Ink Solvents Market | Acumen Research and Consulting

Ink Solvents Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

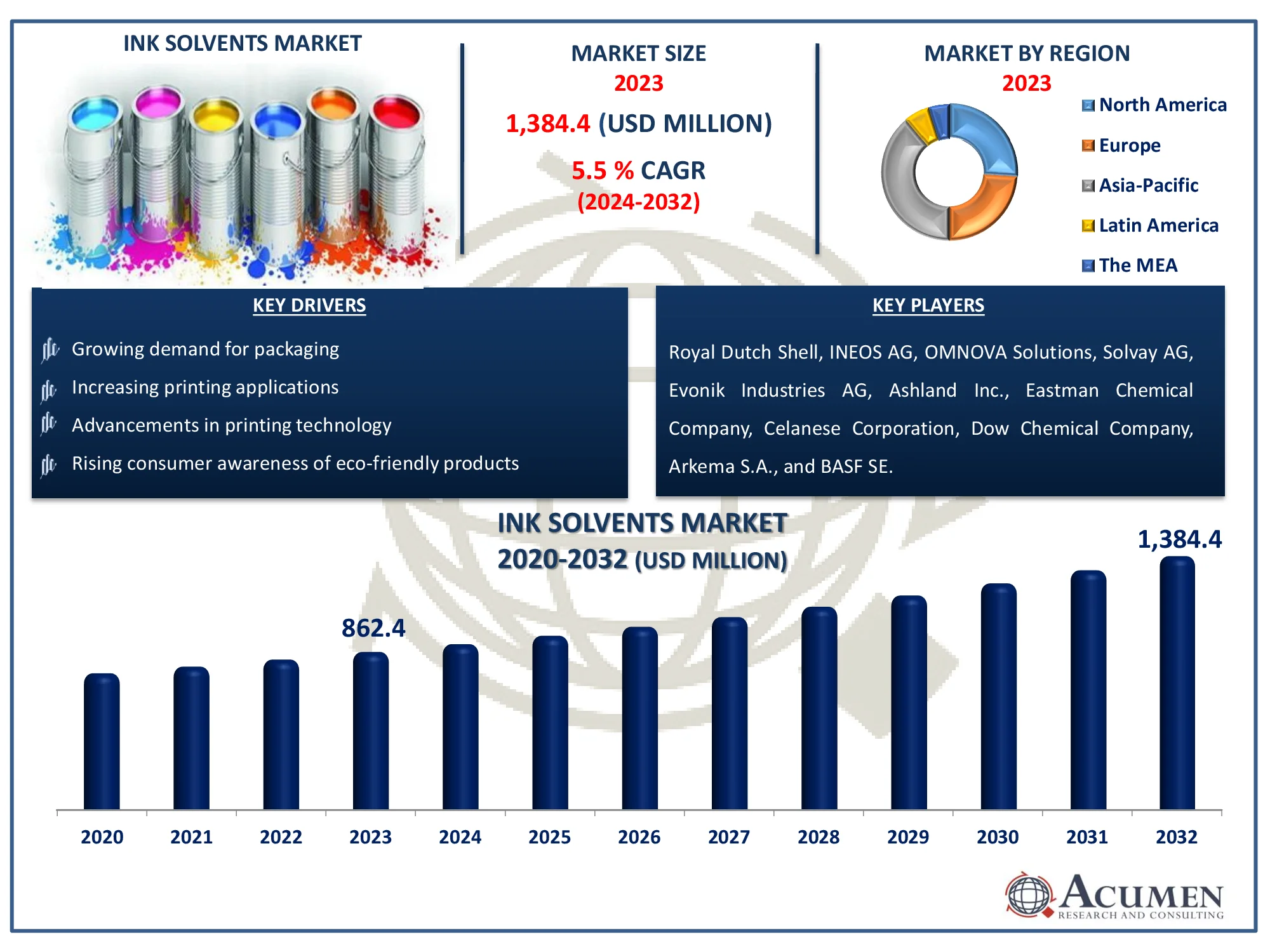

The Global Ink Solvents Market Size accounted for USD 862.4 Million in 2023 and is estimated to achieve a market size of USD 1,384.4 Million by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

