Incinerator Equipment Market | Acumen Research and Consulting

Incinerator Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

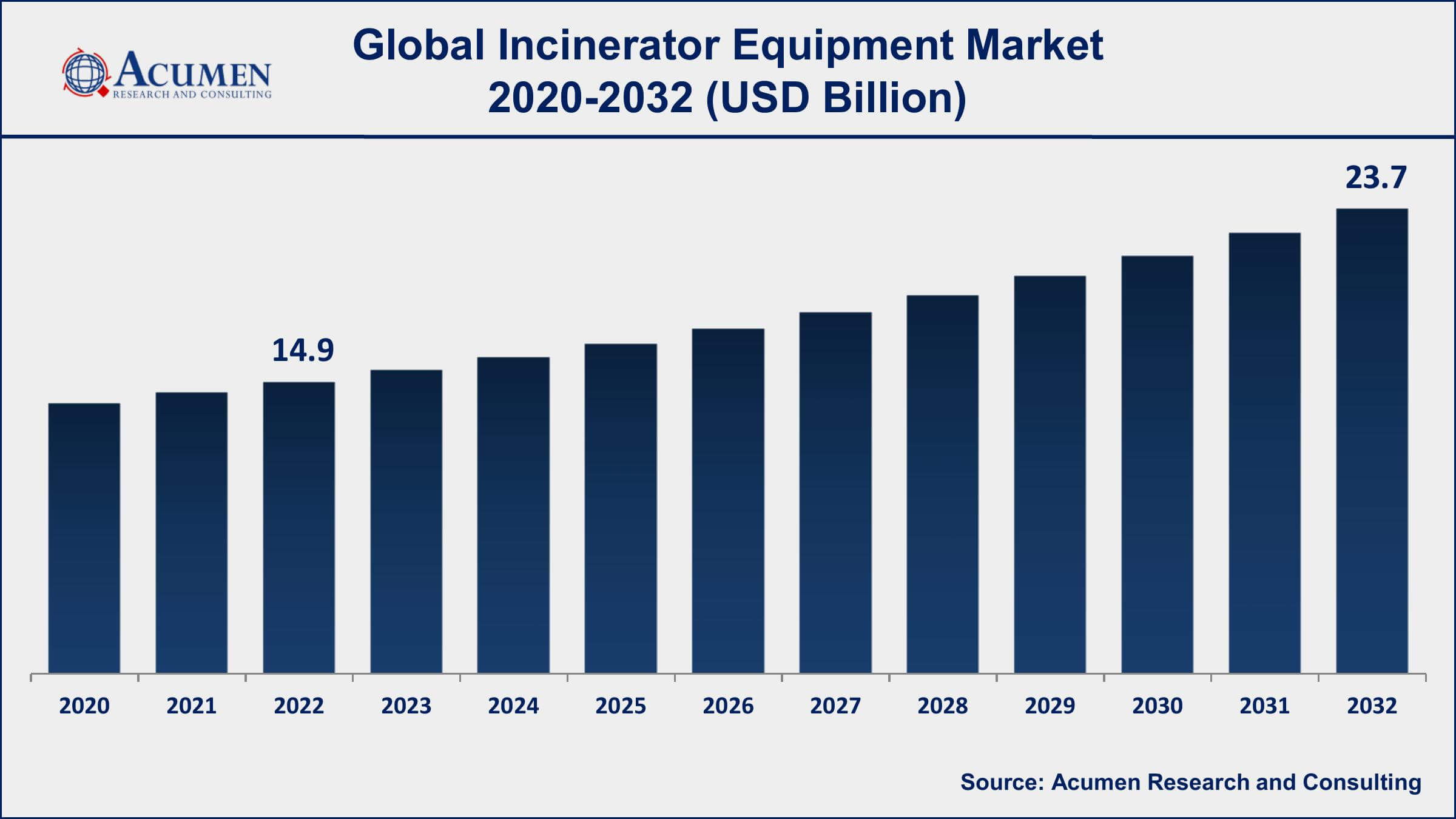

The Global Incinerator Equipment Market Size accounted for USD 14.9 Billion in 2022 and is projected to achieve a market size of USD 23.7 Billion by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

Report Key Highlights

- Global incinerator equipment market revenue is expected to increase by USD 23.7 Billion by 2032, with a 4.9% CAGR from 2023 to 2032

