Hydrogen Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Hydrogen Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

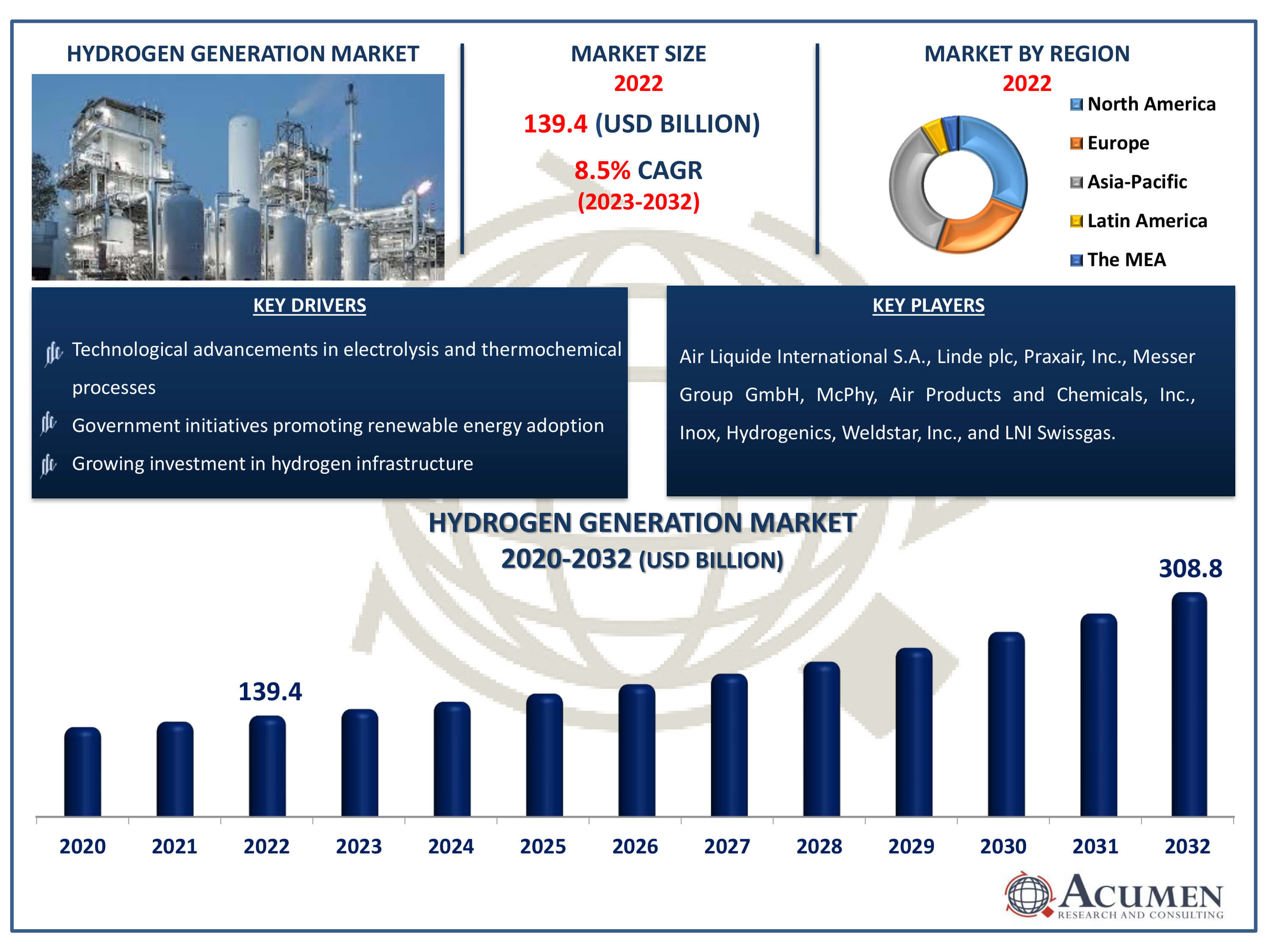

The Hydrogen Generation Market Size accounted for USD 139.4 Billion in 2022 and is estimated to achieve a market size of USD 308.8 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Hydrogen Generation Market Highlights

- Global hydrogen generation market revenue is poised to garner USD 308.8 billion by 2032 with a CAGR of 8.5% from 2023 to 2032

