Industrial Battery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Battery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

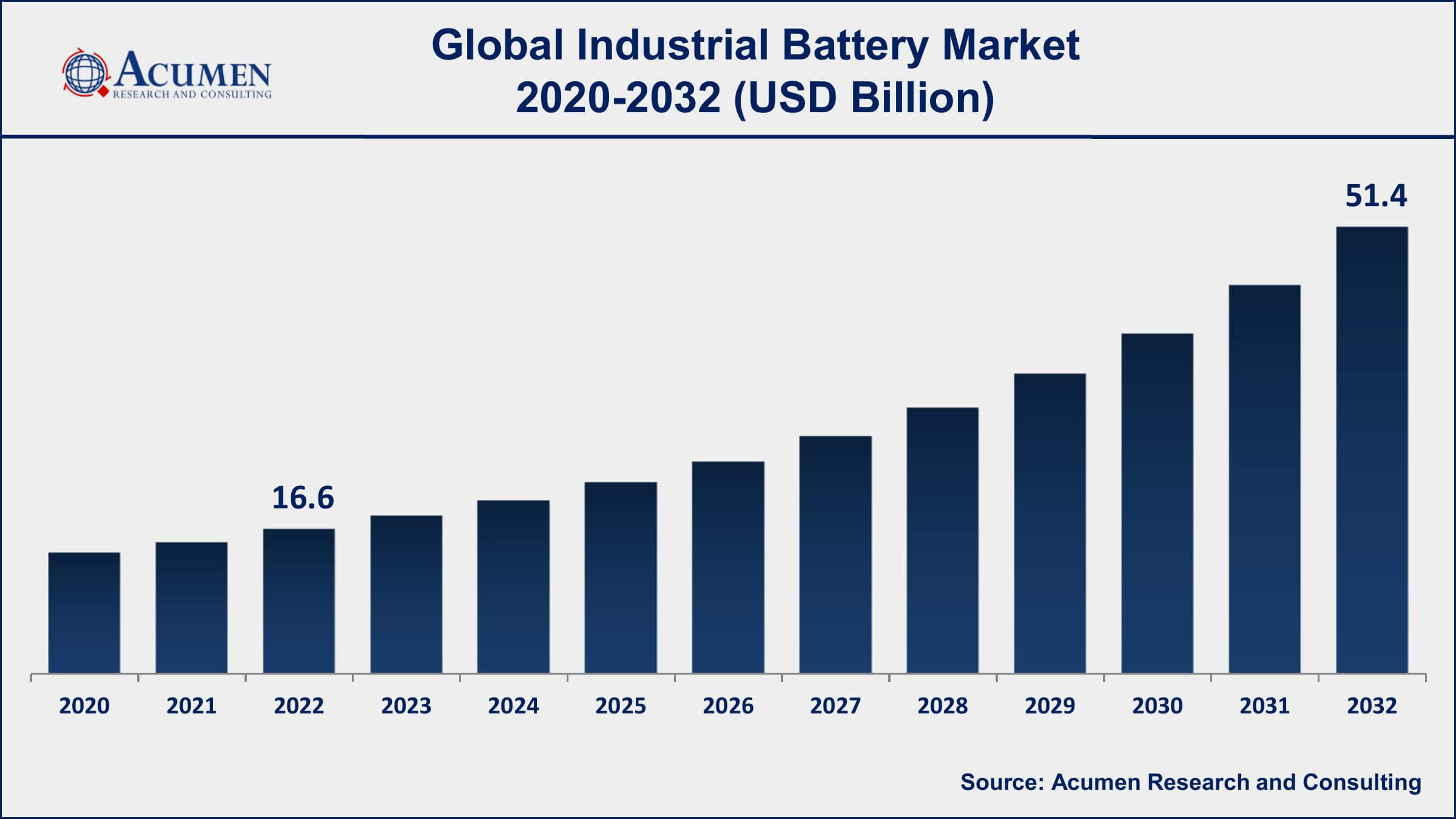

The Global Industrial Battery Market Size accounted for USD 16.6 Billion in 2022 and is projected to achieve a market size of USD 51.4 Billion by 2032 growing at a CAGR of 11% from 2023 to 2032.

