Hydrogen Electrolyzers Market | Acumen Research and Consulting

Hydrogen Electrolyzers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

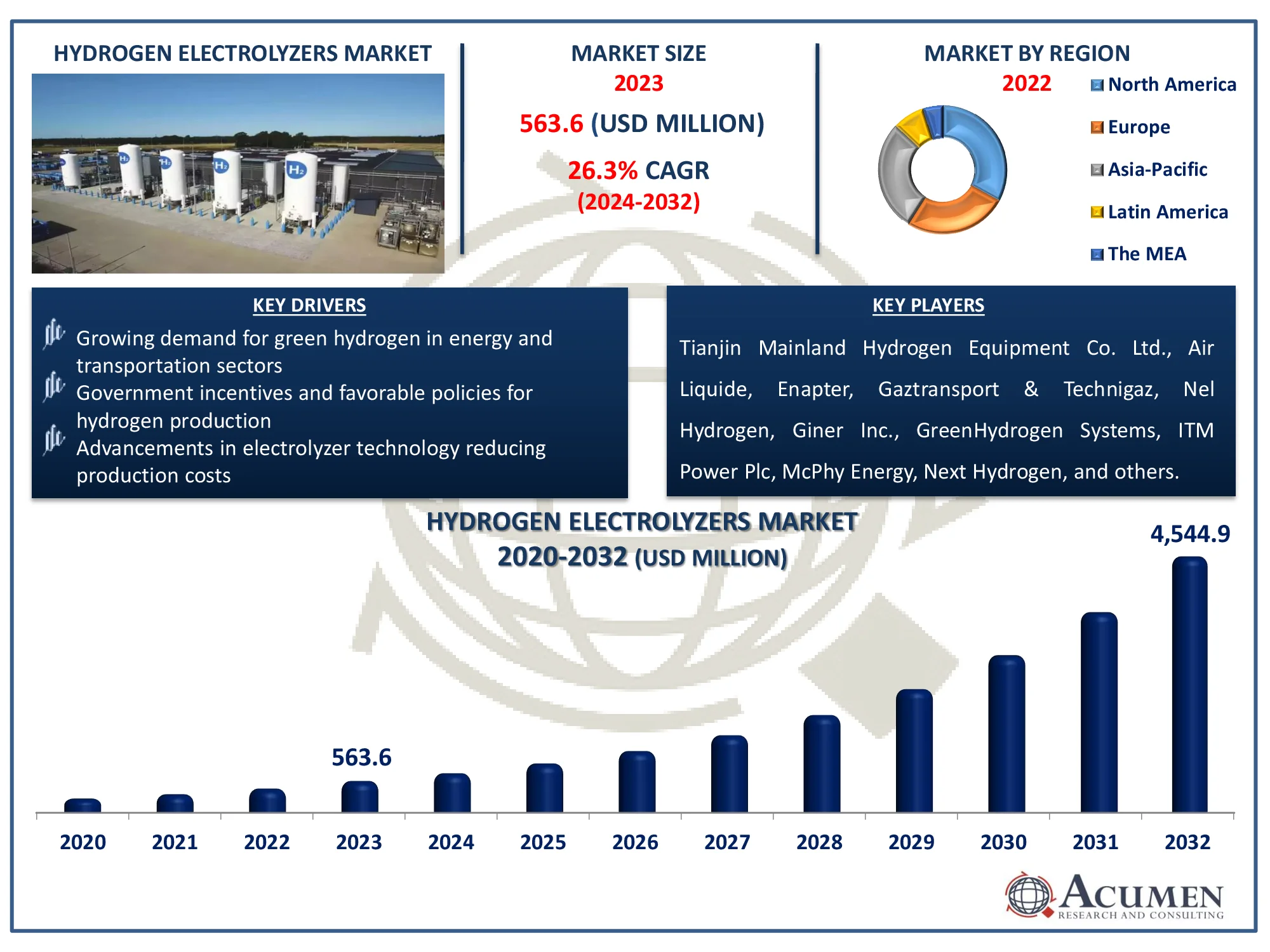

The Global Hydrogen Electrolyzers Market Size accounted for USD 563.6 Million in 2023 and is estimated to achieve a market size of USD 4,544.9 Million by 2032 growing at a CAGR of 26.3% from 2024 to 2032

