Lactic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Lactic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

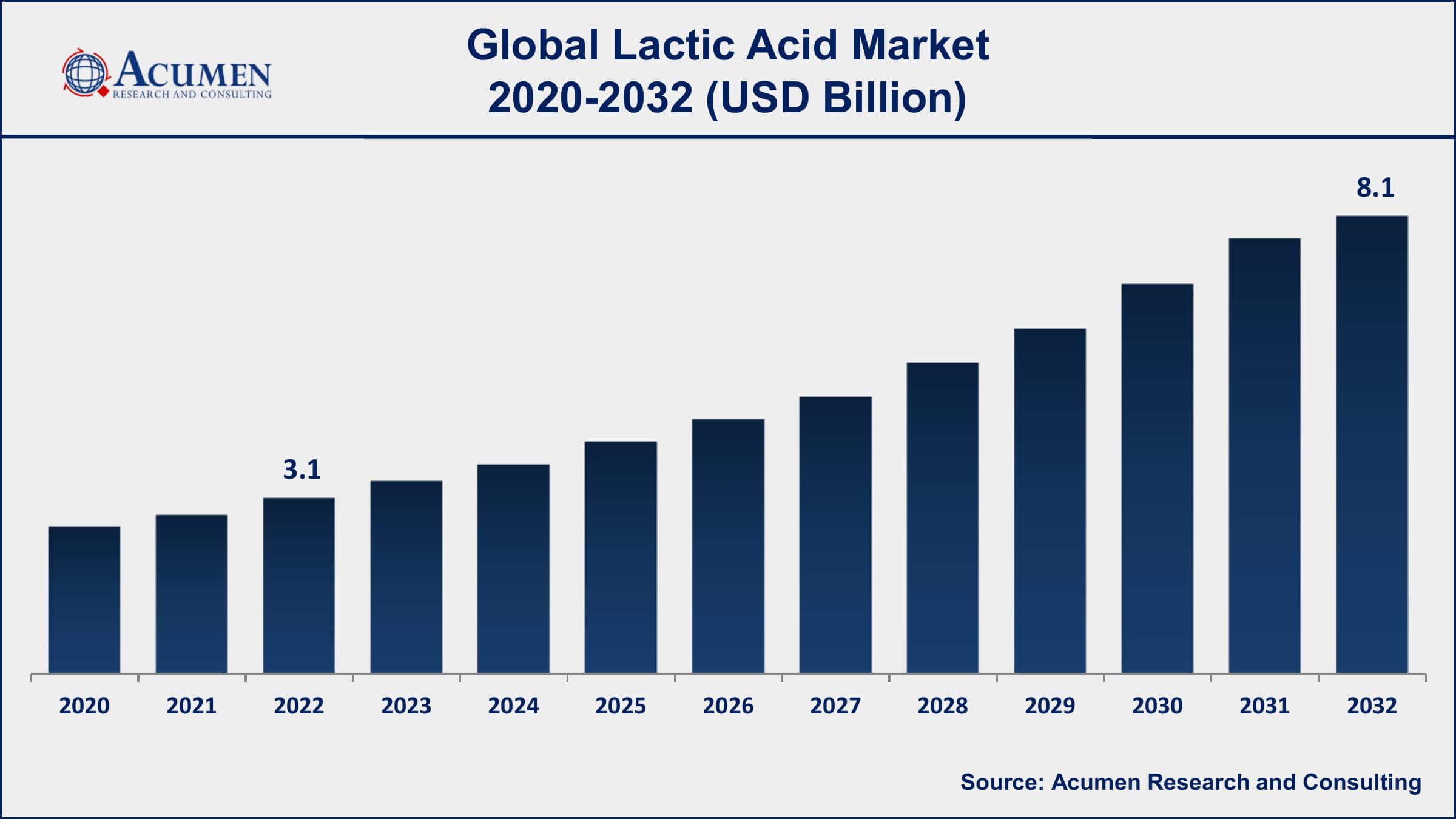

The Global Lactic Acid Market Size accounted for USD 3.1 Billion in 2022 and is projected to achieve a market size of USD 8.1 Billion by 2032 growing at a CAGR of 9.9% from 2023 to 2032.

