Liquid Analytical Instrument Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Liquid Analytical Instrument Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

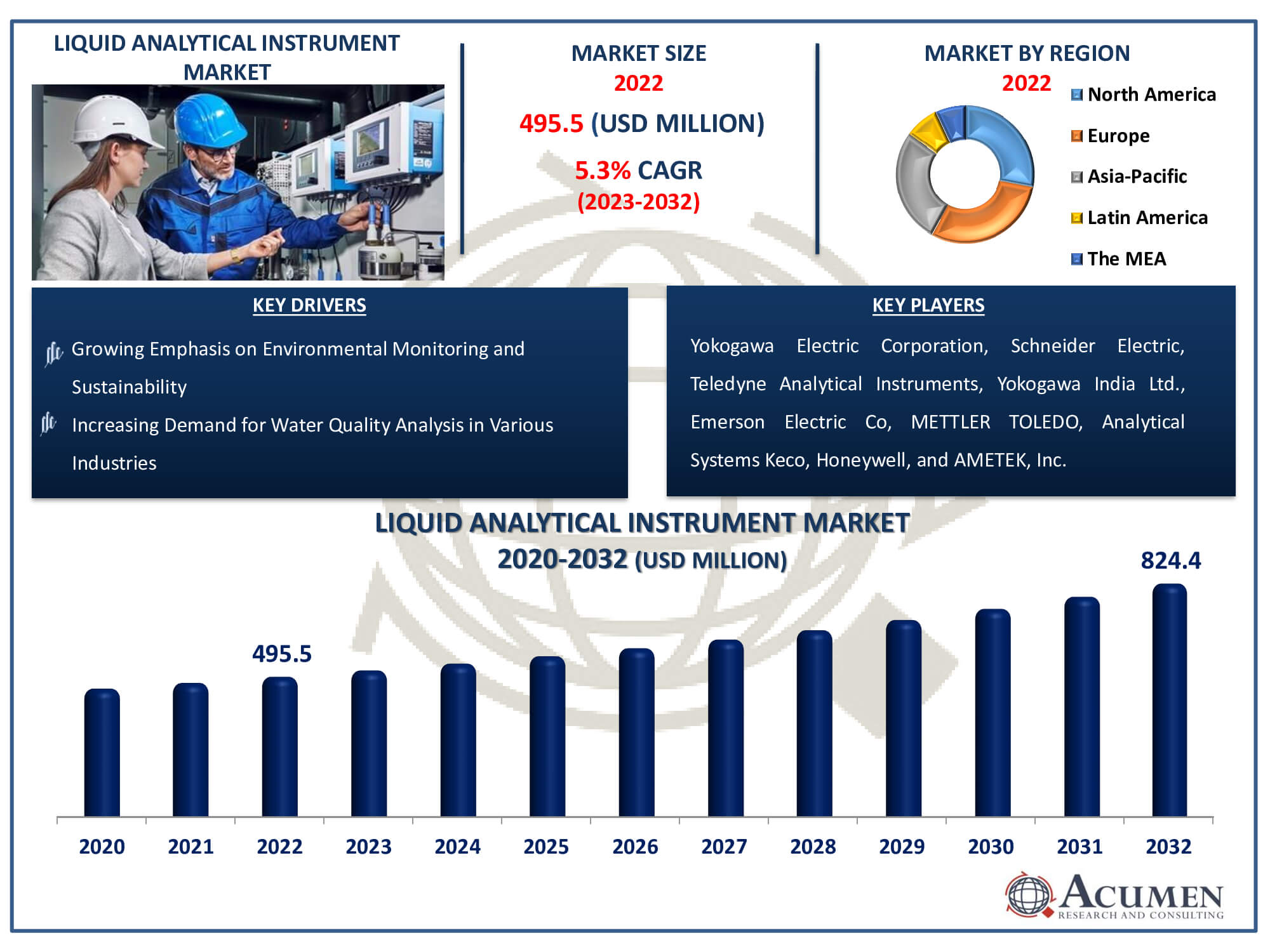

The Liquid Analytical Instrument Market Size accounted for USD 495.5 Million in 2022 and is estimated to achieve a market size of USD 824.4 Million by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

Liquid Analytical Instrument Market Highlights

- Global liquid analytical instrument market revenue is poised to garner USD 824.4 million by 2032 with a CAGR of 5.3% from 2023 to 2032

