Internal Combustion Engine Market | Acumen Research and Consulting

Internal Combustion Engine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

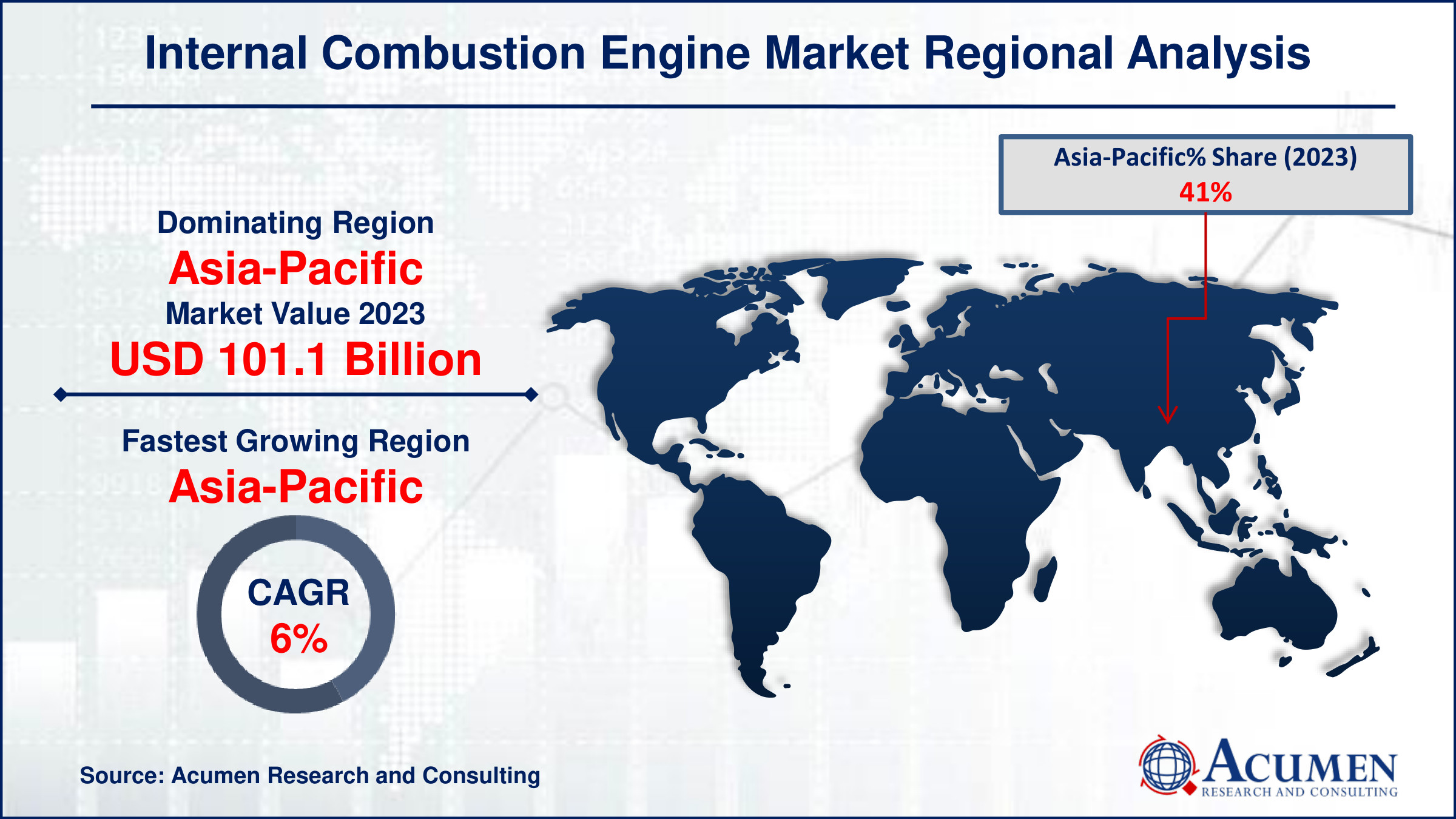

The Internal Combustion Engine Market Size accounted for USD 246.8 Billion in 2023 and is estimated to achieve a market size of USD 396.9 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

Internal Combustion Engine Market Highlights

- Global internal combustion engine market revenue is poised to garner USD 396.9 billion by 2032 with a CAGR of 5.5% from 2024 to 2032