Report Key Highlights

- Global industrial battery market revenue is expected to increase by USD 51.4 Billion by 2032, with a 11% CAGR from 2023 to 2032

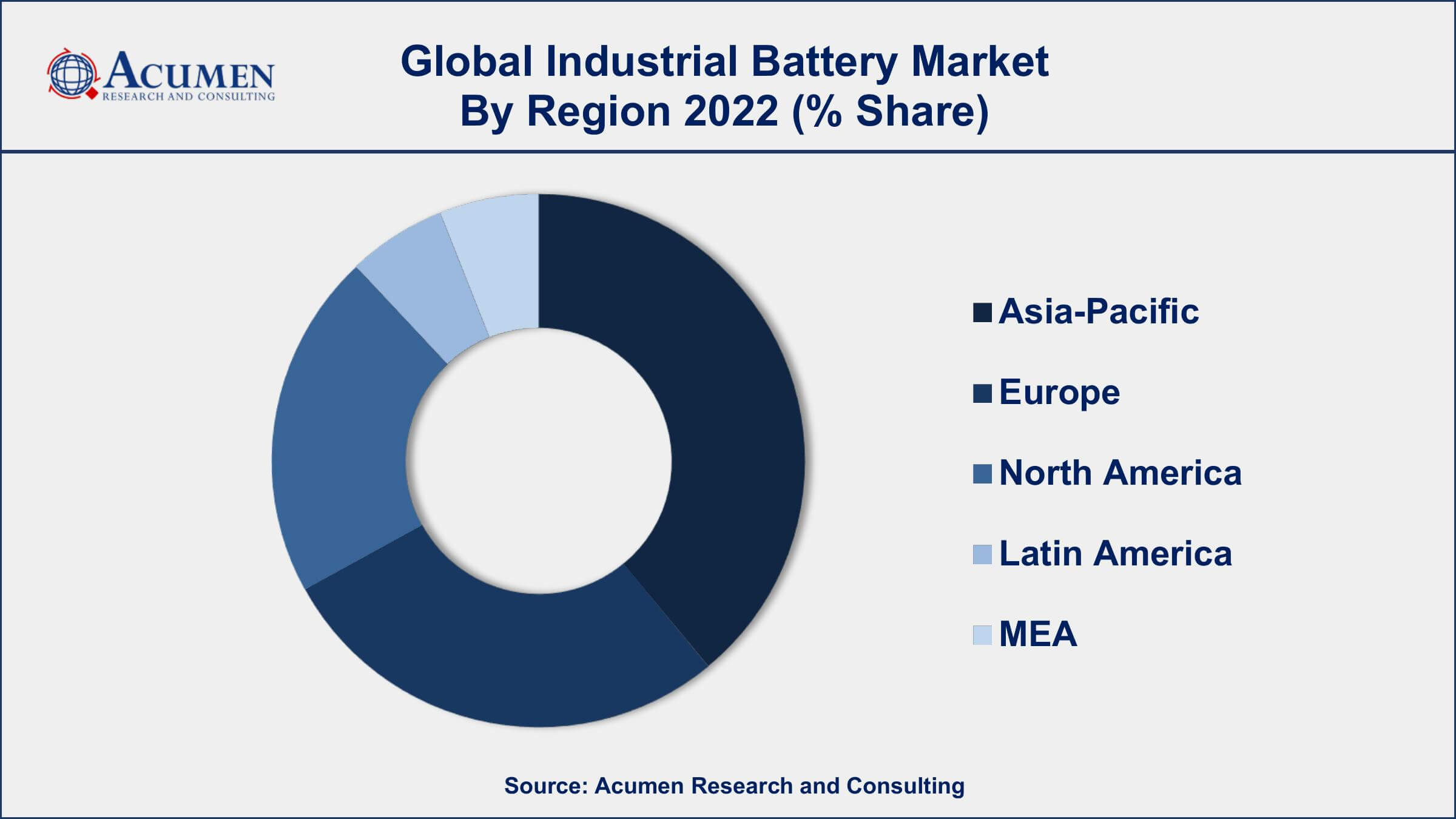

- Asia-Pacific region led with more than 40% of industrial battery market share in 2022

