Industrial Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

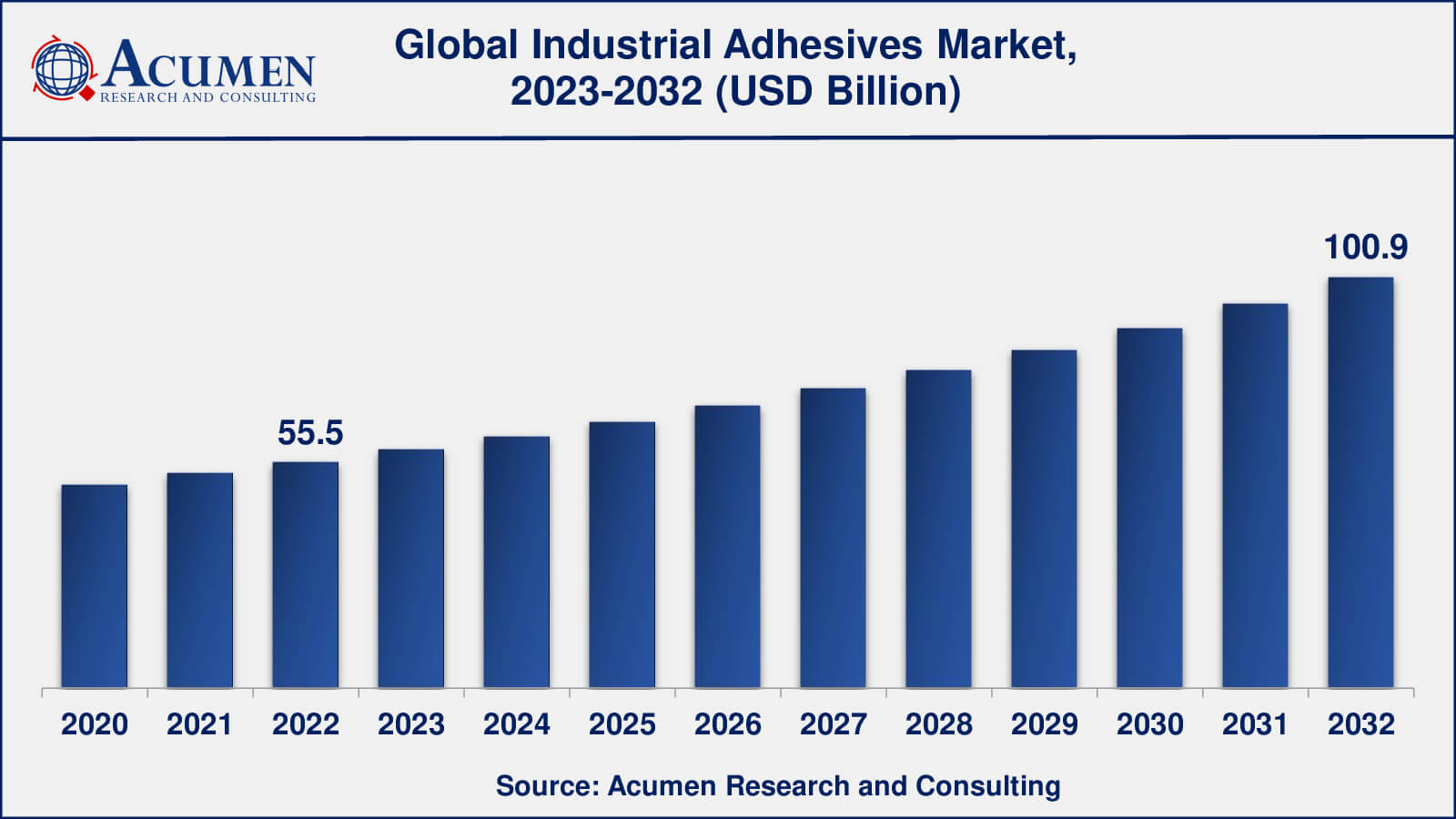

The Global Industrial Adhesives Market Size collected USD 55.5 Billion in 2022 and is set to achieve a market size of USD 100.9 Billion in 2032 growing at a CAGR of 6.2% from 2023 to 2032.

