Industrial Protective Clothing Market | Acumen Research and Consulting

Industrial Protective Clothing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

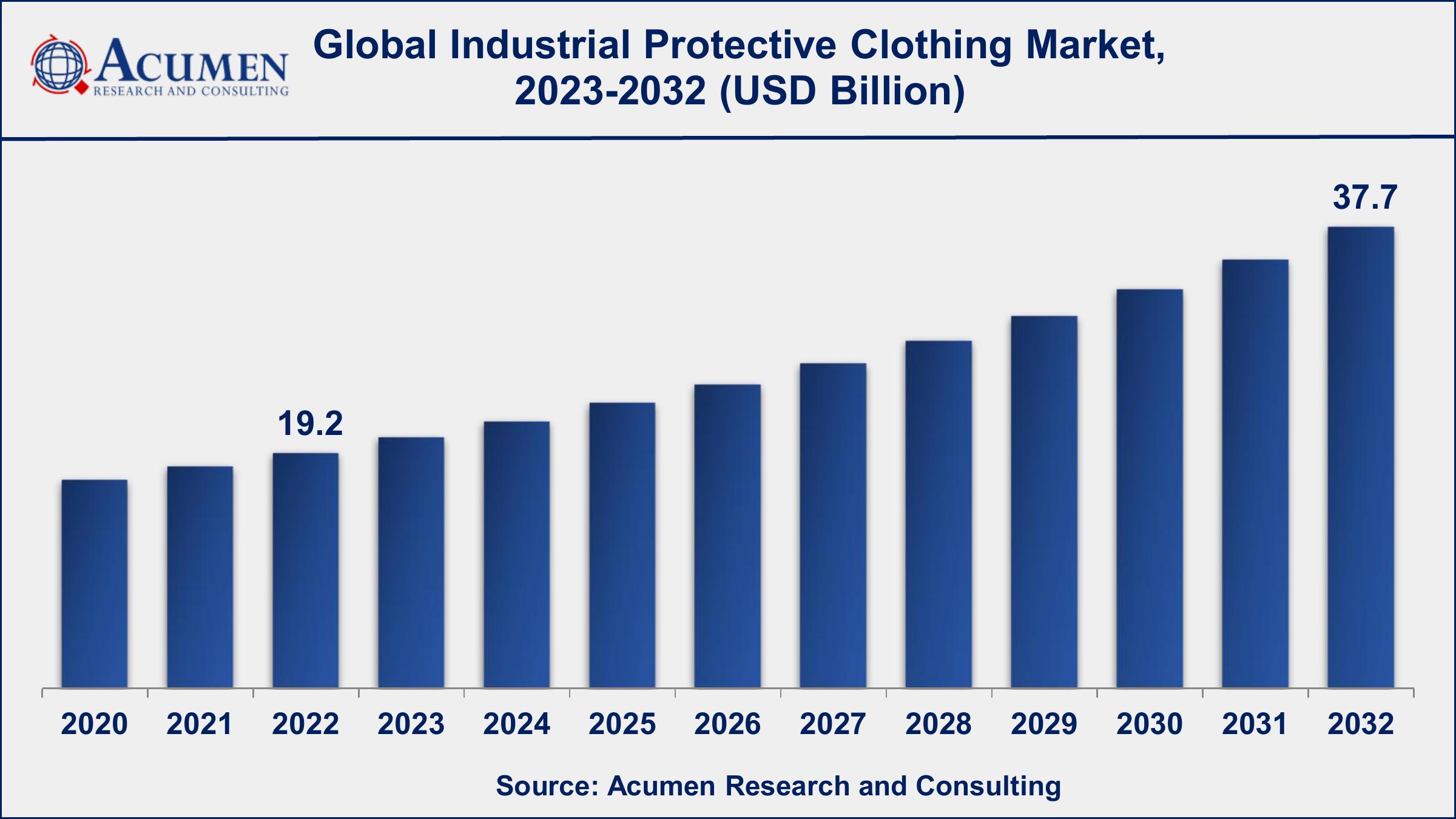

The Global Industrial Protective Clothing Market Size collected USD 19.2 Billion in 2022 and is set to achieve a market size of USD 37.7 Billion in 2032 growing at a CAGR of 7.0% from 2023 to 2032.

