Lecithin Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Lecithin Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

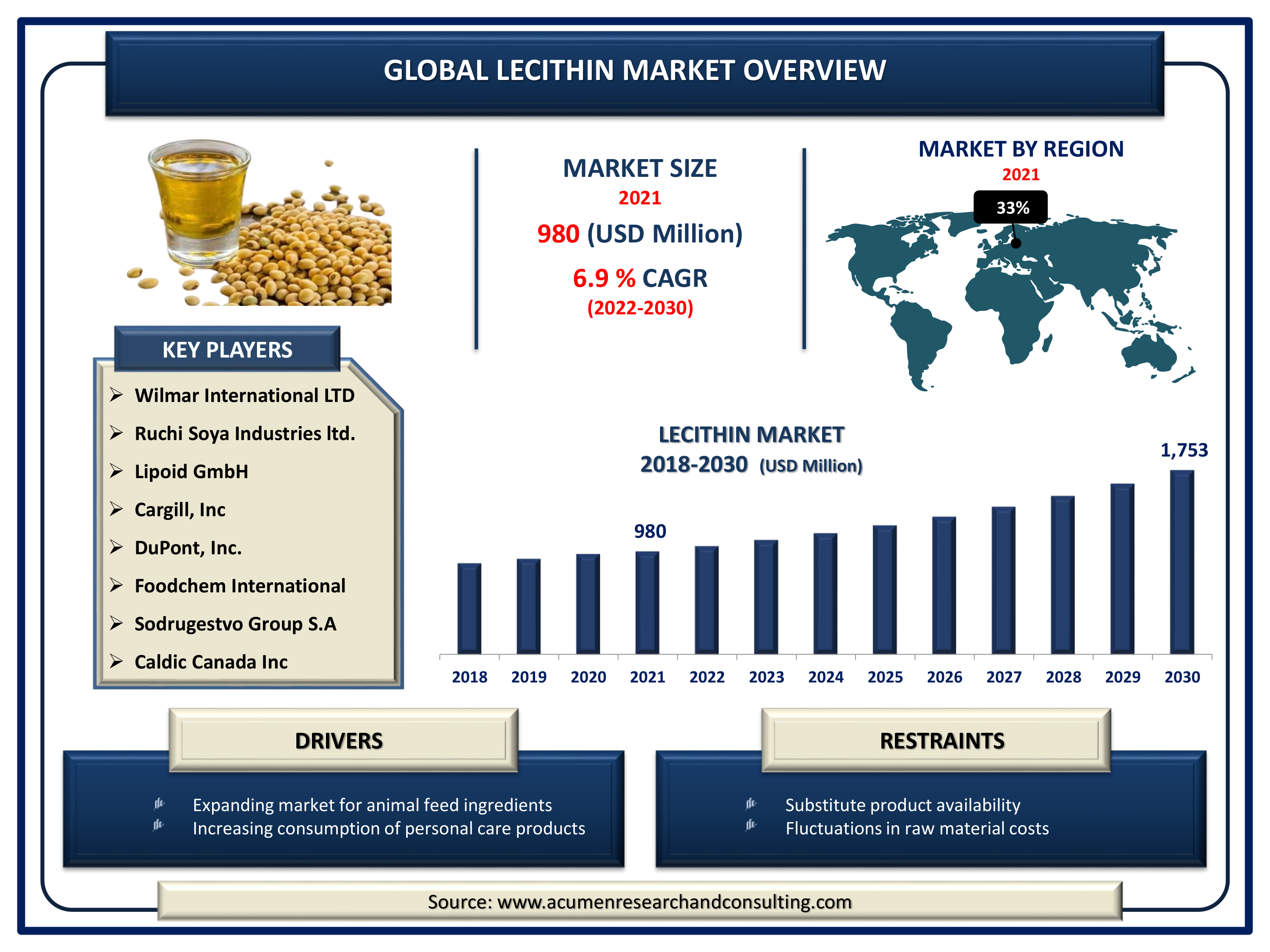

The global lecithin market size accounted for US$ 980 Mn in 2021 and is expected to reach US$ 1,753 Mn by 2030 with a considerable CAGR of 6.9% during the forecast timeframe of 2022 to 2030.

