Indium Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Indium Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

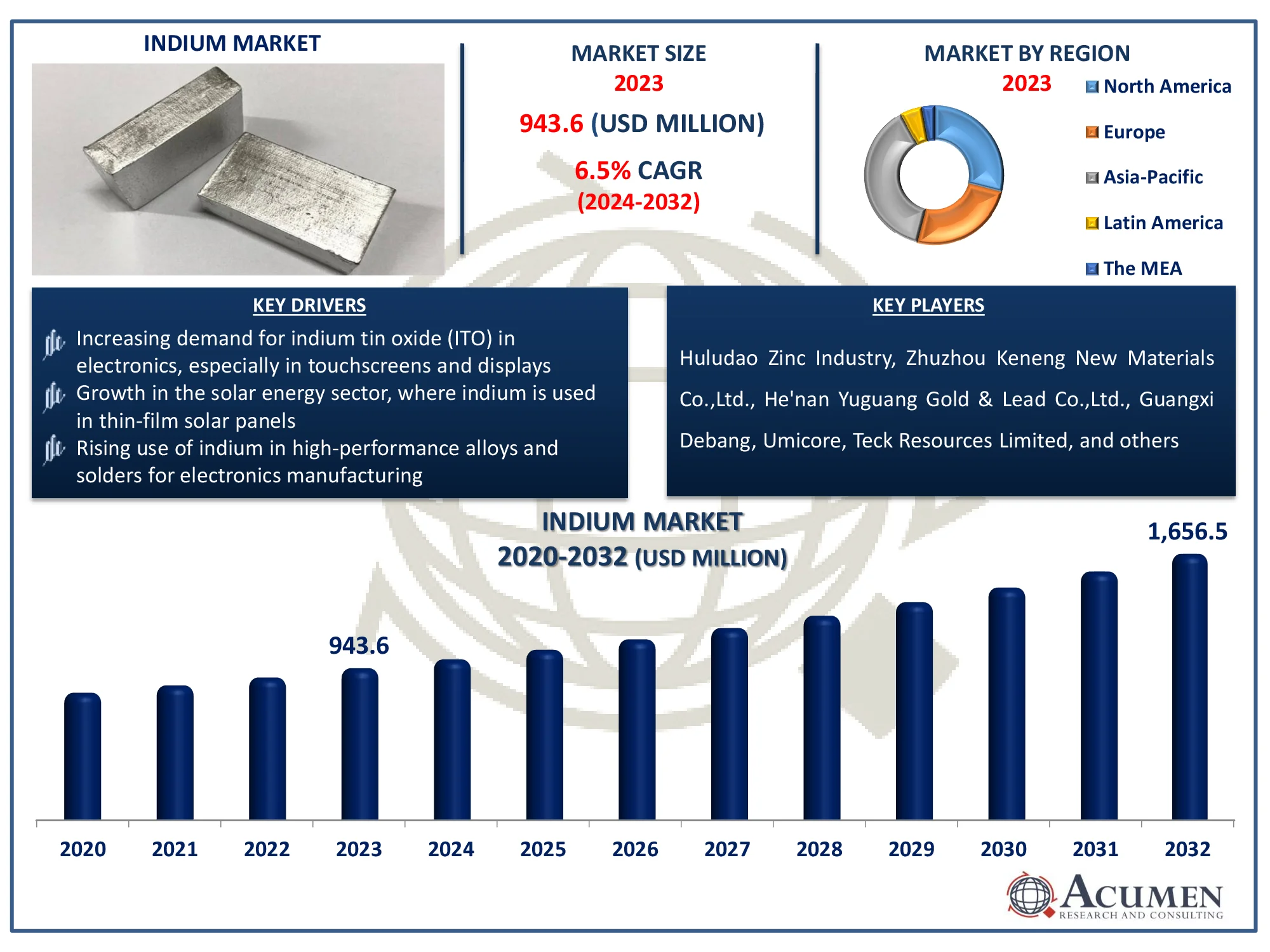

Request Sample Report

The Global Indium Market Size accounted for USD 943.6 Million in 2023 and is estimated to achieve a market size of USD 1656.5 Million by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Indium Market Highlights

