Laser Technology Market | Acumen Research and Consulting

Laser Technology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

The Global Laser Technology Market Size accounted for USD 11,579 Million in 2021 and is estimated to achieve a market size of USD 24,171 Million by 2030 growing at a CAGR of 8.7% from 2022 to 2030. Rising usage of laser technology in the electronic industry and medical applications, as well as increasing adoption of various developing technologies in the field of nano and micro applications, are driving the laser technology market growth. Furthermore, factors such as advancements in technology, government regulations governing the use of lasers in engraving, growing preference for laser technology in medical, petroleum & natural gas, as well as industrial applications, as well as the expansion of emerging economies are expected to drive the laser technology market revenue throughout the forecast period.

Laser Technology Market Report Key Highlights

- Global laser technology market revenue intended to gain USD 24,171 million by 2030 with a CAGR of 8.7% from 2022 to 2030

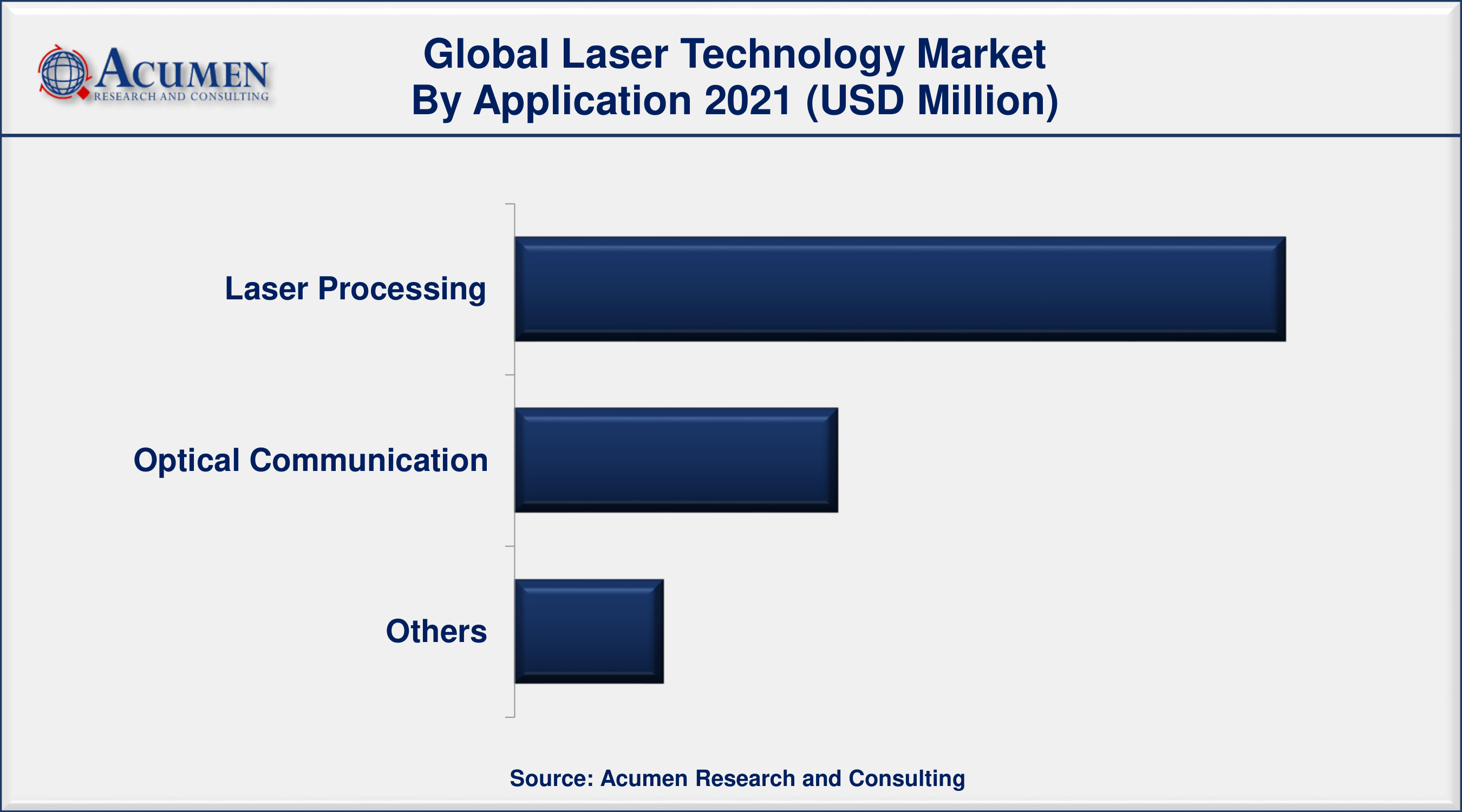

- By application, the laser processing segment has accounted 60% market share in 2021

