Law Enforcement Software Market | Acumen Research and Consulting

Law Enforcement Software Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

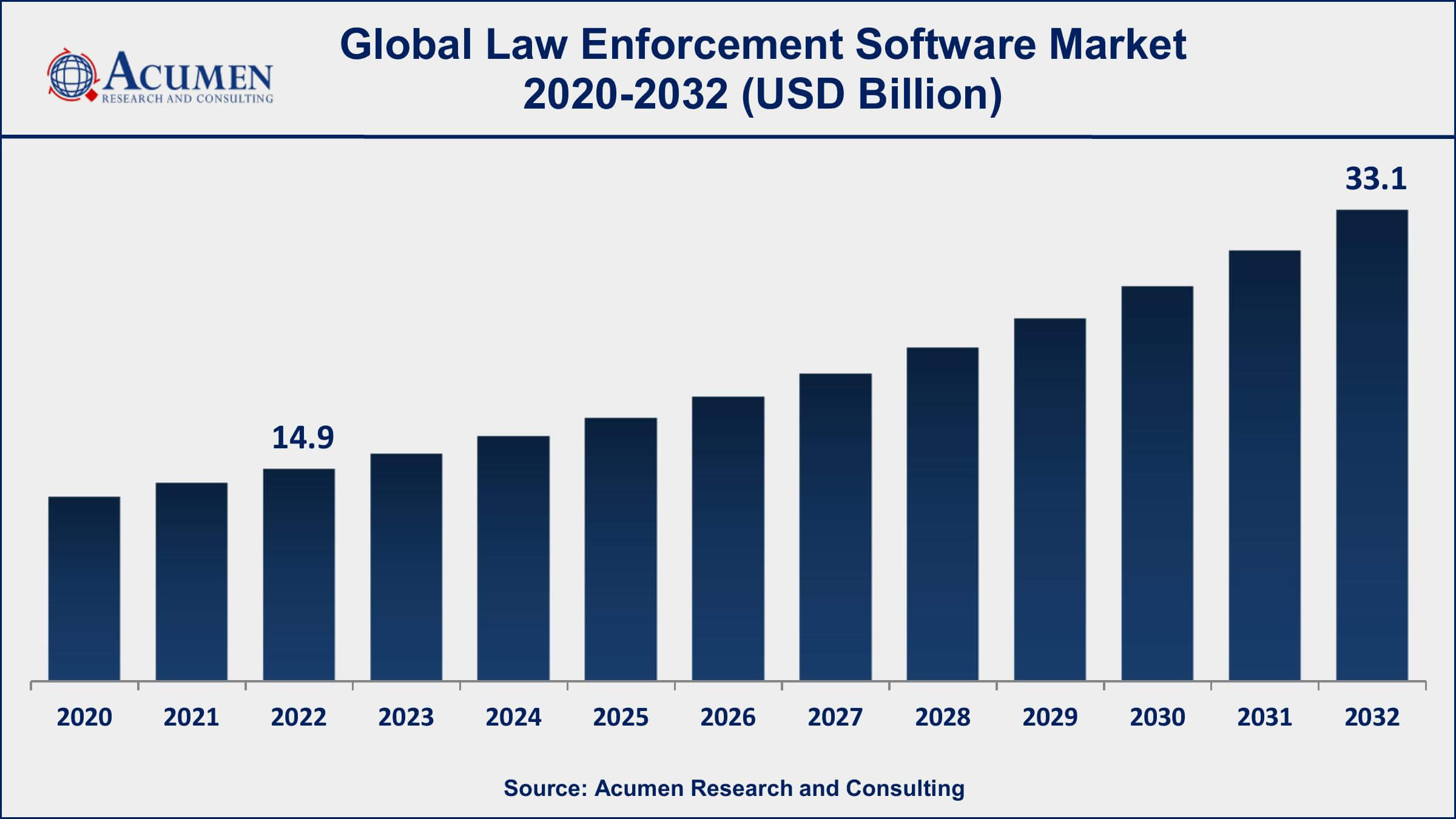

The Global Law Enforcement Software Market Size accounted for USD 14.9 Billion in 2022 and is projected to achieve a market size of USD 33.1 Billion by 2032 growing at a CAGR of 8.4% from 2023 to 2032.