Report Key Highlights

- Global lactic acid market revenue is expected to increase by USD 8.1 Billion by 2032, with a 9.9% CAGR from 2023 to 2032

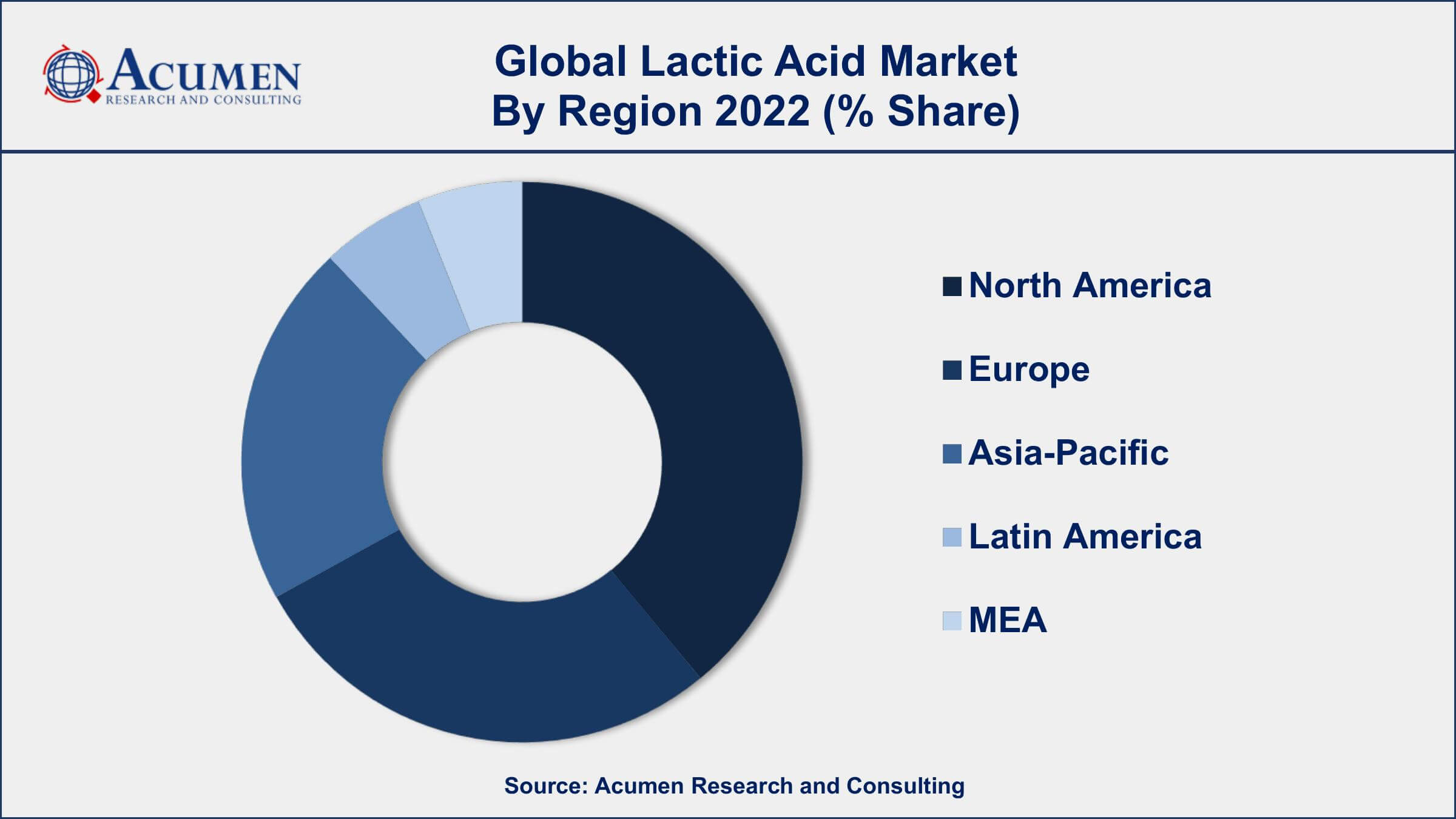

- North America region led with more than 40% of lactic acid market share in 2022

- Asia-Pacific lactic acid market growth will register a CAGR of more than 10% from 2022 to 2030

