Isocyanates Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Isocyanates Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

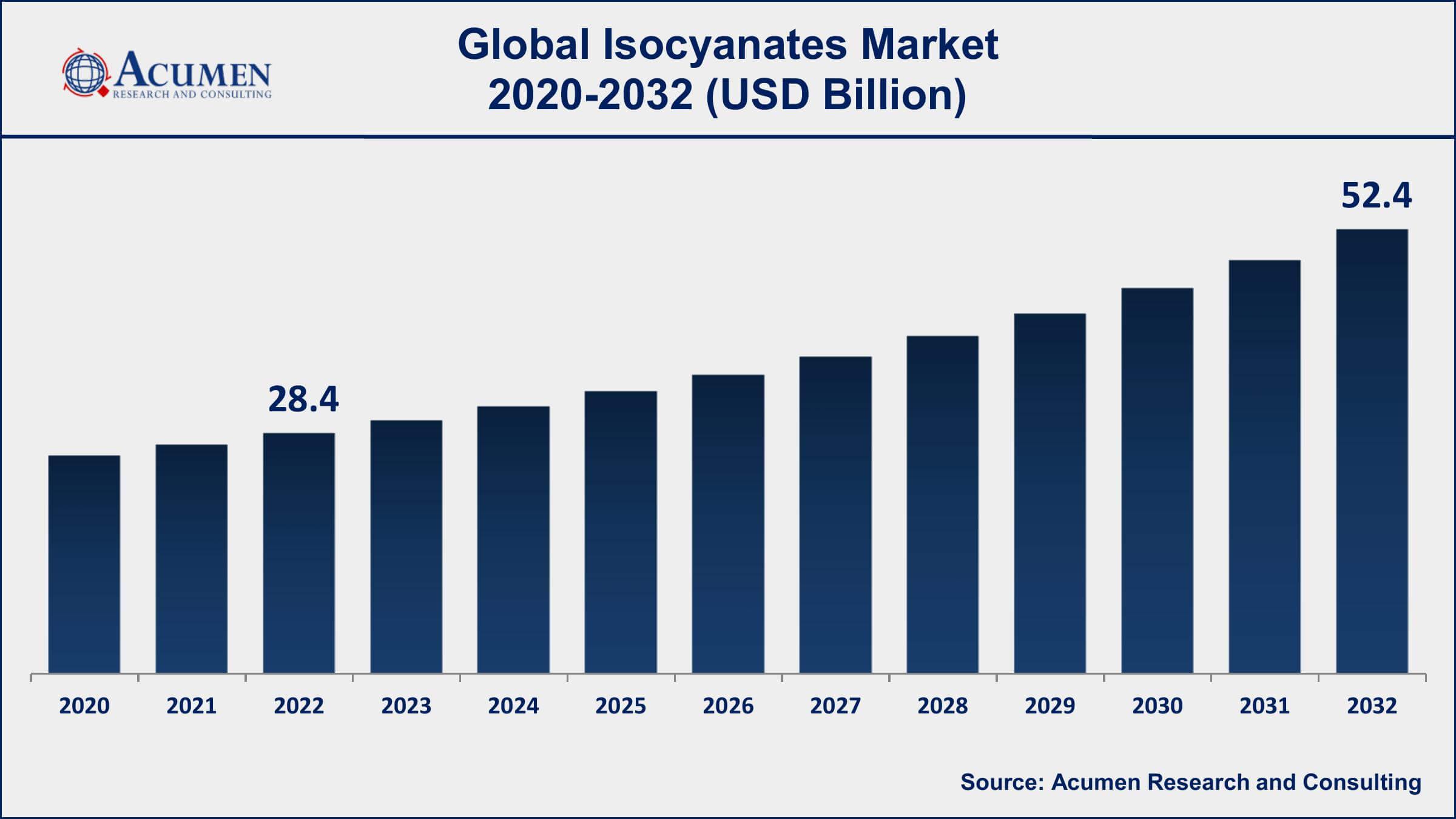

The Global Isocyanates Market Size accounted for USD 28.4 Billion in 2022 and is projected to achieve a market size of USD 52.4 Billion by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Isocyanates Market Key Highlights

- Global isocyanates market revenue is expected to increase by USD 52.4 Billion by 2032, with a 6.4% CAGR from 2023 to 2032

