L-Cysteine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

L-Cysteine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

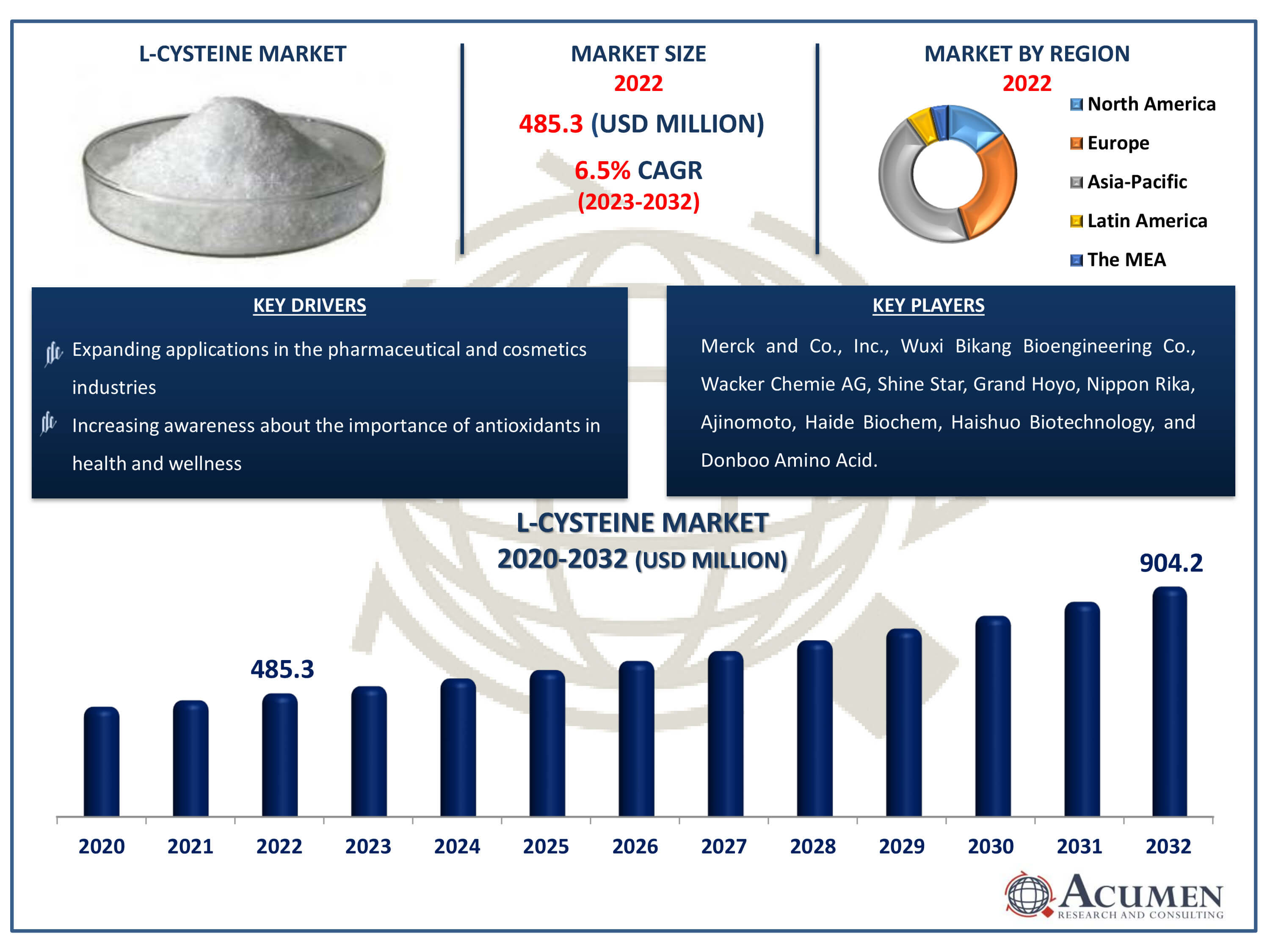

The L-Cysteine Market Size accounted for USD 485.3 Million in 2022 and is estimated to achieve a market size of USD 904.2 Million by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

L-Cysteine Market Highlights

- Global L-cysteine market revenue is poised to garner USD 904.2 million by 2032 with a CAGR of 6.5% from 2023 to 2032

