Leather Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Leather Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

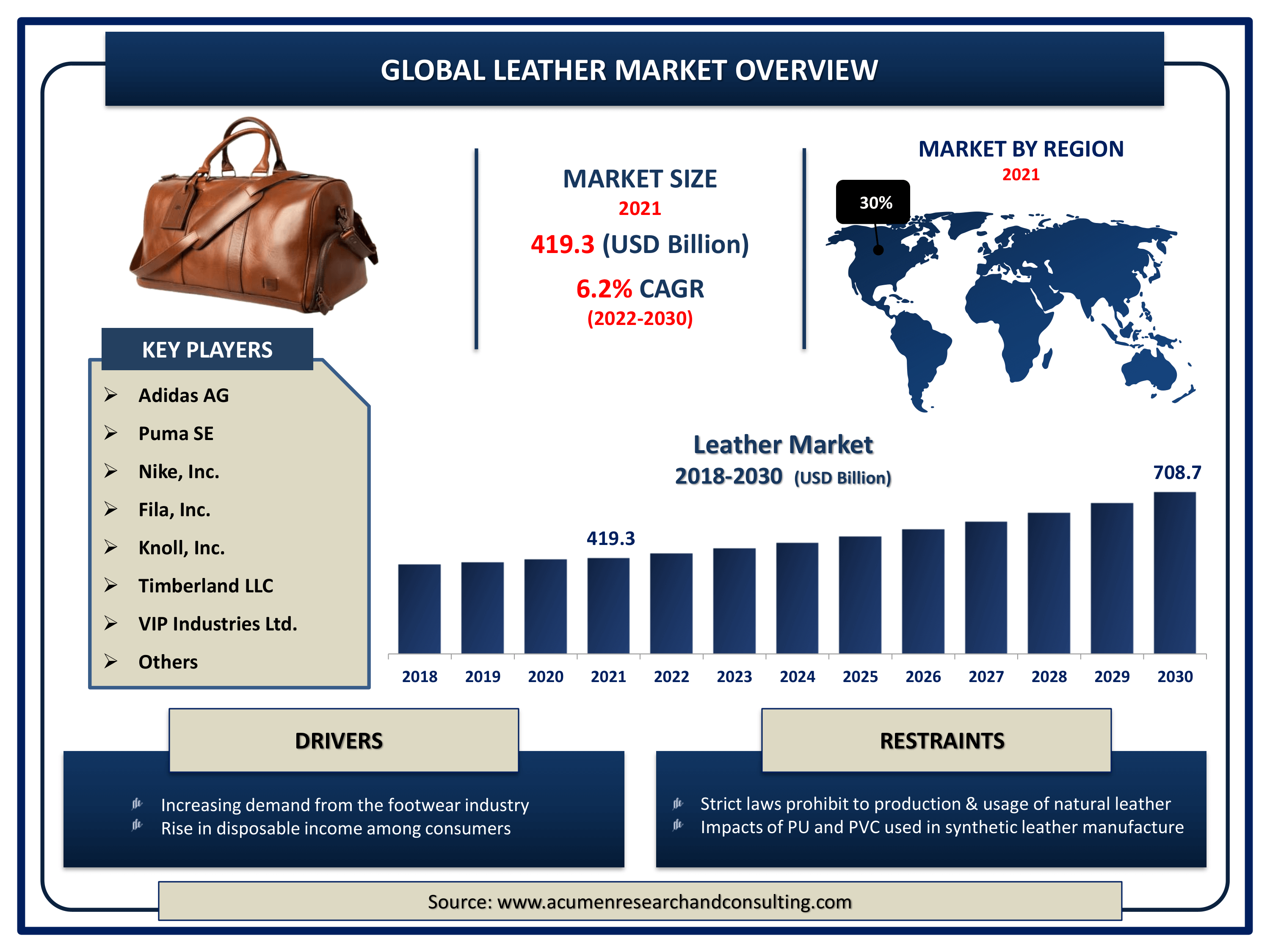

The Global Leather Market Size accounted for USD 419.3 Billion in 2021 and is estimated to achieve a market size of USD 708.7 Billion by 2030 growing at a CAGR of 6.2% from 2022 to 2030. Rising disposable consumer income, increasing standards of living, evolving fashion trends, as well as more international and domestic tourism, are the primary drivers for the leather market growth. Furthermore, increasing adoption of comfortable, contemporary, and fancy leather garments, footwear, & accessories, as well as growing brand awareness, are likely to benefit the leather market value.

