Insulin Delivery Pens Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Insulin Delivery Pens Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

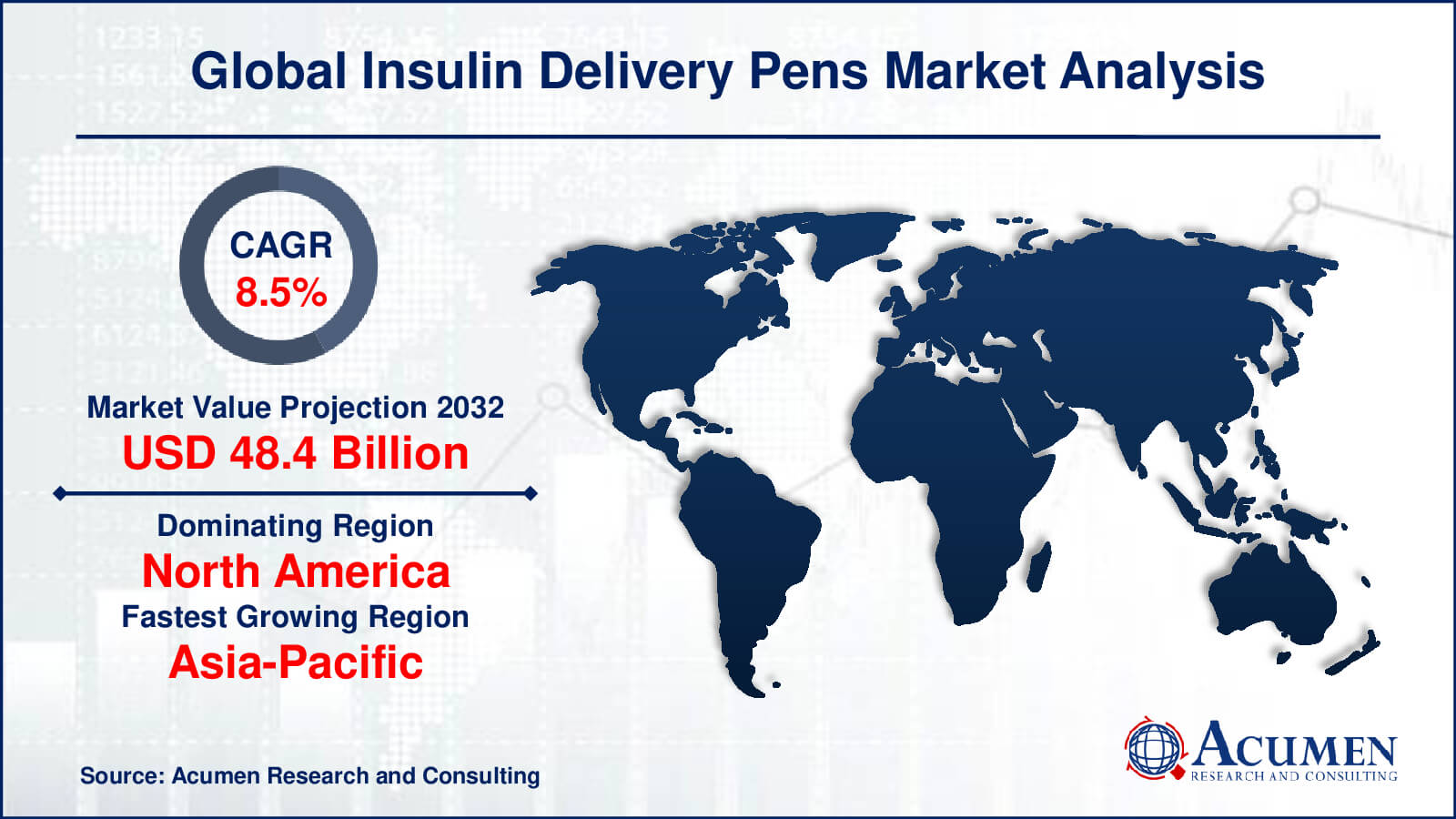

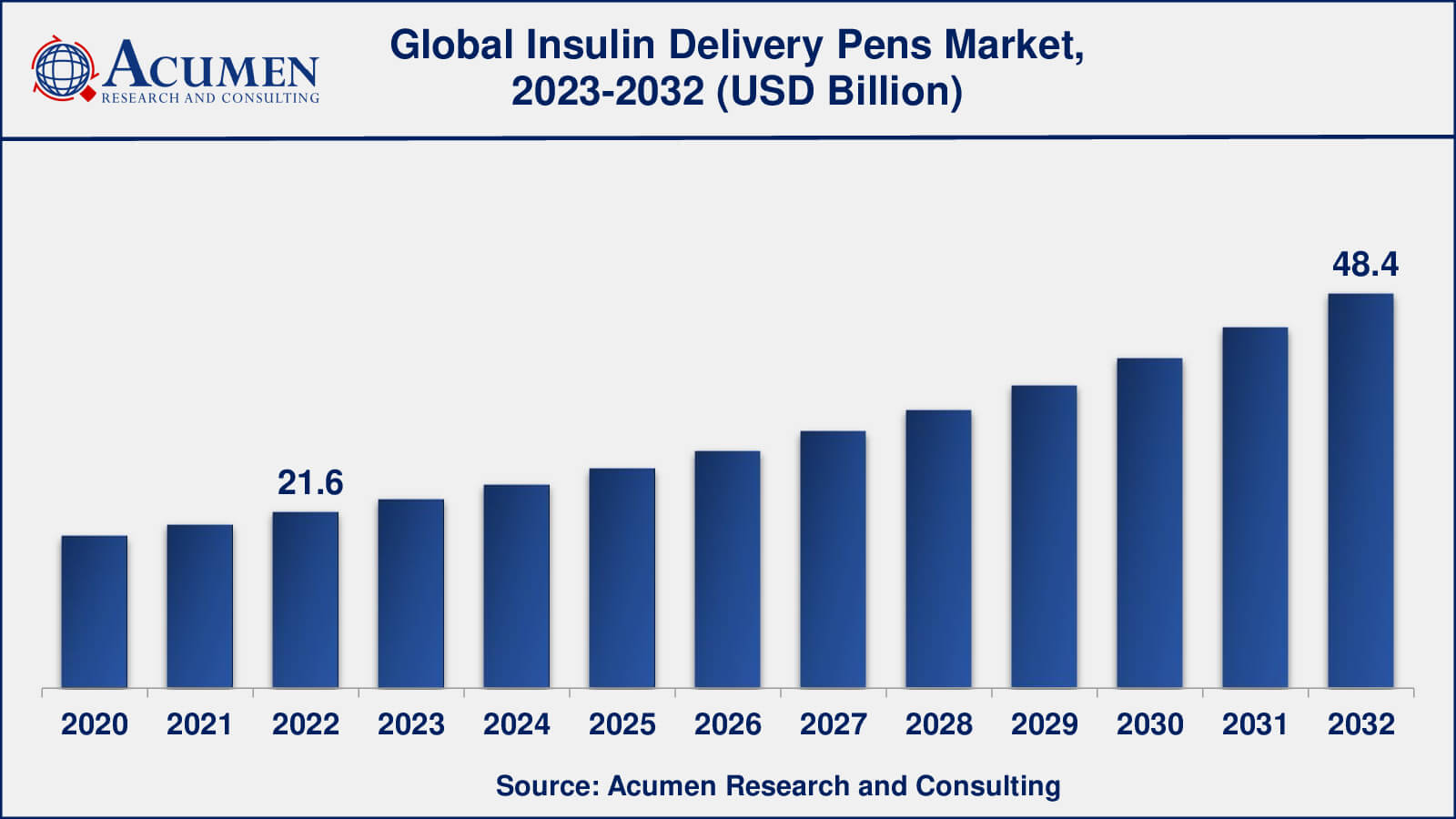

The Global Insulin Delivery Pens Market Size accounted for USD 21.6 Billion in 2022 and is estimated to achieve a market size of USD 48.4 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Insulin Delivery Pens Market Highlights

