Jet Engine Blades Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Jet Engine Blades Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

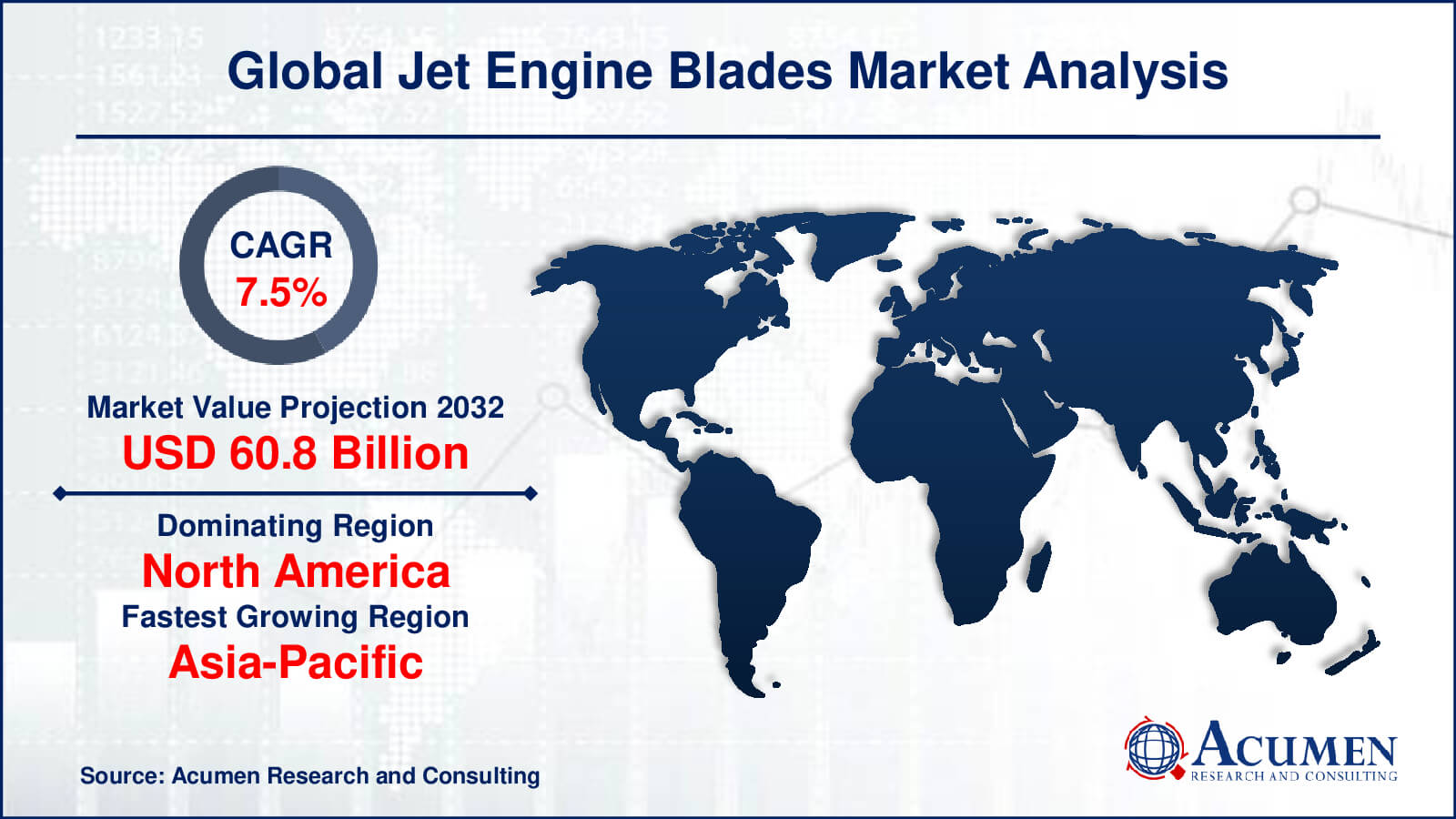

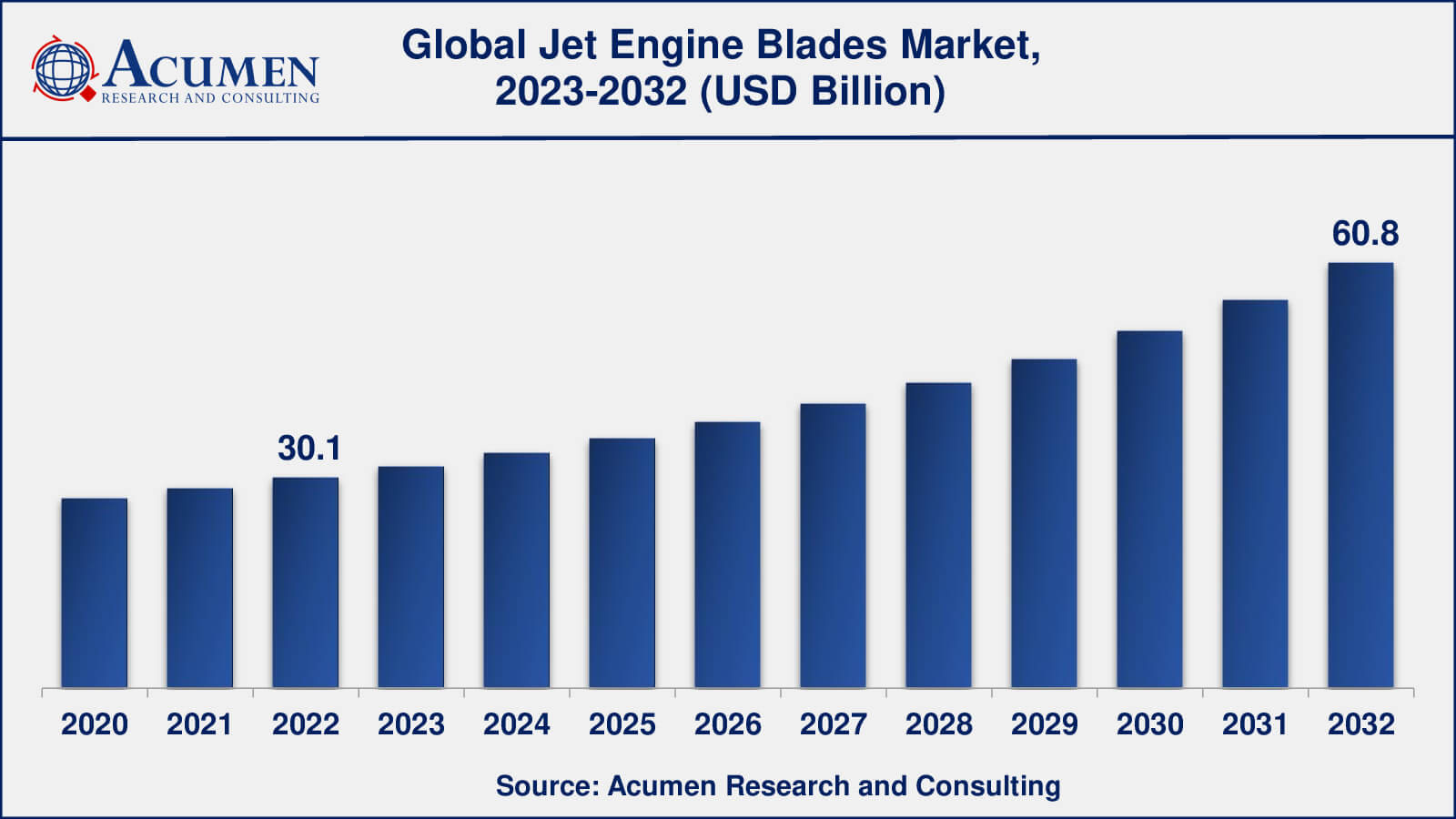

The Global Jet Engine Blades Market Size accounted for USD 30.1 Billion in 2022 and is estimated to achieve a market size of USD 60.8 Billion by 2032 growing at a CAGR of 7.5% from 2023 to 2032.

