Laboratory Information System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Laboratory Information System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

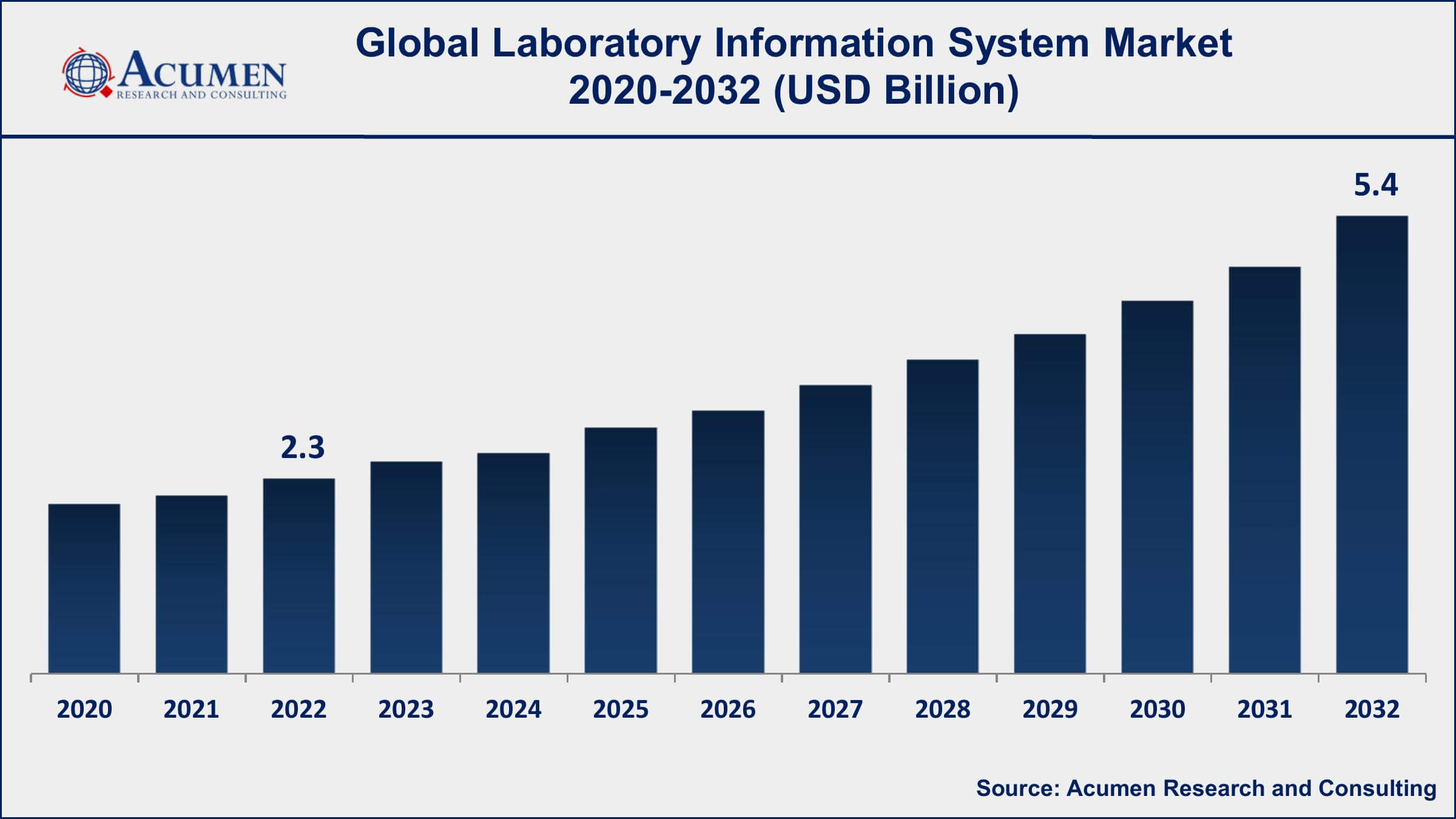

The Global Laboratory Information System (LIS) Market Size accounted for USD 2.3 Billion in 2022 and is projected to achieve a market size of USD 5.4 Billion by 2032 growing at a CAGR of 8.1% from 2023 to 2032.

