Iron Oxide Pigment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Iron Oxide Pigment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

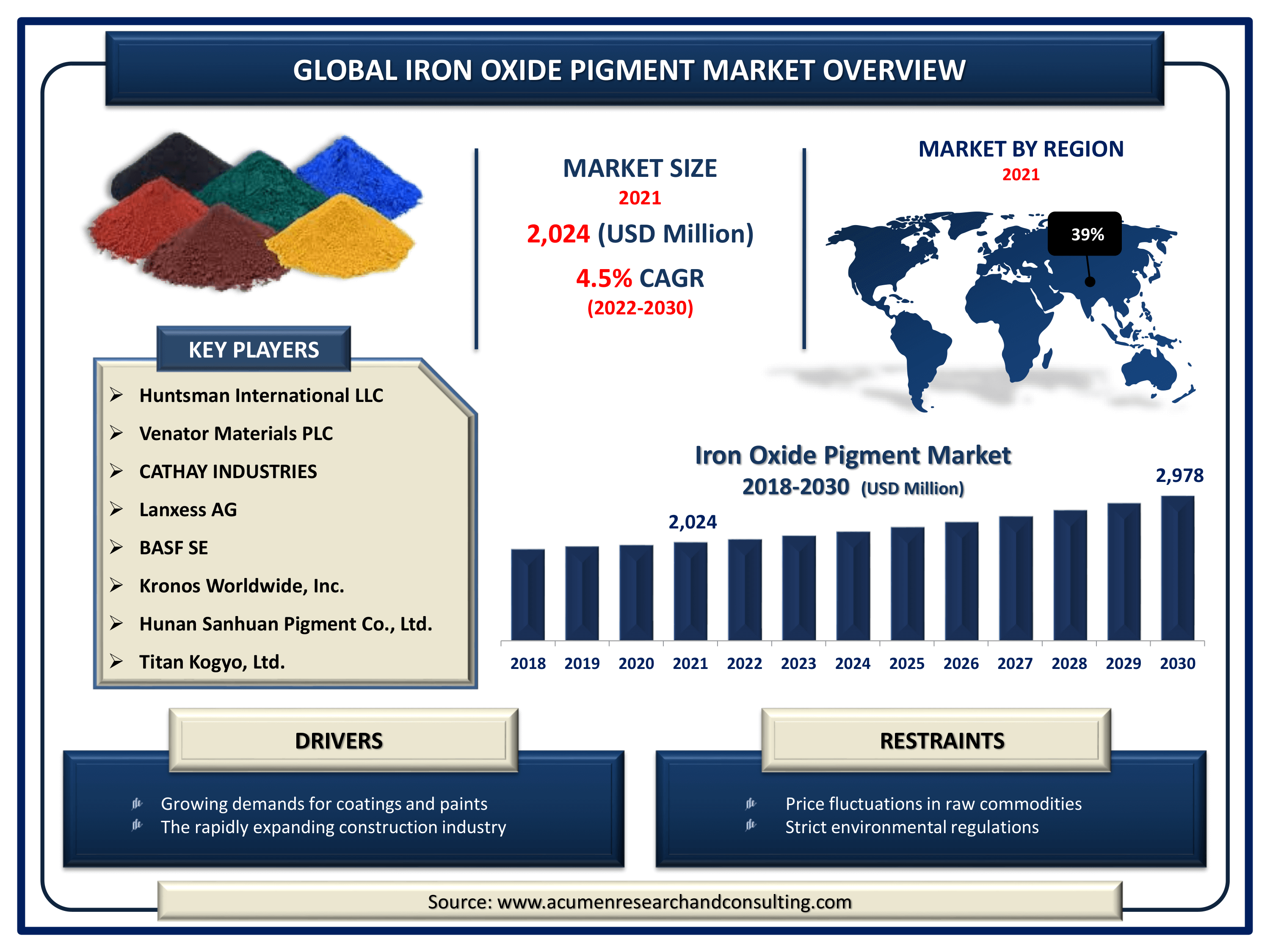

The Global Iron Oxide Pigment Market Size accounted for USD 2,024 Million in 2021 and is estimated to achieve a market size of USD 2,978 Million by 2030 growing at a CAGR of 4.5% from 2022 to 2030. The growing demand for iron oxide pigments for usage in ceramics, inks, paper & pulp, & rubbers is the primary driver of the iron oxide pigment market growth. Furthermore, expanding industrialization, combined with a fast-growing construction sector in emerging economies, is predicted to be the key growth factor for the iron oxide pigment market value over the forecast period.

