In-Vitro Fertilization Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

In-Vitro Fertilization Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

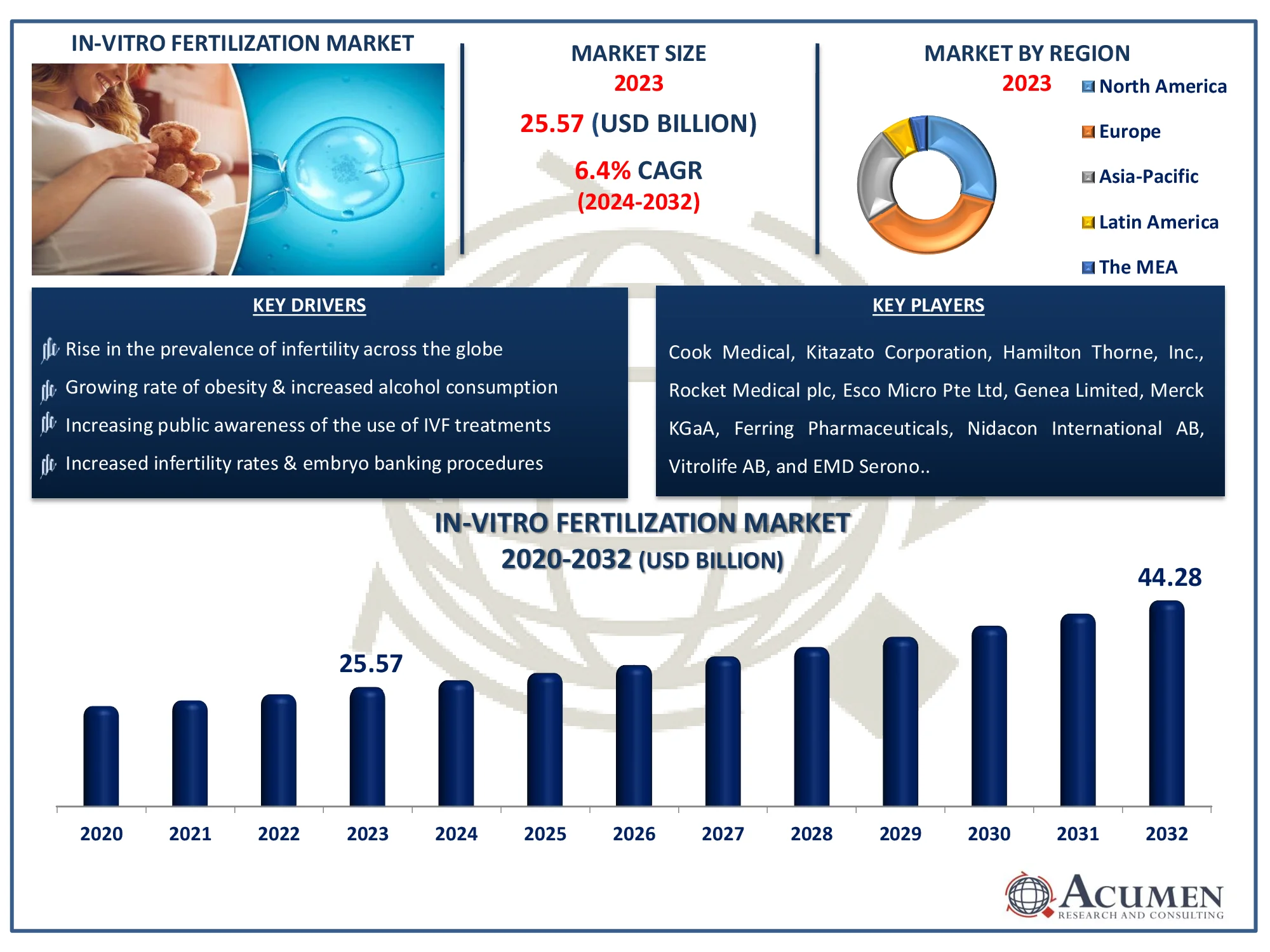

The Global In-Vitro Fertilization Market Size accounted for USD 25.57 Billion in 2023 and is estimated to achieve a market size of USD 44.28 Billion by 2032 growing at a CAGR of 6.4% from 2024 to 2032.

