Investor ESG Software Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Investor ESG Software Market Size - Global Industry Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

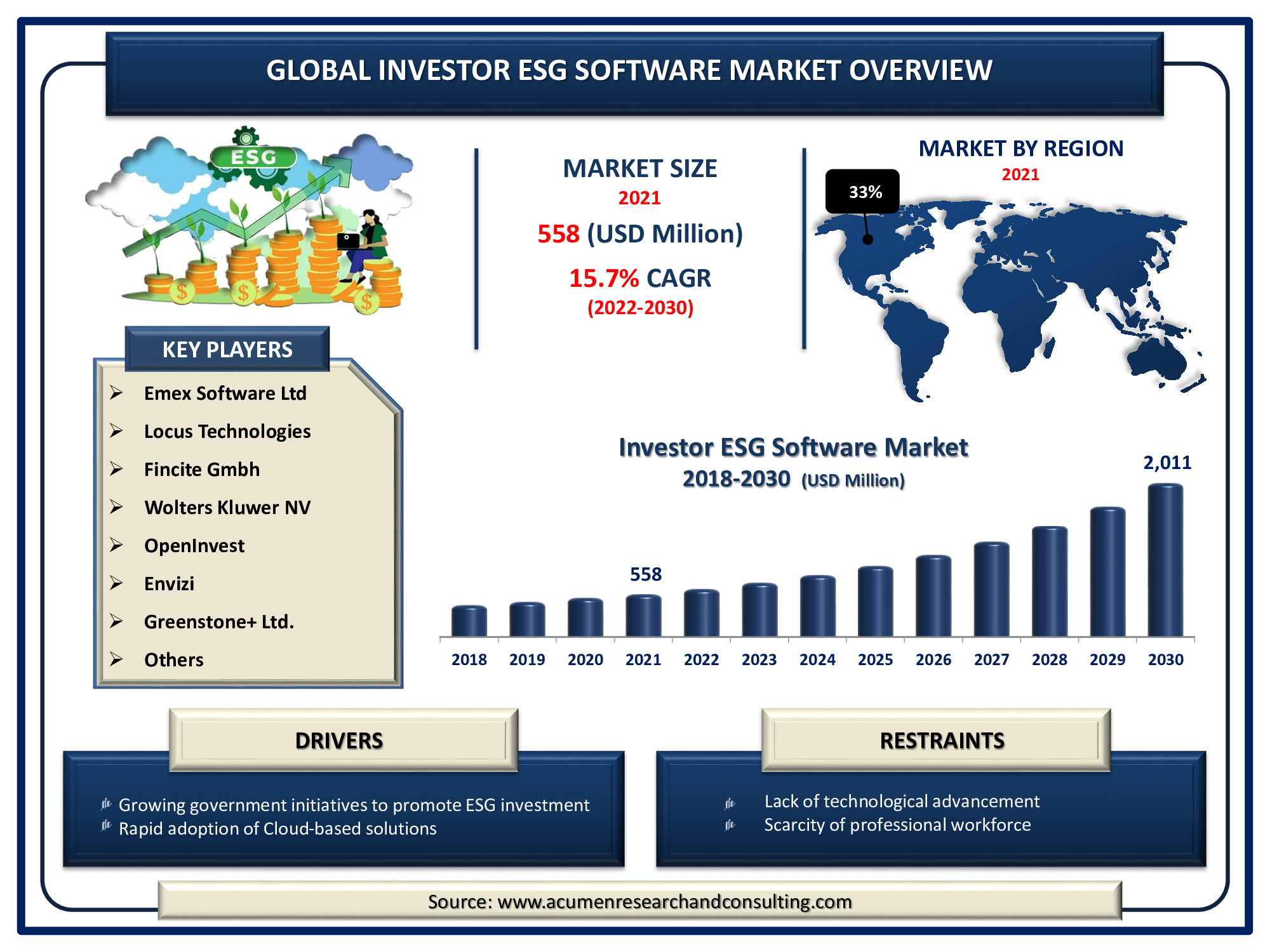

The Global Investor ESG Software Market Size Accounted for USD 558 Million in 2021 and is predicted to be worth USD 2,011 Million by 2030, with a CAGR of 15.7% during the forthcoming period from 2022 to 2030.