Hydrogen Electrolyzers Market Highlights

- Global hydrogen electrolyzers market revenue is poised to garner USD 4,544.9 Million by 2032 with a CAGR of 26.3% from 2024 to 2032

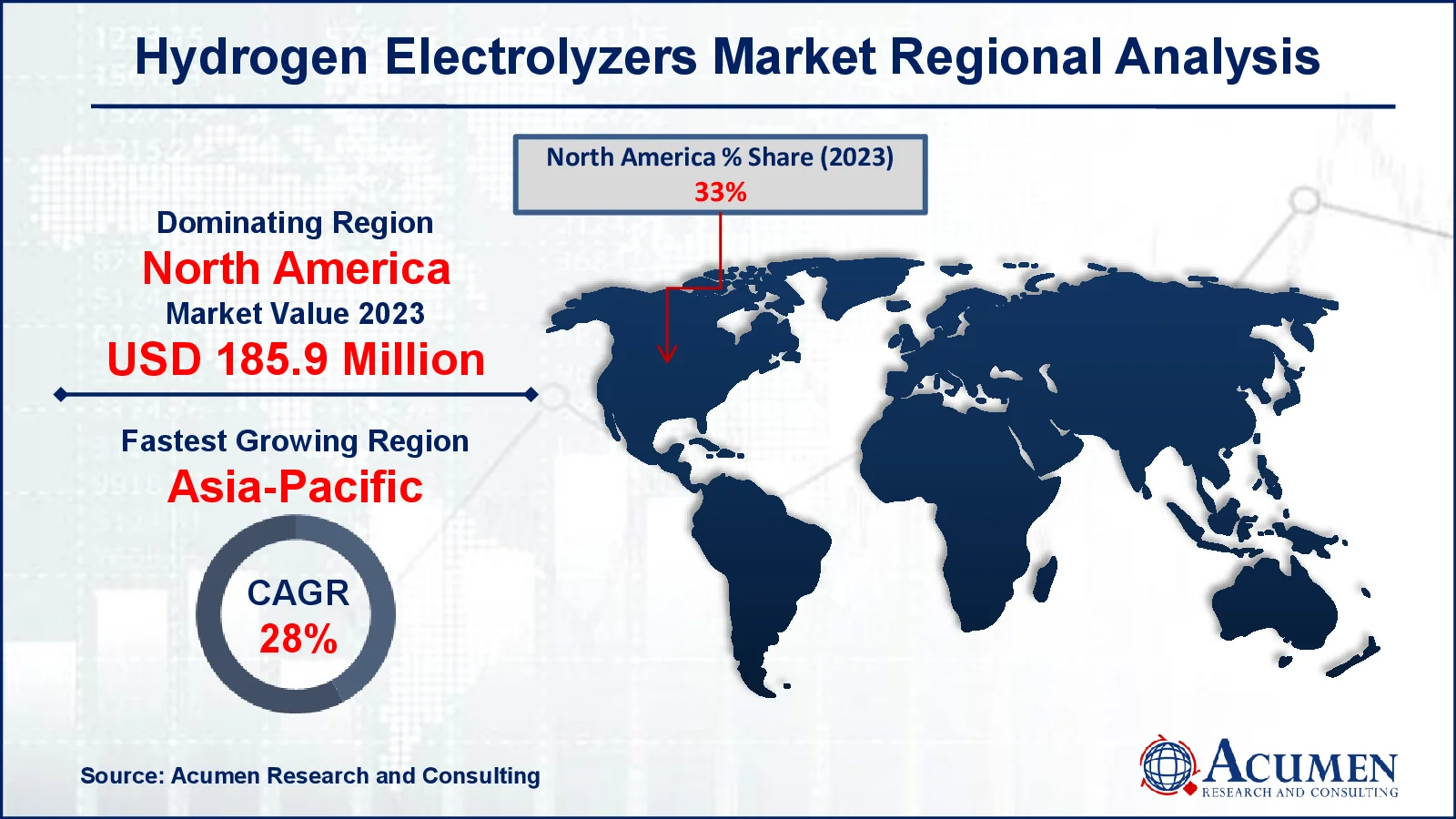

- North America hydrogen electrolyzers market value occupied around USD 185.9 million in 2023

- Asia-Pacific hydrogen electrolyzers market growth will record a CAGR of more than 28% from 2024 to 2032