In-Vitro Fertilization Market Highlights

- Global in-vitro fertilization market revenue is poised to garner USD 44.28 billion by 2032 with a CAGR of 6.4% from 2024 to 2032

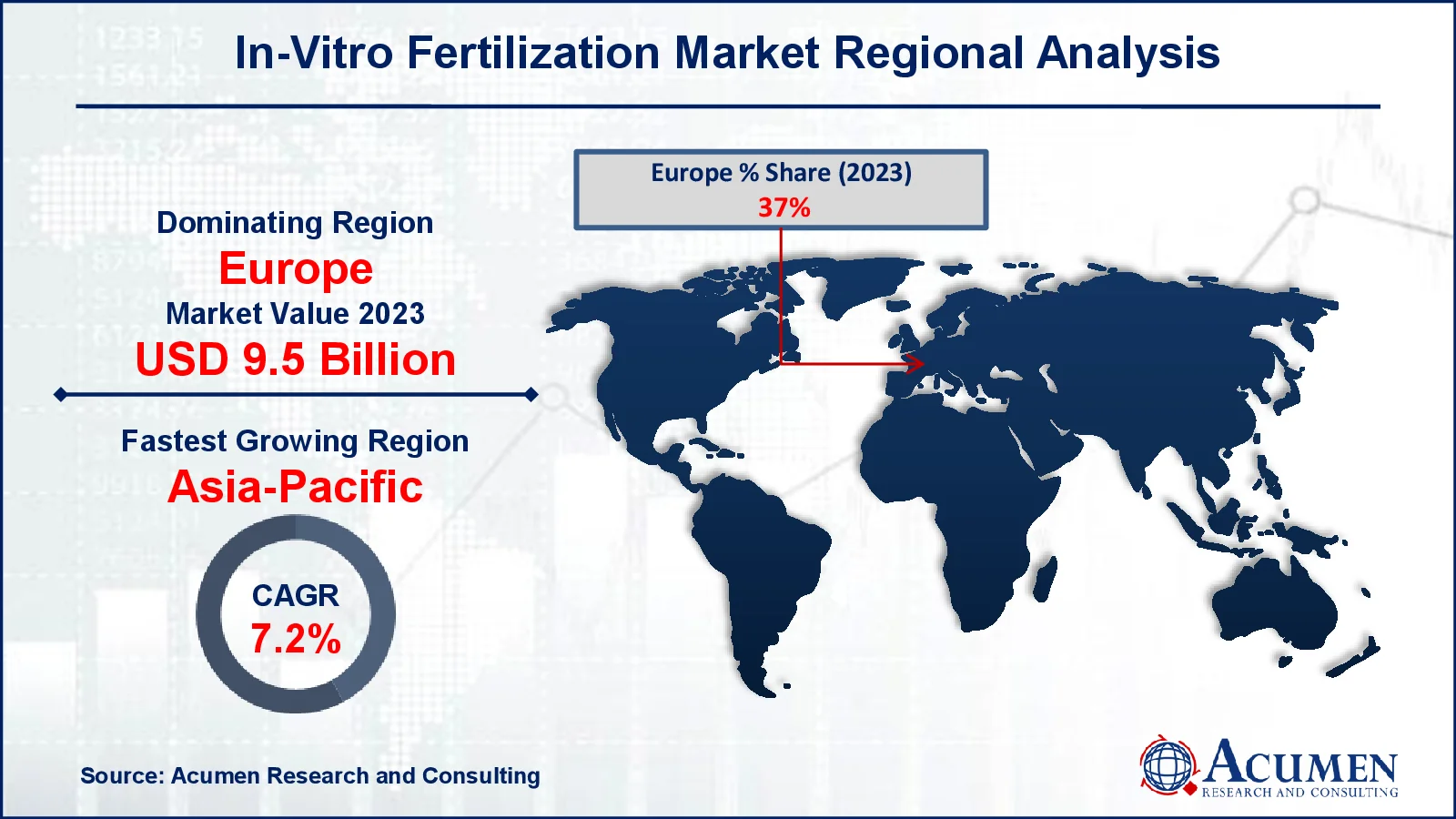

- Europe in-vitro fertilization market value occupied around USD 9.5 billion in 2023

- Asia-Pacific in-vitro fertilization market growth will record a CAGR of more than 7.2% from 2024 to 2032

- Among instrument, the culture media sub-segment generated more than USD 10.5 billion revenue in 2023

- Based on end-use, the fertility clinics sub-segment generated around 80% market share in 2023

- Increased investments in research for innovative IVF techniques is a popular in-vitro fertilization market trend that fuels the industry demand

In-vitro fertilization (IVF) is a type of assisted reproductive technique in which in laboratory environments the ovum is artificially fertilized and then implanted into the womb. IVF is one of the most common therapies used for infertility problems in pairs, single mothers, and the LGBT community. Growing male infertility, an increase in the median age of first-time mothers, growing obesity, diminishing fertility rates, with growing alcohol intake are driving the global in-vitro fertilization (IVF) market growth. Furthermore, increased awareness of infertility, combined with the accessibility of enhanced therapeutic approaches, is boosting the market value.

