Hydrolyzed Vegetable Protein Market | Acumen Research and Consulting

Hydrolyzed Vegetable Protein Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

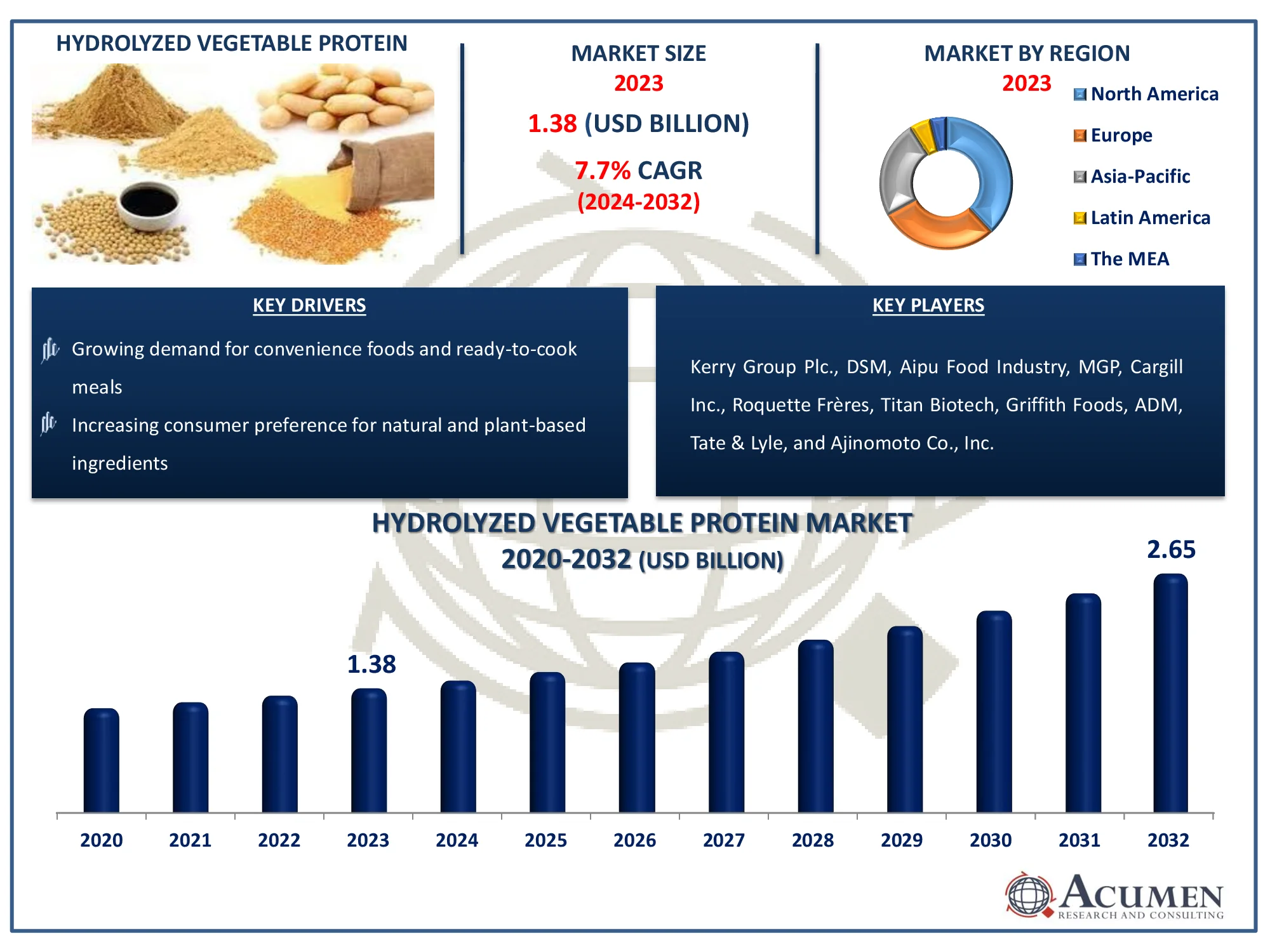

The Global Hydrolyzed Vegetable Protein Market Size accounted for USD 1.38 Billion in 2023 and is estimated to achieve a market size of USD 2.65 Billion by 2032 growing at a CAGR of 7.7% from 2024 to 2032.

