Liquid Handling Technology Market | Acumen Research and Consulting

Liquid Handling Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

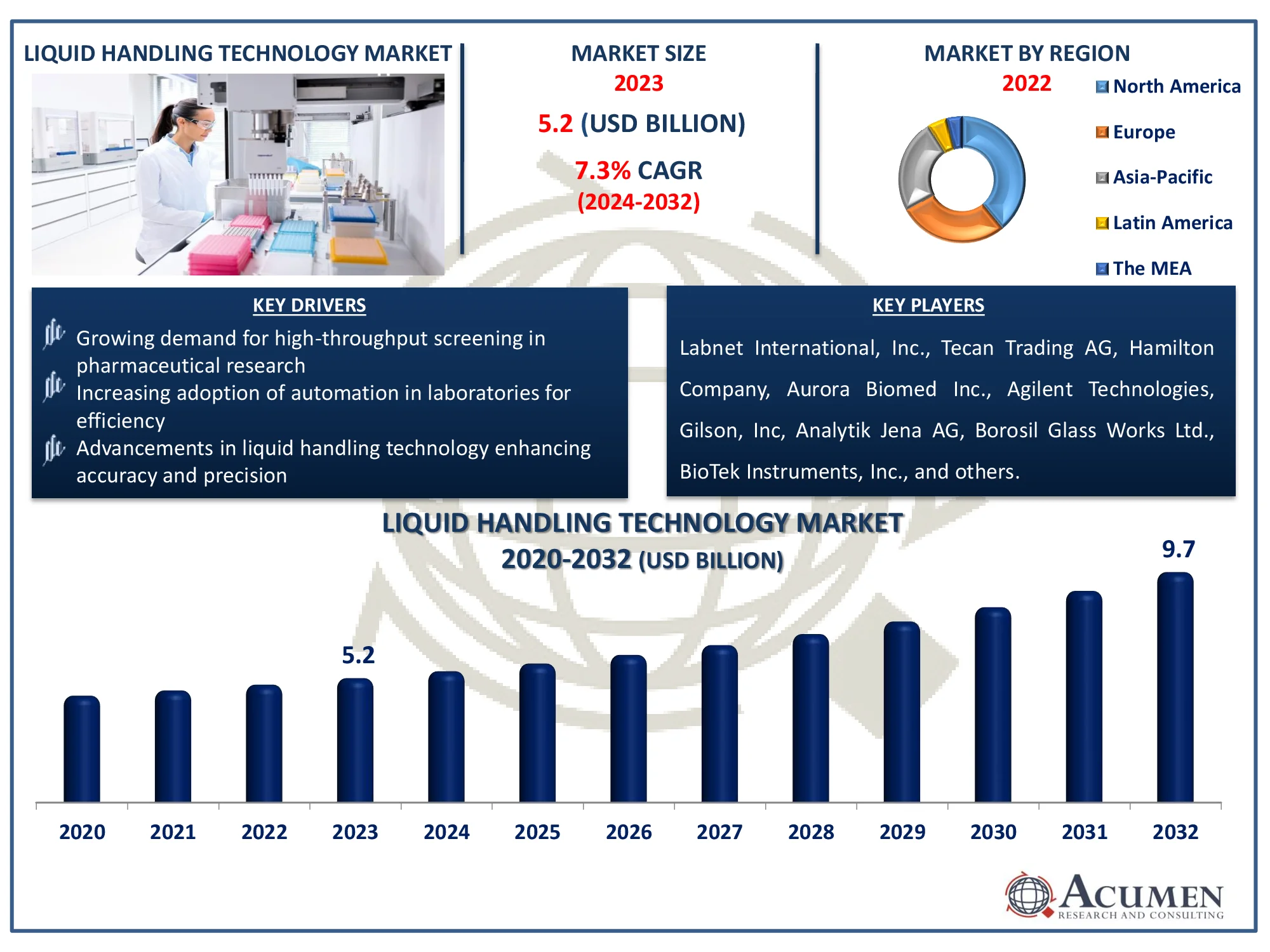

The Global Liquid Handling Technology Market Size accounted for USD 5.2 Billion in 2023 and is estimated to achieve a market size of USD 9.7 Billion by 2032 growing at a CAGR of 7.3% from 2024 to 2032.

