Intravenous Immunoglobulin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Intravenous Immunoglobulin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

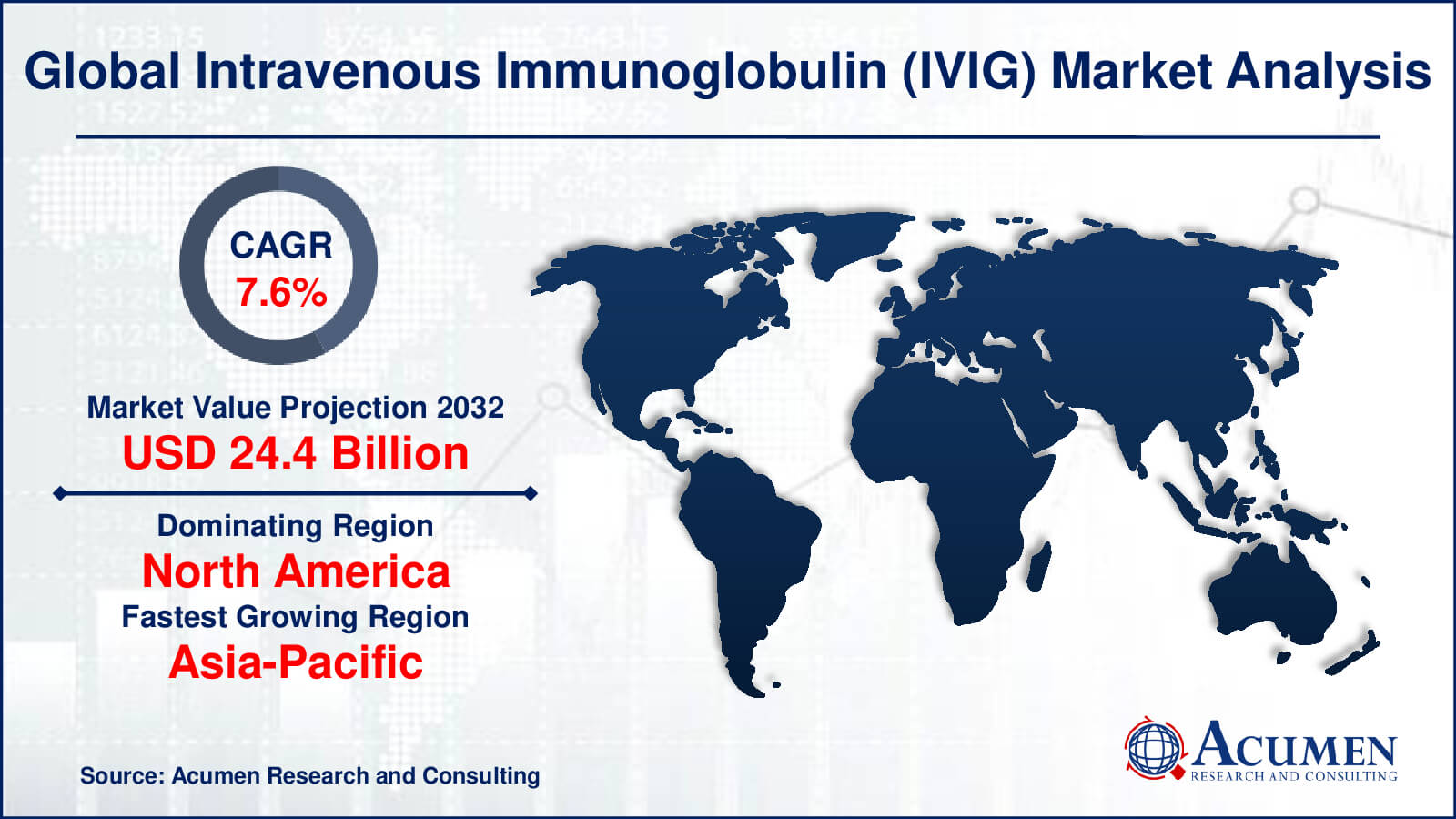