- The global indium market is expected to reach USD 1,656.5 million by 2032, growing at a CAGR of 6.5% from 2024 to 2032

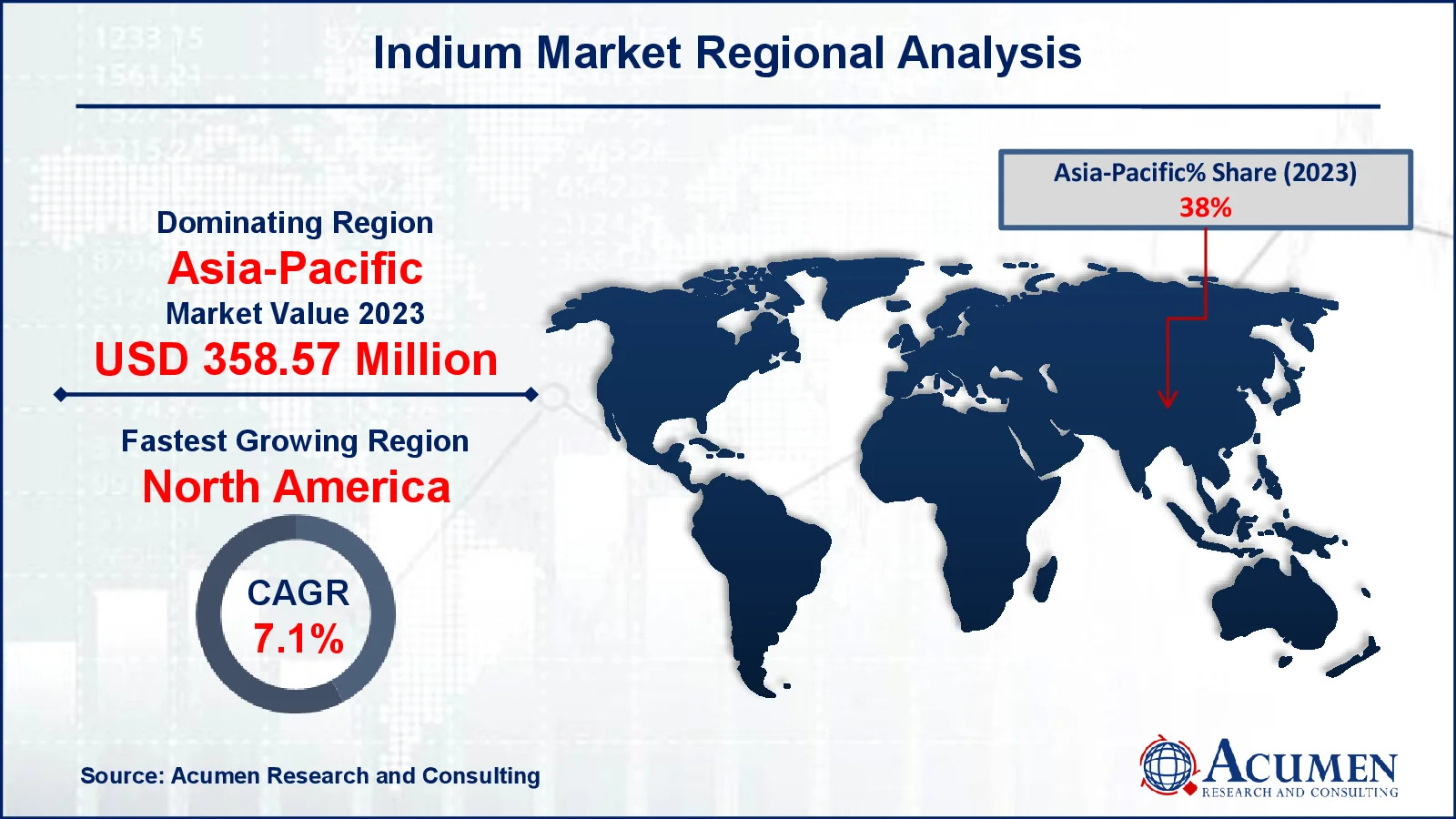

- In 2023, the Asia-Pacific indium market was valued at approximately USD 358.57 million