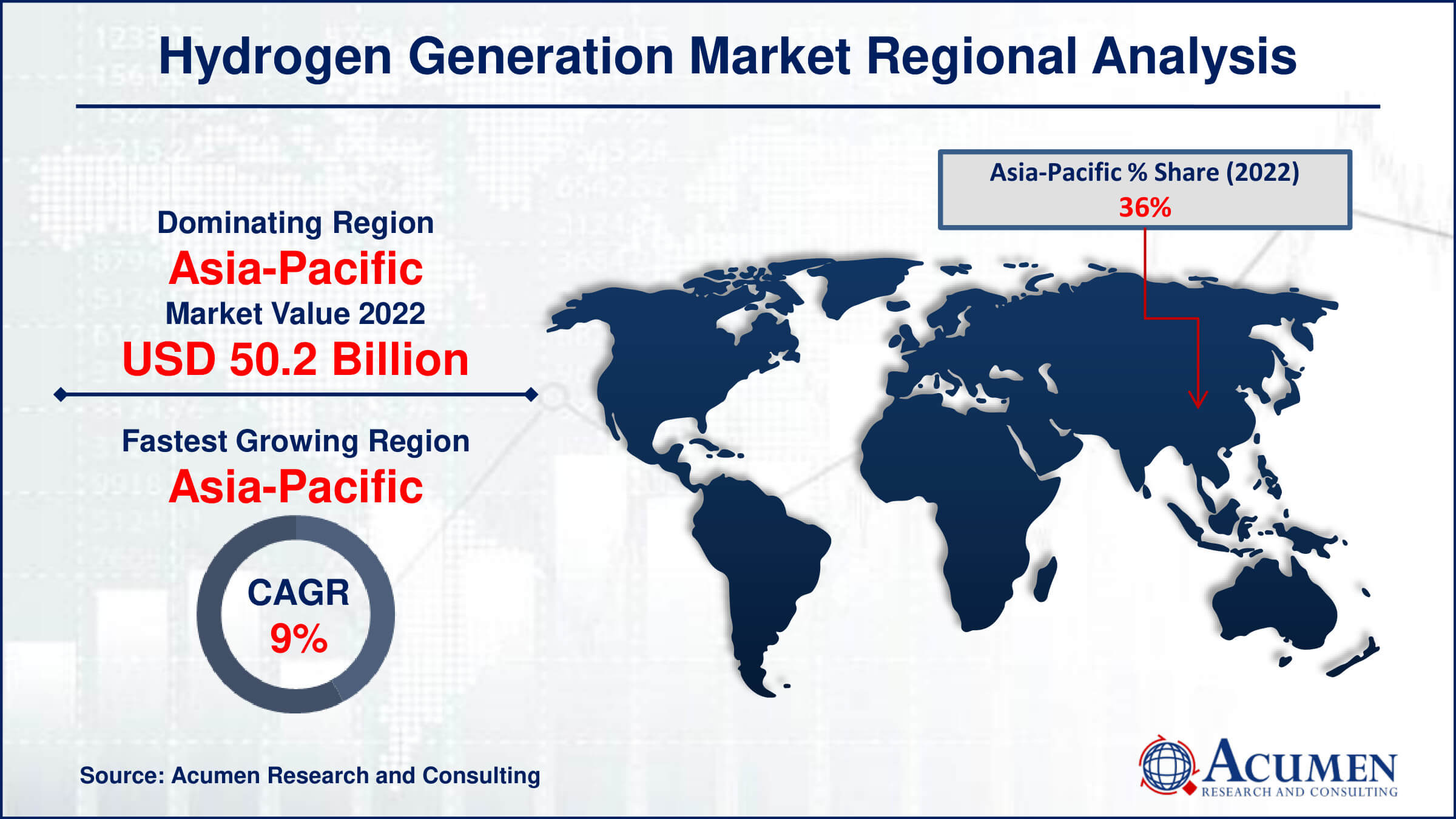

- Asia-Pacific hydrogen generation market value occupied around USD 50.2 billion in 2022

- Asia-Pacific hydrogen generation market growth will record a CAGR of more than 9% from 2023 to 2032

- Among system, the merchant sub-segment generated more than USD 85 billion revenue in 2022

- Based on source, the natural gas sub-segment generated around 72% market share in 2022

- Collaboration between industries and governments to establish hydrogen hubs and supply chains is a popular hydrogen generation market trend that fuels the industry demand

Hydrogen can be produced using a wide range of processes and diverse domestic resources, including fossil fuels such as natural gas and coal, nuclear energy, and various renewable sources such as biomass, wind, solar, geothermal, and hydro-power. The release of hydrogen from organic materials such as coal and biomass occurs through thermochemical processes involving heat and chemical reactions. Additionally, electrolysis or solar energy can be utilized to convert water (H2O) into hydrogen (H2) and oxygen (O2). Moreover, hydrogen can be produced through biological processes involving microorganisms such as bacteria and algae.

