Lancet Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Lancet Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

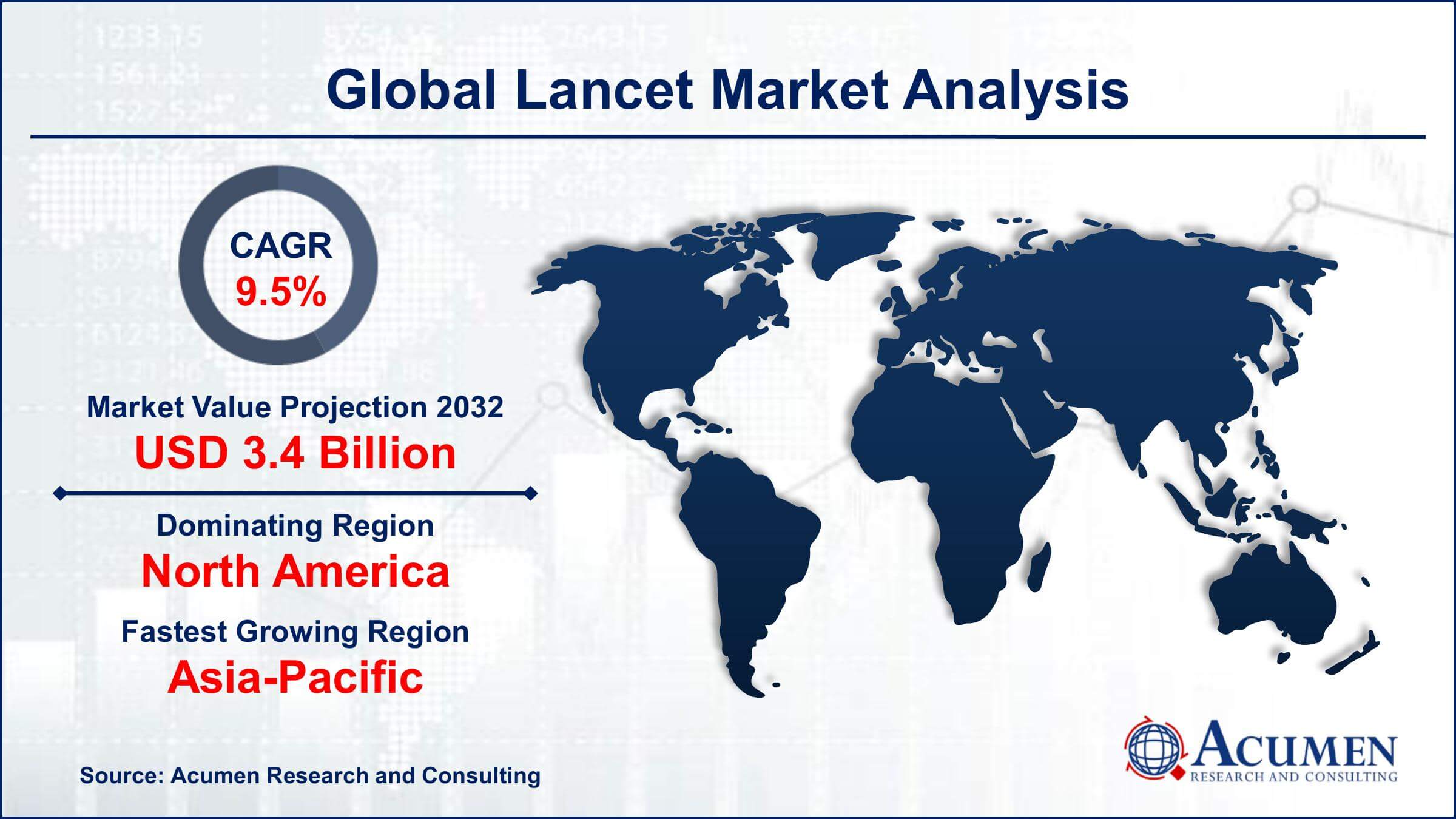

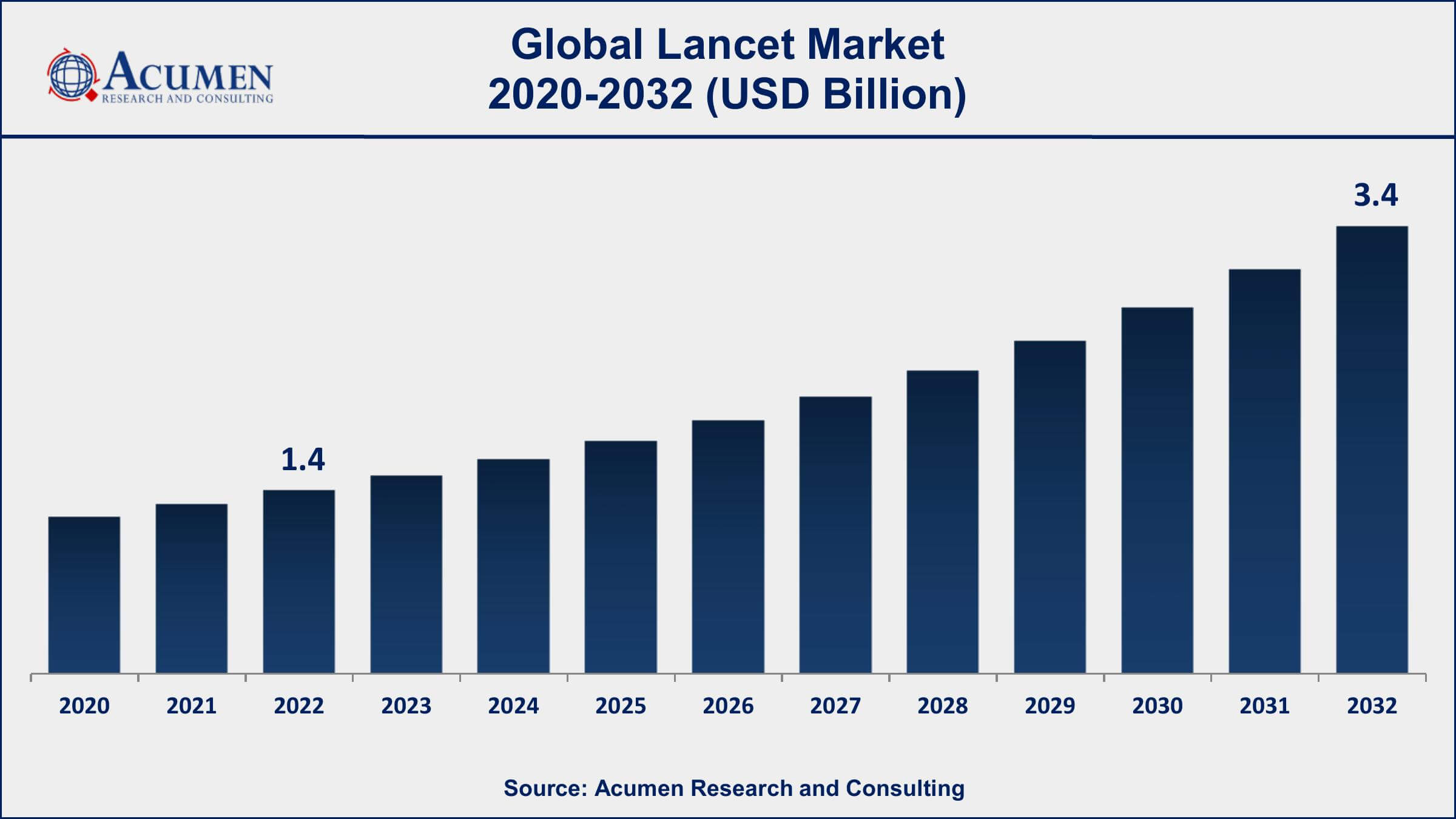

The Global Lancet Market Size accounted for USD 1.4 Billion in 2022 and is projected to achieve a market size of USD 3.4 Billion by 2032 growing at a CAGR of 9.5% from 2023 to 2032.