- The North American indium market is projected to grow at a CAGR of over 7.1% from 2024 to 2032

- The primary indium sub-segment accounted for 60% of the market share in 2023

- The ITO sub-segment in the application category showed a growth of 46% in 2023

- Increased research and development into alternative indium applications in aerospace and automotive industries is the indium market trend that fuels the industry demand

Indium is a soft, silvery-white metal that occurs naturally, often in combination with zinc and other metals. It possesses several distinctive properties, including its unique ability to bond with nonmetals, cold welding capabilities, high thermal conductivity, stable behavior at cryogenic temperatures, and softness. One of its key compounds, indium tin oxide (ITO), is a combination of tin oxide and indium oxide in a 9:1 weight ratio. When applied as a thin layer, ITO is transparent and colorless.

ITO is increasingly favored over alternatives due to its high transparency, resistance to ultraviolet light, and excellent color fastness. As a conductive film, ITO is commonly used to create transparent panels by being deposited onto glass or plastic substrates. This makes it ideal for various antistatic applications, such as in LCDs, plasma displays, and other display technologies. ITO also plays a crucial role in reducing radio frequency interference on touchscreens and flat-panel displays, as well as shielding glass doors and windows through electromagnetic induction. By minimizing the buildup of static electricity on different substrates, ITO proves to be more effective than other materials, making it the preferred choice for manufacturers in these industries.

Global Indium Market Dynamics

Market Drivers

- Increasing demand for indium tin oxide (ITO) in electronics, especially in touchscreens and displays

- Growth in the solar energy sector, where indium is used in thin-film solar panels

- Rising use of indium in high-performance alloys and solders for electronics manufacturing

Market Restraints

- Limited availability of indium, as it is primarily a byproduct of zinc mining

- High production costs and price volatility of indium

- Environmental concerns related to the extraction and processing of indium

Market Opportunities

- Expanding applications of indium in electric vehicles and battery technologies

- Emerging uses in quantum computing and advanced electronics

- Potential for increased recycling and recovery of indium from electronic waste

Indium Market Report Coverage

|

Market |

Indium Market |

|

Indium Market Size 2023 |

USD 943.6 Million |

|

Indium Market Forecast 2032 |

USD 1,656.5 Million |

|

Indium Market CAGR During 2024 - 2032 |

6.5% |

|

Indium Market Analysis Period |

2020 - 2032 |

|

Indium Market Base Year |

2023 |

|

Indium Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Huludao Zinc Industry, Zhuzhou Keneng New Materials Co.,Ltd., He'nan Yuguang Gold & Lead Co.,Ltd., Guangxi Debang, Umicore, Teck Resources Limited, PPM Pure Metals GmbH, Doe Run, China Tin Group, Dowa Holdings, China Germanium, Zhuzhou Smelter Group, Nyrstar, Asahi Holdings, and Young Poong. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Indium Market Insights

The growing demand for LCDs is a key driver of the indium market, with most of the produced indium being used in the form of indium tin oxide (ITO) for LCDs. The increasing demand for larger displays and tablets, particularly with the rise in TV screen sizes, is expected to further boost market growth. For instance, in May 2022, Panasonic unveiled its 2022 core and premium TV lineup, featuring advanced OLED and Core LED models ranging in size from 42 to 77 inches. These TVs are equipped with Ultra HD OLED screens that enhance picture quality using advanced sensors to adjust ambient color and brightness, ensuring an optimal viewing experience. However, price instability and the significant demand-supply gap are anticipated to challenge the market's expansion.