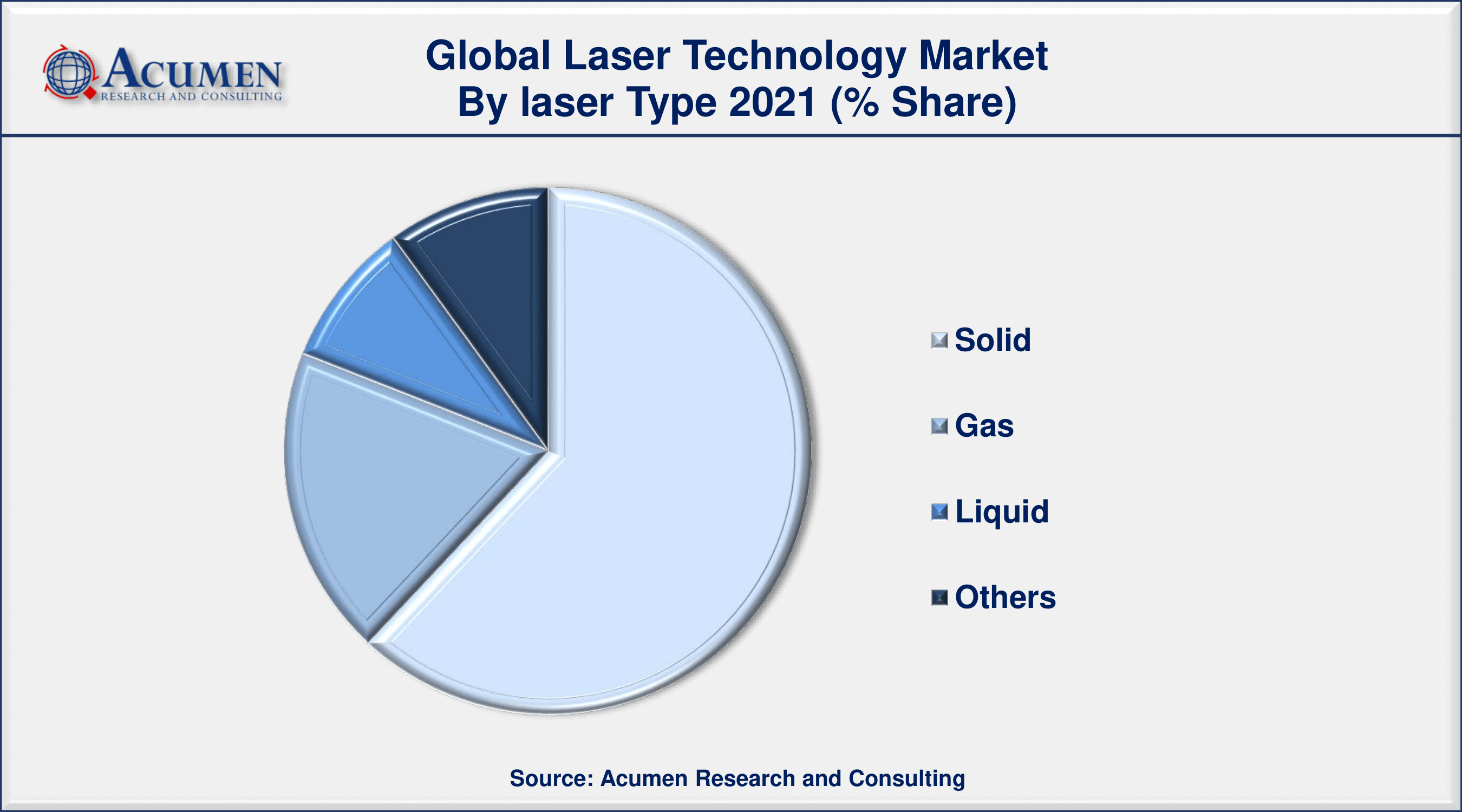

- Among laser type, the solid segment contributed 60% market share in 2021

- North America region accounted maximum revenue share of around 41% in 2021

- Asia-Pacific region is expected to expand at a CAGR of 9% over 2022 to 2030

- Growing demand for laser technologies in the healthcare industry, fuels the laser technology market trend