Lancet Market Highlights

- Global Lancet Market revenue is expected to increase by USD 3.4 Billion by 2032, with a 9.5% CAGR from 2023 to 2032

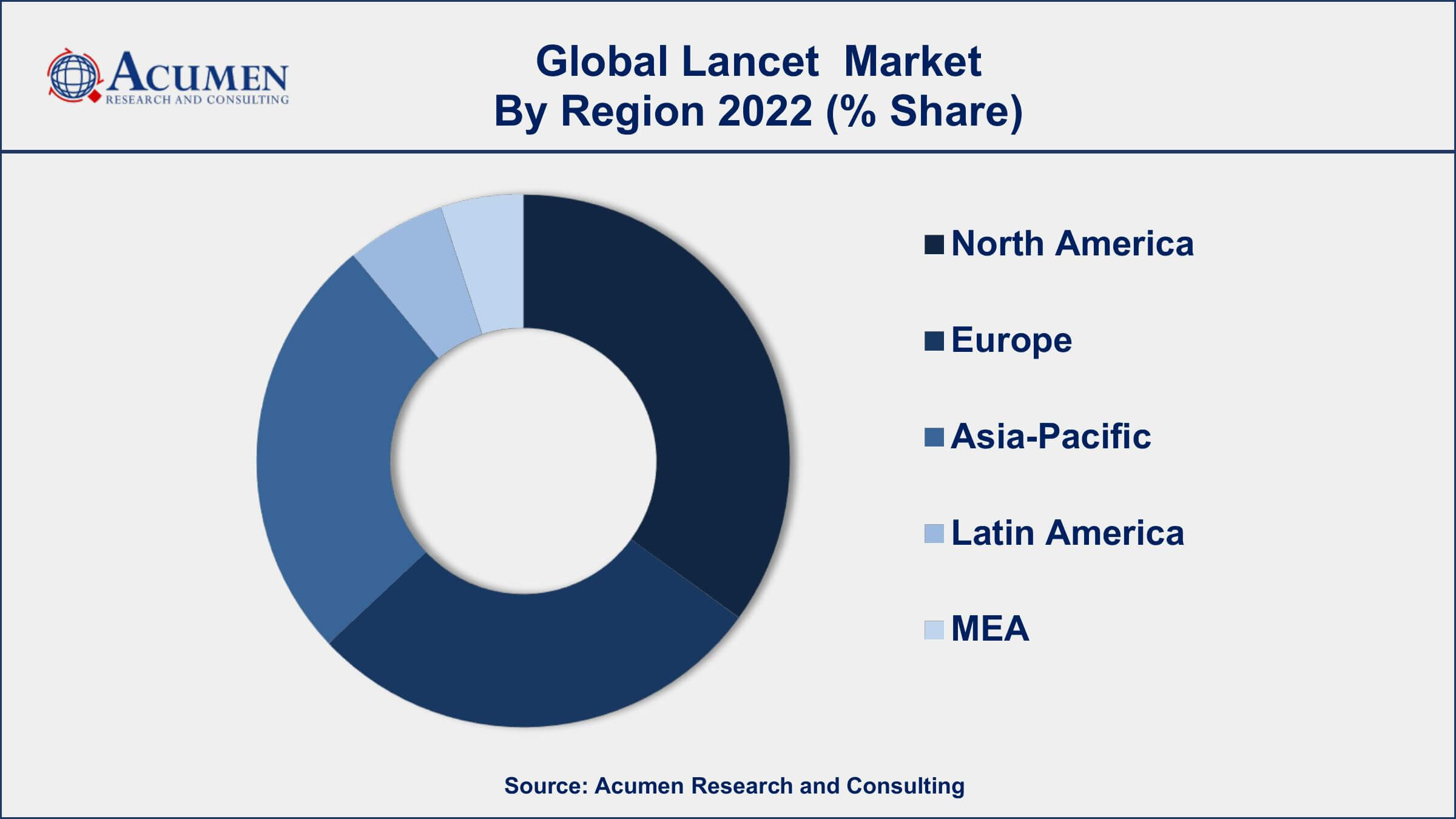

- North America region led with more than 38% of Lancet Market share in 2022

- Asia-Pacific Lancet Market growth will record a CAGR of more than 10% from 2023 to 2032

- By type, the safety lancets segment has recorded more than 39% of the revenue share in 2022

- By size, the 23G-33G segment has accounted more than 42% of the revenue share in 2022

- Rising demand for advanced medical treatments, drives the Lancet Market value

The Lancet is a renowned and prestigious medical journal that has played a crucial role in disseminating cutting-edge research and advancements in the field of medicine since its establishment in 1823. Published by Elsevier, The Lancet covers a wide range of medical topics, including clinical medicine, public health, and medical research. Its rigorous peer-review process and reputation for publishing high-quality, evidence-based research have made it a trusted source of information for healthcare professionals, researchers, and policymakers worldwide. The Lancet's influence extends beyond academia, as its articles often contribute to shaping medical guidelines, policies, and public health strategies.

