Incontinence and Ostomy Care Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Incontinence and Ostomy Care Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Incontinence and Ostomy Care Products Market Size accounted for USD 18.1 Billion in 2021 and is projected to achieve a market size of USD 27.8 Billion by 2030 rising at a CAGR of 5% from 2022 to 2030. The growing number of elderly and obese population is a leading aspect that is driving the global incontinence and ostomy care products market growth. In addition, advancement in personalized medicine is one of the recent incontinence and ostomy care products market trends that is fueling the industry demand.

Incontinence and Ostomy Care Products Market Report Statistics

- Global incontinence and ostomy care products market revenue is estimated to reach USD 27.8 Billion by 2030 with a CAGR of 5% from 2022 to 2030

- According to the International Continence Society (ICS), urinary incontinence affects 200 million people worldwide

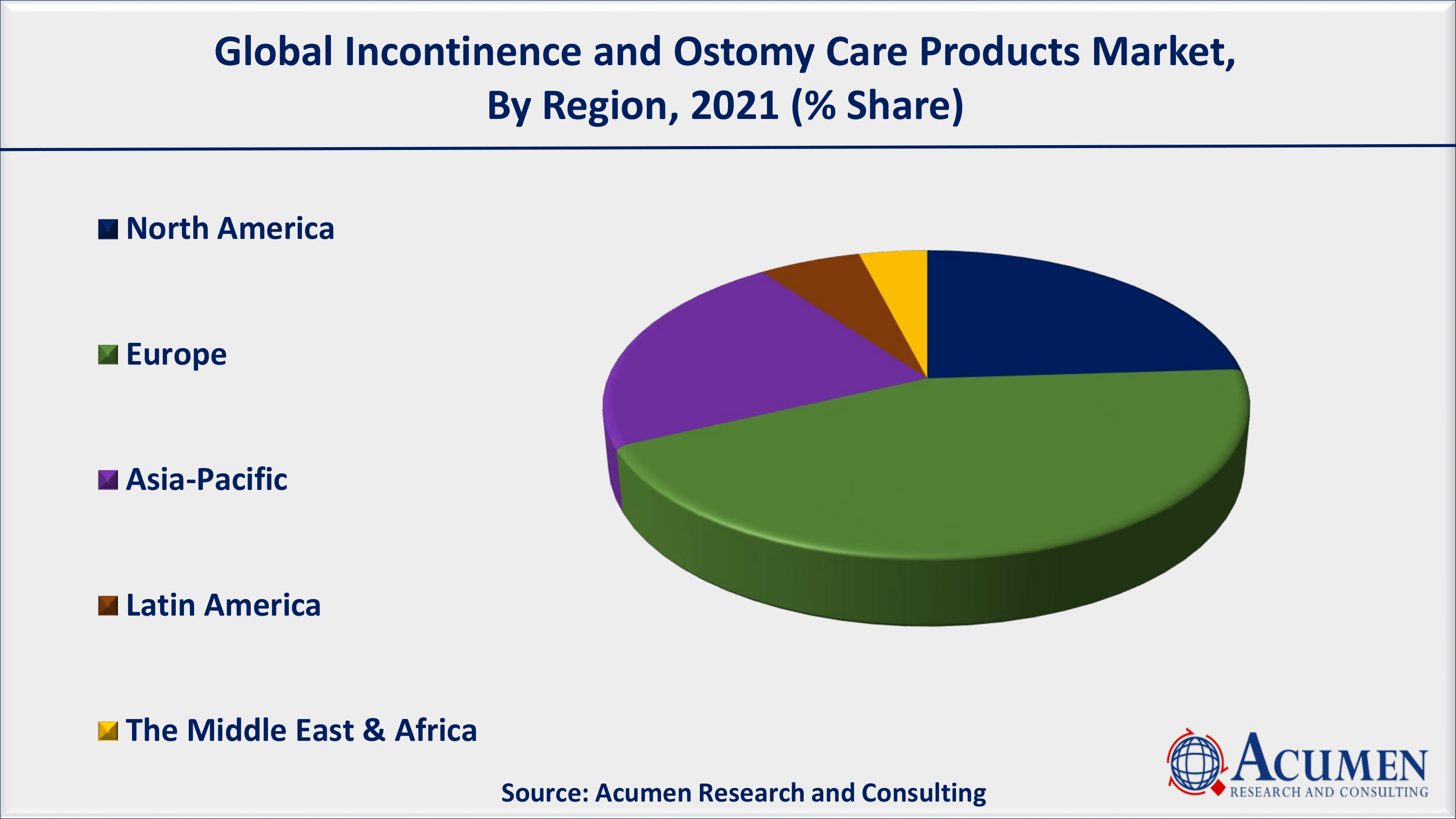

- Europe incontinence and ostomy care products market share accounted for over 44% shares in 2021

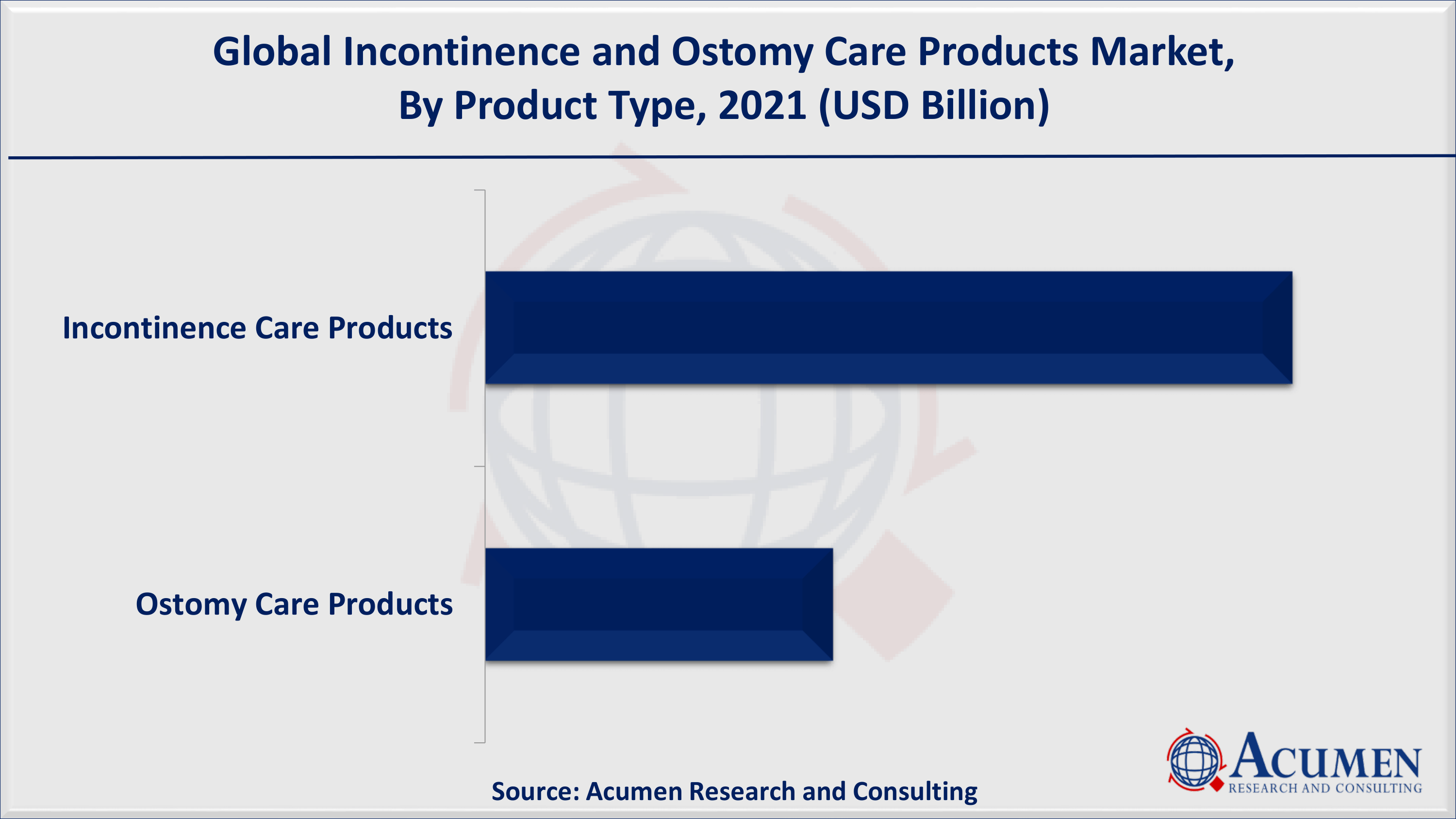

- Based on product type, incontinence care products accounted for over 75% of the overall market share in 2021

