Lacrimal Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Lacrimal Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

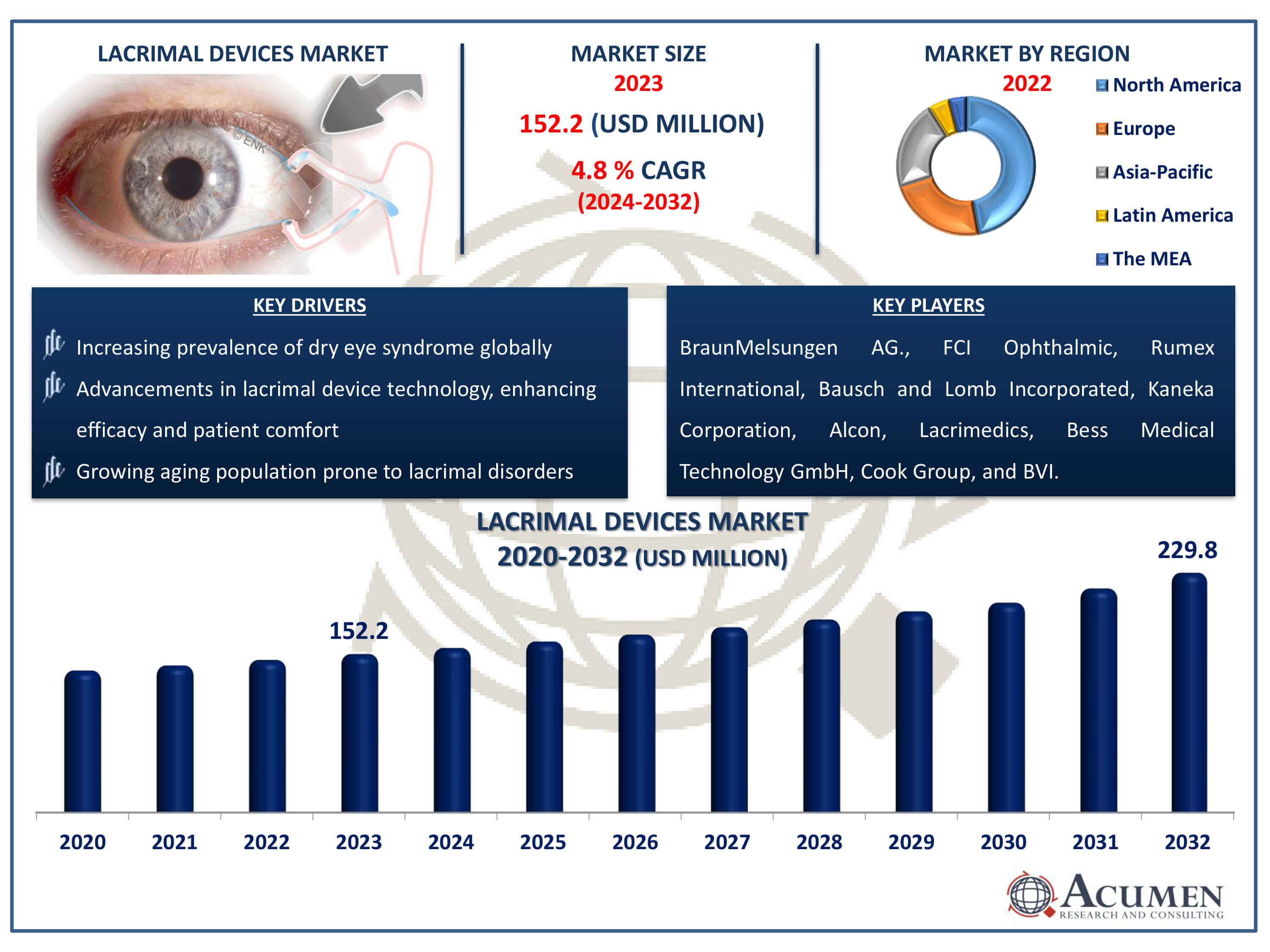

The Lacrimal Devices Market Size accounted for USD 152.2 Million in 2023 and is estimated to achieve a market size of USD 229.8 Million by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Lacrimal Devices Market Highlights

- Global lacrimal devices market revenue is poised to garner USD 229.8 million by 2032 with a CAGR of 4.8% from 2024 to 2032