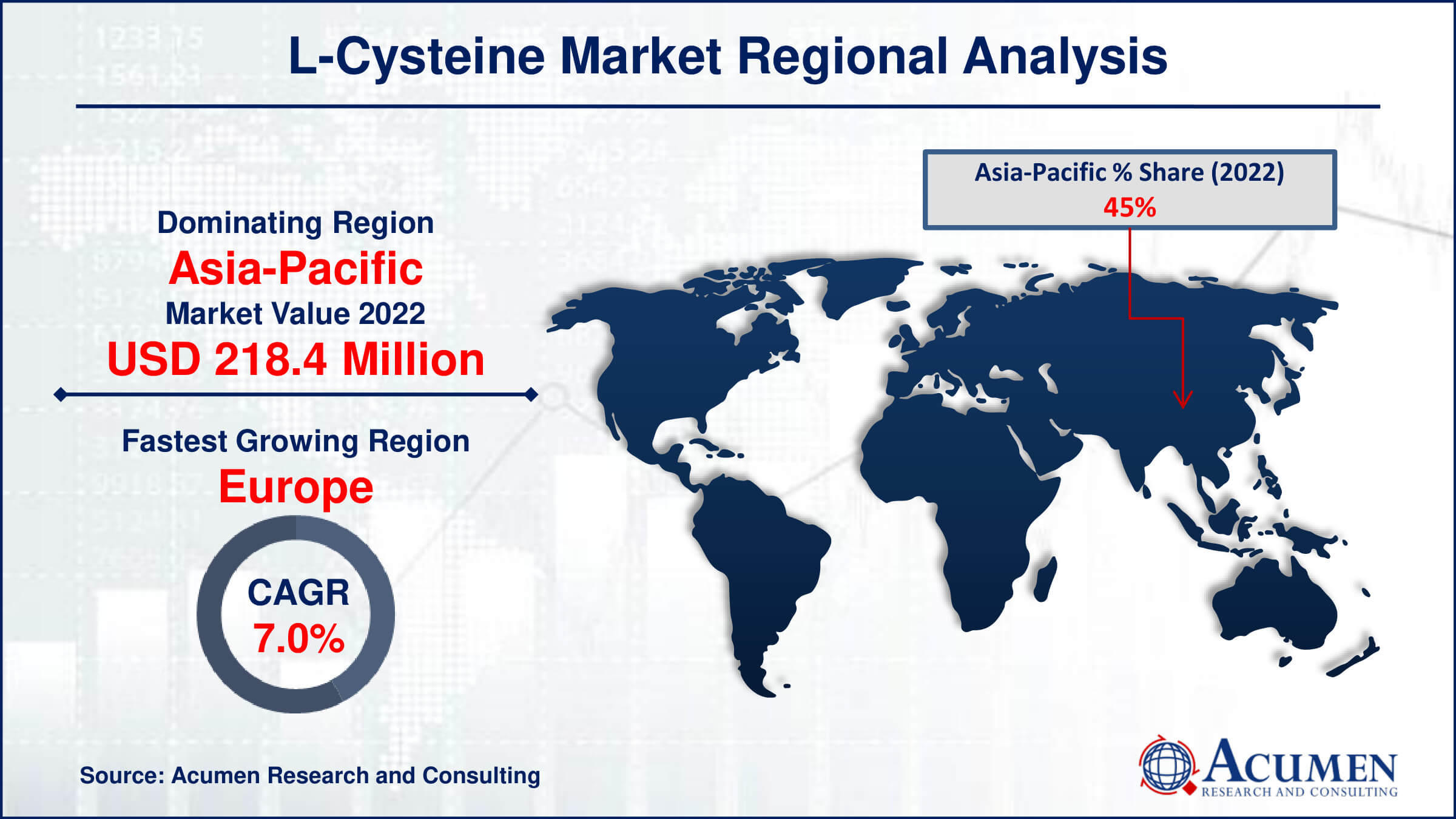

- Asia-Pacific L-cysteine market value occupied around USD 218.4 million in 2022

- Europe L-cysteine market growth will record a CAGR of more than 7% from 2023 to 2032

- Among industrial use, the food sub-segment generated noteworthy revenue in 2022

- Based on application, the flavor enhancer sub-segment generated significant market share in 2022

- Collaboration with research institutions to explore novel therapeutic applications is a popular L-cysteine market trend that fuels the industry demand

L-cysteine, an essential amino acid, is important for human health because it promotes the formation of the antioxidant glutathione. It acts as a vital building block for muscle development and repair, making it an essential component of dietary supplements for general health. L-cysteine is spontaneously synthesized in the body and functions as an excellent scavenger of damaging radicals as well as a powerful reducing agent. L-cysteine is widely used in a variety of sectors, including cosmetics, dietary supplements, and pharmaceutical formulations. Although originally produced from human hair and feathers, modern manufacturing methods have evolved to provide more sustainable and efficient production processes, keeping with today's norms of ethical sourcing and environmental responsibility.

