Liquid Nitrogen Cryopreservation Market Size (By Application, By End-Use, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Liquid Nitrogen Cryopreservation Market Size (By Application, By End-Use, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

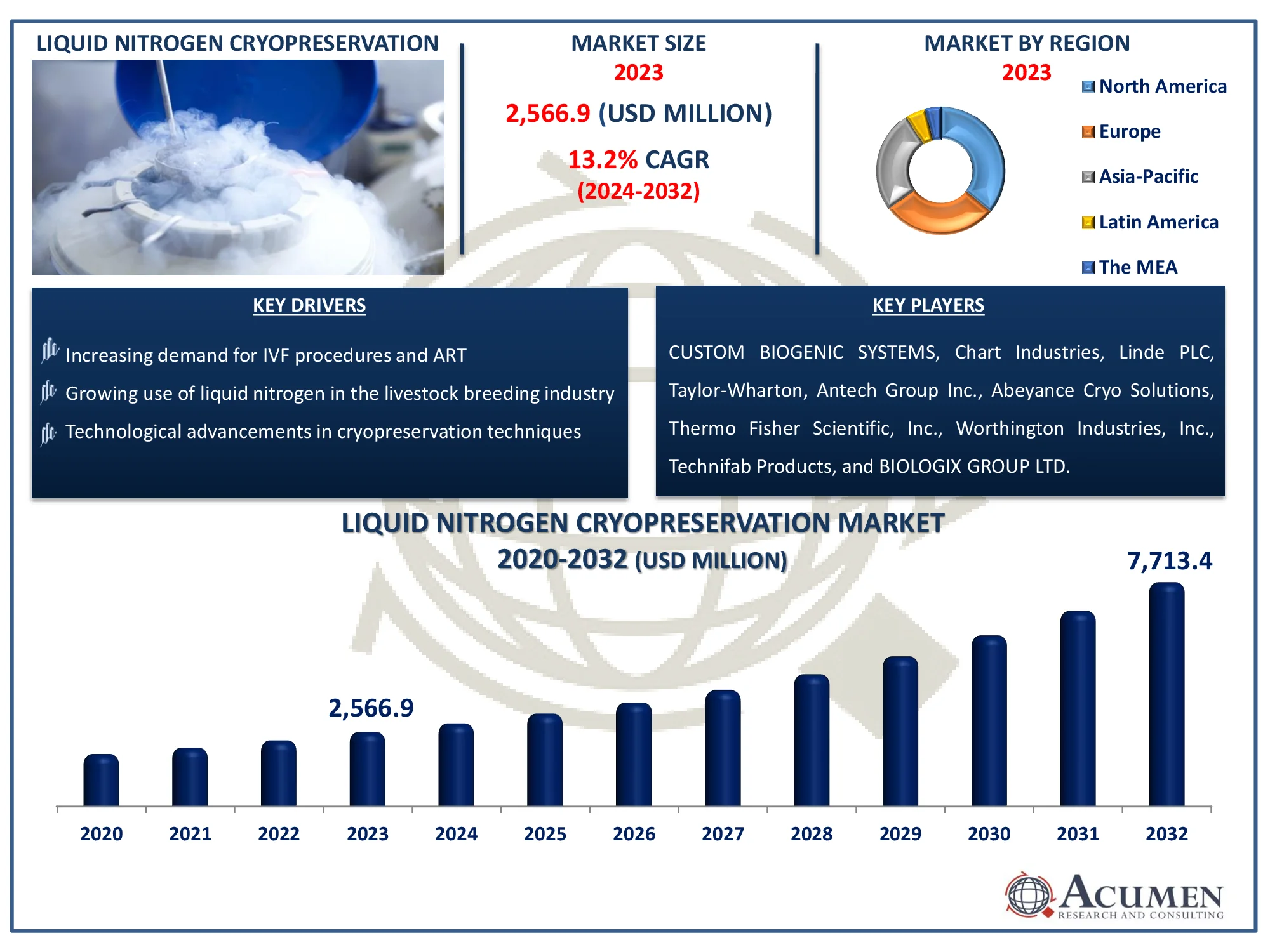

The Global Liquid Nitrogen Cryopreservation Market Size accounted for USD 2,566.9 Million in 2023 and is estimated to achieve a market size of USD 7,713.4 Million by 2032 growing at a CAGR of 13.2% from 2024 to 2032.