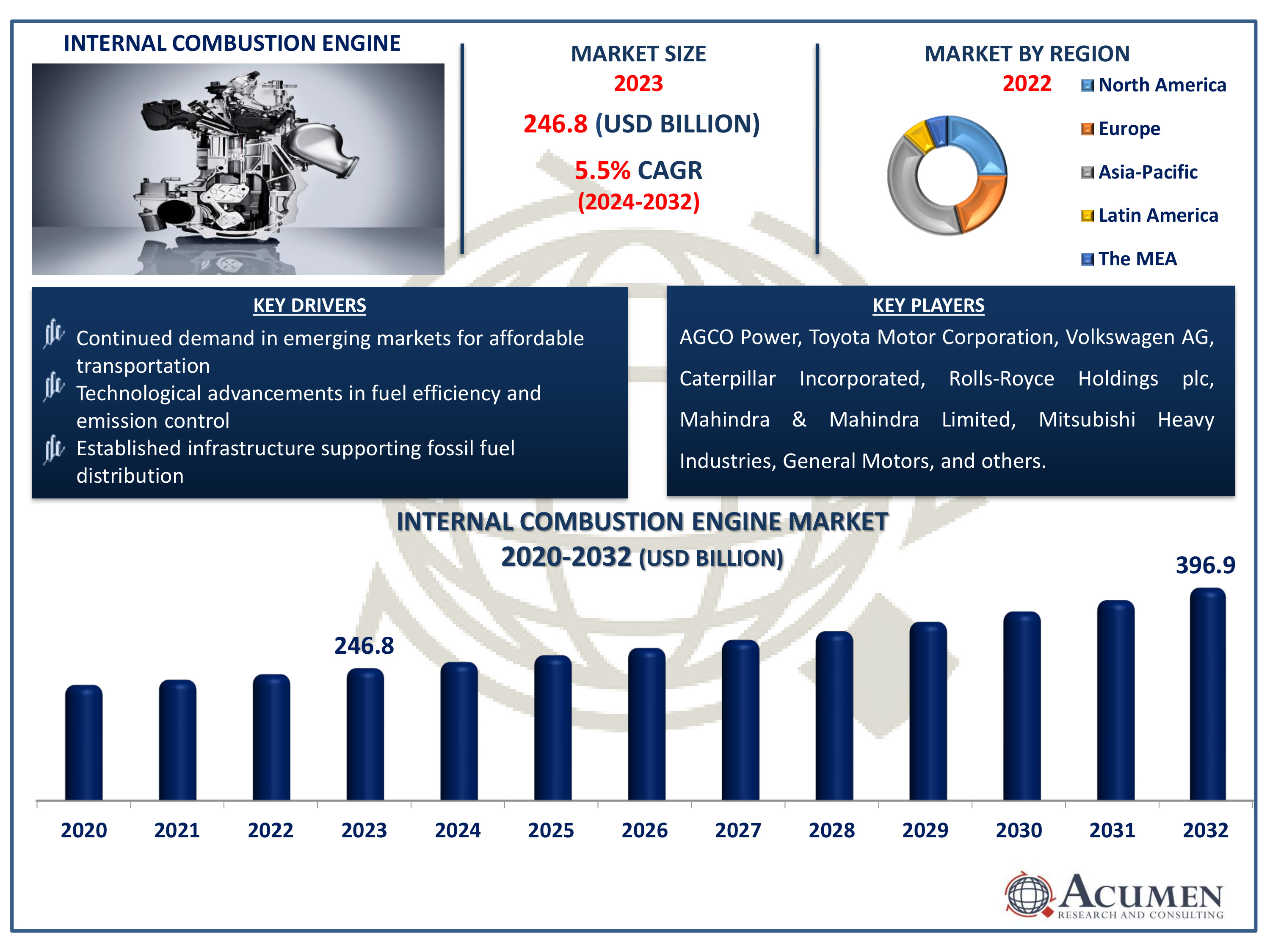

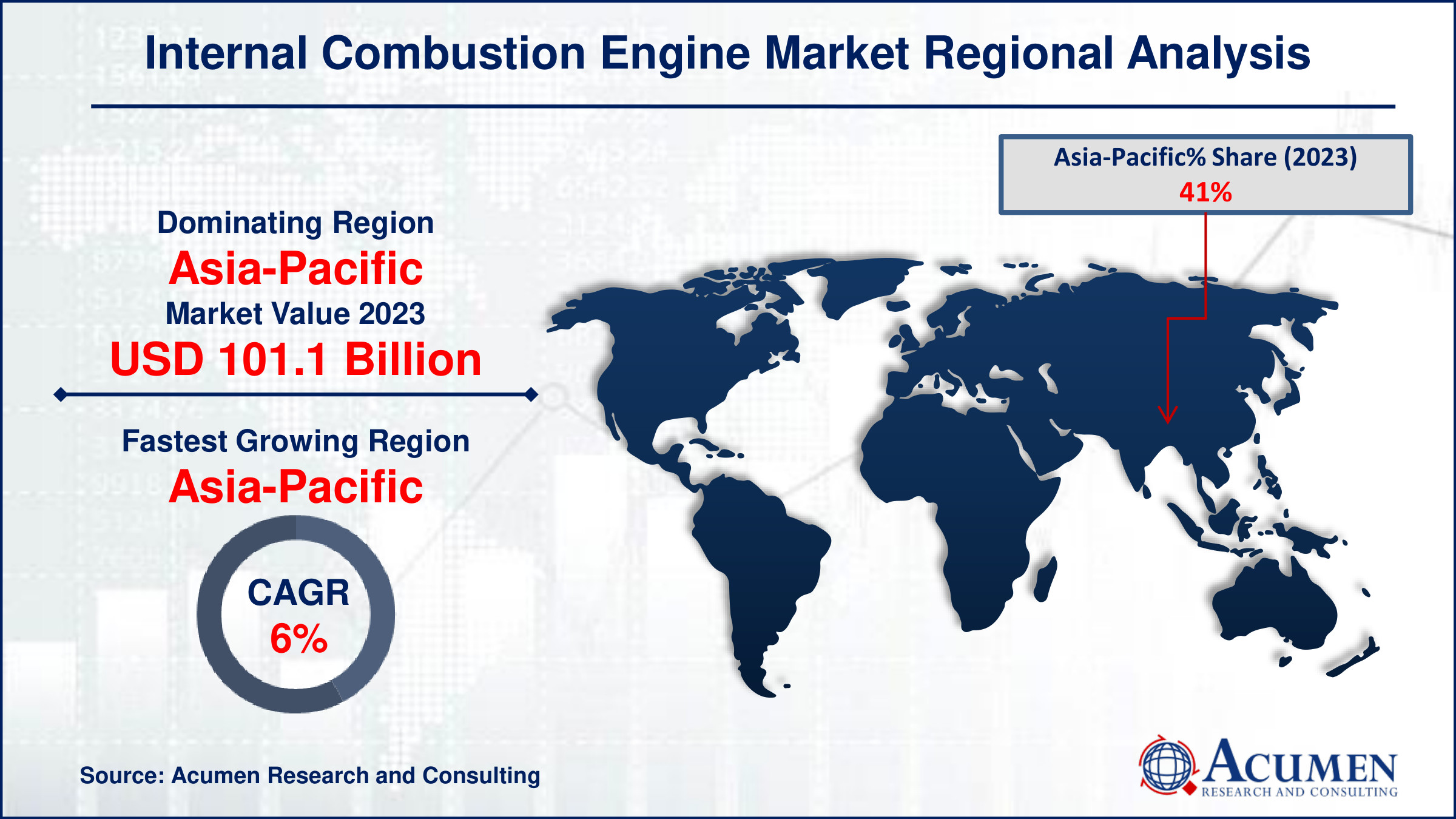

- Asia-Pacific internal combustion engine market value occupied around USD 101.1 billion in 2023

- Asia-Pacific internal combustion engine market growth will record a CAGR of more than 5.5% from 2024 to 2032

- Based on fuel, the petroleum sub-segment generated 81% market share in 2023

- Based on end-user, the automotive sub-segment shows 68% market growth in 2023

- Integration of turbo charging, direct fuel injection, and lightweight materials to enhance fuel efficiency in traditional internal combustion engines is the internal combustion engine market trend that fuels the industry demand

An internal combustion engine (ICE) is a type of heat engine where fuel combustion occurs within the engine itself, typically within cylinders. This process generates high-temperature, high-pressure gases that directly drive mechanical components, such as pistons or turbine blades, converting chemical energy into mechanical work. ICEs come in various forms, including gasoline and diesel engines, and are commonly used in vehicles due to their power-to-weight ratio and reliability. They play a crucial role in powering Automotives, motorcycles, ships, and airplanes. Additionally, ICEs are utilized in power generation for portable generators, backup power systems, and small-scale electricity production. In industrial settings, they drive machinery, pumps, and compressors, contributing significantly to manufacturing and processing operations. Despite advancements in electric and alternative power sources, ICEs remain a dominant technology in many sectors due to their established infrastructure and versatility.