Light amplification by stimulated emission of radiation (LASER) is a type of electromagnetic radiation that sends an equal amount of light in terms of intensity and wavelength that combines to form a high-energy and highly coherent light pulse. Laser technology now plays an important role in the modern world, as it has a wide range of applications in a variety of fields. Barcode scanners, laser printers, optical disc drivers, cutting and welding materials, semiconducting chip manufacturing, law enforcement devices, and free space optical communication are a few of the amazing applications of laser technology. Laser technology is also used in DNA sequencing instruments, hair removal products for surgery, and skin treatments. It is also effective in the treatment of gallbladder and kidney stones.

Global Laser Technology Market Dynamics

Market Drivers

- Growing demand for laser technologies in the healthcare industry

- The shift toward the fabrication of nano- and micro-devices

- Increasing adoption of Smart production techniques

- Growing preference for laser-based material processing over traditional methods

Market Restraints

- High deployment costs

- Technical difficulties related to high-power lasers

Market Opportunities

- Increasing use of laser technology for quality control in different verticals

- Laser technology is becoming more prevalent in optical communication

Laser Technology Market Report Coverage

| Market | Laser Technology Market |

| Laser Technology Market Size 2021 | USD 11,579 Million |

| Laser Technology Market Forecast 2030 | USD 24,171 Million |

| Laser Technology Market CAGR During 2022 - 2030 | 8.7% |

| Laser Technology Market Analysis Period | 2018 - 2030 |

| Laser Technology Market Base Year | 2021 |

| Laser Technology Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Laser Type, By Revenue, By Application, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Coherent, Inc., IPG Photonics Corporation, TRUMPF, Lumentum Operations LLC, Jenoptik, Novanta, LUMIBIRD, LaserStar Technologies Corporation, and Epilog Laser. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Big Calls For "Laser Technology" In The Medical Industry Witness High Growth

There are numerous applications for tiny and powerful lasers, but one of the most common applications is for the treatment of glaucoma. Laser surgery is increasingly popular for glaucoma treatment as it's a quick, painless, and effective treatment option. In 2018, Q-Peak began working in collaboration with a medical equipment supplier on a variant of the Moonbow CB-G laser source, one of the most closely based practices conducted on Mars 2020, as the laser source in a small, portable, rugged unit to perform laser surgery in the field. Apart from that, various laser products are used for various procedures. Carbon dioxide (CO2) lasers, for example, make shallow cuts. These are used to treat superficial cancers such as skin cancer. Argon lasers are designed to make shallow cuts and can be used during photodynamic therapy to activate photosensitizing drugs. To kill more cancer cells, this type of cancer treatment combines light with chemotherapy. Furthermore, low-level laser therapy (LLLT), also known as cold laser therapy, uses light with wavelengths ranging from 600 to 980 nanometers to perform minor surgeries and promote tissue regeneration.

Technological Advancements Propel The Growth Of The Laser Technology Market Share Globally

The development of basic lasers has now made huge progress. Hundreds of millions of them work reliably in tens of thousands of applications. According to laser fest reports, basic laser product innovation is on the rise. Some enhancements gradually increase the number of wavelengths, which gradually expands the laser's capabilities. X-rays with shorter wavelengths of a few Angstroms have shown promising results for biochemists to observe chemical reactions in a single molecule as they occur. Additionally, security is one of the most common applications. Lasers emitting millimeter waves at terahertz frequencies have the potential to assist airport personnel in performing a safe, yet thorough passenger body scan for hidden weapons. Other modifications include changing the laser light pulse rate or, more recently, the laser pulse shape. These customized pulse shapes can trigger chemical reactions by interacting with highly targeted molecules. Laser fusion is currently gaining traction in the global laser technology market value.

Furthermore, recent advances in laser technology are a significant contributor to alternative energy and play a critical role in emissions and environmental monitoring. According to laser fest reports, the Department of Energy's Lawrence Livermore National Laboratory is conducting tests at its National Ignition Facility to develop the world's largest laser system, which will open new doors for laser fusion-providing a virtually limitless carbon-free alternative energy source. Furthermore, laser technologies such as spectroscopy can be used to measure environmental impurities, monitor emission levels, water pollutants, and so on.