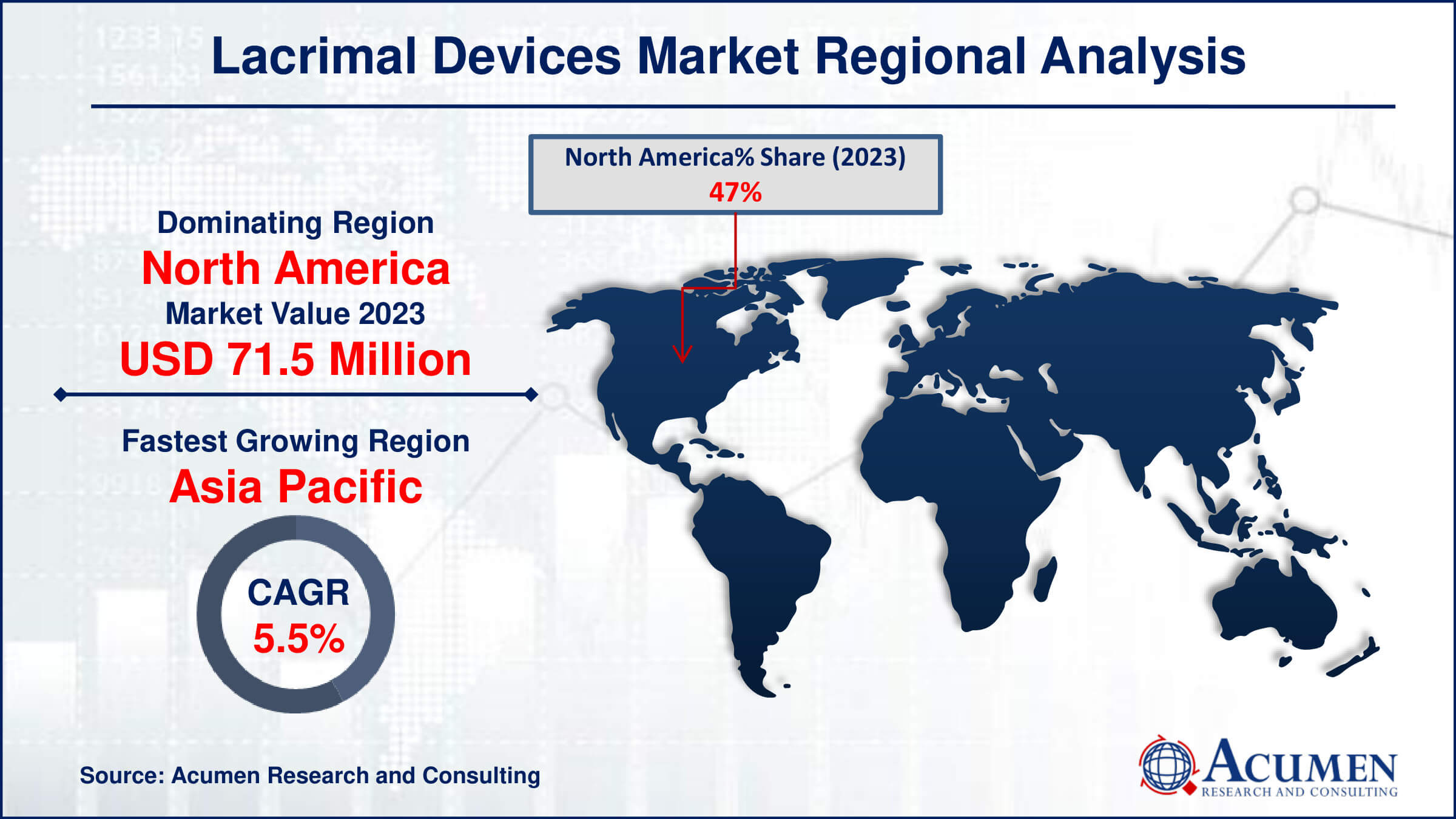

- North America lacrimal devices market value occupied around USD 71.5 million in 2023

- Asia-Pacific lacrimal devices market growth will record a CAGR of more than 5.5% from 2024 to 2032

- Among product, the stents sub-segment generated 26% of the market share in 2023

- Based on application, the dry eye sub-segment occupied USD 39.5 million revenue in 2023

- Growing prevalence of dry eye disease is the lacrimal devices market trend that fuels the industry demand

Disorders affecting the tear drainage system can result in excessive tear accumulation within the eye, leading to constant watering and irritation. In addition, blockages in the tear ducts can trigger recurrent painful infections necessitating antibiotic treatment via drops and tablets. Such conditions can significantly impair vision and overall well-being. Conversely, lacrimal devices serve as an eye protection system, shielding watery eyes from dust and dirt. Moreover, lacrimal duct devices like stents and intubation devices have historically been employed to maintain tear flow following trauma, surgery, or other procedures, highlighting their importance in addressing epiphora. Furthermore, Stents eye syndrome, a prevalent and complex condition, often stems from insufficient hydrophilic tears, primarily produced by the lacrimal gland. The lacrimal gland plays a crucial role in preserving ocular surface health and shielding it from environmental stressors.