Iron Oxide Pigment Market Report Key Highlights

- Global iron oxide pigment market revenue is expected to increase by USD 2,978 million by 2030, with a 4.5% CAGR from 2022 to 2030.

- Asia-Pacific region led with more than 39% iron oxide pigment market share in 2021

- According to a study, the Indian government has earmarked USD 63 billion for the construction sector in 2019-20 and plans to invest USD 1.4 trillion over the next five years

- By product, the synthetic segment has accounted market share of over 68% in 2021

- By color, red segment engaged more than 41% of the total market share in 2021

- Among application, construction sector is growing at a strongest CAGR over the forecast period

Since early humans began painting on cave walls, iron oxide pigments, whether natural or synthetic, have been used as colorants. Iron oxide pigments are low-cost materials that are resistant to color change due to sunlight exposure, have good chemical resistance, and are stable under normal ambient conditions. Pigments are primarily used in paints, coatings, and construction materials such as concrete, mortar, paving stones, and roofing tiles. Natural pigments are used in primers and undercoats where color consistency is not as important, whereas synthetic pigments are used in topcoat paints where color consistency is critical. Granular forms of iron oxides and new versions of nano-sized materials, which are used in computer disc drives and high-performance loudspeakers, as well as in biology and medicine, including nuclear magnetic resonance imaging, have been developed in the synthetic iron oxide pigment industry in recent years.

Global Iron Oxide Pigment Market Dynamics

Market Drivers

- Growing demands for coatings and paints

- The rapidly expanding construction industry

- Increasing use in the electronic industry

- Rising demand in the biological and medical industries

Market Restraints

- Price fluctuations in raw commodities

- Strict environmental regulations

Market Opportunities

- Global industrialization and urbanization are accelerating.

- Increased government and private investment in R&D fields

Iron Oxide Pigment Market Report Coverage

| Market | Iron Oxide Pigment Market |

| Iron Oxide Pigment Market Size 2021 | USD 2,024 Million |

| Iron Oxide Pigment Market Forecast 2030 | USD 2,978 Million |

| Iron Oxide Pigment Market CAGR During 2022 - 2030 | 4.5% |

| Iron Oxide Pigment Market Analysis Period | 2018 - 2030 |

| Iron Oxide Pigment Market Base Year | 2021 |

| Iron Oxide Pigment Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Color, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Huntsman International LLC, Venator Materials PLC, CATHAY INDUSTRIES, Kronos Worldwide, Inc. (Kronos), Lanxess AG, Hunan Sanhuan Pigment Co., Ltd., and Titan Kogyo, Ltd. (Titanium Industry Co., Ltd.) |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

According to the U.S. Geological Survey's Mineral Commodity Summaries released in January 2020, residential construction, in which IOPs are commonly used to color concrete block and brick, ready-mixed concrete, and roofing tiles, increased in the first nine months of 2017 compared to the same period in 2016; housing starts and completions increased by about 3% and 11%, respectively. Residential construction spending increased by 11% in the first nine months of 2017 compared to the same period in 2016. Nonresidential construction spending, which accounts for 57% of total construction spending, increased slightly in the first nine (9) months of 2017 compared to the same period in 2016.

Iron Oxide Pigment Market Growth Factor

Rapidly Growing Construction Industry Bolster The Growth Of Global Iron Oxide Pigments Market Trend

As per the statistics revealed by the OGL, monthly construction output grew by 5.8% in March 2021 because of growth in both new work (6.7%) and repair and maintenance (4.4%). Quarterly construction output grew by 2.6% in Quarter 1 2021 compared with Quarter 4 2020. This was majorly driven by growth in both New York (2.8%) and repair and maintenance (2.2%). According to the Mineral Commodity Summaries of the United States Geological Survey, approximately 59% of natural and synthetic finished IOPs were used in concrete and other construction materials; 11% in plastics; 7% in coatings and paints; 5% in foundry sands and other foundry uses; 3% each in animal food, industrial chemicals, glass and ceramics; and 9% in other uses.