Lecithin is a fat-based essential component that is required by living organisms. It's found in a variety of food products, including soy and rapeseed. Choline, a chemical related to the B vitamins, is found mostly in lecithin, which is the principal dietary supply. Lecithin is used to make acetylcholine, a substance that conducts nerve stimulants. Lecithin helps to transfer cholesterol and lipids from the liver to places where they can be used or stored. Due to its multiple medical benefits, it can also be used in medicine manufacturing and taken as a medicine. Lecithin is a popular component in a number of new products since it enhances liver and cell performance, healthy reproductive and early childhood development, lipid transport and metabolism, and gallstone treatment. However, due to a reduction in calorie and sugar consumption, higher demand for lecithin, especially for food and beverage applications, could help the lecithin market expand.

Drivers

Drivers

- Expanding market for animal feed ingredients

- Increasing consumption of personal care products

- Growing demands for baked products

- Increasing pharmaceutical section

Restraints

- Substitute product availability

- Fluctuations in raw material costs

Opportunity

- Increasing packaged food product demand and a growing food and beverage industry

Report Coverage

| Market | Lecithin Market |

| Market Size 2021 | US$ 980 Mn |

| Market Forecast 2028 | US$ 1,753 Mn |

| CAGR | 6.9% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Source, By Application, By Form, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Archer Daniels Midland Company, Wilmar International Limited, Ruchi Soya Industries ltd., Lipoid GmbH, Cargill, Inc, DuPont, Inc., Foodchem International Corporation, Sodrugestvo Group S.A, Caldic Canada Inc, Imcopa Food Ingredients B.V., Orison Chemicals Limited, and Clarkson Specialty Lecithins. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Lecithin Market Dynamics

The worldwide lecithin market size is expected to grow steadily throughout the forecast period, owing to growing consumer awareness of the importance of eating a balanced diet that includes healthy fats like lecithin. The growing use of lecithin in the healthcare industry, as well as the medical benefits associated with its consumption, are likely to propel the market forward in the coming years. The lecithin industry is being propelled forward by its use as a food ingredient, in the pharmaceutical sector for treatments associated with hepatic and cholesterol effects, cardiovascular illnesses, neurological difficulties, and improved health awareness among customers.

Furthermore, the growing demand for convenient, functional, and unprocessed foods is expected to support the lecithin market. However, religious prohibitions on lecithin usage, as well as frequently fluctuating raw material prices, may hamper the global lecithin market's expansion over the projection period.

Market Segmentation

The global lecithin market segmented into source, application, form, and region.

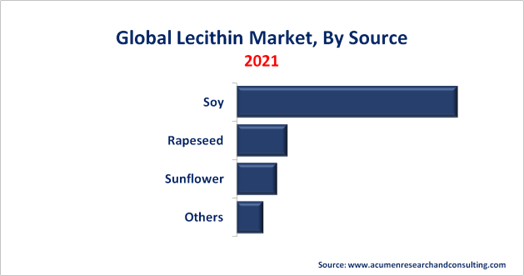

Market By Source

- Soy

- Rapeseed

- Sunflower

- Others

Based on the source, the soy segment captured the largest market share in 2021. Soy lecithin is a brownish-yellow compound that consists of phospholipids, glycolipids, neutral lipids, and carbohydrates. When compared to the other sources of lecithin, soy is the most often used. Due to its vast functional, nutritional, and therapeutic properties, soy lecithin is used in a variety of applications. Soy lecithin is used as an emulsifier in animal feed, food, paint, cosmetics, pharmaceuticals, and other industrial applications. The wide and rising category of Lecithin usage is a promising sign of the growing demand for soy lecithin. Furthermore, it's used to make ice creams, dairy products, dietary supplements, infant formulas, bread, margarine, and other convenience foods. However, increased concerns over increasing cholesterol levels and the allergic properties of soybeans are likely to restrict demand during the forecast period.

