Injectable Contraceptives Market | Acumen Research and Consulting

Injectable Contraceptives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

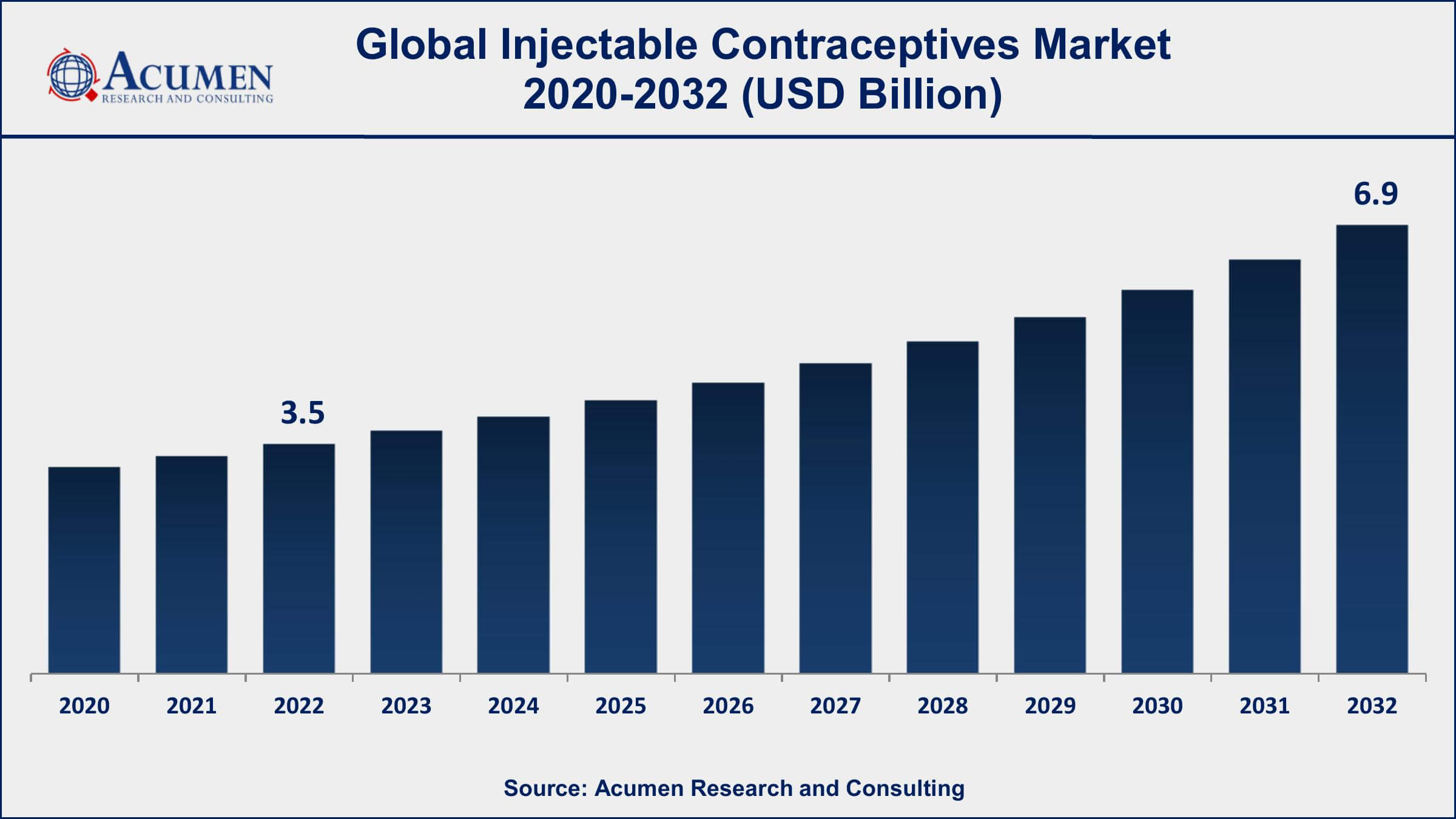

The Global Injectable Contraceptives Market Size accounted for USD 3.5 Billion in 2022 and is projected to achieve a market size of USD 6.9 Billion by 2032 growing at a CAGR of 7.1% from 2023 to 2032.

Injectable Contraceptives Market Highlights

- Global Injectable Contraceptives Market revenue is expected to increase by USD 6.9 Billion by 2032, with a 7.1% CAGR from 2023 to 2032

- North America region led with more than 52% of Injectable Contraceptives Market share in 2022

- Asia-Pacific Injectable Contraceptives Market growth will record a CAGR of around 7.5% from 2023 to 2032

- By type, the progesterone-only injectables segment is the largest segment in the market, accounting for over 64% of the market share in 2022

- By duration of action, the short-acting segment has recorded more than 58% of the revenue share in 2022

- Increasing awareness of family planning and reproductive health, drives the Injectable Contraceptives Market value

Injectable contraceptives, often referred to as birth control shots, are a form of hormonal contraception designed to prevent pregnancy. They typically contain synthetic versions of the hormones progesterone or a combination of progesterone and estrogen. These hormones work by suppressing ovulation (the release of an egg from the ovaries), thickening cervical mucus to impede sperm movement, and altering the uterine lining to make it less receptive to a fertilized egg. Injectable contraceptives are administered through a shot, usually given every one to three months, depending on the specific product. They offer a convenient and effective option for women seeking long-acting birth control without the need for daily pills or other methods.