Iron Oxide Pigment Market Segmentation

The global iron oxide pigment market segmentation is based on product, color, application, and geography.

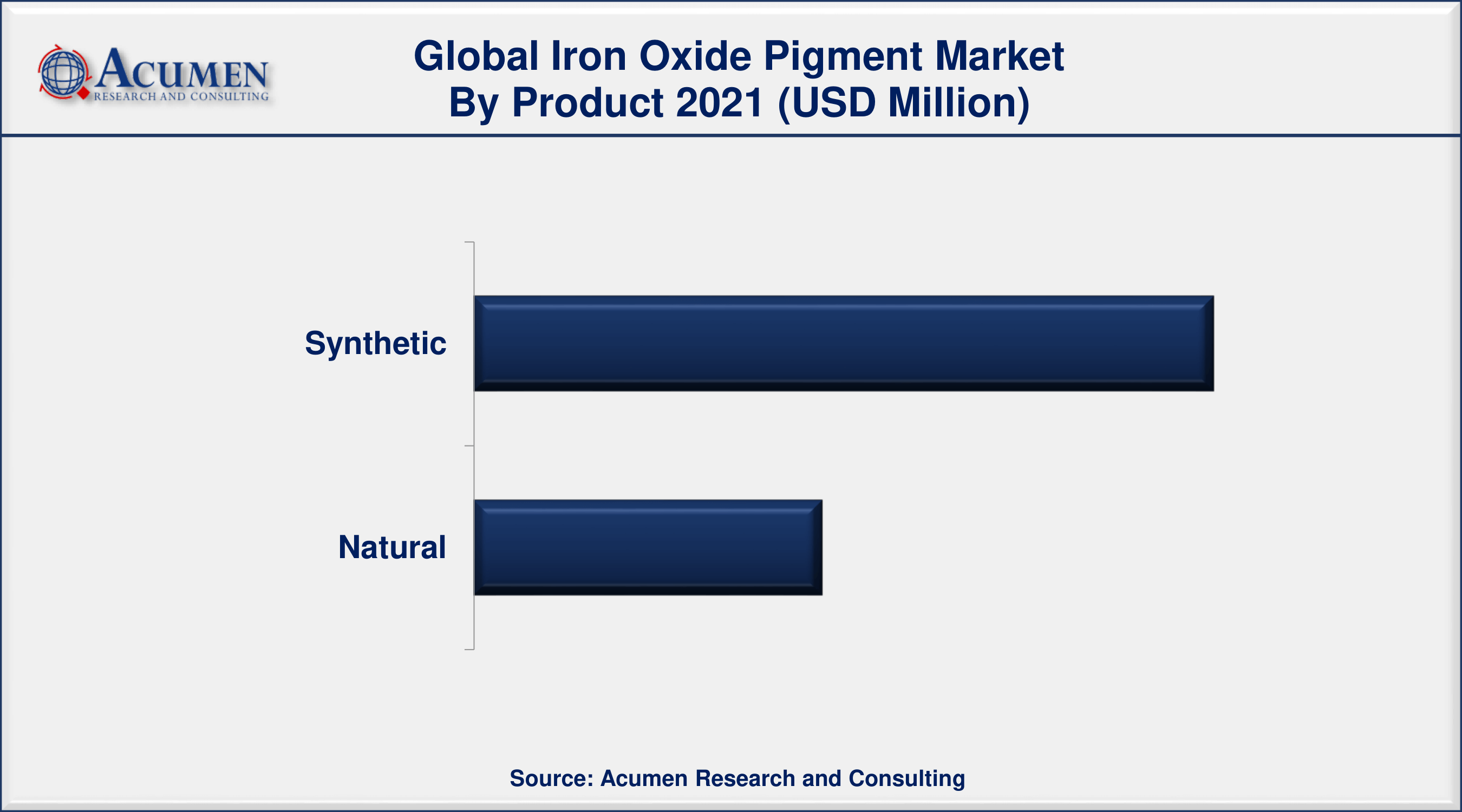

Iron Oxide Pigment Market By Product

- Synthetic

- Natural

According to an iron oxide pigment industry analysis, the synthetic segment is predicted to take the lead, with a significant market share in the global market. This is well supported due to its high strength and stability. They are resistant to UV rays and all types of atmospheric conditions, which allow them to be used in a variety of applications such as coatings, plastics, paper, and anodes. Furthermore, synthetic iron oxide pigments are widely used in the coatings industry, particularly in exterior and industrial coatings where durability, stability, and anti-corrosive properties are critical. Over the forecast period, rising demand for coatings from various industries such as building and construction and oil and gas is expected to have a positive impact on demand for synthetic iron oxide pigments.

Iron Oxide Pigment Market By Color

- Red

- Black

- Yellow

- Other

In terms of color, the red iron oxide pigment holds a dominant market share in the forthcoming years for the global iron oxide pigments market. This is due to their pure color, tinting strength, light fastness, and consistency, which make them ideal for paints and coatings, paper, rubber, ceramic, linoleum, wallpaper, polishing rouge, plastic asphalt, mosaic tiles, and flooring. Commercially available pigments are fine dry powders made by heat processing ferrous sulfate or grinding ore material.