Hydrolyzed Vegetable Protein Market Highlights

- Global hydrolyzed vegetable protein market revenue is poised to garner USD 2.65 billion by 2032 with a CAGR of 7.7% from 2024 to 2032

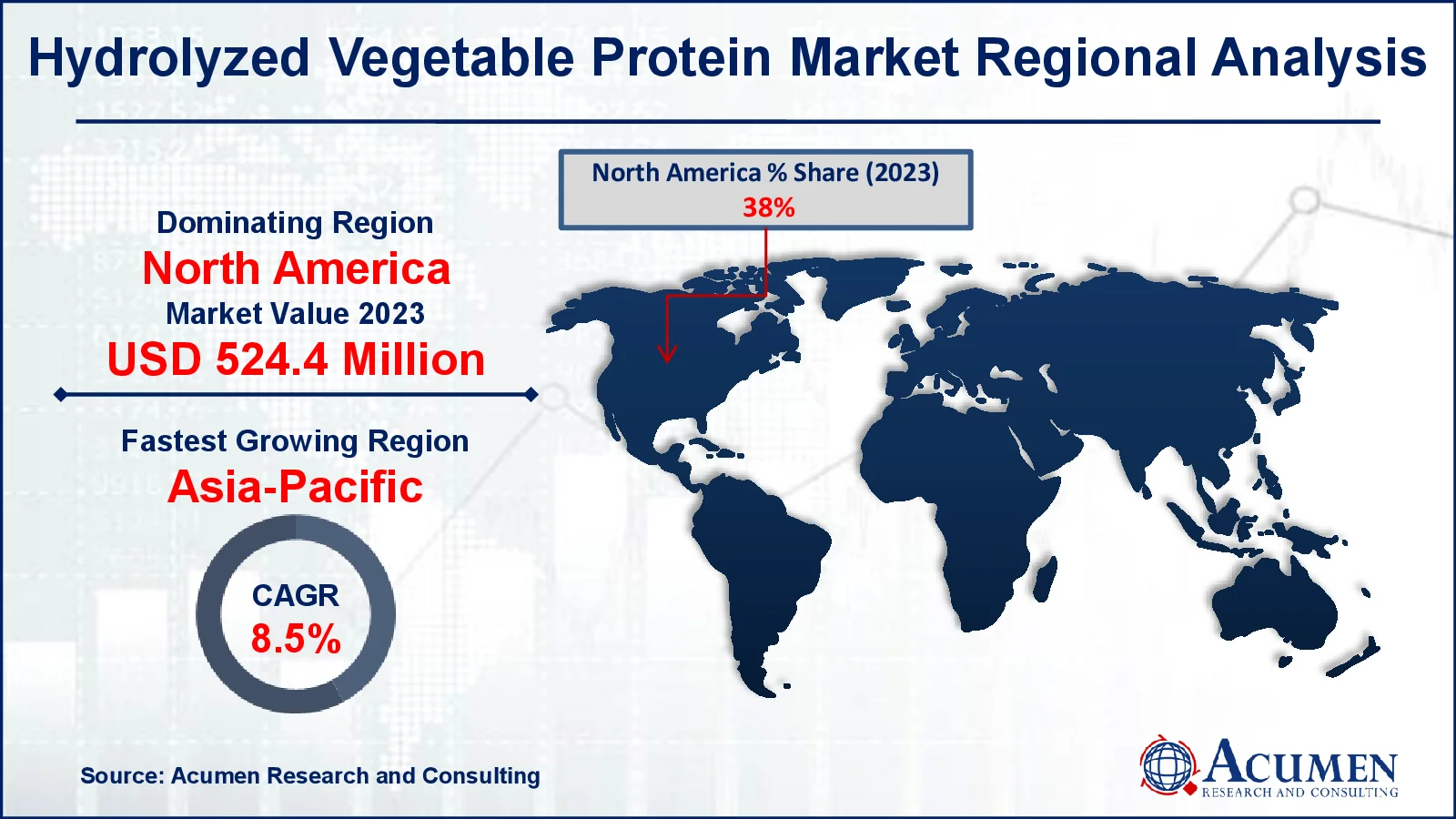

- North America hydrolyzed vegetable protein market value occupied around USD 524.4 million in 2023

- Asia-Pacific hydrolyzed vegetable protein market growth will record a CAGR of more than 8.5% from 2024 to 2032

- Among function, the flavoring agent sub-segment generated more than USD 1.02 billion revenue in 2023

- Based on source, the soy sub-segment generated around 48% market share in 2023

- Innovation in flavor enhancement technologies to cater to diverse culinary needs is a popular hydrolyzed vegetable protein market trend that fuels the industry demand