Global Lacrimal Devices Market Dynamics

Market Drivers

- Increasing prevalence of dry eye syndrome globally

- Advancements in lacrimal device technology, enhancing efficacy and patient comfort

- Growing aging population prone to lacrimal disorders

Market Restraints

- Alternative therapies available for epiphora health issues

- Limited awareness about lacrimal disorders and available treatment options

- High costs associated with lacrimal device procedures

Market Opportunities

- Expansion of distribution networks in emerging markets

- Integration of smart technology in lacrimal devices, offering personalized treatment solutions

- Collaborations between pharmaceutical companies and device manufacturers for novel product development

Lacrimal Devices Market Report Coverage

| Market | Lacrimal Devices Market |

| Lacrimal Devices Market Size 2022 | USD 152.2 Million |

| Lacrimal Devices Market Forecast 2032 | USD 229.8 Million |

| Lacrimal Devices Market CAGR During 2023 - 2032 | 4.8% |

| Lacrimal Devices Market Analysis Period | 2020 - 2032 |

| Lacrimal Devices Market Base Year |

2022 |

| Lacrimal Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BraunMelsungen AG., FCI Ophthalmic, Rumex International, Bausch and Lomb Incorporated, Kaneka Corporation, Alcon, Lacrimedics, Bess Medical Technology GmbH, Cook Group, and BVI. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Lacrimal Devices Market Insights

The increasing prevalence of dry eye syndrome globally significantly drives growth of lacrimal devices market. As more individuals grapple with this uncomfortable condition, demand for innovative solutions to alleviate symptoms surges. Lacrimal devices offer a range of options, from punctal plugs to tear duct implants, providing relief and improving ocular health. This growth trend underscores the pressing need for effective and long-lasting treatments, fostering continuous innovation in the lacrimal device sector. By addressing the unmet needs of dry eye sufferers, these devices play a crucial role in enhancing quality of life and driving market expansion. Furthermore, rising cases of glaucoma further contributes to market growth in coming years.

The lacrimal device sector faces challenges due to the availability of alternative therapies for epiphora. These alternative treatments offer patients options beyond traditional devices, impacting market demand. Innovations in non-invasive or minimally invasive therapies further intensify competition. To thrive, lacrimal device companies must adapt by focusing on unique features and addressing unmet needs in patient care.

The integration of smart technology in lacrimal devices presents a significant opportunity for the market by offering personalized treatment solutions. These advancements allow for tailored interventions based on individual patient needs, improving efficacy and patient outcomes. Smart features such as real-time monitoring and data analysis enhance diagnostic capabilities and enable proactive management of lacrimal disorders. As a result, the adoption of these innovative solutions is poised to drive growth and innovation in the lacrimal device market. Moreover, the advantages of tear irrigation and treatment techniques, together with the spectacular results obtained by using low-cost tear devices, are likely to generate considerable market growth potential throughout the projection period.

Lacrimal Devices Market Segmentation

The worldwide market for lacrimal devices is split based on product, application, end use, and geography.

Lacrimal Device Market By Product

- Stents

- Intubation Sets

- Tubes

- Dilator

- Cannula & Spatula

- Punctal Plugs

- Others

According to the lacrimal devices industry analysis, stent as a product dominates market. A lacrimal stent serves as a bicanalicular intubation device utilized for the management of tear drainage system issues, notably in dacryocystorhinostomy cases. Over time, a variety of materials including synthetic, organic, and metallic substances have been employed as stents for puncta or stenotic tubules. The inception of stent use dates back to 1932 when Graue introduced the concept. Subsequently, materials such as nylon, silk, dacron, and polypropylene have been utilized, with ongoing refinement in design aimed at enhancing retention and minimizing collateral damage. Recent advancements in stent technology have demonstrated improved success rates and reduced risk of complications.