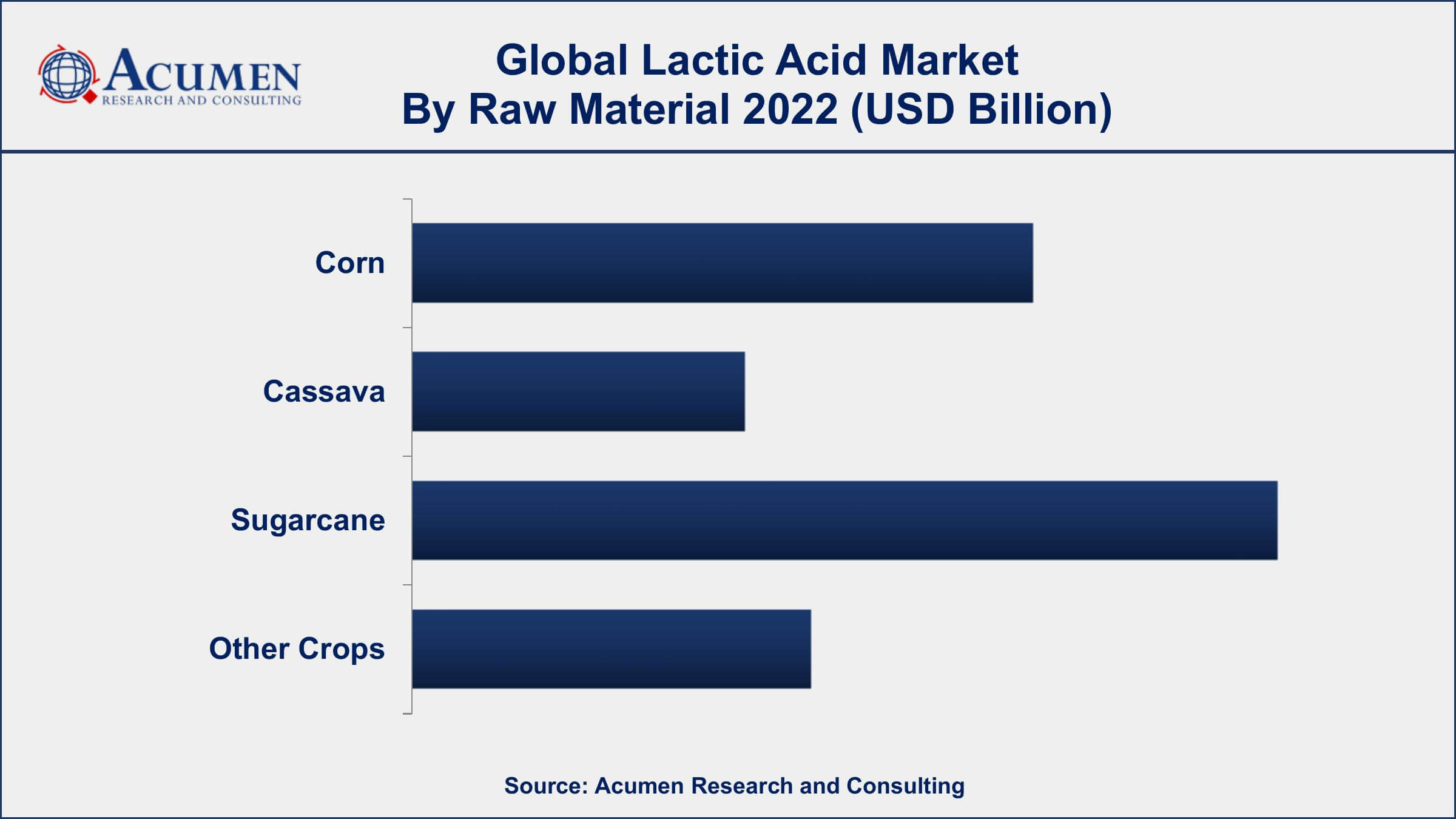

- Based on raw material, the sugarcane generated around US$ 1.2 billion revenue in 2022

- Among application, polylactic acid sub-segment generated around 30% share in 2022

- Increasing use in the pharmaceutical industry, drives the lactic acid market size

Lactic acid is a colorless or pale yellow organic acid that is produced naturally in the human body during physical activity or under anaerobic conditions. It is also produced commercially through the fermentation of carbohydrates by bacteria such as Lactobacillus, Streptococcus, and Bacillus. Lactic acid has various applications in industries such as food and beverages, pharmaceuticals, personal care, and biodegradable polymers.