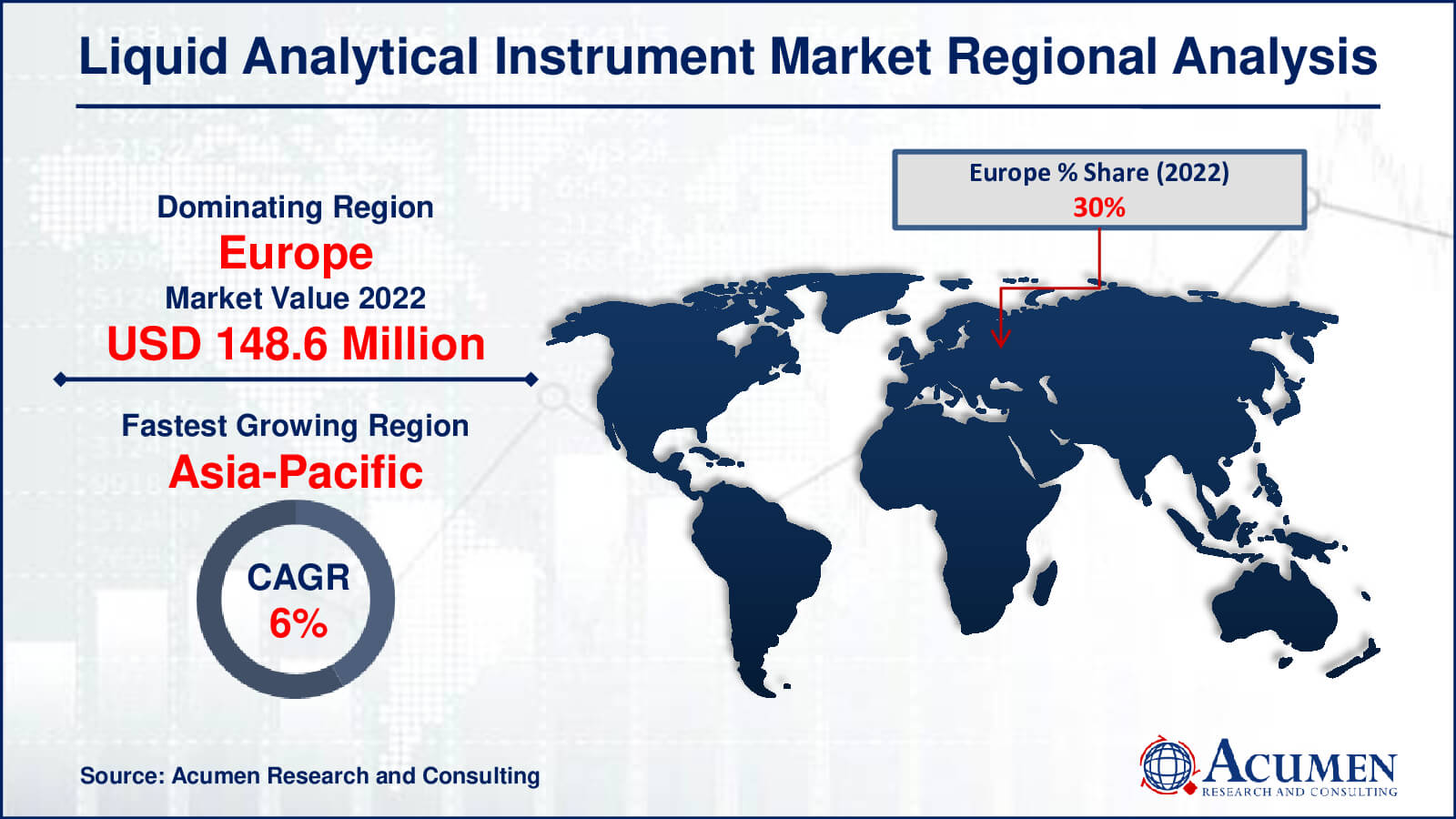

- Europe liquid analytical instrument market value occupied around USD 148.6 million in 2022

- Asia-Pacific liquid analytical instrument market growth will record a CAGR of more than 6% from 2023 to 2032

- Among instruments, the pH/ORP analyzers sub-segment generated over US$ 153.6 million revenue in 2022

- Based on application, the drug discovery sub-segment generated around 24% share in 2022

- Increasing applications in healthcare and biotechnology industries is a popular liquid analytical instrument market trend that fuels the industry demand

Liquid analytical instruments are instruments designed to analyze and measure numerous properties of liquids, such as pH, conductivity, turbidity, and dissolved oxygen. These devices are essential to the pharmaceutical, water treatment, and chemical manufacturing industries because they provide quality control, process optimization, and regulatory compliance. The growing need for precise and instantaneous liquid parameter monitoring in industrial processes is driving the liquid analytical instrument market. The market is expanding as a result of factors like strict environmental laws, a focus on product quality, and the requirement for efficient production. The rise of the liquid analytical instrument market is further propelled by ongoing technological improvements and the incorporation of smart sensors.