Industrial Adhesives Market Report Statistics

- Global industrial adhesives market revenue is estimated to reach USD 100.9 billion by 2032 with a CAGR of 6.2% from 2023 to 2032

- Asia-Pacific industrial adhesives market value occupied more than USD 24.4 billion in 2022

- North America industrial adhesives market growth will record a CAGR of over 6% from 2023 to 2032

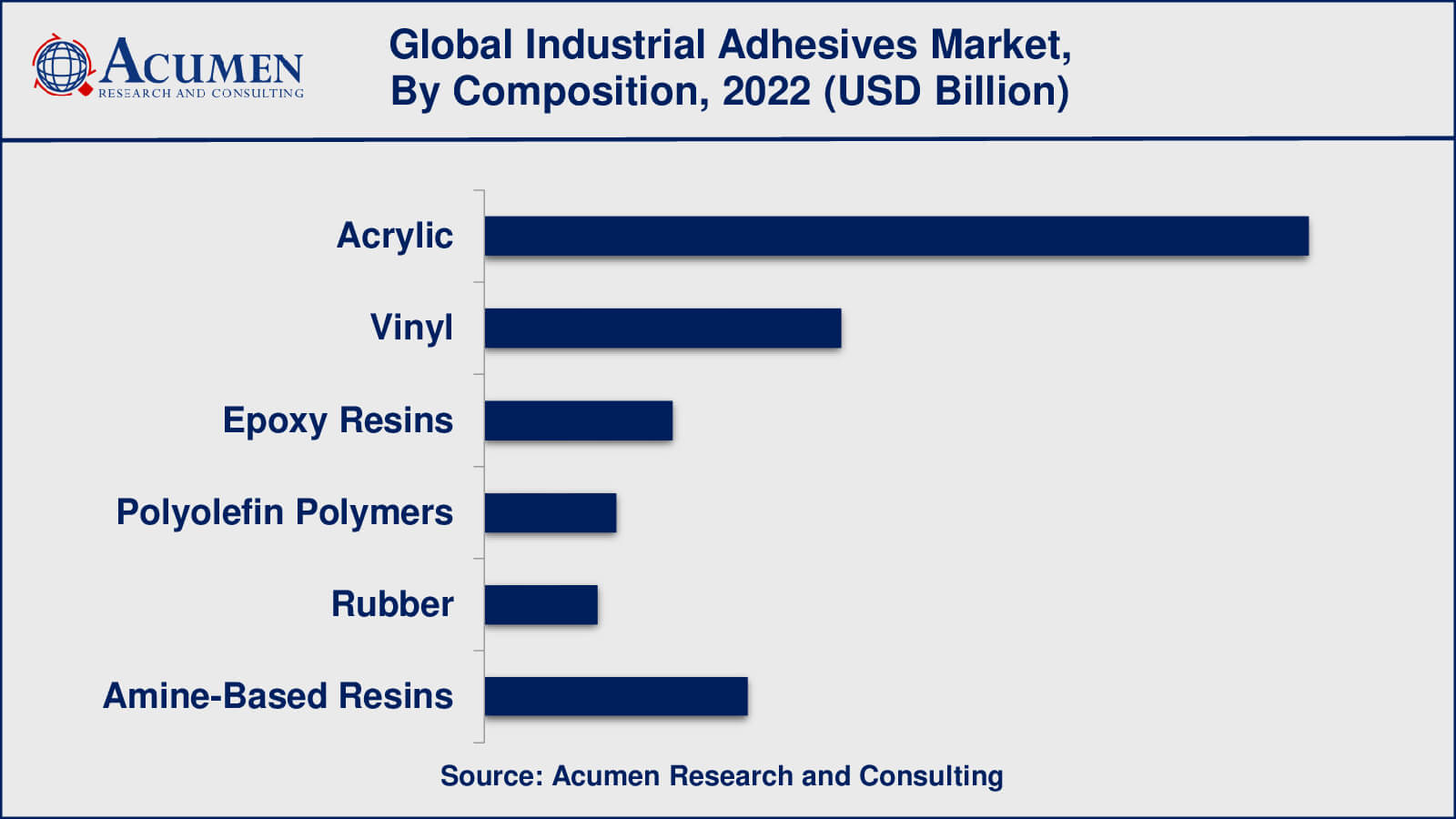

- Among products, the acrylic sub-segment generated around 44% share in 2022

- Based on application, the packaging sub-segment generated around US$ 13.3 billion revenue in 2022

