Industrial Boilers Market | Acumen Research and Consulting

Industrial Boilers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

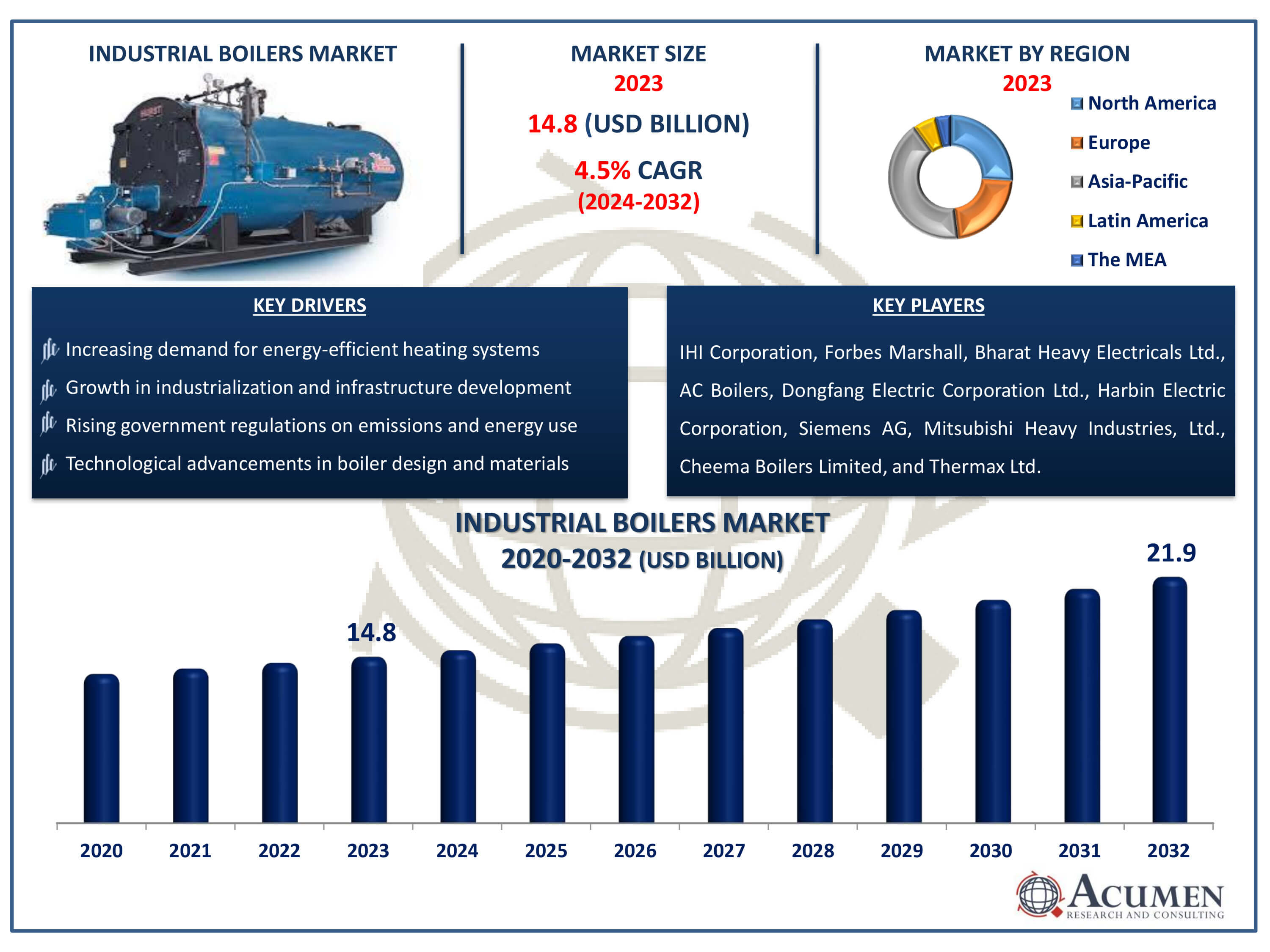

The Industrial Boilers Market Size accounted for USD 14.8 Billion in 2023 and is estimated to achieve a market size of USD 21.9 Billion by 2032 growing at a CAGR of 4.5% from 2024 to 2032.

