Industrial Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

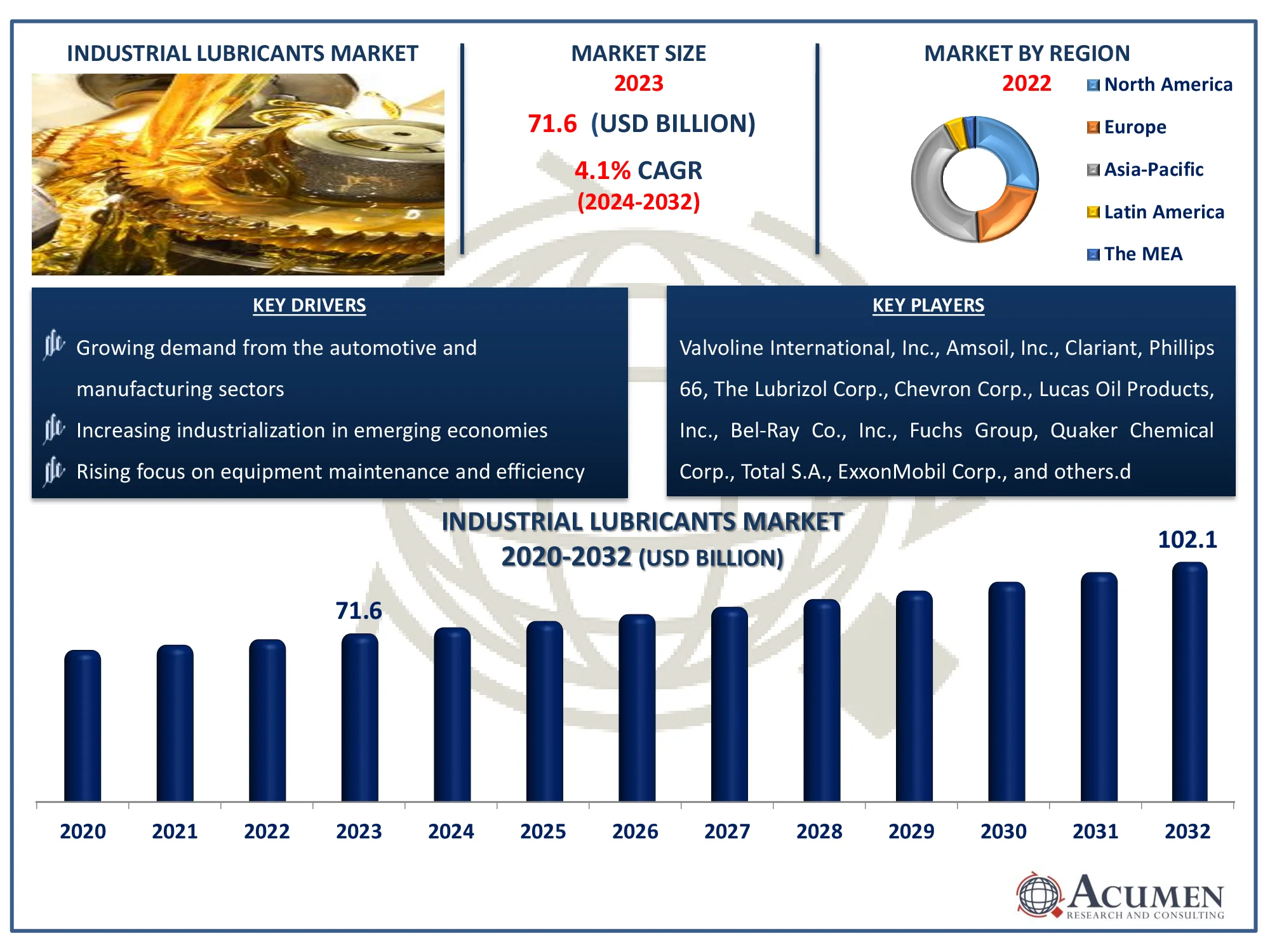

The Global Industrial Lubricants Market Size accounted for USD 71.6 Billion in 2023 and is estimated to achieve a market size of USD 102.1 Billion by 2032 growing at a CAGR of 4.1%from 2024 to 2032.