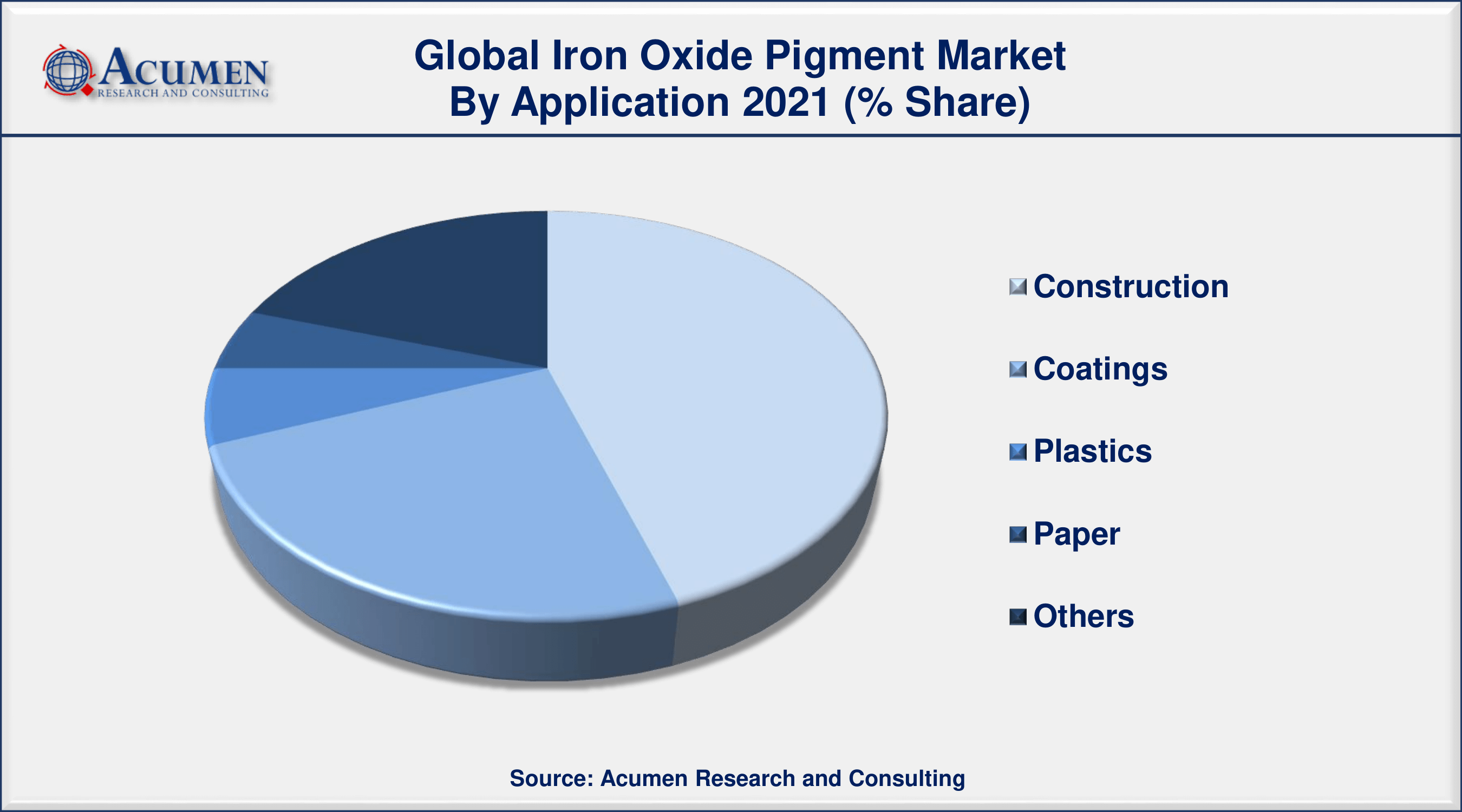

Iron Oxide Pigment Market By Application

- Construction

- Coatings

- Paper

- Plastics

- Others

According to the iron oxide pigment market forecast, the construction application segment has led the market in recent years and will continue to do so during the projected timeline. Iron oxide pigments are widely used as colorants in the building and construction industries, and the market is expected to be the fastest growing during the forecast period. This is highly supportive due to the rising demand for decorative and finished materials in the construction sector, with traditional grey elements in walling, paving, and roofing materials being replaced by a variety of color schemes that are expected to drive demand for iron oxide pigments over the forecast period.

Iron Oxide Pigment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Asia-Pacific Dominates, North America Records Fastest Growing CAGR In The Forthcoming Years For Global Iron Oxide Pigment Market

The Asia-Pacific region dominates the global iron oxide pigment market. This is due to the high demand for iron oxide pigments in the major end-use industries, as well as the region's industrial growth. Golchha Oxides Pvt Ltd, Tata Pigments Limited, Koel Colours Pvt Ltd, Xinxiang Rongbo Pigment Science & Technology Co. Ltd, Jiangsu Yuxing Industry and Trade Co. Ltd, and many others are among the largest producers of iron oxide pigments in the Asia-Pacific region. The rapid industrialization and urbanization of emerging economies such as India, China, Thailand, and Malaysia can be attributed to the market's growth. China had the largest market share in the Asia-Pacific region, accounting for approximately 50% of the market.