Based on the source, the soy segment captured the largest market share in 2021. Soy lecithin is a brownish-yellow compound that consists of phospholipids, glycolipids, neutral lipids, and carbohydrates. When compared to the other sources of lecithin, soy is the most often used. Due to its vast functional, nutritional, and therapeutic properties, soy lecithin is used in a variety of applications. Soy lecithin is used as an emulsifier in animal feed, food, paint, cosmetics, pharmaceuticals, and other industrial applications. The wide and rising category of Lecithin usage is a promising sign of the growing demand for soy lecithin. Furthermore, it's used to make ice creams, dairy products, dietary supplements, infant formulas, bread, margarine, and other convenience foods. However, increased concerns over increasing cholesterol levels and the allergic properties of soybeans are likely to restrict demand during the forecast period.

Market By Application

- Food & Beverages

- Animal Feed

- Pharmaceutical

- Cosmetics

- Industrial

Based on the application, the animal feed segment is projected to expand considerably in the market over the forecasting years. Lecithin was used as a choline supplement in animal feed long before synthetic choline chloride became available. The usage of lecithin oil in poultry helps to prevent liver fattening, promotes faster recovery, increases life expectancy, and promotes growth. Besides that, the food and beverage segment is growing as the demand for organic food grows, as does the usage of vitamins and supplements, as well as preventative healthcare activities. The medical benefits of lecithin, as well as changing culinary preferences, have all contributed to rising market demand for this commodity.

Market By Form

- Liquid

- Powder

- Granules

Based on the form, the liquid segment accounted for the largest market in 2021. This significant proportion is attributed to an increase in liquid form usage in a range of end-use industries, such as cosmetics, industrial coatings, food preparation, and confectionaries. Liquid lecithin is also utilized in the production of paints, coatings, and other products. As a result, during the anticipated timeframe, liquid lecithin revenues are expected to rise due to its growing importance in sophisticated applications. Furthermore, plants provide the majority of liquid lecithin, which are form necessary to integrate vegetable oils and lipid membranes. Thus, consumer preference for liquid lecithin-based food items fuels market expansion.

Lecithin Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The Asia-Pacific region is expected to grow significantly in the market over the next few years. As the demand for natural ingredients grows, lecithin is increasingly being employed in dairy, bread, confectionery, and meat products. An expansion in the number of food platforms and foodservice locations appears to be driving demand for lecithin as a food additive in the Chinese food and beverage sector. Due to rising obesity rates and increased attention to food nutrition, China is likewise a fast-growing market, propelling the industry under consideration. On the other hand, rising demand for personal care products and cosmetics in the region is expected to boost demand for lecithin in Asia-Pacific. In addition, China's booming aquaculture industry is expected to increase lecithin demand in the animal feed business.

Competitive Landscape

Some of the prominent players in global lecithin market are Archer Daniels Midland Company, Wilmar International Limited, Ruchi Soya Industries ltd., Lipoid GmbH, Cargill, Inc, DuPont, Inc., Foodchem International Corporation, Sodrugestvo Group S.A, Caldic Canada Inc, Imcopa Food Ingredients B.V., Orison Chemicals Limited, and Clarkson Specialty Lecithins.

Frequently Asked Questions

How much was the market size of global lecithin market in 2021?

The estimated market size of global lecithin market in 2021 was accounted to be USD 980 Million.

What will be the projected CAGR for global lecithin market during forecast period of 2022 to 2030?

The projected CAGR of lecithin during the analysis period of 2022 to 2030 is 6.9%.

Which are the prominent competitors operating in the market?

The prominent players of the global lecithin market involve Archer Daniels Midland Company, Wilmar International Limited, Ruchi Soya Industries ltd., Lipoid GmbH, Cargill, Inc, DuPont, Inc., Foodchem International Corporation, Sodrugestvo Group S.A, Caldic Canada Inc, Imcopa Food Ingredients B.V., Orison Chemicals Limited, and Clarkson Specialty Lecithins.

Which region held the dominating position in the global lecithin market?

Europe held the dominating share for lecithin during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific North America region exhibited fastest growing CAGR for lecithin during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global lecithin market?

Growing demand for lecithin, principally for food and beverage application areas, as people reduce their calorie and carbohydrate intake are the prominent factors that fuel the growth of global lecithin market.

By segment source, which sub-segment held the maximum share?

Based on source, soy segment held the maximum share for lecithin market in 2021.