among patients

- Growing demand for minimally invasive surgeries and shorter recovery times

Market Restraints

- High costs associated with lithotripsy equipment and procedures

- Limited availability and accessibility in certain regions or healthcare facilities

- Concerns regarding potential complications and side effects post-treatment

Market Opportunities

- Expanding market penetration in emerging economies with growing healthcare infrastructure.

- Innovations in portable and more affordable lithotripsy devices.

- Collaborations and partnerships for research and development in lithotripsy technology

Lithotripsy Device Market Report Coverage

| Market | Lithotripsy Device Market |

| Lithotripsy Device Market Size 2022 | USD 1.4 Billion |

| Lithotripsy Device Market Forecast 2032 | USD 2.4 Billion |

| Lithotripsy Device Market CAGR During 2023 - 2032 | 5.8% |

| Lithotripsy Device Market Analysis Period | 2020 - 2032 |

| Lithotripsy Device Market Base Year |

2022 |

| Lithotripsy Device Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Richard Wolf GmbH., DirexGroup., Medispec, BD., KARL STORZ SE & Co. KG, Lumenis Be Ltd., Verdict Media Limited., Dornier MedTech., MedTech, Siemens, Abaxis, Hologic Inc., and Bio-Rad Laboratories Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Lithotripsy Device Market Insights

The projected rise in kidney stone prevalence stands as the primary driver of the lithotripsy device market's growth. Over the years, lithotripsy has emerged as the preferred treatment for kidney stones, owing to its safety, cost-effectiveness, shorter recovery periods, and favorable patient outcomes. Intracorporeal lithotripsy devices have shown high success rates in treating all types of kidney stone compositions, particularly for ureteral stones, with minimal complications. However, the market's growth is hindered by a lack of innovation and industry inclination to invest in newer technologies.

The impact of modernized farming practices is evident in the global epidemic of obesity, with rates rising from approximately 15% in the 1980s to around 35% in the 21st century. Various research papers on kidney stones indicate a growing prevalence worldwide. Lifestyle changes are considered a significant contributing factor to the increased prevalence of kidney stones, often linked to reduced fluid and calcium intake. Epidemiological studies further highlight that higher sodium and animal protein consumption elevate the risk of kidney stones. Therefore, the anticipated rise in kidney stone cases propels the growth of the lithotripsy market.

The global market for lithotripsy devices is anticipated to grow due to favorable reimbursement policies and increased awareness regarding kidney health. Moreover, there's a global shift towards minimally invasive procedures, propelling the market further. However, the high costs associated with extracorporeal lithotripsy and the availability of alternative treatments are expected to constrain market conditions. Approximately 10% of the world's population suffers from chronic renal diseases, as reported by the National Kidney Foundation. The Eastern Mediterranean Health Journal highlights a high prevalence of upper urinary tract stones among both children and adults. The global lithotripsy market is expected to witness growth during the forecast period, driven by emerging technologies in lithotripsy. One such technology is the Mosses technique, a novel laser lithotripsy method used to separate water from stones using a laser tip. Lumenis' Moses Holmium, a faser-Holmium laser combination, is employed for processing stones in hard-to-reach areas. Techniques like dusting and pop dusting are utilized for stone removal, while laser thulium, a new technology, offers advantages such as smaller fibers, enhanced rock removal, and improved flexibility. LISA Laser Products GmbH's RevoLix DUO, combining holmium and thulium lasers, is designed for urological lithotripsy applications.

Lithotripsy Device Market Segmentation

The worldwide market for lithotripsy device is split based on type, application, end-use, and geography.

Lithotripsy Device Types

- Extracorporeal Shock Wave Lithotripsy Devices

- Intracorporeal Lithotripsy Devices

- Laser Lithotripsy Devices

- Electrohydraulic Lithotripsy Devices

- Ultrasonic Lithotripsy Devices

- Mechanical Lithotripsy Devices

As for type, the extracorporeal lithotripsy segment led the global market in recent year and is projected to maintain this trend throughout the lithotripsy device market forecast period 2023 to 2032. The prevalence of pancreatic, biliary, and ureteral stones worldwide is anticipated to increase during this period, contributing to segment growth. Moreover, the market is expected to be driven by a higher demand for lithotripsy equipment due to the increasing preference for minimally invasive procedures.