Global Liquid Analytical Instrument Market Dynamics

Market Drivers

- Increasing demand for water quality analysis in various industries

- Stringent regulatory standards driving adoption of liquid analytical instruments

- Advancements in technology enhancing instrument accuracy

- Growing emphasis on environmental monitoring and sustainability

Market Restraints

- High initial investment costs for liquid analytical instruments

- Challenges in retrofitting existing systems for instrument integration

- Limited awareness and education regarding liquid analytical instrumentation

Market Opportunities

- Expansion of market reach in emerging economies

- Integration of smart sensors and IoT for enhanced monitoring

- Collaborations and partnerships for research and development

Liquid Analytical Instrument Market Report Coverage

| Market | Liquid Analytical Instrument Market |

| Liquid Analytical Instrument Market Size 2022 | USD 495.5 Million |

| Liquid Analytical Instrument Market Forecast 2032 | USD 824.4 Million |

| Liquid Analytical Instrument Market CAGR During 2023 - 2032 | 5.3% |

| Liquid Analytical Instrument Market Analysis Period | 2020 - 2032 |

| Liquid Analytical Instrument Market Base Year |

2022 |

| Liquid Analytical Instrument Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Instruments, By Application, By End use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Yokogawa Electric Corporation, Schneider Electric, Teledyne Analytical Instruments, Emerson Electric Co, METTLER TOLEDO, Analytical Systems Keco, Honeywell, AMETEK, Inc., General Electric, Analytik Jena GmbH, Danaher, and ABB. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Liquid Analytical Instrument Market Insights

The growing demand for liquid analytical instruments in food and beverage processing units, for controlling and estimating the chemical composition of liquids, is expected to drive the market. Liquid analytical instruments are widely utilized in industrial manufacturing processes due to their ability to provide unbiased results and quick, accurate measurements. The increasing adoption of automated liquid analytical instruments in the pharmaceutical industry aids in reducing human errors and facilitates effective data control and monitoring, further anticipated to propel market growth over the liquid analytical instrument industry forecast period. The rapid and extensive development of the biotechnology industry, coupled with a high adoption rate of precise analytical instruments, is expected to drive the market through 2032. The emergence of advanced technologies, such as high-frequency fluid analysis and technology innovation in selection technology, is also expected to fuel market growth.

The market is anticipated to experience significant growth over the liquid analytical instrument market forecast period due to the increasing demand for products used in water quality analysis within the water and wastewater management industry. Moreover, the adoption of liquid analytical instruments across various end-use industries is being driven by stringent environmental and government regulations. A noteworthy example is the Drinking Water Contaminants Standards and Regulations established by the U.S. Environmental Protection Agency (EPA), specifically addressing public drinking water and water quality in various end-use sectors.

Analyzers are primarily used for measuring the chemical composition of liquids and assessing their characteristics. They find applications in various areas, such as the measurement of dissolved oxygen, determination of pH (potential of hydrogen), oxidation-reduction potential, and conductivity/resistivity of liquids. These highly precise instruments are also employed in the food and beverage industry to uphold water quality standards.

Liquid Analytical Instrument Market Segmentation

The worldwide market for liquid analytical instrument is split based on instruments, application, end use, and geography.

Liquid Analytical Instrument Market By Instruments

- Conductivity & Resistivity Analyzers

- Infrared Analyzers

- Oxygen Analyzers

- pH/ORP Analyzers

- Turbidity Analyzers

- Others

According to liquid analytical instrument industry analysis, since it plays such a crucial role in determining and keeping track of the acidity, alkalinity, and oxidative characteristics of liquids, the pH/ORP Analyzers sector commands the greatest share of the market. Due to their ability to precisely manage chemical processes and maintain ideal conditions, these analyzers are essential to many different sectors. Precise pH and ORP measurements are essential for quality control and legal compliance in industries such as chemical manufacture, water treatment, and medicines. The adaptability of pH/ORP analyzers, which provide real-time data on liquid properties, makes them essential instruments for guaranteeing the safety, effectiveness, and quality of products. The market dominance of the pH/ORP Analyzers sector in the liquid analytical instrument market is largely attributable to its broad adoption in a variety of applications.