Industrial Boilers Market Highlights

- Global industrial boilers market revenue is poised to garner USD 21.9 billion by 2032 with a CAGR of 4.5% from 2024 to 2032

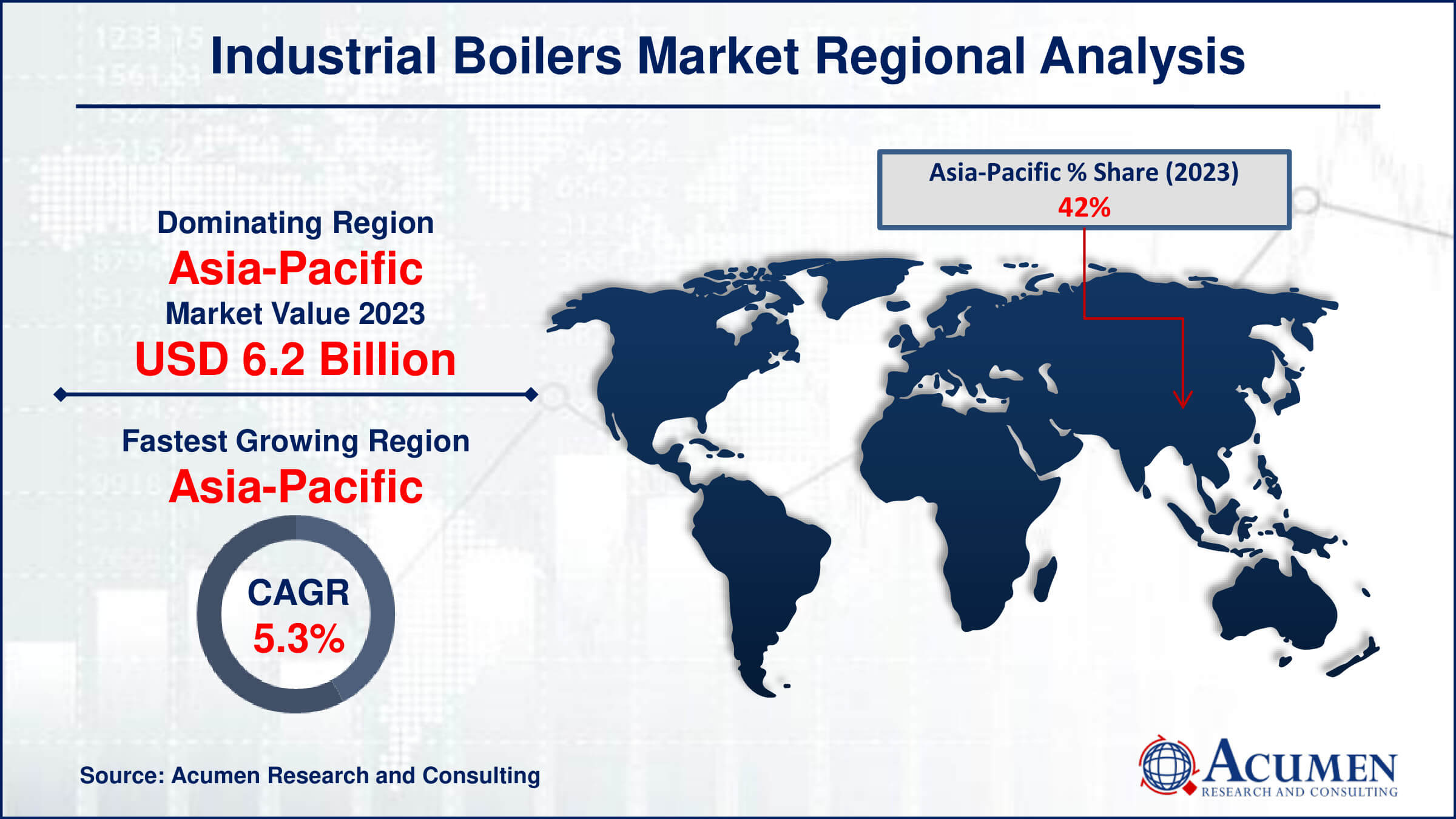

- Asia-Pacific industrial boilers market value occupied around USD 6.2 billion in 2023

- Asia-Pacific industrial boilers market growth will record a CAGR of more than 5.3% from 2024 to 2032

- Among boiler applications, the chemicals & petrochemicals sub-segment generated USD 5.2 billion revenue in 2023

- Based on fuel, the fossil sub-segment generated around 35% industrial boilers market share in 2023

- Increasing retrofitting and upgrading of existing boiler systems is a popular industrial boilers market trend that fuels the industry demand

Industrial boilers are enclosed vessels that heat or vaporize fluids for various industrial applications, including water heating, central heating, power generation, cooking, and sanitation. Their operation fluctuates with seasonal, daily, and hourly changes in temperature and steam demand. Large industrial boilers, particularly those used in electric power generation, primarily use coal as a fuel source. These boilers are essential for many industries, providing a reliable energy supply and ensuring efficient performance. The adaptability of Industrial Boilers to different heating and steam requirements makes them indispensable in maintaining industrial processes and energy production. Their critical role in diverse applications underscores their importance in achieving consistent energy delivery and operational efficiency across numerous sectors, ensuring smooth industrial operations year-round.

