Intumescent Coatings Market | Acumen Research and Consulting

Intumescent Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

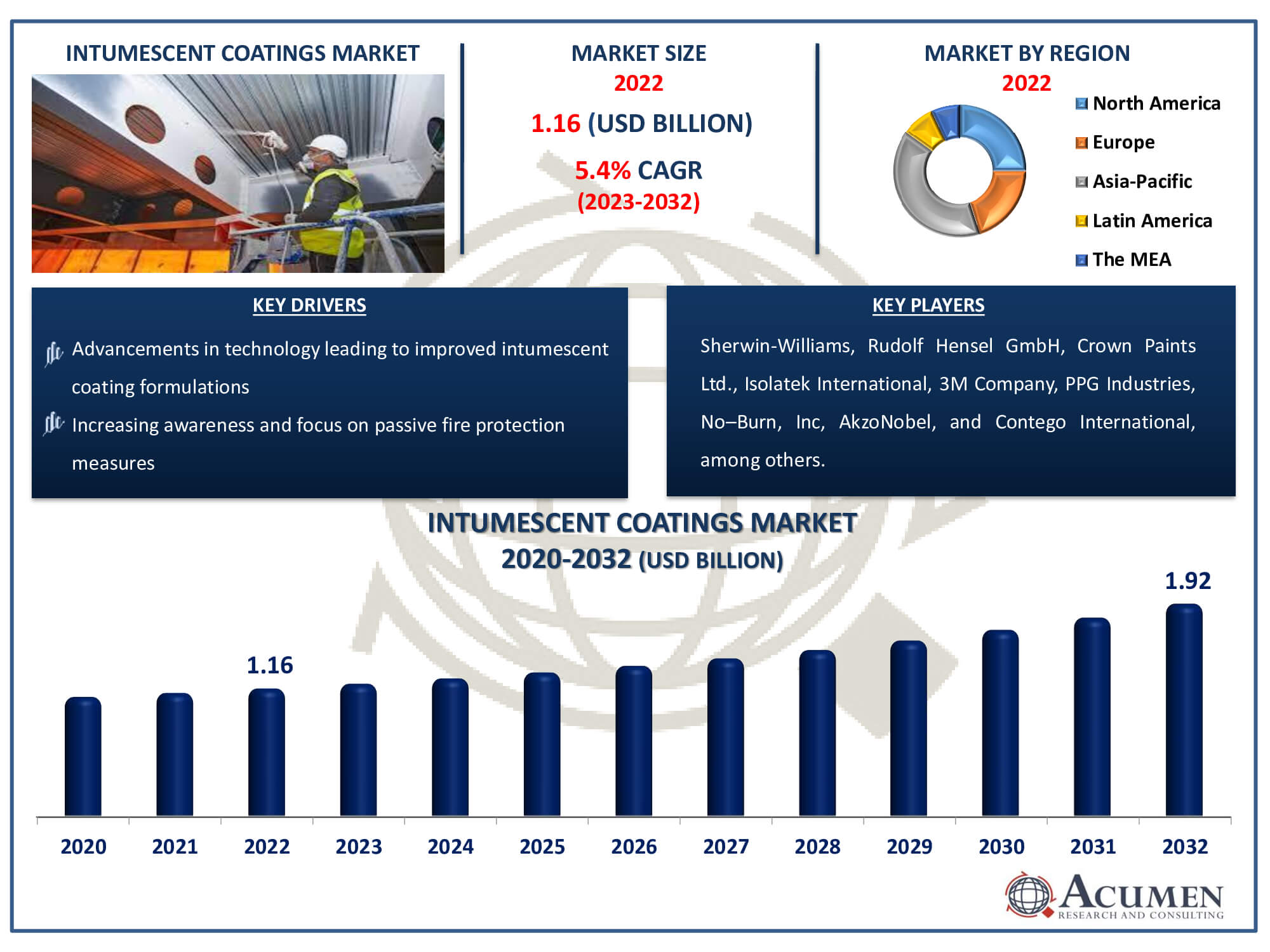

The Intumescent Coatings Market Size accounted for USD 1.16 Billion in 2022 and is estimated to achieve a market size of USD 1.92 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Intumescent Coatings Market Highlights

- Global intumescent coatings market revenue is poised to garner USD 1.92 billion by 2032 with a CAGR of 5.4% from 2023 to 2032