In terms of market growth, The Lancet's influence and reach have expanded significantly in recent years due to the global growth of medical research and advancements. The increasing demand for evidence-based medicine, the rise of interdisciplinary collaborations, and the emphasis on disseminating research findings have contributed to the journal's continued relevance. The Lancet's online presence and digital platforms have further facilitated its accessibility to a global audience, enabling quick dissemination of important research findings and fostering international collaboration among researchers and healthcare experts.

Global Lancet Market Trends

Market Drivers

- Growing global healthcare expenditure

- Increasing prevalence of chronic diseases

- Technological advancements in medical equipment

- Rising demand for advanced medical treatments

- The aging population and longer life expectancy

Market Restraints

- High costs associated with medical research and development

- Limited access to healthcare in certain regions

Market Opportunities

- Increasing investment in biotechnology and pharmaceutical sectors

- Integration of AI and big data analytics in healthcare

Lancet Market Report Coverage

| Market | Lancet Market |

| Lancet Market Size 2022 | USD 1.4 Billion |

| Lancet Market Forecast 2032 | USD 3.4 Billion |

| Lancet Market CAGR During 2023 - 2032 | 9.5% |

| Lancet Market Analysis Period | 2020 - 2032 |

| Lancet Market Base Year | 2022 |

| Lancet Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Size, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AgaMatrix, All Medicus Co. Ltd., Abbott Laboratories, B. Braun Melsungen AG, Ascensia Diabetes Care Holdings AG, Dexcom, Inc., Arkray, Inc, Bionime Corporation, LifeScan Inc., DarioHealth Corp., Essenlife Bioscience, Inc., Nova Biomedical, Inc., F. Hoffmann-La Roche Ltd., Medtronic, and Sinocare Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The lancet is a small, sharp, pointed instrument commonly used in medical and laboratory settings for procedures like blood sampling and skin punctures. It is specifically designed to create a small incision or puncture in the skin or other tissues, typically for the purpose of obtaining a blood sample or performing other diagnostic tests. The lancet's sharp, sterile blade reduces pain and minimizes tissue damage during the procedure.

In medical practice, lancets find significant application in various healthcare procedures. One of the most common uses is for blood glucose monitoring in individuals with diabetes. Lancets are used to prick the fingertip or alternate sites to draw a small drop of blood that can be analyzed for glucose levels. This allows for effective disease management and adjustment of insulin doses. Additionally, lancets are utilized in hemoglobin testing, where a blood sample is taken to assess an individual's iron levels and overall health. In laboratory settings, lancets are employed for various purposes, including the collection of blood samples for medical tests, research, and analysis.

The lancet market is experiencing robust growth driven by several key factors. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular disorders, has led to a rising demand for lancets as they are essential for regular blood testing and monitoring. Moreover, advancements in medical technology have resulted in more innovative and user-friendly lancet devices, enhancing patient comfort and compliance. The global healthcare expenditure is also on the rise, with governments and private entities investing significantly in healthcare infrastructure, thereby contributing to the expansion of the lancet market. Furthermore, the growing trend towards personalized medicine and preventive healthcare has boosted the adoption of lancets.

Lancet Market Segmentation

The global Lancet Market segmentation is based on type, size, end-use, and geography.

Lancet Market By Type

- Safety lancets

- Manually activated lancets

- Automatically activated lancets

- Standard lancets

According to the lancet industry analysis, the safety lancets segment accounted for the largest market share in 2022. Safety lancets are designed to minimize the risk of needlestick injuries and cross-contamination, making them an attractive option for healthcare professionals and patients alike. As awareness about the potential dangers of needlestick injuries has grown, healthcare facilities and providers are adopting safety lancets to mitigate these risks, thereby propelling market growth. Advancements in technology have played a pivotal role in the expansion of the safety lancet segment. These lancets often feature innovative mechanisms such as retractable needles or one-time-use designs that prevent accidental pricks after use. This technological innovation not only enhances patient safety but also simplifies the blood collection process, making it more efficient for healthcare providers.