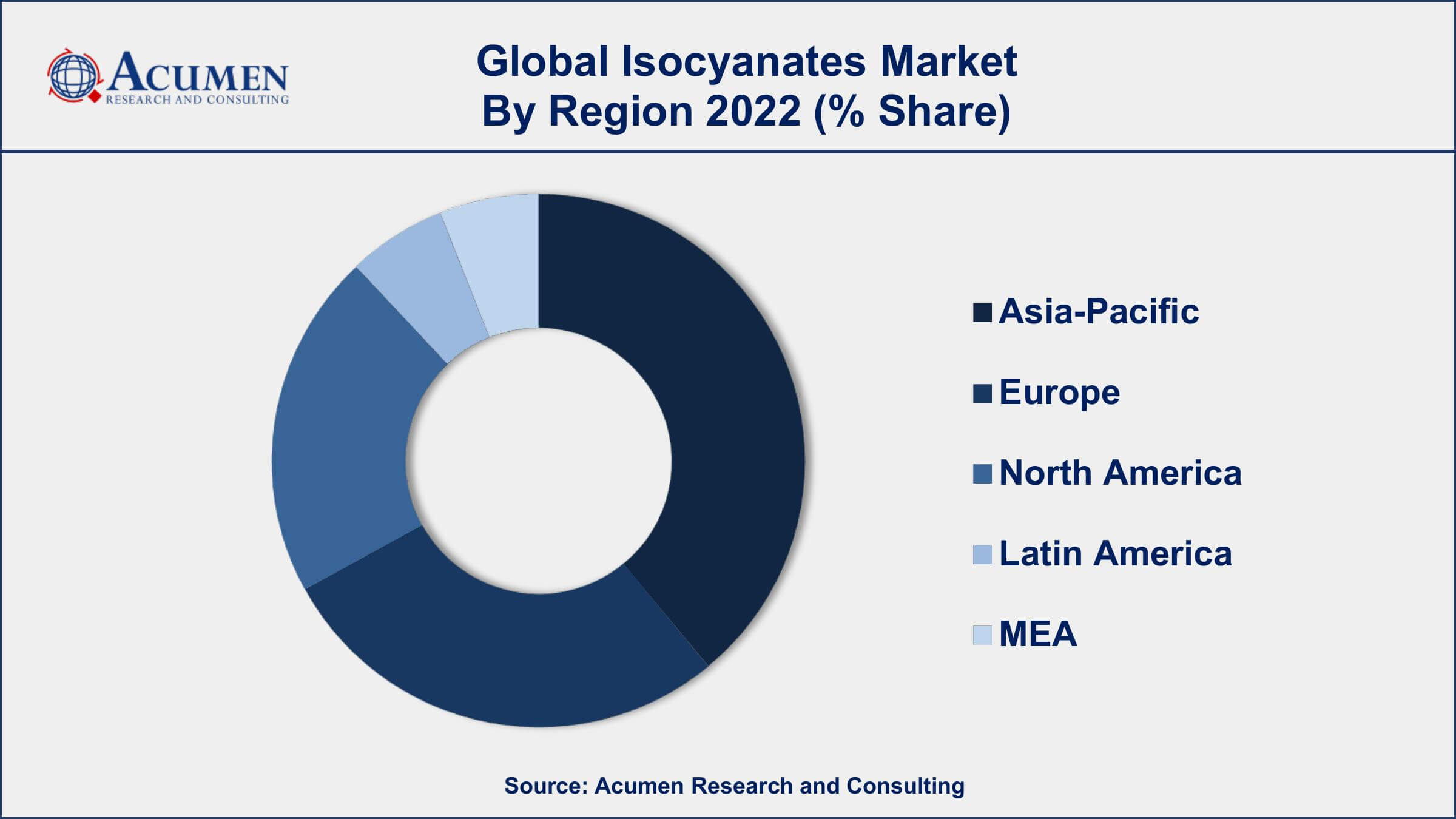

- Asia-Pacific region led with more than 41% of isocyanates market share in 2022

- North America isocyanates market growth will record a CAGR of over 7% from 2023 to 2032

- The building and construction industry is the largest end-user of isocyanates, accounting for more than 40% of the total market share

- The major players in the isocyanates industry include BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, and Wanhua Chemical Group Co. Ltd.