In recent years, an increasing number of corporate firms, government entities, financiers, and stakeholders have become interested in ESG investing. The increasing government measures to sustain ESG investment are attributed to the expansion of the investor ESG software market size. Furthermore, as per the investor ESG software market forecast, the growth of this industry is witnessing a significant implementation of sophisticated technologies such as advanced analytics, the Internet of Things (IoT), SaaS and mobility, as well as cutting-edge sensor systems, which is fuelling business integration demand unlike any other time in history.

Investor ESG software is the simplest solution to automate the gathering, delivery, and management of ESG data. Following the 2008 global financial crisis, environmental, social, and governance (ESG) considerations in stock market investing transactions are becoming increasingly common as a critical component of economic development. ESG takes into consideration the reduction in risk, long-term return, as well as accountability aspects of investing. As a result, the expansion of investor ESG software market shares is projected to grow in the future years.

Over the past few years, investors have been continuing to look for advance and innovative ESG software applications to collect, track, and assess data and assets ESG key performance indicators from the portfolios on a continuous basis. Environmental, Social, and Corporate Governance (ESG) elements are used to assess the long-term viability and societal impact of a firm or business initiative. The evaluation of the three criteria predicts a company's future financial performance, including risk and return. Conserves’ ESG provides a more cost-effective and reliable method of collecting, validating, aggregating, and managing information for corporate social responsibility monitoring and performance enhancements across the organization.

Global Investor ESG Software Market Analysis

Market Drivers

- Increasing utilization of advanced technologies in the banking and financial sectors

- Growing government measures and initiatives to sustain ESG investment

- Rapid adoption of Cloud-based solutions

- Rising number of millennials and Gen Z stepping into the workforce

Market Restraints

- Lack of technological advancement

- Scarcity of professional workforce

Market Opportunities

- Growing adoption of these solutions among enterprises

- Increasing R&D on ESG software for investors

Investor ESG Software Market Report Coverage

| Market | Investor ESG Software Market |

| Investor ESG Software Market Size 2021 | USD 558 Million |

| Investor ESG Software Market Forecast 2030 | USD 2,011 Million |

| Investor ESG Software Market CAGR During 2022 - 2030 | 15.7% |

| Investor ESG Software Market Analysis Period | 2018 - 2030 |

| Investor ESG Software Market Base Year | 2021 |

| Investor ESG Software Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Deployment, By Component, By Enterprise Size, And By Geography |

| Investor ESG Software Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Emex Software Ltd, Locus Technologies, Fincite Gmbh, Wolters Kluwer NV, IsoMetrix Software, Ltd., OpenInvest, Dynamo Software, Inc., Envizi, Greenstone+ Ltd., Intelex Technologies, ULC, Cority Software Inc., and EnHelix Software |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The growing government volition to encourage ESG financing is also boosting the industry's growth. ESG investing is based on the core assumption that integrating ESG data into investment appraisal can benefit shareholders, the community, and the environment. As a result, the investor ESG software market forecast is predicted to expand over the projected timeframe. The implementation and adoption of ESG regulations and guidelines will, in the end, enhance global investor ESG software practices, assisting in the maintenance of social and ecological equilibrium. As a result, the rising use of investor ESG software for capital budgeting across all industries is likely to drive the investor ESG software market throughout the forecast period.