- Among product type, the polymer electrolyte membrane (PEM) electrolyzer sub-segment generated 46% of the market share in 2023

- Based on capacity, the medium (500 kW to 2 MW) sub-segment generated 41% market share in 2023

- Expansion of electrolyzer manufacturing capacities is the hydrogen electrolyzers market trend that fuels the industry demand

Water electrolysis is the simplest way to produce hydrogen, particularly when powered by renewable energy sources. To enhance the use of water electrolysis, it is important to lower the cost and maintenance needs of existing electrolyzers, reduce energy consumption, and improve their durability, efficiency, and safety. Currently, fossil fuel-based sources meet the vast bulk of global hydrogen demand, with water electrolysis accounting for only a small percentage. Electrolyzers come in a variety of sizes to meet the needs of diverse applications, with hydrogen production rates ranging from 100 liters per hour to approximately 1000 liters per hour.

Global Hydrogen Electrolyzers Market Dynamics

Market Drivers

- Growing demand for green hydrogen in energy and transportation sectors

- Government incentives and favorable policies for hydrogen production

- Advancements in electrolyzer technology reducing production costs

Market Restraints

- High initial investment and operational costs

- Limited infrastructure for hydrogen storage and distribution

- Competition from alternative green energy sources like solar and wind

Market Opportunities

- Expanding applications in industrial sectors like chemicals and steel

- Development of decentralized energy systems using hydrogen

- Collaborations and joint ventures to scale up hydrogen production

Hydrogen Electrolyzers Market Report Coverage

| Market | Hydrogen Electrolyzers Market |

| Hydrogen Electrolyzers Market Size 2022 |

USD 563.6 Million |

| Hydrogen Electrolyzers Market Forecast 2032 | USD 4,544.9 Million |

| Hydrogen Electrolyzers Market CAGR During 2023 - 2032 | 26.3% |

| Hydrogen Electrolyzers Market Analysis Period | 2020 - 2032 |

| Hydrogen Electrolyzers Market Base Year |

2022 |

| Hydrogen Electrolyzers Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Capacity, By Output Pressure, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Tianjin Mainland Hydrogen Equipment Co. Ltd., Air Liquide, Enapter, Gaztransport & Technigaz, Nel Hydrogen, Giner Inc., GreenHydrogen Systems, ITM Power Plc, McPhy Energy, Next Hydrogen, Energy GmbH, Plug Power Inc., Ballard Power Systems, and Siemens AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydrogen Electrolyzers Market Insights

Stringent government restrictions and public-private collaborations to promote the use of hydrogen as an automotive fuel and energy carrier are significant drivers of market growth. End users prefer on-site generation for small-scale electrolyzers since long-distance hydrogen transportation is expensive in many places, and natural gas generation costs are substantially greater. Furthermore, technological advancements in hydrogen electrolyzers can help to reduce production costs. As a result, there is a chance to boost the market by developing advanced hydrogen storage systems and high-pressure electrolyzers, which are expected to bring considerable growth between 2024 and 2032.Water electrolysis is the simplest way to produce hydrogen, particularly when powered by renewable energy sources. To increase the usage of water electrolysis, it is critical to cut the cost and maintenance requirements of existing electrolyzers, reduce energy consumption, and improve their durability, efficiency, and safety. Currently, fossil fuel-based sources supply the vast majority of worldwide hydrogen needs, with water electrolysis accounting for only a minor portion. Electrolyzers are available in a variety of sizes to satisfy the needs of various applications, with hydrogen production rates ranging from 100 liters per hour to around 1000 liters per hour.

Hydrogen Electrolyzers Market Segmentation

The worldwide market for hydrogen electrolyzers is split based on product type, capacity, output pressure, application, and geography.

Hydrogen Electrolyzer Market By Product Type

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- Alkaline Electrolyzer

- Solid Oxide Electrolyzer

According to the hydrogen electrolyzers industry analysis, the polymer electrolyte membrane (PEM) electrolyzer leads the market, due to their high efficiency, quick response times, and small size. They perform effectively at low temperatures and are easily scalable, making them ideal for various applications, including green hydrogen production. PEM electrolyzers are also favored due to their ability to utilize renewable energy sources, which reinforces their market dominance.