- Increasing trend towards energy-efficient buildings and lightweight vehicles, drives the isocyanates market value

Isocyanates are highly reactive chemical compounds used in the production of a wide range of polyurethane products, including foams, coatings, adhesives, and elastomers. The two primary types of isocyanates are diisocyanates and polyisocyanates, which are used to create different types of polyurethane products. Isocyanates are highly toxic and can cause respiratory problems, skin irritation, and other health issues, making proper safety measures critical in their handling and use.

The market for isocyanates has been growing steadily in recent years due to the increasing demand for polyurethane products in various industries. The construction and automotive sectors are the two major end-use industries for polyurethane products, driving the demand for isocyanates. The growing trend of energy-efficient buildings and lightweight vehicles has further increased the demand for polyurethane products and, in turn, isocyanates. Asia-Pacific is the largest market for isocyanates, with China being the biggest consumer due to its significant construction and automotive industries. North America and Europe are also significant markets for isocyanates due to the growing demand for polyurethane products in these regions.

Global Isocyanates Market Trends

Market Drivers

- Growing demand for polyurethane products in various industries such as construction and automotive

- Increasing trend towards energy-efficient buildings and lightweight vehicles

- Growth in the global population and urbanization, leading to a rise in construction activities

- Technological advancements and product innovations in the polyurethane industry

- Increasing demand for high-performance coatings and adhesives in various industries

Market Restraints

- Health hazards associated with the handling and use of isocyanates

- Stringent government regulations regarding the use of isocyanates due to their harmful effects on human health and the environment

Market Opportunities

- Growing demand for bio-based and renewable polyurethane products

- Development of new applications for polyurethane products, such as in the healthcare and packaging industries

Isocyanates Market Report Coverage

| Market | Isocyanates Market |

| Isocyanates Market Size 2022 | USD 28.4 Billion |

| Isocyanates Market Forecast 2032 | USD 52.4 Billion |

| Isocyanates Market CAGR During 2023 - 2032 | 6.4% |

| Isocyanates Market Market Analysis Period | 2020 - 2032 |

| Isocyanates Market Market Base Year | 2022 |

| Isocyanates Market Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Covestro AG, Huntsman Corporation, Dow Chemical Company, Mitsui Chemicals Inc., Wanhua Chemical Group Co. Ltd., Sumitomo Chemical Co. Ltd., Asahi Kasei Corporation, Evonik Industries AG, Vencorex Holding SAS, China National Chemical Corporation (ChemChina), and Tosoh Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Isocyanates are highly reactive chemical compounds that are widely used in the production of polyurethane products. These products are used in a variety of industries, including construction, automotive, furniture, and electronics, among others. Isocyanates are primarily used to make polyurethane foams, coatings, adhesives, and elastomers. Polyurethane foams are used in a wide range of applications, such as insulation for buildings and appliances, cushioning for furniture and bedding, and packaging materials for fragile items. Isocyanates are also used to produce coatings for various surfaces, including metals, plastics, and wood. These coatings are used to protect surfaces from corrosion, weathering, and other forms of damage.

The isocyanates market has been experiencing steady growth in recent years and is expected to continue growing at a significant rate over the forecast period. One of the primary drivers of this growth is the increasing demand for polyurethane products in various industries such as construction and automotive. The construction industry, in particular, has been a significant contributor to the demand for isocyanates due to the increasing need for energy-efficient buildings and infrastructure. Additionally, the automotive industry has been a major consumer of isocyanates, as polyurethane foams and coatings are widely used in vehicle manufacturing.

Isocyanates Market Segmentation

The global isocyanates market segmentation is based on type, application, end-use industry, and geography.

Isocyanates Market By Type

- Methylene Diphenyl Diisocyanate (MDI)

- Aliphatic Isocyanates

- Toluene Diphenyl Diisocyanate (TDI)

- Others

According to the isocyanates industry analysis, the methylene diphenyl diisocyanate (MDI) segment accounted for a significant market share in 2022. The growth of the MDI segment is driven by several factors, including its increasing use in various applications, the growth of the end-use industries, and the development of new products. One of the primary drivers of the MDI segment's growth is its increasing use in the construction industry. MDI-based polyurethane foams are widely used as insulation materials in buildings, as they offer excellent thermal insulation properties and help to reduce energy consumption. With the growing demand for energy-efficient buildings, the demand for MDI-based polyurethane foams is also increasing. The automotive industry is another significant consumer of MDI, as it is used to produce various parts and components such as foam seating, headrests, and bumpers. The demand for lightweight vehicles is driving the growth of the MDI segment, as polyurethane foams made from MDI are lighter than traditional materials and help to improve fuel efficiency.