Global Internal Combustion Engine Market Dynamics

Market Drivers

- Continued demand in emerging markets for affordable transportation

- Technological advancements in fuel efficiency and emission control

- Established infrastructure supporting fossil fuel distribution

Market Restraints

- Increasing regulatory pressure on emissions and fuel efficiency standards

- Shift towards electric vehicles impacting demand

- Volatility in crude oil prices affecting fuel costs

Market Opportunities

- Hybridization and alternative fuels integration

- Retrofitting existing fleets with cleaner technologies

- Innovation in internal combustion engine design for efficiency gains

Internal Combustion Engine Market Report Coverage

| Market | Internal Combustion Engine Market |

| Internal Combustion Engine Market Size 2022 | USD 246.8 Billion |

| Internal Combustion Engine Market Forecast 2032 | USD 396.9 Billion |

| Internal Combustion Engine Market CAGR During 2023 - 2032 | 5.5% |

| Internal Combustion Engine Market Analysis Period | 2020 - 2032 |

| Internal Combustion Engine Market Base Year |

2022 |

| Internal Combustion Engine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Fuel, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AGCO Power, Toyota Motor Corporation, Volkswagen AG, Caterpillar Incorporated, Rolls-Royce Holdings plc, Mahindra & Mahindra Limited, Mitsubishi Heavy Industries, General Motors, Renault SA, Ford Motor, Fiat SpA, Volvo AB, Shanghai Diesel Engine Company Limited, and Bosch. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Internal Combustion Engine Market Insights

The continued demand for affordable transportation in emerging markets serves as a pivotal driver for the internal combustion engine market. These regions often prioritize cost-effective solutions, making ICE vehicles a preferred choice due to their relatively lower initial costs compared to electric vehicles. Additionally, infrastructure limitations in emerging markets, such as inadequate charging networks, further bolster the demand for ICE vehicles. Manufacturers continue to innovate within the ICE sector, improving efficiency and reducing emissions to meet regulatory standards while maintaining affordability. For instance, Toyota Motor Corporation has demonstrated its commitment to advancing alternative energy solutions and achieving sustainable transportation by exploring hydrogen-powered engines. In April 2021, Toyota announced the development of a hydrogen engine, which is a key step towards realizing a carbon-neutral mobility society. As part of this initiative, Toyota installed the hydrogen engine in a racing vehicle based on its Corolla Sport model. As urbanization and economic growth accelerate in these regions, the reliance on ICE vehicles persists, sustaining their market relevance.

The shift towards electric vehicles represents a significant restraint for the ICE market due to several factors. Firstly, tightening global emissions regulations incentivize automakers to focus on electrification to meet stringent standards. Secondly, consumer demand is increasingly favoring electric vehicles (EVs) for their lower operating costs and environmental benefits. Thirdly, advancements in battery technology are making EVs more viable and attractive alternatives to traditional ICE vehicles. Moreover, government policies promoting EV adoption further diminish the market prospects for ICE engines, posing a challenge for manufacturers heavily invested in conventional automotive technologies. For instance, according to data presented to the Indian Parliament by the Ministry of Road Transport and Highways in 2013, only 53,387 electric vehicles were registered in the country. By August 2023, this number had surged to 28,30,565. This shift signals a transformative period for the automotive industry as it adapts to a greener, more sustainable future dominated by electric propulsion.

Innovations in ICE design are crucial for enhancing efficiency and sustainability in transportation and industrial sectors. Advances such as direct fuel injection, variable valve timing, and turbo charging have significantly boosted fuel efficiency and reduced emissions. These innovations not only improve performance but also meet stringent environmental regulations, making ICEs a viable option amidst the shift towards electric vehicles. Furthermore, ongoing research into hybridization and alternative fuels further expands the potential for ICEs to remain competitive and relevant in the evolving automotive landscape. For instance, in April 2023, Mercedes unveiled its final new combustion engine model, the sixth-generation E-Class. This vehicle will be manufactured in both Germany and China, and it is set to be released in the European market in the third quarter of 2023. Future versions of the E-Class will be built on a newly designed platform optimized for electric vehicles, but the current generation will already include hybrid options alongside traditional internal combustion engines. This dynamic environment presents opportunities for growth and innovation within the internal combustion engine market.