Law Enforcement Software Market Highlights

- Global law enforcement software market revenue is expected to increase by USD 33.1 Billion by 2032, with a 8.4% CAGR from 2023 to 2032

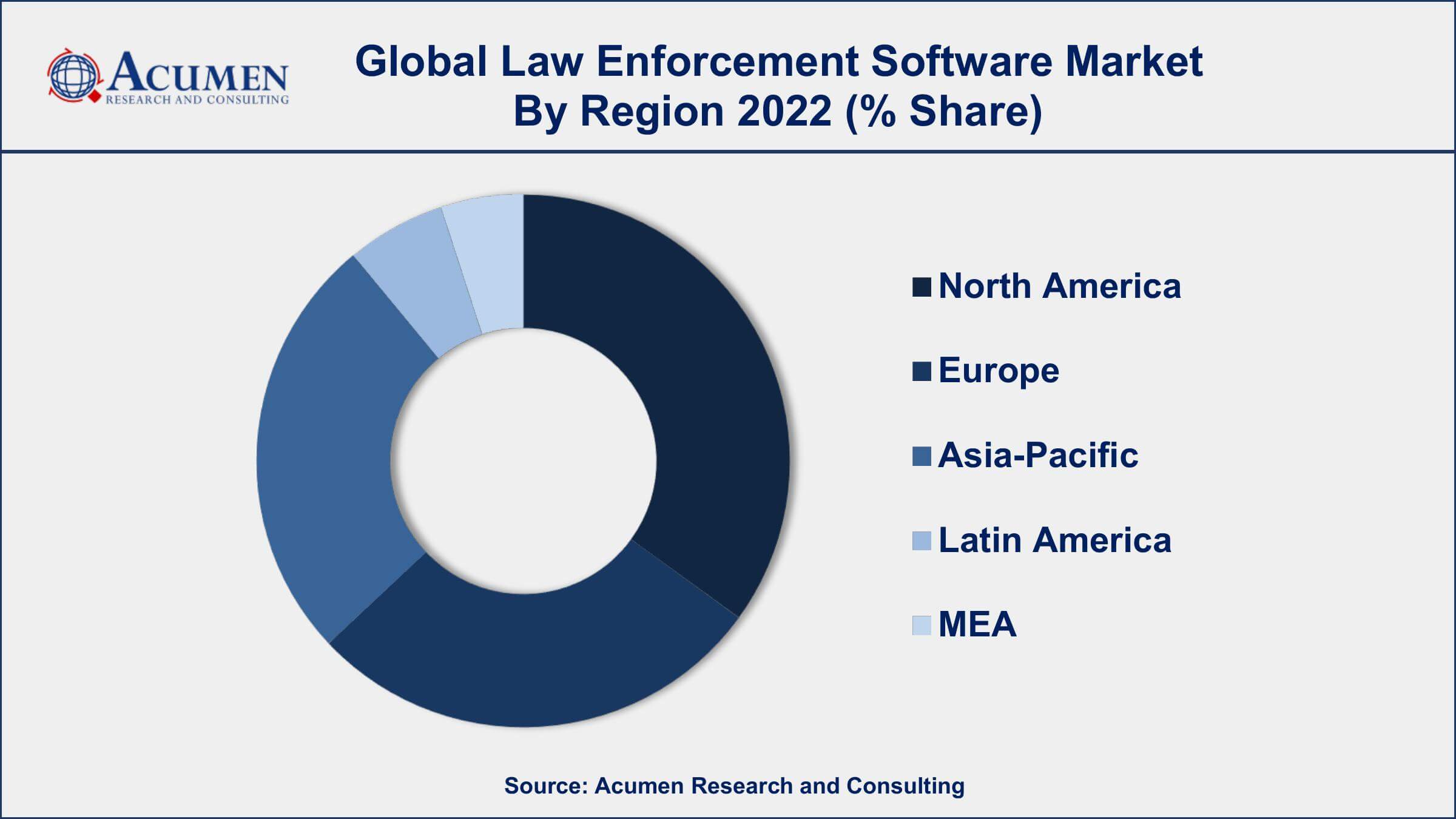

- North America region led with more than 32% of law enforcement software market share in 2022