- Asia-Pacific incontinence and ostomy care products market growth will achieve fastest CAGR from 2022 to 2030

- Growing cases of urinary incontinence worldwide fuels the global incontinence and ostomy care products market value

Incontinence is defined as the inability to control the evacuation of bodily wastes (urine and feces), whereas ostomy is a surgical procedure that alters the way urine or stool exits the body. Because of malfunctioning urinary or digestive system components, bodily waste is rerouted from its usual path. Ostomies can be either temporary or permanent.

Global Incontinence and Ostomy Care Products Market Dynamics

Market Drivers

- Growing incidence of urinary incontinence

- Rising base of elderly population

- Surging case of colorectal cancer

Market Restraints

- Availability of substitute products

- Growing concern of skin irritation

Market Opportunities

- Rapidly growing government initiatives to spread awareness

- Increasing technological advancements in the industry

Incontinence and Ostomy Care Products Market Report Coverage

| Market | Incontinence and Ostomy Care Products Market |

| Incontinence and Ostomy Care Products Market Size 2021 | USD 18.1 Billion |

| Incontinence and Ostomy Care Products Market Forecast 2030 | USD 27.8 Billion |

| Incontinence and Ostomy Care Products Market CAGR During 2022 - 2030 | 5% |

| Incontinence and Ostomy Care Products Market Analysis Period | 2018 - 2030 |

| Incontinence and Ostomy Care Products Market Base Year | 2021 |

| Incontinence and Ostomy Care Products Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | B. Braun, Coloplast AG, ConvaTec Group plc, Hollister Incorporated, Kimberly-Clark Corporation, Medtronic plc, Essity (Svenska Cellulosa Aktiebolaget), Salts Healthcare, Unicharm Corporation, Domtar Corporation, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Incontinence and Ostomy Care Products Market Dynamics

An increase in the number of patients suffering from urological diseases and defective bladders, rising ostomy surgeries of the bowel, and an aging population are all significant factors driving the market during the forecast period. Bladder dysfunction is caused by a high prevalence of urologic disorders such as urinary retention, incontinence, benign prostatic hyperplasia, cystitis, and kidney stones. The vast majority of the population suffers from bladder control issues such as leakage, incontinence, or retention. Rising geriatric and obese populations, increasing prevalence of renal diseases and nephrological injuries, and growing awareness and acceptance of ostomy care products are some of the factors driving the market growth. Adult diapers are extremely important in cases of mobility impairment, severe diarrhea, or dementia. Reduced renal function, which is primarily age-related, is a major indicator of chronic diseases. This may be accelerated by a number of other chronic diseases, such as hypertension, diabetes, and obesity, among others, which frequently lead to various stages of kidney disease. These illnesses are a global health problem, with high financial consequences to health systems.

Incontinence and Ostomy Care Products Market Segmentation

The worldwide incontinence and ostomy care products market is split based on product type, application, and geography.

Incontinence and Ostomy Care Products Market By Product Type

- Incontinence Care Products

- Adsorbents

- Incontinence Bags

- Others

- Ostomy Care Products

- Ostomy Bags

- Deodorants

- Skin Barriers

- Irrigation Products

According to our incontinence and ostomy care products industry analysis, the absorbents segment is expected to dominate the market in the coming years. This is due to high usage rates and the growing popularity of disposable adult diapers, as well as an aging population and an increase in the prevalence of bladder-related conditions. Furthermore, the introduction of innovative and personalized products aimed at achieving user-friendliness and comfort, as well as the gradual de-stigmatization of products such as adult diapers, are some of the factors justifying the segment's growth during the forecast period.