Laboratory Information System Market Report Key Highlights

- Global laboratory information system market revenue is expected to increase by USD 5.4 Billion by 2032, with a 8.1% CAGR from 2023 to 2032

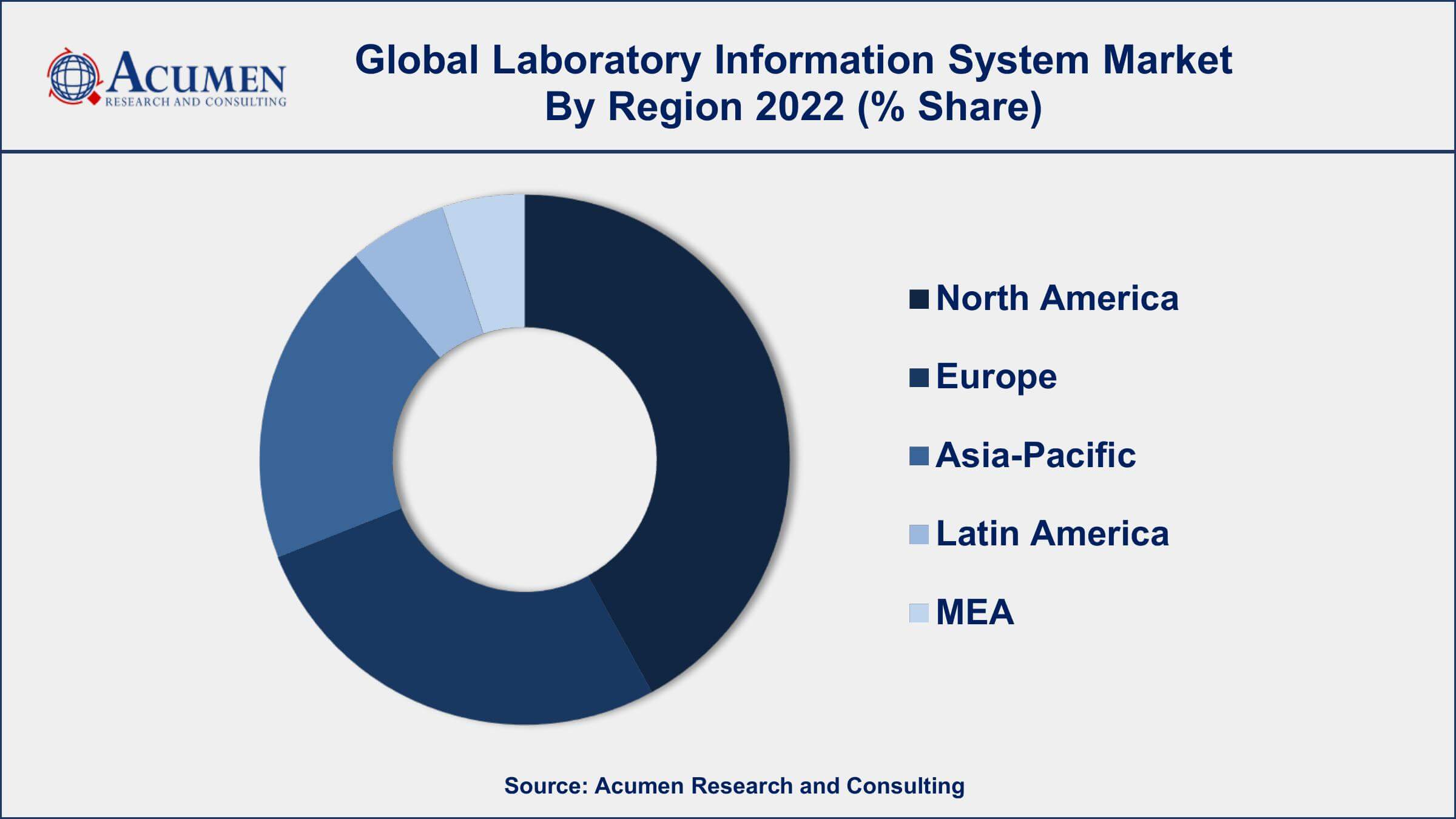

- North America region led with more than 42% of laboratory information system market share in 2022

- Asia-Pacific Laboratory Information System market growth will record a CAGR of over 9% from 2023 to 2032

- According to a US Department of Health and Human Services report, over 80% of laboratory data is created and stored electronically using LIS, making it easier to manage and transfer data across various healthcare companies.

- According to the Centers for Disease Control and Prevention (CDC), laboratory information systems are used to order and process nearly 70% of clinical laboratory tests.

- The World Health Organization (WHO) has underlined the importance of laboratory information systems (LIS) in increasing laboratory capacity and quality, particularly in resource-constrained situations.