- Asia-Pacific law enforcement software market growth will record a CAGR of more than 9% from 2023 to 2032

- By offering, the software segment has accounted more than 73% of the revenue share in 2022

- By deployment model, the cloud segment is expected to grow at the fastest CAGR of 9.7% between 2023 and 2032

- Increasing need for efficient crime prevention and reduction strategies, drives the law enforcement software market value

Law enforcement software refers to a range of computer programs and technologies designed to assist law enforcement agencies in their day-to-day operations. This software encompasses various functionalities, including crime analysis, incident management, records management, investigation management, dispatching and communication, evidence management, and predictive policing. It aims to enhance operational efficiency, improve data management, facilitate information sharing, and support decision-making processes within law enforcement agencies.

The market for law enforcement software has witnessed significant growth in recent years. Factors contributing to this growth include the increasing demand for effective crime prevention and reduction strategies, the need for better resource allocation and deployment, and the rising focus on data-driven policing. Law enforcement agencies are recognizing the potential of software solutions to streamline operations, improve collaboration, and enhance public safety. Additionally, the advancements in technology, such as artificial intelligence, machine learning, and big data analytics, have provided new opportunities for the development of sophisticated law enforcement software. Furthermore, the growing emphasis on the integration of software systems with mobile devices and the cloud has further fueled the market growth.

Global Law Enforcement Software Market Trends

Market Drivers

- Increasing need for efficient crime prevention and reduction strategies

- Growing demand for data-driven policing and predictive analytics

- Rising focus on improving resource allocation and deployment within law enforcement agencies

- Advancements in technology, such as artificial intelligence, machine learning, and big data analytics

- Integration of software systems with mobile devices and cloud-based platforms

Market Restraints

- Concerns regarding data privacy and security

- Budget constraints faced by law enforcement agencies

Market Opportunities

- Increasing adoption of body-worn cameras and associated software solutions

- Potential for integration with emerging technologies like the

Law Enforcement Software Market Report Coverage

| Market | Law Enforcement Software Market |

| Law Enforcement Software Market Size 2022 | USD 14.9 Billion |

| Law Enforcement Software Market Forecast 2032 | USD 33.1 Billion |

| Law Enforcement Software Market CAGR During 2023 - 2032 | 8.4% |

| Law Enforcement Software Market Analysis Period | 2020 - 2032 |

| Law Enforcement Software Market Base Year | 2022 |

| Law Enforcement Software Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Deployment Model, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM Corporation, Accenture, Oracle Corporation, Motorola Solutions, Inc., Microsoft Corporation, Hexagon AB, SAS Institute Inc., Palantir Technologies Inc., ESRI, and Nuance Communications, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Law enforcement software refers to a suite of computer programs and technologies specifically designed to support the operations and activities of law enforcement agencies. These software solutions are developed to streamline processes, enhance data management, and improve collaboration within the law enforcement ecosystem. Law enforcement software finds application in various areas, including crime analysis, incident management, records management, dispatching and communication, investigation management, evidence management, and predictive policing.

One of the primary applications of law enforcement software is crime analysis. This software leverages data analysis and visualization techniques to identify patterns, trends, and correlations in criminal activities. It assists law enforcement agencies in identifying crime hotspots, allocating resources effectively, and developing targeted crime prevention strategies. Additionally, law enforcement software is used for incident management, allowing agencies to track and manage incidents, log relevant information, and coordinate response efforts in real time. It facilitates seamless communication between officers, dispatchers, and other stakeholders, ensuring a swift and coordinated response to emergencies.

The law enforcement software market has been experiencing robust growth in recent years and is expected to continue expanding in the coming years. The increasing adoption of technology and digitization within law enforcement agencies is a key driver of this growth. Law enforcement software offers a wide range of benefits, including improved operational efficiency, streamlined processes, enhanced data management, and more effective crime prevention and investigation. These factors have prompted law enforcement agencies to invest in advanced software solutions to meet their evolving needs. Additionally, the rising demand for data-driven policing and predictive analytics is further fueling the growth of the law enforcement software market.

Law Enforcement Software Market Segmentation

The global law enforcement software market segmentation is based on offering, deployment model, and geography.