Liquid Nitrogen Cryopreservation Market Highlights

- Global liquid nitrogen cryopreservation market revenue is poised to garner USD 7,713.4 million by 2032 with a CAGR of 13.2% from 2024 to 2032

- North America liquid nitrogen cryopreservation market value occupied around USD 924.1 million in 2023

- Asia-Pacific liquid nitrogen cryopreservation market growth will record a CAGR of more than 13.8% from 2024 to 2032

- Among application, the stem cell sub-segment generated considerable revenue in 2023

- Based on end-use, the stem cell research laboratories sub-segment generated significant liquid nitrogen cryopreservation market share in 2023

- Growing application in biobanking and pharmaceutical industries is a popular liquid nitrogen cryopreservation market trend that fuels the industry demand

The Journal of Fertilization: In vitro - IVF-Worldwide, Reproductive Medicine, Genetics & Stem Cell Biology defines liquid nitrogen cryopreservation as a substance produced through an industrial process using the fractional distillation method. Furthermore, liquid nitrogen is a cryogenic fluid that is required for in-vitro reproductive technologies, which are widely used in human IVF, the cattle industry for in-vitro embryo production, and livestock breeding.

Liquid nitrogen cryopreservation is critical for keeping biological materials at extremely low temperatures and preventing cellular deterioration over long periods of time. It is required for cryobanking sperm, oocytes, and embryos, maintaining their long-term viability for future use. Furthermore, it is used in regenerative medicine, organ preservation studies, and stem cell storage. The procedure allows for the safe transportation of genetic materials between locations while preserving their integrity, which aids breakthroughs in assisted reproductive technologies and veterinary sciences.

Global Liquid Nitrogen Cryopreservation Market Dynamics

Market Drivers

- Increasing demand for IVF procedures and assisted reproductive technologies

- Growing use of liquid nitrogen in the livestock breeding industry

- Technological advancements in cryopreservation techniques

- Rising awareness of cryopreservation’s importance in preserving genetic material

Market Restraints

- High cost of cryopreservation equipment and storage

- Risks of biological sample damage during the freezing or thawing process

- Limited awareness in emerging markets about cryopreservation benefits

Market Opportunities

- Expansion of cryopreservation in regenerative medicine and stem cell storage

- Integration of automated systems to improve operational efficiency

- Rising demand for genetic preservation in wildlife conservation

Liquid Nitrogen Cryopreservation Market Report Coverage

|

Market |

Liquid Nitrogen Cryopreservation Market |

|

Liquid Nitrogen Cryopreservation Market Size 2023 |

USD 2,566.9 Million |

|

Liquid Nitrogen Cryopreservation Market Forecast 2032 |

USD 7,713.4 Million |

|

Liquid Nitrogen Cryopreservation Market CAGR During 2024 - 2032 |

13.2% |

|

Liquid Nitrogen Cryopreservation Market Analysis Period |

2020 - 2032 |

|

Liquid Nitrogen Cryopreservation Market Base Year |

2023 |

|

Liquid Nitrogen Cryopreservation Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Application, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

CUSTOM BIOGENIC SYSTEMS, Chart Industries, Linde PLC, Taylor-Wharton, Antech Group Inc., Abeyance Cryo Solutions, Thermo Fisher Scientific, Inc., Worthington Industries, Inc., Technifab Products, and BIOLOGIX GROUP LTD. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Liquid Nitrogen Cryopreservation Market Insights

Rising Number Of Government Initiatives For Preservation Of Stem Cells Foster The Ultimate Growth Of Global Liquid Nitrogen Cryopreservation Market

The National Cord Blood Program (NCBP), created in 1992, investigates cord blood as a potential treatment for critical public health issues. This is used to determine acceptable hemopoetic transplants for patients who do not have a matching bone marrow donor. NCBP freezes and preserves cord blood units in liquid nitrogen for shipment as needed. The Canadian Department of Health launched Canada's first publicly financed national umbilical cord blood bank, accepting contributions for allergic stem cell transplantation and hematopoietic stem cell transplantation.

Furthermore, the UK Stem Cell Bank, sponsored by the UK Medical Research Council, is a quality-controlled, ethically acceptable, and confirmed repository for human embryo, foetus, and adult stem cell lines provided by the Science and Healthcare Growth, Biotechnology, and Biological Research Councils. The Stem Cell Bank (UK) provided human cell lines to Sheffield University for use in medical trials and research. Stem cells, bone marrow cells, foetuses, and sperm require extremely low temperatures for storage and preservation, hence liquid nitrogen is the best alternative. The reasons listed above will have a beneficial impact on the overall growth of the global liquid nitrogen cryopreservation market.

High Risk Associated During Handling Of Liquid Nitrogen Cryopreservation Equipment Limit The Growth Of Global Market

When nitrogen circulates from a cryogenic storage vessel and the oxygen concentration around it is too high, the usability of freezers is threatened. Furthermore, liquid nitrogen is extremely cold in nature, causing quick frostbite or cold contact burns on exposed skin. Accidental releases or overflows of liquid nitrogen pose dangers and cause property damage. The most prevalent reason of accidental releases is a lack of training in handling certain hazardous compounds. Leakage of LN2 into laboratories poses the greatest risk of asphyxiation, physical injury, and environmental damage, among other things.