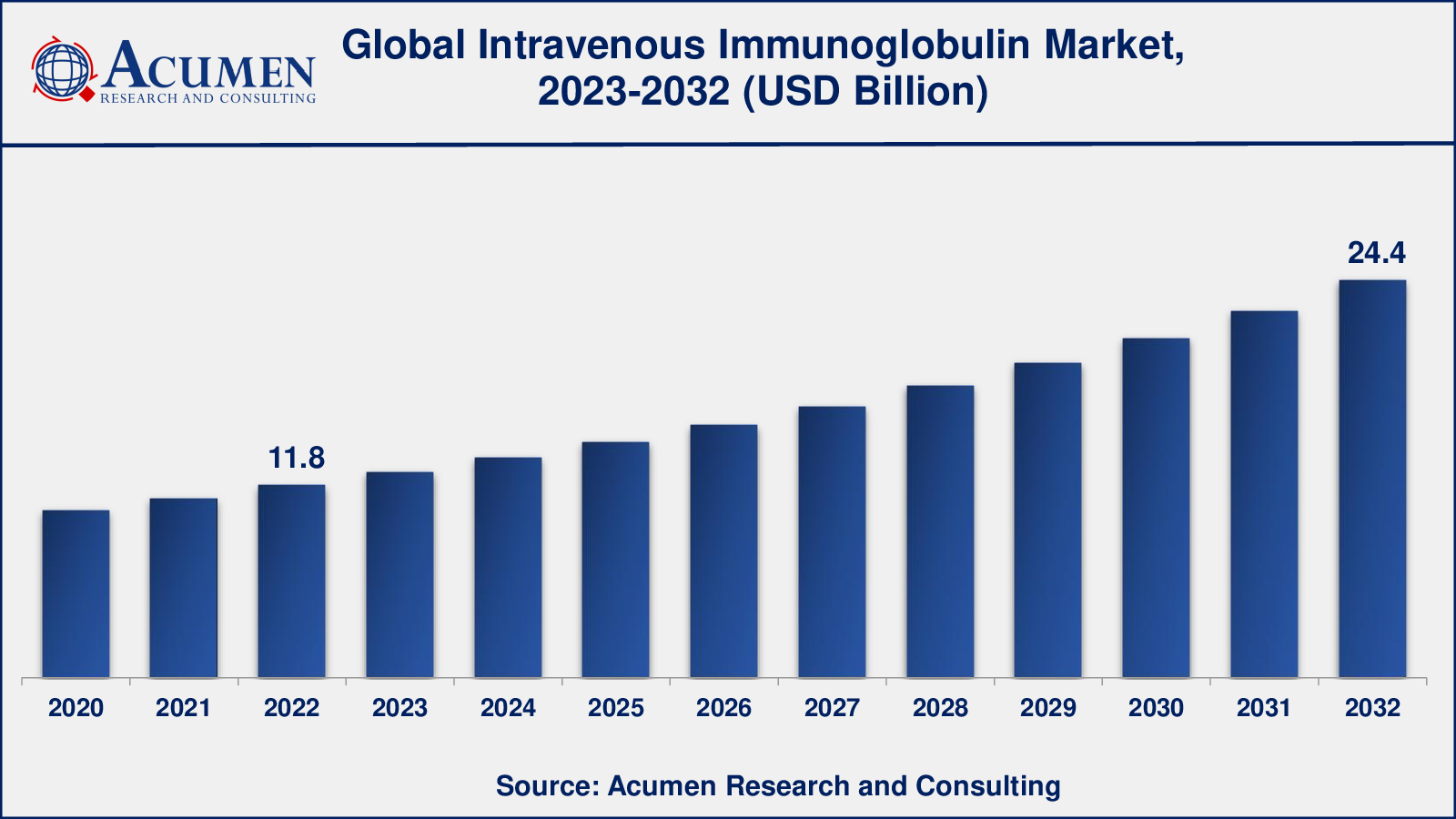

The global Intravenous Immunoglobulin Market size was valued at USD 11.8 Billion in 2022 and is projected to attain USD 24.4 Billion by 2032 mounting at a CAGR of 7.6% from 2023 to 2032.