In the food and beverage industry, lactic acid is used as a preservative, flavor enhancer, and acidity regulator. It is also used in the production of cheese, yogurt, and other fermented foods. In the pharmaceutical industry, lactic acid is used in the formulation of various drugs such as antibiotics and antiseptics. In the personal care industry, it is used as an exfoliant, moisturizer, and pH adjuster in skincare products. The biodegradable polymers market is also expected to drive the growth of the lactic acid market value as it can be used to produce biodegradable plastics. The increasing demand for lactic acid in the food and beverage industry, the growing awareness about biodegradable polymers, and the rising demand for personal care products are some of the key factors driving the growth of the market.

Global Lactic Acid Market Trends

Market Drivers

- Growing demand for lactic acid in the food and beverage industry

- Increasing demand for biodegradable polymers

- Rising demand for personal care products

- Growing consumer awareness about the benefits of lactic acid

- Increasing use of lactic acid in the pharmaceutical industry

Market Restraints

- Fluctuations in raw material prices

- High production costs

Market Opportunities

- Increasing demand for sustainable products

- Rising demand for lactate esters as solvents in various industries

Lactic Acid Market Report Coverage

| Market | Lactic Acid Market |

| Lactic Acid Market Size 2022 | USD 3.1 Billion |

| Lactic Acid Market Forecast 2032 | USD 8.1 Billion |

| Lactic Acid Market CAGR During 2023 - 2032 | 9.9% |

| Lactic Acid Market Analysis Period | 2020 - 2032 |

| Lactic Acid Market Base Year | 2022 |

| Lactic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Form, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Corbion, Sulzer, DuPont, Jungbunzlauer, Henan Jindan Lacic Acid Technology, Cargill, Mushashino Chemical, Unitika, FoodChem International, Vaishnavi Biotech, Galactic, and DOW. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Due to the rising demand from their end-user applications, it is expected that the demand for lactic acid in the global market is going to be very high. Its uses are mainly in the development of PLA plastics that are used in packaging things that work fine with all the norms related to the environment. Polylactic acid is a kind of thermoplastic polyester and is made from renewable products like corn starch, wheat, tapioca roots, and sugarcane. Polylactic acid products consist of bio-related renewable resources. Lactic acid is a sometimes colorless or yellowish, hygroscopic and odorless, sugary, and very thick chemical fluid. Most often it is soluble in other fluids such as ethanol and water. Lactic acids are mostly used in refined preservatives, dairy products, leather processing, textile dyeing, flavoring, and development of biodegradable polymers such as PLA, with plastics manufacturers, inks, solvents, and as a rich source of calcium lactate in pharmaceuticals companies. Lactic acid is a key source for the production of various other chemicals such as propylene oxide, lactate esters, 2,3-pentane-dione, acrylic acid, propylene glycol, dilactide, and propanoic acid. PLA is a biodegradable chemical made from the purest form of lactic acid. It is among one the major resources of resins used by bio-plastics. The various applications of PLA-based plastic comprise beverages and consumer goods packaging, the food packaging market, electronics, agriculture, textiles, and automobiles.

It is analyzed that the global market of lactic acid is fueled by growth in demand for PLA in the healthcare and medical sectors. An increase in demand for bioplastics mixed with the growing acceptance of PLA for products related to packaging is projected to surge the growth of the market in the foreseeable years. It is expected that the increase in crude oil cost will drive the overall demand for PLA since the maximum of plastic products are produced with the help of petroleum-based raw materials. PLA is eco-friendly and compostable; hence, it is proven as a good consumer product, especially for packaging food and beverage products. Increasing demand and consumer preferences for the personal use of PLA are expected to drive the growth of the global lactic acid market, especially in skin care products generally used for anti-acne, anti-aging products, and skin lightening. The need for bio-degradable polymers is mostly due to the increase in sustainable, biodegradable green packaging products from the beverages and food industry. Further, the rise in the price of petroleum minimized petroleum sources and increase in landfill mixed with worldwide concern over greenhouse radiation has proven some positive policies and initiatives for bio-plastics by the makers of policy around the world, which in turn helps in fueling the overall market.

Lactic Acid Market Segmentation

The global lactic acid market segmentation is based on raw material, form, application, and geography.