Industrial Lubricants Market Highlights

- The global industrial lubricants market is expected to reach USD 102.1 billion by 2032, growing at a CAGR of 4.1% from 2024 to 2032

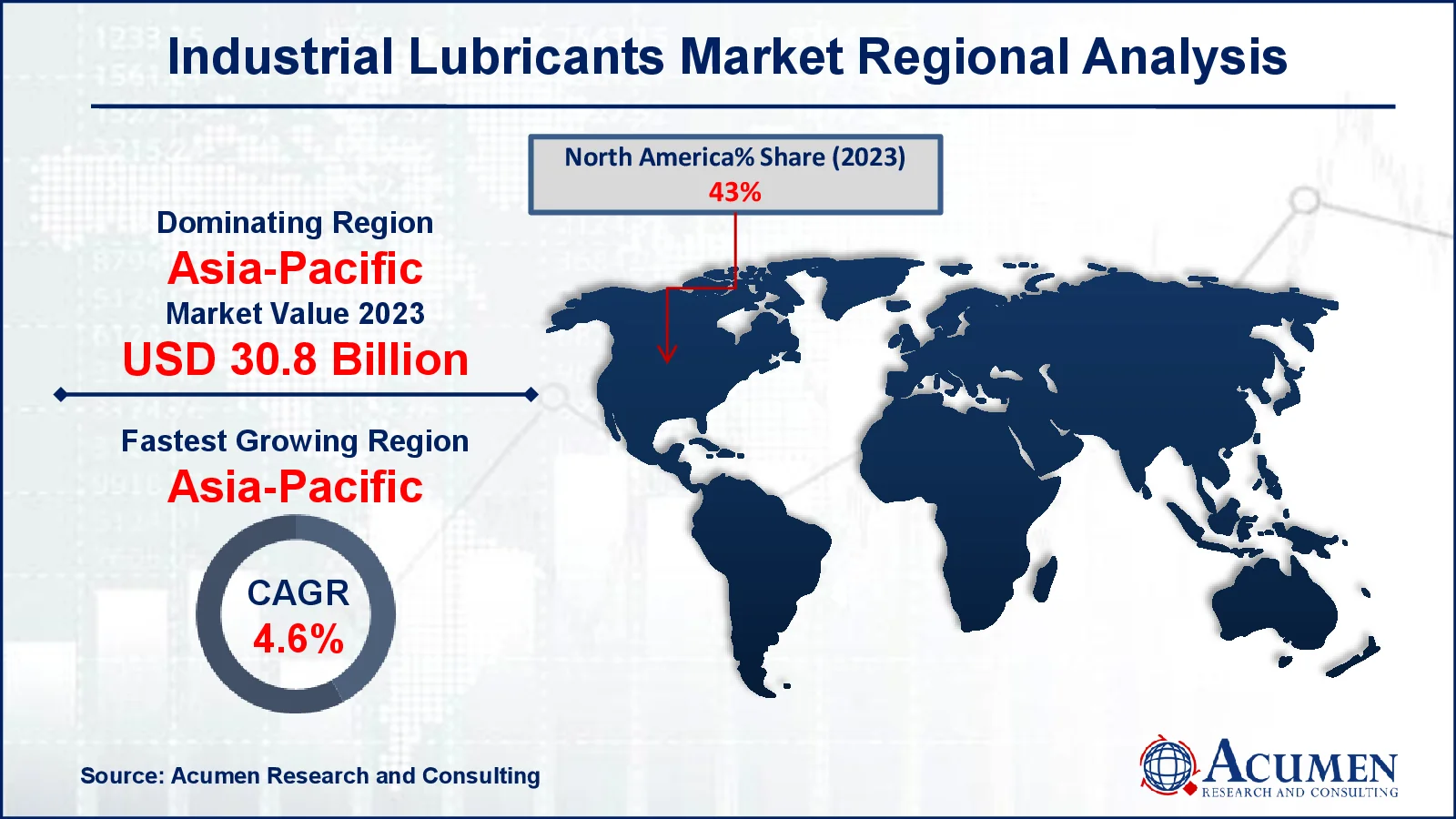

- In 2023, the Asia-Pacific industrial lubricants market was valued at approximately USD 30.8 billion

- The Asia-Pacific region is projected to grow at a CAGR of over 4.6% between 2024 and 2032

- The chemical manufacturing sector accounted for 22% of the market share in 2023

- Rising use of synthetic lubricants for better efficiency and extended machinery life is the industrial lubricants market trend that fuels the industry demand

Industrial lubricants are defined as fluids used to reduce wear and tear and friction. Industrial lubricants can be based on water or oil. Their primary role is to prevent metals from coming into contact with each other through tools or finished components. Industrial lubricants provide corrosion protection, superior demulsibility, and equipment life support properties. It is used to achieve a specific degree of performance in a variety of devices. They contribute to increased productivity and machinery effectiveness. Automobiles, industrial machinery, mining, hydraulics, and a variety of other applications can all benefit from industrial lubricants. The type of lubricant used depends on the exposure to severe chemicals, temperature, and other factors. On the other hand, a moderate single-digit growth is foreseen in the projected time in the industrial lubricants market.

