Inflight Advertising Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Inflight Advertising Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

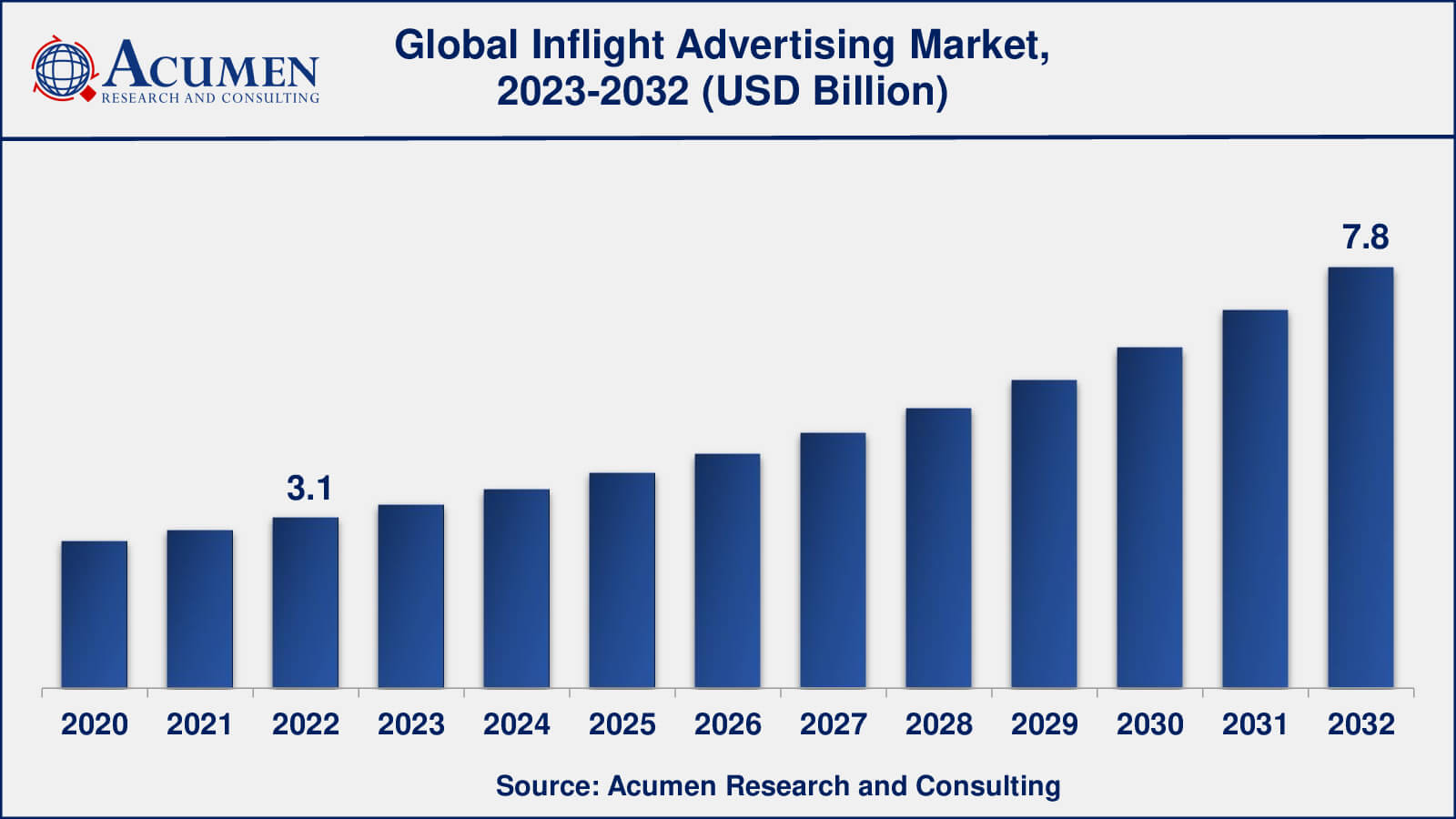

The Global Inflight Advertising Market Size accounted for USD 3.1 Billion in 2022 and is estimated to achieve a market size of USD 7.8 Billion by 2032 growing at a CAGR of 9.7% from 2023 to 2032.

