Liability Insurance Market | Acumen Research and Consulting

Liability Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

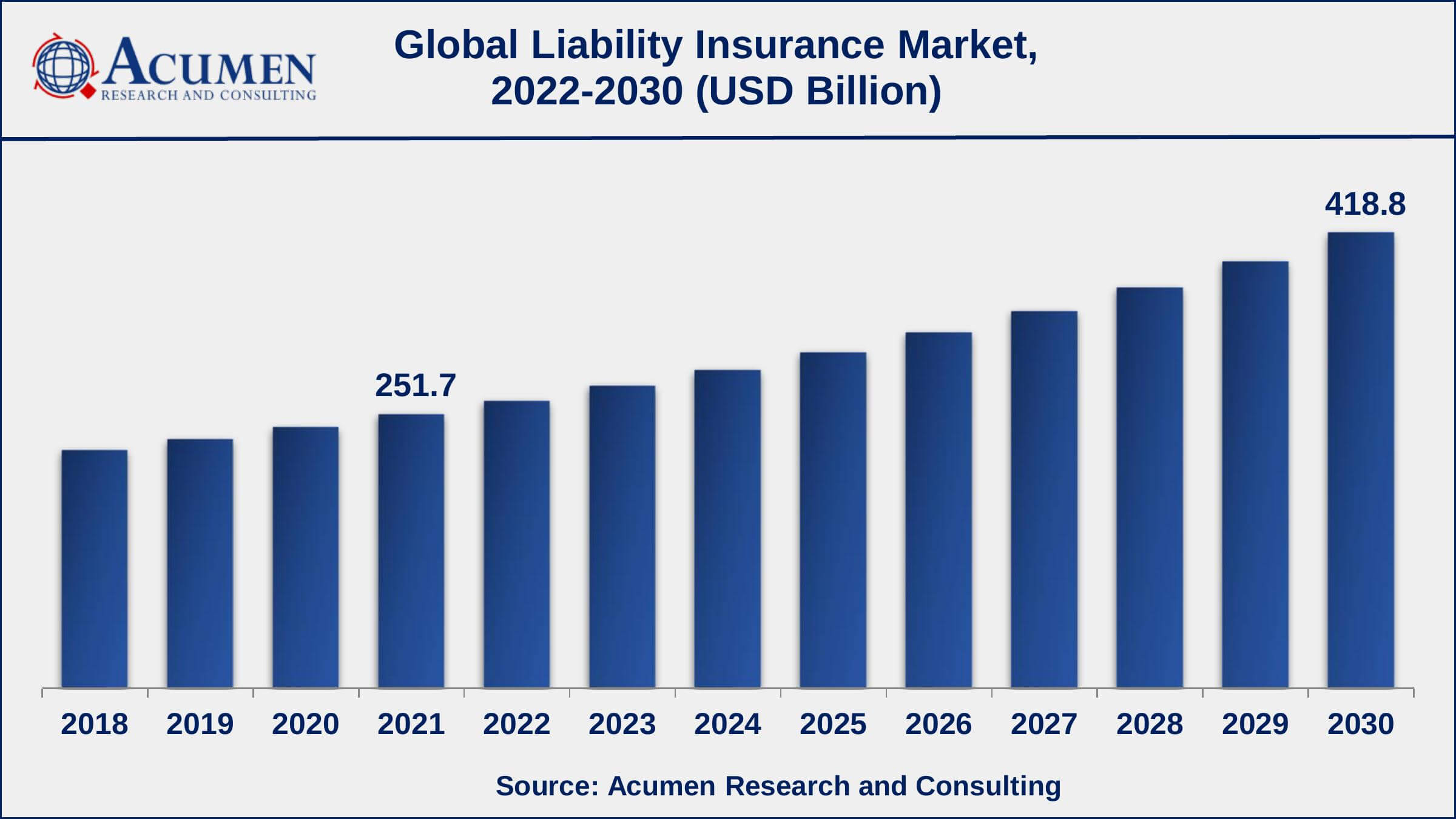

The Global Liability Insurance Market Size gathered USD 251.7 Billion in 2021 and is set to garner a market size of USD 418.8 Billion by 2030 growing at a CAGR of 5.9% from 2022 to 2030.

Liability insurance is a type of insurance that protects policyholders financially if they are found legally responsible for causing harm to another party. Liability insurance can help cover the costs of lawsuits, settlements, and other legal fees resulting from covered incidents. Individuals, such as homeowners and car owners, frequently purchase liability insurance because it is required in certain industries, such as construction. This insurance covers third-party claims for bodily injury, property damage, advertising injury, and other damages. It protects policyholders from claims for professional negligence or errors and omissions. It also covers claims made against policyholders for harm caused by a product they manufactured or sold.