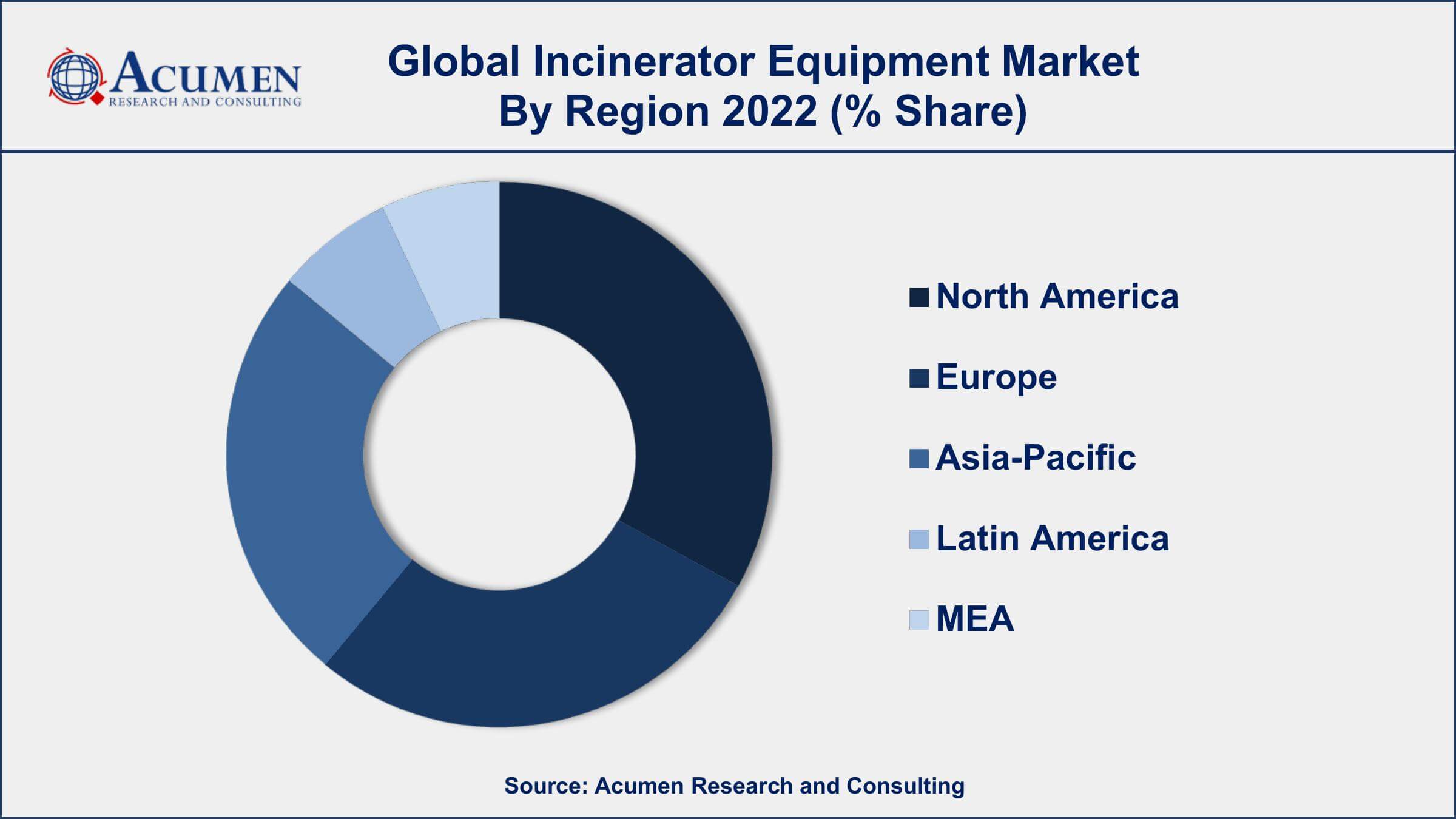

- North America region led with more than 36% of incinerator equipment market share in 2022

- According to the EPA, incinerators can reduce waste volume by up to 90% and waste weight by up to 75%

- Incineration is the third-most common method of waste management in Europe, after landfilling and recycling

- According to the research, there were 2,293 incineration plants operational in the EU in 2018, with a total capacity of 89.2 million tons of trash per year

