Keratin Market | Acumen Research and Consulting

Keratin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

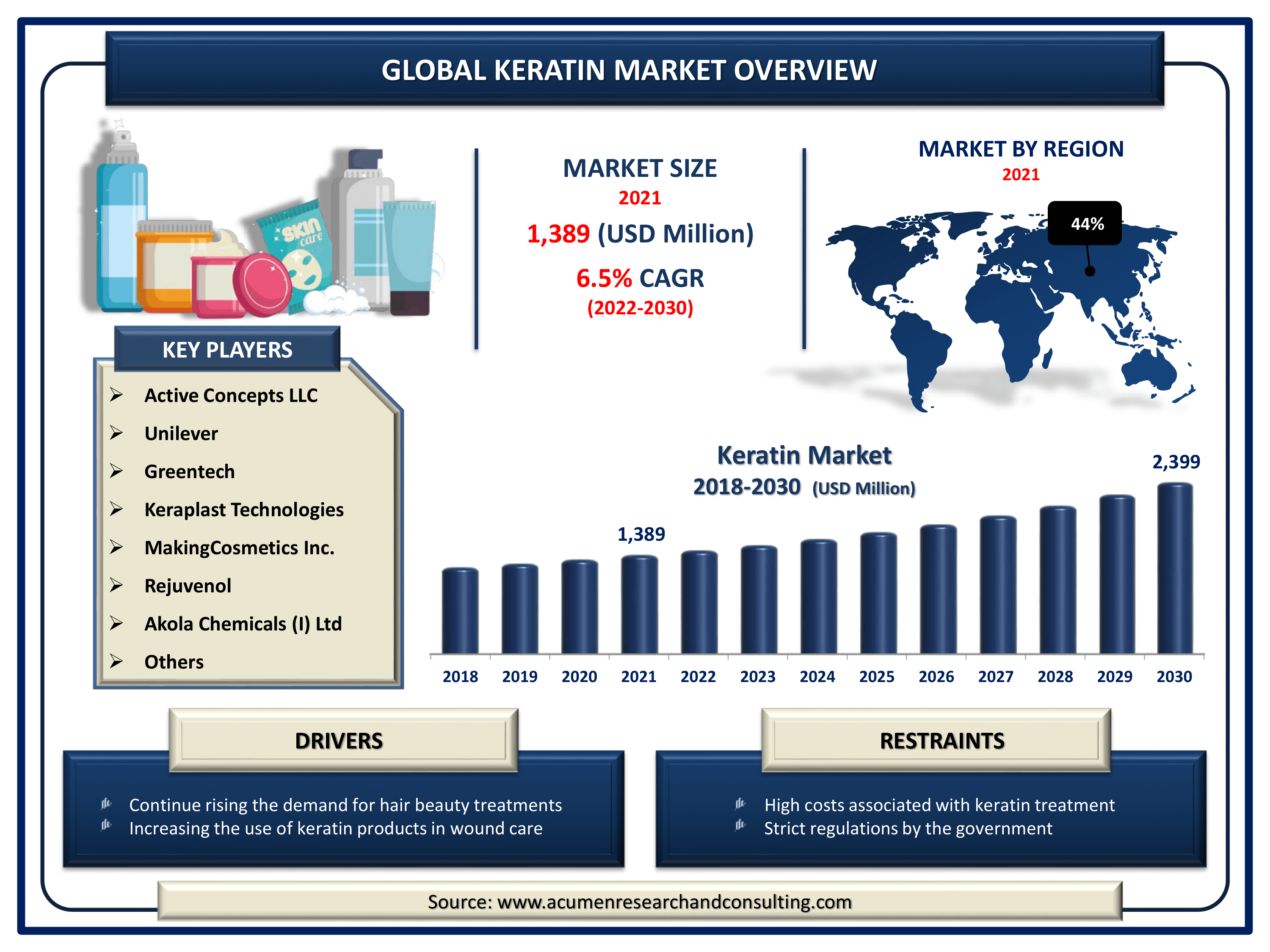

The Global Keratin Market Size accounted for USD 1,389 Million in 2021 and is estimated to achieve a market size of USD 2,399 Million by 2030 growing at a CAGR of 6.5% from 2022 to 2030. The expansion of the keratin market size is primarily driven by rising consumer demand for hair beauty products, personal care products, and various applications in medical and pharmaceutical drug development. Moreover, changing lifestyles, increasing demand for personal grooming products, and expanded use of keratin products in intravenous therapy, wound treatment, and cell cultures are all driving the keratin market growth.

