Industrial Water Treatment Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Water Treatment Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

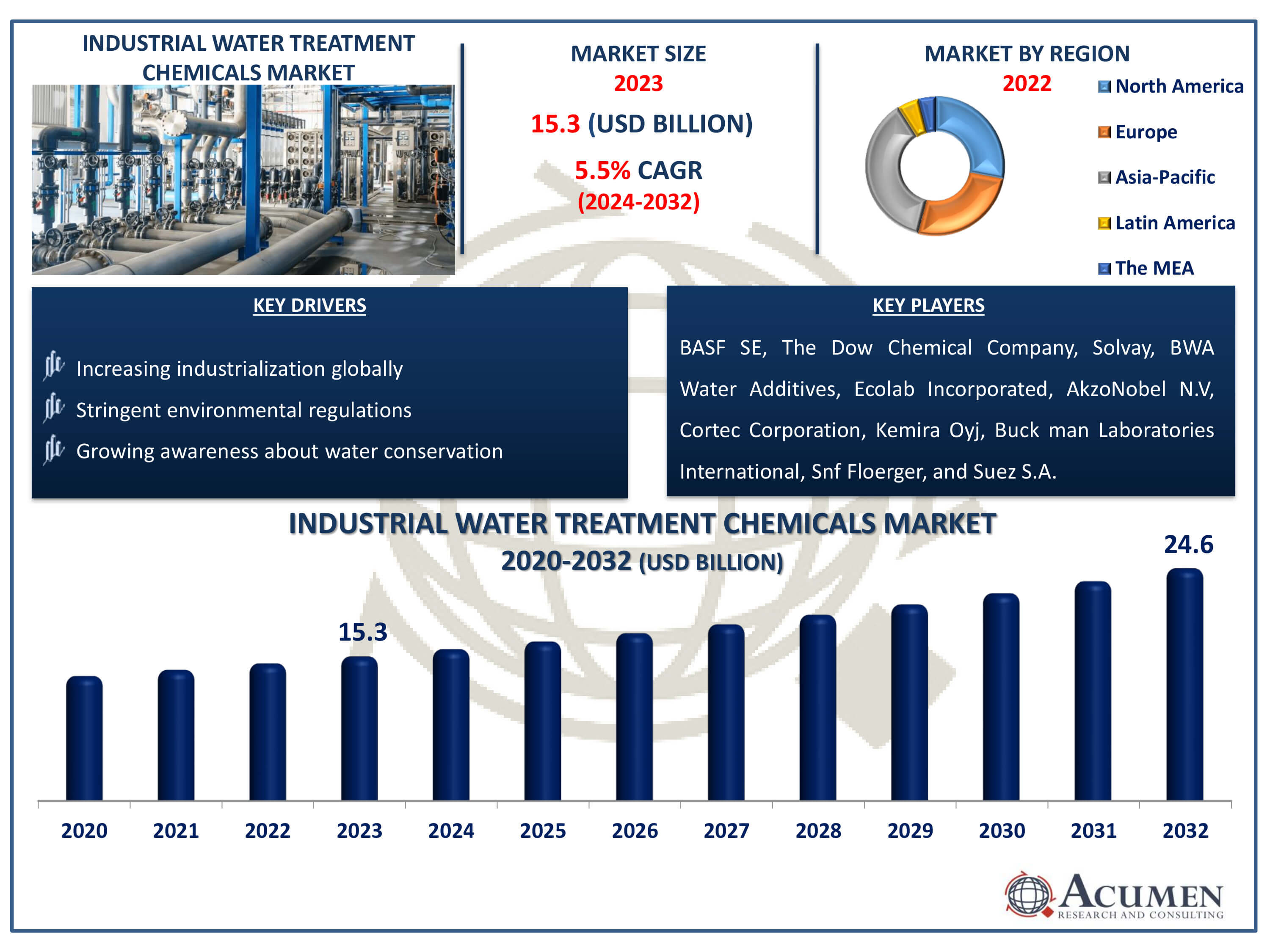

The Industrial Water Treatment Chemicals Market Size accounted for USD 15.3 Billion in 2023 and is estimated to achieve a market size of USD 24.6 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

Industrial Water Treatment Chemicals Market Highlights

- Global industrial water treatment chemicals market revenue is poised to garner USD 24.6 billion by 2032 with a CAGR of 5.5% from 2024 to 2032