The market for injectable contraceptives has been growing steadily due to their effectiveness, convenience, and reliability. This growth is driven by various factors, including rising awareness of family planning and the need for birth control options, particularly in developing countries. Injectable contraceptives have gained popularity among women who prefer a discreet and long-lasting contraceptive method. Additionally, the expansion of healthcare access and the introduction of new formulations have contributed to market growth. However, the market's growth may also be influenced by factors such as regulatory changes, affordability, and cultural attitudes towards contraception.

Global Injectable Contraceptives Market Trends

Market Drivers

- High contraceptive efficacy and user convenience

- Increasing awareness of family planning and reproductive health

- Expanding access to healthcare in developing regions

- Discreet nature of injectable contraceptives

- Rising population and the need for effective birth control

Market Restraints

- Side effects and potential health risks associated with hormonal contraception

- Cultural and social barriers in some regions

Market Opportunities

- Growing emphasis on women's health and empowerment

- Public health initiatives and government support

Injectable Contraceptives Market Report Coverage

| Market | Injectable Contraceptives Market |

| Injectable Contraceptives Market Size 2022 | USD 3.5 Billion |

| Injectable Contraceptives Market Forecast 2032 | USD 6.9 Billion |

| Injectable Contraceptives Market CAGR During 2023 - 2032 | 7.1% |

| Injectable Contraceptives Market Analysis Period | 2020 - 2032 |

| Injectable Contraceptives Market Base Year |

2022 |

| Injectable Contraceptives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Age Group, By Duration of Action, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer Inc., Bayer AG, Merck & Co., Inc., Allergan PLC, Teva Pharmaceutical Industries Ltd., Agile Therapeutics, Novartis AG, Sun Pharmaceutical Industries Ltd., Mylan N.V. (now part of Viatris Inc.), TherapeuticsMD Inc., Afaxys Inc., and Sinopharm Group Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Injectable contraceptives, commonly known as birth control shots, are a form of hormonal contraception designed to prevent pregnancy. They are administered by injecting a synthetic hormone, typically progestin, into a woman's muscle, typically in the arm or buttocks, at regular intervals, usually every few weeks or months. These hormones work by suppressing ovulation (the release of eggs from the ovaries), thickening cervical mucus to hinder sperm movement, and altering the uterine lining to make it less receptive to implantation, thereby preventing pregnancy. Injectable contraceptives offer a highly effective and convenient method of birth control that doesn't require daily attention, making them a popular choice for individuals seeking long-lasting contraception.

The primary application of injectable contraceptives is, of course, pregnancy prevention. They provide a reliable and discreet option for women who want to space pregnancies, delay childbearing, or avoid becoming pregnant altogether. These contraceptives are particularly beneficial for individuals who may have difficulty adhering to daily birth control methods, such as birth control pills. Additionally, injectable contraceptives can be used by women who are unable to use other forms of hormonal contraception, such as those with medical conditions that contraindicate the use of estrogen-containing birth control methods.

The global market for injectable contraceptives had been experiencing steady growth, driven by several key factors. Injectable contraceptives had gained popularity among women seeking effective, long-lasting birth control options that did not require daily attention. The convenience factor of receiving a contraceptive injection every few weeks or months appealed to many individuals, especially those with busy lifestyles or those who had difficulty adhering to daily pill regimens. Moreover, increased awareness of family planning and reproductive health, coupled with efforts to expand access to healthcare services in developing regions, contributed to the growth of the injectable contraceptives market.

Injectable Contraceptives Market Segmentation

The global Injectable Contraceptives Market segmentation is based on type, age group, duration of action, end-user, and geography.

Injectable Contraceptives Market By Type

- Progesterone-only injectables

- Norethisterone enanthate

- Depot medroxyprogesterone acetate

- Combined injectable contraceptives

According to the injectable contraceptives industry analysis, the progesterone-only injectables segment accounted for the largest market share in 2022. These contraceptives, often referred to as progestin-only or depot medroxyprogesterone acetate (DMPA) injections, have gained popularity among women seeking highly reliable contraception with fewer estrogen-related side effects. One of the key growth drivers for progesterone-only injectables is their high contraceptive efficacy. These injections have demonstrated a remarkable ability to prevent pregnancy, with effectiveness rates exceeding 90%, making them a reliable choice for women who want to avoid unintended pregnancies. Additionally, progesterone-only injectables are suitable for women who cannot use estrogen-based contraceptives due to medical reasons or side effects, expanding the market's reach.