Jet Engine Blades Market Highlights

- Global jet engine blades market revenue is poised to garner USD 60.8 billion by 2032 with a CAGR of 7.5% from 2023 to 2032

- North America jet engine blades market value occupied almost USD 12 billion in 2022

- Asia-Pacific jet engine blades market growth will record a CAGR of over 8% from 2023 to 2032

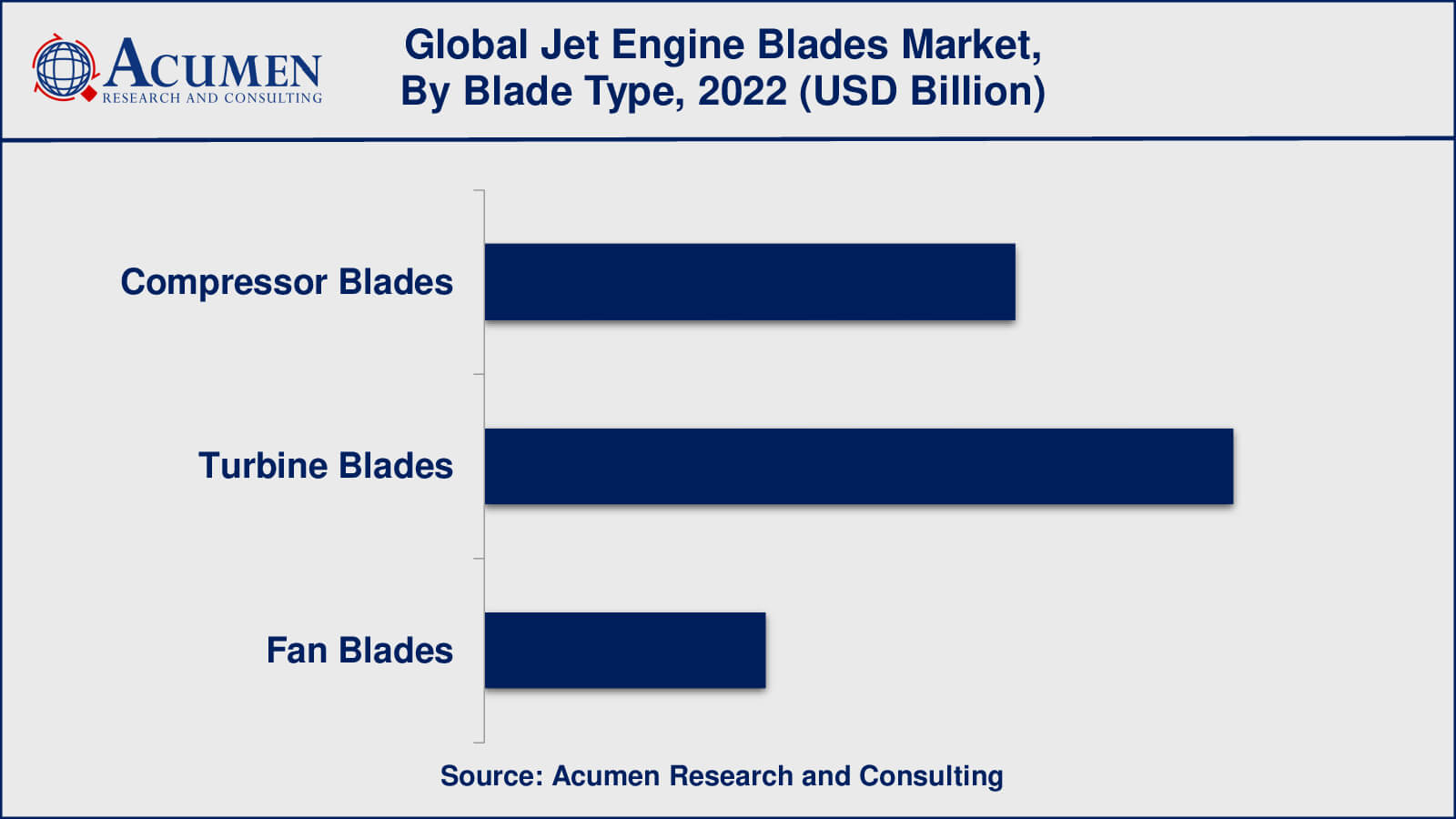

- Among blade type, the turbine blades sub-segment generated over US$ 14.4 billion revenue in 2022