Intravenous Immunoglobulin Market Highlights

- Global intravenous immunoglobulin (IVIG) market revenue is poised to garner USD 24.4 Billion by 2032 with a CAGR of 7.6% from 2023 to 2032

- North America intravenous immunoglobulin market value occupied around USD 5.5 billion in 2022

- Asia-Pacific intravenous immunoglobulin market growth will record a CAGR of more than 8% from 2023 to 2032

- Among application, the immunodeficiency diseases sub-segment occupied over US$ 2.8 billion revenue in 2022

- Based on distribution channel, the hospital pharmacy sub-segment gathered around 58% share in 2022

- Growing demand for subcutaneous immunoglobulin (SCIG) is a popular Intravenous Immunoglobulin market trend that drives the industry demand

Intravenous Immunoglobulin (IVIG) is an antibody-rich medicine derived from human plasma. Plasma is the liquid fraction of the blood that remains after the removal of red blood cells, white blood cells, and platelets. IVIG is made from plasma that has been collected from thousands of healthy donors.

Immunoglobulins, commonly known as antibodies, are proteins that the immune system produces in order to recognize and neutralize foreign molecules such as bacteria, viruses, and other pathogens. IVIG includes a wide variety of antibodies derived from many donors, offering a broad range of immunological protection.

IVIG is given intravenously, usually through a vein in the arm. It is used to treat a variety of medical diseases, most notably immunological deficiencies and autoimmune disorders. Depending on the illness being treated, IVIG acts by replenishing or modifying the immune system.

Global Intravenous Immunoglobulin Market Dynamics

Market Drivers

- Increasing prevalence of immunodeficiency disorders and autoimmune diseases

- Growing geriatric population

- Technological advancements in IVIG production and delivery methods

Market Restraints

- High cost of IVIG therapy

- Potential adverse effects and allergic reactions

- Limited availability of plasma donors

Market Opportunities

- Rising demand for IVIG in emerging markets

- Expanding applications of IVIG in neurological and inflammatory disorders

- Development of novel therapies and formulations

- Increasing research and development activities

Intravenous Immunoglobulin Market Report Coverage

| Market | Intravenous Immunoglobulin Market |

| Intravenous Immunoglobulin Market Size 2022 | USD 11.8 Billion |

| Intravenous Immunoglobulin Market Forecast 2032 | USD 24.4 Billion |

| Intravenous Immunoglobulin Market CAGR During 2023 - 2032 | 7.6% |

| Intravenous Immunoglobulin Market Analysis Period | 2020 - 2032 |

| Intravenous Immunoglobulin Market Base Year | 2022 |

| Intravenous Immunoglobulin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Baxter International, Inc., Bayer AG, Biotest AG (Tiancheng International Investment Limited), CSL Limited (CSL Behring), Grifols, S.A., Kedrion S.p.A, LFB S.A., Octapharma AG, and Takeda Pharmaceutical Company Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Intravenous Immunoglobulin Market Insights

Several main variables drive the intravenous immunoglobulin (IVIG) industry. The rising frequency of immunodeficiency illnesses and autoimmune diseases is one of the key reasons. As the prevalence of these illnesses rises, so does the demand for IVIG, which is used to augment or modify the immune system. Furthermore, the expanding elderly population, which is more sensitive to immune-related illnesses, leads to a growth in IVIG demand.

Technological advances in IVIG manufacturing and delivery systems have also contributed significantly to market expansion. Advances in plasma collection, purification procedures, and IVIG product composition have increased its accessibility and convenience. These developments have aided in streamlining the production process and improving the quality and efficacy of IVIG, hence boosting market expansion.