Liquid Handling Technology Market Highlights

- Global liquid handling technology market revenue is poised to garner USD 9.7 billion by 2032 with a CAGR of 7.3% from 2024 to 2032

- North America liquid handling technology market value occupied around USD 2.02 billion in 2023

- Asia-Pacific liquid handling technology market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product, the consumables sub-segment generated 47% of the market share in 2023

- Based on end-user, the academic & research institutes sub-segment generated 42% market share in 2023

- Increased automation for efficiency and accuracy is the liquid handling technology market trend that fuels the industry demand

Liquid handling technology involves methods and equipment designed for the precise measurement, transfer, and manipulation of liquids in various scientific and industrial settings. This technology is crucial in laboratories for applications like pipetting, mixing, and dispensing, ensuring accurate and reproducible results in experiments. Automated liquid handlers can perform complex tasks such as high-throughput screening and assay development, enhancing efficiency and reducing human error. In medical settings, liquid handling is vital for accurate sample analysis and diagnostics. It is also used in manufacturing for quality control and process optimization. Advances in this technology continue to drive improvements in research, healthcare, and industrial processes.

Global Liquid Handling Technology Market Dynamics

Market Drivers

- Growing demand for high-throughput screening in pharmaceutical research

- Increasing adoption of automation in laboratories for efficiency

- Advancements in liquid handling technology enhancing accuracy and precision

Market Restraints

- High cost of advanced liquid handling systems

- Technical challenges and complexity in handling sophisticated equipment

- Limited adoption in smaller laboratories due to budget constraints

Market Opportunities

- Expansion into emerging markets with growing biotech industries

- Development of user-friendly and cost-effective liquid handling solutions

- Integration of AI and machine learning for enhanced automation and data analysis

Liquid Handling Technology Market Report Coverage

| Market | Liquid Handling Technology Market |

| Liquid Handling Technology Market Size 2022 |

USD 5.2 Billion |

| Liquid Handling Technology Market Forecast 2032 | USD 9.7 Billion |

| Liquid Handling Technology Market CAGR During 2023 - 2032 | 7.3% |

| Liquid Handling Technology Market Analysis Period | 2020 - 2032 |

| Liquid Handling Technology Market Base Year |

2022 |

| Liquid Handling Technology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Type, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Labnet International, Inc., Tecan Trading AG, Hamilton Company, Aurora Biomed Inc., Agilent Technologies, Gilson, Inc, Analytik Jena AG, Borosil Glass Works Ltd., BioTek Instruments, Inc., Beckman Coulter, Inc., and Eppendorf AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Liquid Handling Technology Market Insights

The liquid handling technology market is experiencing growth driven by the increasing adoption of automation in laboratories to enhance efficiency. For instance, in May 2023, Opentrons introduced the Opentrons Flex robot, a budget-friendly and easy-to-use liquid-handling lab robot. This next-generation device aims to democratize advanced lab automation by making it accessible to labs of all sizes and expanding its advantages to a wider range of researchers. Automated systems streamline processes, reduce human error, and accelerate workflows, enabling high-throughput screening and precise liquid handling. Consequently, laboratories are increasingly investing in advanced liquid handling technologies to stay competitive and meet the growing needs of modern research and diagnostics.

The high cost of advanced liquid handling systems acts as a significant restraint in the liquid handling technology market. These sophisticated systems often require substantial investment in initial setup and maintenance, limiting their accessibility for smaller laboratories and research facilities. Additionally, the need for specialized training to operate these complex devices can further escalate costs. Consequently, many potential users may opt for more affordable, albeit less efficient, alternatives, slowing the adoption of cutting-edge liquid handling technologies.

The expansion into emerging markets with burgeoning biotech industries presents a significant opportunity for the liquid handling technology market. These regions are witnessing increased investments in biotech research and development, driving demand for advanced liquid handling solutions. For instance, according to Invest India, the Indian bioeconomy industry is projected to reach $150 billion by 2025 and $300 billion by 2030, driven by increasing demand both domestically and internationally. Consequently, companies can leverage these trends to expand their footprint and capture new revenue streams in these high-potential areas.

Liquid Handling Technology Market Segmentation

The worldwide market for liquid handling technology is split based on product, type, application, end user, and geography.

Liquid Handling Technology Products

- Automated Workstations

- Standalone Workstations

- Integrated Workstations

- Small Devices

- Pipettes

- Electronic Pipettes

- Manual Pipettes

- Pipette Controllers

- Burettes

- Dispensers

- Others

- Pipettes

- Consumables

- Regents

- Disposable Tips

- Tubes & Plates

- Others

According to the liquid handling technology industry analysis, consumables products dominate due to their essential role in ensuring precision and accuracy across various applications. These consumables, such as pipette tips, microcentrifuge tubes, and reagent reservoirs, are crucial for maintaining the integrity of liquid samples and processes. Their frequent use and need for regular replacement drive consistent demand, making them a significant segment of the market.