Ink Solvents Market Highlights

- Global ink solvents market revenue is poised to garner USD 1,384.4 million by 2032 with a CAGR of 5.5% from 2024 to 2032

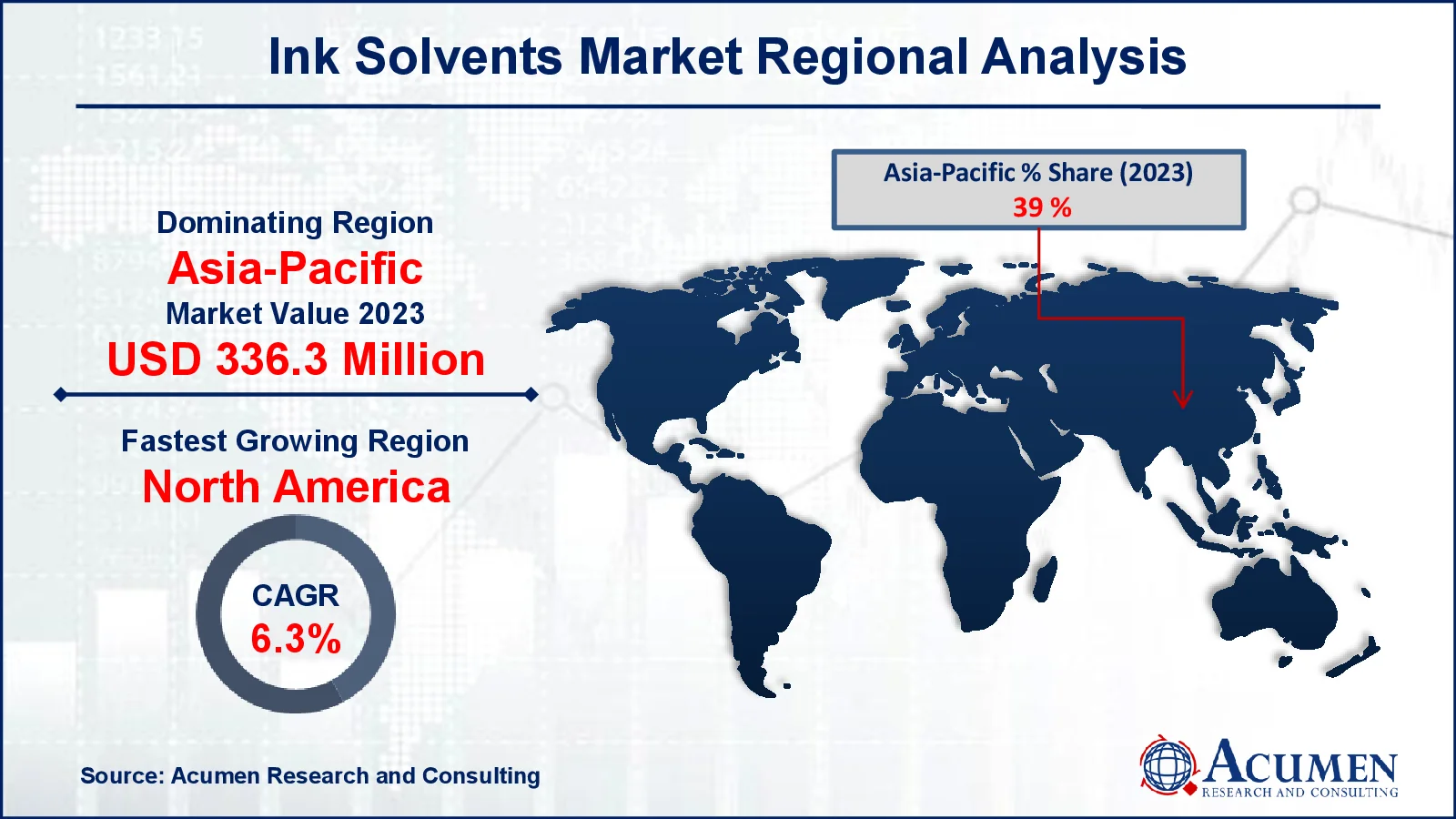

- Asia-Pacific ink solvents market value occupied around USD 336.3 million in 2023