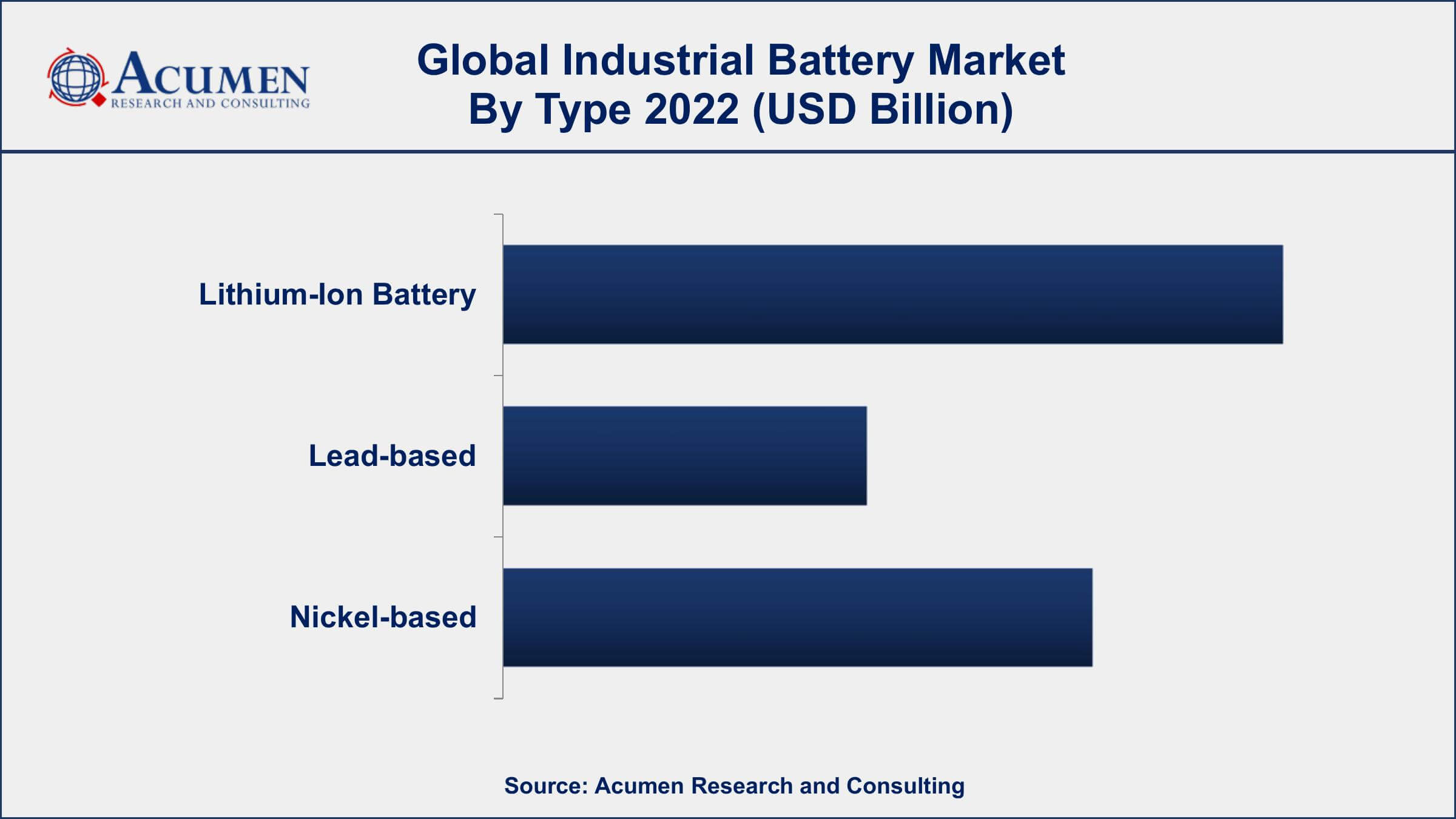

- Lithium-ion batteries are the most popular type of industrial battery, accounting for more than 62% of the market share