Leather Market Report Key Highlights

- Global leather market revenue is estimated to expand by USD 708.7 billion by 2030, with a 6.2% CAGR from 2022 to 2030.

- North America leather market share accounted for over 30% shares in 2021

- Asia-Pacific leather market growth will observe fastest CAGR of 7% from 2022 to 2030

- Based on product, footwear segment accounted for over 45% of the overall market share in 2021

- Among type, genuine sector engaged more than 51% of the total market share

- Changing fashion trends among millennials, drives the leather market size

Leather is a classic, long-lasting material created by tanning animal rawhide to conserve it and create it malleable when dried. It is the oldest form of human endeavor. Leather is utilized in a variety of things, notably footwear, apparel, and military equipment such as covers. Leather has the unique property of keeping you warm during the winter months and cool during the summer. Leather also has qualities such as make, tear resistance, fungus resistance, as well as chemical resistance.

Global Leather Market Dynamics

Market Drivers

- Increasing demand from the footwear industry

- Rise in disposable income among consumers

- Changing fashion trends among millennials

- Rising domestic and international tourism

Market Restraints

- Strict laws prohibit the production and usage of natural leather

- Impacts of PU and PVC used in synthetic leather manufacture

Market Opportunities

- Constantly increasing e-commerce retail market

- Concentrate on the creation of bio-based synthetic leather

Leather Market Report Coverage

| Market | Leather Market |

| Leather Market Size 2021 | USD 419.3 Billion |

| Leather Market Forecast 2030 | USD 708.7 Billion |

| Leather Market CAGR During 2022 - 2030 | 6.2% |

| Leather Market Analysis Period | 2018 - 2030 |

| Leather Market Base Year | 2021 |

| Leather Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Adidas AG, Puma SE, Nike, Inc., New Balance Athletics, Inc., Fila, Inc., Samsonite International S.A., Knoll, Inc., Timberland LLC, VIP Industries Ltd., and Johnston & Murphy. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Rising demand for comfortable, trendy, and fancy goods from consumers, high spending capacity, and changing fashion trends are major factors increasing demand for leather products which is driving the global leather market trend. High spending capacity and leather products such as shoes and bags are witnessing high demand. Availability of raw materials in large quantities manufacturers are focused on providing enhanced quality products to consumers. The U.S. meat industry generated 31.1 million cattle hides in 2016, along with 4.4 million pig skins and 2.3 million goats and sheepskins. The leather industry purchases these hides and skins. With rising cattle waste in the country, waste management on high priority, coupled with favorable business policies for the leather industry, goods made from leather are going to witness high demand. In the U.S., the hide, skin, and leather industry was able to make use of more than 30 million cattle hides in 2016, resulting in nearly 908,000 tonnes of US$ 40 Mn saved in waste management in just one year.

Manufacturers' approach towards enhancing the business through the introduction of new products and acquisitions is expected to boost the target market growth.

Major players' approach toward tracking the untapped market in developing countries is expected to support the revenue growth of the target market. Factors such as the high cost of leather products and stringent government regulations related to product manufacturing are expected to hamper the growth of the global leather market. In addition, the lack of a developed supply chain is expected to challenge the growth of the target market. However, increasing investment by major players and an approach towards new product development are factors expected to create new opportunities for players operating in the leather market over the forecast period. In addition, players' focus on strengthening the distribution channel is expected to support the revenue transaction of the target market.