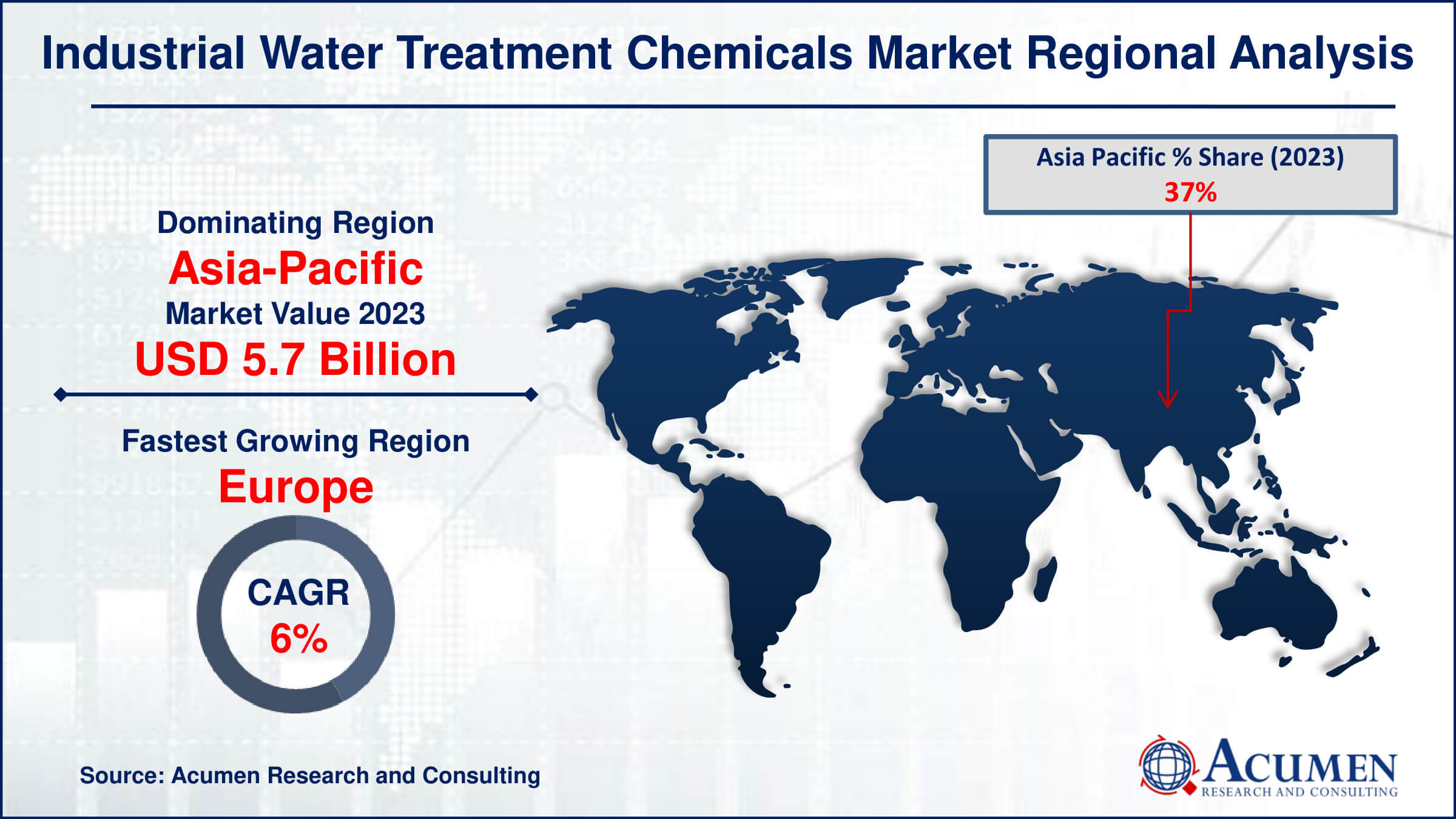

- Asia Pacific industrial water treatment chemicals market value occupied around USD 5.7 billion in 2023

- Europe industrial water treatment chemicals market growth will record a CAGR of more than 6% from 2024 to 2032

- Among application, the cooling & boilers sub-segment generated 56% of the market share in 2023

- Based on end users, the oil and gas sub-segment generated significant market share in 2023

- Increasing demand for eco-friendly and sustainable water treatment chemicals is the industrial water treatment chemicals market trend that fuels the industry demand

Industrial water treatment chemicals are substances used to optimize water quality in various industrial processes. They encompass a range of chemicals designed to address specific water treatment needs, including purification, disinfection, corrosion inhibition, and scale prevention. These chemicals are crucial for maintaining equipment efficiency and longevity by preventing scale buildup, corrosion, and microbial growth. Applications span diverse industries such as power generation, manufacturing, food and beverage production, pharmaceuticals, and oil and gas refining. Industrial water treatment chemicals are carefully formulated to meet stringent quality and safety standards while effectively addressing the unique challenges of each industrial process. Their usage ensures sustainable water management practices and compliance with regulatory requirements, contributing to operational efficiency and environmental control.