Inflight Advertising Market Highlights

- Global inflight advertising market revenue is poised to garner USD 7.8 billion by 2032 with a CAGR of 9.7% from 2023 to 2032

- North America inflight advertising market value occupied more than USD 1.3 billion in 2022

- Asia-Pacific inflight advertising market growth will record a CAGR of more than 10% from 2023 to 2032

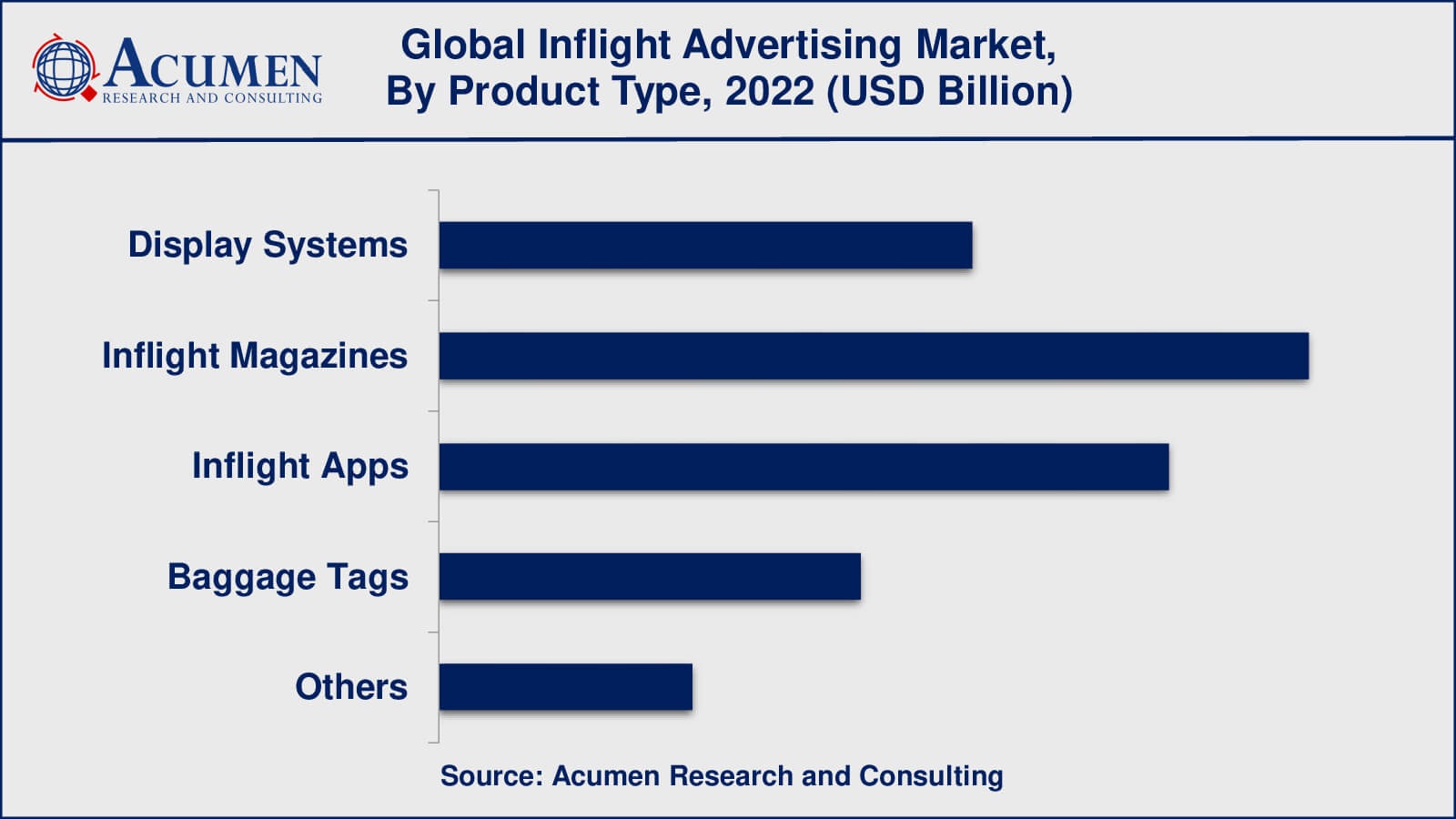

- Among product type, the in-flight magazine sub-segment generated over US$ 973 million revenue in 2022