Laser Technology Market Segmentation

The worldwide laser technology market segmentation is based on the laser type, product, application, end-user industry, and geography.

Laser Technology Market By Laser Type

- Solid

- Gas

- Liquid

- Others

In terms of laser type, the solid-state laser segment will dominate the market during the forecast period. This is due to greater efficiency, good absorption capability, and long-lasting specifications in terms of weight and size. Because only a small region of the emission spectra is used in the absorption process, solid-state lasers are very efficient. The pumping function with diode lasers within the specification in the solid-state laser has significantly achieved 100% results. A diode-pumped solid-state laser has the distinct advantage of being extremely compact, light in weight, and small in size. The flashlamp-pumped, solid-state holmium: yttrium-aluminum-garnet (YAG) laser has achieved great prominence and is especially considered for its utility in ureteroscopic lithotripsy.

Laser Technology Market By Product

- Laser

- System

According to the laser technology industry analysis, the system product segment is predicted to account for the greatest market share in the global market. System product includes sales of various types of laser systems for marking and engraving, welding and brazing, cutting and scribing, cladding and coating, and other multi-functional laser technologies. The ability of these systems to perform a wide range of functions expands their utilization across several industry verticals involving commercial, industrial, medical, and automotive.

Laser Technology Market By Application

- Laser Processing

- Optical Communication

- Others

According to the laser technology market forecast, the optical communication segment is expected to have the largest market share in the coming years. The use of optical communication in manufacturing and other industrial sectors results in better and more precise industrial processes. This is one of the most significant factors influencing the growth of the optical communication segment. The National Aeronautics and Space Administration (NASA) has created a new laser beam pinpointing technology for use in optical communication in space. The Artemis Program for CubeSats in Low-Lunar Orbit is one possible application (LLO). Current architectures employ dynamical systems (i.e., moving parts such as fast-steering mirrors (FSM) and/or gimbals) to direct the laser to the ground terminal and may employ vibration isolation platforms (VIP).

Laser Technology Market By End-User Industry

- Telecommunications

- Industrial

- Semiconductor & Electronics

- Commercial

- Others

Based on the end-user industry, the telecommunication segment holds the largest market share. Laser communication offers high data transfer speeds with low energy consumption as well as a secure communications medium for transmitting data, which is boosting its use in the telecommunication sector. Laser technology is also employed in the telecom industry to optimize transmission power.

Laser Technology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Dominated The Laser Technology Market

Geographically, North America is predicted to dominate the laser technology market. Rising healthcare expenditure and high adoption of advanced technologies are the prominent factors that contribute to the growth of the laser technology market. Additionally, the presence of a large pool of prominent players also acts as a driving factor for the growth of the laser technology market.

On the other hand, Asia-Pacific is projected to witness the fastest growth rate in terms of revenue share for the laser technology market. Noticeable development in healthcare infrastructure and a rising number of original equipment manufacturers (OEMs) is likely to fuel the growth of the laser technology market.

Laser Technology Market Players

Some of the top laser technology companies offered in the professional report includes Coherent, Inc., IPG Photonics Corporation, TRUMPF, Lumentum Operations LLC, Jenoptik, Novanta, LUMIBIRD, LaserStar Technologies Corporation, and Epilog Laser.

Frequently Asked Questions

What is the size of global laser technology market in 2021?

The estimated value of global laser technology market in 2021 was accounted to be USD 11,579 Million.

What is the CAGR of global laser technology market during forecast period of 2022 to 2030?

The projected CAGR laser technology market during the analysis period of 2022 to 2030 is 8.7%.

Which are the key players operating in the market?

The prominent players of the global laser technology market are Coherent, Inc., IPG Photonics Corporation, TRUMPF, Lumentum Operations LLC, Jenoptik, Novanta, LUMIBIRD, LaserStar Technologies Corporation, and Epilog Laser.

Which region held the dominating position in the global laser technology market?

North America held the dominating laser technology during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for laser technology during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global laser technology market?

Growing demand for laser technologies in the healthcare industry, and increasing adoption of Smart production techniques, drives the growth of global laser technology market.

By product segment, which sub-segment held the maximum share?

Based on product, system segment is expected to hold the maximum share laser technology market.