Global Industrial Water Treatment Chemicals Market Dynamics

Market Drivers

- Increasing industrialization globally driving demand for water treatment chemicals

- Stringent environmental regulations propelling adoption of industrial water treatment chemicals

- Growing awareness about water conservation fostering market growth

Market Restraints

- High cost associated with advanced water treatment chemicals hindering market penetration

- Concerns regarding the environmental impact of chemical treatment methods limiting market expansion

- Lack of skilled workforce for proper handling and application of water treatment chemicals posing a challenge

Market Opportunities

- Technological advancements leading to development of more efficient and eco-friendly water treatment chemicals

- Rising investments in water infrastructure projects creating opportunities for market expansion

- Adoption of smart water treatment solutions offering new avenues for growth in the industrial sector

Industrial Water Treatment Chemicals Market Report Coverage

| Market | Industrial Water Treatment Chemicals Market |

| Industrial Water Treatment Chemicals Market Size 2022 | USD 15.3 Billion |

| Industrial Water Treatment Chemicals Market Forecast 2032 |

USD 24.6 Billion |

| Industrial Water Treatment Chemicals Market CAGR During 2023 - 2032 | 5.5% |

| Industrial Water Treatment Chemicals Market Analysis Period | 2020 - 2032 |

| Industrial Water Treatment Chemicals Market Base Year |

2022 |

| Industrial Water Treatment Chemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, The Dow Chemical Company, Solvay S.A., BWA Water Additives, Ecolab Incorporated, AkzoNobel N.V, Cortec Corporation, Kemira Oyj, Buck man Laboratories International Inc., Snf Floerger, and Suez S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Water Treatment Chemicals Market Insights

The surge in global industrialization has significantly boosted the demand for water treatment chemicals, essential for maintaining water quality in industrial processes. For instance, China's industrial production experienced steady growth in 2023, alongside a quicker pace of intelligent and green transformation, according to official data released on Wednesday by the National Bureau of Statistics (NBS). Besides, the value-added industrial output, increased by 4.6 percent year-on-year in 2023. As industries expand, the necessity for treating wastewater to meet environmental regulations and operational standards becomes more critical. This increasing industrial activity enhances the consumption of water treatment chemicals, fostering market growth. The chemicals play a vital role in ensuring the efficiency and longevity of industrial equipment by preventing scale, corrosion, and fouling. Consequently, the industrial water treatment chemicals market is experiencing substantial growth driven by these factors.

The growth of the industrial water treatment chemicals market is constrained by environmental concerns surrounding chemical treatment methods. These methods often involve hazardous substances that can lead to pollution and ecological harm, prompting regulatory inspection and public opposition. As a result, industries face pressure to adopt greener alternatives, which can be more costly and less established. This challenge hinders market expansion by limiting the use of traditional chemical treatments and increasing the demand for sustainable solutions.

Technological advancements in the development of more efficient and eco-friendly water treatment chemicals are driving significant opportunities in the industrial water treatment chemicals market. For instance, in August 2021, the Ministry of Science and Technology reported that the Energy and Resources Institute of New Delhi developed TADOX, a technology that reduces the need for tertiary and biological treatment systems and contributes to Zero Liquid Discharge (ZLD). These innovations are enhancing the effectiveness of water treatment processes, reducing environmental impact, and lowering operational costs for industries. By incorporating green chemistry principles, these new chemicals minimize harmful byproducts and energy consumption. Consequently, industries are increasingly adopting these sustainable solutions to comply with stringent environmental regulations and meet corporate sustainability goals. This shift not only promotes environmental stewardship but also opens lucrative market avenues for manufacturers and suppliers of advanced water treatment chemicals.

Industrial Water Treatment Chemicals Market Segmentation

The worldwide market for industrial water treatment chemicals is split based on application, end-user, and geography.