Keratin Market Report Key Highlights

- Global keratin market revenue is projected to expand by USD 2,399 million by 2030, with a 6.5% CAGR from 2022 to 2030.

- Based on application segment, personal care & cosmetics will account for more than 40% of overall market share in 2021

- Asia Pacific keratin market held more than 40% of the market share in 2021, with a 7.1% CAGR from 2022 to 2030

- According to keratin market analysis, the hydrolyzed product segment held largest revenue share in 2021.

- Expansion of the Indian FMCG industry promotes the regional growth of skin care products.

- Active Concepts LLC, Unilever, Greentech, Keraplast Technologies, MakingCosmetics Inc., etc are some of the key players operating in the industry

Keratin is a fibrous structural protein found in nails, horns, hair, hoofs, feathers, wool, and epithelial cells on the skin's apical surface. Keratin plays critical structural and protective roles, notably in the epithelium. Certain keratins also have been discovered to govern important biological activities like cell proliferation and protein synthesis. Keratin proteins are classified as alpha-keratins or beta-keratins based on their secondary structure.

Keratin is a biochemical present in glands and internal organs that is required for skin, nail, and hair growth. It is used to make various personal care and cosmetics products as well as to heal wounds, tissues, and other ailments. Consumers frequently utilize keratin products for personal care as well as grooming. These product lines include hair care shampoo, skin creams, cosmetics, conditioners, as well as nail improvement products. Even so, its application in various sectors such as personal care & cosmetics, healthcare & pharmaceuticals, and food & beverages is expected to drive the keratin market growth in the coming years.

Global Keratin Market Dynamics

Market Drivers

- Continue rising the demand for hair beauty treatments

- Growing use for various applications in medical and pharmacological advancement

- Growing consumer preference for better personal care products

- Increasing the use of keratin products in wound care

Market Restraints

- High costs associated with keratin treatment

- Strict regulations by the government

Market Opportunities

- Technological advancements in the personal care sector

- Increase the range of shampoo and conditioner applications

Keratin Market Report Coverage

| Market | Keratin Market |

| Keratin Market Size 2021 | USD 1,389 Million |

| Keratin Market Forecast 2030 | USD 2,399 Million |

| Keratin Market CAGR During 2022 - 2030 | 6.5% |

| Keratin Market Analysis Period | 2018 - 2030 |

| Keratin Market Base Year | 2021 |

| Keratin Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Product, By Application, And By Geography |

| Keratin Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Active Concepts LLC, Unilever, Greentech, Keraplast Technologies, MakingCosmetics Inc., Rejuvenol, Akola Chemicals (I) Limited, Keratin Express, Parchem Fine & Specialty Chemicals, and Hefei TNJ Chemical Industry Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Keratin Market Insights

The increasing application of keratin in wound treatments is one of the major factors fueling the global keratin market expansion. For instance, keratin proteins made from ovine wool have a variety of uses for managing acute wound care. They also aid in the treatment of a number of acute skin problems, which including epidermolysis bullosa. Moreover, keratin dressings have been discovered to be particularly successful in tissue regeneration and wound healing because they released keratin compounds into the wound, activating keratinocytes in the afflicted area. This causes fibroblast expansion and migration, collagen production, and the creation of granulation tissue, resulting in efficient wound healing. Furthermore, these keratin-based dressings aid in the cosmetic effect of scar formation. All of these aspects are projected to fuel the expansion of the global keratin market throughout the forecast period.

