Joint Pain Injections Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

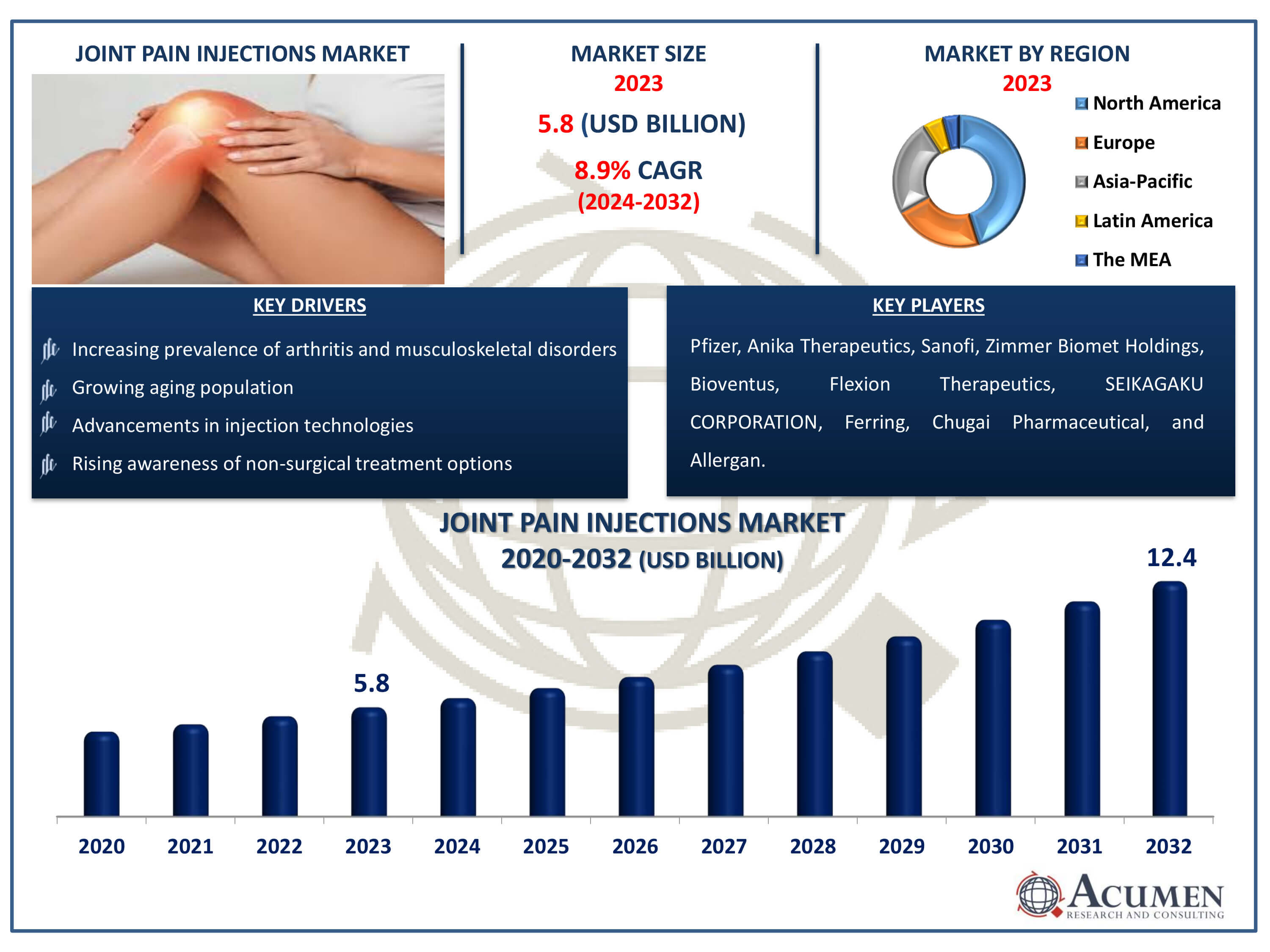

The Joint Pain Injections Market Size accounted for USD 5.8 Billion in 2023 and is estimated to achieve a market size of USD 12.4 Billion by 2032 growing at a CAGR of 8.9% from 2024 to 2032.