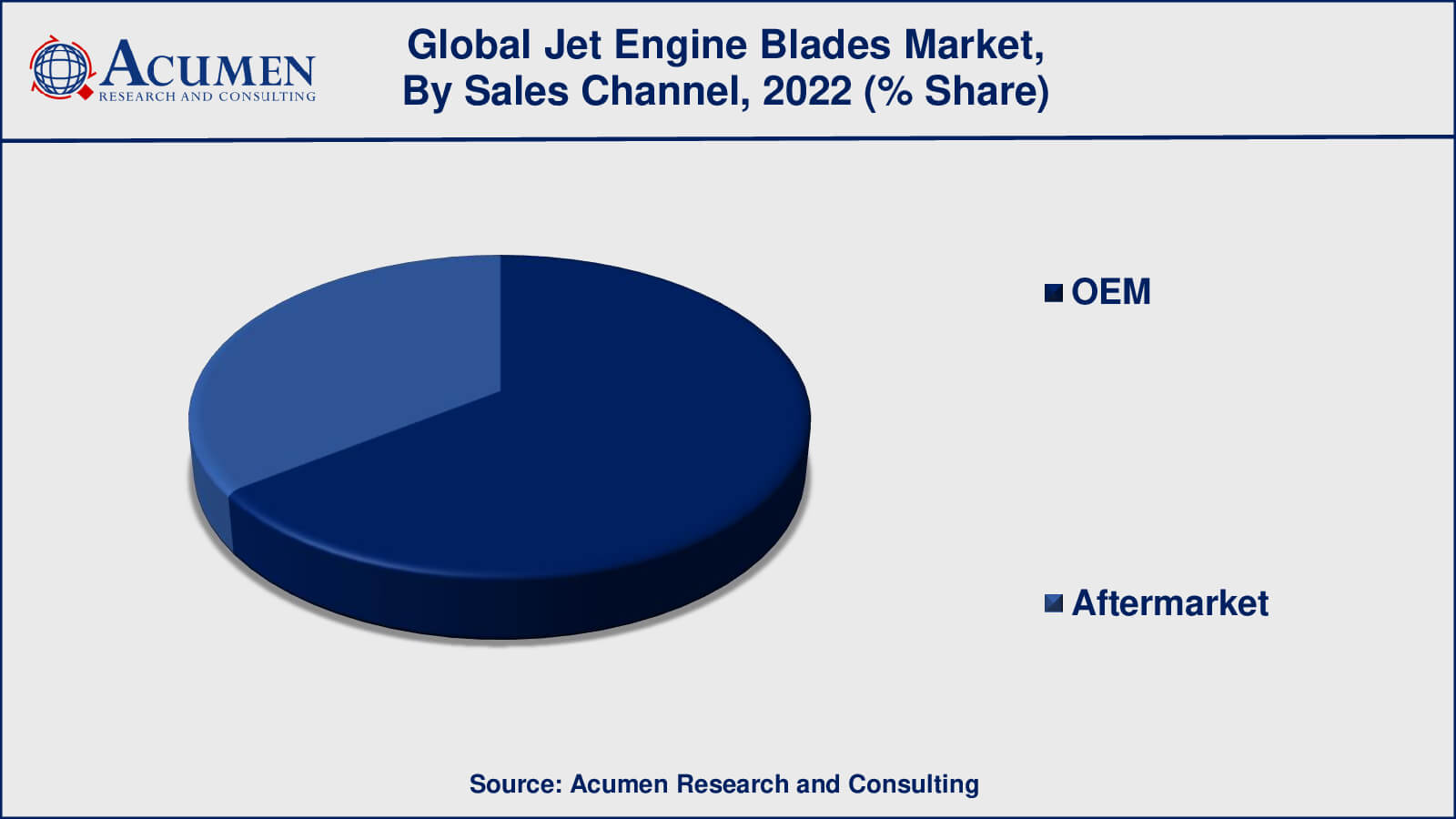

- Based sales channel, the OEM sub-segment generated around 65% share in 2022

- Increase in aftermarket demand is a popular jet engine blades market trend that fuels the industry demand