Liability Insurance Market Report Statistics

- Global liability insurance market revenue is estimated to reach USD 418.8 billion by 2030 with a CAGR of 5.9% from 2022 to 2030

- North America liability insurance market value occupied more than USD 90 billion in 2021

- Asia-Pacific liability insurance market growth will register a CAGR of more than 6% from 2022 to 2030

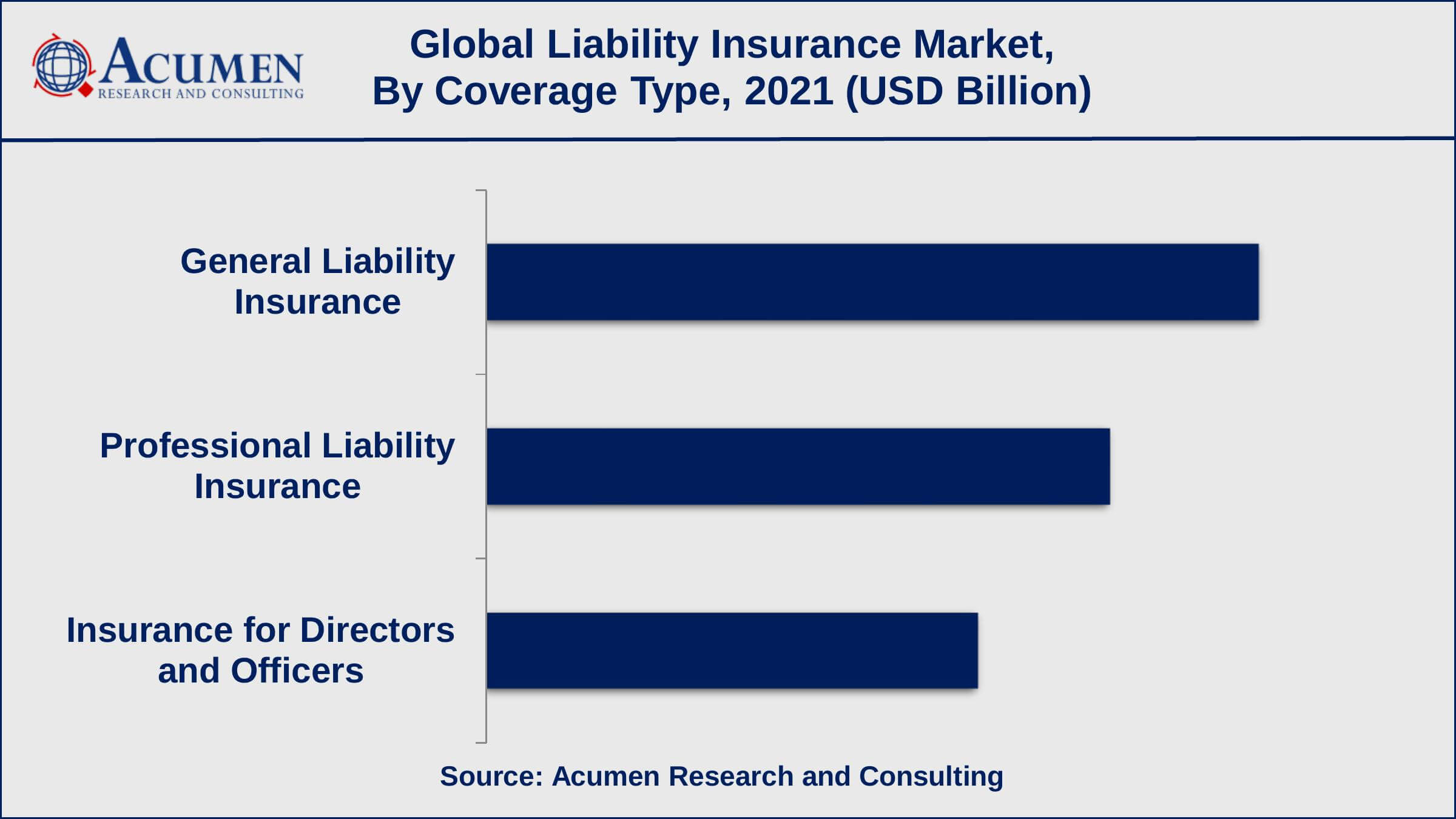

- Among coverage type, the general liability insurance sub-segment generated around 41% share in 2021

- Based on application, the commercial sub-segment achieved more than 50% share in 2021

- The rapid advancement in insurance sector is a popular liability insurance market trend that fuels the industry demand