Despite the strong market drivers, there are certain constraints affecting the intravenous immunoglobulin IVIG market. The high expense of IVIG treatment is a barrier that prevents some people from accessing it. Furthermore, the possible side effects and allergic responses associated with IVIG infusion necessitate careful monitoring and may discourage some patients from pursuing treatment. Another constraint is the scarcity of plasma donors, which has an impact on the supply of IVIG products.

Furthermore, regulatory issues in some places may stymie market expansion. The severe regulatory standards for plasma collection, production, and distribution might differ between nations, complicating and delaying product approvals and market access.

Nonetheless, the IVIG industry offers a number of options. The need for IVIG is increasing in emerging nations, where healthcare facilities and access to innovative medicines are improving. Furthermore, there is a growing interest in the use of IVIG in neurological and inflammatory illnesses, widening its potential market reach. The development of innovative medicines and formulations, as well as increased R&D initiatives, provides significant prospects for market growth and innovation in the IVIG industry.

Intravenous Immunoglobulin Market Segmentation

The worldwide market for intravenous immunoglobulin is split based on product, application, distribution channel, and geography.

Intravenous Immunoglobulin Products

- IGG

- IGA

- IGM

- IGE

- IGD

According to the intravenous immunoglobulin industry analysis, the product that dominates the intravenous immunoglobulin (IVIG) market is IgG (Immunoglobulin G). IgG is the most abundant type of antibody in the human body and plays a crucial role in immune responses against various pathogens. It is widely used in IVIG formulations due to its effectiveness in treating immune deficiencies, autoimmune disorders, and other conditions where immunoglobulin replacement or modulation is required.

Another significant immunoglobulin is IgA (Immunoglobulin A), which is present largely on mucosal surfaces such as the respiratory and gastrointestinal systems. It is less typically employed in IVIG formulations than IgG, however it may be administered in particular circumstances of IgA insufficiency or mucosal immunity. IgM (Immunoglobulin M) is the first antibody to be formed following an immune response and is found largely in the circulation. While IgM is less commonly utilised in IVIG formulations, it is crucial in some situations, such as primary immunodeficiency disorders.