Aside from that, the keratin market trends is being inhibited by the heavy price of keratin treatments, rising price volatility, the need for repeated treatments for greater accuracy, and strict government regulations to ensure environmental protection. On the other hand, the development of environmentally friendly materials, booming operations, and technical progress in the cosmetics market are some additional aspects that are expected to produce opportunities in the keratin market. The technological advancement in the hair and beauty industry, which is likely to widen the spectrum of uses in shampoos and conditioners, is predicted to provide new growth opportunities throughout the projection period.

Keratin Market Segmentation

The worldwide keratin market is split based on type, product, application, and geography.

Keratin Market By Type

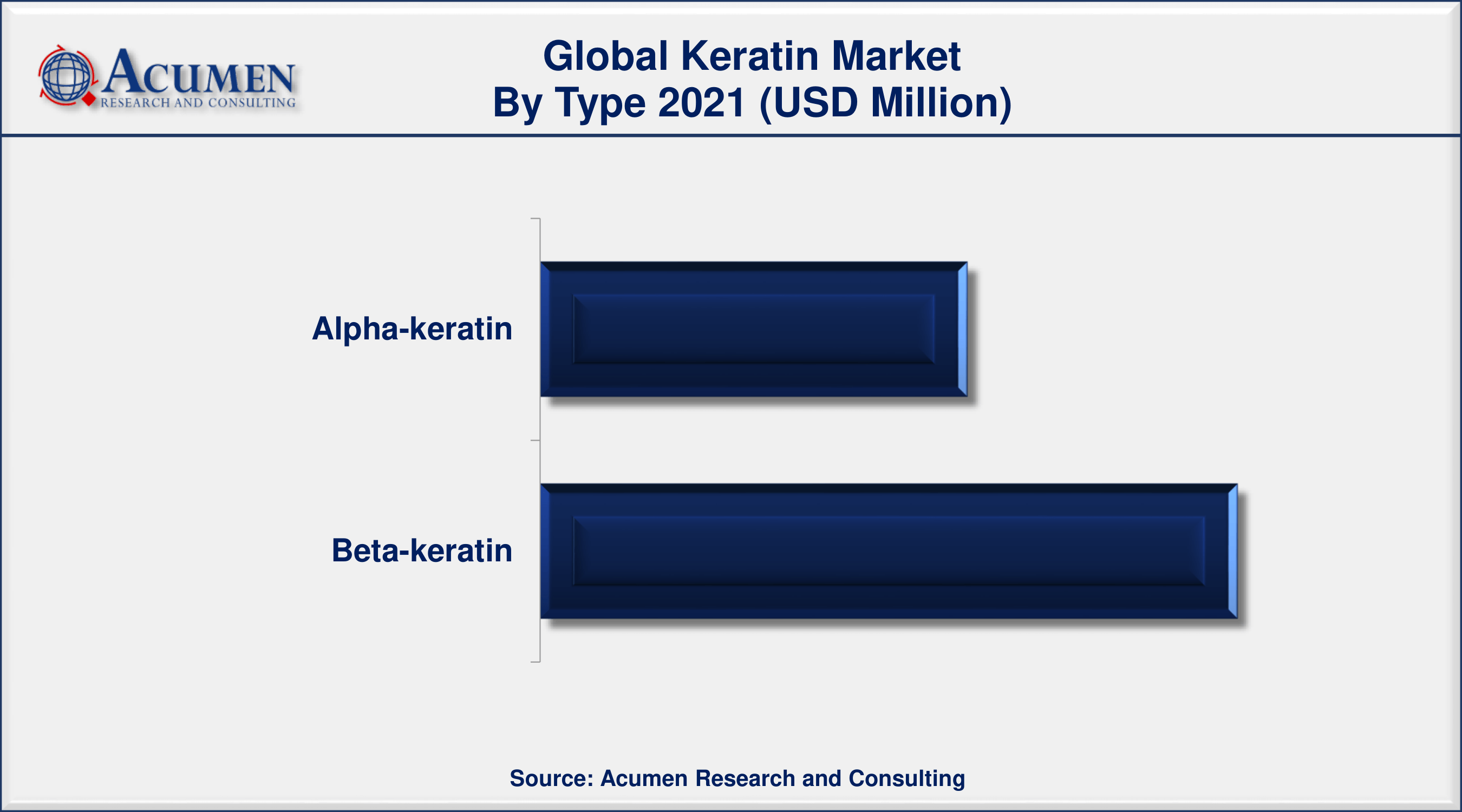

- Alpha-keratin

- Beta-keratin

According to the keratin industry analysis, the alpha-keratine type segment held the largest market share in 2021. Consumers' growing need for high-quality hair cosmetic treatments, desire for hair smoothing & straightening, and the environmentally friendly and safe qualities of these products are propelling the segment's expansion. Alpha-keratin is used to cure nails and hair as well as to make skin supple and wrinkle-free.

Keratin Market By Product

- Hydrolyzed

- Others

In terms of product, the hydrolyzed segment dominates the market, accounting for more than two-thirds of the market in 2021. Hydrolyzed keratin is a peptide and amino acid blend. This cosmetic ingredient is present in a number of hair care, skin care, nail care, and other related products. Hydrolyzed keratin could be used as a moisturizing agent, nail conditioner, antistatic ingredient, hair & biological addition, and many other things. It is crucial for the formation of healthy cells and is used in cosmetic and personal care products to increase health, well-being, and beauty. As a result of these variables, segment growth is expected to accelerate in the next years.