- North America ink solvents market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Among solvent type, the alcohols sub-segment generated more than USD 413.9 million revenue in 2023

- Based on process, the flexography sub-segment generated around 45% market share in 2023

- Integration with advanced printing techniques is a popular ink solvents market trend that fuels the industry demand

Ink solvents are liquid components of inks that dissolve and distribute pigments and other ingredients. They serve an important part in the printing process by ensuring that ink flows smoothly and is applied evenly to varied substrates. Ink solvents are classified into three types: water-based solvents (like water), solvent-based solvents (such as alcohols, ketones, and esters), and eco-solvent solvents. The solvent is chosen based on the ink's desired qualities, such as drying time, adhesion, and colorfastness. Ink solvents are required for ink formulation to ensure adequate flow, drying, and adhesion. They are categorized into three types: water-based, solvent-based, and eco-solvent, each with unique properties and applications.

Global Ink Solvents Market Dynamics

Market Drivers

- Growing demand for packaging

- Increasing printing applications

- Advancements in printing technology

- Rising consumer awareness of eco-friendly products

Market Restraints

- Strict environmental regulations

- Volatility in raw material prices, concerns over health and safety

- Competition from digital printing technologies

Market Opportunities

- Development of sustainable and biodegradable solvents

- Expansion into emerging markets

- Increasing demand for customized ink solutions

Ink Solvents Market Report Coverage

| Market | Ink Solvents Market |

| Ink Solvents Market Size 2022 |

USD 862.4 Million |

| Ink Solvents Market Forecast 2032 | USD 1,384.4 Million |

| Ink Solvents Market CAGR During 2023 - 2032 | 5.5% |

| Ink Solvents Market Analysis Period | 2020 - 2032 |

| Ink Solvents Market Base Year |

2022 |

| Ink Solvents Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Solvent Type, By Type, By Process, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Royal Dutch Shell, INEOS AG, OMNOVA Solutions, Solvay AG, Evonik Industries AG, Ashland Inc., Eastman Chemical Company, Celanese Corporation, Dow Chemical Company, Arkema S.A., and BASF SE. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ink Solvents Market Insights

Low VOC emission of inks and an increase in demand for ink solvents in several industries are the key factors driving the bio-based ink solvents industry. The packaging industry is constantly growing; thus, the printing has expanded its strong foothold in the global inks industry. Also, the advent of solvent-based inks in advertising and textiles applications has increased the demand for ink solvents. Excellent printing quality, image stability, and adaptability in the printing on any substrate are driving the demand in the printing inks industry, thus expanding the growth of ink solvents industry. Moreover, the development in technologies and launch of bio-based solvents have led to the replacement of traditional solvents. The rise in demand for bio-based inks is projected to fuel the industry during the ink solvents market forecast period.

The ink solvents industry is driven by inexpensive nature and non-coating properties that are important factors which are promoting the market positively. The demand for petroleum-based solvents has been declining due to the rise in the number of strict government regulations over increased VOC emissions from printing inks, paints and coatings, and industrial cleaning products; an increase in environmental awareness. Less destructive and environment-friendly ink solvents are substituting the petroleum-based solvents. These factors are projected to drive the bio-based solvents during the ink solvents industry forecast period.

Ink Solvents Market Segmentation

The worldwide market for ink solvents is split based on solvent type, type, process, and geography.