Foodstuffs obtained through protein hydrolysis are known as hydrolyzed vegetable protein (HVP) products and are valued for their authentic bouillon taste. The production process involves comparing acid-hydrolyzed vegetable protein, enzymatically produced HVP, and other seasonings such as fermented soy sauce. Hydrolyzed vegetable protein is primarily used to enhance the flavor of meat products, soups, sauces, snacks, and other dishes, as well as in the production of ready-to-cook soups and bouillons. It is derived from various plant sources such as wheat, corn, pea, soybeans, and canola. When broken down into amino acids through a chemical process, this is referred to as acid hydrolysis. Hydrolyzed vegetable protein is a natural, plant-based product widely used in food preparation to improve mouthfeel, flavor, and lingering taste.

Global Hydrolyzed Vegetable Protein Market Dynamics

Market Drivers

- Growing demand for convenience foods and ready-to-cook meals

- Increasing consumer preference for natural and plant-based ingredients

- Rising need for flavor enhancers in processed foods

- Advancements in hydrolysis technology improving product quality

Market Restraints

- High production costs associated with hydrolyzed vegetable protein

- Potential allergenic reactions in sensitive individuals

- Limited consumer awareness of hydrolyzed vegetable protein benefits

Market Opportunities

- Expansion into emerging markets with increasing food processing activities

- Development of new applications in health and nutrition products

- Growing trend towards clean label products and transparency in ingredients

Hydrolyzed Vegetable Protein Market Report Coverage

| Market | Hydrolyzed Vegetable Protein Market |

| Hydrolyzed Vegetable Protein Market Size 2022 |

USD 1.38 Billion |

| Hydrolyzed Vegetable Protein Market Forecast 2032 | USD 2.65 Billion |

| Hydrolyzed Vegetable Protein Market CAGR During 2023 - 2032 | 7.7% |

| Hydrolyzed Vegetable Protein Market Analysis Period | 2020 - 2032 |

| Hydrolyzed Vegetable Protein Market Base Year |

2023 |

| Hydrolyzed Vegetable Protein Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Source, By Form, By Function, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Kerry Group Plc., DSM, Aipu Food Industry, MGP, Cargill Inc., Roquette Frères, Titan Biotech, Griffith Foods, ADM, Tate & Lyle, and Ajinomoto Co., Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydrolyzed Vegetable Protein Market Insights

The growth of the hydrolyzed vegetable protein market is driven by several key factors. One of the primary drivers is the increasing disposable income and changing lifestyles, which lead to a higher demand for convenient and ready-to-eat foods. As consumers seek out protein-rich, natural ingredients and clean-label products, hydrolyzed vegetable protein, known for its flavor-enhancing properties, is becoming increasingly popular. Additionally, advancements in hydrolysis technology have improved product quality, further fueling market expansion.

However, the market faces challenges related to the presence of monosodium glutamate (MSG) in hydrolyzed vegetable protein. MSG, a common flavor enhancer, can cause various health issues such as chest pain, nausea, headaches, facial pressure or tightness, heart palpitations, weakness, burning sensations in the face and neck, numbness, and sweating. Although the Food and Drug Administration (FDA) has not banned MSG, these health concerns have negatively impacted consumer perceptions and may inhibit market growth.

Despite these challenges, new opportunities are emerging, particularly with the growth of the food and beverage industry in Asia-Pacific. As the demand for hydrolyzed vegetable protein expands in this region, driven by increasing food processing activities and a rising middle class, manufacturers have the chance to tap into new markets and innovate their product offerings. This expansion into emerging markets, coupled with a growing focus on health and clean-label trends, presents significant opportunities for the HVP market to overcome existing barriers and achieve sustained growth.

Hydrolyzed Vegetable Protein Market Segmentation

The worldwide market for hydrolyzed vegetable protein is split based on source, form, function, application, and geography.

Hydrolyzed Vegetable Protein Sources

- Soy

- Wheat

- Corn

- Pea

- Others

According to hydrolyzed vegetable protein industry analysis, soy is the largest segment in the market due to its widespread use and versatility. Soybeans are a rich source of protein, making them ideal for hydrolysis processes that produce high-quality HVP with strong flavor-enhancing properties. Soy-based HVP is commonly used in a variety of applications, including meat products, soups, sauces, and snacks, due to its ability to improve taste and texture. Additionally, soy protein’s well-established production processes and cost-effectiveness contribute to its dominant market position. The extensive availability of soybeans and their established role in the food industry reinforce soy as the leading source for hydrolyzed vegetable protein.