- Advancements in adhesive technology is a popular industrial adhesives market trend that fuels the industry demand

Any substance that is applied to the material surface for binding them together is known as an adhesive. Adhesives used for industrial purposes are industrial adhesives. The first industrial adhesive came into use with the establishment of the first ever glue plant in 1690 in Holland. Pigments, fillers, plasticizers, and other additives are mixed with the base materials such as natural rubber, starch, synthetic polymer, polyvinyl acetate, and neoprene to form industrial adhesives. Adhesives offer huge advantages to industrial works by fixing materials of different shapes and sizes. Industrial adhesives also provide resistance from corrosion with the reduction in the weight of products. Natural polymers and synthetic polymers are the main raw materials for industrial adhesives.

Global Industrial Adhesives Market Dynamics

Market Drivers

- Increasing demand from end-use industries

- Growing trend towards lightweight and energy-efficient products

- Increased investment in R&D

- Rising demand for specialty adhesives

Market Restraints

- Volatility in raw material prices

- Competition from alternative bonding methods

Market Opportunities

- Increasing demand for eco-friendly adhesives

- Growing adoption of hot melt adhesives

Industrial Adhesives Market Report Coverage

| Market | Industrial Adhesives Market |

| Industrial Adhesives Market Size 2022 | USD 55.5 Billion |

| Industrial Adhesives Market Forecast 2032 | USD 100.9 Billion |

| Industrial Adhesives Market CAGR During 2023 - 2032 | 6.2% |

| Industrial Adhesives Market Analysis Period | 2020 - 2032 |

| Industrial Adhesives Market Base Year | 2022 |

| Industrial Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Composition, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pidilite Industries Limited, H. B. Fuller, Huntsman Corporation, Henkel AG & Company, 3M Company, The Dow Chemical Company, Sika AG, BASF SE, Solvay Group, and E. I. Du Pont De Nemours and Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Adhesives Market Growth Factors

The rapidly growing packaging, automotive, infrastructure construction, and woodworking are the driving factors for the growth of the industrial adhesives market. Technological advancement for better industrial adhesive products will also drive the market for industrial adhesives in the coming years. Technological advancement is also likely to influence the cost of industrial adhesive products. Government regulations regarding the production of products with less VOC (Volatile organic compounds) content hamper the growth of the industrial adhesives market. The fluctuating raw material prices of industrial adhesives also hinder market growth. Another restraining factor for the growth of industrial adhesives includes the huge investment required for the R&D of new products containing less VOC content. The sudden demand for lightweight vehicles that emit less VOC content is a major opportunity for industrial adhesives in the coming years.

Industrial Adhesives Market Segmentation

The worldwide market for industrial adhesives is categorized based on composition, type, application, and geography.

Industrial Adhesives Composition Outlook

- Acrylic

- Vinyl

- Epoxy Resins

- Polyolefin Polymers

- Rubber

- Amine-Based Resins

Acrylic adhesives are well-known for their high bonding strength, excellent durability, and temperature and moisture resistance, making them suitable for a wide range of applications in a variety of industries. They have benefits such as quick setting times, high bond strength, and low odour. Acrylic adhesives are used in a variety of industries, including automotive, construction, electronics, and medical devices. Acrylic adhesives are used in the automotive industry to bond interior and exterior parts, and in the construction industry for structural bonding, sealing, and glazing applications. Acrylic adhesives are used in the electronics industry for bonding and encapsulating components.

Acrylic adhesive demand is being driven by factors such as the expansion of end-use industries, rising demand for lightweight and durable materials, and a shift towards environmentally friendly and low-VOC adhesives. Acrylic adhesives are expected to remain a significant market segment in the industrial adhesives market.