Global L-Cysteine Market Dynamics

Market Drivers

- Growing demand for dietary supplements and functional foods

- Increasing awareness about the importance of antioxidants in health and wellness

- Expanding applications in the pharmaceutical and cosmetics industries

- Advancements in biotechnology for efficient production methods

Market Restraints

- Limited availability of raw materials, such as human hair and feathers

- Regulatory challenges regarding sourcing and production standards

- Potential adverse effects associated with high doses or prolonged use

Market Opportunities

- Development of alternative, sustainable sources for L-cysteine production

- Expansion into emerging markets with rising disposable incomes and health awareness

- Innovation in formulations and delivery methods to enhance efficacy and consumer appeal

L-Cysteine Market Report Coverage

| Market | L-Cysteine Market |

| L-Cysteine Market Size 2022 | USD 485.3 Million |

| L-Cysteine Market Forecast 2032 | USD 904.2 Million |

| L-Cysteine Market CAGR During 2023 - 2032 | 6.5% |

| L-Cysteine Market Analysis Period | 2020 - 2032 |

| L-Cysteine Market Base Year |

2022 |

| L-Cysteine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Production Process, By End use Industry, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Merck and Co., Inc., Wuxi Bikang Bioengineering Co., Wacker Chemie AG, Shine Star, Grand Hoyo, Nippon Rika, Ajinomoto, Haide Biochem, Haishuo Biotechnology, and Donboo Amino Acid. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

L-Cysteine Market Insights

The growing demand for processed foods and dietary supplements is a major driver of the L-Cysteine industry. L-Cysteine is an essential element in food processing, notably in the preparation of baked foods, meat products, and flavour enhancers. Demand for L-Cysteine is predicted to increase as consumers favour convenience meals and useful additives. Furthermore, consumers' increased awareness of health and wellbeing is boosting demand for L-Cysteine-containing dietary supplements, accelerating market expansion. However, the market is constrained by several factors, the most noteworthy of which being the scarcity of raw resources. L-Cysteine is largely derived from natural proteins such as human hair, chicken feathers, and microbial fermentation. The extraction procedure from these sources can be difficult and costly, resulting in supply chain issues and price swings. Furthermore, concerns about the ethical and environmental consequences of obtaining L-Cysteine from animal-derived sources limit market expansion, spurring the search for alternative, sustainable sources.

Despite these obstacles, the L-Cysteine industry has great potential, notably in the pharmaceutical and cosmetic industries. L-Cysteine has antioxidant characteristics and plays an important role in cellular processes, making it a beneficial element in pharmaceutical formulations that address a variety of health concerns, such as liver detoxification, hair loss prevention and wound healing. Furthermore, the growing desire for natural and organic cosmetics drives the use of L-Cysteine in skincare and haircare products, which has the capacity to boost collagen production and strengthen hair shafts. Using these applications, producers may capitalise on the rising trend towards clean-label products and natural ingredients, resulting in market increase.

L-Cysteine Market Segmentation

The worldwide market for L-cysteine is split based on production process, End Use Industry, application, and geography.

L-Cysteine Production Process

- Natural

- Synthetic

- Others

According to L-cysteine industry analysis, natural production processes generally dominate the L-cysteine market. Natural approaches include obtaining L-cysteine from sources such as human hair, chicken feathers, and microbial fermentation. This segment's popularity originates from customer desires for clean-label and naturally derived products, particularly in the food and pharmaceutical industries. Furthermore, natural L-cysteine coincides with ethical and environmental issues, which drives its demand. However, market dynamics might vary as a result of technological improvements and regulatory changes. Synthetic production methods, which provide cost-effectiveness and consistency in quality, may gain traction over time. Nonetheless, the natural sector dominates, reflecting current consumer preferences and trends.