Global Liability Insurance Market Dynamics

Market Drivers

- Increasing awareness towards liability insurance

- Rising small-business sector

- Increasing cost of litigation

Market Restraints

- Stringent regulations associated with this insurance

- Lack of knowledge

Market Opportunities

- Surging technological advancements

- Growth in the healthcare sector

Liability Insurance Market Report Coverage

| Market | Liability Insurance Market |

| Liability Insurance Market Size 2021 | USD 251.7 Billion |

| Liability Insurance Market Forecast 2030 | USD 418.8 Billion |

| Liability Insurance Market CAGR During 2022 - 2030 | 5.9% |

| Liability Insurance Market Analysis Period | 2018 - 2030 |

| Liability Insurance Market Base Year | 2021 |

| Liability Insurance Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Coverage Type, By Application, By Enterprise Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | American International Group Inc, Allianz, AXA SA, CNA Financial Corporation, Chubb, IFFCO-Tokio General Insurance Company Limited, Liberty General Insurance Limited, The Hartford, The Travelers Indemnity Company, Zurich American Insurance Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Liability Insurance Systems Market Growth Factors

The growth of small businesses, particularly in emerging economies, has increased demand for liability insurance as these businesses seek to protect themselves from potential legal liabilities. This factor is fueling the liability insurance market value. Rising government regulations in many countries require certain types of liability insurance for specific industries, such as construction or healthcare, leading to increased demand for these types of policies. Additionally, the cost of litigating legal claims has been rising, which has increased the need for liability insurance as a means of protecting against these expenses. This factor is also driving the liability insurance market growth.

On the other hand, economic slowdowns can lead to a decrease in demand for liability insurance as businesses and individuals may cut back on non-essential expenses. The liability insurance market is highly competitive, with many companies offering similar products and services. This intense competition can lead to price wars and lower profit margins for insurance companies. Besides that, a lack of understanding of the need for liability insurance can lead to low demand for these products, particularly among small businesses and individuals.

Furthermore, rising technological advancement has resulted in new products and services, resulting in new types of liabilities and the need for liability insurance to cover these exposures. Finally, as healthcare providers seek to protect themselves from potential legal liabilities, the growth of the healthcare sector, particularly in emerging economies, has increased demand for professional liability insurance.

Liability Insurance Systems Market Segmentation

The worldwide liability insurance market is categorized based on coverage type, application, enterprise size, and geography.

Liability Insurance Market By Coverage Type

- General Liability Insurance

- Professional Liability Insurance

- Insurance for Directors and Officers

According to our liability insurance industry analysis, general liability insurance accounted for the largest market in 2021 and is expected to continue to do so in the future. General liability insurance is one of the most popular types of liability insurance and has historically accounted for a sizable portion of the overall liability insurance market. This type of insurance is intended to protect businesses against a wide range of risks and liabilities, such as property damage, bodily injury, and personal injury claims. General liability insurance is popular due to several factors, including its broad coverage, ease of availability, and low cost when compared to other types of liability insurance. Additionally, many businesses are legally required to carry general liability insurance, which drives demand for this type of coverage even higher.

Liability Insurance Market By Application

- Commercial

- Personal

In 2021, the commercial sub-segment of the application segment held a sizable market share. Businesses of all sizes frequently require commercial liability insurance to protect against risks and liabilities that may arise from their operations. Construction companies, health professionals, manufacturers, retailers, and other types of businesses typically purchase this type of insurance. Personal liability insurance, on the other hand, is purchased directly by individuals to protect against liabilities and risks that may arise from their personal activities, such as owning a home or driving a vehicle. Homeowner's insurance, automobile insurance, and umbrella insurance are examples of personal liability insurance products.