Global Industrial Lubricants Market Dynamics

Market Drivers

- Growing demand from the automotive and manufacturing sectors

- Increasing industrialization in emerging economies

- Rising focus on equipment maintenance and efficiency

Market Restraints

- Volatility in crude oil prices affecting raw material costs

- Stringent environmental regulations on lubricant disposal

- Competition from bio-based and synthetic lubricants

Market Opportunities

- Expanding demand for high-performance lubricants in aerospace and defense

- Growth of electric vehicles requiring specialized lubricants

- Rising investments in industrial automation boosting lubricant consumption

Industrial Lubricants Market Report Coverage

| Market | Industrial Lubricants Market |

| Industrial Lubricants Market Size 2022 |

USD 71.6 Billion |

| Industrial Lubricants Market Forecast 2032 | USD 102.1 Billion |

| Industrial Lubricants Market CAGR During 2023 - 2032 | 10.8% |

| Industrial Lubricants Market Analysis Period | 2020 - 2032 |

| Industrial Lubricants Market Base Year |

2022 |

| Industrial Lubricants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Base Oil, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Valvoline International, Inc., Amsoil, Inc., Clariant, Phillips 66 Company, The Lubrizol Corp., Chevron Corp., Lucas Oil Products, Inc., Bel-Ray Co., Inc., Fuchs Group, Quaker Chemical Corp., Total S.A., ExxonMobil Corp., Kluber Lubrication, Royal Dutch Shell, and Quaker Chemical Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Lubricants Market Insights

The worldwide industrial lubricant market is predicted to increase significantly in the future years as the automobile sector expands. The increasing manufacturing of automobiles is a major contributor to the growth of the global market for industrial lubricants. During the projected period, growing demand for low viscosity fluids in the automotive sector will boost the industrial lubricant market. Increased demand for greases is expected to drive growth in the worldwide industrial lubricants market in the coming years, allowing machinery to operate more smoothly.

The increasing food industry is likely to be a major development factor in the global industrial lubricant market. Rapid industrialization in developing countries is expected to drive the global industrial lubricant market. Each location has its own set of rules for the minimum requirements for industrial lubricants that are imported and produced. Research and development efforts, as well as adequate growth, might help the expanding global companies in the industrial lubricant market.

Rapid industrialization in developing countries, followed by an increase in the number of commercial operations, drives the demand for industrial lubricants. Increasing R&D investments and choosing the correct route of expansion help significant firms achieve worldwide success. For instance, on December 2023, FUCHS invests USD 11.5 million to increase production capacity at Isando, South Africa. The investment is intended to enhance the plant's capacity by 40 percent. This move is part of the company's ongoing strategic objective to expand capacity to meet rising market demand. Some businesses that will see significant expansion include unconventional energy, chemicals, and mining. Compressors, hydraulics, industrial motors, centrifuges, and bearings are expected to see even higher demand.

The United States has progressed and adopted high-quality lubricants with longer oil drain intervals, resulting in less efficient lubricant consumption. The growing demand for a wide range of completed goods, combined with the need to expand manufacturing capacity has prompted businesses to rely on machines to automate manufacturing and manufacturing. The key driving drivers for the forecast period include initiatives such as constantly changing pollution rules, improved power engine technology, and carbon footprint reductions implemented in growing economies such as China and India.

Modern consumer habits and a Western standard of living have driven up demand for processed and frozen foods. Automation of the packaging line and adaptability to robotic high-pressure operations are expected to drive the growth of processed food markets. Further advancements in the sector are expected to expand the significance of agro processing. The usage of synthetic lubricants is a major source of environmental pollution, which is raising concerns and requiring more environmental regulations.

Industrial Lubricants Market Segmentation

The worldwide market for industrial lubricants is split based on product, base oil, application, and geography.

