Immunosuppressants Market | Acumen Research and Consulting

Immunosuppressants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

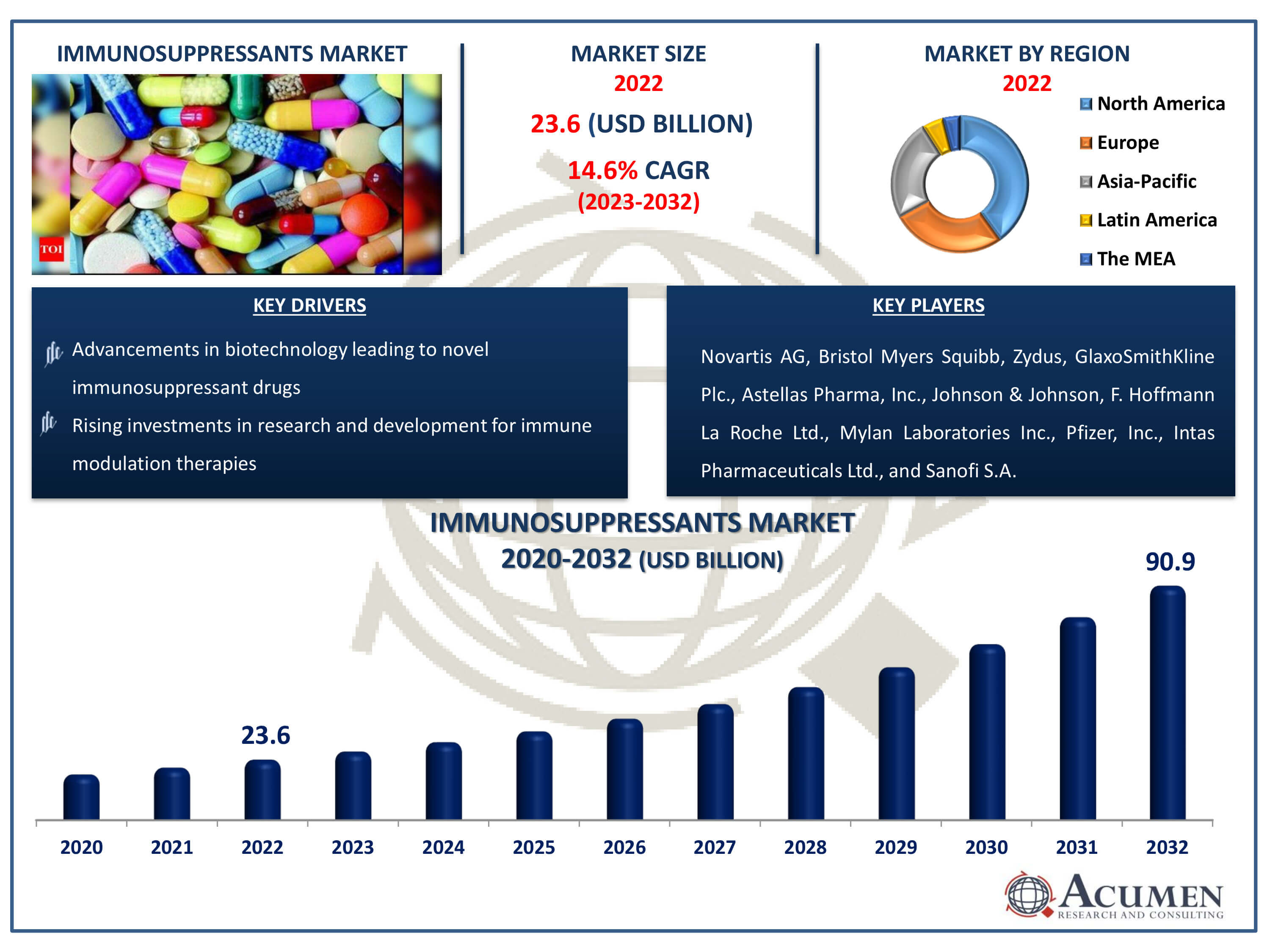

The Immunosuppressants Market Size accounted for USD 23.6 Billion in 2022 and is estimated to achieve a market size of USD 90.9 Billion by 2032 growing at a CAGR of 14.6% from 2023 to 2032.