Global In-Vitro Fertilization Market Dynamics

Market Drivers

- Rise in the prevalence of infertility across the globe

- Growing rate of obesity & increased alcohol consumption

- Increasing public awareness of the use of IVF treatments

- Increased infertility rates & embryo banking procedures

Market Restraints

- High cost of IVF treatment

- Inadequate regulatory framework and homogenous regulation

Market Opportunities

- Government programs to encourage IVF treatments

- Rising demand for fertility preservation among cancer patients drives market expansion

- Development of AI-driven embryo selection and automation enhances IVF procedure efficiency

In-Vitro Fertilization Market Report Coverage

|

Market |

In-Vitro Fertilization Market |

|

In-Vitro Fertilization Market Size 2023 |

USD 25.57 Billion |

|

In-Vitro Fertilization Market Forecast 2032 |

USD 44.28 Billion |

|

In-Vitro Fertilization Market CAGR During 2024 - 2032 |

6.4% |

|

In-Vitro Fertilization Market Analysis Period |

2020 - 2032 |

|

In-Vitro Fertilization Market Base Year |

2023 |

|

In-Vitro Fertilization Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Instrument, By Type, By Procedure Type, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Cook Medical, Kitazato Corporation, Hamilton Thorne, Inc., Rocket Medical plc, Esco Micro Pte Ltd, Genea Limited, Thermo Fisher Scientific, Inc., Merck KGaA, Ferring Pharmaceuticals, Nidacon International AB, Vitrolife AB, and EMD Serono. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

In-Vitro Fertilization Market Insights

The global in-vitro fertilization (IVF) market is being pushed by a rise in infertility, a tendency toward delayed pregnancies, an increase in IVF success, and an increase in available earnings globally. However, increasing costs, IVF-related problems, and a lack of awareness of IVF in some developing countries impede the growth of the business.

The global IVF market value is predicted to increase dramatically throughout this period because of an increase in infertility, a rise in delayed pregnancies, an increase in IVF success rates, and a global growth in disposable revenues. High expenses, IVF-related problems, and a lack of IVF awareness impede the expansion of the market in some developing countries. Inversely, the expansion of fertility tourism, increasing fertility clinics, and the potential for growth in newly industrialized nations will pave the way for the future development of the IVF service market.

Most IVF supplies are imported into underdeveloped African countries and can only be utilized once per cycle. According to the University of Benin, the incidence of infertility in Nigeria is approximately 25%, compared to 10-15% in the United States and the United Kingdom. IVF techniques assisted couples in dealing with these high levels of infertility. The low cost of IVF therapy, combined with the rise in fertility tourism trends in South Africa, continues to drive Africa's in vitro market growth. On the other side, lack of finance, low income, little understanding about IVF, inadequate coverage of health services, and a scarcity of educated professionals stymie progress in Africa's growing economy.

In-Vitro Fertilization Market Segmentation

The worldwide market for in-vitro fertilization is split based on instrument, type, procedure type, end-use, and geography.

In Vitro Fertilization Market By Instruments

- Culture Media

- Cryopreservation Media

- Ovum Processing Media

- Embryo Culture Media

- Sperm Processing Media

- Disposable Devices

- Equipment

- Sperm Analyzer Systems

- Ovum Aspiration Pumps

- Imaging Systems

- Incubators

- Micromanipulator Systems

- Others

According to in-vitro fertilization industry analysis, the culture media instrument segment held the largest market share in 2023. This expansion was attributed to causes such as increased funding availability as well as a rise in research programs to improve culture media. However, as market players provide disposable equipment such as slides, needles, and chambers to fulfill sterility & regulatory standards, the disposable equipment category is predicted to develop at the quickest rate during the projection years.