The jet engine blade or turbine blades are made of nickel-based superalloys that are amalgamated from cobalt, chromium, and rhenium. Nonetheless, a major breakthrough was developed via improvisation from superalloys, as single crystal production and directional solidification method. The turbine is the key component in the jet engine which uses these superalloy materials.

Global Jet Engine Blades Market Dynamics

Market Drivers

- Increase in air travel

- Rise in military spending

- Growing demand for business jets

- Technological advancements

Market Restraints

- High cost

- Long development cycle

- Maintenance requirements

Market Opportunities

- Demand for lighter and more durable materials

- Advancements in 3D printing

- Growing demand for electric aircraft

Jet Engine Blades Market Report Coverage

| Market | Jet Engine Blades Market |

| Jet Engine Blades Market Size 2022 | USD 30.1 Billion |

| Jet Engine Blades Market Forecast 2032 | USD 60.8 Billion |

| Jet Engine Blades Market CAGR During 2023 - 2032 | 7.5% |

| Jet Engine Blades Market Analysis Period | 2020 - 2032 |

| Jet Engine Blades Market Base Year | 2022 |

| Jet Engine Blades Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Blade Type, By Aircraft Type, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aviadvigatel OJSC, UTC Aerospace Systems, GE Aviation, PowerJet, IAE, Rolls-Royce, Safran, Lycoming Engines, Pratt & Whitney, MTU Aero Engines, and Engine Alliance. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Jet Engine Blades Market Insights

The adoption of composites in jet engines will be one of the leading trends for the development of the market. GE Leap engines of the next generation are expected to have a significant amount of carbon ceramic composites in high-pressure turbines instead of nickel metal alloys. The usage of thin and fewer blades is the innovation strategy of vendors to reduce fuel consumption by up to 5% more than other engines and is driving the scope of the aircraft engine blades market. Metal reflects the plastic's anticipation, by which they are able to pass through disruption (turn or stretch) before they are broken, while the metal is used to handle the load with little impact and less deficiency in the basic strength of the structure. The high smoothness of metal permits them to distribute the load on the structure and protect them from the status of permanent structural failure. However, the high cost of raw materials is a key factor considered to hamper the market growth subsequently. Jet engine blades are the most crucial component of the turbine engine in a jet, which compiles gas or steam turbine in the turbine section and hence will witness a huge growth in the upcoming period.

Jet Engine Blades Market, By Segmentation

The worldwide market for jet engine blades is split based on material type, blade type, aircraft type, sales channel, and geography.

Jet Engine Blade Market, By Material Type

- Titanium

- Nickel-Based Alloys

- Composites

- Others

Nickel-based alloys have traditionally dominated the aircraft engine blades market due to their excellent high-temperature strength, corrosion resistance, and durability. These alloys can withstand the extreme conditions within a jet engine, including high temperatures and pressure.

However, in recent years, there has been a growing trend towards the use of composites in jet engine blades. Composites offer several advantages over traditional metal alloys, including lighter weight, higher strength-to-weight ratio, and better resistance to fatigue and corrosion. They also offer greater design flexibility and can be molded into complex shapes.

Titanium is another material that is commonly used in jet engine blades. It is known for its high strength, low weight, and excellent corrosion resistance, making it an ideal material for use in the aerospace industry.

Jet Engine Blade Market, By Blade Type

- Compressor Blades

- Turbine Blades

- Fan Blades

Turbine blades have traditionally been the most dominant type of aircraft engine blade in the market. This is because they are subjected to the highest temperatures and stresses in the engine, and therefore require the use of advanced materials and manufacturing processes to ensure their reliability and durability.