Lactic Acid Market By Raw Material

- Corn

- Cassava

- Sugarcane

- Other Crops

According to the lactic acid industry analysis, the sugarcane segment accounted for the largest market share in 2022. Sugarcane molasses is a byproduct of sugar production and is a popular feedstock for lactic acid production due to its high sugar content. The sugarcane segment is expected to witness significant growth in the lactic acid market due to various factors such as increasing demand for bio-based products, government regulations encouraging the use of bio-based products, and the availability of low-cost sugarcane molasses in regions such as Asia Pacific and Latin America. Additionally, the growing popularity of sugarcane-derived lactic acid as a sustainable alternative to petroleum-based chemicals is expected to boost the demand for lactic acid from this segment.

Lactic Acid Market By Form

- Solid

- Liquid

In terms of forms, the liquid segment is expected to witness significant growth in the coming years. The lactic acid in liquid form is widely used in various industries such as food and beverages, personal care, and pharmaceuticals. In the food and beverage industry, liquid lactic acid is used as a preservative and acidity regulator. It is also used in the production of fermented foods such as yogurt, cheese, and sauerkraut. In the personal care industry, liquid lactic acid is used as an exfoliant and pH adjuster in skincare products. In the pharmaceutical industry, it is used in the formulation of various drugs such as antibiotics and antiseptics. The growth of the liquid form segment in the lactic acid market can be attributed to several factors such as the increasing demand for food and beverage products, the growing consumer awareness about the benefits of natural ingredients, and the rising demand for personal care products.

Lactic Acid Market By Application

- Industrial

- Pharmaceuticals

- Food & Beverages

- Polylactic Acid

- Personal Care

- Others

According to the lactic acid market forecast, the food & beverages segment is expected to witness significant growth in the coming years. Lactic acid is widely used in the food and beverage industry as a preservative, flavor enhancer, and acidity regulator. It is also used in the production of fermented foods such as cheese, yogurt, and sauerkraut. The growth of the food and beverages segment in the market can be attributed to several factors such as the increasing demand for packaged food products, the growing consumer preference for natural and organic ingredients, and the rising demand for convenience food products. Additionally, the increasing use of lactic acid as a natural alternative to synthetic preservatives in the food and beverage industry is expected to boost the demand for lactic acid from this segment.

Lactic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Lactic Acid Market Regional Analysis

North America is dominating the lactic acid market due to various factors such as the increasing demand for bio-based products, the presence of key players in the region, and favorable government regulations supporting the growth of the market. The region is witnessing significant growth in the lactic acid market due to the increasing demand for bio-based products in various end-use industries such as food and beverages, personal care, and pharmaceuticals. Additionally, the growing consumer awareness about the benefits of natural and organic ingredients is driving the demand for lactic acid in the region. Moreover, North America is home to some of the key players in the lactic acid market, such as Corbion, Purac Biomaterials, and Galactic. These companies are investing heavily in research and development activities to develop innovative products and expand their product portfolio, which is driving the growth of the market in the region.

Lactic Acid Market Player

Some of the top lactic acid market companies offered in the professional report include Corbion, Sulzer, DuPont, Jungbunzlauer, Henan Jindan Lacic Acid Technology, Cargill, Mushashino Chemical, Unitika, FoodChem International, Vaishnavi Biotech, Galactic, and DOW.

Frequently Asked Questions

What was the market size of the global lactic acid in 2022?

The market size of lactic acid was USD 3.1 Billion in 2022.

What is the CAGR of the global lactic acid market from 2023 to 2032?

The CAGR of lactic acid is 9.9% during the analysis period of 2023 to 2032.

Which are the key players in the lactic acid market?

The key players operating in the global market are including Corbion, Sulzer, DuPont, Jungbunzlauer, Henan Jindan Lacic Acid Technology, Cargill, Mushashino Chemical, Unitika, FoodChem International, Vaishnavi Biotech, Galactic, and DOW.

Which region dominated the global lactic acid market share?

North America held the dominating position in lactic acid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of lactic acid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global lactic acid industry?

The current trends and dynamics in the lactic acid industry include growing demand in food and beverage industry, and increasing demand for biodegradable polymers.

Which raw material held the maximum share in 2022?

The sugarcane raw material held the maximum share of the lactic acid industry.