Joint Pain Injections Market Highlights

- Global joint pain injections market revenue is poised to garner USD 12.4 billion by 2032 with a CAGR of 8.9% from 2024 to 2032

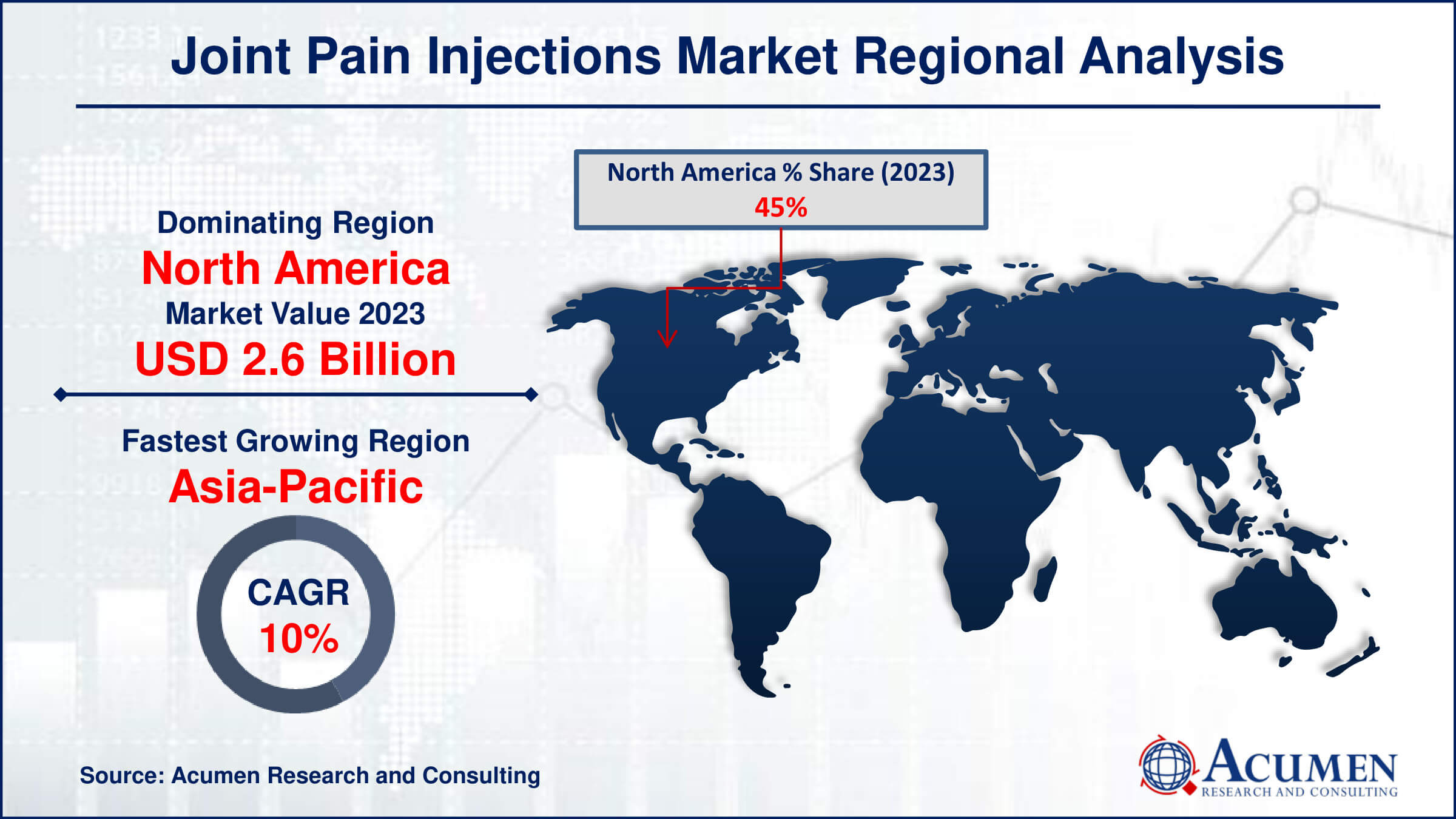

- North America joint pain injections market value occupied around USD 2.6 billion in 2023

- Asia-Pacific joint pain injections market growth will record a CAGR of more than 10% from 2024 to 2032

- Among joint type, the knee and ankle sub-segment generated more than USD 4.12 billion revenue in 2023

- Based on type, the hyaluronic acid injections sub-segment generated around 26% market share in 2023

- Shift towards minimally invasive procedures is a popular joint pain injections market trend that fuels the industry demand

Joint pain injections, also known as intra-articular injections, are medical treatments in which corticosteroids, hyaluronic acid, or platelet-rich plasma (PRP) are administered directly into the afflicted joint. These injections are intended to relieve pain, reduce inflammation, and enhance joint function in those suffering from illnesses such as osteoarthritis, rheumatoid arthritis, or injury-induced joint pain. Corticosteroids are potent anti-inflammatory medicines, hyaluronic acid supplements the joint's natural lubrication, and PRP uses the body's own healing components. To ensure precision, healthcare practitioners frequently deliver injections using imaging techniques such as ultrasound or fluoroscopy. While injections are generally safe and successful, the frequency and long-term consequences may vary based on the patient's condition and reaction to treatment.