- Growing demand for mobile and cloud-based LIS solutions, drives the laboratory information system market size

A laboratory information system (LIS) is a software solution that manages and stores data generated by clinical laboratories. The system automates laboratory processes, such as test ordering, specimen processing, and result reporting, making the laboratory workflow more efficient and streamlined. LIS is typically used in hospitals, clinics, and diagnostic laboratories, and it is an essential tool for clinical laboratories to manage their workload, ensure quality control, and maintain regulatory compliance.

The LIS market has experienced significant growth over the past few years, driven by several factors, including the increasing demand for automation in clinical laboratories, the rising incidence of chronic diseases, and the growing adoption of electronic health records (EHRs). Moreover, the market growth is attributed to several factors, such as the increasing adoption of cloud-based LIS solutions, the growing demand for personalized medicine, and the emergence of artificial intelligence (AI) and machine learning (ML) technologies in clinical laboratories. Cloud-based LIS solutions offer several benefits, such as easy accessibility, scalability, and cost-effectiveness, which have driven their adoption in the market. The growing demand for personalized medicine has also led to the development of advanced LIS solutions that enable laboratories to deliver personalized diagnostics and treatments. The emergence of AI and ML technologies has also impacted the LIS market, as these technologies have the potential to automate laboratory processes, improve diagnostic accuracy, and reduce errors, thereby driving market growth.

Global Laboratory Information System Market Trends

Market Drivers

- Increasing demand for laboratory automation to enhance efficiency and reduce errors

- Growing incidence of chronic diseases and infectious diseases

- Need for better patient care and diagnostic accuracy

- Rising adoption of EHRs and other digital health technologies

Market Restraints

- High implementation and maintenance costs of LIS solutions

- Limited interoperability with other healthcare IT systems

Market Opportunities

- Integration of AI and ML technologies in LIS solutions for advanced data analytics and decision-making

- Growing demand for mobile and cloud-based LIS solutions

Laboratory Information System Market Report Coverage

| Market | Laboratory Information System Market |

| Laboratory Information System Market Size 2022 | USD 2.3 Billion |

| Laboratory Information System Market Forecast 2032 | USD 5.4 Billion |

| Laboratory Information System Market CAGR During 2023 - 2032 | 8.1% |

| Laboratory Information System Market Analysis Period | 2020 - 2032 |

| Laboratory Information System Market Base Year | 2022 |

| Laboratory Information System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Component, By Delivery Mode, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | McKesson Corporation, Cerner Corporation, Sunquest Information Systems, Inc., Medical Information Technology Inc., Epic Corporation Inc., Computer Programs and Systems, Inc., SCC Soft Computer, Orchard Software Corporation, CompuGroup Medical AG, and Merge Healthcare, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A laboratory information system is a software-based information management system with additional features that support a modern laboratory’s operations. The laboratory information system provides several key features including flexible architecture, workflow and data tracking support, and a data exchange interface. The laboratory information system provides dynamic architecture since the laboratory’s requirements are rapidly evolving and different laboratories often have different needs. The laboratory information system is a healthcare technology tool often used in capturing, recording, and managing patent-captured data gathered during medical tests and processes. The stored data and information are saved in the laboratory information system database for future reference. Laboratory information systems have various added features such as patient check-in, patient demographics, specimen processing, order entry, and result entry. The laboratory information system provides information that helps in the prevention, treatment, management, and diagnosis of a disease, as well as acts as an indicator for the population and individual health.

Healthy economic growth witnessed in most developing countries across the globe and an increase in the number of healthcare IT companies are some major factors driving the overall growth of the global LIS market. The uptrend in per-capita expenditure in healthcare in both developing and developed economies is anticipated to lead to a rise in the quality of patient treatment and care options, thus fuelling the market growth for laboratory information systems. Also, the increasing number of private hospitals, private laboratories, and clinics is another key element driving the LIS market growth. The rise in government initiatives coupled with the increase in the need for integrated healthcare information systems and a surge in the prevalence of chronic diseases are equally contributing to the growth of the global LIS market value. However, the lack of skilled healthcare IT professionals and the high initial costs of laboratory information systems are some key aspects hindering the growth of this market. Moreover, the increasing use of mobile phones is the pertaining trend in the laboratory information system market.

Laboratory Information System Market Segmentation

Laboratory Information System Market Segmentation

The global laboratory information system market segmentation is based on product, component, delivery mode, end user, and geography.