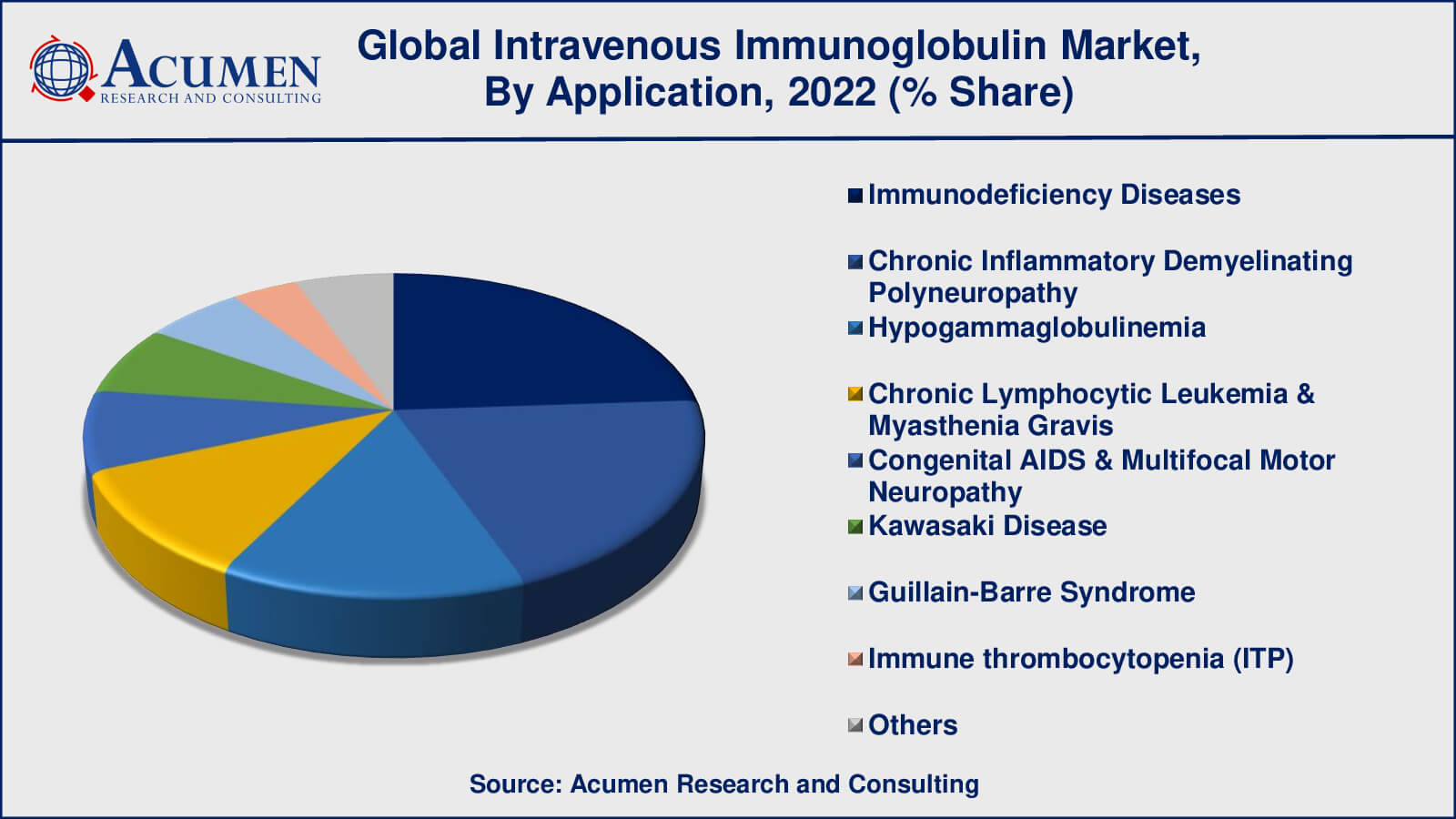

Intravenous Immunoglobulin Applications

- Chronic Inflammatory Demyelinating Polyneuropathy

- Chronic Lymphocytic Leukemia & Myasthenia Gravis

- Congenital AIDS & Multifocal Motor Neuropathy

- Guillain-Barre Syndrome

- Hypogammaglobulinemia

- Immune thrombocytopenia (ITP)

- Immunodeficiency Diseases

- Kawasaki Disease

- Others

Immunodeficiency diseases, such as primary immunodeficiency diseases, is one of the leading applications in the intravenous immunoglobulin market. This is because IVIG therapy is widely used to treat patients with immunodeficiency diseases who lack the necessary levels of immunoglobulins to fight off infections and diseases. IVIG therapy helps to boost the immune system by providing immunoglobulin antibodies extracted from donated human blood, and has proven to be an effective treatment for immunodeficiency diseases. The increasing prevalence of immunodeficiency diseases globally is also driving the growth of the intravenous immunoglobulin IVIG market, making it a leading application in this market.