The COVID-19 epidemic has caused havoc in a number of businesses. The unprecedented spread of the new coronavirus has compelled governments around the world to put tight restrictions on automobiles and human travel. The epidemic has had a negative impact on economies as well as multiple businesses in different countries due to travel restrictions, mass curfews, and company shutdowns. The enforcement of the quarantine has resulted in a decreased output of consumables, goods, and services. Manufacturers, automotive, oil & gas, mining, aerospace, semiconductor & electronics, as well as other sectors have seen a drop in activity as a result of the temporary closure of operations. Several governments throughout the world have implemented lockdowns in order to prevent the transmission of the infection. As a result, in the midst of the pandemic, enterprises in both developed and emerging economies are implementing investor ESG software to extract sustainable investment profiles of clients, promote responsible and sustainably grown, and limit enterprise risk. During the global COVID-19 epidemic, this circumstance is boosting the expansion of the investor ESG software market.

Investor ESG Software Market Segmentation

The global investor ESG software market segmentation is based on the deployment, component, enterprise size, and geographical region.

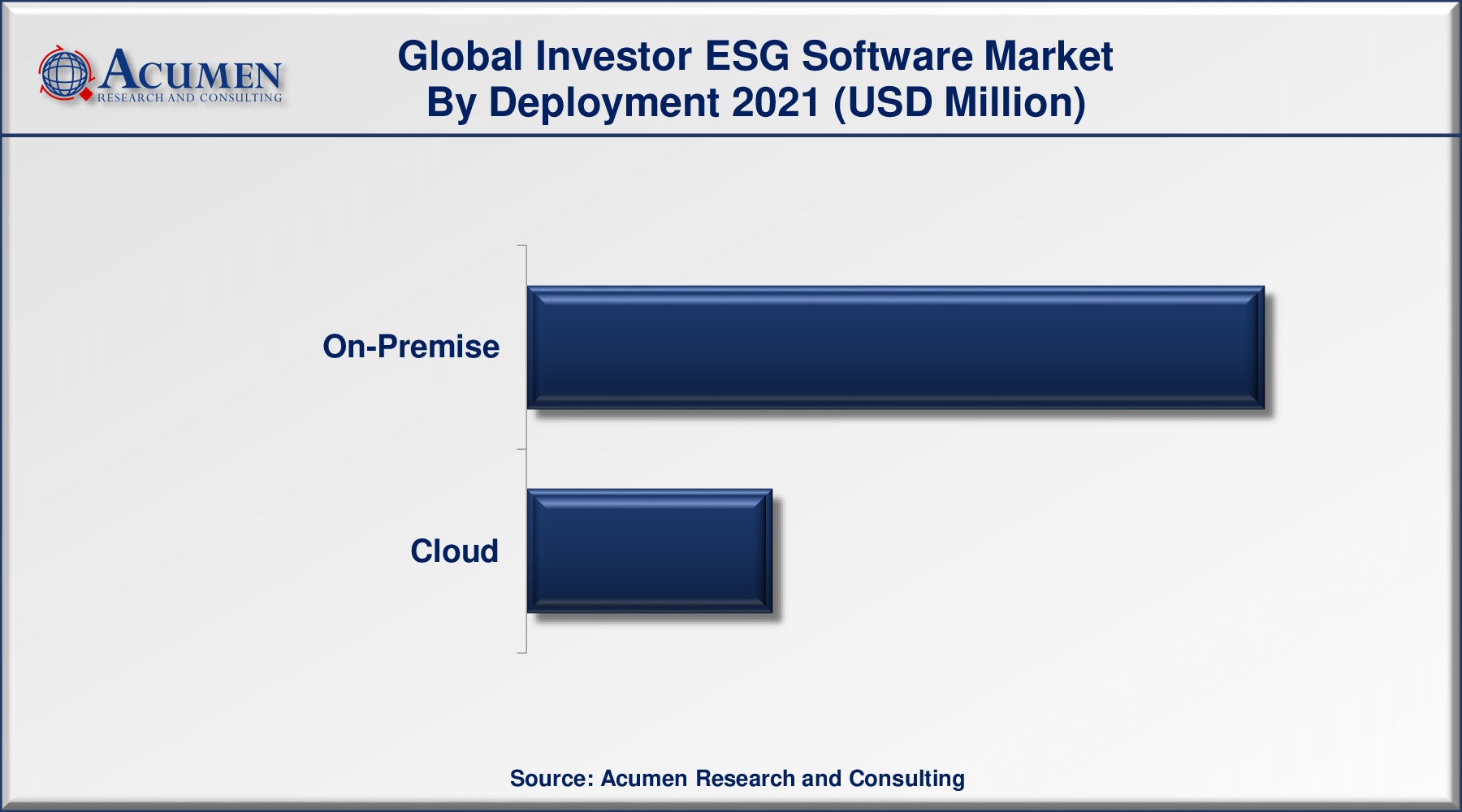

Investor ESG Software Market by Deployment

- On-Premise

- Cloud

In terms of deployment mode, the cloud-based segment is predicted to rise significantly in the market over the next several years. The advancement of cloud computing has enabled banks to create a robust trade finance structure in order to maximize profitability. Financial institutions are looking for ways to profit from lower-cost private cloud solutions in financial transactions as well as other commercial transaction financial products. As a result, the solution's low-cost implementation and administration are propelling the cloud-based software market in both developed and emerging economies.

Investor ESG Software Market by Component

- Software

- Services

According to the investor ESG software industry analysis, the software segment will have the largest market share in 2021. This growth can be linked to the numerous prominent corporations making innovative techniques for lowering executive pay to more equitable levels, which benefits shareholders who belong to this category. As a result of the growing environmental and social concerns around the world, ESG investors are adopting investor ESG software for better data evaluation and analysis. This is fueling the expansion of the investor ESG software segment.