Industrial Adhesives Type Outlook

- Solvent-Based Adhesives

- Pressure Sensitive Adhesives

- Water-Based Adhesives

- Hot-Melt Adhesives

- Others

Solvent-based adhesives are commonly used in applications requiring high bond strength and temperature and chemical resistance, such as the automotive, construction, and aerospace industries. In the packaging, labelling, and medical industries, pressure-sensitive adhesives are commonly used. They provide a strong but removable bond and can be used at room temperature. Water-based adhesives are low-VOC and environmentally friendly, and are widely used in industries such as woodworking, paper and packaging, and textiles. Hot-melt adhesives are applied while molten and solidify after cooling. They're popular in the packaging, bookbinding, and woodworking industries. UV-curing adhesives, reactive adhesives, and structural adhesives are examples of industrial adhesives.

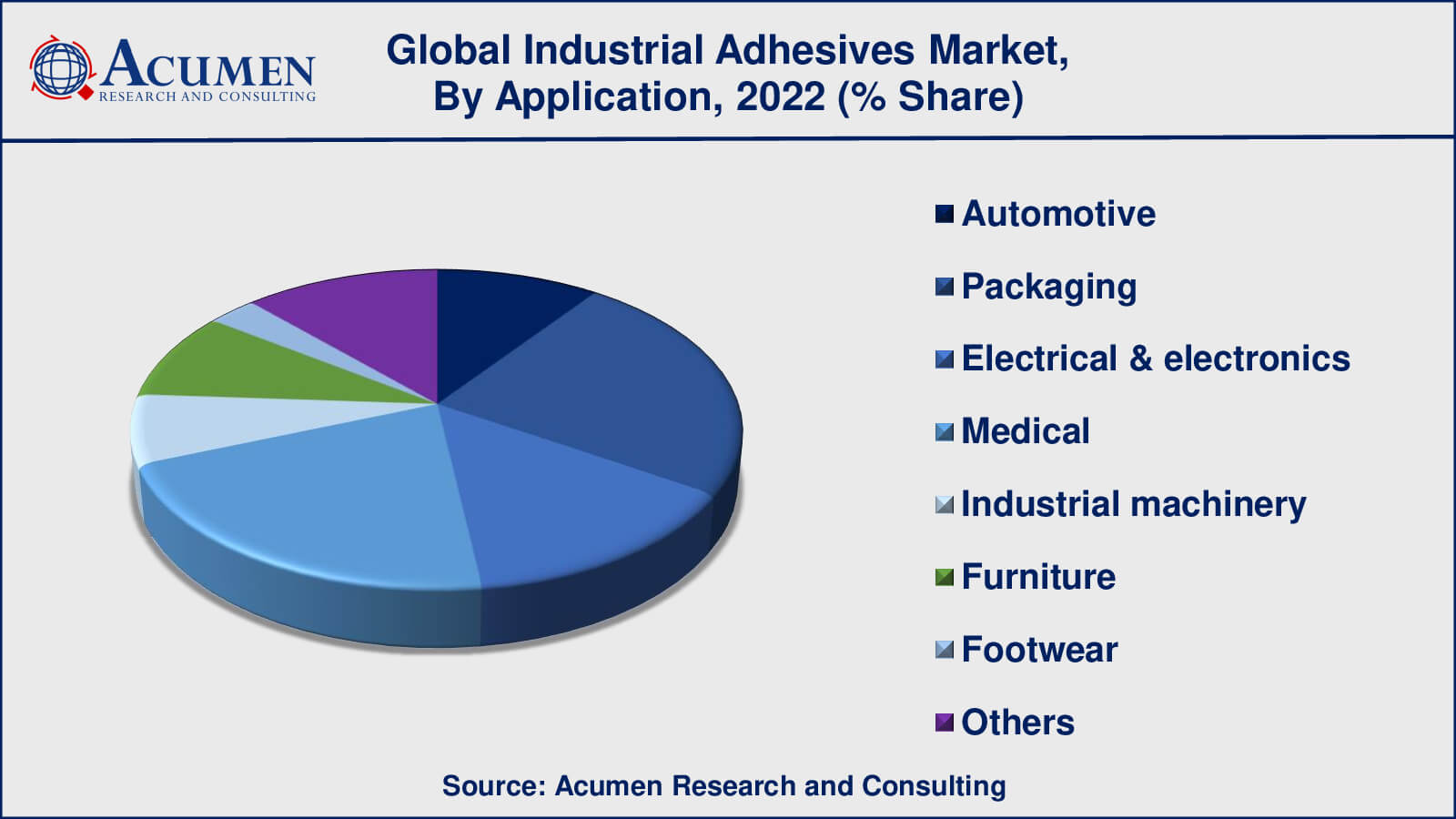

Industrial Adhesives Application Outlook

- Automotive

- Packaging

- Electrical & electronics

- Medical

- Industrial machinery

- Furniture

- Footwear

- Others

According to the industrial adhesives industry analysis, the packaging segment is one of the important applications of industrial adhesives and has a significant market share in the industrial adhesives market. Industrial adhesives are essential in the packaging industry because they are used to bond, seal, and label a variety of packaging materials such as cardboard, paper, plastics, and metal. Because of their eco-friendliness, low VOC emissions, and quick curing times, water-based adhesives and hot-melt glues are the most frequently employed kinds of adhesives in the packaging industry. Pressure-sensitive adhesives are also commonly used in the packaging industry for label and tape bonding.

Factors such as the growth of e-commerce, the increasing demand for sustainable and eco-friendly packaging, as well as the requirement for high-speed and efficient packaging processes drive demand for industrial adhesives in the packaging industry. The demand for industrial adhesives in the packaging industry is expected to rise in the future as the e-commerce sector expands.

Industrial Adhesives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Adhesives Market Regional Analysis

Asia-Pacific is the region with the greatest market for industrial adhesives due to the existence of significant manufacturing hubs and expanding end-use industries like the automotive, electronics, and construction. Growing number of production facilities across the globe, growing investments from foreign companies; strong industrial base in infrastructure construction sector and rise in living standards are the major factors accounting for the growth of concrete industrial adhesives market in this region. The three biggest markets in the area are China, Japan, and South Korea.