Compressor blades are also an important component of jet engines, as they are responsible for compressing the air before it enters the combustion chamber. These blades need to be highly efficient and durable to ensure the proper functioning of the engine.

Fan blades are used in the front of the engine to create the thrust needed to propel the aircraft forward. They typically operate at lower temperatures and stresses than turbine blades, but still require high levels of efficiency and durability.

Jet Engine Blade Market, By Aircraft Type

- Commercial Aircraft

- General Aviation

- Regional Aircraft

- Military Aircraft

Commercial aircraft, including narrow-body and wide-body jets, have traditionally dominated the jet engine blades market due to their high demand and large number of engines required. Commercial aircraft engines also tend to be larger and more complex, requiring a greater number of blades and more advanced materials and manufacturing processes.

Regional aircraft, which are smaller and typically used for shorter flights, also have a significant presence in the jet engine blades market. These aircraft generally use smaller engines with fewer blades, but still require high levels of reliability and efficiency.

Military aircraft, including fighter jets and transport planes, also play an important role in the jet engine blades market. These aircraft often require specialized engines and blades designed to operate in extreme conditions, such as high speeds and altitudes.

Jet Engine Blade Market, By Sales Channel

- OEM

- Aftermarket

As per the jet engine blades market forecast, the OEM (original equipment manufacturer) sales channel has traditionally dominated the jet engine blades market. This is because OEMs are responsible for the initial design and production of the engines, and therefore have the greatest influence over the choice of materials and components used in the engine, including the blades.

In addition, OEMs typically have long-term contracts with aircraft manufacturers to supply engines and components, providing a stable and predictable source of demand for jet engine blades.

However, the aftermarket sales channel has been growing in importance in recent years, particularly as engines become more complex and require more frequent maintenance and repairs. Aftermarket sales refer to the sales of replacement parts and services for engines that are already in use, including jet engine blades.

Jet Engine Blades Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Jet Engine Blades Market Regional Analysis

North America has traditionally been a significant market for jet engine blades, with major manufacturers such as General Electric, Pratt & Whitney, and Rolls-Royce having a significant presence in the region. The United States is the largest market in the region, driven by its large fleet of commercial and military aircraft.

Europe is also a significant market for jet engine blades, with major manufacturers such as Rolls-Royce, Safran, and MTU Aero Engines having a strong presence in the region. The European market is driven by demand from both commercial and military aviation sectors, as well as advancements in technology and materials.

Asia-Pacific is the fastest-growing market for jet engine blades, driven by increasing air travel demand in the region and a growing demand for more fuel-efficient engines. China, India, and Japan are the major markets in the region, with significant investments being made in the aerospace industry.

Jet Engine Blades Market Players

Some of the top jet engine blades companies offered in the professional report include Aviadvigatel OJSC, UTC Aerospace Systems, GE Aviation, PowerJet, IAE, Rolls-Royce, Safran, Lycoming Engines, Pratt & Whitney, MTU Aero Engines, and Engine Alliance.

Frequently Asked Questions

What was the market size of the global jet engine blades in 2022?

The market size of jet engine blades was USD 30.1 billion in 2022.

What is the CAGR of the global jet engine blades market from 2023 to 2032?

The CAGR of jet engine blades is 7.5% during the analysis period of 2023 to 2032.

Which are the key players in the jet engine blades market?

The key players operating in the global jet engine blades market are including Aviadvigatel OJSC, UTC Aerospace Systems, GE Aviation, PowerJet, IAE, Rolls-Royce, Safran, Lycoming Engines, Pratt & Whitney, MTU Aero Engines, and Engine Alliance.

Which region dominated the global jet engine blades market share?

North America held the dominating position in jet engine blades industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of jet engine blades during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global jet engine blades industry?

The current trends and dynamics in the jet engine blades industry include increase in air travel, rise in military spending, growing demand for business jets, and technological advancements.

Which material type held the maximum share in 2022?

The nickel-based material type held the maximum share of the jet engine blades industry.