Global Joint Pain Injections Market Dynamics

Market Drivers

- Increasing prevalence of arthritis and musculoskeletal disorders

- Growing aging population

- Advancements in injection technologies

- Rising awareness of non-surgical treatment options

Market Restraints

- High cost of treatment

- Potential side effects and complications

- Limited insurance coverage and reimbursement issues

Market Opportunities

- Development of novel biologic treatments

- Expanding applications in sports medicine

- Growth in emerging markets

- Collaboration between pharmaceutical companies and research institutions

Joint Pain Injections Market Report Coverage

| Market | Joint Pain Injections Market |

| Joint Pain Injections Market Size 2023 | USD 5.8 Billion |

| Joint Pain Injections Market Forecast 2032 |

USD 12.4 Billion |

| Joint Pain Injections Market CAGR During 2024 - 2032 | 8.9% |

| Joint Pain Injections Market Analysis Period | 2020 - 2032 |

| Joint Pain Injections Market Base Year |

2023 |

| Joint Pain Injections Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Joint Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer, Anika Therapeutics, Sanofi, Zimmer Biomet Holdings, Bioventus, Flexion Therapeutics, SEIKAGAKU CORPORATION, Ferring, Chugai Pharmaceutical, and Allergan. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Joint Pain Injections Market Insights

The global joint pain injections market is growing due to more patients with arthritis needing better pain management. Technological advancements in healthcare, increased government focus on patient care, and higher consumer healthcare spending also contribute to market growth. Arthritis is on the rise in both adults and children, increasing the demand for pain management drugs and injections. In the US, arthritis cases are particularly high. According to the US Arthritis Foundation, there are 54 million adults and 300,000 children with arthritis. Osteoarthritis is the most common form, affecting about 31 million people in the US. Around 10% of men and 13% of women suffer from knee osteoarthritis, and in 2010, over 719,000 knee replacements were performed in the US.

The global market for joint pain injections is growing due to rising cases of joint pain in both developed and developing countries. New injection technologies that help doctors diagnose and quickly relieve pain are also boosting market growth. These injections often contain anesthetics that numb the muscles, ligaments, and joint capsules. The demand for non-surgical treatments is driving the production of these injections. Major companies are expanding their businesses through mergers, acquisitions, and new product launches. For example, in 2017, Bioventus received US FDA approval for "Durolane," a single-injection hyaluronic acid product that has been relieving knee osteoarthritis pain for over 15 years.

However, the market faces challenges such as strict government regulations and high treatment costs. In 2017, Sanofi Genzyme had to recall a batch of Synvisc-One due to contamination that increased side effects. Additionally, there were over 1 million joint replacements in the US in 2012, costing $18.8 billion. Each knee replacement revision surgery in 2010 cost $49,360. The market also struggles with unmet patient needs, as current treatments mainly focus on symptom relief and pain reduction. There are no cures or preventive medications for conditions like arthritis, and some patients do not find relief with existing treatments. Despite these challenges, there are opportunities for growth. Increased investment in research and development, higher healthcare spending by governments in developing countries, and the introduction of improved solutions are expected to create new opportunities for companies in the joint pain injections industry forecast period.

Joint Pain Injections Market Segmentation

The worldwide market for joint pain injections is split based on type, joint type product, and geography.

Joint Pain Injection Types

- Hyaluronic Acid Injections

- Corticosteroid Injections

- Interleukin Inhibitors

- Platelet-rich Plasma Injections

- Other (Steroid Joint Injections, Placental tissue matrix (PTM) Injections, etc.)