North America, on the other hand, has the fastest growing CAGR during the projection period. The region's growth is primarily attributed to the presence of major end-use industries and advanced technologies.

Iron Oxide Pigment Market Players

Some of the top iron oxide pigment market companies offered in the professional report include BASF SE, Huntsman International LLC, Venator Materials PLC, CATHAY INDUSTRIES, Kronos Worldwide, Inc. (Kronos), Lanxess AG, Hunan Sanhuan Pigment Co., Ltd., and Titan Kogyo, Ltd. (Titanium Industry Co., Ltd.).

Frequently Asked Questions

What is the size of global iron oxide pigment market in 2021?

The estimated value of global iron oxide pigment market in 2021 was accounted to be USD 2,024 Million.

What is the CAGR of global iron oxide pigment market during forecast period of 2022 to 2030?

The projected CAGR iron oxide pigment market during the analysis period of 2022 to 2030 is 4.5%.

Which are the key players operating in the market?

The prominent players of the global iron oxide pigment market are BASF SE, Huntsman International LLC, Venator Materials PLC, CATHAY INDUSTRIES, Kronos Worldwide, Inc. (Kronos), Lanxess AG, Hunan Sanhuan Pigment Co., Ltd., and Titan Kogyo, Ltd. (Titanium Industry Co., Ltd.).

Which region held the dominating position in the global iron oxide pigment market?

Asia-Pacific held the dominating iron oxide pigment during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

North America region exhibited fastest growing CAGR for iron oxide pigment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Iron Oxide Pigment market?

Growing demands for coatings and paints, as well as rapidly expanding construction industry, drives the growth of global iron oxide pigment market.

By Color segment, which sub-segment held the maximum share?

Based on color, red segment is expected to hold the maximum share of the iron oxide pigment market.