Global Hydrogen Generation Market Dynamics

Market Drivers

- Increasing demand for clean energy solutions

- Government initiatives promoting renewable energy adoption

- Technological advancements in electrolysis and thermochemical processes

- Growing investment in hydrogen infrastructure

Market Restraints

- High initial capital investment required for establishing hydrogen production facilities

- Limited availability of renewable energy sources

- Regulatory hurdles and safety concerns regarding hydrogen storage and transportation

Market Opportunities

- Expansion of hydrogen applications in transportation, industry, and energy storage sectors

- Integration of hydrogen production with renewable energy sources, such as wind and solar power

- Development of hydrogen fuel cell technologies for automotive and stationary power applications

Hydrogen Generation Market Report Coverage

| Market | Hydrogen Generation Market |

| Hydrogen Generation Market Size 2022 | USD 139.4 Billion |

| Hydrogen Generation Market Forecast 2032 |

USD 308.8 Billion |

| Hydrogen Generation Market CAGR During 2023 - 2032 | 8.5% |

| Hydrogen Generation Market Analysis Period | 2020 - 2032 |

| Hydrogen Generation Market Base Year |

2022 |

| Hydrogen Generation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By System, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Air Liquide International S.A., Linde plc, Praxair, Inc., Messer Group GmbH, McPhy, Air Products and Chemicals, Inc., Inox, Hydrogenics, Weldstar, Inc., and LNI Swissgas. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydrogen Generation Market Insights

The hydrogen generating business is expanding rapidly, owing to the increased use of cleaner fuels. This move to greener energy sources is being driven by growing environmental concerns and governmental actions targeted at lowering greenhouse gas emissions. Furthermore, the expansion and development of the transportation industry contribute significantly to the need for hydrogen as a clean energy option, notably in fuel cell-powered automobiles. Furthermore, the declining quality of crude oil has presented issues in refining operations, necessitating the usage of hydrogen for desulfurization. As a result, tight rules are being introduced to ensure environmental compliance during transportation, which is increasing the worldwide hydrogen generating market.

Moreover, increasing demand for distillate fuels and the rising hydrogen fuel cell sector are projected to boost expansion in the hydrogen generation industry forecast period. However, the diminishing quality of crude oil has highlighted the significance of hydrogen in refining operations, emphasising its crucial role in product quality and regulatory compliance. Nonetheless, hydrogen's flammability needs severe safety precautions during shipping, which contributes to higher transportation costs. The absence of sufficient transportation networks complicates hydrogen distribution operations, providing barriers to industry development.

Hydrogen Generation Market Segmentation

The worldwide market for hydrogen generation is split based on technology, system, source, application, and geography.

Hydrogen Generation Technology

- Steam Methane Reforming

- Coal Gasification

- Others

According to hydrogen generation industry analysis, steam methane reforming (SMR) is the main segment for numerous reasons. First and foremost, SMR is the most commonly used and established technology for large-scale hydrogen generation, with excellent efficiency and dependability. Methane and steam react at high temperatures to create hydrogen and carbon monoxide, which is then transformed to CO2. Second, SMR benefits from its capacity to use commonly accessible natural gas feedstocks, making it a cost-effective hydrogen generation method. Furthermore, SMR facilities can be linked with carbon capture and storage (CCS) technology to reduce greenhouse gas emissions and match with environmental objectives. Additionally, SMR's versatility enables the co-production of hydrogen and syngas, which caters to a wide range of industrial applications. Overall, steam methane reforming's proven track record, efficiency, and adaptability make it the industry leader in hydrogen generating technology.

Hydrogen Generation System

- Captive

- Merchant

As per the H2 generation market analysis, several significant reasons contribute to the merchant segment's dominance in the hydrogen generating industry. Merchant hydrogen generating systems are intended to create hydrogen for sale to external consumers, offering flexibility and scalability to meet fluctuating demand levels. This methodology enables providers to optimize production capacity and utilize economies of scale, hence increasing cost-effectiveness and profitability. Furthermore, merchant systems allow suppliers to service several consumers from various sectors, diversifying income streams and lowering risks associated with market swings. Furthermore, with rising demand for hydrogen in industries such as transportation, industrial, and energy storage, merchant systems provide a flexible option to fulfill market demands. Furthermore, the use of renewable energy sources for hydrogen generation improves merchant systems' position, harmonizing with environmental ideals while promoting market development. Overall, the Merchant segment's flexibility, efficiency, and versatility help it lead the hydrogen generating industry.