Industrial Protective Clothing Market Report Statistics

- Global industrial protective clothing market revenue is estimated to reach USD 37.7 billion by 2032 with a CAGR of 7.0% from 2023 to 2032

- Europe industrial protective clothing market value occupied more than USD 6.5 billion in 2022

- Asia-Pacific industrial protective clothing market growth will record a CAGR of over 7% from 2023 to 2032

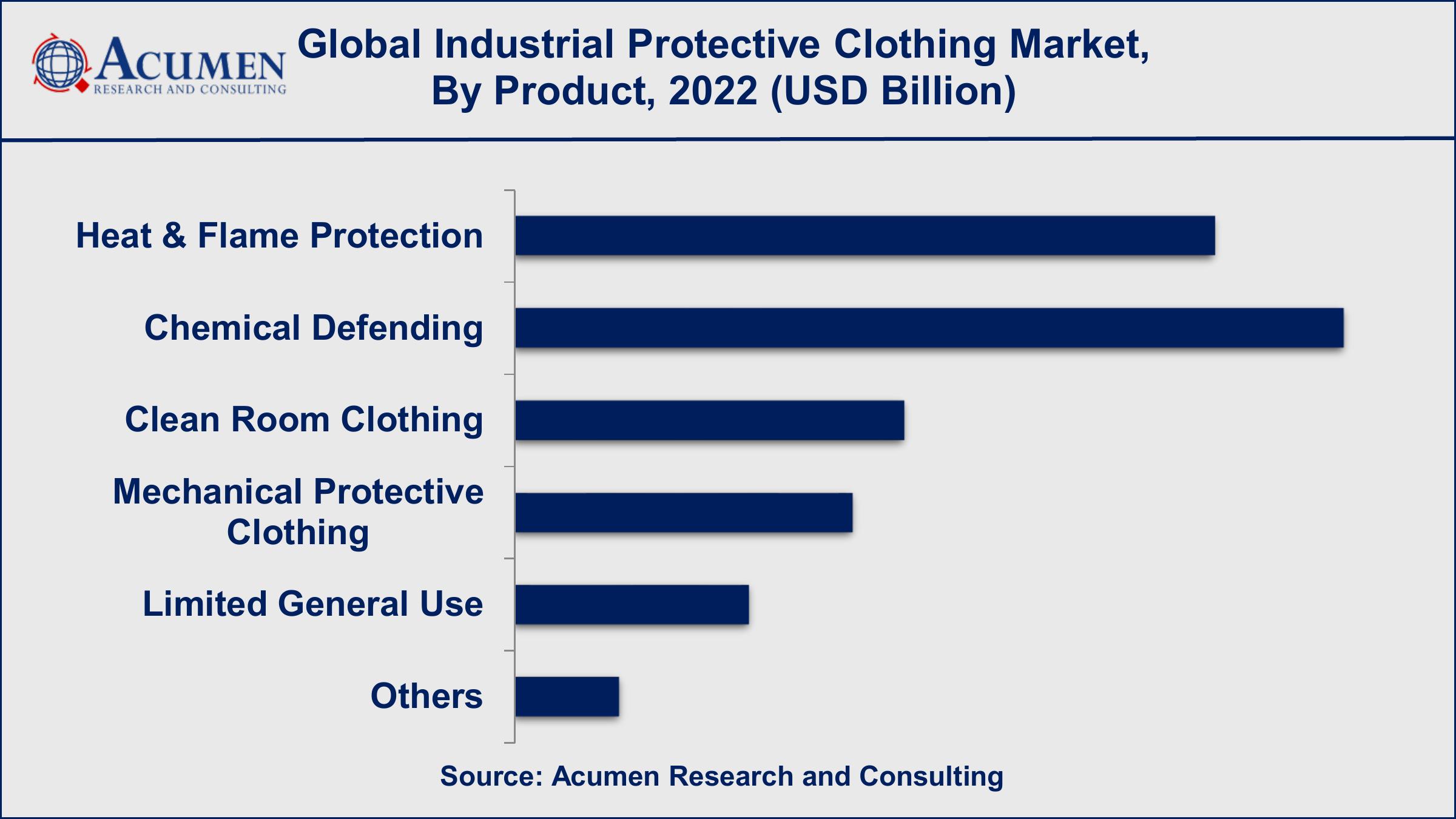

- Among products, the chemical defending sub-segment generated around 32% share in 2022