Immunosuppressants Market Highlights

- Global immunosuppressants market revenue is poised to garner USD 90.9 billion by 2032 with a CAGR of 14.6% from 2023 to 2032

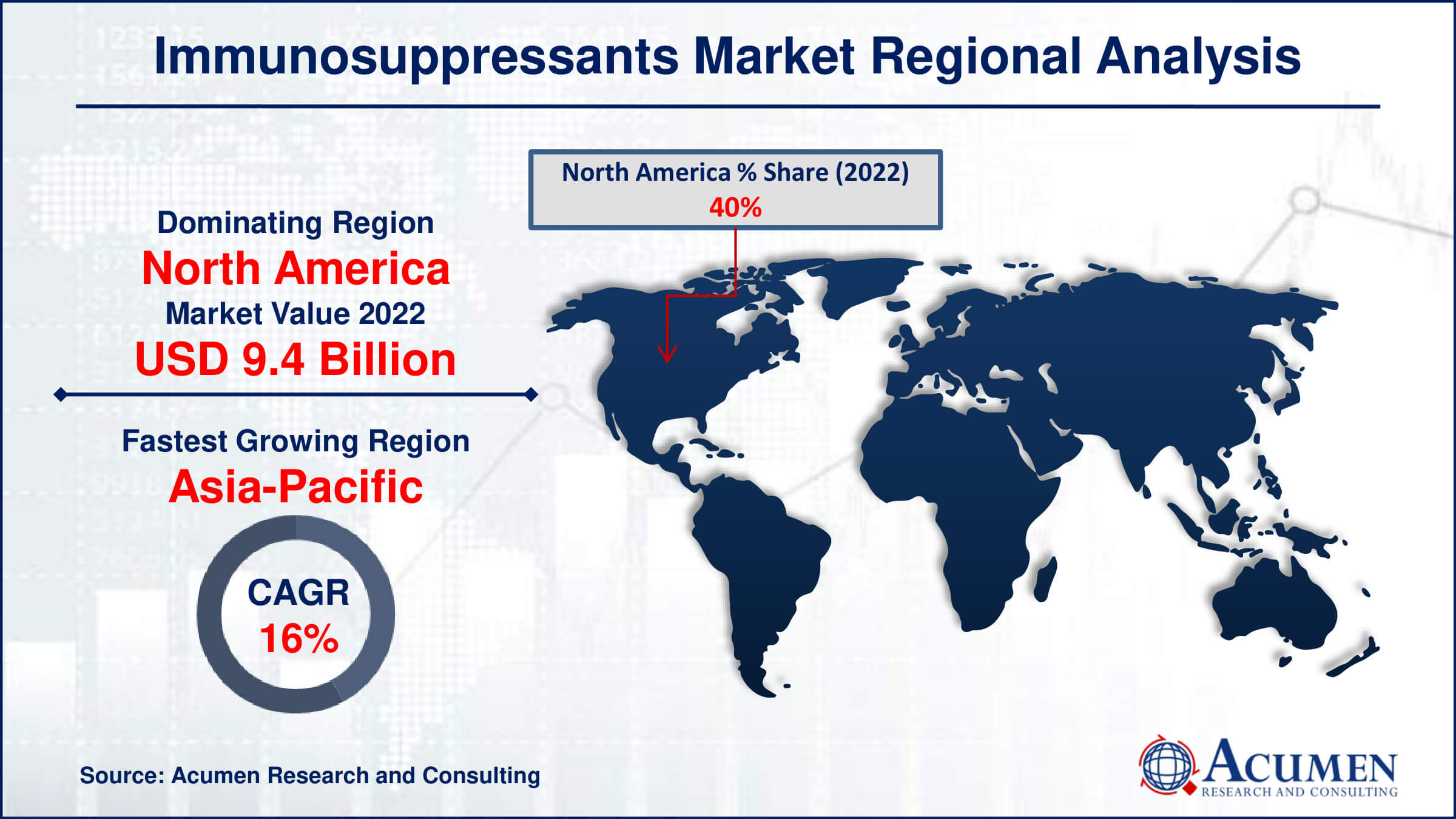

- North America immunosuppressants market value occupied around USD 9.4 Billion in 2022

- Asia-Pacific immunosuppressants market growth will record a CAGR of more than 16% from 2023 to 2032

- Among indication, the autoimmune disorders sub-segment generated more than USD 9.7 billion revenue in 2022

- Based on drug class, the calcineurin inhibitors sub-segment generated around 36% market share in 2022

- Collaborations between pharmaceutical companies and research institutions for drug discovery and innovation is a popular immunosuppressants market trend that fuels the industry demand

Immunosuppressants are essential during transplant surgery because they suppress the immunological reaction that is brought on by introducing foreign tissue into the recipient's body. The freshly transplanted organ may be rejected during organ transplantation because the recipient's immune system may perceive it as an invader. These medications function by inhibiting immune cells' ability to recognise and combat foreign substances. Examples of these cells are T and B cells. Immunosuppressant’s work by reducing this reaction, which helps stop the recipient's body from attacking the transplanted organ in a harmful way. Because they enable the integration of donor organs into the recipient's body with a reduced risk of rejection and related difficulties, they are therefore essential to the success of transplantation procedures.