Lacrimal Device Market By Application

- Dry Eye

- Drainage Obstruction

- Glaucoma

- Lacrimal Gland Inflammation

- Epiphora

- Others

The dry eye segment is the largest application category in the lacrimal devices market and it is expected to increase over the industry. Dry eyes pose a significant global concern, impacting more than 344 million individuals worldwide, with over 30 million affected in the United States alone. It occurs when tears fail to adequately nourish and lubricate the eyes. Symptoms stem from various factors including aging, autoimmune diseases, hormonal fluctuations, inflamed eyelid glands, allergens, eye diseases, and adverse reactions to certain medications like antihistamines. Additionally, environmental factors such as dry air from air conditioning, heating, or other sources can exacerbate the condition by drying out the tear film and disrupting the eye's lacrimal system.

Lacrimal Device Market By End-Use

- Hospitals

- Diagnostic Centers

- Ophthalmic Clinics

- Others

According to the lacrimal devices industry forecast, hospital segment expected to boost demand of market due to its advanced infrastructure, skilled personnel, and access to cutting-edge equipment and technology. Additionally, the surge in hospital visits, the escalating incidence of eye ailments, the expanding pool of patients requiring surgical interventions, and the availability of reimbursement options for these therapies are all contributing to the segment's expansion.

Lacrimal Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Lacrimal Devices Market Regional Analysis

For several reasons, North America dominates lacrimal device market primarily due to the region's widespread acceptance of lacrimal equipment, a well-established healthcare sector, and an increasing incidence of eye diseases. Within North America, the United States holds the largest market share, attributed to its stringent surgical device regulations and rising public awareness regarding the necessity of such procedures for lacrimal duct obstruction cases. Notably, in the United States, approximately 12 million individuals aged over 40 are affected by eye diseases, with around 1 million experiencing blindness. Moreover, the market is expected to witness significant growth in the forecasted periods, driven by factors such as the expanding elderly population and the presence of key market players. For instance, in November 2021, Lacrimedics, Inc. and Innovia Medical established a partnership. Lacrimedics, headquartered in Du Pont, Washington, has been producing and distributing occlusion therapy devices for nearly forty years, specializing in treating Dry Eye Disease and its associated symptoms. This collaboration enhances Innovia's current ophthalmic product portfolio, which includes Dissolvable VisiPlug, OPAQUE Herrick Lacrimal Plugs with ComfortTip, and AccuFlo Punctal Occluders. As a result, these factors maintain its dominance in forecast year.

The Asia-Pacific region is witnessing rapid growth in the lacrimal devices market due to increasing awareness about eye health and rising incidences of eye disorders. Furthermore, favorable government initiatives and increasing investments in healthcare are further propelling the market expansion in the Asia-Pacific region. For instance, in January 2022, Kaneka Corporation announced its intention to build a state-of-the-art medical device manufacturing plant in the Tomakomai Tohbu Industrial Area of Hokkaido. With an estimated investment of around 10 billion yen, the facility is slated to commence operations in May 2024. This new facility will embody the concept of a "smart factory," leveraging advanced automation and upgraded production processes to enhance productivity significantly. Moreover, advancements in healthcare infrastructure and the growing geriatric population are driving demand for lacrimal devices.

Lacrimal Devices Market Players

Some of the top lacrimal devices companies offered in our report include BraunMelsungen AG., FCI Ophthalmic, Rumex International, Bausch and Lomb Incorporated, Kaneka Corporation, Alcon, Lacrimedics, Bess Medical Technology GmbH, Cook Group, and BVI.

Frequently Asked Questions

How big is the lacrimal devices market?

The lacrimal devices market size was valued at USD 152.2 million in 2023.

What is the CAGR of the global lacrimal devices market from 2024 to 2032?

The CAGR of lacrimal devices is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the lacrimal devices market?

The key players operating in the global market are including BraunMelsungen AG., FCI Ophthalmic, Rumex International, Bausch and Lomb Incorporated, Kaneka Corporation, Alcon, Lacrimedics, Bess Medical Technology GmbH, Cook Group, and BVI.

Which region dominated the global lacrimal devices market share?

North America held the dominating position in lacrimal devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of lacrimal devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global lacrimal devices industry?

The current trends and dynamics in the lacrimal devices industry include increasing prevalence of dry eye syndrome globally, advancements in lacrimal device technology, enhancing efficacy and patient comfort, and growing aging population prone to lacrimal disorders.

Which product held the maximum share in 2023?

The stents product held the maximum share of the lacrimal devices industry.