Industrial Lubricant Market By Product

- Metal working fluids

- Turbine lubricants

- Gear lubricants

- Hydraulic lubricants

- Compressor lubricants

According to the industrial lubricants industry analysis, metal working fluids shows robust growth due to their critical function in machining and production processes. These fluids provide cooling, lubrication, and protection during operations including cutting, grinding, and drilling, thereby extending tool life and increasing product quality. The increased demand from industries such as automotive, aerospace, and heavy machinery increases their market share. Furthermore, advances in metalworking technology and the demand for high-performance fluids further boosts their dominance.

Industrial Lubricant Market By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

Mineral oil is the most widely available and cost-effective base oil. Mineral oils are produced by refining crude oil and are noted for their consistent performance in a variety of applications, making them a popular choice among manufacturers. However, increasing awareness of environmental issues and a shift toward sustainability are driving up demand for synthetic and bio-based oils. Synthetic oils provide better performance and longevity, whilst bio-based lubricants appeal to ecologically aware customers, indicating a progressive shift in market preferences.

Industrial Lubricant Market By Application

- Energy

- Chemical Manufacturing

- Metalworking

- Hydraulic

- Textiles

- Food Processing

- Others

According to the industrial lubricants market forecast, in 2023, chemical manufacturing was the leading application segment. To remain competitive, energy installations, such as gas and steam turbines, wind turbines, natural gas compression plants, and coal-fired power plants, rely heavily on the efficiency of their equipment. Metalwork is also expected to expand rapidly due to rising industrial and metal demand in applications such as machineries and buildings. Metalworking techniques such as cutting, welding, and forming will be required in a variety of applications, including foundry, ships, aircraft, milling, and industrial gear. Food processing demand was estimated during the forecast period. The increased knowledge of equipment maintenance, as well as changes in industrial maintenance policies to reduce machine costs, are expected to lead to positive growth for general industrial oils.

Industrial Lubricants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Lubricants Market Regional Analysis

For several reasons, Asia-Pacific dominates and expected to have the highest CAGR in developing markets, such as India, Indonesia, Thailand, and Malaysia, due to established end-use sectors. For instance, on October 2023, Chevron Corporation announced collaboration with Hindustan Petroleum Corporation Ltd (HPCL) to launch its Caltex brand in India. As part of this relationship, the businesses agreed that HPLC might license, produce, sell, and promote Chevron's lubricant products in India. The move allowed Chevron to re-enter the Indian lubricants sector after a 12-year absence, focusing on delivering lubrication solutions for industrial and commercial vehicles. Furthermore, increasing awareness of the benefits of lubricant application on the operational efficiency of industrial equipment is predicted to improve the products.

Despite a relative slowdown in industrial development, demand for industrial lubricants is likely to remain high in North America and Europe. As drilling and exploration operations increase, demand for petroleum field chemicals is likely to rise, boosting market growth in North America. The recovery and upgrading of industrial machinery is the primary driving force behind the projection period's demand for European industrial lubricants.

Industrial Lubricants Market Players

Some of the top industrial lubricants companies offered in our report include Valvoline International, Inc., Amsoil, Inc., Clariant, Phillips 66 Company, The Lubrizol Corp., Chevron Corp., Lucas Oil Products, Inc., Bel-Ray Co., Inc., Fuchs Group, Quaker Chemical Corp., Total S.A., ExxonMobil Corp., Kluber Lubrication, Royal Dutch Shell, and Quaker Chemical Corp.

Frequently Asked Questions

How big is the industrial lubricants market?

The industrial lubricants market size was valued at USD 71.6 billion in 2023.

What is the CAGR of the global industrial lubricants market from 2024 to 2032?

The CAGR of industrial lubricants is 4.1% during the analysis period of 2024 to 2032.

Which are the key players in the industrial lubricants market?

The key players operating in the global market are including Valvoline International, Inc., Amsoil, Inc., Clariant, Phillips 66 Company, The Lubrizol Corp., Chevron Corp., Lucas Oil Products, Inc., Bel-Ray Co., Inc., Fuchs Group, Quaker Chemical Corp., Total S.A., ExxonMobil Corp., Kluber Lubrication, Royal Dutch Shell, and Quaker Chemical Corp.

Which region dominated the global industrial lubricants market share?

Asia-Pacific held the dominating position in industrial lubricants industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of industrial lubricants during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global industrial lubricants industry?

The current trends and dynamics in the industrial lubricants industry include growing demand from the automotive and manufacturing sectors, increasing industrialization in emerging economies, and rising focus on equipment maintenance and efficiency.

Which product held the maximum share in 2023?

The metal working fluids product held the maximum share of the industrial lubricants industry.