Hydrogen Generation Source

- Natural Gas

- Coal

- Biomass

- Water

Natural gas emerges as the major source of hydrogen generation due to a number of compelling arguments. First and foremost, natural gas is a low-cost and widely available fuel for hydrogen synthesis, making it the favored choice for large-scale industrial applications. The existing infrastructure for natural gas production, processing, and distribution improves its accessibility and dependability as a hydrogen source. Furthermore, natural gas-based hydrogen generating methods, such as steam methane reforming (SMR) and autothermal reforming (ATR), are well known and technologically mature, assuring great efficiency and scalability. On other hand Furthermore, developments in carbon capture and storage (CCS) technology enable the reduction of greenhouse gas emissions related with natural gas-based hydrogen generation, which is consistent with sustainability goals. Overall, natural gas's abundance, affordability, and efficiency position it as the primary source of hydrogen generation, resulting in the highest market share.

Hydrogen Generation Application

- Methanol production

- Ammonia Production

- Petroleum Refining

- Transportation

- Power Generation

- Others

In terms of hydrogen generation market forecast, the ammonia manufacturing segment is is expected to take maximum share for a variety of reasons. For starters, ammonia is a critical component in the worldwide fertiliser industry, resulting in high demand for hydrogen as a feedstock. Second, hydrogen is used in the Haber-Bosch process for ammonia synthesis, a critical step in ammonia manufacturing. Furthermore, ammonia is used as a precursor in a variety of industrial processes, including the production of polymers, fibres, and medicines. Furthermore, the global agriculture sector fuels continued need for ammonia-based fertilisers, which strengthens the market for hydrogen in ammonia manufacturing. Overall, ammonia's critical position in agriculture and industrial uses reinforces its supremacy in driving demand for hydrogen generation.

Hydrogen Generation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydrogen Generation Market Regional Analysis

Asia Pacific stands out as a major stakeholder globally, owing to its high population density, diverse production facilities, and substantial investments in fuel cell development. The region's governments, with a positive outlook for the refinery sector, are focusing on developing new industrial installations in sectors like chemicals, automotive, and power, which will drive demand for hydrogen generation. Market statistics indicate significant growth in hydrogen generation across Asia Pacific, fueled by increasing energy demand. Growing refinery operations, particularly in countries like China and India, are expected to further boost demand throughout the hydrogen generation market forecast period. According to the IEA 2019 report, Japan and China are the main importers of hydrogen-induced LNG. Japan continues pilot projects such as procuring natural gas fuel for power plants, contributing to the country's fuel trade initiatives. Furthermore, producers in the region are prioritizing international hydrogen exchange to establish a low-carbon hydrogen economy.

Hydrogen Generation Market Players

Some of the top hydrogen generation companies offered in our report include Air Liquide International S.A., Linde plc, Praxair, Inc., Messer Group GmbH, McPhy, Air Products and Chemicals, Inc., Inox, Hydrogenics, Weldstar, Inc., and LNI Swissgas.

Frequently Asked Questions

How big is the hydrogen generation market?

The hydrogen generation market size was valued at USD 139.4 billion in 2022.

What is the CAGR of the global hydrogen generation market from 2023 to 2032?

The CAGR of hydrogen generation is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the hydrogen generation market?

The key players operating in the global market are including Air Liquide International S.A., Linde plc, Praxair, Inc., Messer Group GmbH, McPhy, Air Products and Chemicals, Inc., Inox, Hydrogenics, Weldstar, Inc., and LNI Swissgas.

Which region dominated the global hydrogen generation market share?

Asia-Pacific held the dominating position in hydrogen generation industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hydrogen generation during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hydrogen generation industry?

The current trends and dynamics in the hydrogen generation industry include increasing demand for clean energy solutions, government initiatives promoting renewable energy adoption, technological advancements in electrolysis and thermochemical processes, and growing investment in hydrogen infrastructure.

Which system held the maximum share in 2022?

The merchant system held the maximum share of the hydrogen generation industry.