- The recycling rate of industrial batteries is believed to be over 70%, with lead-acid batteries having the highest recycling rate

- The European Union (EU) has set recycling targets for batteries, intending to recycle at least 50% of all batteries by 2025 and 70% by 2030

- According to the International Energy Agency (IEA), the energy storage market, which includes batteries, will rise from 11 gigawatt-hours (GWh) in 2020 to 175 GWh by 2030

- Increasing adoption of renewable energy and energy storage solutions, drives the industrial battery market size

An industrial battery is a type of battery that is designed for use in heavy-duty equipment and machinery, such as forklifts, cranes, and mining equipment. These batteries are designed to be durable and reliable, with a longer lifespan than consumer-grade batteries. Industrial batteries come in a variety of chemistries, including lead-acid, nickel-cadmium, and lithium-ion.

The industrial battery market value has seen steady growth in recent years, driven by increasing demand for electric vehicles and renewable energy storage solutions. The COVID-19 pandemic has also had an impact on the market, with increased demand for backup power solutions for hospitals, data centers, and other critical infrastructure. The market for industrial batteries is expected to continue to grow in the coming years, with a CAGR of around 11% projected between 2023 and 2032. Factors driving this growth include the increasing adoption of electric vehicles, growth in renewable energy, and the need for reliable backup power solutions in critical infrastructure.

Global Industrial Battery Market Trends

Market Drivers

- Increasing demand for electric vehicles

- Growth in renewable energy storage solutions

- Rise in the adoption of automation and IoT devices in industries

- Growing demand for energy storage in critical infrastructure

Market Restraints

- High initial investment is required for setting up battery manufacturing plants

- Safety concerns and risks associated with the use of industrial batteries

Market Opportunities

- Increasing adoption of renewable energy and energy storage solutions in emerging economies

- Growing demand for energy storage in residential and commercial buildings

Industrial Battery Market Report Coverage

| Market | Industrial Battery Market |

| Industrial Battery Market Size 2022 | USD 16.6 Billion |

| Industrial Battery Market Forecast 2032 | USD 51.4 Billion |

| Industrial Battery Market CAGR During 2023 - 2032 | 11% |

| Industrial Battery Market Analysis Period | 2020 - 2032 |

| Industrial Battery Market Base Year | 2022 |

| Industrial Battery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LG Chem Ltd., Tesla, Inc., Samsung SDI Co., Ltd., Panasonic Corporation, Contemporary Amperex Technology Co., Limited (CATL), Saft Groupe S.A., BYD Company Limited, Johnson Controls International plc, GS Yuasa Corporation, East Penn Manufacturing Co., Inc., EnerSys, and Exide Technologies. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Batteries or battery pack is used as a source of power for various industrial purposes for instance construction, robotics, handling, and railroad applications. Industrial batteries are able to provide a power source as long as the device operates. These batteries are used in remote sensors, oceanographic devices, GPS tracking devices, and toll tags of automotive and are able to operate for as long as 50 years in outdoor conditions. Industrial batteries are capable of operating in temperature ranges from -55 to 150° C. Most industrial applications require lithium-ion (Li-ion) cells as they can operate for 20 years and work under diverse climatic conditions. The oldest industrial battery was made up of Nickel Cadmium (NiCad). The demand for NiCad batteries has decreased over the years as they were large in size and have low energy density. Lithium batteries are the most modern industrial batteries in the market.

The global industrial batteries market is growing at a significant pace owing to the growth in demand from the automotive industry. Emerging economies such as India, China, Brazil, UAE, Saudi Arabia, and some parts of Africa are witnessing rapid growth in the automotive sector, thereby driving the market for industrial batteries. Also, the growth in the renewable energy sector paves the opportunities for the industrial batteries market growth. However, the market for industrial batteries faces hindrances owing to the safety issues associated with their operation. Moreover, the huge capital investment required by manufacturers for the production of industrial batteries also restricts the growth of the global industrial batteries market. The growing telecom & data center industry offer huge growth opportunity for the global batteries market in the coming years.