Hydrogen Electrolyzer Market By Capacity

- Low (<500 kW)

- Medium (500 kW to 2 MW)

- High (Above 2 MW)

According to the hydrogen electrolyzers industry analysis, medium-capacity hydrogen electrolyzers, ranging from 500 kW to 2 MW, are dominates because to their efficiency and scalability. They're adaptable enough to be used in a variety of situations, including industrial applications and smaller, decentralized energy systems. This adaptability makes them suitable for both large and small projects, assisting in meeting the growing demand for sustainable energy. Their market dominance is due in large part to their capacity to create hydrogen effectively and affordably.

Hydrogen Electrolyzer Market By Output Pressure

- Low (Upto 10 Bar)

- Medium (10 Bar – 40 Bar)

- High (More than 40 Bar)

According to the hydrogen electrolyzers industry analysis, low-pressure systems (up to 10 Bar) shows notable growth due to their lower cost, higher safety, and compatibility with most downstream applications. These systems are sufficient for many hydrogen production uses, where high pressure isn't necessary, making them a cost-effective choice. However, as demand for more efficient storage and transportation grows, medium and high-pressure systems are gaining traction.

Hydrogen Electrolyzer Market By Application

- Ammonia

- Methanol

- Refinery industry

- Electronics

- Energy

- Power to gas

- Other (Transport, Metal production & fabrication, etc.)

Historoically, ammonia is the most common application, owing to green ammonia's critical function in the production of fertilizers and other vital compounds. As companies seek to decarbonize and meet global sustainability targets, demand for green ammonia has increased, accelerating the use of hydrogen electrolyzers. Furthermore, existing infrastructure and high demand in the ammonia industry contribute to its dominant position.

Hydrogen Electrolyzers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydrogen Electrolyzers Market Regional Analysis

For several reasons, North America's supremacy in the hydrogen electrolyzer market is due to considerable expenditures in green hydrogen projects, favorable government policies, and superior technological infrastructure. For instance, In January 2023, NewHydrogen, a U.S.-based company, introduced its prototype for a green hydrogen generator. This prototype acts as a basis for incorporating future improvements in electrolyzer components. The region's emphasis on lowering carbon emissions and shifting to renewable energy sources hastens the implementation of hydrogen electrolyzers. Furthermore, interactions between significant industry players and research institutions promote innovation and market growth.

The Asia-Pacific region is developing as the fastest-growing market for hydrogen electrolyzers, because to rapid industrialization, favorable government laws, and increased investments in green energy projects. Countries such as China, Japan, and South Korea are driving the push for hydrogen technology, motivated by a desire to cut carbon emissions and transition to renewable energy.

Hydrogen Electrolyzers Market Players

Some of the top hydrogen electrolyzers companies offered in our report include Tianjin Mainland Hydrogen Equipment Co. Ltd., Air Liquide, Enapter, Gaztransport & Technigaz, Nel Hydrogen, Giner Inc., GreenHydrogen Systems, ITM Power Plc, McPhy Energy, Next Hydrogen, Energy GmbH, Plug Power Inc., Ballard Power Systems, and Siemens AG.

Frequently Asked Questions

How big is the hydrogen electrolyzers market?

The hydrogen electrolyzers market size was valued at USD 563.6 million in 2023.

What is the CAGR of the global hydrogen electrolyzers market from 2024 to 2032?

The CAGR of hydrogen electrolyzers is 20.1% during the analysis period of 2024 to 2032.

Which are the key players in the hydrogen electrolyzers market?

The key players operating in the global market are including Tianjin Mainland Hydrogen Equipment Co. Ltd., Air Liquide, Enapter, Gaztransport & Technigaz, Nel Hydrogen, Giner Inc., GreenHydrogen Systems, ITM Power Plc, McPhy Energy, Next Hydrogen, Energy GmbH, Plug Power Inc., Ballard Power Systems, and Siemens AG.

Which region dominated the global hydrogen electrolyzers market share?

North America held the dominating position in hydrogen electrolyzers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hydrogen electrolyzers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hydrogen electrolyzers industry?

The current trends and dynamics in the hydrogen electrolyzers industry include growing demand for green hydrogen in energy and transportation sectors, government incentives and favorable policies for hydrogen production, and advancements in electrolyzer technology reducing production costs.

Which product type held the maximum share in 2023?

The polymer electrolyte membrane (PEM) electrolyzer product type held the maximum share of the hydrogen electrolyzers industry.