- According to the ASME, modern incinerators are equipped with advanced emission control systems capable of removing more than 99.99 percent of contaminants from exhaust gases

- Increasing adoption of renewable energy and energy storage solutions, drives the incinerator equipment market size

An incinerator is a device used for the combustion of waste materials, converting them into ash, gas, and heat. It is commonly used for the disposal of hazardous waste, medical waste, municipal solid waste, and other types of waste materials. Incinerator equipment includes burners, reactors, scrubbers, and control systems, among other components. The design and capacity of incinerator equipment depend on the type and quantity of waste to be processed, as well as environmental regulations and safety standards.

The market growth for incinerator equipment is driven by several factors, including increasing concerns over environmental pollution, the need for efficient waste management systems, and the growing demand for renewable energy. With a growing global population and increasing levels of waste production, the need for effective waste management solutions is becoming increasingly critical. Incinerator equipment offers a sustainable solution to waste management, as it can reduce the volume of waste, generate energy, and reduce the release of harmful pollutants into the environment. Additionally, with the increased focus on renewable energy sources, incinerator equipment is becoming a more attractive option for generating electricity from waste materials.

Global Incinerator Equipment Market Trends

Market Drivers

- Increasing levels of waste generation globally

- Stringent government regulations for waste disposal and environmental protection

- Growing focus on renewable energy sources

- Demand for sustainable waste management solutions

- Increasing adoption of incinerator equipment in medical waste treatment

Market Restraints

- High initial cost of installation and maintenance

- Concerns over the release of harmful emissions and pollutants

Market Opportunities

- Increasing adoption of incinerator equipment in industrial applications such as chemical and pharmaceutical waste treatment

- Emergence of waste-to-energy projects as an alternative energy source

Incinerator Equipment Market Report Coverage

| Market | Incinerator Equipment Market |

| Incinerator Equipment Market Size 2022 | USD 14.9 Billion |

| Incinerator Equipment Market Forecast 2032 | USD 23.7 Billion |

| Incinerator Equipment Market CAGR During 2023 - 2032 | 4.9% |

| Incinerator Equipment Market Analysis Period | 2020 - 2032 |

| Incinerator Equipment Market Base Year | 2022 |

| Incinerator Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Babcock & Wilcox Enterprises, Inc., Covanta Holding Corporation, Mitsubishi Heavy Industries, Ltd., Suez Environment S.A., Hitachi Zosen Inova AG, Gershman, Brickner & Bratton, Inc. (GBB), Martin GmbH für Umwelt- und Energietechnik, Steinmüller Babcock Environment GmbH, BMH Technology Oy, and Babcock Noell GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The major factor propelling the incinerator equipment market growth is the increasing demand for waste management technologies. The incinerator process helps to minimize the cost of transportation of waste to landfills as well as reduce pressure executed on available land. It also helps to eliminate harmful gases that are produced from landfills which further reduces environmental risks. On the other hand, the incinerator equipment market value is greatly affected due to regulatory policies relating to carbon emissions, implemented by different organizations such as US Environmental Protection Agency (USEPA) and others. Dioxins which are produced on a huge scale during the waste treatment process are very toxic in nature due to the high content of carcinogenic chemicals in them. Incineration is mainly introduced in line with waste-to-energy plants rather than separate installation due to its high setup cost. Also, there is rising demand for skilled professionals who can efficiently manage continuous operation and maintenance of the incinerator equipment.

Incinerators with newer technology and cleaner combustion are expected to be the future trends for this market. The rapid growth of technology has been in progress to initiate technologies at economical costs and leading to further enhanced environmental performance. The energy produced from this incineration process is highly regulated and it is usually provided to limited public and private operators. Since the tariff of electricity formed through incineration is wholly based on production costs, the government, therefore, is planning to subsidize the prices to make it affordable for the consumers to purchase.

Governments across the world are also encouraging a lot of private players to participate in order to overcome huge investments associated with the development of incineration plants. Also, the collective involvement of public as well as private companies has reduced the ownership issues which initially would have affected energy generation and waste management process. The suitable location of the plant is also crucial to commence cost-effective services for waste disposal.

Incinerator Equipment Market Segmentation

The global incinerator equipment market segmentation is based on technology, application, and geography.