- Global insulin delivery pens market revenue is poised to garner USD 48.4 billion by 2032 with a CAGR of 8.5% from 2023 to 2032

- North America insulin delivery pens market value occupied almost USD 8 billion in 2022

- Asia-Pacific insulin delivery pens market growth will record a CAGR of over 9% from 2023 to 2032

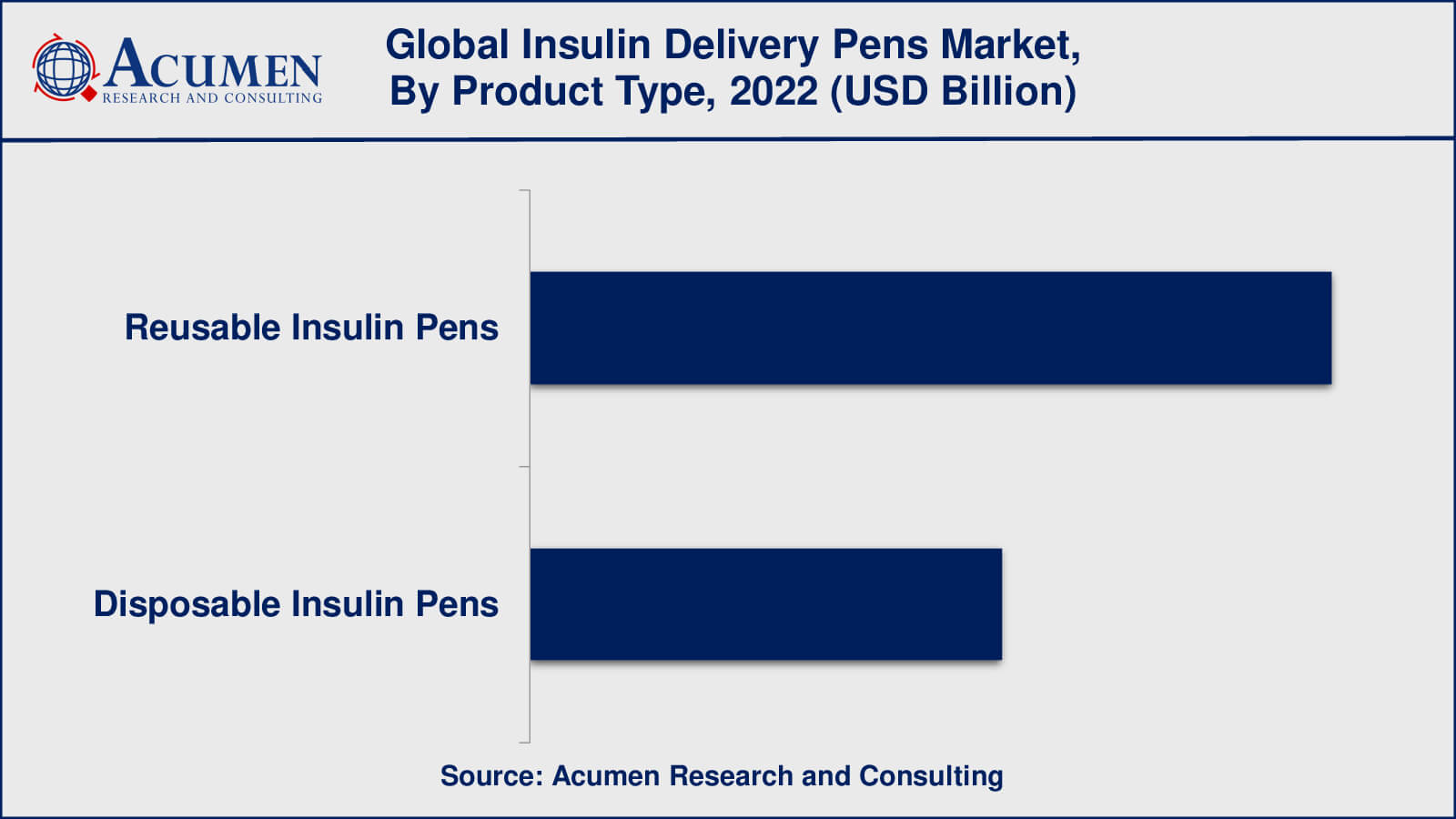

- Among product type, the disposable insulin pens sub-segment generated over US$ 13.6 billion revenue in 2022