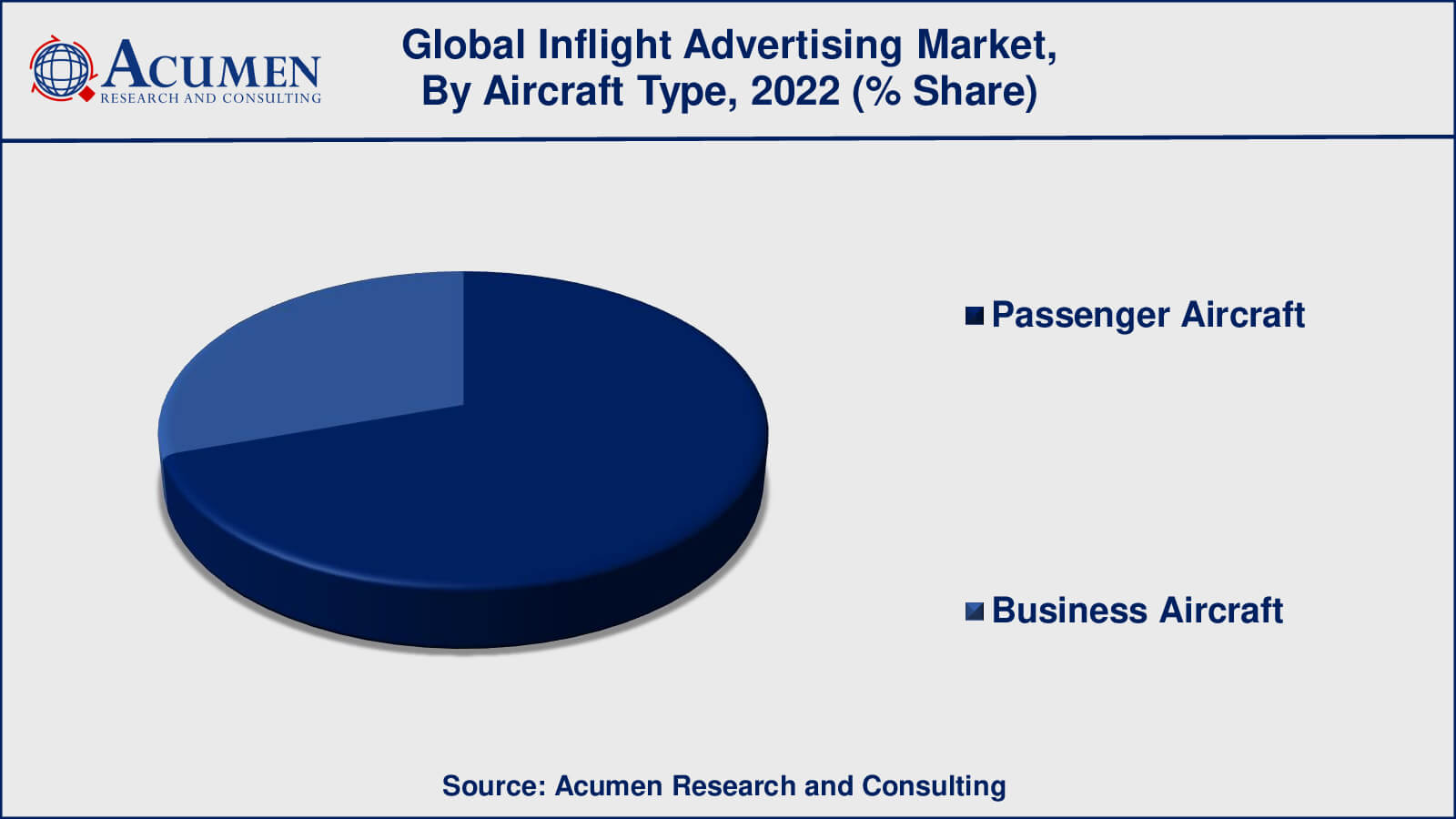

- Based aircraft type, the passenger aircraft sub-segment generated around 70% share in 2022

- Development of new advertising formats is a popular inflight advertising market trend that fuels the industry demand

In-flight advertising is the practice of displaying advertisements to air travelers during a flight. This can include a variety of advertising formats such as video advertisements on seat-back screens, product placements in in-flight entertainment programming, and branded content in in-flight magazines.

In-flight advertising campaigns have increasingly emphasized sustainability and environmental friendliness in recent years. Many airlines and advertisers are promoting environmentally friendly products and services, such as reusable water bottles and carbon offset programs.

In-flight advertising companies are moving into fresh markets, such as Asia and the Middle East, as airline companies in these regions invest in new in-flight entertainment systems and pursue to generate more revenue from ancillary sources. Spafax, for example, recently expanded its Asian operations by opening a new office in Singapore.

Global Inflight Advertising Market Dynamics

Market Drivers

- Increasing number of air travelers

- Growing demand for inflight entertainment

- Availability of inflight Wi-Fi

- Increased focus on ancillary revenue

Market Restraints

- Competition from other advertising channels

- Limited advertising space

- Privacy concerns

Market Opportunities

- Increased use of programmatic advertising

- Integration with inflight entertainment systems

- Emphasis on sustainability

Inflight Advertising Market Report Coverage

| Market | Inflight Advertising Market |

| Inflight Advertising Market Size 2022 | USD 3.1 Billion |

| Inflight Advertising Market Forecast 2032 | USD 7.8 Billion |

| Inflight Advertising Market CAGR During 2023 - 2032 | 9.7% |

| Inflight Advertising Market Analysis Period | 2020 - 2032 |

| Inflight Advertising Market Base Year | 2022 |