North America is a prominent market for industrial adhesives due to the existence of key end-use sectors including the automotive, construction, and electronics. The market for industrial adhesives in the region is established and is predicted to increase moderately over the next few years.

Europe is an important market for industrial adhesives due to the presence of strong automotive and construction sectors. The demand for water-based and hot-melt adhesives in the region is being driven by a shift towards environmentally friendly and sustainable adhesives.

The demand for industrial adhesives in the regions like North America and Europe is likely to increase in the future years owing to the heavy investment by key manufacturers for development of bio-based alternatives. In LAMEA region, the market for industrial adhesives will grow due to increased construction activities in countries such as Brazil, UAE, Saudi Arabia and parts of Africa.

Industrial Adhesives Market Players

Some of the global industrial adhesives companies profiled in the report include Pidilite Industries Limited, H. B. Fuller, Huntsman Corporation, Henkel AG & Company, 3M Company, The Dow Chemical Company, Sika AG, BASF SE, Solvay Group, and E. I. Du Pont De Nemours and Company.

Frequently Asked Questions

What was the market size of the global industrial adhesives in 2022?

The market size of industrial adhesives was USD 55.5 billion in 2022.

What is the CAGR of the global industrial adhesives market from 2023 to 2032?

The CAGR of industrial adhesives is 6.2% during the analysis period of 2023 to 2032.

Which are the key players in the Industrial Adhesives market?

The key players operating in the global market are including Pidilite Industries Limited, H. B. Fuller, Huntsman Corporation, Henkel AG & Company, 3M Company, The Dow Chemical Company, Sika AG, BASF SE, Solvay Group, and E. I. Du Pont De Nemours and Company.

Which region dominated the global industrial adhesives market share?

Asia-Pacific held the dominating position in industrial adhesives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of industrial adhesives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global industrial adhesives industry?

The current trends and dynamics in the industrial adhesives industry include increasing demand from end-use industries, growing trend towards lightweight and energy-efficient products, increased investment in R&D, and rising demand for specialty adhesives.

Which product held the maximum share in 2022?

The acrylic product held the maximum share of the industrial adhesives industry.