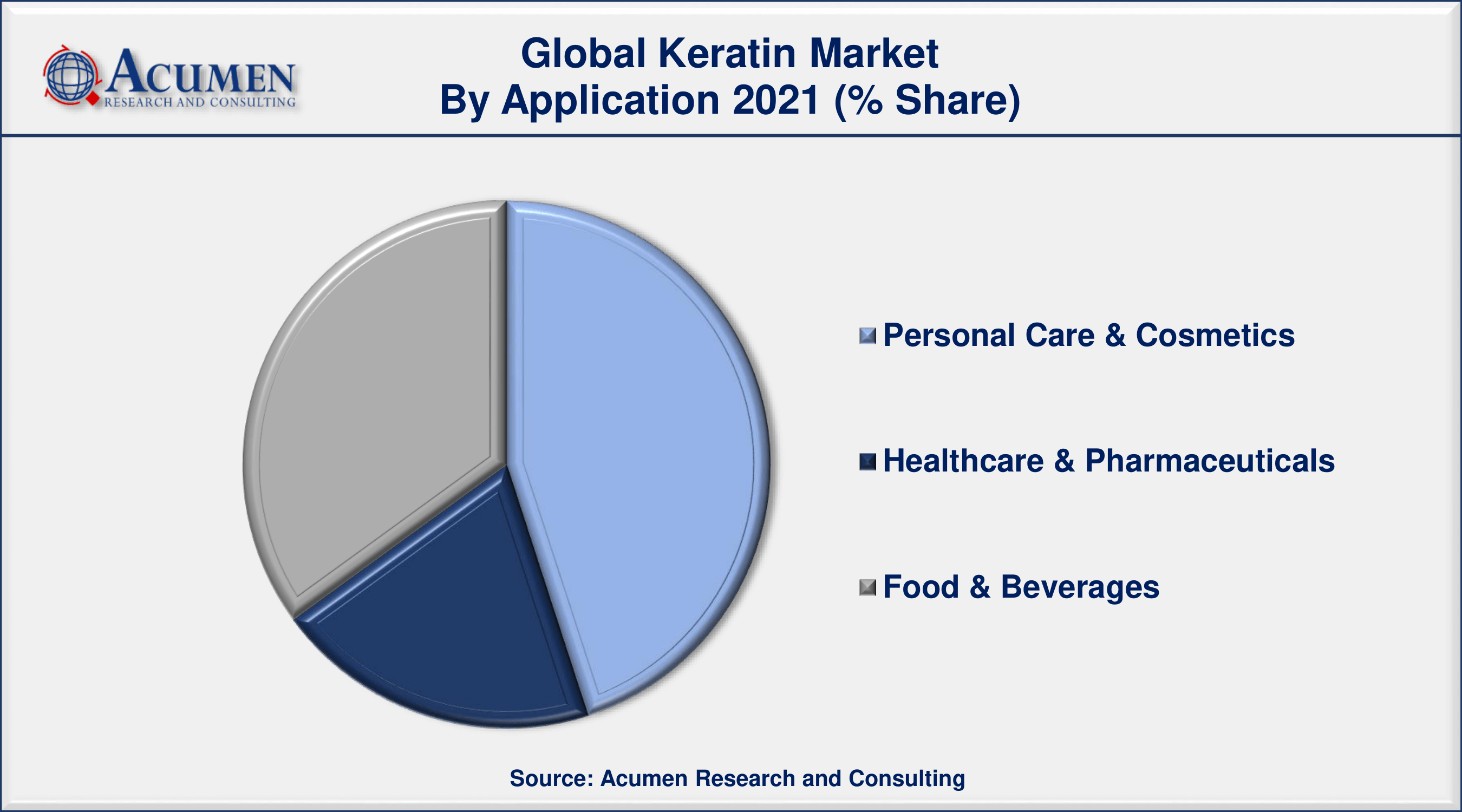

Keratin Market By Application

- Personal Care & Cosmetics

- Healthcare & Pharmaceuticals

- Food & Beverages

According to the keratin market forecast, the healthcare and pharmaceuticals segment is predicted to increase significantly in the market over the next several years. Keratin is important in the manufacturing of a variety of drugs and medications that boost human immunity. It is also utilized as a supplement to supply consumers with the nutrition they require. As a result, it is rapidly being used in the pharmaceutical and healthcare industries. Furthermore, growing demand for dermatological products, as well as expanded use of keratin in cell cultures wound treatments as well as medication discovery, are driving segment expansion. Also, the high demand for personalized care products and expanded therapeutic potential of keratin in the healthcare industry are propelling the segment's rise.

Keratin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Geographically, the Asia-Pacific region dominates the global keratin market and is predicted to grow significantly in the coming years. The region's market is expanding due to high consumer demand for personal care products and rising therapeutic applications of keratin in the healthcare industry. Further, changing lifestyles, increasing consumer spending power, and rising demand for natural and organic cosmetics in this region boost the keratin market. Additionally, the existence of major multinational corporations in the region indicates a high consumption from end-user industries such as personal care and cosmetics, healthcare and pharmaceuticals, as well as food and beverages.