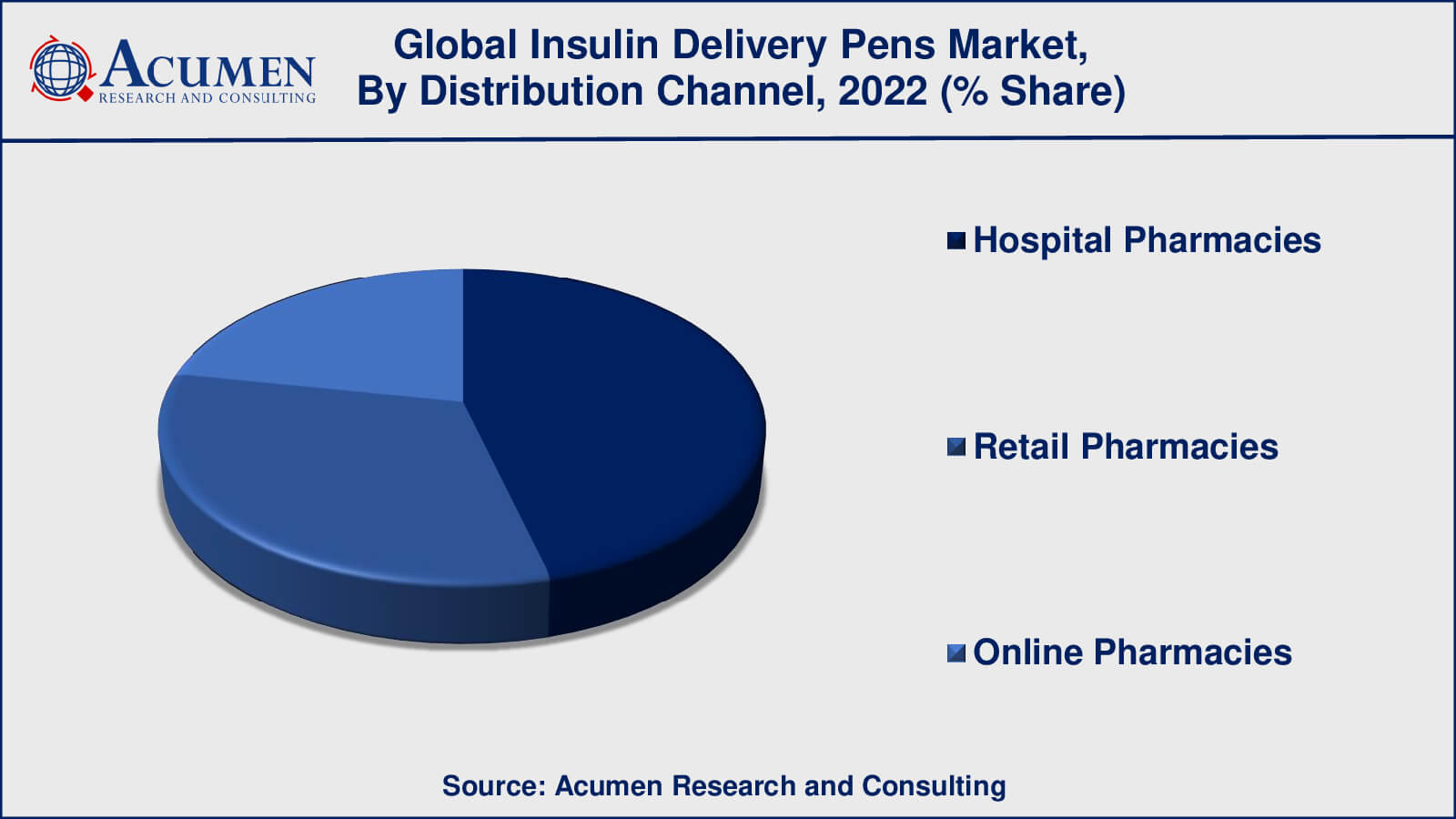

- Based on distribution channel, the hospital pharmacies sub-segment generated around 46% share in 2022

- Collaborations and partnerships is a popular insulin delivery pens market trend that fuels the industry demand

Insulin pens are utilized as a machine for the effective determination of diabetes. With the current innovative headways, insulin now accompanies diverse variations like reusable pens that can be utilized by simply stacking insulin cartridges accessible in packs. Dispensable insulin pens contain a prefilled cartridge and the whole pen is arranged or discarded giving helpful conveyance of insulin. Keen insulin pens are the most recent progression in diabetes administration. These brilliant insulin pens are either Bluetooth-empowered remote gadgets permitting programmed information sharing or gadgets that require information offering to a devoted USB information link. These pens likewise accompany an element joining a clinician-arranged bolus number cruncher with the capacity to convey different insulin measurements consistently, securely, and watchfully.

Global Insulin Delivery Pens Market Dynamics

Market Drivers

- Increasing prevalence of diabetes

- Growing awareness about the benefits of insulin pens

- Surging demand for self-administration of insulin

- Rise in geriatric population

Market Restraints

- High cost

- Device complexity

- Technical issues

Market Opportunities

- Growing adoption of insulin pumps

- Technological advancements

- Increasing demand for disposable pens

Insulin Delivery Pens Market Report Coverage

| Market | Insulin Delivery Pens Market |