Lithotripsy Device Applications

- Kidney Stones

- Ureteral Stones

- Pancreatic Stones

- Bile Duct Stones

According to the lithotripsy device industry analysis, the kidney stones subsegment dominates the market due to its greater global incidence rates compared to other stone types. Kidney stones impact a broader demography, resulting in a significant demand for lithotripsy solutions designed exclusively for kidney stone treatment. Furthermore, the complexity and frequency of kidney stone cases need a broader range of lithotripsy equipment and treatments, cementing the Kidney Stones subsegment's supremacy. This predominance corresponds to healthcare trends, pushing increased research, innovation, and investment in this specific industry, establishing its strong market presence.

Lithotripsy Device End-Uses

- Hospitals

- Ambulatory Surgical Centers

- Others

The hospitals subsegment is largest in the lithotripsy device market because to its extensive infrastructure and capabilities to handle a wide range of medical cases, including difficult stone-related illnesses. Hospitals are the principal centres for stone-related treatments, providing a wide range of specialised lithotripsy procedures and patient care. Their vast resources, including innovative equipment and competent medical personnel, attract a significant number of stone patients seeking a variety of treatment choices. Furthermore, hospitals frequently serve as referral centres, enhancing their prominence in providing full lithotripsy treatments and positioning them as the preferred choice for patients requiring stone-related operations.

Lithotripsy Device Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Lithotripsy Device Market Regional Analysis

North America dominates the lithotripsy device market due to advanced healthcare infrastructure, extensive technological adoption, and a high prevalence of kidney stone patients. The region benefits from significant R&D investments, which promote ongoing innovation in lithotripsy equipment and processes. Furthermore, the industry is supported by a well-established healthcare system and reimbursement policies.

Europe is closely following, led by rising urinary stone occurrences and an ageing population. This region's countries prioritize healthcare, ensuring access to sophisticated lithotripsy treatments. Partnerships between leading industrial firms and research institutions drive technological improvements and market expansion.

The Asia-Pacific area has emerged as the fastest-growing region, driven by rising healthcare expenditure, improved healthcare infrastructure, and an increasing patient pool with kidney stone problems. Countries such as China and India are experiencing considerable market expansion as a result of increased healthcare access, more awareness, and the use of minimally invasive procedures. Furthermore, encouraging government measures and an increasing emphasis on healthcare development contribute to the region's lithotripsy market growth.

Lithotripsy Device Market Players

Some of the top lithotripsy device companies offered in our report includes Richard Wolf GmbH., DirexGroup., Medispec, BD., KARL STORZ SE & Co. KG, Lumenis Be Ltd., Verdict Media Limited., Dornier MedTech., MedTech, Siemens, Abaxis, Hologic Inc., and Bio-Rad Laboratories Inc.

Frequently Asked Questions

How big is the lithotripsy device market?

The market size of lithotripsy device was USD 1.4 billion in 2022.

What is the CAGR of the global lithotripsy device market from 2023 to 2032?

The CAGR of lithotripsy device is 5.8% during the analysis period of 2023 to 2032.

Which are the key players in the lithotripsy device market?

The key players operating in the global market are including Richard Wolf GmbH., DirexGroup., Medispec, BD., KARL STORZ SE & Co. KG, Lumenis Be Ltd., Verdict Media Limited., Dornier MedTech., MedTech, Siemens, Abaxis, Hologic Inc., and Bio-Rad Laboratories Inc.

Which region dominated the global lithotripsy device market share?

North America held the dominating position in lithotripsy device industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of lithotripsy device during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global lithotripsy device industry?

The current trends and dynamics in the lithotripsy device industry include technological advancements improving precision and efficacy of lithotripsy procedures, rising prevalence of kidney stones and urinary tract disorders globally, increasing preference for non-invasive procedures among patients, and growing demand for minimally invasive surgeries and shorter recovery times.

Which type held the maximum share in 2022?

The extracorporeal shock wave lithotripsy devices type held the maximum share of the lithotripsy device industry.