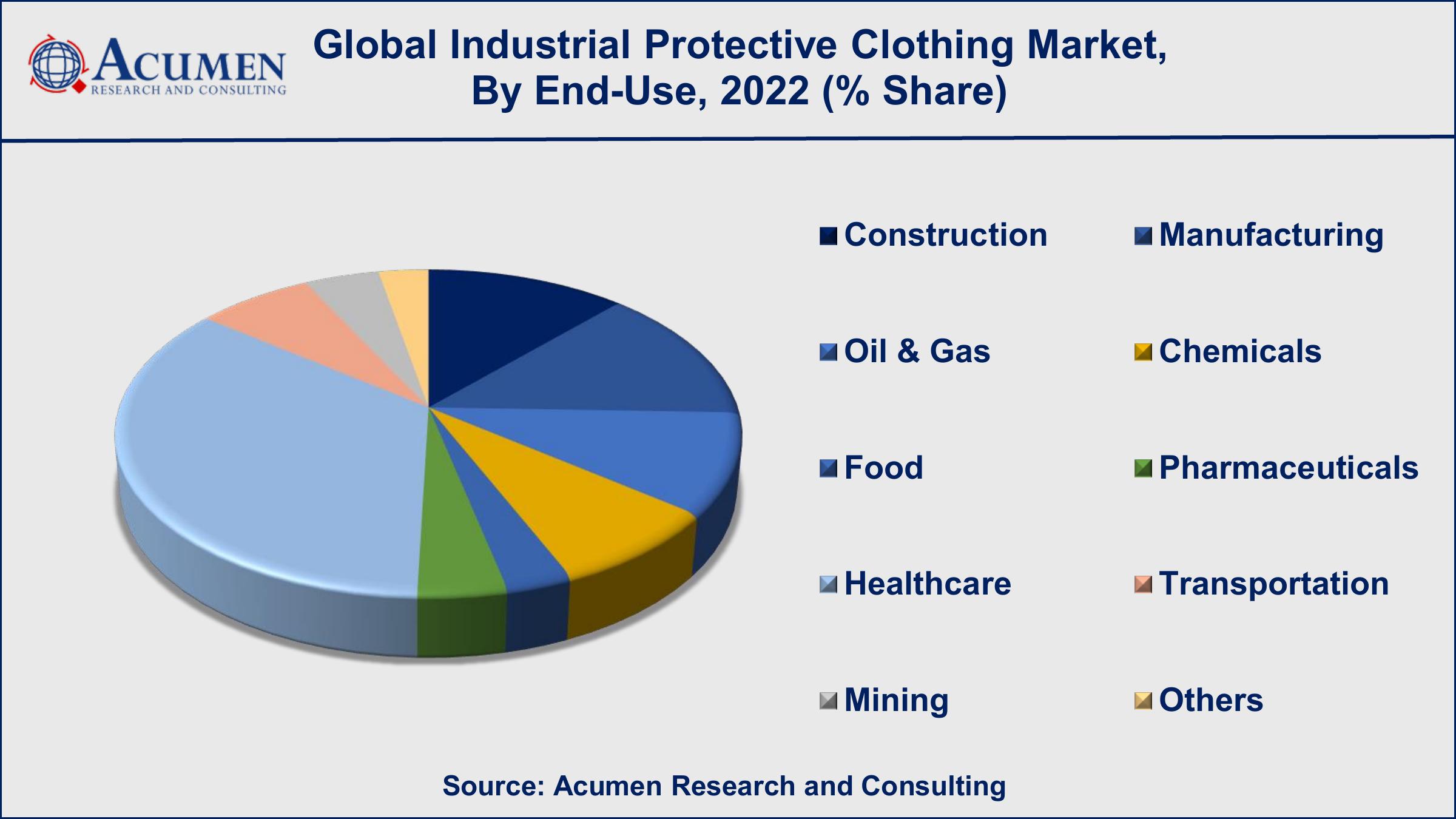

- Based on end-use, the healthcare sub-segment generated around US$ 6.7 billion revenue in 2022