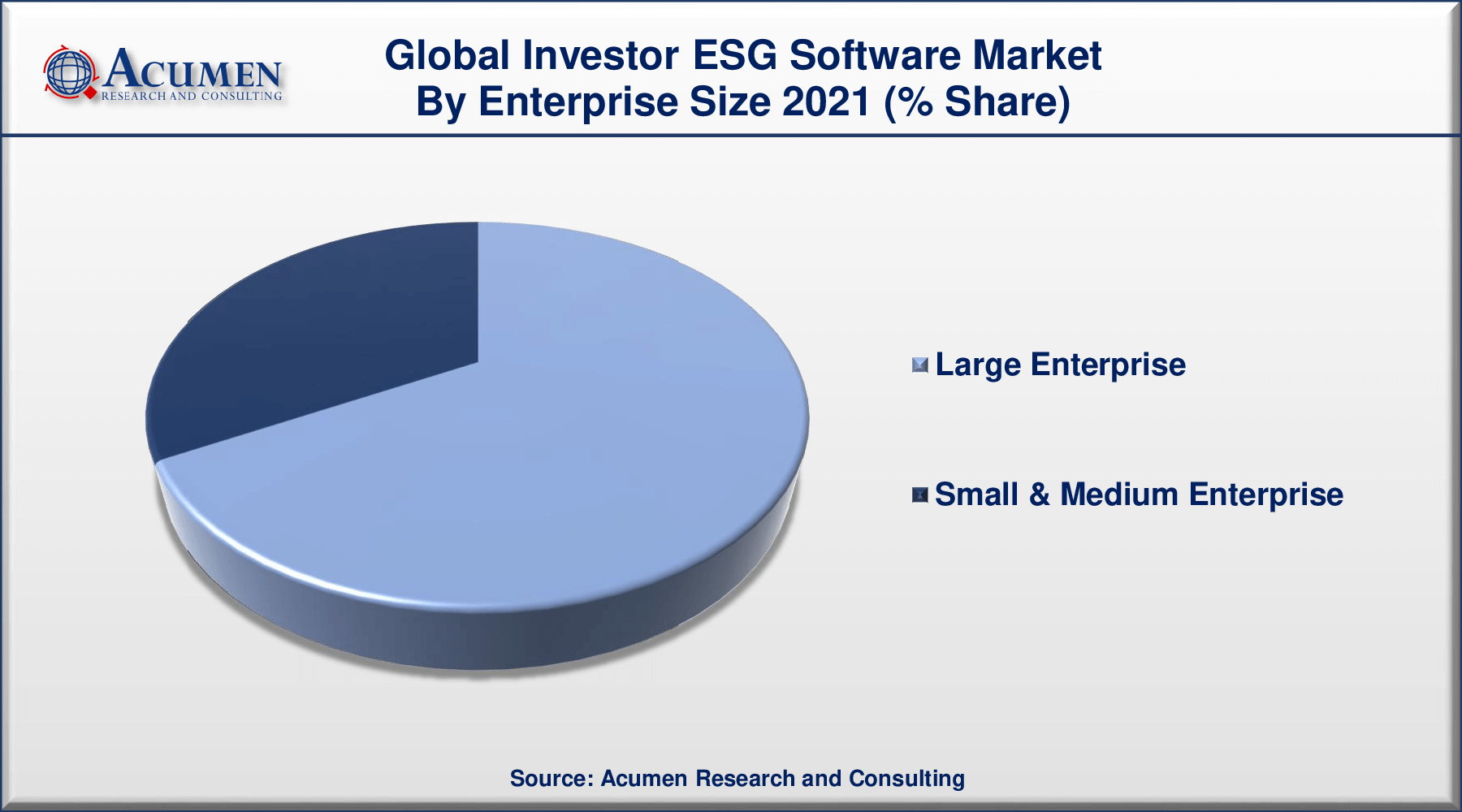

Investor ESG Software Market by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

In terms of enterprise size, the large enterprise segment led the investor ESG software market in 2021. These businesses could have a diverse clientele from many regions, as well as strong technical skills and excellent business tactics. However, large enterprises engage in cutting-edge technologies such as investor ESG software to oversee processes smoothly, gather data consistently and rapidly, and automatically perform assessments and publish results.

Investor ESG Software Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Rising Adoption of Cutting-Edge Technology in North America, Fuels Expansion of the Regional Market

Geographically, North America is predicted to have a significant market share in 2021. The increased acceptance of the ESG in the regional institutional financial community is expected to open up significant growth opportunities for the North American investor ESG software market. The advantages of shareholder ESG software are also boosting the industry's expansion. Investors are interested in learning about the environmental, social, and governance (ESG) issues and possibilities that organizations confront. This entails assessing the impact of ESG effects on an organization's ultimate business strategy and the industry's ability to adapt to ESG developments. These factors will alter comparative edge over time, impacting the long-term sustainability of growing business and the formation of shareholder value in North America.

Investor ESG Software Market Players