Hydrolyzed Vegetable Protein Forms

- Dry Powder

- Paste

- Liquid

Dry powder holds the maximum share in the hydrolyzed vegetable protein market due to its convenience and versatility. It is favored for its ease of storage, extended shelf life, and simplicity in handling and transportation. The powder form can be easily incorporated into a wide range of food products, from processed meats to snacks and seasonings, enhancing flavor and texture effectively. Additionally, dry powder allows for precise dosing and consistent application in food formulations. Its broad applicability across various food and beverage sectors combined with its cost-effective production and handling, solidifies dry powder's dominant position in the hydrolyzed vegetable protein market.

Hydrolyzed Vegetable Protein Functions

- Flavoring Agent

- Emulsifying Agent

- Others

The flavoring agent function dominates the hydrolyzed vegetable protein market due to its critical role in enhancing and improving taste profiles in various food products. HVP is widely utilized as a flavoring agent because it provides a rich, savory umami taste that is desirable in many processed foods, including soups, sauces, snacks, and ready meals. Its ability to intensify and complement the flavor of different ingredients makes it an essential component in food formulation. The demand for flavoring agents is driven by the need for taste enhancement and consistency in food products, reinforcing the significant share of flavoring agents in the hydrolyzed vegetable protein market.

Hydrolyzed Vegetable Protein Applications

- Bakery & Confectionary

- Processed Food Products

- Meat Substitutes

- Beverages

- Others

The processed food products sector taking leading position due to its widespread application in improving the flavor and texture of a variety of processed meals. HVP is frequently used in ready meals, snacks, and convenience foods to enhance flavor profiles and improve mouthfeel. Its effectiveness as a flavor enhancer and texture modifier makes it a popular component in the processed food industry, where consistency in quality and taste is critical. The processed food industry's expansion and rising customer demand for delicious, easy food options all contribute to processed food items' dominance in the hydrolyzed vegetable protein market.

Hydrolyzed Vegetable Protein Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydrolyzed Vegetable Protein Market Regional Analysis

In terms of hydrolyzed vegetable protein market analysis, North America also holds a major share in the industry, attributed to the wide application of HVP in the food, beverage, and cosmetic industries. The U.S. and Canada, as developed nations with strong fiscal conditions, see high consumption of processed foods and cosmetics, contributing to market growth. In Europe, the tourism industry is driving market expansion, as tourism is closely related to the food industry. This trend is expected to boost market growth during the hydrolyzed vegetable protein market forecast period. Asia-Pacific is the fastest growing region in the industry due to increasing investments in the food industry and rising disposable incomes. Major regions in Asia-Pacific include China, India, Japan, Australia, and South Korea. China, with its large population and growing foreign trade, accounts for a substantial portion of the market.

Hydrolyzed Vegetable Protein Market Players

Some of the top hydrolyzed vegetable protein companies offered in our report include Kerry Group Plc., DSM, Aipu Food Industry, MGP, Cargill Inc., Roquette Frères, Titan Biotech, Griffith Foods, ADM, Tate & Lyle, and Ajinomoto Co., Inc.

Frequently Asked Questions

How big is the hydrolyzed vegetable protein market?

The hydrolyzed vegetable protein market size was valued at USD 1.38 billion in 2023.

What is the CAGR of the global hydrolyzed vegetable protein market from 2024 to 2032?

The CAGR of hydrolyzed vegetable protein is 7.7% during the analysis period of 2024 to 2032.

Which are the key players in the hydrolyzed vegetable protein market?

The key players operating in the global market are including Kerry Group Plc., DSM, Aipu Food Industry, MGP, Cargill Inc., Roquette Frères, Titan Biotech, Griffith Foods, ADM, Tate & Lyle, and Ajinomoto Co., Inc.

Which region dominated the global hydrolyzed vegetable protein market share?

North America held the dominating position in hydrolyzed vegetable protein industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hydrolyzed vegetable protein during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hydrolyzed vegetable protein industry?

The current trends and dynamics in the hydrolyzed vegetable protein industry include growing demand for convenience foods and ready-to-cook meals, increasing consumer preference for natural and plant-based ingredients, rising need for flavor enhancers in processed foods, and advancements in hydrolysis technology improving product quality.

Which application held the maximum share in 2023?

The processed food products application held the maximum share of the hydrolyzed vegetable protein industry.