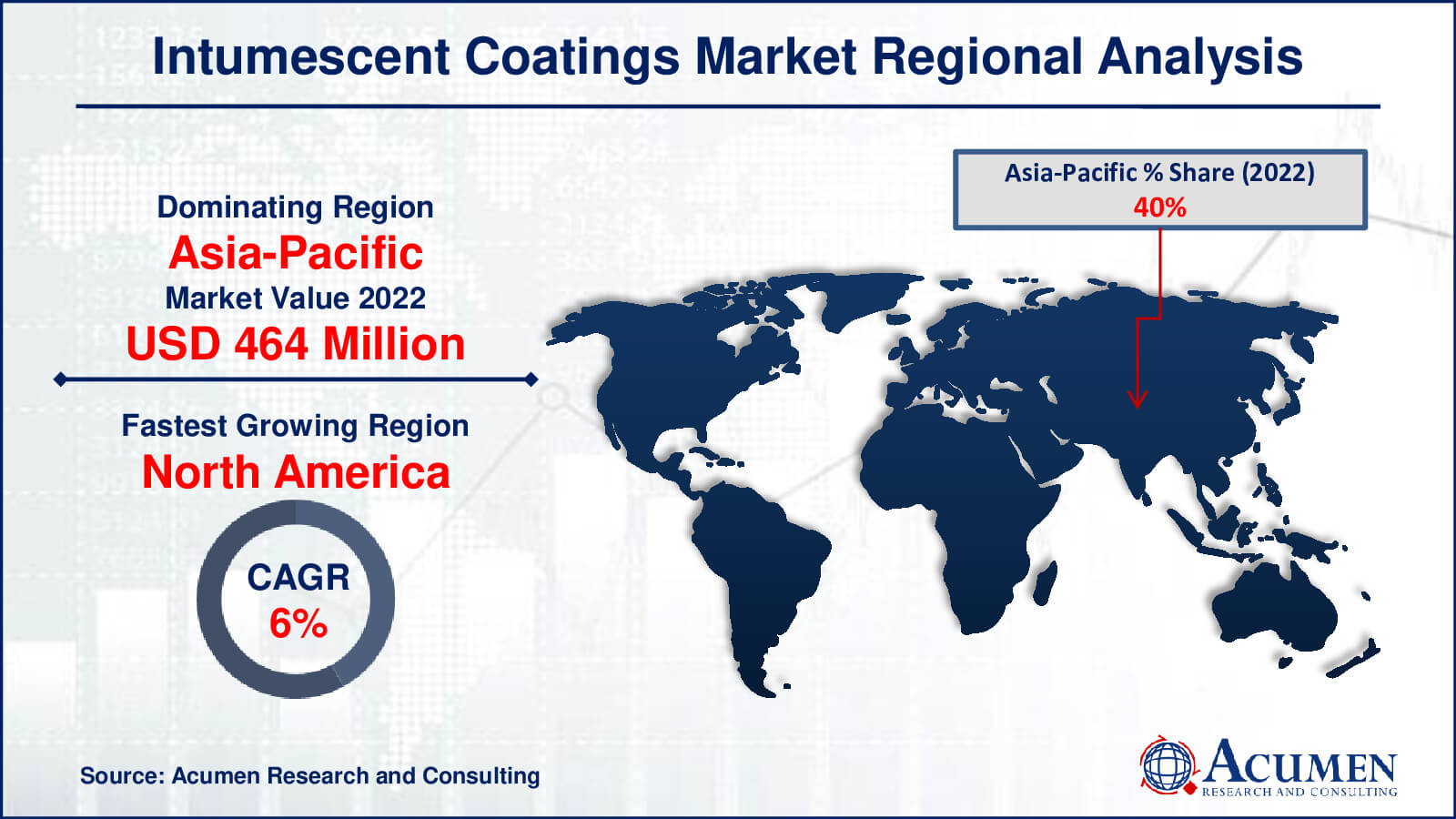

- Asia-Pacific intumescent coatings market value occupied around USD 464 million in 2022

- North America intumescent coatings market growth will record a CAGR of more than 6% from 2023 to 2032

- Among technology, the water-based sub-segment generated over US$ 560 million revenue in 2022

- Based on application, the hydrocarbons sub-segment generated around 53% share in 2022