Incinerator Equipment Market By Technology

- Rotary kiln

- Direct flame

- Liquid injection

- Catalytic combustion

- Static fluidised bed

- Furnace

- Multiple hearth incinerator

- Moving grate incinerator

- Waste gas flare

In terms of technology, the rotary kiln segment has seen significant growth in the incinerator equipment market in recent years. Rotary kilns are cylindrical vessels that rotate on an axis, and they are commonly used in incineration processes for solid and liquid waste. The primary advantage of rotary kilns is their ability to handle a wide range of waste types, including hazardous and medical waste, with high efficiency and reliability. One of the key drivers of the growth of the rotary kiln segment is the increasing demand for sustainable waste management solutions. As waste volumes continue to rise globally, there is a growing need for effective and efficient waste disposal systems that can reduce the environmental impact of waste disposal. Rotary kilns offer a viable solution for this problem, as they can reduce waste volumes by up to 95% and generate energy through the combustion process.

Incinerator Equipment Market By Application

- Chemical and industrial wastes

- Agricultural incineration

- Municipal wastes

- Sewage incineration

- Building wastes

- Medical waste incineration

- Ashes

According to the incinerator equipment market forecast, the chemical and industrial waste segment is expected to witness significant growth in the coming years. Chemical and industrial waste can be hazardous and difficult to dispose of, and incinerator equipment is a popular solution for their treatment. The growth of the chemical and industrial wastes segment is driven by several factors, including stringent government regulations on waste disposal and increasing environmental concerns. As the need for effective and sustainable waste management solutions continues to grow, there is an increasing demand for incinerator equipment that can handle a wide range of waste types, including chemical and industrial waste. Furthermore, the growth of the chemical and industrial wastes segment is also driven by the increasing adoption of waste-to-energy projects.

Incinerator Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Incinerator Equipment Market Regional Analysis

North America is a dominant player in the incinerator equipment market, accounting for a significant share of the global market. One of the primary drivers of the growth of the incinerator equipment market in North America is the strict government regulations on waste disposal and environmental protection. The US Environmental Protection Agency (EPA) has set strict regulations for waste disposal, which have encouraged the adoption of incinerator equipment as a safe and effective method for waste treatment. These regulations have led to the development of a robust market for incinerator equipment in North America. Another factor contributing to the dominance of North America in the incinerator equipment market is the increasing adoption of waste-to-energy projects. These projects involve the use of waste as a fuel source to generate electricity or heat, and incinerator equipment is a key component in this process. The US has been at the forefront of the development of waste-to-energy projects, with many successful projects already in operation. This has further fueled the demand for incinerator equipment in North America.

Incinerator Equipment Market Player

Some of the top incinerator equipment market companies offered in the professional report include Babcock & Wilcox Enterprises, Inc., Covanta Holding Corporation, Mitsubishi Heavy Industries, Ltd., Suez Environment S.A., Hitachi Zosen Inova AG, Gershman, Brickner & Bratton, Inc. (GBB), Martin GmbH für Umwelt- und Energietechnik, Steinmüller Babcock Environment GmbH, BMH Technology Oy, and Babcock Noell GmbH.

Frequently Asked Questions

What was the market size of the global incinerator equipment in 2022?

The market size of incinerator equipment was USD 14.9 Billion in 2022.

What is the CAGR of the global incinerator equipment market from 2023 to 2032?

The CAGR of incinerator equipment is 4.9% during the analysis period of 2023 to 2032.

Which are the key players in the incinerator equipment market?

The key players operating in the global market are including Babcock & Wilcox Enterprises, Inc., Covanta Holding Corporation, Mitsubishi Heavy Industries, Ltd., Suez Environment S.A., Hitachi Zosen Inova AG, Gershman, Brickner & Bratton, Inc. (GBB), Martin GmbH für Umwelt- und Energietechnik, Steinmüller Babcock Environment GmbH, BMH Technology Oy, and Babcock Noell GmbH.

Which region dominated the global incinerator equipment market share?

North America held the dominating position in incinerator equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of incinerator equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global incinerator equipment industry?

The current trends and dynamics in the incinerator equipment industry include increasing levels of waste generation globally, and growing focus on renewable energy sources.

Which technology held the maximum share in 2022?

The rotary kiln technology held the maximum share of the incinerator equipment industry.