Internal Combustion Engine Market Segmentation

The worldwide market for internal combustion engine is split based on fuel, end-user, and geography.

Internal Combustion Engine (ICE) Market By Fuel

- Petroleum

- Diesel

- Gasoline

- Others

- Natural Gas

- CNG

- LNG

- Others

According to the internal combustion engine industry analysis, the petroleum segment dominates market primarily due to its energy density, availability, and infrastructure support. Internal combustion engines are designed to efficiently combust petroleum-based fuels like gasoline and diesel, which offer high energy content per unit volume. This dominance is reinforced by extensive global distribution networks for refining, distribution, and retailing petroleum fuels, making them convenient and accessible for widespread use in vehicles and machinery worldwide. Despite advancements in alternative fuels, petroleum's established infrastructure and energy density continue to sustain its dominance in the internal combustion engine market.

Internal Combustion Engine (ICE) Market End-User

- Automotive

- Aviation

- Marine

- Others

According to the internal combustion engine market forecast, the automotive segment is projected to lead the end user due to its massive demand for personal and commercial vehicles. This dominance is driven by the global need for efficient transportation solutions, continuous advancements in ICE technology, and a well-established manufacturing infrastructure. Additionally, the widespread availability of fueling stations and the relatively lower cost of ICE vehicles compared to electric alternatives further bolster this segment's prominence. As a result, the automotive industry remains the primary driver of growth and innovation in the ICE market.

Internal Combustion Engine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Internal Combustion Engine Market Regional Analysis

For several reasons, the Asia-Pacific region leads and fastest-growing region in the internal combustion engine (ICE) market due to its robust industrial growth, increasing vehicle production, and expanding construction activities. For instance, according to a report by the India Brand Equity Foundation (IBEF), a total of 6.01 million passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles were produced in the first quarter of 2023-24. High demand in countries like China and India, combined with government initiatives to boost manufacturing, further propels this dominance. Additionally, the presence of major automotive manufacturers contributes significantly. This regional advantage is bolstered by continuous technological advancements and investments in ICE technologies.

North America is shows notable growth in internal combustion engine market due to increasing demand for commercial vehicles and advancements in engine technology. Stringent emission regulations are driving innovations in fuel efficiency and performance. The presence of major automotive manufacturers and a robust supply chain further bolster this growth. For instance, in June 2023, General Motors announced a significant investment of USD 632 million to upgrade its Fort Wayne Assembly facility in Indiana. This investment is intended to prepare the plant for the production of the next generation of full-sized internal combustion engine (ICE) trucks. This strategic move underscores the company's commitment to enhancing its manufacturing capabilities and meeting the evolving demands of the automotive industry. Additionally, government incentives for eco-friendly engines contribute to the ICE market's rapid expansion.

Internal Combustion Engine Market Players

Some of the top internal combustion engine companies offered in our report include AGCO Power, Toyota Motor Corporation, Volkswagen AG, Caterpillar Incorporated, Rolls-Royce Holdings plc, Mahindra & Mahindra Limited, Mitsubishi Heavy Industries, General Motors, Renault SA, Ford Motor, Fiat SpA, Volvo AB, Shanghai Diesel Engine Company Limited, and Bosch.

Frequently Asked Questions

How big is the internal combustion engine market?

The internal combustion engine market size was valued at USD 246.8 Billion in 2023.

What is the CAGR of the global internal combustion engine market from 2024 to 2032?

The CAGR of internal combustion engine is 5.5% during the analysis period of 2024 to 2032.

Which are the key players in the internal combustion engine market?

The key players operating in the global market are including AGCO Power, Toyota Motor Corporation, Volkswagen AG, Caterpillar Incorporated, Rolls-Royce Holdings plc, Mahindra & Mahindra Limited, Mitsubishi Heavy Industries, General Motors, Renault SA, Ford Motor, Fiat SpA, Volvo AB, Shanghai Diesel Engine Company Limited, and Bosch.

Which region dominated the global internal combustion engine market share?

Asia-Pacific held the dominating position in internal combustion engine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of internal combustion engine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global internal combustion engine industry?

The current trends and dynamics in the internal combustion engine industry include continued demand in emerging markets for affordable transportation, technological advancements in fuel efficiency and emission control, and established infrastructure supporting fossil fuel distribution

Which fuel held the maximum share in 2023?

The petroleum expected to hold the maximum share of the internal combustion engine industry.