The rising adoption of touchscreens and advanced displays in consumer electronics, such as smartphones, tablets, and TVs, has significantly boosted the demand for indium tin oxide (ITO). National Library of Medicine stats that, the use of touchscreen devices with internet connectivity, such as smartphones and tablets, is on the rise. Children are increasingly engaging with these devices. Among children aged 2–4 years, the most effective way to utilize touchscreen devices is through joint usage with their parents. ITO’s excellent optical transparency and electrical conductivity make it indispensable for modern display technologies. This trend is further supported by continuous innovation in wearable devices and interactive displays.

The growing electric vehicle (EV) industry presents significant opportunities for indium, particularly in battery technology and thermal management systems. According to India Brand Equity Foundation, in 2023, EV sales experienced a significant 28% increase from the previous year, reaching a total of 88,619 vehicles. This represents a remarkable growth of 714% over three years, compared to just 10,885 units sold in 2021. Indium is being explored for its role in enhancing battery efficiency and lifespan, aligning with the increasing focus on EV innovation. This expanding application base is set to create new avenues for indium demand in the near future.

Indium Market Segmentation

The worldwide market for indium is split based on types, application, and geography.

Indium Market By Type

- Primary Indium

- Secondary Indium

- Type III

Among the various types of indium, primary indium holds a dominant market share, accounting for approximately 60% of the market. It is primarily obtained as a byproduct during the processing and refining of zinc ores. The extraction of sulfidic zinc ores is closely tied to primary indium production. Indium is then processed in specialized metal plants, where it is refined for use in consumer electronics. After processing, indium is shaped into ingots, indium tin oxide powder, and wires, which are subsequently used in the production of photovoltaic cells, liquid crystal displays, and for sputtering thin films for other commercial applications.

Indium Market By Application

- ITO

- Semiconductor

- Solder and Alloys

- Others

According to the indium market forecast, the indium tin oxide (ITO) is a primary application due to its widespread use in electronics, particularly in touchscreens, LCDs, and solar cells. ITO's high transparency, electrical conductivity, and resistance to UV light make it essential for display technologies and photovoltaic applications. The demand for larger displays, tablets, and solar energy solutions continues to drive the growth of this segment. While other applications such as semiconductors, solders, and alloys also contribute to the market, ITO remains the most significant driver of indium consumption.

Indium Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Indium Market Regional Analysis

For several reasons, the Asia-Pacific region dominates the indium market, driven by the strong demand for electronics, particularly in countries like China, Japan, and South Korea, which are key manufacturers of LCDs, smartphones, and solar panels. According to India Brand Equity Foundation, the Indian electronics industry is among the fastest-growing sectors globally. As stated in the report ‘A Call to Action for Broadening and Deepening Electronics Manufacturing’ by the Ministry of Electronics and IT, India aims to reach a target of US$ 300 Billion in electronics manufacturing by 2026. This growth in electronics manufacturing is driving the increasing demand for indium in India, particularly for use in display technologies and solar panels.

North America, on the other hand, is the fastest-growing region due to the increasing adoption of indium in renewable energy technologies, particularly in the solar sector, and advancements in electronics. In June 2024, Iltani Resources extended the Orient silver-indium deposit in north Queensland by 550 meters. Reverse circulation drilling revealed significant silver-lead-zinc-indium mineralization, with notable assays including 7 meters at 63 grams per tonne (g/t) silver equivalent (AgEq) and 69 meters at 45 g/t AgEq. These results reinforce the deposit's potential for open-pit mining. The growing demand for indium in renewable energy technologies, particularly in solar power, is one of the key factors driving the growth of the indium market in North America. Both regions are expected to continue driving significant growth in indium consumption.

Indium Market Players

Some of the top indium companies offered in our report include Huludao Zinc Industry, Zhuzhou Keneng New Materials Co.,Ltd., He'nan Yuguang Gold & Lead Co.,Ltd., Guangxi Debang, Umicore, Teck Resources Limited, PPM Pure Metals GmbH, Doe Run, China Tin Group, Dowa Holdings, China Germanium, Zhuzhou Smelter Group, Nyrstar, Asahi Holdings, and Young Poong.