Global Industrial Boilers Market Dynamics

Market Drivers

- Increasing demand for energy-efficient heating systems

- Growth in industrialization and infrastructure development

- Rising government regulations on emissions and energy use

- Technological advancements in boiler design and materials

Market Restraints

- High initial investment and installation costs

- Stringent environmental regulations

- Fluctuating fuel prices impacting operational costs

Market Opportunities

- Growing adoption of renewable energy sources for boiler fuel

- Expansion of industrial activities in emerging economies

- Development of smart boiler systems with IoT integration

Industrial Boilers Market Report Coverage

| Market | Industrial Boilers Market |

| Industrial Boilers Market Size 2022 | USD 14.8 Billion |

| Industrial Boilers Market Forecast 2032 | USD 21.9 Billion |

| Industrial Boilers Market CAGR During 2023 - 2032 | 4.5% |

| Industrial Boilers Market Analysis Period | 2020 - 2032 |

| Industrial Boilers Market Base Year |

2022 |

| Industrial Boilers Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Boiler Type, By Function, By Fuel, By Horsepower, By Applications, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IHI Corporation, Forbes Marshall, Bharat Heavy Electricals Ltd., AC Boilers, Dongfang Electric Corporation Ltd., Harbin Electric Corporation, Siemens AG, Mitsubishi Heavy Industries, Ltd., Cheema Boilers Limited, and Thermax Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Boilers Market Insights

The industrial boilers market is expanding rapidly, owing to a variety of factors across several business sectors. A important driver is the growing need for Industrial Boilers in the food and beverage industry. This sector requires reliable and effective heating solutions for processes like as pasteurization, sterilization, and cooking, which is driving up the market value of industrial boilers. As consumer demand for processed and packaged goods grows, so does the need for dependable industrial boiler systems. Clean technology is in high demand not only in the food and beverage business, but also in the chemical industry. Chemical production operations frequently demand precise temperature control and steam generation, making industrial boilers indispensable. The rising emphasis on decreasing emissions and complying with environmental standards has resulted in the development of cleaner, more efficient boiler technology in this sector, propelling market growth.

Electricity generation also contributes significantly to the market value of Industrial Boilers. As global energy demand rises, power plants need efficient and dependable boiler systems to generate electricity. Industrial boilers transform water into steam, which drives turbines to generate energy. The ongoing need for power in the residential, commercial, and industrial sectors ensures a consistent demand for Industrial Boilers. Another driving force is global rapid industrialization. As countries grow and urbanize, there is an increased demand for industrial infrastructure, such as factories and manufacturing plants. Industrial Boilers are essential components of these facilities, supplying heat and steam for a variety of industrial processes. The increasing use of Industrial Boilers across numerous industry verticals emphasizes their importance in promoting economic growth and industrial productivity.

Stringent pollution and energy efficiency requirements are helping to boost the industry even further. Governments and regulatory organizations around the world are establishing measures to minimize greenhouse gas emissions and encourage energy-efficient technologies. Industrial Boilers, as major emitters of industrial emissions, are subject to these rules. This promotes the use of sophisticated boiler technologies that meet environmental criteria, hence boosting market growth. Looking ahead, many opportunities are expected to affect the Industrial Boilers market between 2024 and 2032. One significant opportunity is the growing demand for the renovation of power producing facilities. As older power plants age, they must replace and modernize their boiler systems to improve efficiency and satisfy current regulatory criteria.

Industrial Boilers Market Segmentation

The worldwide market for industrial boilers is split based on boiler type, function, fuel, horsepower, applications, and geography.

Industrial Boiler Market By Boiler Type

- Fire-Tube

- Water-Tube

According to industrial boilers industry analysis, the water-tube category dominates the market because to its high efficiency and capacity to handle high-pressure steam applications. Water-tube boilers are constructed with water running through tubes surrounded by hot gasses, allowing for faster heat transfer and more control over steam generation. This makes them excellent for large-scale operations in industries like power generation, chemical processing, and refineries that require regular and dependable high-pressure steam. Furthermore, water-tube boilers are more adaptable to changing load needs and provide superior safety measures, making them the preferred choice over fire-tube boilers in many industrial applications. Their market supremacy is due in large part to their adaptability and efficiency.

Industrial Boiler Market By Function

- Hot Water

- Steam

Hot water is the leading category and it is expected to grow over the Industrial Boilers industry forecast period due to its widespread use in a variety of industries. These boilers are critical for dependable heating in industries such as food and beverage, pharmaceuticals, and commercial buildings, facilitating processes like as cleaning, sterilization, and space heating. Hot water boilers are used because they are energy efficient and reliable. They operate at lower pressures than steam boilers, posing fewer safety issues and requiring less maintenance. Hot water boilers are the most popular choice due to their versatility and efficiency, cementing their place as the largest category in the industrial boilers market.