Leather Market Segmentation

The worldwide leather market segmentation is based on product, type, and geography.

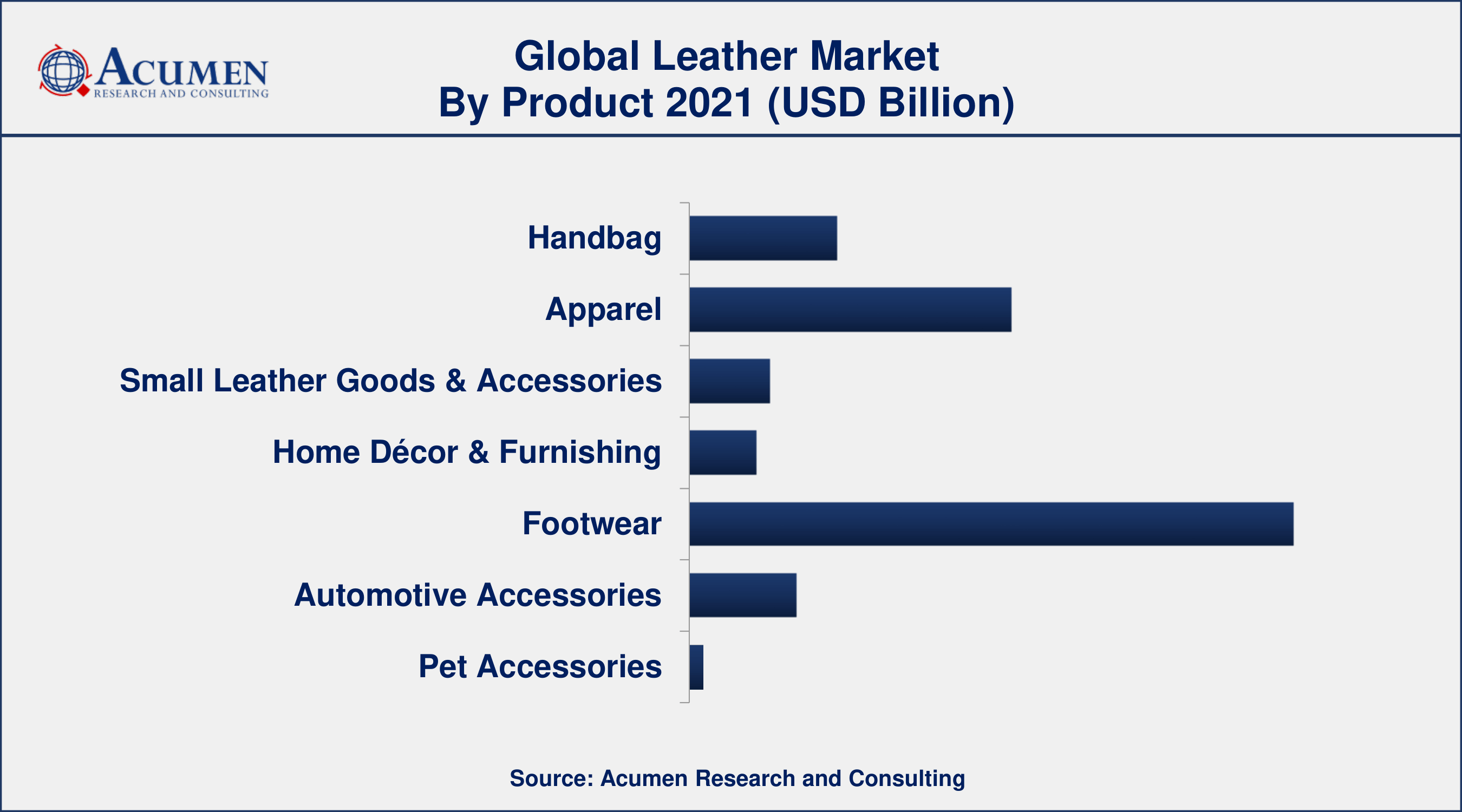

Leather Market By Product

- Handbag

- Apparel

- Small Leather Goods & Accessories

- Home Décor & Furnishing

- Footwear

- Automotive Accessories

- Pet Accessories

According to the leather industry analysis, the footwear segment will hold the largest market share in 2021. With the desire for leather athletic footwear rising, major brands in the footwear market, including Nike, Adidas, Puma, New Balance, Reebok, Allbirds, as well as Converse, have begun to venture into the leather athletic manufacturing market.