| Inflight Advertising Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Aircraft Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Atin OOH, EAM Advertising LLC, Epsilon, Global Eagle, IMM International, INK, JCDecaux, MaXposure Media Group (I) Pvt. Ltd., Panasonic Avionics Corporation, and Spafax. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Inflight Advertising Market Insights

The growing number of air travelers is a major factor driving the in-flight advertising market value. As more people fly, there is a larger audience for in-flight advertising that can be targeted to specific demographics and regions. Another factor driving the in-flight advertising market growth is the raising demand for in-flight entertainment. Passengers expect high-quality in-flight entertainment, such as movies, television shows, and music. As airlines invest in new in-flight entertainment systems, new advertising opportunities emerge.

In-flight Wi-Fi is becoming more widely available, allowing passengers to stay connected while also providing advertisers with new opportunities to deliver targeted digital ads. Furthermore, advancements in programmatic advertising, personalized targeting, and real-time bidding make it easier for advertisers to deliver personalized ads to the right audiences at the right time.

However, inflight advertising competes with other advertising channels, such as online and outdoor advertising, which may have an impact on market growth. Furthermore, while there are numerous opportunities for in-flight advertising, there is a limited amount of space on an airplane, which may limit the market growth. However, the airline industry is vulnerable to economic downturns and global events such as pandemics, which can affect the number of air travelers as well as the number of money advertisers, are willing to spend on in-flight advertising.

Furthermore, airlines are looking for additional revenue streams other than ticket sales, and in-flight advertising can be a lucrative source of income. Advertisers are also experimenting with new ways to engage passengers, such as immersive experiences, virtual reality, and augmented reality. All of these factors are expected to generate numerous growth opportunities for the in-flight advertising industry from 2023 to 2032.