L-Cysteine End Use Industry

- Food

- Pharmaceuticals

- Cosmetics

- Animal Feed

The food sector is the largest segment in the market and its expected to grow over the L-cysteine industry forecast period. L-cysteine is widely used as a food ingredient, especially in baked foods, meat products, and flavour enhancers. Its involvement in dough conditioning and flavour improvement renders it vital in food preparation. Furthermore, as customer demand for convenience meals and functional ingredients increases, so does the food industry's demand for L-cysteine. While medicines and cosmetics use L-cysteine for a variety of purposes such as liver purification and hair strengthening, the sheer volume of consumption in the food industry cements its place as the largest section of the L-cysteine market.

L-Cysteine Applications

- Conditioner

- Flavor Enhancer

- Reducing Agent

- Radical Scavenger

- Production of Human Insulin

- Others

Among the stated applications, the flavour enhancer sector is likely to dominate the L-Cysteine market. L-Cysteine is a vital element in flavour enhancers since it may enhance and balance savory flavors in a variety of food items. Its importance in boosting taste profiles, particularly in processed foods such as soups, sauces, snacks, and savory baked products, supports its high demand in the flavour enhancer market. As customers seek out better taste experiences and food producers endeavor to match these expectations, the demand for L-Cysteine as a flavour enhancer grows. Furthermore, as worldwide consumption of processed and convenience foods rises, the need for flavour enhancers like L-Cysteine is predicted to grow significantly. Furthermore, L-Cysteine's flexibility in increasing umami and meaty flavors strengthens its position as a dominant application in the L-Cysteine market.

L-Cysteine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

L-Cysteine Market Regional Analysis

Asia Pacific is often regarded as the greatest market for L-Cysteine, owing to reasons such as rapid industrialization, population increase, and rising demand for processed foods and medicines. Countries such as China, Japan, and India contribute significantly to market growth in Asia Pacific over the L-Cysteine market forecast period. China, in particular, stands out as a prominent participant in the L-Cysteine market, because to its big population, powerful food processing industry, and expanding pharmaceutical sector. The presence of significant manufacturers and suppliers, favorable government regulations, and increased investment in R&D all contribute to the region's supremacy. Furthermore, Asia Pacific's booming cosmetics sector drives up demand for L-Cysteine, notably in South Korea, which is recognized for its innovation and export-oriented cosmetics market. As disposable incomes rise and consumer knowledge of skincare and hair care products grows, the demand for L-Cysteine in cosmetics is likely to surge in the area.

In terms of L-cysteine market analysis, the Europe is predicted to be the fastest-growing market for L-Cysteine. Factors driving this expansion include increased urbanization, rising disposable incomes, and shifting dietary preferences towards processed foods. Furthermore, the Europe region's pharmaceutical and cosmetics businesses are rapidly expanding, pushed by rising healthcare costs and changing lifestyles. Furthermore, the rising frequency of chronic illnesses and an ageing population are pushing up demand for L-Cysteine-containing medications, enhancing regional market growth. Furthermore, the growing demand for natural and organic cosmetics creates potential for L-Cysteine makers to meet the growing customer preference for clean-label and sustainable goods.

L-Cysteine Market Players

Some of the top L-Cysteine companies offered in our report includes Merck and Co., Inc., Wuxi Bikang Bioengineering Co., Wacker Chemie AG, Shine Star, Grand Hoyo, Nippon Rika, Ajinomoto, Haide Biochem, Haishuo Biotechnology, and Donboo Amino Acid.

Frequently Asked Questions

How big is the L-Cysteine market?

The L-Cysteine market size was valued at USD 485.3 Million in 2022.

What is the CAGR of the global L-Cysteine market from 2023 to 2032?

The CAGR of L-Cysteine is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the L-Cysteine market?

The key players operating in the global market are including Merck and Co., Inc., Wuxi Bikang Bioengineering Co., Wacker Chemie AG, Shine Star, Grand Hoyo, Nippon Rika, Ajinomoto, Haide Biochem, Haishuo Biotechnology, and Donboo Amino Acid.

Which region dominated the global L-Cysteine market share?

Asia-Pacific held the dominating position in L-Cysteine industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of L-cysteine during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global L-Cysteine industry?

The current trends and dynamics in the L-Cysteine industry include growing demand for dietary supplements and functional foods, increasing awareness about the importance of antioxidants in health and wellness, expanding applications in the pharmaceutical and cosmetics industries, and advancements in biotechnology for efficient production methods.

Which industrial use held the maximum share in 2022?

The food industrial use held the maximum share of the L-cysteine industry.