| Insulin Delivery Pens Market Size 2022 | USD 21.6 Billion |

| Insulin Delivery Pens Market Forecast 2032 | USD 48.4 Billion |

| Insulin Delivery Pens Market CAGR During 2023 - 2032 | 8.5% |

| Insulin Delivery Pens Market Analysis Period | 2020 - 2032 |

| Insulin Delivery Pens Market Base Year | 2022 |

| Insulin Delivery Pens Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic plc, Tandem Diabetes Care, Inc.., Sanofi S.A., Owen Mumford Ltd, Biocon Ltd, DiabNext, Emperra GmbH, B. Braun Melsungen AG, Novo Nordisk A/S, Eli Lilly and Company, and Ypsomed AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Insulin Delivery Pens Market Insights

A few elements add to the development of the worldwide insulin conveyance pens market. One noteworthy driver is the move towards esteem pay models for treatments from unit-estimated installment models that are usually used to self-direct treatment for interminable ailments like diabetes. The interest in exceptional insulin pens has increased since human service partners look to accumulate valuable data from clinical trials with the current health condition of the patient. Likewise, diabetes being unending and an exceptionally costly sickness, individuals search for alternatives to lessen the costs identified with the general registration of diabetes. Savvy insulin pens enable patients to keep a check on their diabetes severity by monitoring all the vital measurements relating to the malady and its powerful administration.

Insulin Delivery Pens Market, By Segmentation

The worldwide market for insulin delivery pens is split based on product type, distribution channel, and geography.