Inflight Advertising Market Segmentation

The worldwide market for inflight advertising is split based on product type, aircraft type, and geography.

In-Flight Advertising Market Product Types

- Display Systems

- Inflight Magazines

- Inflight Apps

- Baggage Tags

- Others

As per the inflight advertising industry analysis, in-flight magazines have been the dominant product type in the in-flight entertainment industry. Inflight magazines, which typically feature articles on travel, lifestyle, and culture, are a popular form of reading material provided to passengers during flights. For many years, in-flight magazines have been a staple of the aviation industry, and they remain popular with both airlines and passengers. However, as digital media and in-flight connectivity become more popular, in-flight apps are becoming more popular as well. Inflight apps, for example, are becoming increasingly popular with passengers as digital media and in-flight connectivity become more prevalent. In-flight apps provide passengers with a variety of entertainment options, such as movies, TV shows, games, and music, which they can access on their personal devices.

In-Flight Advertising Market Aircraft Types

- Passenger Aircraft

- Business Aircraft

According to inflight advertising market forecast, commercial passenger airlines typically carry the majority of inflight advertising. This is due to the fact that commercial airlines have a larger passenger base and thus provide more opportunities for advertisers to reach their target audience. Furthermore, passenger aircraft are used for a broader range of flights, including short-, medium-, and long-haul routes, providing advertisers with a more diverse audience with varying demographics and interests. Furthermore, passenger aircraft are commonly used for commercial flights that are more focused on leisure and tourism, attracting passengers who are more receptive to advertising messages.

Business aircraft, on the other hand, are normally used by smaller groups of executives or wealthy individuals and may not be suitable for mass-market advertising. However, some business aircraft may provide opportunities for targeted advertising, such as custom-branded interior design or endorsement of specific events or experiences.

Inflight Advertising Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Inflight Advertising Market Regional Analysis

North America is one of the most important markets for in-flight advertising, accounting for a sizable portion of the global market. The region is home to several major airlines, and North American passengers have a high demand for in-flight entertainment and amenities. Furthermore, the region has a well-developed advertising industry, with many of the region's leading advertisers and agencies based in the United States.

Europe is another important market for in-flight advertising, with many major airlines headquartered there. Furthermore, Europe has a thriving tourism industry, which drives demand for in-flight entertainment and facilities. Numerous major advertising markets, such as the United Kingdom, Germany, and France, are also located in the region.

Asia Pacific is one of the fastest-growing markets for in-flight advertising, with many airlines investing heavily in new in-flight entertainment systems and amenities. The region also has a sizable and expanding middle class, which drives demand for air travel and in-flight services. Furthermore, China, Japan, and South Korea are all major advertising markets in Asia Pacific.

Inflight Advertising Market Players

Some of the top inflight advertising companies offered in the professional report include Atin OOH, EAM Advertising LLC, Epsilon, Global Eagle, IMM International, INK, JCDecaux, MaXposure Media Group (I) Pvt. Ltd., Panasonic Avionics Corporation, and Spafax.

Frequently Asked Questions

What was the market size of the global inflight advertising in 2022?

The market size of inflight advertising was USD 3.1 billion in 2022.

What is the CAGR of the global inflight advertising market from 2023 to 2032?

The CAGR of inflight advertising is 9.7% during the analysis period of 2023 to 2032.

Which are the key players in the inflight advertising market?

The key players operating in the global market are including Atin OOH, EAM Advertising LLC, Epsilon, Global Eagle, IMM International, INK, JCDecaux, MaXposure Media Group (I) Pvt. Ltd., Panasonic Avionics Corporation, and Spafax.

Which region dominated the global inflight advertising market share?

North America held the dominating position in inflight advertising industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of inflight advertising during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global inflight advertising industry?

The current trends and dynamics in the inflight advertising industry include increasing number of air travelers, growing demand for inflight entertainment, and availability of inflight Wi-Fi.

Which product type held the maximum share in 2022?

The inflight magazines product type held the maximum share of the inflight advertising industry.