- Collaborations for research and development to enhance product performance is a popular intumescent coatings market trend that fuels the industry demand

An intumescent substance swells upon exposure to heat, expanding in volume while decreasing in density. When subjected to high temperatures, this layer undergoes a thermochemical reaction, providing thermal protection to the surface. Ensuring fire protection for structural elements, especially columns, beams, and hollow sections, is crucial for intumescent coatings. These coatings offer varying degrees of fire resistance, dependent on their specific type. They can be applied to a wide range of structural parts, including beams, columns, circular and rectangular pathways, and filled tubes in concrete structures. The level of people's protection post-fire can extend up to three hours, contingent upon the type of intumescent coating used.

Global Intumescent Coatings Market Dynamics

Market Drivers

- Stringent fire safety regulations and building codes worldwide

- Increasing awareness and focus on passive fire protection measures

- Growth in construction and infrastructure development projects

- Advancements in technology leading to improved intumescent coating formulations

Market Restraints

- High initial costs and application complexities

- Limited compatibility with certain substrate materials

- Stringent regulatory approval processes for new coatings

Market Opportunities

- Rising demand for fire-resistant coatings in the oil & gas industry

- Expansion in emerging markets with increasing construction activities

- Innovations in eco-friendly and low-VOC intumescent coatings

Intumescent Coatings Market Report Coverage

| Market | Intumescent Coatings Market |

| Intumescent Coatings Market Size 2022 |

USD 1.16 Billion |

| Intumescent Coatings Market Forecast 2032 | USD 1.92 Billion |

| Intumescent Coatings Market CAGR During 2023 - 2032 | 5.4% |

| Intumescent Coatings Market Analysis Period | 2020 - 2032 |

| Intumescent Coatings Market Base Year |

2022 |

| Intumescent Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sherwin-Williams, Rudolf Hensel GmbH, AkzoNobel, Crown Paints Ltd., Isolatek International, 3M Company, PPG Industries, No–Burn, Inc, Contego International, Albi Manufacturing, Jotun Group, Sika AG, and Firetherm. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Intumescent Coatings Market Insights

Stringent regulations and expanding shale gas exploration globally are set to drive heightened product demand in the petroleum and gas sectors, fostering intumescent coatings market growth. Additionally, the anticipated surge in the automotive market demand over the projected period will further propel market expansion. Within the automotive sector, intumescent coatings are poised to dominate in public transport and freight vehicles. The rising need for these products aligns with increasingly strict fire safety regulations worldwide, boosting demand.

The US market is expected to witness positive growth due to rapid developments in the aerospace and automotive industries, coupled with a heightened demand for fireproof residential and commercial buildings. Further, increased investments in shale gas exploration within the United States are projected to drive product demand over the next nine years. The introduction of advanced, thin, lightweight intumescent films is anticipated to further stimulate demand. Given the superior characteristics of intumescent coatings, the industry faces low risk of substitution by alternatives, such as vermiculite fire protection. Increased awareness of fire protection in residential buildings is expected to continuously fuel market growth throughout the intumescent coatings industry forecast period.

The rapid expansion of the construction sector and significant infrastructure development are poised to positively influence product demand in developed economies like India and Indonesia. Intumescent coatings, with properties like durability and aesthetic appeal, showcase high potential, particularly for automotive and construction applications. However, the expected volatility in raw material prices may somewhat dampen product demand.

The expansion of the intumescent coatings market is poised to align with increased population, urbanization, and advancements in coating-related technologies. The global demand for intumescent coatings is expected to surge, driven by the automotive industry's need for cellulosic composites to meet stringent fire protection standards, ensuring consumer safety. Wide ranging operating temperatures and ease of installation are anticipated to further boost the worldwide intumescent coatings market. The necessity for safety measures in industries like chemical, oil, or gas prone to fire hazards due to fuel element production stands as a key driver for the intumescent coatings market. Moreover, rising consumer awareness regarding fire protection systems is expected to significantly propel the growth over the intumescent coatings market forecast period.

Intumescent Coatings Market Segmentation

The worldwide market for intumescent coatings is split based on technology, application, end-use, and geography.