Industrial Water Treatment Chemical Market By Application

- Raw Water Treatment

- Deoiling Polyelectrolytes (DOPE)

- Organic Coagulants

- Flocculants

- Filtration Aids

- Dewatering Aids

- Others

- Water Desalination

- Biocides

- Cleaning Agents

- Carbonates

- Sulfates

- Metal Oxides

- Silica

- Chelating Agents incl. NaOH

- Biofilms

- Others

- Antiscalants

- Flocculants

- Defoaming Agents

- Others

- Cooling & Boilers

- Sludge Controllers

- Antifoams

- Antiscalants

- Oxygen Scavengers

- Others

- Effluent Water Treatment

- Deoiling Polyelectrolytes (DOPE)

- Organic Coagulants

- Flocculants

- Filtration Aids

- Dewatering Aids

- Others

- Others

According to the industrial water treatment chemicals industry analysis, the cooling & boilers segment holds a significant share in the industrial water treatment chemicals market due to its critical role in maintaining efficiency and longevity of industrial equipment. These chemicals are essential for preventing scaling, corrosion, and microbial growth in boiler and cooling systems, which can lead to operational disruptions and costly repairs. The demand is driven by industries such as power generation, oil & gas, and manufacturing, where high-temperature processes are prevalent. Additionally, regulatory standards for water quality and environmental impact necessitate the use of effective treatment solutions. This segment's dominance is further reinforced by ongoing advancements in chemical formulations aimed at enhancing performance and sustainability.

Industrial Water Treatment Chemical Market By End-User

- Oil and Gas

- Metal and Mining

- Chemical

- Power

- Paper

- Other Industries

According to the industrial water treatment chemicals industry forecast, oil and gas industries are anticipated to dominate the market due to their high demand for water in extraction and refining processes. These sectors require extensive water treatment solutions to manage large volumes of wastewater and ensure regulatory compliance. The complexity and scale of their operations necessitate advanced chemical treatments to protect equipment and optimize production. Consequently, their investment in water treatment chemicals significantly drives market growth. Furthermore, the power industry expected to grow in forecast year due to its all activities involved in the generation, transmission, and distribution of electricity. It includes power plants, utilities, and infrastructure that produce and deliver energy to consumer

Industrial Water Treatment Chemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Water Treatment Chemicals Market Regional Analysis

For several reasons, the Asia-Pacific region, including China, held the largest share in both revenue and volume. Thailand, Vietnam, the Philippines, and Indonesia are at the forefront of water PPP development, driven by regulatory support from policymakers encouraging private sector participation in wastewater management and urban infrastructure. These factors are expected to boost the regional market over the forecast period. Taiwan, experiencing significant drought, receives only about 21% of extreme precipitation annually. This not only reduces air quality and affects the well-being of its population but also impacts key manufacturing industries. Consequently, Taiwan's resource planners are focusing on securing and expanding the country's water supply in response to a steady increase in industrial demand, which is projected to grow from 15.4 million m³ per year to 16.4 million m³ per year in the coming years.

The industrial water treatment chemicals market in Europe is rapidly expanding as a result of strict environmental regulations and an increased need for sustainable water management solutions. The region's strong industrial base, combined with advances in water treatment technology, fuels demand for these chemicals. For instance, in June 2021, the France-based marketing and distribution company, REDA Group, launched ZenTreat, a range of water treatment solutions designed for drinking water, wastewater, and power generation. Additionally, increased awareness of water scarcity and pollution issues drives market growth. As industrialization grows, the market for water treatment chemicals in Europe continues to grow.

Industrial Water Treatment Chemicals Market Players

Some of the top industrial water treatment chemicals companies offered in our report include BASF SE, The Dow Chemical Company, Solvay S.A., BWA Water Additives, Ecolab Incorporated, AkzoNobel N.V, Cortec Corporation, Kemira Oyj, Buck man Laboratories International Inc., Snf Floerger, and Suez S.A.

Frequently Asked Questions

How big is the Industrial water treatment chemicals market?

The industrial water treatment chemicals market size was valued at USD 15.3 billion in 2023.

What is the CAGR of the global industrial water treatment chemicals market from 2024 to 2032?

The CAGR of industrial water treatment chemicals is 5.5% during the analysis period of 2024 to 2032.

Which are the key players in the industrial water treatment chemicals market?

The key players operating in the global market are including BASF SE, The Dow Chemical Company, Solvay S.A., BWA Water Additives, Ecolab Incorporated, AkzoNobel N.V, Cortec Corporation, Kemira Oyj, Buck man Laboratories International Inc., Snf Floerger, and Suez S.A

Which region dominated the global industrial water treatment chemicals market share?

Asia-Pacific held the dominating position in industrial water treatment chemicals industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of industrial water treatment chemicals during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global industrial water treatment chemicals industry?

The current trends and dynamics in the industrial water treatment chemicals industry include increasing industrialization globally driving demand for water treatment chemicals, stringent environmental regulations propelling adoption of industrial water treatment chemicals, and growing awareness about water conservation fostering market growth.

Which application held the maximum share in 2023?

The cooling & boilers held the maximum share of the industrial water treatment chemicals industry.