In Vitro Fertilization Market By Type

- Conventional IVF

- IVF with Donar Eggs

- IVF with ICSI

Among the several forms of IVF service market, conventional IVF has a substantial market share. This treatment is extensively utilized because of its proven success rates, low cost when compared to sophisticated procedures, and little invasiveness. Conventional IVF is the best option for couples dealing with infertility concerns such ovulation abnormalities, endometriosis, or unexplained infertility. Furthermore, advances in embryo culture techniques and tailored ovarian stimulation procedures have increased its success, making it a preferred option for many patients. While IVF with ICSI (Intracytoplasmic Sperm Injection) is critical for severe male infertility cases and IVF with Donor Eggs is critical for age-related fertility decrease, traditional IVF continues to be the most popular due to its broad application and widespread adoption.

In Vitro Fertilization Market By Procedure Type

- Frozen Non-Donor

- Fresh Non-Donor

- Frozen Donor

- Fresh Donor

In terms of procedure type, the fresh non-donor category is expected to dominate in 2023. This is due to a multitude of factors, including a high success rate, higher birth rates than frozen eggs, easier fertilization, and improved results from fresh egg retrievals. The key driver of this industry is the increased adoption of the new non-donor cycle, which is combined with rising infertility rates worldwide. The increased popularity of this cycle is likely to keep it in control for the duration of the predicted period.

In Vitro Fertilization Market By End-Use

- Fertility Clinics

- Hospitals

- Others

According to the in-vitro fertilization market forecast, the fertility clinics segment generates maximum revenue around USD 20.5 billion. Also the hospital segment is predicted to increase significantly in the industry in the coming years. The extensive infiltration of hospitals, expanding digital infrastructure in emerging economies, the availability of health experts around the time, and the introduction of modern surgical technologies and innovations in health facilities are the key factors contributing to the growth of hospital services.

In-Vitro Fertilization Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

In-Vitro Fertilization Market Regional Analysis

Geographically, Europe is expected to dominate the market in 2023. Increasing medical tourism and legislation modifications connected to IVF treatments will drive regional market expansion in the projected timeframe. Additionally, the Asia-Pacific region is predicted to grow at a rapid pace during the in-vitro fertilization market forecast period. This is due to a large population, rapidly dropping fertility rates, a spike in the amount of women-focused federal programs, a growing choice for jobs over families among women, and more understanding about fertility clinics & treatments. Growing public awareness of in-vitro fertilization, increasing healthcare spending, and expanding use of sophisticated reproductive technology in Asia-Pacific are major factors of the IVF market.

Furthermore, breakthroughs in cryopreservation technology and growing acceptance of embryo freezing in Asia-Pacific have driven up demand for treatments. Governments in India and China are actively supporting reproductive healthcare initiatives, increasing market expansion. The growing number of reproductive clinics with cutting-edge technology has increased access to treatment, particularly in urban areas. Furthermore, the region's affordable IVF choices have attracted both domestic and international patients looking for cost-effective fertility treatments. The availability of experienced reproductive specialists, as well as the implementation of AI-driven embryo selection procedures, is projected to boost success rates and position Asia-Pacific as a prominent participant in the worldwide market.

In-Vitro Fertilization Market Players

Some of the top in-vitro fertilization companies offered in our report includes Cook Medical, Kitazato Corporation, Hamilton Thorne, Inc., Rocket Medical plc, Esco Micro Pte Ltd, Genea Limited, Thermo Fisher Scientific, Inc., Merck KGaA, Ferring Pharmaceuticals, Nidacon International AB, Vitrolife AB, and EMD Serono.

Frequently Asked Questions

How big is the in-vitro fertilization market?

The in-vitro fertilization market size was valued at USD 25.57 Billion in 2023.

What is the CAGR of the global in-vitro fertilization market from 2024 to 2032?

The CAGR of in-vitro fertilization is 6.4% during the analysis period of 2024 to 2032.

Which are the key players in the in-vitro fertilization market?

The key players operating in the global market are including Cook Medical, Kitazato Corporation, Hamilton Thorne, Inc., Rocket Medical plc, Esco Micro Pte Ltd, Genea Limited, Thermo Fisher Scientific, Inc., Merck KGaA, Ferring Pharmaceuticals, Nidacon International AB, Vitrolife AB, and EMD Serono.

Which region dominated the global in-vitro fertilization market share?

Europe held the dominating position in in-vitro fertilization industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of in-vitro fertilization during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global in-vitro fertilization industry?

The current trends and dynamics in the in-vitro fertilization industry include increasing public awareness of the use of IVF treatments, and increased infertility rates & embryo banking procedures.

Which procedure type held the maximum share in 2023?

The fresh non-donor type held the significant share of the in-vitro fertilization industry.