Key takeaways:

Every year, the capacity to replace organs and tissues on demand saves and improves millions of lives around the world, resulting in public health benefits by curing a variety of life-threatening illnesses. Advanced organ preservation procedures may potentially enable cutting-edge pretransplant therapies that have the potential to improve transplant outcomes, such as immunomodulation or gene therapy approaches for functional augmentation in specialist laboratories. Such factors have resulted in strong demand for the liquid nitrogen cryopreservation industry, resulting in total worldwide market growth.

Liquid Nitrogen Cryopreservation Market Segmentation

The worldwide market for liquid nitrogen cryopreservation is split based on application, end-use, and geography.

Liquid Nitrogen Cryopreservation Application

- Stem Cells

- Embryos & Oocytes

- Sperms, Semen & Testicular Tissues

- Others

According to liquid nitrogen cryopreservation industry analysis, based on application, the stem cell segment dominates the overall market by recording considerable revenue and will continue to do so till the foreseeable future. This dominance is being driven by advances in regenerative medicine, increased demand for stem cell banking, and growing uses in disease treatment and customized medicine. Furthermore, the increasing number of clinical trials focusing on stem cell therapies helps to enhance its market position.

Liquid Nitrogen Cryopreservation End-Use

- Stem Cell Banks

- Contract Research Organizations

- Biotechnology & Pharmaceutical Organizations

- Research and Academic Institutes

- Stem Cell Research Laboratories

Based on end-use, the stem cell research laboratories sector leads segmental growth, accounting for a large part. This is due to increased funding in biomedical research, cooperation between research institutions and biopharmaceutical businesses, and government efforts that promote stem cell research. The rising frequency of chronic and degenerative diseases has also increased the demand for extensive stem cell research, resulting in the widespread use of liquid nitrogen cryopreservation techniques in laboratories.

Liquid Nitrogen Cryopreservation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Liquid Nitrogen Cryopreservation Market Regional Analysis

North America is the Largest Region in the Liquid Nitrogen Cryopreservation Industry

North America dominates the liquid nitrogen cryopreservation market, with the United States leading the way because of a well-established biopharmaceutical sector, large investments in stem cell research, and growing acceptance of cryopreservation techniques for assisted reproductive technologies (ART). The presence of significant industrial players, as well as increased government financing for biomedical research, all help to improve the region's liquid nitrogen cryopreservation market position. Furthermore, the rising prevalence of chronic diseases and cancer creates a demand for biobanking solutions for research and therapeutic purposes.

Europe Records Considerable Market Share for Liquid Nitrogen Cryopreservation

The increasing number of contract manufacturing organizations (CMO) and contract research organizations (CRO), as well as increased R&D activities related to cell line development and stem cell research are key factors driving the global market. Furthermore, rising partnerships and agreements enhances the business presence with rising customer base will positively influence the target market's growth.

Asia Pacific Registers Fastest Growing CAGR in the Liquid Nitrogen Cryopreservation Market Forecast Period

Countries such as South Korea, Russia, India, and others are focusing on strengthening their research and development capabilities in response to the rising COVID-19, and are spending on the development and establishment of advanced laboratories. As a result, the demand for liquid nitrogen freezers is increasing. Furthermore, favorable government business policies and the emergence of small and mid-sized players with innovative solutions will drive the global liquid nitrogen cryopreservation market.

Liquid Nitrogen Cryopreservation Market Players

Some of the top liquid nitrogen cryopreservation companies offered in our report includes CUSTOM BIOGENIC SYSTEMS, Chart Industries, Linde PLC, Taylor-Wharton, Antech Group Inc., Abeyance Cryo Solutions, Thermo Fisher Scientific, Inc., Worthington Industries, Inc., Technifab Products, and BIOLOGIX GROUP LTD.

Frequently Asked Questions

How big is the liquid nitrogen cryopreservation market?

The liquid nitrogen cryopreservation market size was valued at USD 2,566.9 Million in 2023.

What is the CAGR of the global liquid nitrogen cryopreservation market from 2024 to 2032?

The CAGR of liquid nitrogen cryopreservation is 13.2% during the analysis period of 2024 to 2032.

Which are the key players in the liquid nitrogen cryopreservation market?

The key players operating in the global market are including CUSTOM BIOGENIC SYSTEMS, Chart Industries, Linde PLC, Taylor-Wharton, Antech Group Inc., Abeyance Cryo Solutions, Thermo Fisher Scientific, Inc., Worthington Industries, Inc., Technifab Products, and BIOLOGIX GROUP LTD.

Which region dominated the global liquid nitrogen cryopreservation market share?

North America held the dominating position in liquid nitrogen cryopreservation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of liquid nitrogen cryopreservation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global liquid nitrogen cryopreservation industry?

The current trends and dynamics in the liquid nitrogen cryopreservation industry include technological advancements in cryopreservation techniques, and rising awareness of cryopreservation�s importance in preserving genetic material.

Which application held the maximum share in 2023?

The stem cells application held the maximum share of the liquid nitrogen cryopreservation industry.