Incontinence and Ostomy Care Products Market By Application

- Bladder Cancer

- Colorectal Cancer

- Crohn’s Disease

- Kidney Stone

- Chronic Kidney Failure

- Other Applications

As per the incontinence and ostomy care products market forecast, by application, colorectal cancer is anticipated to witness lucrative growth in the forecast period. Colorectal cancer has one of the highest incidence and prevalence rates of any cancer type in the world. The main causes of colorectal cancer have been identified as lifestyle disorders, aging, and diet. According to the American Institute for Cancer Research, more than 1.8 million new cases of colorectal cancer were diagnosed worldwide in 2018. Colorectal cancer is a leading cause of ileostomy and colostomy procedures, both temporary and permanent. As a result, the rising prevalence of colorectal cancer is increasing ostomy procedures and opening up new opportunities for ostomy product manufacturers.

Incontinence and Ostomy Care Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Incontinence and Ostomy Care Products Market Regional Analysis

Europe is projected to hold dominant market share for the incontinence and ostomy care products market in the forthcoming years

After Europe, North America will have a reasonable market share for incontinence and ostomy care products. During the forecast period, factors such as an increase in the number of stoma patients due to Crohn's disease, ulcerative colitis, or IBD are expected to drive the market in Europe as Europe comprises about 731,000 people living with an ostomy.

Asia Pacific is exhibited to record significant growth in the forthcoming years for the incontinence and ostomy care products market

Because of the large number of people in the Asia-Pacific who suffer from urinary and bladder problems as a result of unhealthy lifestyles, the market for incontinence and ostomy care products is expected to grow significantly in the future. Furthermore, several nursing centers in this region organize a variety of programs, such as motivational programs and educational seminars, to raise ostomy patient awareness. The Asia and South Pacific Ostomy Association (ASPOA) organizes World Ostomy Day every year to improve ostomate rehabilitation by bringing their aspirations and needs to the attention of the general public and the global community. As a result, rising consumer awareness is expected to drive demand for incontinence and ostomy care products in this region.

North America is expected to record second largest market share for the incontinence and ostomy care products market

Incontinence is a common health problem, with Crohn's Disease afflicting a sizable proportion of the population. However, it is rarely discussed because, in most cases, people are embarrassed to discuss it. Every day, more than 25 million people in the United States experience bladder leakage, according to the National Association for Incontinence. Urinary incontinence is primarily associated with aging, afflicting up to 30% of the elderly population. It affects 85 percent of long-term care patients and is frequently the reason for admission. Several companies, including Kimberly-Clark and Svenska Cellulosa Aktiebolaget (SCA), have a strong retail presence in the region, which is beneficial for adults in at-home care, hospitals, and institutions.

Incontinence and Ostomy Care Products Market Players

Some of the key incontinence and ostomy care products companies in the market are B. Braun, Coloplast AG, ConvaTec Group plc, Hollister Incorporated, Kimberly-Clark Corporation, Medtronic plc, Essity (Svenska Cellulosa Aktiebolaget), Salts Healthcare, Unicharm Corporation, Domtar Corporation, and others.

Frequently Asked Questions

What is the size of global incontinence and ostomy care products market in 2021?

The market size of incontinence and ostomy care products market in 2021 was accounted to be USD 18.1 Billion.

What is the CAGR of global incontinence and ostomy care products market during forecast period of 2022 to 2030?

The projected CAGR of incontinence and ostomy care products market during the analysis period of 2022 to 2030 is 5%.

Which are the key players operating in the market?

The prominent players of the global incontinence and ostomy care products market are B. Braun, Coloplast AG, ConvaTec Group plc, Hollister Incorporated, Kimberly-Clark Corporation, Medtronic plc, Essity (Svenska Cellulosa Aktiebolaget), Salts Healthcare, Unicharm Corporation, Domtar Corporation, and others.

Which region held the dominating position in the global incontinence and ostomy care products market?

Europe held the dominating incontinence and ostomy care products during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for incontinence and ostomy care products during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global incontinence and ostomy care products market?

Growing incidence of urinary incontinence, rising base of elderly population, and surging case of colorectal cancer drives the growth of global incontinence and ostomy care products market.

Which product type held the maximum share in 2021?

Based on product type, incontinence products segment is expected to hold the maximum share incontinence and ostomy care products market.