Ink Solvents Market By Solvent Type

- Alcohols

- Ketones

- Hydrocarbons

- Others (Including Ethers and Esters)

According to ink solvents industry analysis, the alcohols category is expected to be the largest in the market. Alcohols are commonly employed because of their great qualities, such as rapid evaporation, low toxicity, and high solvency. They are excellent for a variety of uses, including packaging, paper, and publishing. Ketones are also important, as they dry quickly and have a high solubility. However, because of their instability, they may pose environmental risks. Hydrocarbons are another option that provides good solubility and cost, although they are frequently associated with increased toxicity and flammability. Other solvents, such as ethers and esters, have specialized applications and are utilized in certain types of ink. While they may have advantages in some situations, they have smaller market shares than alcohols, ketones, and hydrocarbons.

Ink Solvents Market By Type

- Conventional

- Bio-based

The ink solvents market is primarily classified into conventional and bio-based categories. The bio-based segment has grown significantly, accounting for about 60% of the market share. This trend is due to the increased demand for sustainable and ecologically friendly alternatives in the printing and packaging industries. Bio-based ink solvents are obtained from renewable resources, resulting in a lower environmental effect and VOC (volatile organic compound) emissions than their conventional counterparts. As regulatory demands on eco-friendly practices increase, companies are shifting to greener options, reinforcing the bio-based segment's dominance in the ink solvent market.

Ink Solvents Market By Process

- Flexography

- Gravure

- Others (Including Screen and Digital)

Flexography is growing as the major section of the ink solvents industry. This technology is frequently used in packaging, labeling, and flexible materials since it is versatile and efficient. Flexography's ability to print on a wide range of substrates, including non-porous materials such as plastics, making it excellent for high-volume enterprises. The procedure employs fast-drying, low-viscosity inks, including those using bio-based solvents, which increases its attractiveness. Flexography's adaptation to eco-friendly inks contributes to its prominence in the ink solvents industry, propelling its expansion over Gravure and other techniques such as Screen and Digital printing.

Ink Solvents Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ink Solvents Market Regional Analysis

Asia-Pacific is the largest region in the market. In Asia-Pacific, particularly in China and India, the market is expanding rapidly due to rising demand for packaging and flexible materials in industries such as food and beverage and consumer goods. While conventional solvents remain dominant, bio-based alternatives are gradually gaining traction. North America's market benefits from a robust printing industry and growing awareness in sustainable practices. The region is seeing a growth in the use of bio-based solvents, spurred by regulatory rules that promote environmentally friendly solutions.

Europe is also in the forefront of the transition to bio-based solvents, owing to strict environmental legislation such as REACH. The region's commitment to sustainability and circular economy principles drives up demand for greener alternatives. Latin America, the Middle East, and Africa are experiencing steady growth, which is being driven mostly by increased industrial uses and rising environmental awareness. However, these places are slower to adopt bio-based solvents than more developed countries.

Ink Solvents Market Players

Some of the top ink solvents companies offered in our report includes Royal Dutch Shell, INEOS AG, OMNOVA Solutions, Solvay AG, Evonik Industries AG, Ashland Inc., Eastman Chemical Company, Celanese Corporation, Dow Chemical Company, Arkema S.A., and BASF SE.

Frequently Asked Questions

How big is the ink solvents market?

The ink solvents market size was valued at USD 862.4 million in 2023.

What is the CAGR of the global ink solvents market from 2024 to 2032?

The CAGR of ink solvents is 5.5% during the analysis period of 2024 to 2032.

Which are the key players in the ink solvents market?

The key players operating in the global market are including Royal Dutch Shell, INEOS AG, OMNOVA Solutions, Solvay AG, Evonik Industries AG, Ashland Inc., Eastman Chemical Company, Celanese Corporation, Dow Chemical Company, Arkema S.A., and BASF SE.

Which region dominated the global ink solvents market share?

Asia-Pacific held the dominating position in ink solvents industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of ink solvents during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global ink solvents industry?

The current trends and dynamics in the ink solvents industry include growing demand for packaging, increasing printing applications, advancements in printing technology, and rising consumer awareness of eco-friendly products.

Which type held the maximum share in 2023?

The bio-based type held the maximum share of the ink solvents industry.