Laboratory Information System Market By Product

- Standalone LIS

- Integrated LIS

According to our laboratory information system industry analysis, the integrated LIS segment held the largest market share in 2022. Integrated LIS solutions refer to those that are tightly integrated with other healthcare IT systems, such as EHRs, laboratory information management systems (LIMS), and clinical decision support systems (CDSS). These solutions offer several benefits, including improved data sharing and interoperability, streamlined workflows, and better patient care. The growth of the integrated LIS segment is driven by several factors, including the increasing demand for healthcare IT integration, the growing adoption of EHRs, and the need for better patient outcomes. Integrated LIS solutions enable laboratories to seamlessly integrate with other healthcare IT systems, such as electronic medical records, which improves the accuracy and speed of clinical data sharing. This, in turn, leads to better patient care and outcomes.

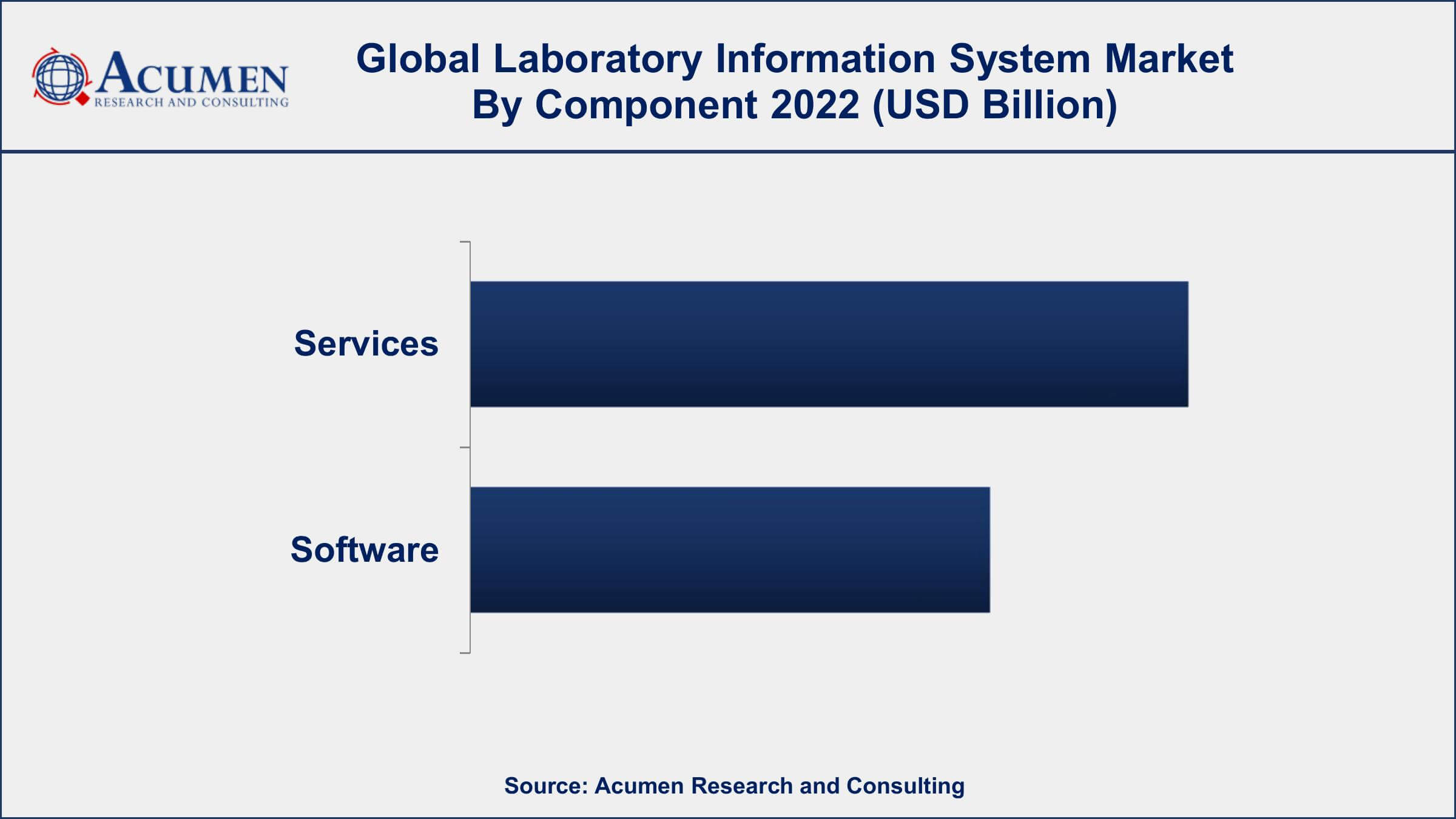

Laboratory Information System Market By Component

- Services

- Software

In terms of components, the services segment is an important component of the laboratory information system (LIS) market and has been experiencing significant growth in recent years. The services segment includes implementation and integration, support and maintenance, and consulting services related to LIS solutions. One of the primary drivers of growth in the services segment is the increasing adoption of LIS solutions by healthcare organizations worldwide. As more organizations adopt LIS solutions to manage their laboratory operations, the demand for implementation and integration services also increases. These services are crucial for ensuring that LIS solutions are installed and configured correctly and can integrate with other healthcare IT systems, such as electronic medical records (EMRs) and laboratory information management systems (LIMS).