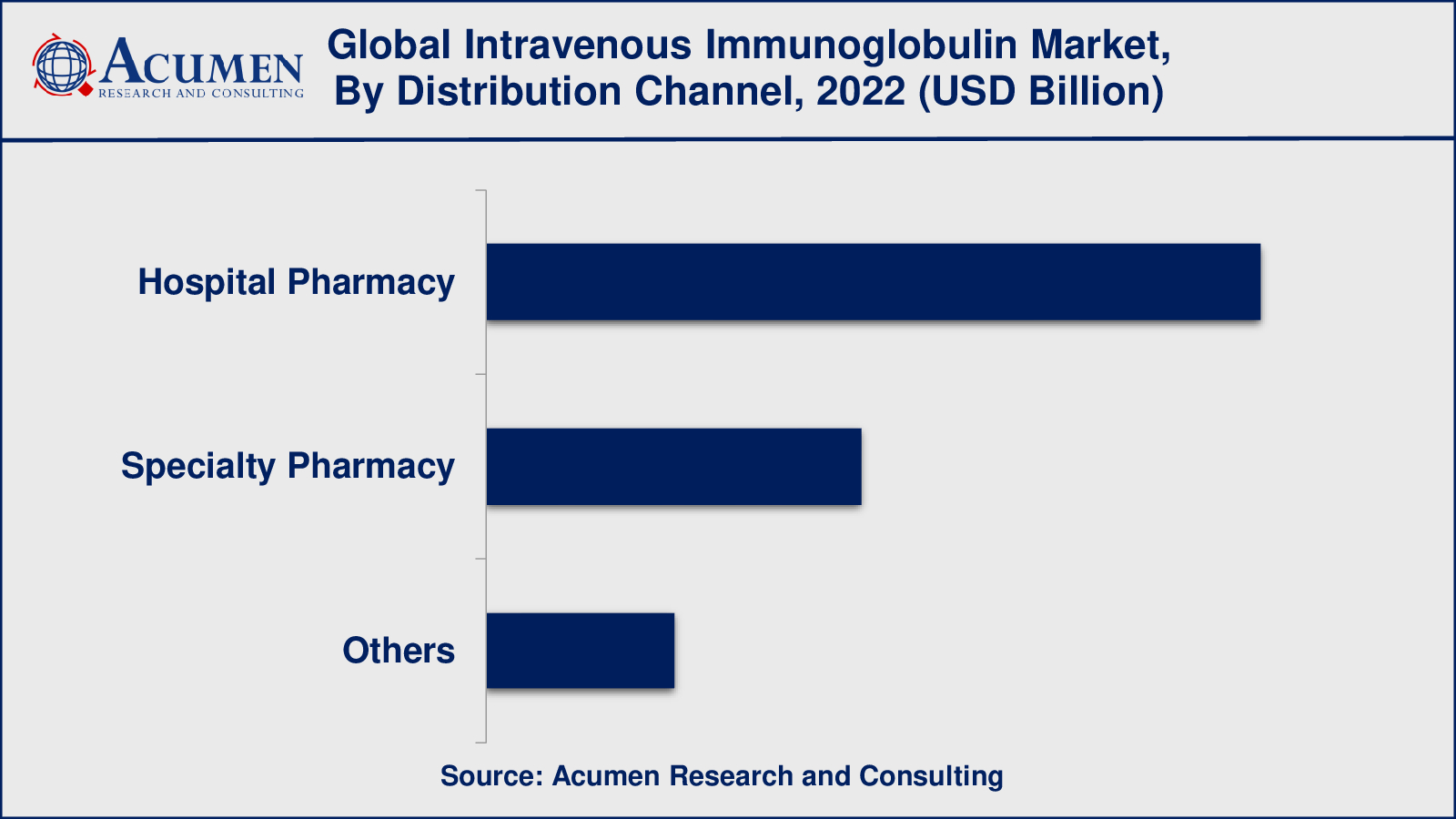

Intravenous Immunoglobulin Distribution Channels

- Hospital Pharmacy

- Specialty Pharmacy

- Others

As per the intravenous immunoglobulin market forecast, the hospital pharmacy segment is expected to dominate the intravenous immunoglobulin (IVIG) market with a revenue share of over 58%. The popularity of hospital pharmacies can be attributed to their large network of hospitals and the convenient range of IVIG products that are easily accessible through these outlets. Moreover, there is a growing incidence of primary immune deficiencies, hepatitis C, and other diseases, which has resulted in an increased number of hospitalizations worldwide. This trend has led to a surge in customer preference for hospital pharmacies. Hospitals provide timely reimbursement, treatment, and proper care to a large number of patients, which has resulted in a rise in the prevalence of patients choosing hospital pharmacies.