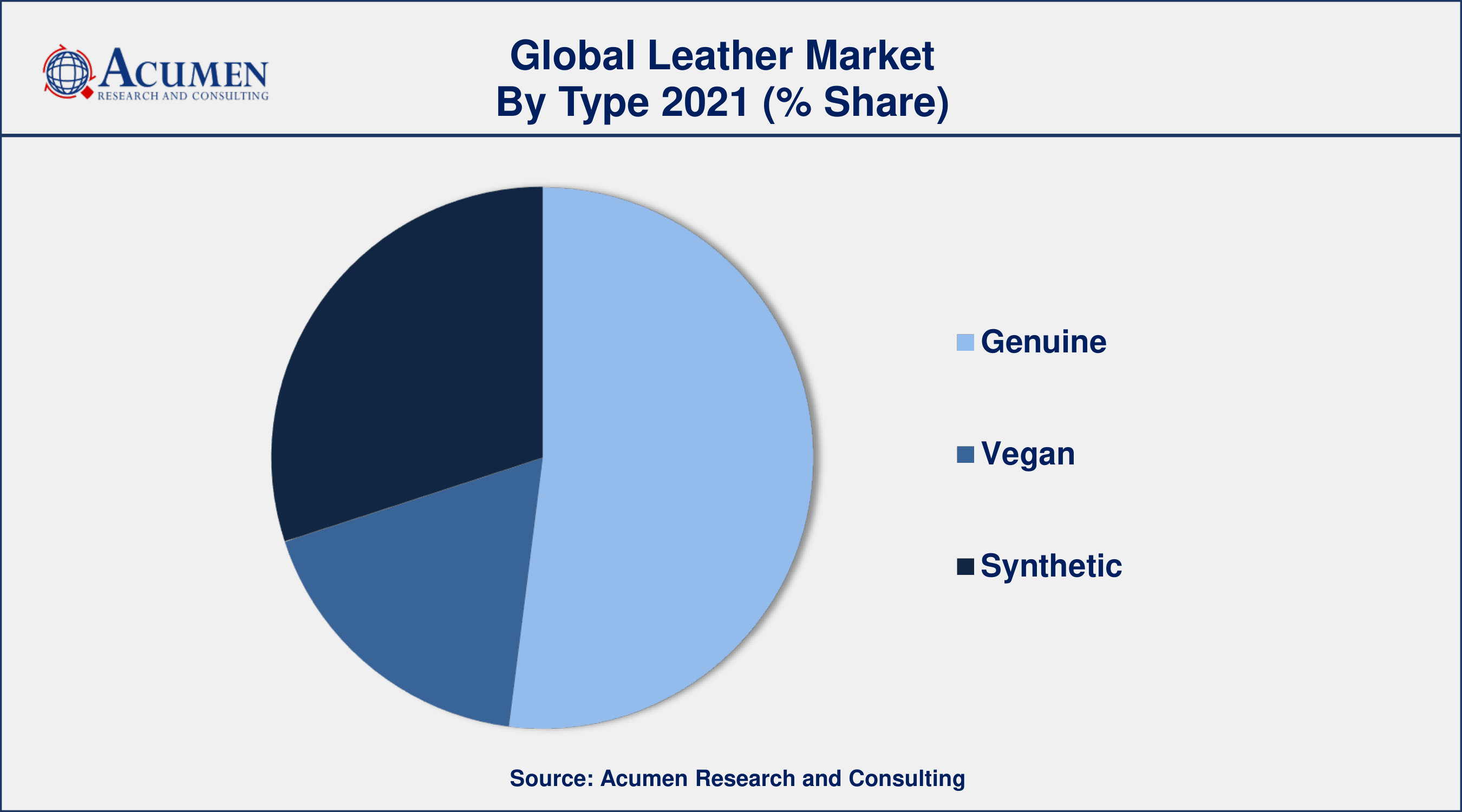

Leather Market By Type

- Genuine

- Vegan

- Synthetic

According to the leather market forecast, the synthetic leather segment is predicted to grow significantly in the coming years. This expansion is due to the low-cost & heavy-duty construction of these types of products. Plastic leather goods, like newspapers, are offered in a variety of environmental solutions. Leather items produced from PLA maize polymer, for instance, are biodegradable and provide complete product exposure for increased marketability. PET-based products are heavily loaded, and flexible, and feature a medium wall architecture that flexes yet maintains crack-resistant. These elements are expected to propel the industry in the forthcoming years.

Leather Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Is Expected To Grow Significantly In the Global Leather Market

The market in the Asia-Pacific is expected to witness faster growth in the target market due to the presence of the large number of leather product manufacturers operating in the region. A country such as China and India are major exporters of leather. China produces 67% of the world’s shoes and exports 36% of its leather goods. Favorable business policies by the government and a focus on strengthening the regional manufacturing capabilities are resulting in the emergence of small & mid-size enterprises this is expected to impact the growth of the target market. The government is changing the regulations related to the leather industry and taking various initiatives to help sustain the industry even during the pandemic. The government of India outlays US$ 250 Bn through the initiation of the Indian Footwear, Leather, and Accessories Development Programme (IFLADP). It focused on providing financial support for core areas namely capacity augmentation and technological upgradation of production units, up-gradation of CETPs, HRD, the establishment of institutional facilities, etc. The Council for Leather Exports is undertaking a multi-pronged, aggressive, and proactive marketing strategy to tap the potential available in various markets.

Leather Market Players