Lancet Market By Size

- 22G and below

- 23G-33G

- Above 33G

In terms of sizes, the 23G-33G segment is expected to witness significant growth in the coming years. Lancets are available in a range of gauges (needle sizes), with the 23G-33G range being particularly significant. These smaller gauge lancets (higher numbers indicate smaller needles) are gaining traction due to their benefits in terms of patient comfort, reduced pain, and improved blood sample collection efficiency. The adoption of smaller gauge lancets, such as those in the 23G-33G range, has been driven by advancements in medical technology that allow for the design of lancet devices with finer and sharper needles. These thinner needles cause less tissue damage and pain when compared to larger gauge lancets. As patient comfort becomes an essential consideration in healthcare, medical practitioners and patients are increasingly choosing smaller gauge lancets for blood sampling, especially for regular monitoring and point-of-care testing.

Lancet Market By End-use

- Hospitals

- Clinics

- Ambulatory surgical centers

- Homecare settings

- Others

According to the lancet market forecast, the hospitals segment is expected to witness significant growth in the coming years. This growth driven by factors such as the increasing burden of chronic diseases, advancements in healthcare infrastructure, and the rising demand for accurate diagnostics. Hospitals play a central role in providing a wide range of medical services, including diagnostic testing that often requires blood samples. This has led to a consistent demand for lancets as an essential tool for safe and efficient blood collection. The prevalence of chronic diseases, such as diabetes and cardiovascular conditions, has led to a higher need for regular blood testing and monitoring, both for inpatients and outpatients. Hospitals utilize lancets to obtain blood samples quickly and with minimal discomfort for patients.

Lancet Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Lancet Market Regional Analysis

North America's dominance in the Lancet market can be attributed to a combination of factors that collectively contribute to its significant growth in this sector. The region's robust healthcare infrastructure, technological advancements, favorable regulatory environment, and high healthcare expenditure all play pivotal roles in shaping its dominance. The United States and Canada, as major contributors to the North American healthcare landscape, have highly developed healthcare systems that emphasize early diagnosis and patient-centric care. This emphasis has led to a considerable demand for lancets as essential tools for various diagnostic procedures, including blood glucose monitoring for diabetes management and regular health screenings. Furthermore, the prevalence of chronic diseases in North America, such as diabetes and cardiovascular disorders, has created a substantial need for lancets, as routine blood tests are integral to managing and monitoring these conditions. Technological advancements in medical devices have propelled the lancet market in North America. The region has been at the forefront of developing innovative lancet devices that prioritize patient comfort, ease of use, and safety.

Lancet Market Player

Some of the top Lancet market companies offered in the professional report include AgaMatrix, All Medicus Co. Ltd., Abbott Laboratories, B. Braun Melsungen AG, Ascensia Diabetes Care Holdings AG, Dexcom, Inc., Arkray, Inc, Bionime Corporation, LifeScan Inc., DarioHealth Corp., Essenlife Bioscience, Inc., Nova Biomedical, Inc., F. Hoffmann-La Roche Ltd., Medtronic, and Sinocare Inc.

Frequently Asked Questions

What was the market size of the global lancet in 2022?

The market size of lancet was USD 1.4 Billion in 2022.

What is the CAGR of the global lancet market from 2023 to 2032?

The CAGR of lancet is 9.5% during the analysis period of 2023 to 2032.

Which are the key players in the lancet market?

The key players operating in the global market are including AgaMatrix, All Medicus Co. Ltd., Abbott Laboratories, B. Braun Melsungen AG, Ascensia Diabetes Care Holdings AG, Dexcom, Inc., Arkray, Inc, Bionime Corporation, LifeScan Inc., DarioHealth Corp., Essenlife Bioscience, Inc., Nova Biomedical, Inc., F. Hoffmann-La Roche Ltd., Medtronic, and Sinocare Inc.

Which region dominated the global lancet market share?

North America held the dominating position in lancet industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of lancet during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global lancet industry?

The current trends and dynamics in the lancet industry include growing global healthcare expenditure, increasing prevalence of chronic diseases, and technological advancements in medical equipment.

Which size held the maximum share in 2022?

The 23G-33G size held the maximum share of the lancet industry.