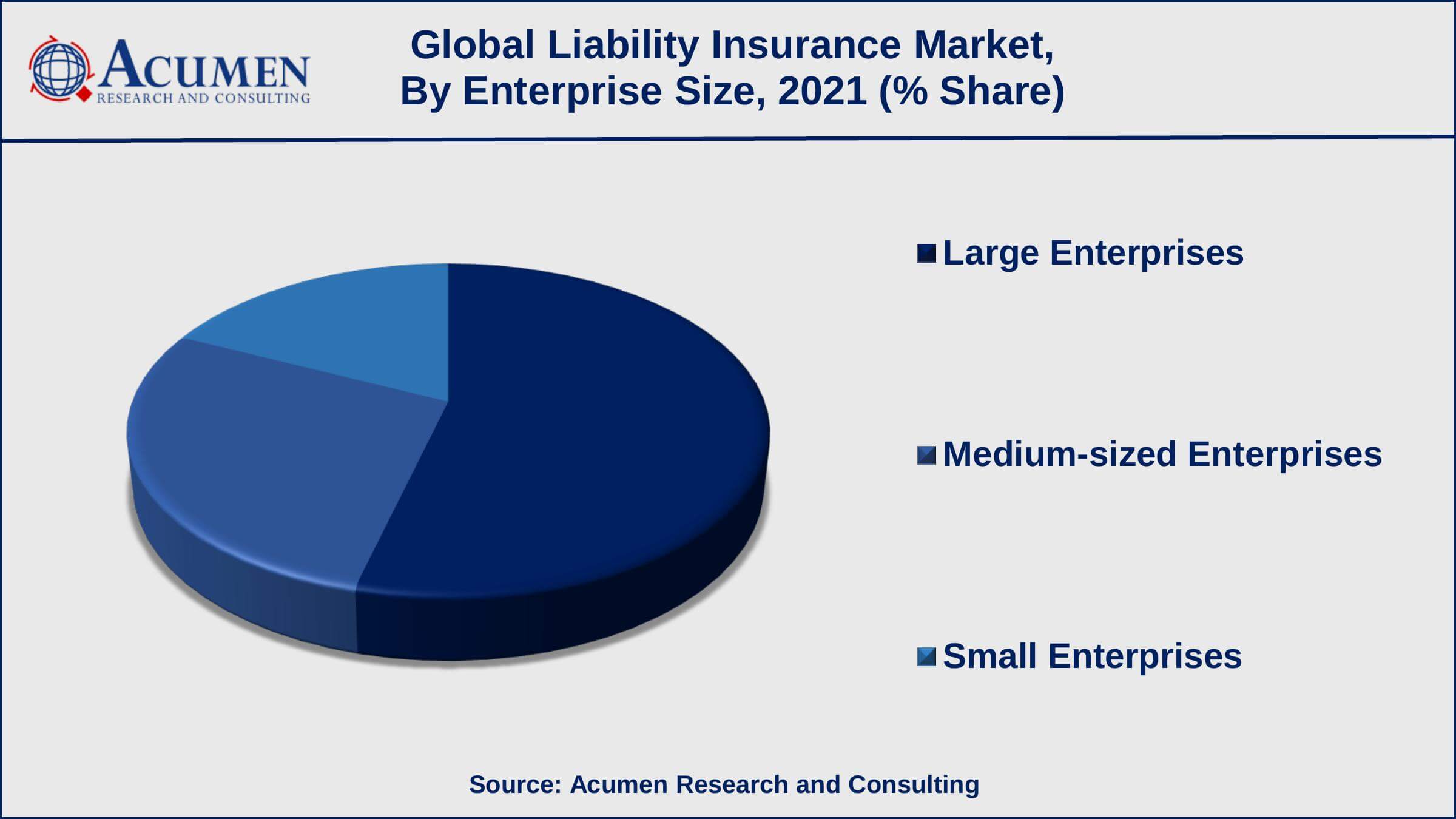

Liability Insurance Market By Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

According to the liability insurance market forecast, large enterprises will generate significant growth opportunities between 2022 and 2030. Due to their size and the complexity of their operations, large enterprises typically have a greater need for liability insurance. These businesses typically require comprehensive liability insurance coverage to protect themselves against a wide range of risks and liabilities that may arise as a result of their operations. Liability insurance is required for medium-sized businesses as well, though the specific types and amounts of coverage may be less extensive than for large businesses. Small businesses may have a lower demand for liability insurance because they have fewer resources to invest in insurance and are less exposed to liability risks.

Liability Insurance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Liability Insurance Market Regional Analysis

The North American liability insurance market is sizable, encompassing both the United States and Canada. This region has a mature insurance market, elevated amounts of insurance literacy, and a large number of insurance companies that provide liability insurance products. The liability insurance market in North America is highly competitive, with many insurance companies offering liability insurance products. The market is dominated by large insurance companies, though medium and small insurance companies are also present in significant numbers.

The Asia-Pacific liability insurance market is rapidly expanding, with countries such as China, India, Japan, Australia, and others participating. This region is distinguished by a rapidly growing insurance market, rising insurance literacy, and an increasing number of insurance companies offering liability insurance products.

Liability Insurance Market Players

Some of the leading liability insurance companies include Allianz, American International Group Inc, AXA SA, IFFCO-Tokio General Insurance Company Limited, CNA Financial Corporation, Chubb, Liberty General Insurance Limited, The Travelers Indemnity Company, The Hartford, and Zurich American Insurance Company.

Frequently Asked Questions

What was the market size of the global liability insurance in 2021?

The market size of liability insurance was USD 251.7 Billion in 2021.

What is the CAGR of the global liability insurance market during forecast period of 2022 to 2030?

The CAGR of liability insurance market is 5.9% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global market are Allianz, American International Group Inc, AXA SA, IFFCO-Tokio General Insurance Company Limited, CNA Financial Corporation, Chubb, Liberty General Insurance Limited, The Travelers Indemnity Company, The Hartford, and Zurich American Insurance Company.

Which region held the dominating position in the global liability insurance market?

North America held the dominating position in liability insurance market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for liability insurance market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global liability insurance market?

The current trends and dynamics in the liability insurance industry include increased awareness, rising small-business sector, and increasing cost of litigation.

Which coverage type held the maximum share in 2021?

The general liability insurance coverage type held the maximum share of the liability insurance market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date