Injectable Contraceptives Market By Age Group

- 15–24 years

- 25–34 years

- 35–44 years

- Above 44 years

In terms of age groups, the 15–24 years segment is expected to witness significant growth in the coming years. This demographic is increasingly turning to injectable contraceptives as a preferred method of birth control due to its effectiveness, convenience, and privacy. One key driver of growth in this age segment is the desire for reliable and discreet contraception among young adults who may not be ready for parenthood. Injectable contraceptives offer a highly effective solution, with typical-use effectiveness rates of over 90%, making them an attractive option for preventing unintended pregnancies. Additionally, the convenience of receiving an injection every few weeks or months appeals to young adults who are often busy with educational pursuits or early career development, reducing the risk of missed doses associated with daily birth control pills.

Injectable Contraceptives Market By Duration of Action

- Short-acting

- Long-acting

According to the injectable contraceptives market forecast, the short-acting segment is expected to witness significant growth in the coming years. Short-acting injectable contraceptives typically involve progestin-only formulations and are administered every few weeks or months, providing effective birth control with a relatively quick return to fertility once discontinued. This adaptability is a key factor driving their popularity. One of the primary drivers of growth in the short-acting segment is the desire for effective contraception without the long-lasting commitment associated with some other methods. Women who may be planning to start a family in the near future or are uncertain about their long-term family planning goals often opt for short-acting injectables. These contraceptives provide a high level of effectiveness while offering the flexibility to discontinue their use and regain fertility relatively quickly. This appeals to individuals who value control over their reproductive choices and appreciate the convenience of a reversible method.

Injectable Contraceptives Market By End-User

- Gynecology clinics

- Hospital

- Others

Based on the end-user, the hospital segment is expected to continue its growth trajectory in the coming years. One of the primary drivers of growth in the hospital segment is the increasing emphasis on comprehensive reproductive healthcare services. Hospitals are often seen as trusted healthcare providers offering a wide range of services, including family planning and contraception. As healthcare systems expand their reproductive health offerings, more women are turning to hospitals for access to injectable contraceptives. The hospital setting provides a convenient and well-regulated environment for women to receive contraceptive injections, often accompanied by counseling and education about family planning. Another factor contributing to the growth of the hospital segment is the rising awareness of the importance of safe and effective birth control methods.

Injectable Contraceptives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Injectable Contraceptives Market Regional Analysis

North America's dominance in the injectable contraceptives market can be attributed to a combination of factors that create a favorable environment for the growth and adoption of these contraceptive methods. North America boasts a well-established and sophisticated healthcare infrastructure. The region has a robust network of healthcare providers, including clinics, hospitals, and private healthcare facilities, which makes it easier for individuals to access injectable contraceptives. This accessibility, combined with a strong emphasis on reproductive health and family planning services, encourages more women in North America to opt for injectable contraceptives as a reliable and convenient birth control option. Moreover, the region benefits from a high level of awareness and education about reproductive health and contraception. Comprehensive sex education programs, public health initiatives, and campaigns promoting family planning have contributed to an informed population. This awareness has led to increased demand for effective contraceptive options, with many individuals choosing injectable contraceptives due to their high efficacy rates and the convenience of not requiring daily attention, as opposed to oral contraceptives.

Injectable Contraceptives Market Player

Some of the top injectable contraceptives market companies offered in the professional report include Pfizer Inc., Bayer AG, Merck & Co., Inc., Allergan PLC, Teva Pharmaceutical Industries Ltd., Agile Therapeutics, Novartis AG, Sun Pharmaceutical Industries Ltd., Mylan N.V. (now part of Viatris Inc.), TherapeuticsMD Inc., Afaxys Inc., and Sinopharm Group Co., Ltd.

Frequently Asked Questions

What was the market size of the global injectable contraceptives in 2022?

The market size of injectable contraceptives was USD 3.5 Billion in 2022.

What is the CAGR of the global injectable contraceptives market from 2023 to 2032?

The CAGR of injectable contraceptives is 7.1% during the analysis period of 2023 to 2032.

Which are the key players in the injectable contraceptives market?

The key players operating in the global market are including Pfizer Inc., Bayer AG, Merck & Co., Inc., Allergan PLC, Teva Pharmaceutical Industries Ltd., Agile Therapeutics, Novartis AG, Sun Pharmaceutical Industries Ltd., Mylan N.V. (now part of Viatris Inc.), TherapeuticsMD Inc., Afaxys Inc., and Sinopharm Group Co., Ltd.

Which region dominated the global injectable contraceptives market share?

North America held the dominating position in injectable contraceptives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of injectable contraceptives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global injectable contraceptives industry?

The current trends and dynamics in the injectable contraceptives industry include high contraceptive efficacy and user convenience, and increasing awareness of family planning and reproductive health.

Which type held the maximum share in 2022?

The progesterone-only injectables type held the maximum share of the injectable contraceptives industry.