Keratin Market Players

Some of the top keratin market companies offered in the professional report include Active Concepts LLC, Unilever, Greentech, Keraplast Technologies, MakingCosmetics Inc., Rejuvenol, Akola Chemicals (I) Limited, Keratin Express, Parchem Fine & Specialty Chemicals, and Hefei TNJ Chemical Industry Co., Ltd.

Frequently Asked Questions

What is the size of global keratin market in 2021?

The estimated value of global keratin market in 2021 was accounted to be USD 1,389 Million.

What is the CAGR of global keratin market during forecast period of 2022 to 2030?

The projected CAGR Keratin market during the analysis period of 2022 to 2030 is 6.5%.

Which are the key players operating in the market?

The prominent players of the global keratin market are Active Concepts LLC, Unilever, Greentech, Keraplast Technologies, MakingCosmetics Inc., Rejuvenol, Akola Chemicals (I) Limited, Keratin Express, Parchem Fine & Specialty Chemicals, and Hefei TNJ Chemical Industry Co., Ltd.

Which region held the dominating position in the global keratin market?

Asia-Pacific held the dominating keratin during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for keratin during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global keratin market?

Rising keratin demand in the personal care and cosmetics industries, and increasing use for wound treatment, drives the growth of global keratin market.

By product segment, which sub-segment held the maximum share?

Based on product, hydrolyzed segment is expected to hold the maximum share keratin market.