Intumescent Coatings Technology

- Solvent-Based

- Water-Based

- Epoxy-Based

The market is dominated by epoxy-based intumescent coatings because of their remarkable fire-retardant qualities and adaptability. These coatings are made of epoxy resins that expand and generate a thick char layer that acts as insulation when exposed to high temperatures during a fire catastrophe. By acting as a shield, this layer stops heat from reaching the substrate, preventing structural damage and the spread of fire. Epoxy-based coatings are chosen in industrial and construction environments where fire protection is essential for compliance and safety because of its adaptability, durability, and adherence to a variety of surfaces.

Intumescent Coatings Applications

- Cellulosic

- Hydrocarbons

According to intumescent coatings industry analysis, the market was segmented into hydrocarbons and cellulosics based on application, with hydrocarbons anticipated to exhibit the fastest growth over the forecast period. The increased utilization of intumescent hydrocarbon coatings is likely propelling product demand, notably in industries such as oil & gas and energy. The rapid adoption of international standards for testing and certification in the global offshore market is poised to further accelerate the growth of this segment. Additionally, the segment's development is bolstered by high product demand in construction, particularly in industrial and commercial buildings, alongside the escalating worldwide exploration activities in the oil and gas sector.

Intumescent Coatings End-uses

- Oil & Gas

- Automotive

- Construction

- Others

The market has been segmented based on end-use categories such as construction, oil & gas, automotive, among others. The oil and gas sector held the largest market share in 2022, and its dominance is expected to persist throughout the forecast period. Product demand within this sector is projected to drive heightened investments in exploration, deep-water projects, marginalized sectors, and expansion of refining capacities. In 2022, the building sector also held a significant market share. Anticipated growth in this segment is driven by increased awareness of personal safety, coupled with regulatory emphasis on implementing robust fire protection systems in buildings. A strong compound annual growth rate (CAGR) is expected from 2023 to 2032 due to these factors.

Intumescent Coatings Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Intumescent Coatings Market Regional Analysis

In 2022, Asia-Pacific emerged as the market leader, projected to sustain this position with the highest compound annual growth rate (CAGR) in the coming years. This growth is attributed to rapid industrialization and a thriving construction industry, both pivotal drivers of market expansion. Increasing awareness of fire safety measures further fuels product demand in the region.

Conversely, Europe, with its mature market, anticipates limited growth. However, advancements in product development and growing demand from automotive manufacturers are set to propel market growth. The automotive sector's increasing inclination toward fire protection solutions is expected to be a significant contributor in Europe.

In North America, the intumescent coatings market is rapidly expanding due to stringent building safety standards and a heightened emphasis on fire protection in construction practices. Stringent norms set by organizations like the National Fire Protection Association (NFPA) drive the need for fire-resistant solutions. The region's focus on sustainable development also favors intumescent coatings due to their eco-friendly formulas, contributing to LEED certifications. Additionally, strong growth in residential, commercial construction, and infrastructure repair augments the demand for these coatings.

Intumescent Coatings Market Players

Some of the top intumescent coatings companies offered in our report includes Sherwin-Williams, Rudolf Hensel GmbH, AkzoNobel, Crown Paints Ltd., Isolatek International, 3M Company, PPG Industries, No–Burn, Inc, Contego International, Albi Manufacturing, Jotun Group, Sika AG, and Firetherm.

Frequently Asked Questions

How big is the intumescent coatings market?

The intumescent coatings market size was valued at USD 1.16 Billion in 2022.

What is the CAGR of the global intumescent coatings market from 2023 to 2032?

The CAGR of intumescent coatings is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the intumescent coatings market?

The key players operating in the global market are including Sherwin-Williams, Rudolf Hensel GmbH, AkzoNobel, Crown Paints Ltd., Isolatek International, 3M Company, PPG Industries, No-Burn, Inc, Contego International, Albi Manufacturing, Jotun Group, Sika AG, and Firetherm.

Which region dominated the global intumescent coatings market share?

Asia-Pacific held the dominating position in intumescent coatings industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of intumescent coatings during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global intumescent coatings industry?

The current trends and dynamics in the intumescent coatings industry include stringent fire safety regulations and building codes worldwide, increasing awareness and focus on passive fire protection measures, growth in construction and infrastructure development projects, and advancements in technology leading to improved intumescent coating formulations.

Which technology held the maximum share in 2022?

The epoxy-based technology held the maximum share of the intumescent coatings industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date