Industrial Battery Market Segmentation

The global Industrial Battery market segmentation is based on Type, application, and geography.

Industrial Battery Market By Type

- Lithium-Ion Battery

- Lithium Titanite

- Lithium Magnesium Oxide

- Lithium Cobalt Oxide

- Others

- Lead-based

- Nickel-based

In terms of types, the lithium-ion battery segment has seen significant growth in the industrial battery market in recent years. This can be attributed to several factors, such as the increasing adoption of electric vehicles and renewable energy storage solutions, as well as the growing demand for high-performance and long-lasting batteries in various industrial applications. One of the key advantages of lithium-ion batteries is their high energy density, which allows them to store more energy in a smaller and lighter package compared to other types of batteries. This makes them ideal for use in electric vehicles, which require lightweight and high-energy-density batteries for the extended driving range. Lithium-ion batteries are also increasingly being used in renewable energy storage systems, such as for storing excess energy generated by solar panels or wind turbines.

Industrial Battery Market By Application

- Telecom & Data Communication

- Grid Storage

- Energy

- Uninterruptible Power Supply (UPS)

- Equipment

- Others

According to the industrial battery market forecast, the telecom & data communication segment is expected to witness significant growth in the coming years. With the increasing use of mobile devices and the growing demand for data, the telecom and data communication industry is increasingly relying on the uninterrupted power supply to ensure the continuous operation of their infrastructure. Industrial batteries play a crucial role in providing backup power for telecom and data centers during power outages and other disruptions. Some of the factors driving the growth of the telecom and data communication segment in the industrial battery market include the increasing demand for high-speed internet, the rise in data traffic, and the growing number of data centers globally. With the shift towards cloud computing and the increasing use of IoT devices, the demand for industrial batteries in this segment is expected to continue to grow in the coming years.

Industrial Battery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Battery Market Regional Analysis

The Asia-Pacific region is currently the leading market for industrial batteries, and it is expected to continue to grow in the coming years. One of the main reasons for this is the rapid industrialization and urbanization of countries in the region, particularly in China and India. As these countries continue to develop their infrastructure and expand their manufacturing capabilities, there is a growing need for reliable and sustainable sources of power, which is driving the demand for industrial batteries. Another factor contributing to the growth of the industrial battery market in the Asia-Pacific region is the increasing adoption of renewable energy solutions. With the region being home to some of the world's largest renewable energy projects, including solar and wind farms, there is a growing need for energy storage solutions to ensure a reliable and continuous power supply. Industrial batteries are well-suited to this application, and as a result, their demand is increasing rapidly in the region.

Industrial Battery Market Player

Some of the top industrial battery market companies offered in the professional report include LG Chem Ltd., Tesla, Inc., Samsung SDI Co., Ltd., Panasonic Corporation, Contemporary Amperex Technology Co., Limited (CATL), Saft Groupe S.A., BYD Company Limited, Johnson Controls International plc, GS Yuasa Corporation, East Penn Manufacturing Co., Inc., EnerSys, and Exide Technologies.

Frequently Asked Questions

What was the market size of the global industrial battery in 2022?

The market size of industrial battery was USD 16.6 Billion in 2022.

What is the CAGR of the global industrial battery market from 2023 to 2032?

The CAGR of Industrial Battery is 11% during the analysis period of 2023 to 2032.

Which are the key players in the industrial battery market?

The key players operating in the global market are including LG Chem Ltd., Tesla, Inc., Samsung SDI Co., Ltd., Panasonic Corporation, Contemporary Amperex Technology Co., Limited (CATL), Saft Groupe S.A., BYD Company Limited, Johnson Controls International plc, GS Yuasa Corporation, East Penn Manufacturing Co., Inc., EnerSys, and Exide Technologies.

Which region dominated the global industrial battery market share?

Asia-Pacific held the dominating position in industrial battery industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of industrial battery during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global industrial battery industry?

The current trends and dynamics in the industrial battery industry include increasing demand for electric vehicles, and growth in renewable energy storage solutions.

Which type held the maximum share in 2022?

The lithium-ion battery type held the maximum share of the industrial battery industry.