Liquid Analytical Instrument Market By Applications

- Liquid Chemistry Monitoring

- Drug Discovery

- Wastewater Management

- Water Purification

- Others

The drug discovery category leads the liquid analytical instrument market due to its significance to the pharmaceutical industry. Being able to precisely and instantly monitor a variety of liquid characteristics makes liquid analytical devices indispensable to the drug discovery process. While pharmaceutical substances are being researched and developed, these tools play a critical role in guaranteeing their safety, effectiveness, and quality. Pharmaceutical companies have prioritised modern technology to increase efficiency and accuracy in their research endeavours, which has led to a boom in demand for liquid analytical equipment in the field of drug development. The liquid analytical instrument market is propelled by the drug discovery segment, which matches the changing demands of the pharmaceutical industry by emphasising innovation and quick progress in drug development.

Liquid Analytical Instrument Market By End Uses

- Chemicals

- Energy

- Food & Beverage

- Healthcare & Biotechnology

- Oil & Gas

- Pharmaceutical

- Others

In the liquid analytical instrument market analysis, the food and beverage category holds the top spot thanks to its crucial role in guaranteeing product quality, safety, and regulatory compliance. In order to monitor and regulate critical characteristics like pH, conductivity, and composition all essential for preserving the quality of food and beverage products—liquid analytical instruments are widely used in this industry. These tools support the improvement of overall operational efficiency, adherence to quality standards, and production process optimisation. The need for liquid analytical instruments is only going to increase as the food and beverage industry places a greater emphasis on accuracy and adherence to strict guidelines. The industry's competition, consumer expectations, and upholding high standards in food and beverage production are all reflected in the segment's leadership position.

Liquid Analytical Instrument Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Liquid Analytical Instrument Market Regional Analysis

In terms of liquid analytical instrument market analysis, Europe is the largest region in the industry, with strong growth and a significant market share. The region's leadership is attributable to the extensive deployment of liquid analytical instruments across many industries, including pharmaceuticals, chemicals, and food & beverage. The demand for these devices in wastewater management, pharmaceutical research, and food processing is driven by the strict environmental legislation and quality control standards prioritized by European countries.

On the other hand, the liquid analytical instrument market is expanding at the quickest rate in Asia-Pacific. The region's quick expansion is attributed to its rapid industrialization, rapid economic development, and growing understanding of the value of liquid analysis in industries like energy generation and water purification. Increased spending on biotechnology, drugs, and healthcare is driving up demand for liquid analytical instruments. Moreover, the Asia-Pacific region's adoption of these instruments is boosted by governmental programmes that support environmental sustainability and the demand for effective water management solutions. Asia-Pacific is a major player in the liquid analytical instrument market due to its rapidly expanding manufacturing sectors and booming R&D activities, which are indicative of the region's changing economic landscape and dedication to technical improvements.

Liquid Analytical Instrument Market Players

Some of the top liquid analytical instrument companies offered in our report include Yokogawa Electric Corporation, Schneider Electric, Teledyne Analytical Instruments, Emerson Electric Co, METTLER TOLEDO, Analytical Systems Keco, Honeywell, AMETEK, Inc., General Electric, Analytik Jena GmbH, Danaher, and ABB.

Frequently Asked Questions

How big is the liquid analytical instrument market?

The liquid analytical instrument market size was valued at USD 495.5 million in 2022.

What is the CAGR of the global liquid analytical instrument market from 2023 to 2032?

The CAGR of liquid analytical instrument is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the liquid analytical instrument market?

The key players operating in the global market are including Yokogawa Electric Corporation, Schneider Electric, Teledyne Analytical Instruments, Emerson Electric Co, METTLER TOLEDO, Analytical Systems Keco, Honeywell, AMETEK, Inc., General Electric, Analytik Jena GmbH, Danaher, and ABB.

Which region dominated the global liquid analytical instrument market share?

Europe held the dominating position in liquid analytical instrument industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of liquid analytical instrument during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global liquid analytical instrument industry?

The current trends and dynamics in the liquid analytical instrument industry include increasing demand for water quality analysis in various industries, stringent regulatory standards driving adoption of liquid analytical instruments, advancements in technology enhancing instrument accuracy, and growing emphasis on environmental monitoring and sustainability.

Which instruments held the maximum share in 2022?

The pH/ORP analyzers instruments held the maximum share of the liquid analytical instrument industry.?