Global Immunosuppressants Market Dynamics

Market Drivers

- Increasing prevalence of autoimmune diseases

- Growing organ transplant procedures worldwide

- Advancements in biotechnology leading to novel immunosuppressant drugs

- Rising investments in research and development for immune modulation therapies

Market Restraints

- Concerns regarding adverse side effects and long-term complications

- High cost associated with immunosuppressant drugs

- Regulatory challenges and stringent approval processes

Market Opportunities

- Expanding applications in treating inflammatory and allergic disorders

- Emerging markets with untapped potential for immunosuppressant therapies

- Development of personalized medicine approaches for optimized treatment outcomes

Immunosuppressants Market Report Coverage

| Market | Immunosuppressants Market |

| Immunosuppressants Market Size 2022 | USD 23.6 Billion |

| Immunosuppressants Market Forecast 2032 |

USD 90.9 Billion |

| Immunosuppressants Market CAGR During 2023 - 2032 | 14.6% |

| Immunosuppressants Market Analysis Period | 2020 - 2032 |

| Immunosuppressants Market Base Year |

2022 |

| Immunosuppressants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Class, By Indication, By Route of Administration, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Novartis AG, Bristol Myers Squibb, Zydus, GlaxoSmithKline Plc., Astellas Pharma, Inc., Johnson & Johnson, F. Hoffmann La Roche Ltd., Mylan Laboratories Inc., Pfizer, Inc., Intas Pharmaceuticals Ltd., and Sanofi S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Immunosuppressants Market Insights

The increasing incidence of autoimmune illnesses including asthma, multiple sclerosis (MS), and alopecia areata is one of the main causes of the rise in the market for immunosuppressants. Effective immunosuppressive medication is required for these disorders in order to manage symptoms and stop the disease from progressing, as they are characterised by the body's immune system erroneously attacking its own tissues. Further driving the need for immunosuppressant medications is the rising prevalence of organ failure, especially in those requiring liver and kidney transplants. The U.S. Government Information on Organ Donation and Transplantation, for example, provided statistics from 2018 that showed 36,528 organs were transferred, highlighting the vital role that these drugs play in transplant procedures.

But even with the clear need, there are a number of obstacles preventing the industry from growing. The high transplantation rates and ongoing difficulties in finding sufficient organ donors put additional burden on healthcare systems and increase the demand for immunosuppressive treatments. Furthermore, worries are raised about the side effects connected to these drugs, which could slow the surge in demand. Of the prominent adverse effects, osteoporosis especially when associated with corticoids stands out as a major concern. This disease is characterized by a decrease in bone density, which increases the risk of fractures. These fractures typically occur in weight-bearing bones including the wrists, spine, and legs.

In spite of these obstacles, there are still plenty of prospects for growth in the industry. Tissue engineering is a rapidly developing science that has opportunities for developing novel organ transplantation techniques, which might reduce the need for conventional immunosuppressive treatment regimens. Researchers want to revolutionize transplant treatment by overcoming the obstacles posed by organ shortage and compatibility difficulties by utilizing cutting-edge technology to create bioengineered implants. Furthermore, it is anticipated that rising wealth in industrialized countries would promote increased knowledge of and involvement in organ donation programs, creating a favourable atmosphere for tackling the current issues with immunosuppression and transplantation. Therefore, despite ongoing challenges, the ever-changing field of medical technology and public perceptions of healthcare offer hope for the immunosuppressant market's sustained expansion and innovation.

Immunosuppressants Market Segmentation

The worldwide market for immunosuppressants is split based on drug class, indication, route of administration, distribution channel, and geography.

Immunosuppressant Market by Drug Classes

- Corticosteroids

- Monoclonal Antibodies (mAbs)

- Calcineurin Inhibitors

- mTOR Inhibitors

- Anti-Proliferative Agents

- Others

According to immunosuppressants industry analysis, calcineurin inhibitors are the leader segment due to their vital role in preventing organ rejection following transplantation.. These drugs, which include tacrolimus and cyclosporine, suppress the immune system by blocking calcineurin, an important enzyme in T-cell activation. For transplant recipients, calcineurin inhibitors are frequently administered as first-line maintenance medication because of their well-established effectiveness and strong immunosuppressive qualities. They are also used in the management of autoimmune conditions including psoriasis and rheumatoid arthritis. The market domination of calcineurin inhibitors in immunosuppressants is firmly established by their wide application in a variety of therapeutic contexts, as well as their recognized safety profile and effectiveness.