- Increasing focus on sustainable materials is a popular industrial protective clothing market trend that fuels the industry demand

Industrial protective clothing is specialized clothing designed to protect workers from occupational hazards in different industries. It is designed to shield workers from various hazards, such as chemical exposure, high temperatures, physical injuries, and other hazardous substances.

Industrial protective clothing is typically made from materials that provide resistance to hazards, including fire-retardant fabrics, chemical-resistant materials, and high-visibility materials. The clothing may also feature reflective stripes, insulation, and padding to enhance protection and comfort for the wearer.

Global Industrial Protective Clothing Market Dynamics

Market Drivers

- Increasing demand for safety equipment

- Stringent government regulations

- Growing awareness of safety in the workplace

- Growth in industrial sectors

Market Restraints

- High cost of industrial protective clothing

- Lack of standardization

- Technological limitations

Market Opportunities

- Increasing use of smart fabrics

- Growing popularity of flame-resistant clothing

- Rising demand for high-visibility clothing

Industrial Protective Clothing Market Report Coverage

| Market | Industrial Protective Clothing Market |

| Industrial Protective Clothing Market Size 2022 | USD 19.2 Billion |

| Industrial Protective Clothing Market Forecast 2032 | USD 37.7 Billion |

| Industrial Protective Clothing Market CAGR During 2023 - 2032 | 7.0% |

| Industrial Protective Clothing Market Analysis Period | 2020 - 2032 |

| Industrial Protective Clothing Market Base Year | 2022 |

| Industrial Protective Clothing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Australian Defense Apparel, Bennett & Ansell, DuPont, Honeywell International, Kimberly Clarke, Lakeland Industries, Inc., PBI Performance Products, Inc., TEIJIN LIMITED, TenCate Protective, W.L. Gore & Associates, and Workwear Outfitters, LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Protective Clothing Market Growth Factors

Rapid industrialization in developing countries, increasing manufacturing activities across the globe, and developing regulatory scenarios related to worker safety are major factors expected to drive the growth of the global market. In addition, high investment by major players for product development and rising demand for lightweight and multipurpose products are other factors expected to further support the growth of the target market.

The presence of a large number of players operating on a global level, coupled with business development activities in order to increase the presence is another factor expected to further support the growth of the target market.

In 2019, Honeywell Norcross acquired Safety Products L.L.C., a leading manufacturer of personal protective equipment (PPE). This acquisition is expected to help the company to enhance its business presence and increase its profit ratio.

In 2016, Lakeland Industries an international provider of protective clothing opened new distribution and warehouse facility in Texas. This is expected to help the company to increase customer reach and enhance the profit ratio.

High investment by major players for R&D activities and the introduction of innovative products in order to attract new customers is another important factor expected to positively impact the growth of the target market.

In 2017, Teijin Limited launched a cooling west that protects firefighters with heat resistance, flame retardance, and body-heat reduction. This will help the company to enhance its product portfolio and enhance its customer base.

In 2016, Sioen Industries a manufacturer of textile products launched w-air protective fabric that provides comfort, durability, lightweight, and flexible design for spring and summer monsoons. This is expected to help the company to enhance its customer base.

In 2017, Ansell Limited global manufacturers of protective industrial and medical gloves acquired gamma SUPPLIES a company specializing in validated sterile RABS/ Isolator long gloves. This is expected to help the company to enhance its product portfolio.

However, factors such as fluctuating raw material processes and complex manufacturing processes are expected to hamper the growth of the global industrial protective clothing market. In addition, high pricing related to specialty clothing is another factor expected to further challenge the growth of the target market.