Industrial Boiler Market By Fuel

- Fossil

- Oil & Gas

- Non-fossil

- Biomass

The fossil category, which includes coal, oil, and gas, leads the industrial boilers market because of its existing infrastructure, high energy output, and dependability. These fuels are widely available and have historically been selected for their efficiency in producing huge amounts of heat and power. Fossil fuels provide a regular and predictable energy supply, which is essential for industrial processes that require steady and high-intensity heat. Despite growing environmental concerns and a trend toward cleaner energy sources, the vast current investment in fossil fuel-based systems, together with their cost-effectiveness, ensures their continued market dominance. This dominance is strengthened by the sluggish shift to alternative fuels, which keeps the fossil segment's considerable market share.

Industrial Boiler Market By Horsepower

- 10-150 BHP

- 151-300 BHP

- 301-600 BHP

- Above 600 BHP

The 10-150 BHP segment expected to holds the largest share in the industrial boilers market. This dominance is primarily due to the widespread application of these boilers across various industries such as food processing, textile, and pharmaceuticals, which typically require lower horsepower for their operations. Additionally, smaller capacity boilers are often preferred for their lower initial investment, ease of installation, and greater flexibility in meeting the specific process heating requirements of small to medium-sized enterprises. The ability to operate efficiently at varying load demands and the relatively straightforward maintenance further enhance their appeal, leading to higher adoption rates and a significant market share for the 10-150 BHP segment.

Industrial Boiler Market By Application

- Chemicals & Petrochemicals

- Paper & Pulp

- Food & Beverages

- Metals & Mining

- Others

In terms of industrial boilers market analysis, the chemicals & petrochemicals segment commands a substantial share in the industry, propelled by the rapid expansion of petrochemical industries and significant investments in large-scale power projects, particularly in emerging economies worldwide. Furthermore, the increasing focus on cleaner energy sources, coupled with efforts to reduce carbon emissions, is stimulating growth within this segment. Developing nations, in particular, are directing investments towards sustainable energy solutions, fostering a conducive environment for the adoption of industrial boilers tailored for cleaner energy generation. This collective momentum towards cleaner and more efficient industrial processes augments the trajectory of growth for the chemicals & petrochemicals segment in the global market.

Industrial Boilers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Boilers Market Regional Analysis

Asia-Pacific emerged as the frontrunner in the global industry in 2023 and is poised for the most rapid growth throughout the industrial boilers market forecast period spanning from 2024 to 2032. This ascent is underpinned by the region's swift industrialization and concerted efforts towards bolstering infrastructure in both the power generation and industrial domains. Moreover, manufacturers are increasingly prioritizing eco-friendly solutions in response to stringent governmental regulations, thereby amplifying market dynamics. Notably, key economies like China and India play pivotal roles in propelling regional market expansion, showcasing substantial contributions to the overall growth trajectory. These factors collectively underscore Asia-Pacific's pivotal position as a powerhouse driving the evolution and expansion of the global industrial boilers market.

Industrial Boilers Market Players

Some of the top industrial boilers companies offered in our report include IHI Corporation, Forbes Marshall, Bharat Heavy Electricals Ltd., AC Boilers, Dongfang Electric Corporation Ltd., Harbin Electric Corporation, Siemens AG, Mitsubishi Heavy Industries, Ltd., Cheema Boilers Limited, and Thermax Ltd.

Frequently Asked Questions

How big is the industrial boilers market?

The industrial boilers market size was valued at USD 14.8 Billion in 2023.

What is the CAGR of the global industrial boilers market from 2024 to 2032?

The CAGR of Industrial Boilers is 4.5% during the analysis period of 2024 to 2032.

Which are the key players in the industrial boilers market?

The key players operating in the global market are including IHI Corporation, Forbes Marshall, Bharat Heavy Electricals Ltd., AC Boilers, Dongfang Electric Corporation Ltd., Harbin Electric Corporation, Siemens AG, Mitsubishi Heavy Industries, Ltd., Cheema Boilers Limited, and Thermax Ltd.

Which region dominated the global industrial boilers market share?

Asia-Pacific held the dominating position in industrial boilers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Industrial Boilers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Industrial Boilers industry?

The current trends and dynamics in the industrial boilers industry include increasing demand for energy-efficient heating systems, growth in industrialization and infrastructure development, rising government regulations on emissions and energy use, and technological advancements in boiler design and materials.

Which boiler type held the maximum share in 2023?

The water-tube held the notable share of the industrial boilers industry.