Isocyanates Market By Application

- Rigid Foam

- Paints and Coatings

- Flexible Foam

- Elastomers

- Adhesives and Sealants

- Binders

- Others

In terms of applications, the rigid foam segment is expected to witness significant growth in the coming years. The growth of the rigid foam segment is driven by several factors, including its increasing use in the building and construction industry, the growing demand for energy-efficient materials, and the development of new and innovative products. One of the primary drivers of the rigid foam segment's growth is its increasing use in the building and construction industry. Rigid foam is widely used as insulation material in buildings, as it offers excellent thermal insulation properties and helps to reduce energy consumption. The increasing demand for energy-efficient buildings is driving the growth of the rigid foam segment, as more and more builders and architects are specifying rigid foam insulation materials in construction projects.

Isocyanates Market By End-Use Industry

- Building and Construction

- Healthcare

- Furniture

- Automotive

- Others

According to the isocyanates market forecast, the building and construction segment is expected to witness significant growth in the coming years. This growth is driven by several factors, including the increasing demand for energy-efficient materials, the growing population, and increasing urbanization. One of the primary drivers of the building and construction segment's growth is the increasing demand for energy-efficient materials. Isocyanates are widely used in the production of polyurethane foams, which are used as insulation materials in buildings. Polyurethane foam insulation offers excellent thermal insulation properties, and it helps to reduce energy consumption and greenhouse gas emissions. As governments worldwide set targets for reducing greenhouse gas emissions and promoting energy efficiency, the demand for energy-efficient materials in the building and construction industry is expected to increase, driving the market growth of isocyanates.

Isocyanates Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Isocyanates Market Regional Analysis

Asia-Pacific dominates the global isocyanates market, accounting for a significant share of the total market. The region's dominance is driven by several factors, including the increasing demand for isocyanates in various end-use industries, the growing population, and rising urbanization. One of the primary drivers of the Asia-Pacific region is the increasing demand for isocyanates in various end-use industries, including construction, automotive, furniture, and packaging. The construction industry in the region is booming, driven by rapid urbanization and infrastructure development. Isocyanates are widely used in the construction industry for the production of polyurethane foam insulation and coatings, which are used in buildings and infrastructure projects. The automotive industry in the region is also growing rapidly, and isocyanates are used in the production of various automotive components, such as seating and interior trims. The increasing demand for furniture and packaging materials is also driving the regional growth.

Isocyanates Market Player

Some of the top isocyanates market companies offered in the professional report include BASF SE, Covestro AG, Huntsman Corporation, Dow Chemical Company, Mitsui Chemicals Inc., Wanhua Chemical Group Co. Ltd., Sumitomo Chemical Co. Ltd., Asahi Kasei Corporation, Evonik Industries AG, Vencorex Holding SAS, China National Chemical Corporation (ChemChina), and Tosoh Corporation.

Frequently Asked Questions

What was the market size of the global isocyanates in 2022?

The market size of isocyanates was USD 28.4 Billion in 2022.

What is the CAGR of the global isocyanates market from 2023 to 2032?

The CAGR of isocyanates is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the isocyanates market?

The key players operating in the global market are including BASF SE, Covestro AG, Huntsman Corporation, Dow Chemical Company, Mitsui Chemicals Inc., Wanhua Chemical Group Co. Ltd., Sumitomo Chemical Co. Ltd., Asahi Kasei Corporation, Evonik Industries AG, Vencorex Holding SAS, China National Chemical Corporation (ChemChina), and Tosoh Corporation.

Which region dominated the global isocyanates market share?

Asia-Pacific held the dominating position in isocyanates industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of isocyanates during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global isocyanates industry?

The current trends and dynamics in the isocyanates industry include growing demand for polyurethane products in various industries such as construction and automotive, increasing trend towards energy-efficient buildings and lightweight vehicles, and rise in construction activities.

Which Type held the maximum share in 2022?

The methylene diphenyl diisocyanate type held the maximum share of the isocyanates industry.