Some of the prominent global investor ESG software market companies are Emex Software Ltd, Locus Technologies, Fincite Gmbh, Wolters Kluwer NV, IsoMetrix Software, Ltd., OpenInvest, Dynamo Software, Inc., Envizi, Greenstone+ Ltd., Intelex Technologies, ULC, Cority Software Inc., and EnHelix Software

Frequently Asked Questions

How much was the global investor ESG software market size in 2021?

The global investor ESG software market size in 2021 was accounted to be USD 558 Million.

What will be the projected CAGR for global investor ESG software market during forecast period of 2022 to 2030?

The projected CAGR of investor ESG software during the analysis period of 2022 to 2030 is 15.7%.

Which are the prominent competitors operating in the market?

The prominent players of the global investor ESG software market involve Emex Software Ltd, Locus Technologies, Fincite Gmbh, Wolters Kluwer NV, IsoMetrix Software, Ltd., OpenInvest, Dynamo Software, Inc., Envizi, Greenstone+ Ltd., Intelex Technologies, ULC, Cority Software Inc., and EnHelix Software.

Which region held the dominating position in the global investor ESG software market?

North America held the dominating share for investor ESG software during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for investor ESG software during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Investor ESG Software market?

Increasing utilization of advanced technologies in the banking and financial sectors, as well as Increasing government initiatives to implement sustainable investing are the prominent factors that fuel the growth of global investor ESG software market.

By segment deployment, which sub-segment held the maximum share?

Based on deployment, on-premise segment hold the maximum share for investor ESG software market in 2021.