Rapid technological advancements in advanced material increasing the use of nanotechnology, coupled with innovative offerings by major players are factors expected to further create new opportunities for players operating in the target market over the forecast period. In addition, increasing partnerships and agreements between regional and international players is another factor expected to further support the revenue traction of the target market.

Industrial Protective Clothing Market Segmentation

The worldwide market for industrial protective clothing is categorized based on product, end-use, and geography.

Industrial Protective Clothing Product Outlook

- Heat & Flame Protection

- Chemical Defending

- Clean Room Clothing

- Mechanical Protective Clothing

- Limited Construction Use

- Others

According to the industrial protective clothing market forecast, chemical defending is expected to lead the market with utmost shares in the coming years. Chemical defending protective clothing is intended to protect workers from hazardous chemicals, acids, and other potentially harmful substances. This market has grown significantly in recent years, owing to increased safety regulations and public awareness of the dangers of hazardous chemical exposure. Chemical-resistant clothing is used in many industries, including chemical manufacturing, pharmaceuticals, agriculture, and oil and gas. The growing use of hazardous chemicals in industrial processes, the increasing emphasis on worker safety, and the development of new, more extra preventative materials and technologies are all factors driving the growth of the chemical defending segment.

Industrial Protective Clothing End-Use Outlook

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Healthcare

- Transportation

- Mining

- Others

According to the industrial protective clothing industry analysis, one of the significant segments in the industrial protective clothing market is the healthcare sector. Protective clothing is used in the healthcare industry to protect workers from infectious agents such as bacteria and viruses, as well as chemical and physical hazards. Gloves, gowns, masks, and shoe covers are examples of protective clothing used in healthcare. Manufacturing, construction, oil and gas, chemicals, and mining, on the other hand, are typically larger consumers of industrial protective clothing than the healthcare sector. Protective clothing is required in these industries to protect workers from a variety of hazards, including high temperatures, chemical exposure, and physical injuries.

Industrial Protective Clothing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Protective Clothing Market Regional Analysis

North America and Europe are significant regions for the industrial protective clothing market due to their stringent laws and standards pertaining to employee safety. The existence of established industries such as oil and gas, construction, and manufacturing in these areas also drives demand for industrial protective clothing.

Because of rapid industrialization and urbanization in countries such as China and India, the Asia Pacific region is expected to see significant growth in the industrial protective clothing market. The region's demand for industrial protective clothing is also being driven by a growing emphasis on worker safety and increased awareness about the benefits of using protective clothing.

Industrial Protective Clothing Market Players

Some of the industrial protective clothing companies include Australian Defense Apparel, Bennett & Ansell, DuPont, Honeywell International, Kimberly Clarke, Lakeland Industries, Inc., PBI Performance Products, Inc., TEIJIN LIMITED, TenCate Protective, W.L. Gore & Associates, and Workwear Outfitters, LLC.

Frequently Asked Questions

What was the market size of the global industrial protective clothing in 2022?

The market size of industrial protective clothing was USD 19.2 billion in 2022.

What is the CAGR of the global industrial protective clothing market from 2023 to 2032?

The CAGR of industrial protective clothing is 7.0% during the analysis period of 2023 to 2032.

Which are the key players in the industrial protective clothing market?

The key players operating in the global market are including Australian Defense Apparel, Bennett & Ansell, DuPont, Honeywell International, Kimberly Clarke, Lakeland Industries, Inc., PBI Performance Products, Inc., TEIJIN LIMITED, TenCate Protective, W.L. Gore & Associates, and Workwear Outfitters, LLC.

Which region dominated the global industrial protective clothing market share?

Europe held the dominating position in industrial protective clothing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of industrial protective clothing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global industrial protective clothing industry?

The current trends and dynamics in the industrial protective clothing industry include increasing demand for safety equipment, stringent government regulations, and growing awareness of safety in the workplace.

Which product held the maximum share in 2022?

The chemical defending product held the maximum share of the industrial protective clothing industry.