According to joint pain injections industry analysis, hyaluronic acid (HA) injections are the most profitable in the industry due to their efficacy in treating osteoarthritis, particularly in the knee. HA is a naturally occurring chemical found in synovial fluid that provides lubrication and cushioning in joints. When injected, HA supplemented the body's natural supply, relieving discomfort and enhancing joint functionality. The increasing demand for HA injections stems from its capacity to provide longer-term relief than other therapies, frequently up to six months. They are also deemed safer and have fewer negative effects than corticosteroids. Additionally, HA injections are generally approved and recommended by healthcare professionals, which adds to their popularity. The increased aging population and rising incidence of osteoarthritis help to maintain HA injections market dominance.

Joint Pain Injection Joint Types

- Knee and Ankle

- Shoulder and Elbow

- Hip Joint

- Hand and Wrist

- Facet Joints of the Spine

The knee and ankle segment is the largest in the joint pain injections market due to the high prevalence of osteoarthritis and injuries involving these joints. The knee, in particular, is prone to wear and tear, especially in older persons and sports, creating a strong demand for pain management options. Knee osteoarthritis is one of the most common types of arthritis, impacting millions of people worldwide, and it frequently requires injectable treatments to relieve pain and maintain mobility. Similarly, ankle injuries and arthritis are common, especially among active people and those who work physically demanding occupations. Injections such as hyaluronic acid and corticosteroids are widely used because they provide comfort and improve joint function in these weight-bearing joints. As a result, the Knee and Ankle segment leads the market, demonstrating the crucial need for efficient pain management in these areas.

Joint Pain Injection Distribution Channels

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

The retail pharmacies sector dominates the industry and it is expected to grow during the joint pain injections market forecast period due to its extensive availability and convenience to patients. Retail pharmacies are generally more convenient than hospital or online pharmacies, allowing patients to immediately get prescribed injections. This accessibility is especially significant for people who require ongoing care, such as patients suffering from chronic joint pain or osteoarthritis. Retail pharmacies also provide customized care, which allows pharmacists to advise patients on how to use injections correctly and answer any questions they may have. Many retail pharmacies are prepared to store and dispense these injections, ensuring product purity and safety. Furthermore, the presence of retail pharmacies in both urban and rural locations broadens their reach, making them a popular choice among many patients.

Joint Pain Injections Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Joint Pain Injections Market Regional Analysis

In terms of joint pain injections market analysis, North America is the largest region due to a high frequency of joint illnesses such as osteoarthritis and rheumatoid arthritis, as well as a well-established healthcare system. The region has a large elderly population, which is more prone to joint pain. Furthermore, the presence of major pharmaceutical companies and strong R&D efforts help to accelerate the development and distribution of improved joint pain therapies. High healthcare spending, improved patient awareness, and access to cutting-edge medical treatments all contribute to market growth in North America.

The Asia-Pacific (APAC) region is the fastest expanding market for joint pain injections. This expansion is being driven by rising healthcare spending, improved healthcare infrastructure, and more knowledge of joint pain management. The aging populations in countries such as Japan and China, together with the rising frequency of osteoarthritis and other joint problems, are driving demand for effective pain management options. Economic development in the region has resulted in increased consumer healthcare spending, accelerating market expansion. Government initiatives to improve healthcare services, the entry of global pharmaceutical companies, and the growing popularity of minimally invasive therapies all contribute to the rapid growth of the joint pain injections market in Asia Pacific.

Joint Pain Injections Market Players

Some of the top joint pain injections companies offered in our report include Pfizer, Anika Therapeutics, Sanofi, Zimmer Biomet Holdings, Bioventus, Flexion Therapeutics, SEIKAGAKU CORPORATION, Ferring, Chugai Pharmaceutical, and Allergan.

Frequently Asked Questions

How big is the joint pain injections market?

The joint pain injections market size was valued at USD 5.8 billion in 2023.

What is the CAGR of the global joint pain injections market from 2024 to 2032?

The CAGR of joint pain injections is 8.9% during the analysis period of 2024 to 2032.

Which are the key players in the joint pain injections market?

The key players operating in the global market are including Pfizer, Anika Therapeutics, Sanofi, Zimmer Biomet Holdings, Bioventus, Flexion Therapeutics, SEIKAGAKU CORPORATION, Ferring, Chugai Pharmaceutical, and Allergan.

Which region dominated the global joint pain injections market share?

North America held the dominating position in joint pain injections industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of joint pain injections during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global joint pain injections industry?

The current trends and dynamics in the joint pain injections industry include increasing prevalence of arthritis and musculoskeletal disorders, growing aging population, advancements in injection technologies, and rising awareness of non-surgical treatment options.

Which type held the maximum share in 2023?

The mammalian type held the maximum share of the joint pain injections industry.