Some of the top Leather market companies offered in the professional report include Adidas AG, Puma SE, Nike, Inc., New Balance Athletics, Inc., Fila, Inc., Samsonite International S.A., Knoll, Inc., Timberland LLC, VIP Industries Ltd., and Johnston & Murphy.

Leather Market Strategies

Some of the key strategies in the market:

- In 2021, TIMBERLAND, a leather goods manufacturer launched the “Greenstride Solar Wave EK+” eco-conscious collection of hikers made from regenerative leather. The product launch is expected to help the company increase its customer base.

- In 2021, Hermès International S.A., a luxury goods manufacturing company launched “Victoria Handbag” mushroom-based vegan leather. The product is expected to attract new customers and enhance the business.

- In 2020, Adidas, a global footwear manufacturing company launched vegan leather shoes made from mycelium. The product launch is expected to help the company enhance its business and increase its revenue share in the market.

Frequently Asked Questions

What is the size of global leather market in 2021?

The estimated value of global leather market in 2021 was accounted to be USD 489.3 Billion.

What is the CAGR of global leather market during forecast period of 2022 to 2030?

The projected CAGR leather market during the analysis period of 2022 to 2030 is 6.2%.

Which are the key players operating in the market?

The prominent players of the global leather market are Adidas AG, Puma SE, Nike, Inc., New Balance Athletics, Inc., Fila, Inc., Samsonite International S.A., Knoll, Inc., Timberland LLC, VIP Industries Ltd., and Johnston & Murphy.

Which region held the dominating position in the global leather market?

North America held the dominating leather during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for leather during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global leather market?

Increasing demand from the footwear industry and changing fashion trends among millennials drives the growth of global leather market.

By type segment, which sub-segment held the maximum share?

Based on type, genuine segment is expected to hold the maximum share of the leather market.