Insulin Delivery Pen Market, By Product Type

- Reusable Insulin Pens

- Disposable Insulin Pens

According to the insulin delivery pens industry analysis, the disposable insulin pens segment dominated the insulin delivery pens market. This can be attributed to factors such as disposable insulin pens' ease of use, convenience, and cost-effectiveness when compared to reusable insulin pens. Disposable insulin pens have several advantages over reusable insulin pens, including lower infection risk, no need for cleaning, and lower cost of ownership, making them a preferred choice for many diabetic patients. Furthermore, the availability of a diverse range of disposable insulin pen products from various manufacturers contributes to the disposable insulin pen segment's market dominance. It is important to note, however, that the insulin delivery pens market is constantly evolving, and the dominance of any product type may change over time due to a variety of factors such as technological advancements, changes in patient preferences, and market trends.

Insulin Delivery Pen Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

According to the insulin delivery pens market forecast, the retail pharmacies segment will achieve utmost shares from 2023 to 2032. This is due to factors such as the widespread availability of insulin delivery pens in retail pharmacies, increased adoption of insulin delivery pens by diabetic patients, and the convenience of purchasing insulin delivery pens at retail pharmacies. Retail pharmacies provide patients and their families with easy access to insulin delivery pens, as well as a variety of insulin delivery pen brands to choose from. Furthermore, retail pharmacies frequently offer pharmacist consultation services, which can help diabetic patients better understand how to use insulin delivery pens and manage their diabetes. It is important to note, however, that the dominance of any distribution channel can shift over time due to a variety of variables including shifts in patient preferences, healthcare policies, and market trends.

Insulin Delivery Pen Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Insulin Delivery Pens Market Regional Analysis

North America led the global market for insulin delivery pens, followed by Europe and Asia-Pacific. North America's dominance is attributed to factors such as high diabetes prevalence, well-established healthcare infrastructure, and growing penetration of insulin delivery pens over traditional insulin delivery methods such as vials and syringes. The presence of significant market players in the region also contributes to the growth of the North American insulin delivery pens market.

Europe is the world's second-largest market for insulin delivery pens, with growth fueled by factors such as rising diabetes prevalence, favorable government efforts to encourage the use of insulin delivery pens, and rising adoption of insulin delivery pens over traditional insulin delivery methods.

The Asia-Pacific region is expected to see significant growth in the insulin delivery pens market because of variables such as a large patient pool with diabetes, increased awareness about diabetes management, and increased adoption of insulin delivery pens as a primary option of insulin delivery.

Insulin Delivery Pens Market Players

Some of the top insulin delivery pens companies offered in the professional report includes Medtronic plc, Tandem Diabetes Care, Inc., Sanofi S.A., Owen Mumford Ltd, Biocon Ltd, DiabNext, Emperra GmbH, B. Braun Melsungen AG, Novo Nordisk A/S, Eli Lilly and Company, and Ypsomed AG.

Frequently Asked Questions

What was the market size of the global insulin delivery pens in 2022?

The market size of insulin delivery pens was USD 21.6 billion in 2022.

What is the CAGR of the global insulin delivery pens market from 2023 to 2032?

The CAGR of insulin delivery pens is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the insulin delivery pens market?

The key players operating in the global insulin delivery pens market are including Medtronic plc, Tandem Diabetes Care, Inc.., Sanofi S.A., Owen Mumford Ltd, Biocon Ltd, DiabNext, Emperra GmbH, B. Braun Melsungen AG, Novo Nordisk A/S, Eli Lilly and Company, and Ypsomed AG.

Which region dominated the global insulin delivery pens market share?

North America held the dominating position in insulin delivery pens industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of insulin delivery pens during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global insulin delivery pens industry?

The current trends and dynamics in the insulin delivery pens industry include increasing prevalence of diabetes, growing awareness about the benefits of insulin pens, and surging demand for self-administration of insulin.

Which product type held the maximum share in 2022?

The disposable insuline pens product type held the maximum share of the insulin delivery pens industry.