Laboratory Information System Market By Delivery Mode

- On-premise LIS

- Cloud-based LIS

- Web-based LIS

According to the laboratory information system market forecast, the cloud-based LIS segment is expected to witness a considerable growth rate in the coming years. Cloud-based LIS solutions are those that are hosted on remote servers and can be accessed via the internet, rather than being installed locally on a healthcare organization's own servers. These solutions offer several benefits, including cost-effectiveness, scalability, and ease of access. One of the primary drivers of growth in the cloud-based LIS segment is the increasing adoption of cloud computing technology in healthcare. Cloud computing enables healthcare organizations to store and manage large volumes of data, such as laboratory test results, more efficiently and cost-effectively than traditional on-premise solutions. This has led to the development of cloud-based LIS solutions that offer similar benefits, including reduced capital expenditures and IT infrastructure costs.

Laboratory Information System Market By End User

- Hospital Laboratories

- Physician Office Laboratories

- Independent Laboratories

- Others

In terms of the end user, the hospital laboratories segment dominates the laboratory information system market in 2022. Hospital laboratories are facilities within hospitals that perform a wide range of laboratory tests to help diagnose and treat patients. The LIS solutions used in hospital laboratories help manage the entire laboratory workflow, including test ordering, specimen tracking, test results reporting, and quality control. The growth of the hospital laboratories segment is driven by several factors, including the increasing demand for laboratory automation, the growing prevalence of chronic diseases, and the need for better patient care. Hospital laboratories are facing increasing pressure to improve their efficiency and reduce errors, and LIS solutions can help achieve these goals by automating many of the routine laboratory workflows. The growing prevalence of chronic diseases, such as diabetes and cancer, is also driving the growth of the hospital laboratories segment.

Laboratory Information System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Laboratory Information System Market Regional Analysis

North America is currently dominating the laboratory information system (LIS) market, accounting for the largest share of the market. There are several reasons why North America is leading the LIS market, including the high adoption rate of healthcare IT solutions, a large number of established healthcare organizations, and favorable government initiatives. One of the primary drivers of the LIS market in North America is the high adoption rate of healthcare IT solutions. Healthcare organizations in North America have been early adopters of healthcare IT solutions, including LIS solutions, to improve patient care and increase efficiency. The widespread use of electronic health records (EHRs) and other healthcare IT systems have also created a demand for LIS solutions that can integrate with these systems. North America also has a large number of established healthcare organizations that require LIS solutions to manage their laboratory operations. These organizations include hospitals, clinics, and independent laboratories, which generate a high volume of laboratory data that needs to be managed efficiently. The demand for LIS solutions is particularly high in the United States, which has a large and complex healthcare system.

Laboratory Information System Market Player

Some of the top laboratory information system market companies offered in the professional report includes McKesson Corporation, Cerner Corporation, Sunquest Information Systems, Inc., Medical Information Technology Inc., Epic Corporation Inc., Computer Programs and Systems, Inc., SCC Soft Computer, Orchard Software Corporation, CompuGroup Medical AG, and Merge Healthcare, Inc.

Frequently Asked Questions

What was the market size of the global laboratory information system in 2022?

The market size of laboratory information system was USD 2.3 Billion in 2022.

What is the CAGR of the global laboratory information system market during forecast period of 2023 to 2032?

The CAGR of LIS market is 8.1% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global laboratory information system (LIS) market are McKesson Corporation, Cerner Corporation, Sunquest Information Systems, Inc., Medical Information Technology Inc., Epic Corporation Inc., Computer Programs and Systems, Inc., SCC Soft Computer, Orchard Software Corporation, CompuGroup Medical AG, and Merge Healthcare, Inc.

Which region held the dominating position in the global laboratory information system market?

North America held the dominating position in LIS market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for laboratory information system industry during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global laboratory information system market?

The current trends and dynamics in the laboratory information system industry include the growing incidence of chronic diseases and infectious diseases, and increasing demand for laboratory automation to enhance efficiency and reduce errors.

Which component held the maximum share in 2022?

The services component held the maximum share of the LIS market.