Intravenous Immunoglobulin (IVIG) Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Intravenous Immunoglobulin Market Regional Analysis

North America, notably the United States, has a significant intravenous immunoglobulin IVIG market. The region has a well-developed healthcare system, significant healthcare spending, and a huge patient pool. Demand for IVIG is driven by the frequency of autoimmune illnesses, primary immunodeficiency disorders, and neurological ailments such as Alzheimer's and multiple sclerosis. Furthermore, favorable reimbursement rules and the presence of important market participants aid in the expansion of the IVIG market in North America.

Europe is another important IVIG market. Countries with strong healthcare systems and a high frequency of immunodeficiency illnesses include Germany, France, and the United Kingdom. In the region, the European Medicines Agency (EMA) controls the approval and use of IVIG products. Market expansion is being driven by an ageing population and increased knowledge of IVIG treatment. However, pricing constraints and severe regulatory requirements might stymie industry growth.

The IVIG market has enormous development potential in the Asia-Pacific area. Countries with big populations and an increasing frequency of immunodeficiency diseases include China, Japan, and India. Increasing healthcare expenditure, better healthcare infrastructure, and increasing access to sophisticated medicines all contribute to regional market growth. However, in certain countries, financial constraints, regulatory complexity, and a lack of understanding regarding IVIG treatment among healthcare providers might be barriers.

Intravenous Immunoglobulin Market Players

Some of the top intravenous immunoglobulin companies offered in our report include Baxter International, Inc., Bayer AG, Biotest AG (Tiancheng International Investment Limited), CSL Limited (CSL Behring), Grifols, S.A., Kedrion S.p.A, LFB S.A., Octapharma AG, and Takeda Pharmaceutical Company Limited

Intravenous Immunoglobulin Industry Recent Developments

- In May 2023, CSL Behring has started a phase 3 clinical trial for their innovative plasma-derived immunoglobulin (IG) therapy for Alzheimer's disease. The trial's goal is to assess the therapy's safety and efficacy in halting the course of Alzheimer's disease in individuals with moderate cognitive impairment.

- In April 2023, Takeda has started a phase 3 clinical study for their experimental subcutaneous immunoglobulin therapy for the treatment of individuals with primary immunodeficiency diseases. The trial's goal is to evaluate the subcutaneous formulation's safety, effectiveness, and tolerability to the intravenous mode of administration.

Frequently Asked Questions

What was the size of the global intravenous immunoglobulin market in 2022?

The size of intravenous immunoglobulin market was USD 11.8 Billion in 2022.

What is the intravenous immunoglobulin market CAGR from 2023 to 2032?

The intravenous immunoglobulin market CAGR during the analysis period of 2023 to 2032 is 7.6%.

Which are the key players in the intravenous immunoglobulin market?

The key players operating in the global intravenous immunoglobulin market are including Baxter International, Inc., Bayer AG, Biotest AG (Tiancheng International Investment Limited), CSL Limited (CSL Behring), Grifols, S.A., Kedrion S.p.A, LFB S.A., Octapharma AG, and Takeda Pharmaceutical Company Limited.

Which region dominated the global intravenous immunoglobulin market share?

North America region held the dominating position in intravenous immunoglobulin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of intravenous immunoglobulin during the analysis period of 2023 to 2032.

What are the current trends in the global intravenous immunoglobulin industry?

The current trends and dynamics in the intravenous immunoglobulin industry include increasing prevalence of immunodeficiency disorders and autoimmune diseases, growing geriatric population, and technological advancements in IVIG production and delivery methods

Which product held the maximum share in 2022?

The IGG product held the maximum share of the intravenous immunoglobulin industry.?