Liquid Handling Technology Types

- Automated Liquid Handling

- Manual Liquid Handling

- Semi-Automated Liquid Handling

According to the liquid handling technology market forecast, semi-automated liquid handling systems is expected to lead the market due to their balance of efficiency and cost-effectiveness. They offer increased precision and reproducibility compared to manual methods while remaining more affordable than fully automated systems. Their versatility and ease of integration into existing workflows make them a popular choice across various applications, including pharmaceuticals and research laboratories. As demand for accurate and scalable liquid handling solutions grows, semi-automated systems are well-positioned to meet these needs effectively.

Liquid Handling Technology Applications

- Drug Discovery & ADME-Tox Research

- Cancer & Genomic Research

- Bioprocessing/Biotechnology

- Others

Based on applications, drug discovery, and ADME-Tox research are leading sectors due to their critical role in accelerating drug development and ensuring safety. Advanced liquid handling systems facilitate precise and high-throughput processing of samples, which is essential for testing drug efficacy and toxicity. These technologies enhance efficiency, accuracy, and reproducibility in screening assays and compound management. Consequently, their adoption in research labs is driving market growth and innovation.

Liquid Handling Technology End Users

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

According to the liquid handling technology industry forecast, academic and research institutes dominate market due to their extensive need for precise and reliable equipment for experiments and studies. These institutions drive demand for advanced technologies that ensure accuracy and efficiency in handling small volumes of liquids. Their significant research budgets and focus on cutting-edge developments fuel innovation in liquid handling solutions.

Liquid Handling Technology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Liquid Handling Technology Market Regional Analysis

For several reasons, North America leads the liquid handling technology market due to its advanced healthcare infrastructure, substantial investments in research and development, and a strong presence of key industry players. For instance, in December 2023, Hudson Robotics and Art Robbins Instruments, a global provider of laboratory automation solutions and a portfolio company of Argosy Healthcare Partners, successfully acquired Tomtec Inc. Tomtec is known for its automated liquid handling instruments, which are mainly used for sample preparation in mass spectrometry. The region's high demand for precision and automation in laboratories and manufacturing processes further drives market growth.

The Asia-Pacific region is the fastest-growing market for liquid handling technology due to rapid industrialization, increasing investments in healthcare and research, and expanding pharmaceutical and biotechnology sectors. Governments and private sectors are heavily investing in infrastructure and innovation, further fueling market growth. For instance, the Indian government plans to launch a credit incentive program valued at Rs. 50,000 crore (US$ 6.8 billion) to enhance the nation’s healthcare infrastructure. Additionally, the region's large population base drives demand for advanced laboratory technologies and efficient fluid management solutions further accelerate growth.

Liquid Handling Technology Market Players

Some of the top liquid handling technology companies offered in our report include Labnet International, Inc., Tecan Trading AG, Hamilton Company, Aurora Biomed Inc., Agilent Technologies, Gilson, Inc., Analytik Jena AG, Borosil Glass Works Ltd., BioTek Instruments, Inc., Beckman Coulter, Inc., and Eppendorf AG.

Frequently Asked Questions

How big is the liquid handling technology market?

The liquid handling technology market size was valued at USD 5.2 billion in 2023.

What is the CAGR of the global liquid handling technology market from 2024 to 2032?

The CAGR of liquid handling technology is 7.3% during the analysis period of 2024 to 2032.

Which are the key players in the liquid handling technology market?

The key players operating in the global market are including Labnet International, Inc., Tecan Trading AG, Hamilton Company, Aurora Biomed Inc., Agilent Technologies, Gilson, Inc, Analytik Jena AG, Borosil Glass Works Ltd., BioTek Instruments, Inc., Beckman Coulter, Inc., and Eppendorf AG.

Which region dominated the global liquid handling technology market share?

North America held the dominating position in liquid handling technology industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of liquid handling technology during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global liquid handling technology industry?

The current trends and dynamics in the liquid handling technology industry include growing demand for high-throughput screening in pharmaceutical research, increasing adoption of automation in laboratories for efficiency, and advancements in liquid handling technology enhancing accuracy and precision.

Which product held the maximum share in 2023?

The consumable held the maximum share of the liquid handling technology industry.