Law Enforcement Software Market By Offering

- Software

- Crime Management Software

- Record Management Software

- Digital Policing Software

- Jail management Software

- Others

- Service

- Training & Education Services

- Implementation & Integration Services

- Support & Maintenance Services

According to law enforcement software industry analysis, the software has dominated the photoacoustic imaging market. These segments cater to specific functionalities and requirements of law enforcement agencies, enabling them to enhance their operations and improve overall effectiveness. One of the prominent segments is crime analysis software. With the increasing focus on data-driven policing, there is a growing demand for software solutions that can analyze crime data, identify patterns, and provide actionable insights. Crime analysis software allows law enforcement agencies to identify crime hotspots, allocate resources efficiently, and develop targeted strategies for crime prevention and reduction. The adoption of advanced analytics techniques, such as predictive modeling and data visualization, within crime analysis software has contributed to its significant growth. Another growing segment is digital evidence management software. As the volume and complexity of digital evidence continue to increase, law enforcement agencies require robust solutions to manage and analyze this data effectively.

Law Enforcement Software Market By Deployment Model

- On-premise

- Cloud

According to the law enforcement software market forecast, the cloud segment is expected to witness significant growth in the coming years. Cloud-based solutions offer numerous advantages to law enforcement agencies, including scalability, flexibility, cost-efficiency, and improved data accessibility and collaboration. One key factor driving the growth of the cloud segment is the increasing need for efficient data management and storage. Law enforcement agencies generate and accumulate vast amounts of data, including criminal records, incident reports, surveillance footage, and digital evidence. Cloud-based solutions provide a centralized and secure platform for storing and managing this data, eliminating the need for on-premises infrastructure and reducing maintenance costs. Additionally, cloud storage offers scalability, allowing agencies to easily expand their storage capacity as data volumes grow. Another driver of the cloud segment is the emphasis on data sharing and collaboration among law enforcement agencies. Cloud-based platforms enable seamless sharing of information between different agencies and jurisdictions, promoting better coordination and joint efforts in combating crime.

Law Enforcement Software Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Law Enforcement Software Market Regional Analysis

North America dominates the law enforcement software market for several reasons, including its advanced technological infrastructure, strong investment in law enforcement agencies, and a high level of awareness and adoption of innovative software solutions within the region. North America boasts a highly developed technological infrastructure, which provides a solid foundation for the implementation and utilization of law enforcement software. The region has robust internet connectivity, extensive network coverage, and advanced data centers, enabling seamless data management and access to cloud-based solutions. This infrastructure facilitates the efficient deployment and utilization of sophisticated software systems by law enforcement agencies. Moreover, North America is known for its substantial investment in law enforcement agencies. The region's governments allocate significant budgets to enhance public safety and improve law enforcement operations. These investments often include funding for the acquisition and implementation of advanced software solutions to support crime prevention, investigation, and overall law enforcement efficiency.

Law Enforcement Software Market Player

Some of the top law enforcement software market companies offered in the professional report include IBM Corporation, Accenture, Oracle Corporation, Motorola Solutions, Inc., Microsoft Corporation, Hexagon AB, SAS Institute Inc., Palantir Technologies Inc., ESRI, and Nuance Communications, Inc.

Frequently Asked Questions

What was the market size of the global law enforcement software in 2022?

The market size of law enforcement software was USD 14.9 Billion in 2022.

What is the CAGR of the global law enforcement software market from 2023 to 2032?

The CAGR of law enforcement software is 8.4% during the analysis period of 2023 to 2032.

Which are the key players in the law enforcement software market?

The key players operating in the global market are including IBM Corporation, Accenture, Oracle Corporation, Motorola Solutions, Inc., Microsoft Corporation, Hexagon AB, SAS Institute Inc., Palantir Technologies Inc., ESRI, and Nuance Communications, Inc.

Which region dominated the global law enforcement software market share?

North America held the dominating position in law enforcement software industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of law enforcement software during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global law enforcement software industry?

The current trends and dynamics in the law enforcement software market growth include increasing need for efficient crime prevention and reduction strategies, and growing demand for data-driven policing and predictive analytics in law enforcement agencies.

Which offering held the maximum share in 2022?

The software offering held the maximum share of the law enforcement software industry.