Immunosuppressant Market Indications

- Organ Transplantation

- Autoimmune Disorders

- Non-Autoimmune Inflammatory Diseases

Autoimmune diseases make up the majority of the industry due to their complexity and prevalence it is expected to grow over the immunosuppressants market forecast period. Immunosuppressive medications modulate the hyperactive immune response that assaults healthy tissues, which is a critical part of controlling autoimmune illnesses. Numerous autoimmune illnesses, including psoriasis, lupus, multiple sclerosis, and rheumatoid arthritis, need immunosuppressive therapy in order to manage symptoms and stop the disease from progressing. The long-term need for immunosuppressants in this market is fueled by the wide variety of autoimmune illnesses and the chronic nature of their treatment. The importance of immunosuppressants in treating autoimmune illnesses is further highlighted by continuous research and development initiatives targeted at discovering novel therapeutic targets, thus strengthening their market dominance.

Immunosuppressant Market By Route of Administration

- Oral

- Parenteral

In terms of immunosuppressants market analysis, the oral method of administration is likely to be the biggest segment. This is mostly attributable to a number of causes. For starters, oral administration is more convenient and user-friendly for patients, resulting in greater compliance rates when compared to parenteral methods. Furthermore, advances in medication formulation have increased the absorption and effectiveness of orally given immunosuppressants. Furthermore, the oral route enables self-administration, which reduces healthcare resource utilization. Overall, these considerations contribute to the oral route's dominance in the immunosuppressant industry, making it the favored option for both patients and healthcare professionals.

Immunosuppressant Market By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

In the immunosuppressants market, hospital pharmacies are expected to be the dominant distribution channel. This forecast is supported by various factors. For starters, hospital pharmacists serve a diverse variety of patients undergoing organ transplants or treating autoimmune illnesses, accounting for a sizable percentage of the immunosuppressant market. Furthermore, hospitals frequently retain established ties with pharmaceutical suppliers and have the capacity to handle specialised pharmaceuticals, such as immunosuppressants. Furthermore, healthcare professionals in hospitals play an important role in prescribing and administering immunosuppressants, which strengthens hospital pharmacists' position in the distribution landscape. Overall, these characteristics establish hospital pharmacies as the primary avenue for immunosuppressive distribution.

Immunosuppressants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Immunosuppressants Market Regional Analysis

North America immunosuppressant market account for a significant share of global immunosuppressant markets attributed for an expansion in auto-immune disease prevalence and drug launches throughout the U.S. For instance, according to the American Autoimmune Related Disease Association in 2018, approximately 55 Mn people were suffering from the autoimmune diseases. The European market in immunosuppressant drugs is projected to expand significantly due to the current growth in the rate of organ transplantation develop new medicines, and improved health services in the region. For instance, in 2023, according to the Eurotransplant report, more than 43 million cases of deceased organ transplantation were reported in Eastern European countries. However, Asia Pacific is an developing region for the immunosuppressants market, is projected to boost the demand due to increased medical tourism due to low medical costs, the launch of newer drugs and an rise in the incidence of autoimmune diseases.

Immunosuppressants Market Players

Some of the top immunosuppressants companies offered in our report include Novartis AG, Bristol Myers Squibb, Zydus, GlaxoSmithKline Plc., Astellas Pharma, Inc., Johnson & Johnson, F. Hoffmann La Roche Ltd., Mylan Laboratories Inc., Pfizer, Inc., Intas Pharmaceuticals Ltd., and Sanofi S.A.

Frequently Asked Questions

How big is the immunosuppressants market?

The immunosuppressants market size was valued at USD 23.6 Billion in 2022.

What is the CAGR of the global immunosuppressants market from 2023 to 2032?

The CAGR of immunosuppressants is 14.6% during the analysis period of 2023 to 2032.

Which are the key players in the immunosuppressants market?

The key players operating in the global market are including Novartis AG, Bristol Myers Squibb, Zydus, GlaxoSmithKline Plc., Astellas Pharma, Inc., Johnson & Johnson, F. Hoffmann La Roche Ltd., Mylan Laboratories Inc., Pfizer, Inc., Intas Pharmaceuticals Ltd., and Sanofi S.A.

Which region dominated the global immunosuppressants market share?

North America held the dominating position in immunosuppressants industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of immunosuppressants during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global immunosuppressants industry?

The current trends and dynamics in the immunosuppressants industry include increasing prevalence of autoimmune diseases, growing organ transplant procedures worldwide, advancements in biotechnology leading to novel immunosuppressant drugs, and rising investments in research and development for immune modulation therapies.

Which indication held the maximum share in 2022?

The autoimmune disorders indication the maximum share of the immunosuppressants industry.